Interpreting Financial Statements

1/18

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

19 Terms

Key Points

Accounting is the scorecard of business.

Managers who understand accounting can diagnose ills and prescribe remedies.

To start we will review accounting concepts that are essential for financial management.

The material covered here should be review. You may wish to review your introductory Accounting and Introductory Finance course materials if you need a refresher.

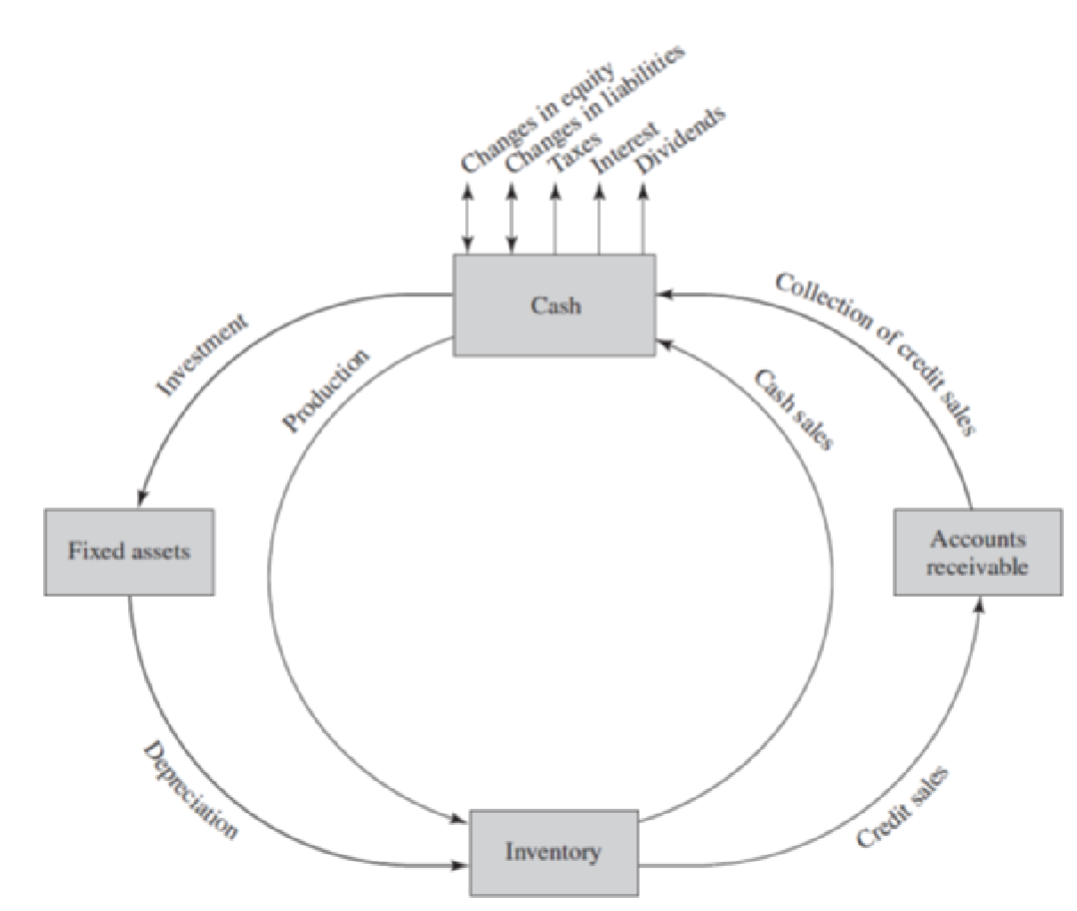

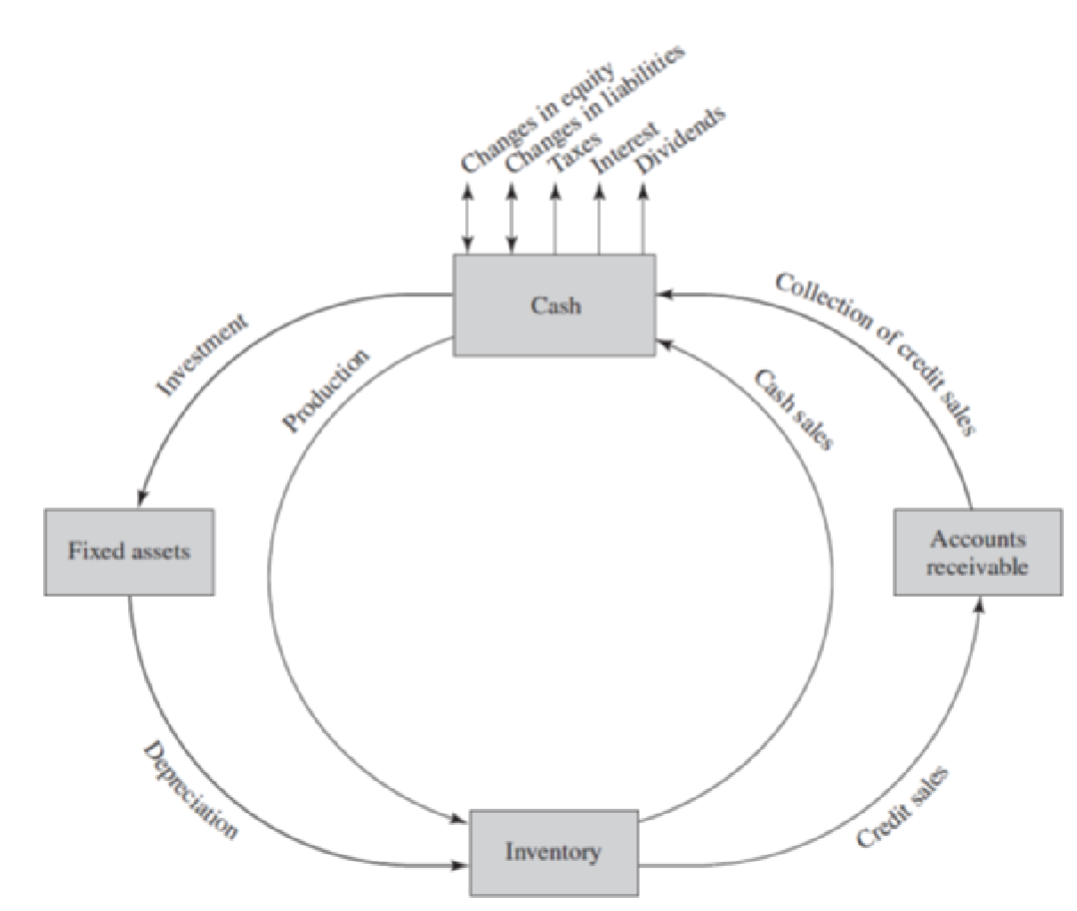

Finance and operations are integrally connected.

• Company operations and strategy affect financing.

• Financial decisions affect company operations.

The cash flow–production cycle demonstrates this.

Where is production (operations) in this cycle?

Principles Demonstrated in the Cycle

1. Financial statements are

an important window on

reality.

2. Profits do not equal cash

flow.

6

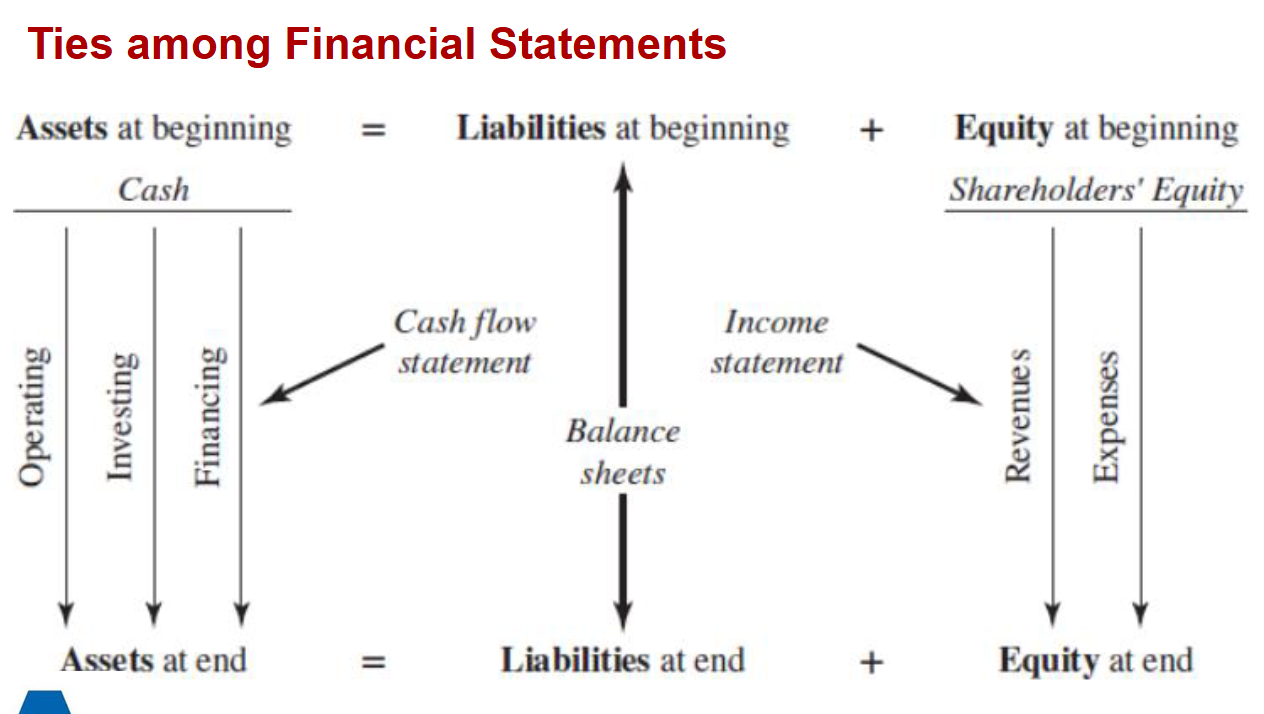

The balance sheet is a financial snapshot.

Assets = Liabilities + Shareholders’ Equity

If the balance sheet is a snapshot, the income statement and

cash flow statement are videos.

The income statement shows how revenues and expenses

determine changes in owners’ equity over a period of time.

The cash flow statement provides details of the change in

cash balances over time.

How Financial Statements are Connected

Other Balance Sheet Points

Current assets and liabilities

• “Current” means it is expected to turn into cash within one

year.

Shareholders’ equity

• Don’t worry too much about the different categories of

equity (common stock, paid-in capital, retained earnings,

treasury stock).

• Net income (less any dividends paid) goes into retained

earnings.

The Income Statement

Basic relation: Revenues − Expenses = Net Income

Distinction between operating and nonoperating expenses

Measuring Earnings

Accrual accounting and the matching principle

Depreciation

• Straight-line versus accelerated.

Taxes

• 2 sets of books: one to report financial condition of company

to investors and the second to compute taxes.

Research and marketing

• Expense it all! (Why?)

Tax Arithmetic

Provision for income taxes on income statement

+ increase in prepaid income taxes on asset side of balance

sheet

− increase in income taxes payable and deferred income

taxes on liabilities side of balance sheet

= Taxes paid

18

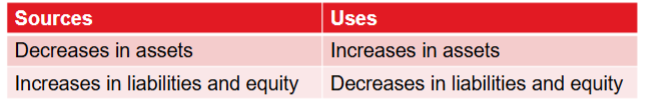

Sources and Uses Statements

The income statement does not accurately show the

movement of cash.

• It includes items that are not cash flows.

• It only lists cash flows pertaining to sales during the period.

For cash flows, we need something else.

Where does a company get its cash, and where does it spend

its cash?

21

Statement of Cash Flows

Expansion and rearrangement of sources and uses

Divides cash flows into 3 categories

• Operations.

• Investing.

• Financing.

Typically reports additional categories, such as dividends,

repurchases, capital expenditures

Highlights the solvency of the firm

Cash Flow and Net Income 1

Which is the better measure of performance?

Net income includes estimates, allocations, and

approximations.

Cash flow from operations is actual cash.

Low or negative cash flow does not necessarily imply poor

performance.

Cash flow statements can record items such as AR and

employee stock options differently from sources and uses.

Market Value vs. Book Value

The financial statements are a mix of historical amounts and

mark-to-market amounts.

Book values are historical.

Market values are forward-looking.

Intangible assets not appearing in the financial statements

include patents, brand reputation, superior technology,

human capital of workforce, etc.

Fair Value Accounting

Some quirks revealed by financial crisis of 2008

Drop in market value of debt

Fair value accounting required firms to record this change as

a gain, because they were able to repurchase the debt at a

lower price than they originally issued (sold) it.

Effect reversed when market rebounded

Goodwill

Intangible on the balance sheet

Goodwill is the difference between acquisition price and the

fair value of the asset acquired.

Fair value corresponds to either the book value or the

replacement value of the target, whichever is more

appropriate.

For Polaris, how important is goodwill (see Table 1.2)?

Economic Income and Accounting Income

Realized versus unrealized income

Marketable securities are marked to market, but other assets

are not.

Imputed costs: Economic income recognizes the cost of

equity as well as the cost of debt, while accounting income

does not.

Adjusted earnings

Reported by two-thirds of companies in the S&P 500

Common adjustments

• Restructuring charges.

• Litigation expenses.

• Acquisitions.

SEC regulates use of adjusted earnings

Are adjusted earnings informative for investors or simply

an effort by managers to hide problems?

International Financial Reporting

Standards

2005, Europe adopts IFRS

140+ countries have adopted

What about Japan, China, and U.S.?

Impact of accounting scandals in the U.S.

Principles versus rules