unit 3 econ final review

1/46

Earn XP

Description and Tags

12th grade ap microeconomics

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

47 Terms

accountants

explicit costs only

economists

explicit costs and implicit costs

explicit costs

- payments paid by firms for using the resources of others

- out of pocket costs

- ex: rent, wages, materials, electricity bills

implicit costs

- opportunity costs that firms "pay" for using their own resources

- ex: time

production

converting inputs into outputs

inputs

- resources used to make outputs

- also called factors

total physical product (TP)

total output or quantity produced

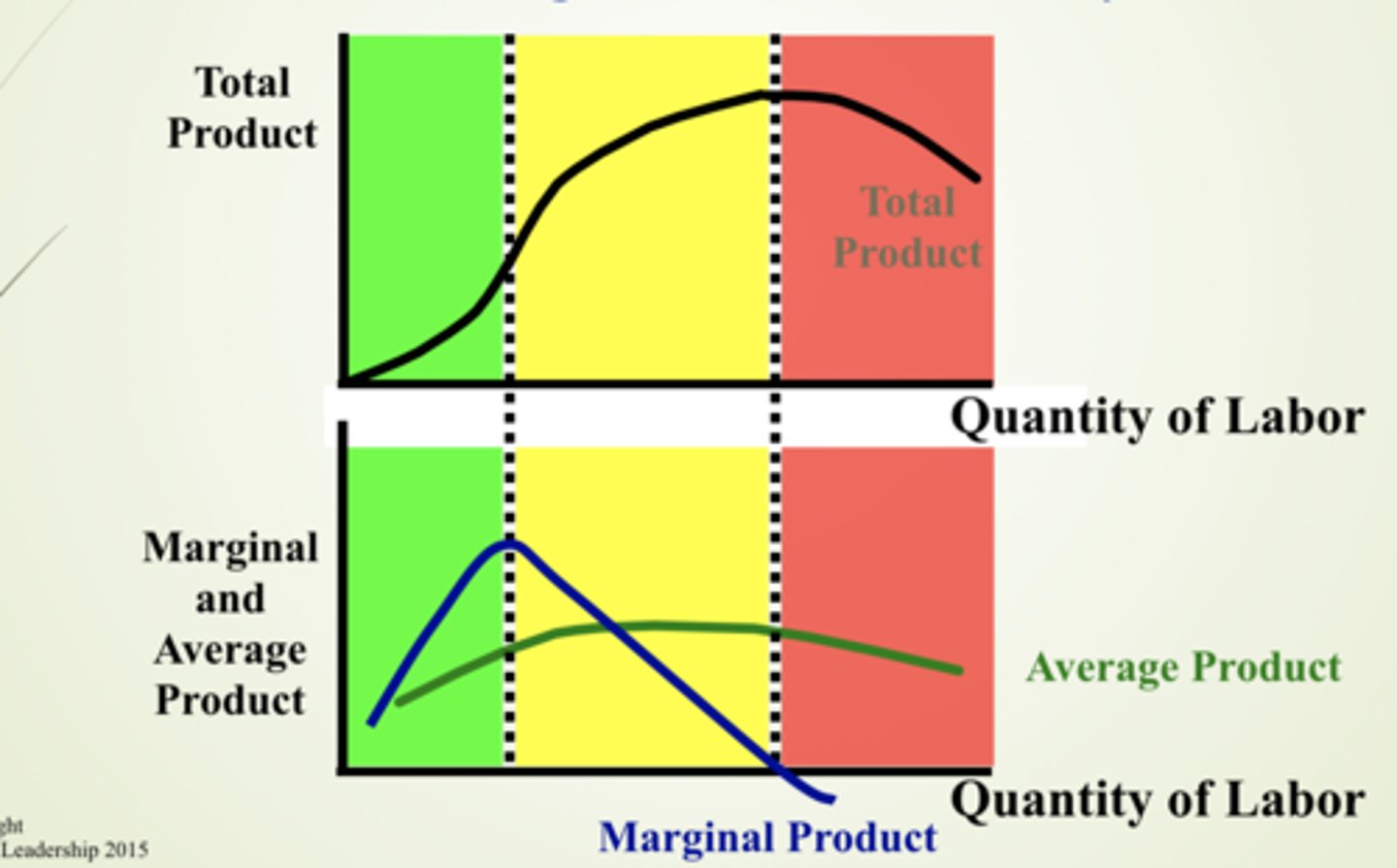

marginal product (MP)

- additional output generated by additional inputs (workers)

- ΔTP/ Δinput

average product (AP)

- output per unit of input

- TP/ units of labor

law of diminishing marginal returns

- as resources (workers) are added to fixed resources (machinery), the additional output produced from each new worker will eventually fall

- short run concept bc of fixed resources

stages of returns

- increasing marginal returns

- decreasing/diminishing marginal returns

- negative marginal returns

increasing marginal returns

- MP rising

- TP increasing at an increasing rate

decreasing/diminishing marginal returns

- MP falling

- TP increasing at a decreasing rate

negative marginal returns

- MP is negative

- TP decreasing

accounting profit

total revenue - accounting costs

economic profit

total revenue - economic costs

short run

period in which at least one resource is fixed

long run

- all resources are variable

- no fixed resources

total costs

- total fixed costs (FC)

- total variable costs (VC)

- total costs (TC)

per unit costs

- average fixed costs (AFC)

- average variable costs (AVC)

- average total costs (ATC)

- marginal cost (MC)

fixed costs

- costs for fixed resources that don't change with the amount produced

- ex: rent, insurance, managers, salaries

average fixed costs

fixed costs/ quantity

variable costs

- costs for variable resources that do change as more/less is produced

- ex: raw materials, labor, electricity

average variable costs

variable costs/ quantity

total cost

sum of fixed and variable costs

average total cost

total costs/ quantity

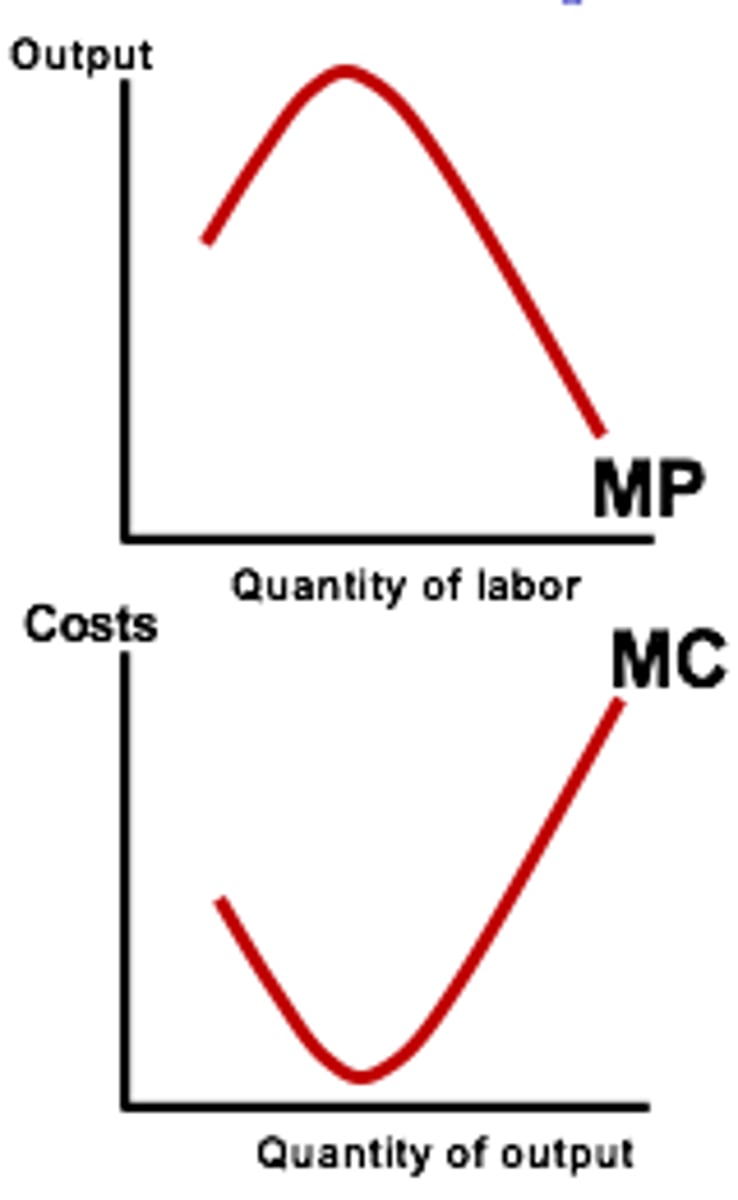

marginal cost

- additional costs of an additional output

- U-shaped bc of diminishing marginal returns

marginal cost

Δtotal costs/ Δquantity

MP and MC

mirror images of each other

ATC

- lowest point at MC

- MC below average = pulls average down

- MC above average = pulls average up

fixed costs change

only AFC and ATC change

variable costs change

only MC, AVC, and ATC change

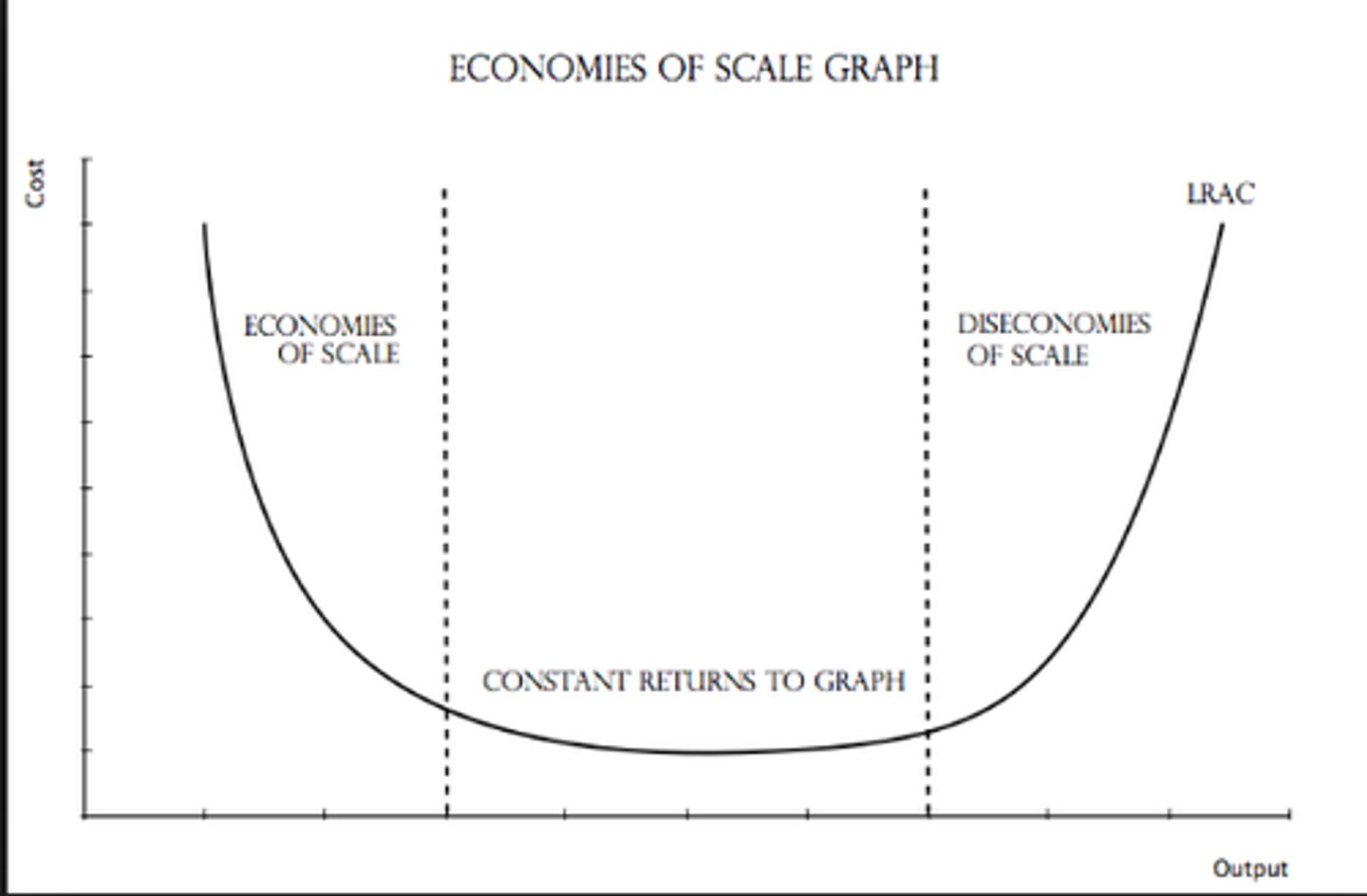

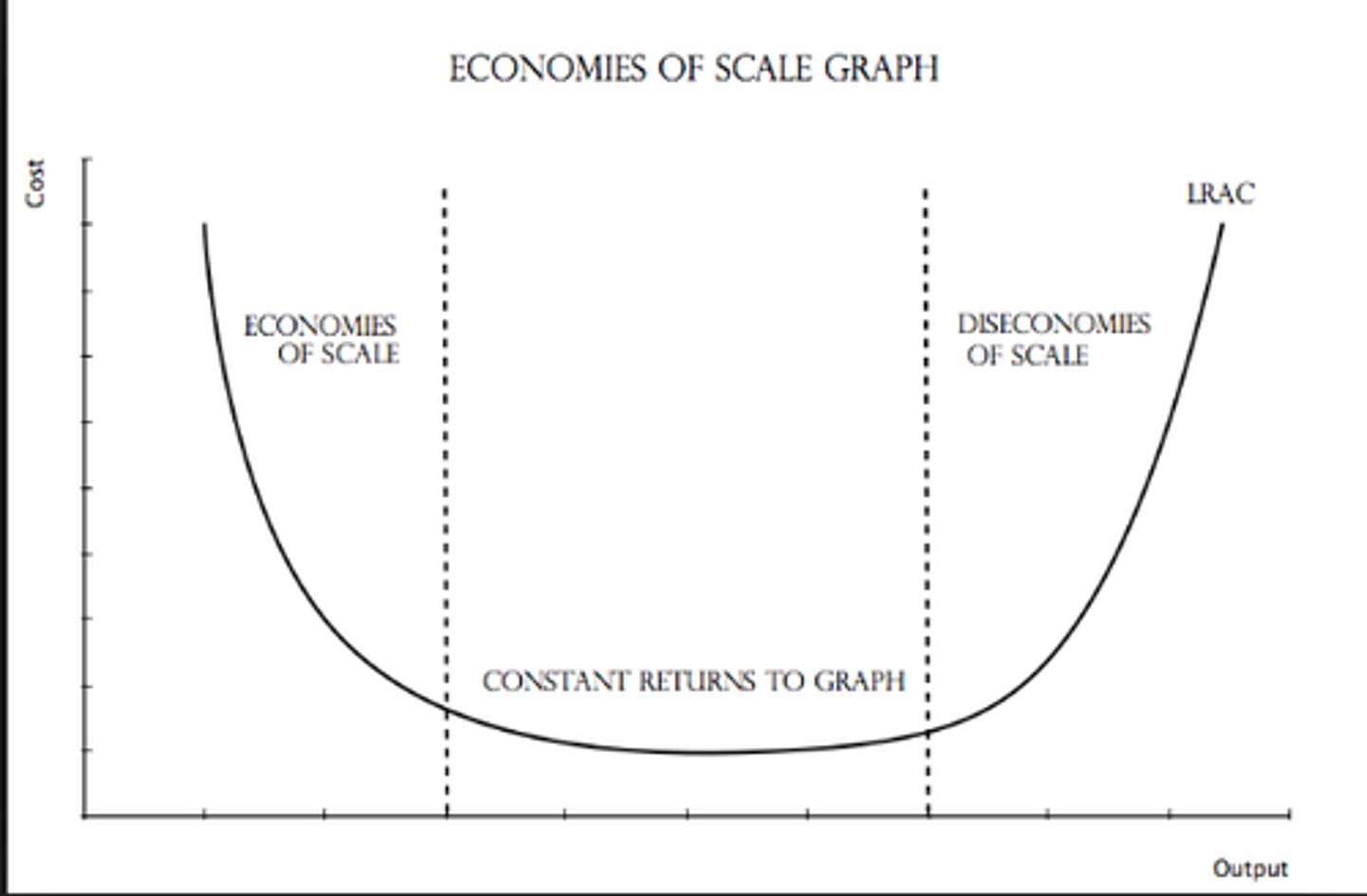

LRATC

made up of all the different short run ATC curves

economies of scale

LRATC falls as more output is produced

constant returns to scale

LRATC is as low as it can get

diseconomies of scale

LRATC increase as more output is produced

perfect competition

- many small firms

- identical products

- no barriers to entry

- no ads

- price takers

why perfect competitive firms are price takers

- no one will buy if firm charges above market price bc they will go to other firms

- no reason to price low bc consumers buy at market price

perfect competitive firm demand curve

perfectly elastic (price is the same at all quantities demanded)

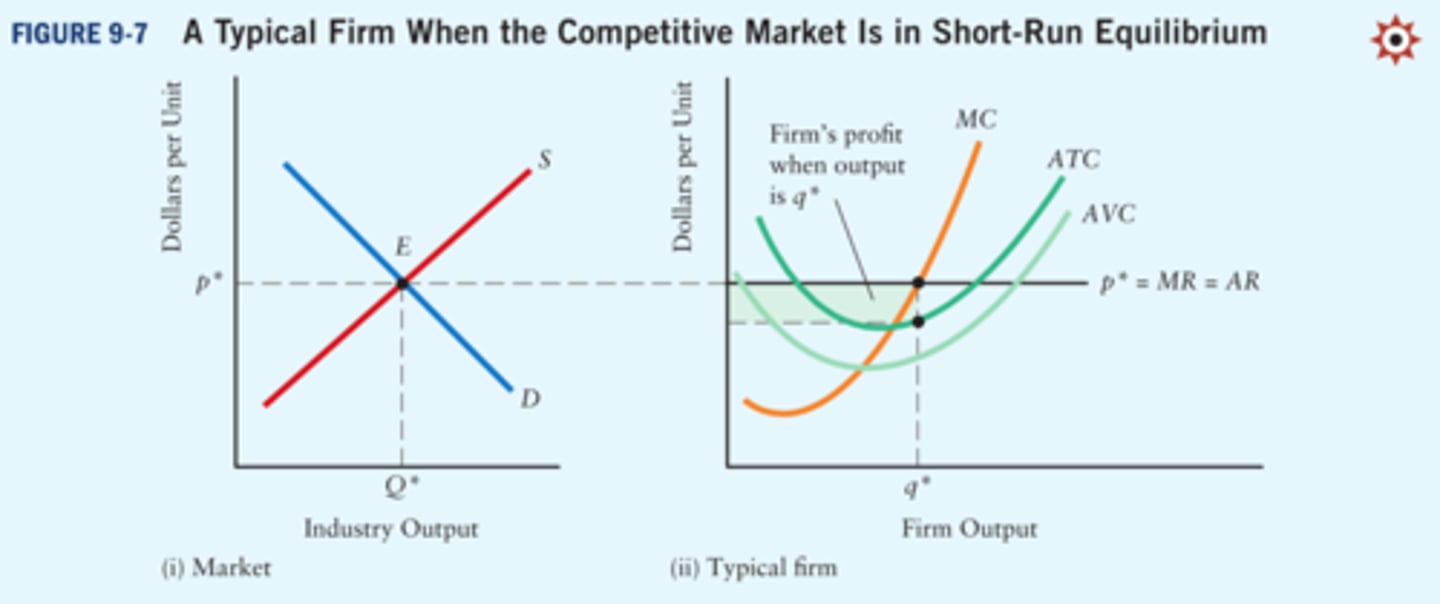

short-run profit maximization

- firms should continue to produce until the additional revenue from each new output equals the additional cost

- MR = MC

shut down rule

- produce as long as price is above AVC

- shut down when price is below AVC to minimize losses

- if price is below AVC, firm is losing more money by producing than shutting down

profit maximizing rule

- loss minimizing rule

- applies to all market structures

- only applies if P is above AVC

- perf comp -> P = MC bc MR = P

perfectly competitive graph

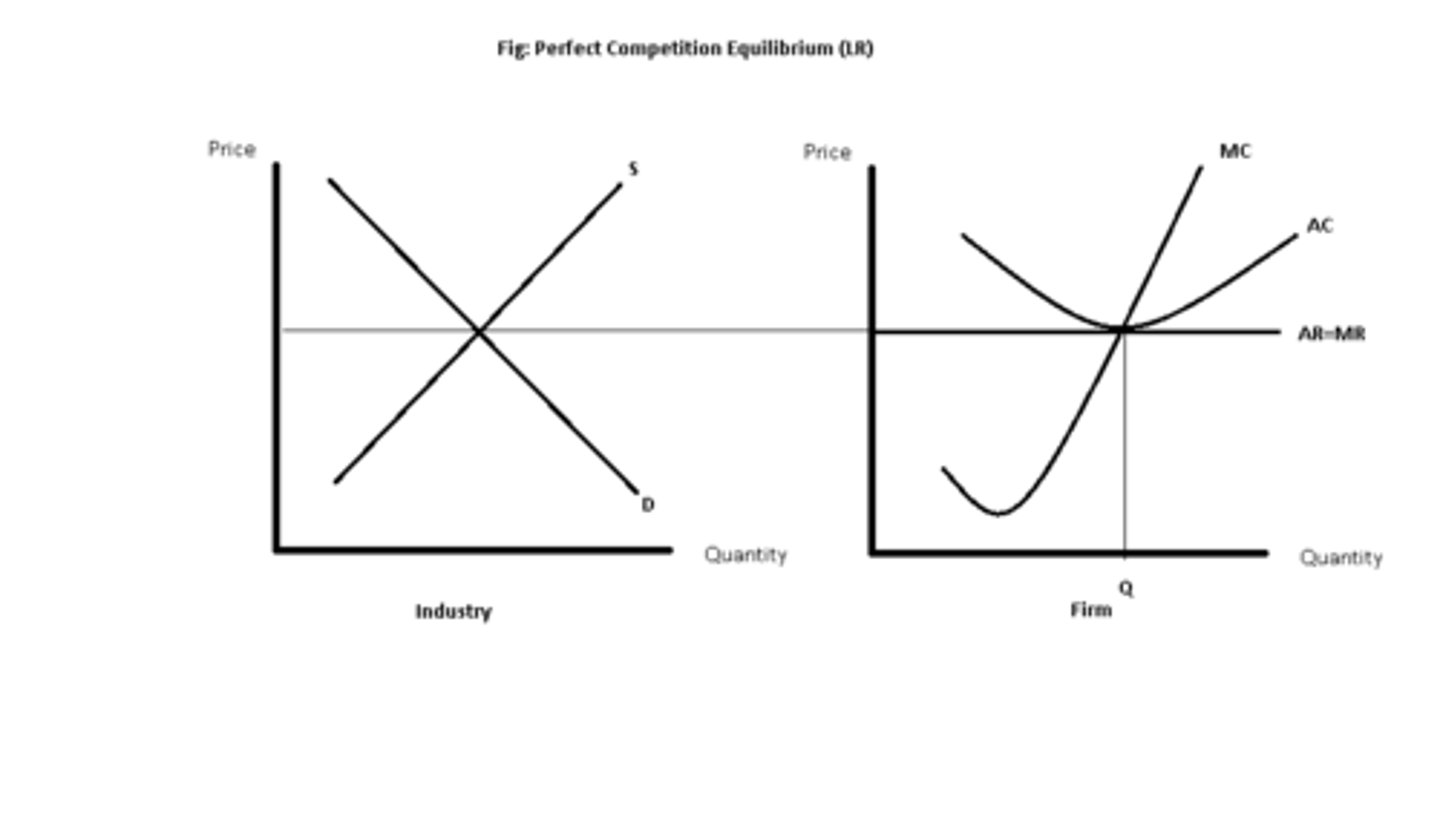

long run perfect competition

- firms enter if there is profit

- firms leave if there is loss

- firms break even, no economic profit (normal profit)

- extremely efficient

long run perfectly competitive graph

- price = MC = minimum ATC

- normal profit

- no incentive to leave or enter industry

productive efficiency

P = minimum ATC

allocative efficiency

P = MC