BUSS1040 Lecture 5 - Perfectly Competitive Markets

1/28

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

29 Terms

Characteristics of a market

Concentration

number & size distribution of firms in market and market share

high concen - small no. of firms control large market share (telecomm, power)

low concen - large no. of firm and no firms have market power (food)

Product differentiation

physical/subjective diffs in consumers minds between rival firm products

feature of a prod that sets it apart from other similar prods

homogenous vs differentiated products

Barriers to entry

how difficult for new firm to enter market and compete w existing firms

legal barriers (govt reg, patent rights etc)

nature (technical, costs, financial)

Characteristics - Perfect comp

large no of buyers and sellers

single seller has no impact on p by either prod more or less

homogenous prod

each sellers prod is identical to its competitiors

low barriers

freedom of entry and exits by firms

perfect info

p and quality of prod assumed to be known to all consu and prod

perfect mobility of FOPs

price takers

indv firms take the market price as given — cant exert influence on p

Basic market structures - Monopolistic comp

many sellers (low concen)

differentiated prods

some barriers

Basic market structures - Oligopoly

few sellers (high concen)

homogenous or differentiated

high barriers

Basic market structures - Monopoly

one seller

unique; no close substitute

high barriers/blocked

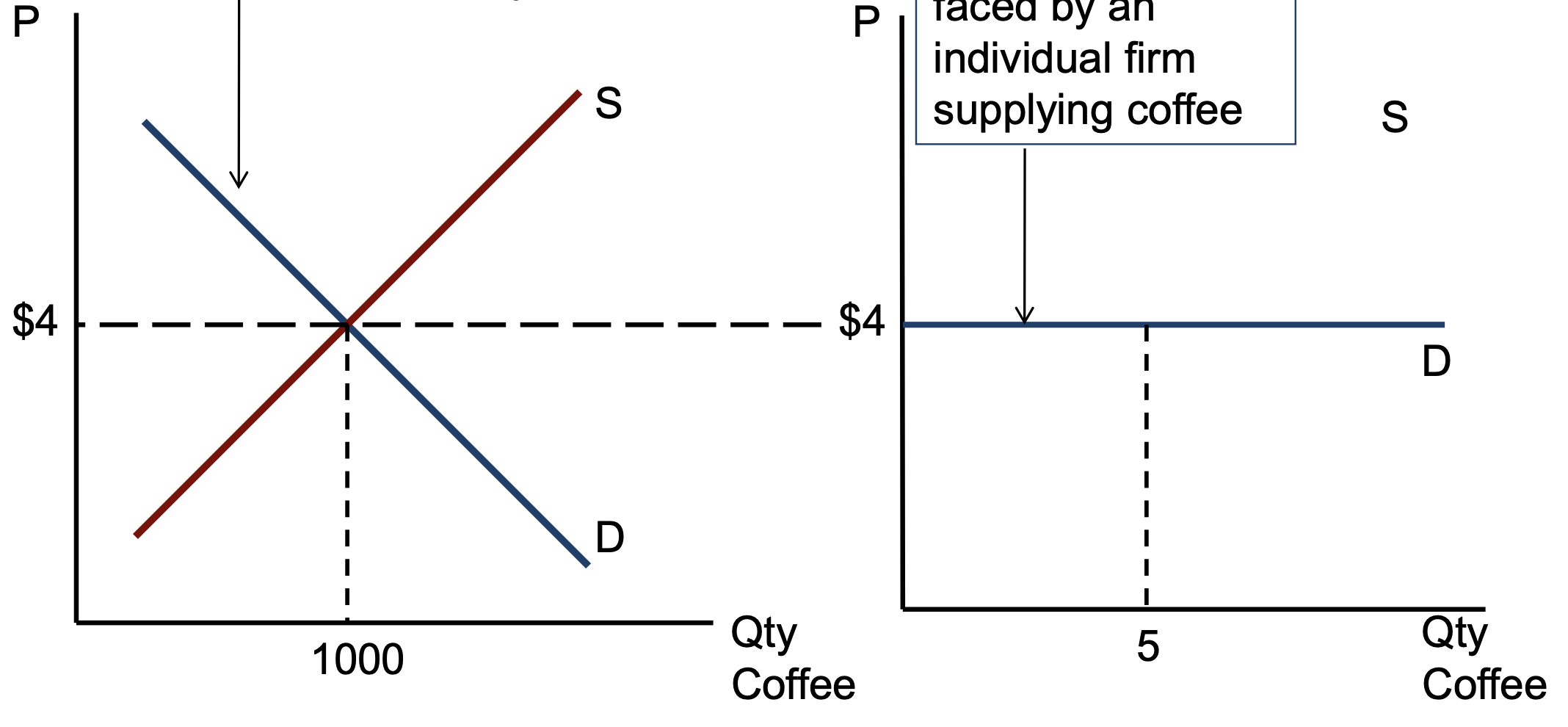

Market D curve vs D curve for firm (coffee supplier)

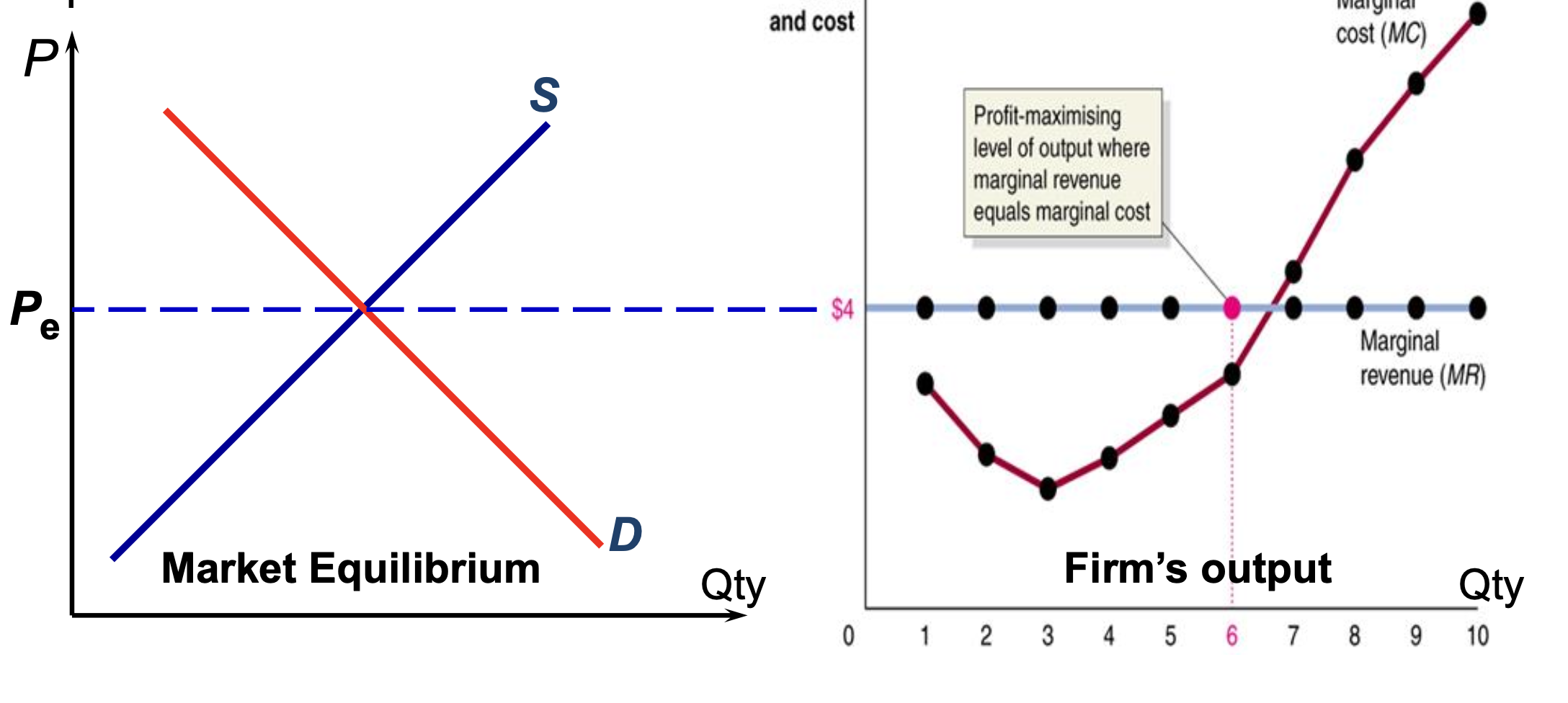

Profit

Profit = TR - TC

TR

TR = P x Q

Average Rev

AR = TR/Q = (P x Q)/Q = P

Marginal Rev

MR = △TR/△Q

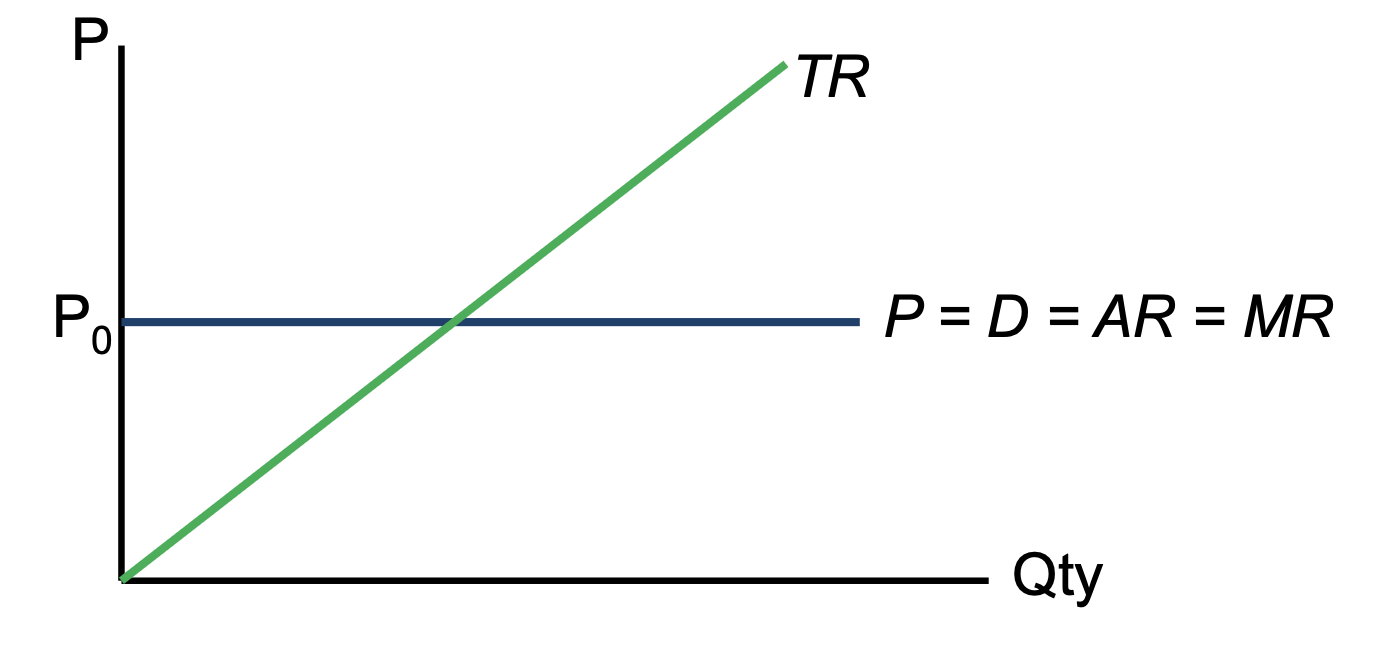

Perfect Comp D Curve

MR = △TR/△Q = (P x △Q)/△Q = P

Therefore, P = D = AR = MR

Firms Cost formulas

TC, AFC, AVC, ATC, MC

TC = TFC + TVC

AFC = TFC/Q

AVC = TVC/Q

ATC = TC/Q

MC = △TC/△Q

Profit Max

Profit max occurs when MR = MC and MC cuts MR curve from below

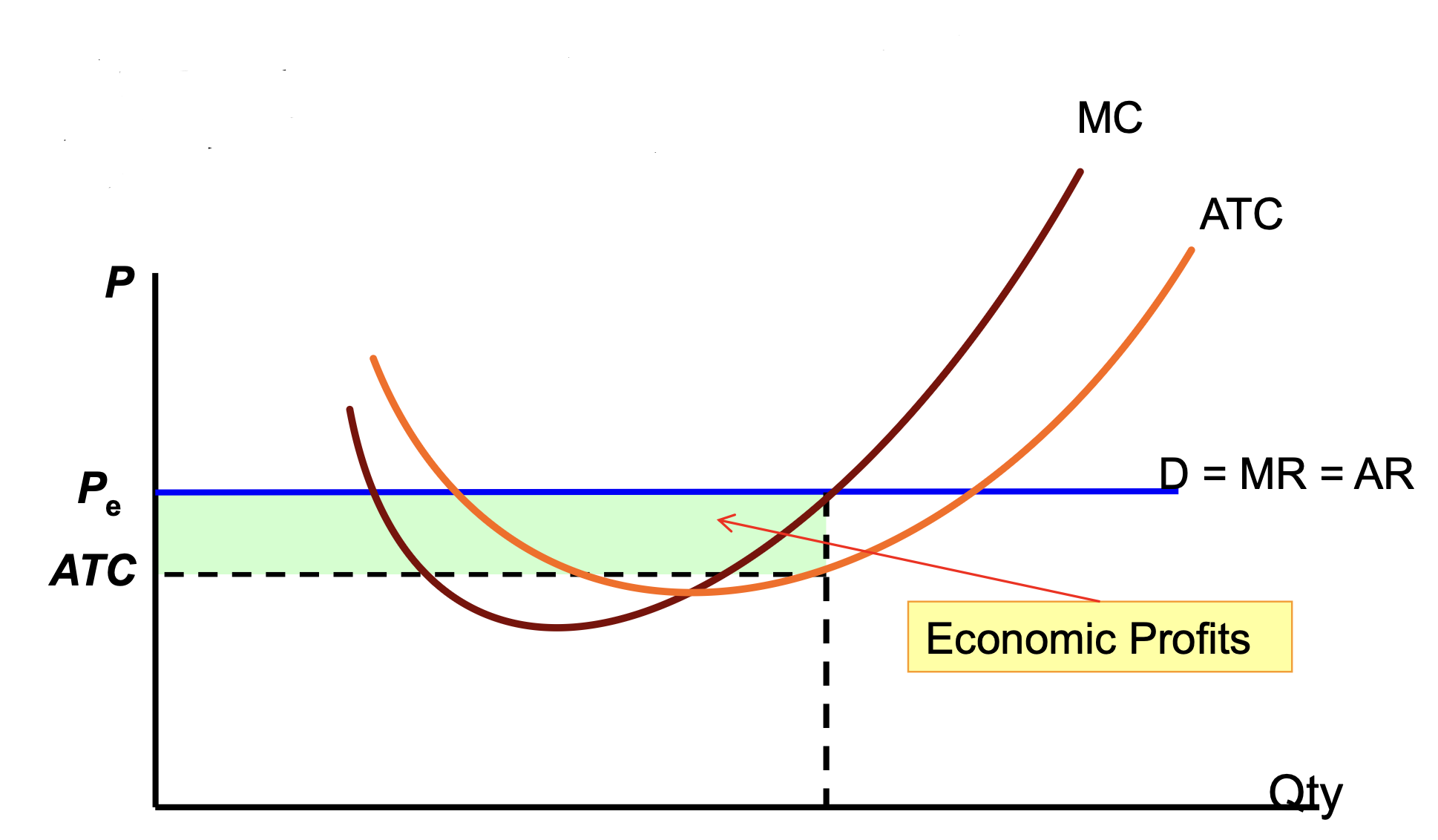

Economic Profits SR

Profit = (P-ATC) x Q

Econ profits

TR>TC or Profit>0

when P>ATC

Remember — TC = explicit costs + implicit costs

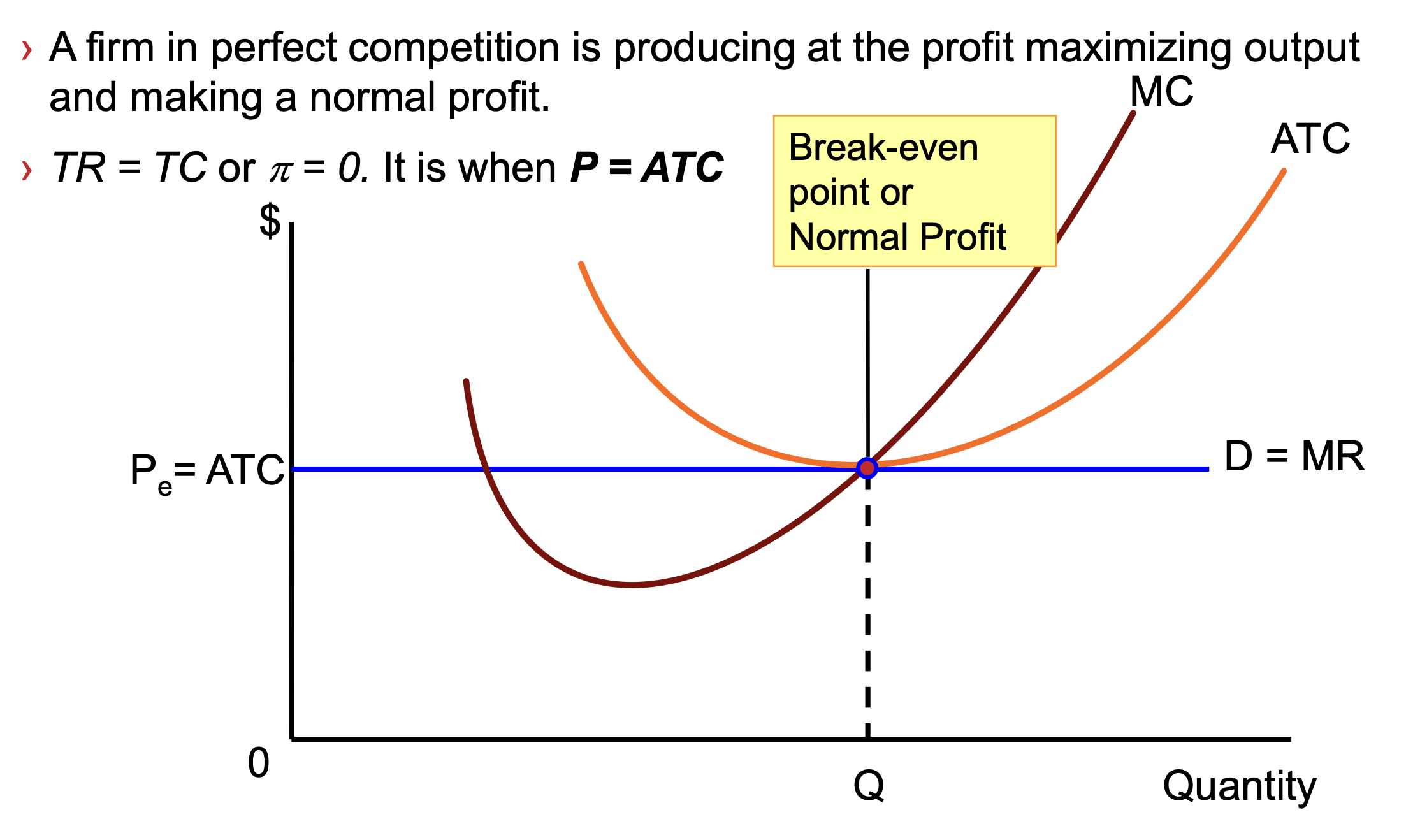

Break-even/Normal Profit SR

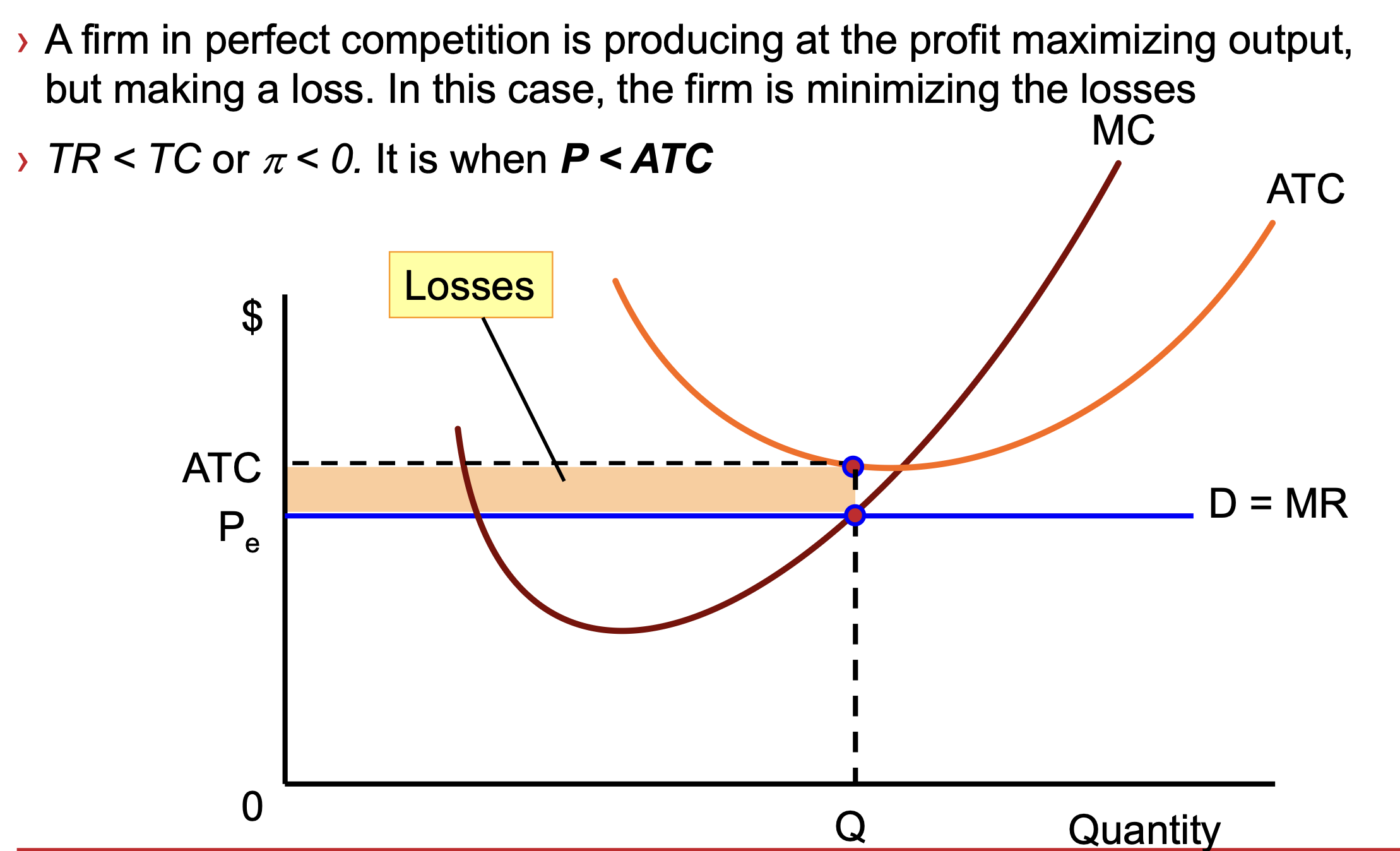

Making a loss SR

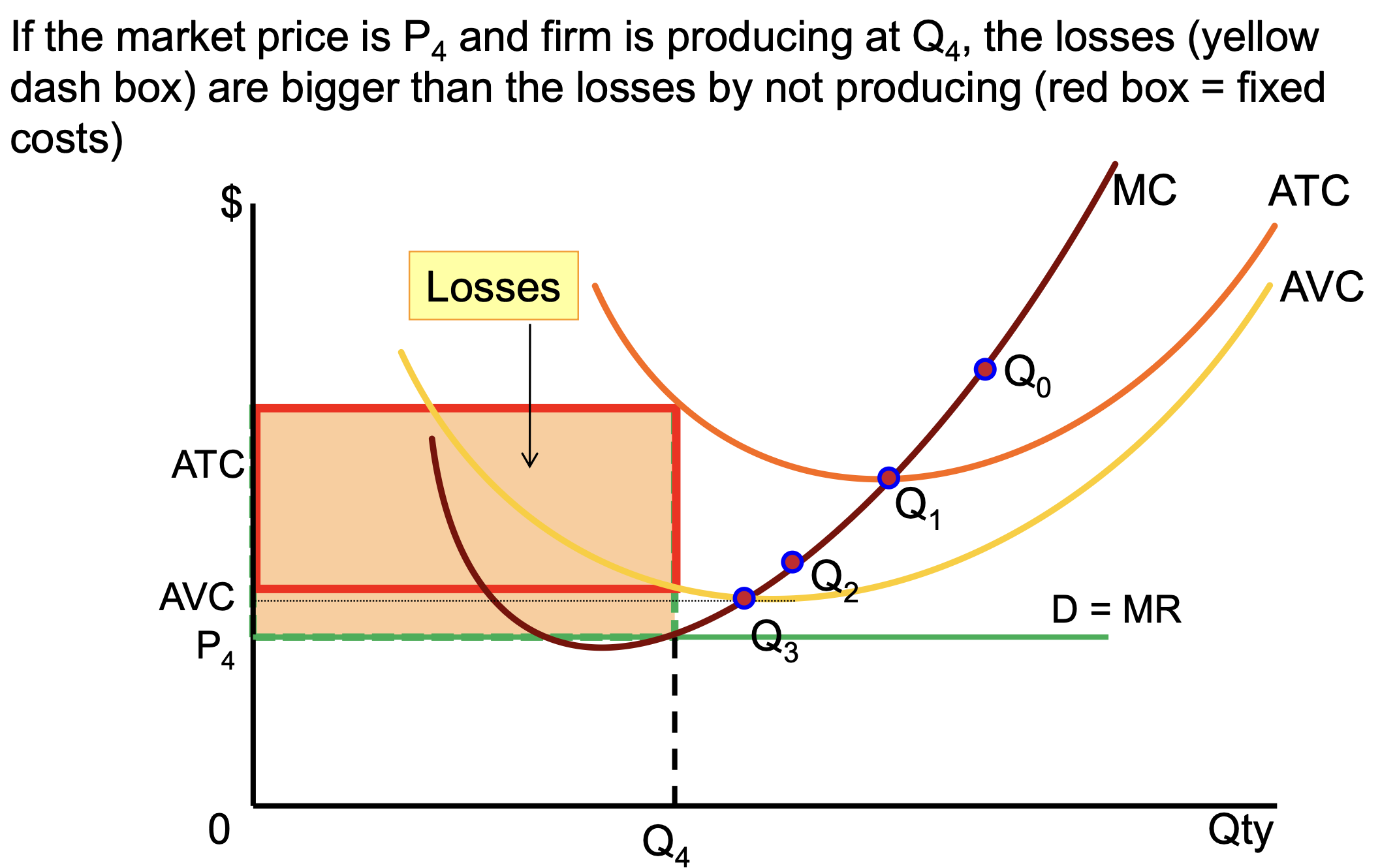

How firm can minimise losses SR

in SR — no firm will entry/exit

in SR — fixed costs will be incurred whether or not firm produces

if P>AVC — firm still produces because at least some fixed costs are recovered

if P<AVC — firm will shut down as by producing - losses are bigger

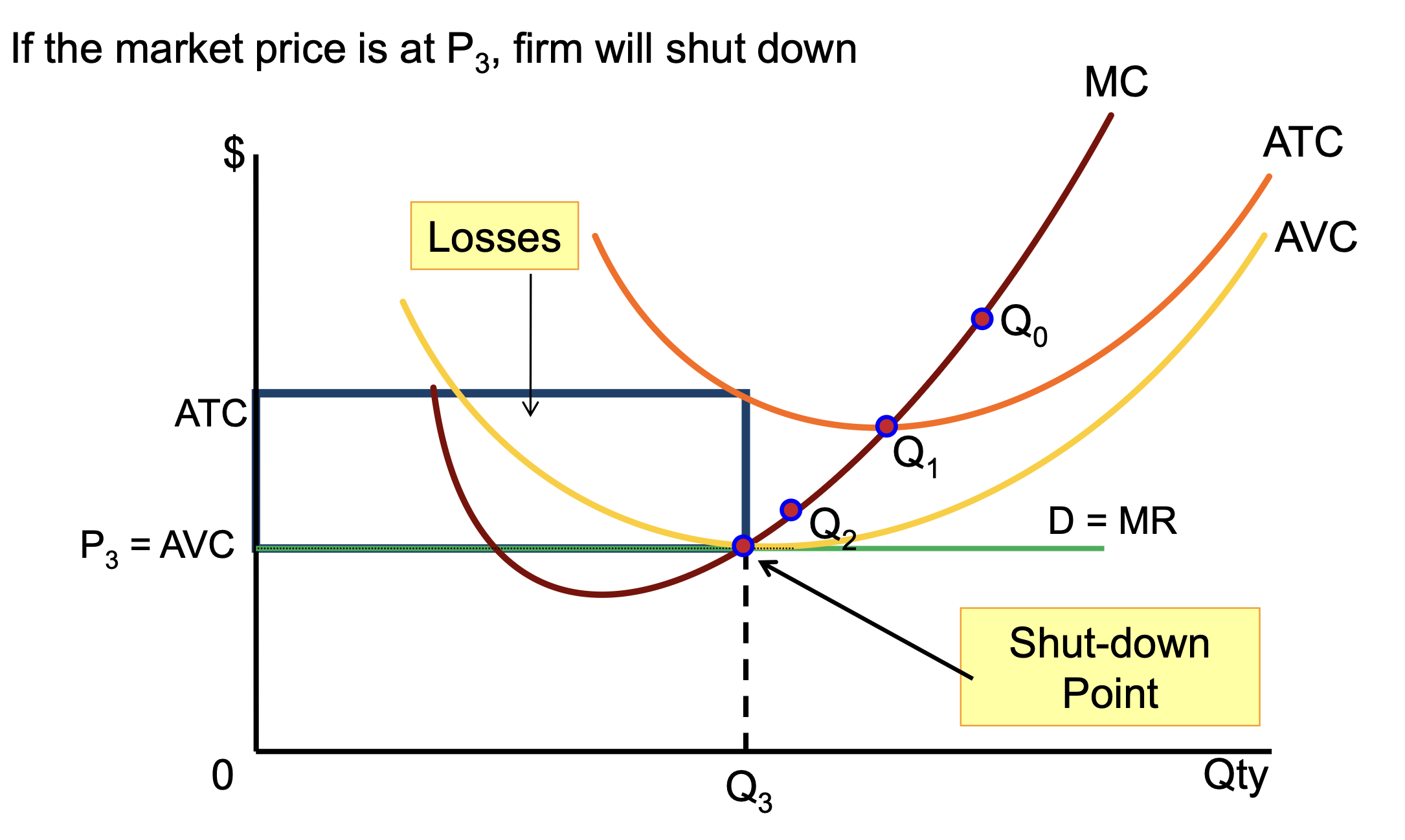

Shut down point on SR Curve

Losses bigger than losses by not producing

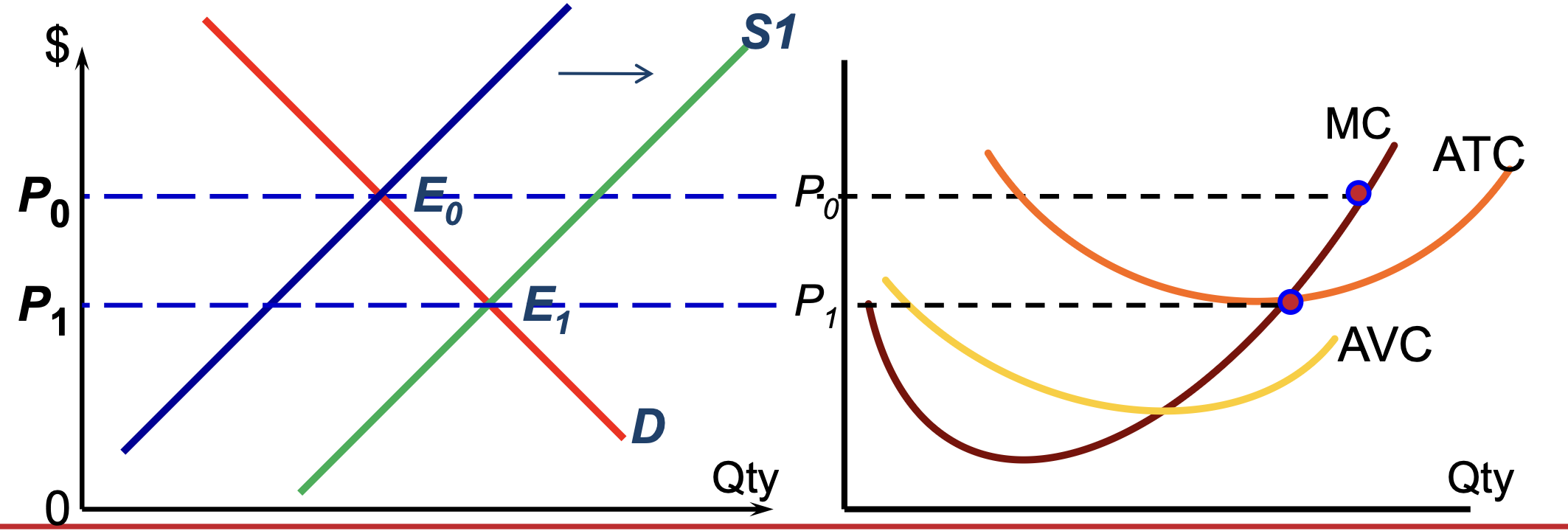

Econ to Normal Profit — LR Eq

firms can enter and exit freely in market

labour and capital perfectly mobile

if market eq p at P0 — firms will make economic profit — leads to entry of new firms into the market

marks eq p lower (P1) — until firms only make normal profit

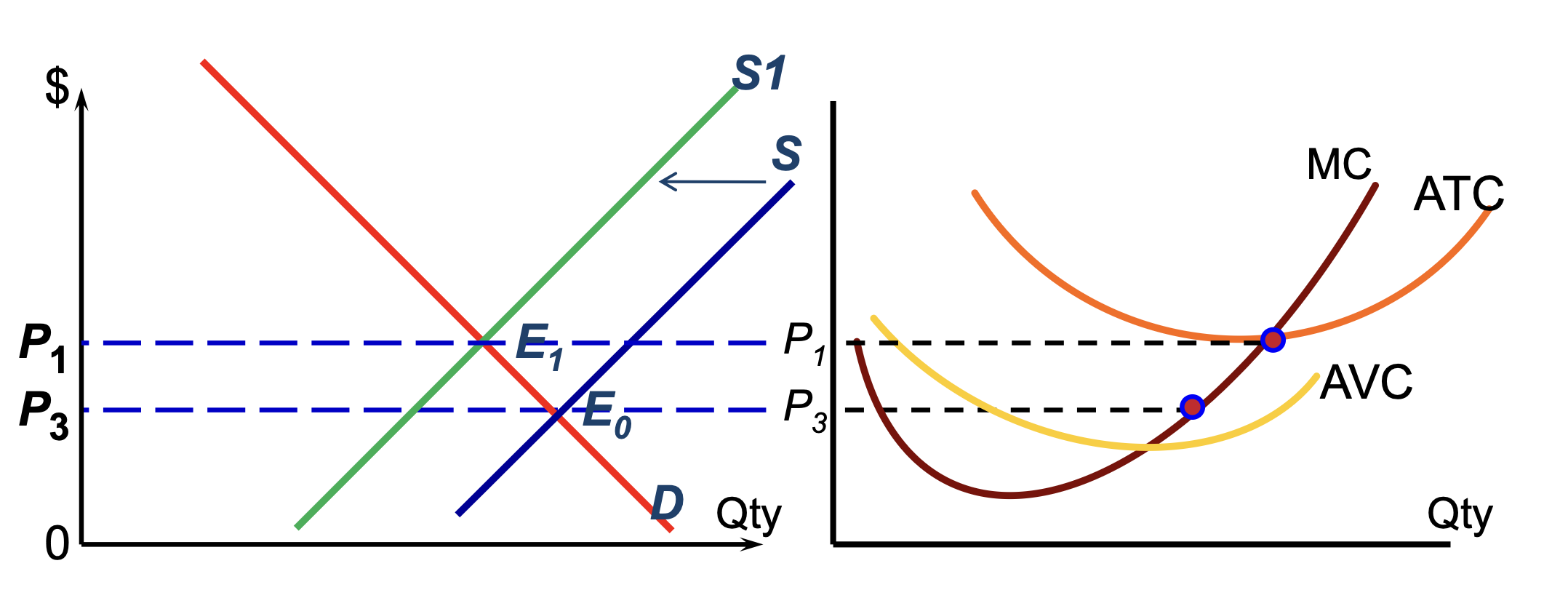

Loss to Normal Profit - LR Eq

if market eq is at P3 — losses

leads to exit of firms

makes eq p higher (P1) until firms make normal profit

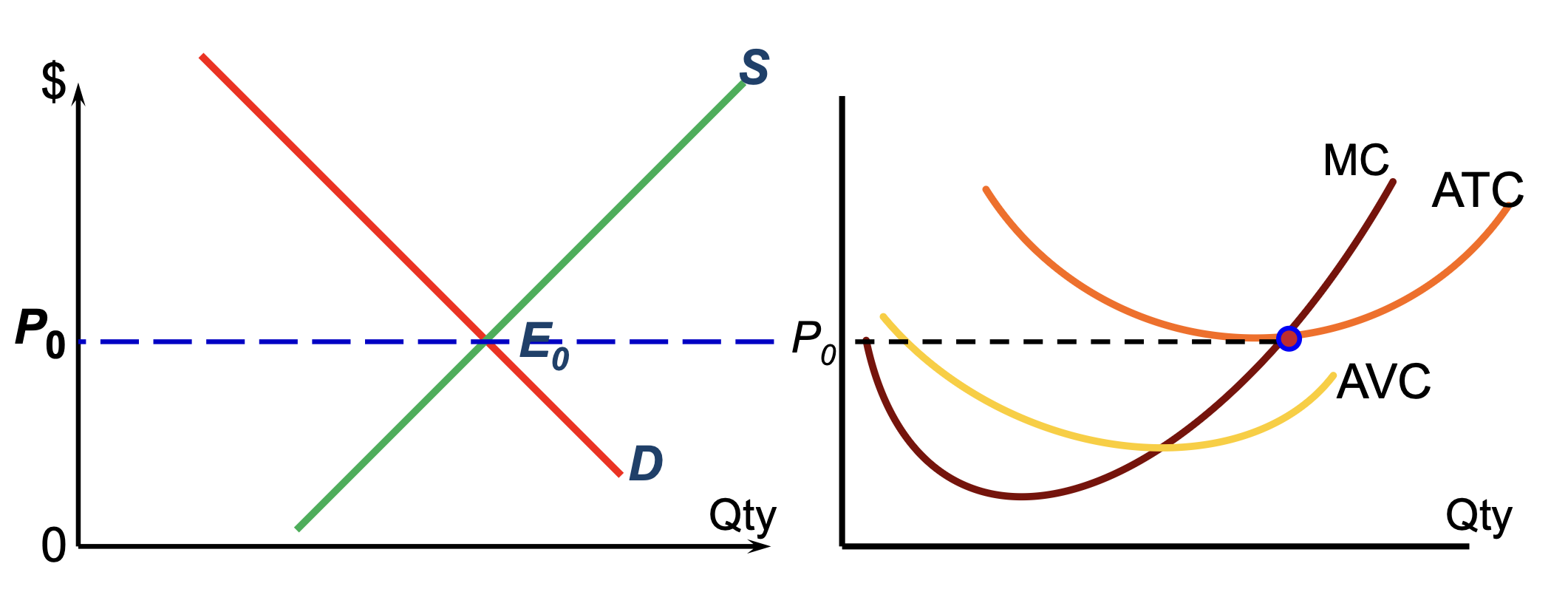

In Eq in the LR…

firms can only make normal or zero economic profit

P = MR = MC = ATC (min of ATC since MC cuts ATC at min pt)

External economies & diseconomies (LR indus s)

External economies

factors beyond control of indv firm that lower costs as indus expands

e.g. as computer indus expands — cost of chips fall

External diseconomies

factors outside control of a firm that raises firm’s costs as indus ouput increases

e.g. as wine indus expands — cost of water increases

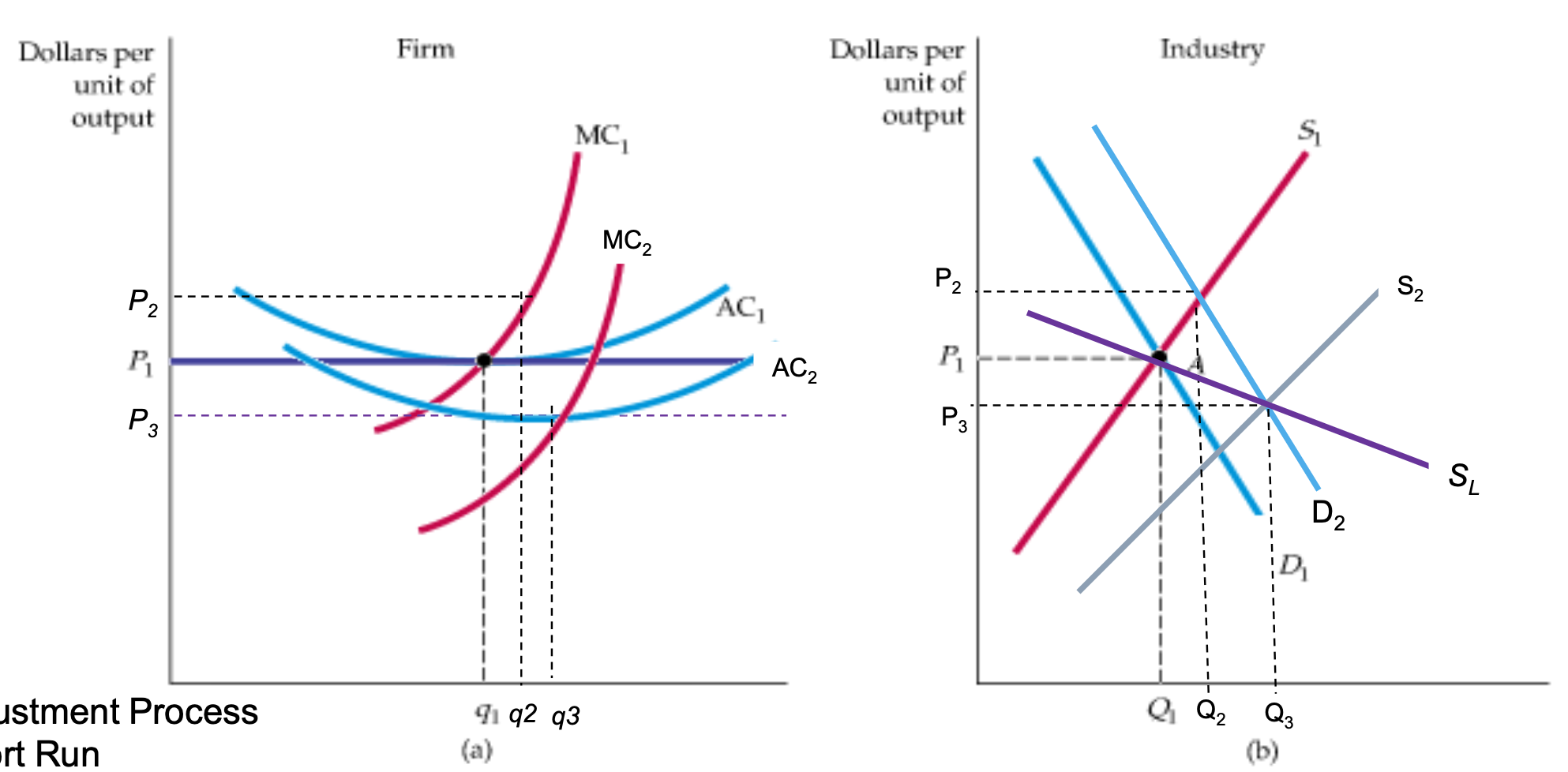

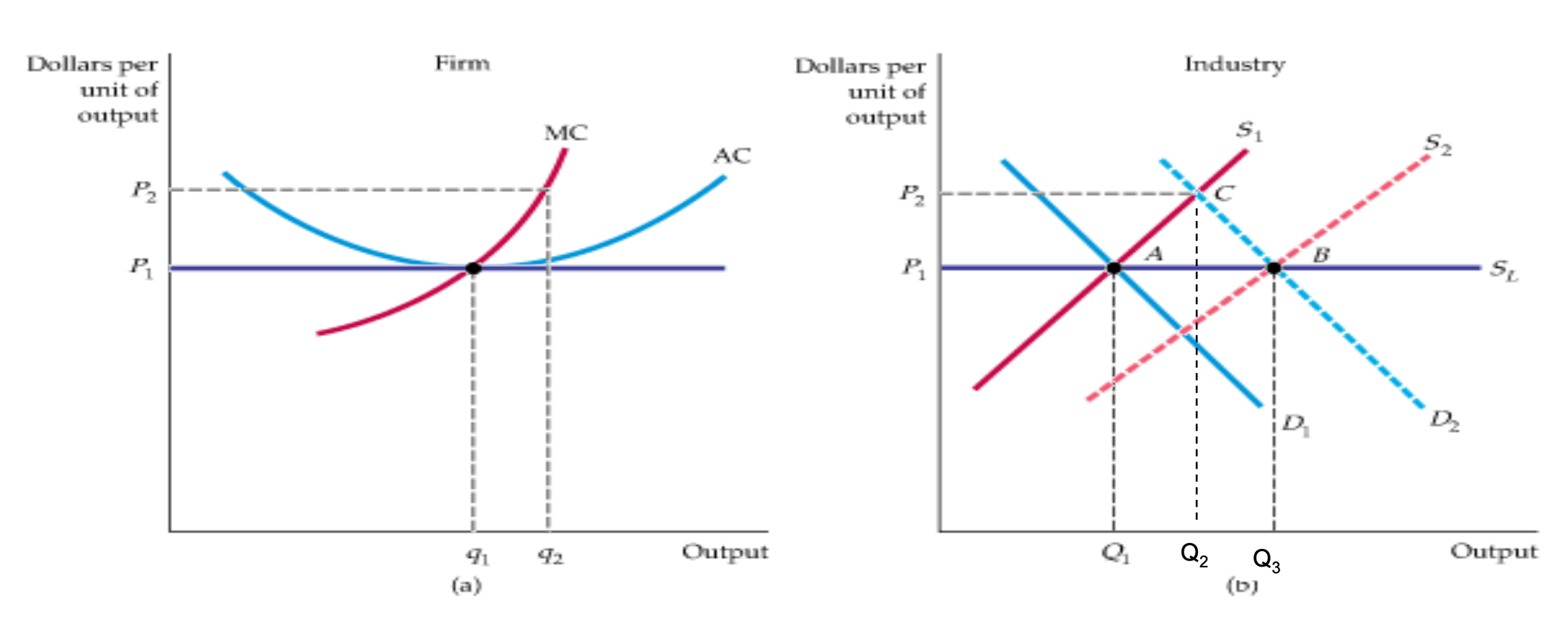

Constant Cost Industry (Graph + Adjustment Process)

SR

Industry

D decreases (D1→D2)

P rises (P1→P2)

SR Eq at C

Firm

Output increases (q1→q2) + rising MC

LR

economic profit attracts new firms — Market supply curve shifts (S1→S2)

Prices fall back to P1 w LR Eq at B

LR S curve is SL

Constant cost industry

entry and exit in LR ensures all firms earn zero profits and the price is P* = ATCmin

assumes that all firms have access to same tech and same cost structure and does not change as indus grows

Increasing cost industry

upward sloping LR S curve

if potential entrants have a higher cost than incumbent firms (already in market)

some resources used in prod maybe available in limited qtys (input p rises as indus expands) — costs for all firms rise

congestion may rise w indus output (e.g. airlines)

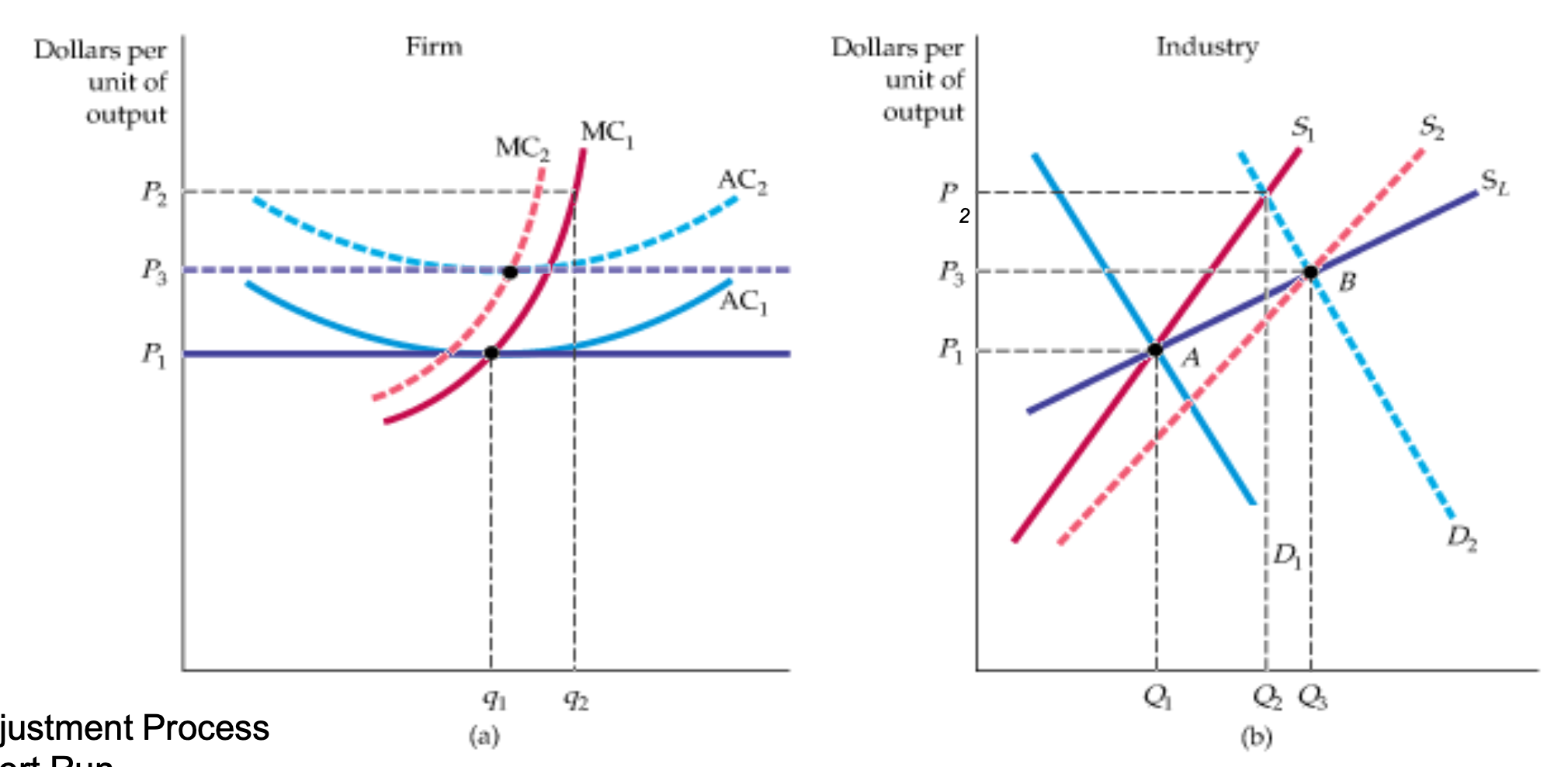

Increasing Cost Industry (Graph + Adjustment Process)

SR

Industry

Increase in D (D1→D2)

Increase in P (P1→P2)

Firm

q1 to q2 by moving along MC1

LR

Industry

increase in profits cause new firms to enter indus

shifts SR S curve (S1→S2)

P falls back (P2→P3)

as output expands — input p increases (AC1→AC2)

economic profit eliminated — LR S curve is SL

Decreasing Cost Industry

as output in indus expands — costs for all firms fall

if there are EOS in input markets

e.g. computer software — as market expanded — avg costs for all firms fall

following increase in d — entry will continue till no longer profitable

new LR Eq p has to be lower than initial Eq

LR indus s curve is downward sloping

Decreasing Cost Industry (Graph + Adjustment Process)

SR

Industry

increase in D (D1→D2)

increase in P (P1→P2)

Qty increases (Q2→Q2)

Firm

q1→q2 along MC1

LR

Industry

increase in profits cause new firms to enter

shift in SR s curve (S1→s2)

Qty increases (Q2→Q3)

p falls back (P2→P3)

output expands — input p falls — AC1→AC2

economic profit eliminated

LR s curve is SL