AP Macroeconomics Unit 2

1/41

Earn XP

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

42 Terms

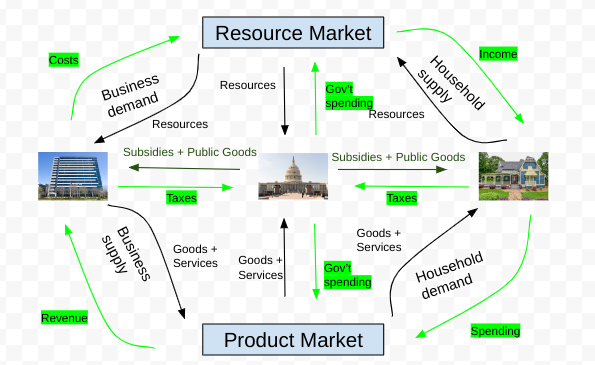

Circular Flow Model

A model showing how money, goods, and services flow through the economy. In this case, the “private” sector refers to households and the “public” sector refers to the government.

Nominal

Based on the current purchasing power.

Real

Adjusted for inflation. Does a better job than nominal things in comparing economic growth.

The Three Macroeconomic Goals

Promote Economic Growth

Limit Unemployment

Keep Prices Stable

Gross Domestic Product

The dollar value of all final goods and services within a country in one year.

GDP per Capita

The GDP per person. An accurate way of calculating the standard of living.

Calculating the percent change in GDP

(Year2-Year1/Year1) x 100

What’s not included in GDP?

Intermediate goods (the wheels of a car)

Nonproduction transactions (stocks)

Nonmarket and illegal activities (bake sale/black market)

If the intermediate good, by the end of the year, is still considered inventory (hasn’t been used), then it will count towards GDP.

Three Ways to Calculate GDP

The Income approach

Value-added approach

Expenditure approach

All methods should come to the same number.

Income approach

Adds up all income from producing goods and services.

Labor Income

Rental income (property)

Interest income (loans)

Profit

Mnemonic: WRIP. These are factor payments.

Expenditures approach

The most common method in this course.

Consumer spending: C

Business investment: I

Government spending: G

Net exports (exports - imports): Xn

Consumer Spending

Made up of: Any final good and service

Investment

Made up of: Businesses buying capital goods

Not made up of: Anybody else buying the same capital good for noncommercial purposes (consumer spending)

Government spending

Any spending made by the government. Doesn’t include transfer payments or interest payments on the national debt.

Net exports

Exports - imports. If you export more, you sell more. If you import more, you’re buying more.

Value-added approach

Adding up the value each stage adds to that product, up till it sells.

Unemployment

Workers looking for a job but aren’t currently working.

Unemployment rate

number of unemployed people/labor force

Labor Force

The amount of people who are eligible to work. They must be at least 16 years old, able and willing to work, not institutionalized (military), in schools, or retired.

Labor force participation rate

Labor Force/civilian population

The Three Types of Unemployment

Frictional

Seasonal (part of frictional)

Structural (also known as creative0

Cyclical

Frictional Unemployment

Temporary unemployment or between jobs. Usually when you’re moving to a new town. Seasonal unemployment is one type. It happens when your job is temporarily closed due to the season.

Structural Unemployment

When workers’ skills become obsolete due to changes in the labor force. This happens to steel workers, even today. Technological unemployment is one type of this.

Cyclical Unemployment

Unnatural employment. It is caused by a recession. As demand falls, labor falls, and workers are laid off.

Natural Rate of Unemployment

Frictional plus structural unemployment. Where the economy should be at its healthiest. If the UE is greater than NRU, the economy is inefficient. If the UE is less than NRU, the economy is in an unusually high production benefit. No unemployment results in extremely high prices.

What’s not included in unemployment?

Discouraged workers: people who supposed to be in the labor force but are not counted due to not wanting to look for a job.

Underemployed workers: people who are considered employed, but can’t work more hours/get enough pay.

Race/age inequalities.

Inflation

The rising general level of prices. You can expect this to happen every year. It causes the value of money to go down. This is considered bad, since banks won’t lend out as much and people will not save.

Deflation

A decrease in general prices. It is considered worse than inflation. In this scenario, people will hoard their money.

Disinflation

Remedying inflation by trying to do so at slower rates.

Inflation rate (%)

[(Y2-Y1)/Y1] × 100

Consumer Price Index (CPI)

A “market basket” including similar products. The CPI is set on a base year, whose value is 100. That value may change depending on the inflation rate.

(Price of market basket/Price in base year) x 100

Problems with the CPI

Substitution Bias: As prices increases, consumers may buy of some products and buy a product in a substitute not necessarily in that market basket. (CPI may be higher than shown.)

New Products: The market basket may not include the latest consumer goods. (CPI only measures prices.)

Product quality: The CPI disregards product quality. (CPI may not change, but economic well-being has.)

The Three Costs of Inflation

Menu costs: It costs money to change prices and print new menus.

Shoe leather costs: It costs time and effort to reduce any inflation.

Unit of account costs: Money’s value is now uncertain due to inflation. This decreases efficient spending.

Hyperinflation

A very sharp increase in the price levels of goods. This makes money useless.

GDP deflator

A measurement looking at the contrast between nominal and real GDP for a year.

(Nominal GDP/Real GDP) x 100.

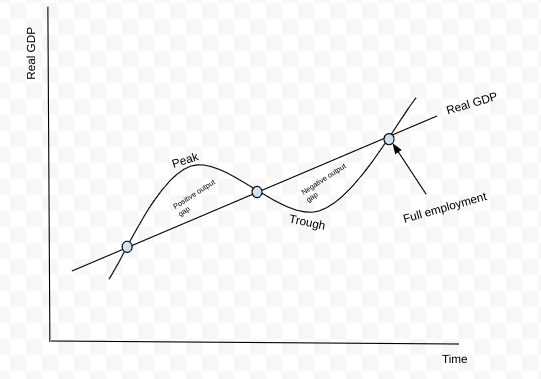

The Business Cycle

A graph that shows how the economy naturally fluctuates over time.

Positive output gap (inflationary)

When the current output is more than that of potential output. Represented when the curve is above the real GDP line.

Negative output gap (recessionary)

When the current output is less than that of potential output. Represented when the curve is below the real GDP line.

Recession

A generally six-month period of decline in real GDP.

Depression

An extreme recession that significantly lowers real GDP. It lasts more than a year.

Expansion

The upward sloping of the curve. It signals an improvement in the economy from the trough.

Contraction

The downward sloping of the curve. It signals the economy going into a downturn.