Chapter 4: Other costing techniques

1/25

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

26 Terms

There are two main types of costing system, describe them:

Specific order costing

Continuous costing

What type of costing is job costing? Explain it with some examples.

What type of costing is batch costing? Explain it with some examples.

What type of costing is service costing? Explain it with some examples.

What type of costing is process costing? Explain it with some examples.

describe costing in the public sector

What type of cost does process costing incur? What types of product does it produce?

What are joint products, what is an example?

What are by products, what is an example?

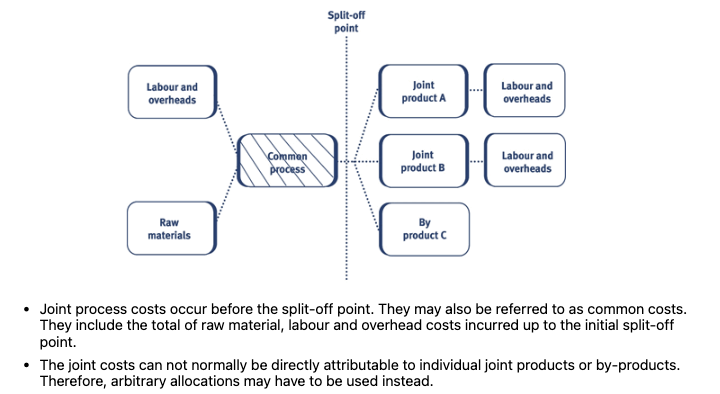

Where do joint/common process costs occur? What do they include? Why must arbitrary allocations be used?

Joint products are, by definition, subject to individual accounting procedures.

Joint costs will require apportionment between products for inventory valuation purposes. The main bases for appointment are as follows, explain them:

Physical measurement of joint products

Market value

Net realisable value

Explain the accounting for by-products (two main points)

What is throughput accounting?

What is the core formula?

What are some of the main assumptions?

What is its objective?

What are Total Factory Costs (TFC)?

🎯 What is Throughput Accounting?

Throughput Accounting is a management accounting method focused on maximising profit in the short term by focusing on bottlenecks and constraint-based decision-making.

Unlike marginal costing, it treats only one cost as truly variable:

📌 Core Formula

Throughput = Sales revenue – Direct material costs

🔹 Key term: Throughput Contribution

Same as above — it's the value generated by selling a product minus the raw materials used to make it.

📌 Assumptions Behind Throughput Accounting

Only direct material costs are variable.

These change directly with output (e.g. more raw wood if you make more chairs).

All other costs are treated as fixed in the short term.Direct labour is not variable.

Even if workers are paid per unit, they often have guaranteed hours or salaries, so their cost is fixed in the short run.All other costs (like rent, labour, electricity, admin, etc.) are lumped into one and called:

Total Factory Costs (TFC) or Operating Expenses.

🎯 Objective of Throughput Accounting

Maximise throughput contribution, in other words:

Maximise how much money you make per unit of limited resource (usually time at the bottleneck).

💡 Simple Example:

You make and sell wooden chairs.

Selling price per chair: £50

Direct material (wood, screws, glue): £15

Direct labour: £10 (but treated as fixed under throughput)

Factory rent and wages: £5,000/month

🔹 Step 1: Calculate Throughput per Unit

Throughput per unit = £50 – £15 = £35

This £35 must now cover all fixed costs (labour, rent, overhead) and then generate profit.

⏳ Where it becomes powerful — Focus on the Bottleneck

Let’s say the bottleneck is a cutting machine with 100 hours available per month, and it takes:

Chair A: 1 hour

Chair B: 2 hours

Both give throughput of £35 per unit

Then:

Chair A → £35 per hour

Chair B → £17.50 per hour

➡ You should produce Chair A first, because it generates more throughput per hour of the bottleneck.

How is investment defined in terms of throughput accounting? What does it include?

In throughput accounting, investment refers to all the money tied up in assets that are used to generate throughput. This includes both current and some non-current assets.

🧾 Investment includes:

Raw materials

→ Bought but not yet usedWork-in-progress (WIP)

→ Partially completed goods still in productionFinished goods

→ Products made but not yet soldNon-current assets (when used for creating throughput)

→ E.g. machinery, buildings, or R&D linked to production

🧠 Key Idea:

Investment = everything the business has spent money on to enable it to make and sell products

→ It’s the money tied up in the system

💡 Simple Example:

Let’s say a business has:

£5,000 in unused raw materials

£3,000 in WIP

£4,000 in unsold finished goods

£20,000 in machines used to produce goods

➡ Total investment = £32,000

This figure is important when assessing how efficiently a business converts investment into profit through throughput.

How are operating expenses defined in terms of throughput accounting? What are some alternative terms? What is included in operating expenses?

⚙ Operating Expenses – Definition (Throughput Accounting)

Operating expenses are all the money a business spends to turn inventory into throughput — i.e., to produce and sell its goods or services.

💡 Key Points:

❌ Don’t think of them strictly as fixed costs.

✅ Think of them as "not totally variable" — meaning they don't change directly with each unit produced, but they do exist regardless of activity.

🔁 Alternative Terms:

Total factory costs

Conversion costs

These terms are often used interchangeably with operating expenses in a throughput environment.

🧾 What’s included in Operating Expenses?

Labour costs (salaries, wages, supervisors)

Rent

Equipment running costs

Utility bills (not directly tied to unit volume)

Selling and admin costs (where related to production/sales effort)

💡 Simple Example:

Let’s say in one month, a business has:

£10,000 staff wages

£3,000 rent

£2,000 on utilities

£1,000 machine maintenance

➡ Operating expenses = £16,000

These costs exist to turn raw materials into sold products, regardless of whether 100 or 1,000 units are made.

🧠 In Throughput Accounting:

Only direct material costs are variable.

Everything else = operating expenses.

The goal is to maximise throughput contribution to cover these operating expenses and generate profit.

What two key impacts does throughput accounting have on the management accounting system?

How is inventory values under throughput accounting?

Complete the sentence:

If the business has more capacity than there is customer demand, it should…..

If the business has a constraint that prevents it from meeting customer demand in full, it should……

Explain what a bottleneck is.

🎯 Goal of Throughput Accounting

The main aim is to:

Maximise throughput contribution (i.e. Sales – Direct Material Costs)

...assuming fixed costs don't change in the short term, so they don’t affect the production decision directly.

✅ Two Scenarios for Production Decisions: 1. If Capacity > Demand

The business should simply produce enough to meet customer demand.

No need to prioritise; just deliver what's required.

2. If Demand > Capacity (i.e. a Constraint Exists)

The business must prioritise how it uses its limited resources.

Specifically, focus on:

Producing the products that generate the highest throughput per unit of the constrained resource

(e.g. the most throughput per bottleneck hour).

🔧 What Is a Bottleneck?

A bottleneck is the limiting factor in production.

It could be:

A machine with limited output capacity

Limited labour hours

A process step that takes the longest

🧠 Throughput Accounting focuses on managing the bottleneck because it controls how much money the company can make.

🛠 How to Manage Bottlenecks:

Identify the bottleneck

Maximise its use – keep it running constantly

Schedule all other resources to support the bottleneck

Don’t let non-bottleneck areas overproduce!

Only produce what the bottleneck can absorb

💡 Simple Example:

Let’s say:

Machine A (cutting) = 100 chairs/hour

Machine B (painting) = only 50 chairs/hour

→ Machine B is the bottleneck

You can only sell 50 chairs/hour no matter how fast Machine A is.

🔹 So: Focus on maximising value per hour on Machine B

→ Prioritise the products that earn the most throughput per painting hour.

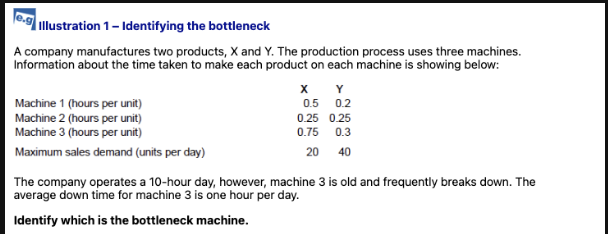

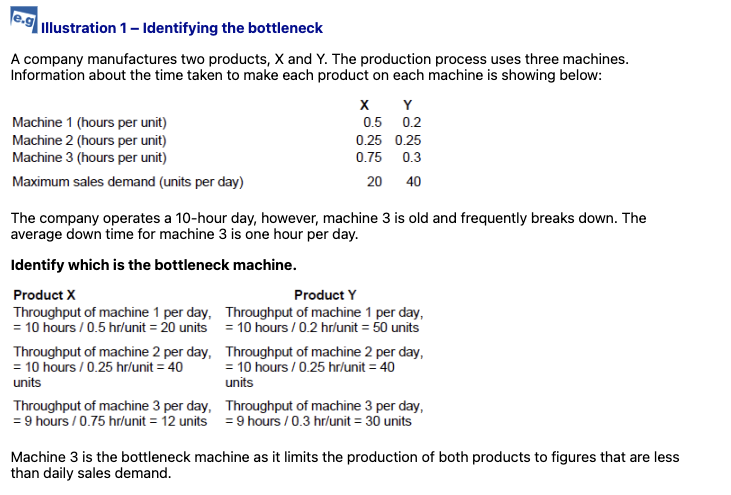

Bottleneck example

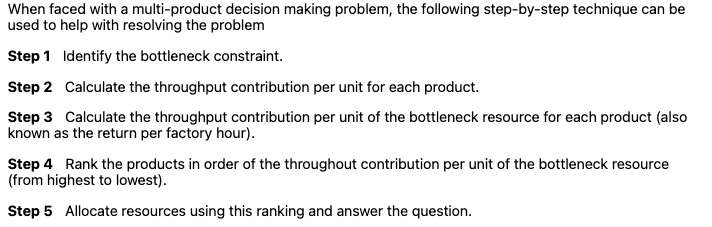

When faced with a multi-product decision making problem, what is the step-by-step technique that can be used to help with resolving the problem (5 steps)

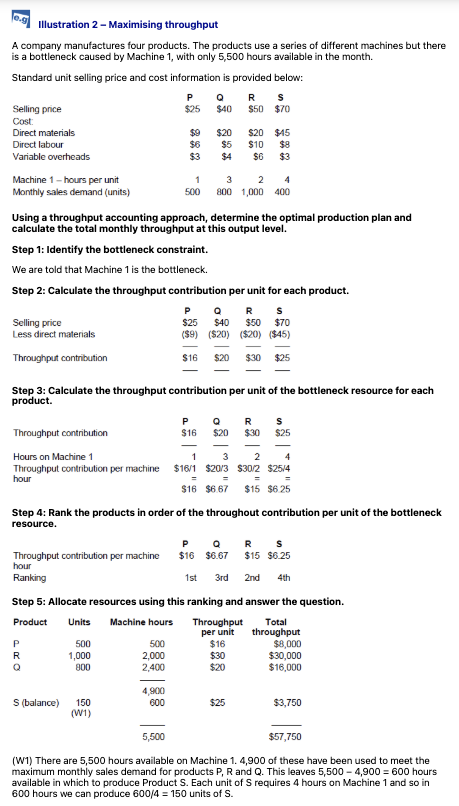

Multi product decision making example

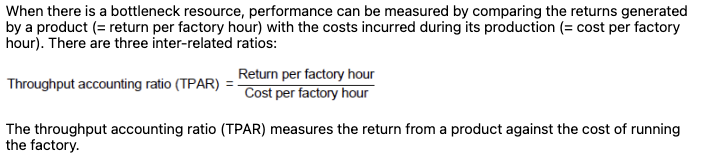

What is the formula for throughput accounting ratio, what does it show?

🔍 What does it measure?

TPAR shows how much return (throughput) a product generates per hour of the bottleneck resource, compared to how much that hour costs to run.

It's a measure of efficiency at the constraint.

🎯 Interpretation:

TPAR > 1 → the product generates more return than it costs to produce → ✅ profitable

TPAR < 1 → the cost of the bottleneck exceeds the return → ❌ not profitable under current setup

💡 Example: Product Details:

Selling price: £60

Direct material cost: £20

Bottleneck time per unit: 2 hours

Total factory costs: £24,000

Available bottleneck time: 3,000 hours

Step 1: Throughput per unit

= £60 – £20 = £40

Step 2: Return per factory hour

= £40 ÷ 2 hours = £20/hour

Step 3: Cost per factory hour

= £24,000 ÷ 3,000 hours = £8/hour

Step 4: TPAR

= £20 ÷ £8 = 2.5

✅ This product is profitable — it generates £2.50 for every £1 spent on the bottleneck resource.

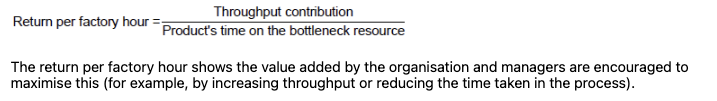

How do you calculate return per factory hour? What does it show?

💡 What does it mean?

This tells you how much value (i.e. throughput contribution) you earn for each hour spent using the constrained resource (the bottleneck).

It’s used to:

Compare products competing for limited bottleneck time

Prioritise production of the most profitable items per hour

🎯 Management Goal:

Maximise return per factory hour by:

Increasing throughput (e.g. raise selling price, lower material cost)

Reducing time spent on the bottleneck resource (e.g. faster process, automation)

📌 Example:

Throughput contribution per unit = £30

Time per unit on bottleneck = 1.5 hours

Return per factory hour = £30 ÷ 1.5 = £20 per hour

If another product gives £25 per hour, you'd prioritise that product instead.

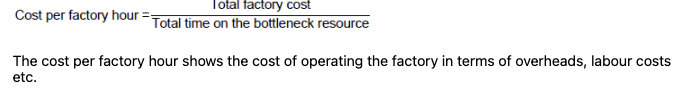

How do you calculate cost per factory hour? What does it show?

💡 What does it mean?

It tells you how much it costs the business per hour to operate the factory — based on the time available on the bottleneck resource.

Think of it as the "hourly cost of your constraint", including:

Overheads

Labour

Rent

Maintenance

Admin costs (if factory-related)

🔍 Why it matters:

Used in the Throughput Accounting Ratio (TPAR):

TPAR = Return per factory hour ÷ Cost per factory hour

If TPAR > 1 → return exceeds cost

If TPAR < 1 → product is not covering its share of factory costs

A criticism of throughput accounting is that it concentrates on the short term, when a business has a fixed supply of resources and operating expenses are largely fixed. Elaborate on this point