Chapter 2: The Balance Sheet

5.0(1)

5.0(1)

Card Sorting

1/31

Last updated 11:31 PM on 12/10/22

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

32 Terms

1

New cards

Assets, liabilities, and stockholders' equity

The three categories you find on the Balance Sheet are:

2

New cards

Debt financing

__________ is the money and loans that a business borrows from banks and must repay in the future.

3

New cards

Equity financing

__________ is raising money by selling shares to stockholders or investors.

4

New cards

Assets

A business will invest in __________ to benefit the company.

5

New cards

Activities

Companies must document all __________, which includes loans, purchases, sales, and returns.

6

New cards

give and a get

A transaction or exchange must always include a(n) __________.

7

New cards

Cost principle

By having a designated dollar amount (ex: American dollar), you are following the __________.

8

New cards

External exchanges

__________ happen between a company and someone, like selling a product to a customer.

9

New cards

Internal events

__________ involve utilizing assets to create another asset, like a product to sell to get cash.

10

New cards

accounting cycle

The __________ is used to report the financial information of a company.

11

New cards

transaction

A(n) __________ is an activity that occurs between at least two people.

12

New cards

Analyze

Record

Summarize

Prepare a Trial Balance

Report Financial Statements

Record

Summarize

Prepare a Trial Balance

Report Financial Statements

The order of the accounting cycle is:

13

New cards

duality of effects

When a transaction has two effects on the accounting equation, this is called __________.

14

New cards

account titles

Assets, liabilities, and stockholders' equity all have a variety of __________.

15

New cards

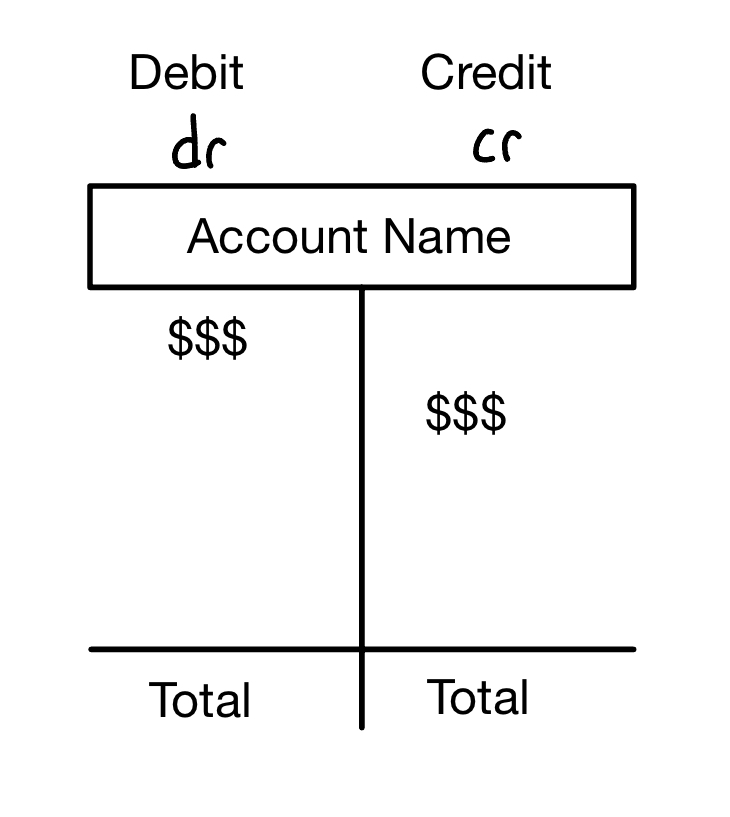

T-accounts

Ledger accounts, aka __________ summarize information from the journal entries.

16

New cards

debit credit framework

The __________ is used when making journal entries, which shows how transactions effect accounts. Where you write the total depends on if the account has a normal credit or debit balance.

17

New cards

normal balance

The __________ of an account is the side that makes the account increase.

18

New cards

debit

An has a normal __________ balance.

19

New cards

credit

Liabilities and Stockholders' Equity have a normal __________ balance.

20

New cards

The date of the transaction

The account name

Debits

Credits

The account name

Debits

Credits

A journal entry includes:

21

New cards

Journal entries

__________ are created to record financial effects and can have multiple entries listed by the date transactions occurred.

22

New cards

trial balance

After journal entries, a __________ is created to total up debits and credits of all accounts and to make sure debits = credits.

23

New cards

classified balance sheet

After creating a trial balance sheet, the __________ is created.

24

New cards

Current assets

__________, also known as short term assets, will be used or sold within a year.

25

New cards

Non-current assets

__________, also known as long term assets, will not be used or sold within the year.

26

New cards

Current liabilities

__________, also known as short term liabilities, will be due and repaid within one year.

27

New cards

Non-current liabilities

__________, also known as long term liabilities, will be paid after a year or more.

28

New cards

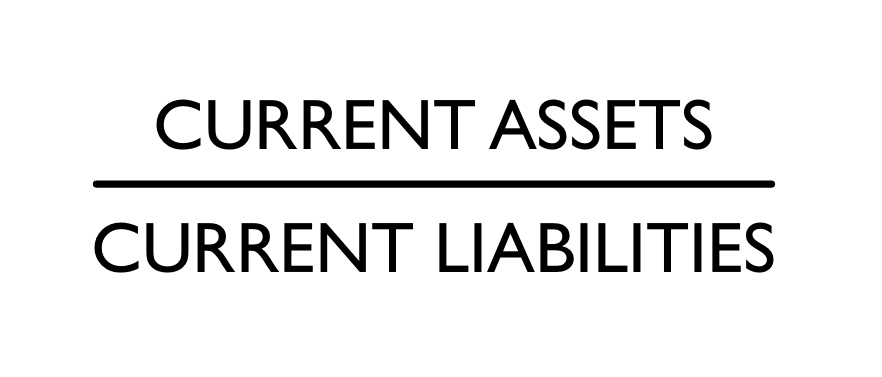

current ratio

The __________ provides information on a company's ability to pay. You want more assets than liabilities.

29

New cards

\

Equation to calculate the Current Ratio:

30

New cards

higher

When the current ratio is __________, that indicates a better ability to pay.

31

New cards

What is and is not reported on the balance sheet

The cost amounts assigned to the recorded items

The cost amounts assigned to the recorded items

The process of recording and reporting transactions has an effect on:

32

New cards

cost principle

When first recorded, assets and liabilities are recorded at initial cost, which follows the __________.