The Income Statement (Sections 2.1 - 2.3)

1/27

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

28 Terms

Define “income statement.”

A financial report that depicts the operating performance of a company (i.e. revenues less expenses generated — profitability) over a specific period of time (typically a quarter or a year).

(Slide 54 / 315)

Net revenue

Total dollar payment for goods and services that are credited to an income statement over a particular time period.

(Slide 55 / 315)

Cost of Goods Sold (COGS)

Represents a company’s direct cost of manufacture (for manufacturers) or procurement (for merchandisers) of a good or service that the company sells to generate revenue.

(Slide 55 / 315)

⭐️ Gross Profit

Gross Profit = Revenues - COGS

Gross Profit Margin

GRM = (Gross Profit / Revenue) x 100

Selling, General, & Administrative (SG&A)

Operating costs not directly associated with the production or procurement of the product or service that the company sells to generate revenue. Payroll, wages, commissions, meal and travel expenses, stationery, advertising, and marketing expenses fall under this line item.

(Slide 55 / 315)

Research & Development (R&D)

A company’s activities that are directed at developing new products or procedures.

(Slide 55 / 315)

⭐️ EBITDA (Earnings before interest, taxes, depreciation & amortization)

EBITDA = Gross Profit - SG&A - R&D

(Slide 56 / 315)

Depreciation & Amortization (D&A)

The allocation of cost over a fixed asset’s useful life in order to match the timing of the cost of the asset with when it is expected to generate revenue benefits.

(Slide 56 / 315)

Other Operating Expenses/Income

Any operating expenses not allocated to COGS, SG&A, R&D, and D&A.

(Slide 56 / 315)

⭐️ Operating Profit (EBIT)

EBIT = EBITDA - D&A

(Slide 56 / 315)

Interest Expense

The amount the company has to pay on debt owed. This could be to bondholders or to banks.

EBT = EBIT - Interest Expense

(Slide 56 / 315)

Interest Income

A company’s income from its cash holdings and investments (stocks, bonds, and savings accounts).

(Slide 57 / 315)

Non-operating items

Items peripheral to core operations. Includes gains/losses on investments and reevaluation of certain financial assets and debt obligations.

(Slide 57 / 315)

Income Tax Expense

The tax liability a company reports on the income statement.

(Slide 57 / 315)

Net Income

Net Income = EBIT - Net Interest Expense - Other Non-operating Income - Taxes

(Slide 57 / 315)

Basic Earnings Per Share (EPS)

EPS = Net Income ÷ Basic Weighted Average Shares Outstanding

(Slide 57 / 315)

Diluted EPS

Diluted EPS = Net Income ÷ Diluted Weighted Average Shares Outstanding

(Slide 57 / 315)

Define “revenue.”

Revenue represents proceeds from the sale of goods and services produced or offered by a company.

(Slide 58 / 315)

What are some examples of income that isn’t considered as revenue?

Interest income earned from investments (recorded as non-operating income on the IS)

Income received from a legal settlement (if material, identified as a separate line item on the IS below revenue) or netted against operating expenses

Literal cash (under accrual accounting, receiving cash in and of itself doesn’t constitute revenue)

(Slides 59-61 / 315)

According to revenue recognition principle, a company cannot record revenue until __________ — that is, until that order is shipped to a customer and collection from that customer, who used a credit card, is __________.

it is earned ; reasonably assured

(Slide 62 / 315)

For sales of bundled products, companies should __________ to each of the bundled products.

Ex. Apple’s bundled products

Apple sells their iPhone for $499.

Apple estimates the standalone selling price for the unspecified software upgrade rights implicit when a customer buys an iPhone to be $25.

Apple immediately recognizes the remainder of the sales price ($499 - $25).

Apple recognizes the remaining $25 in revenue ____________.

assign individual values ; evenly over several years

(Slide 64 / 315)

For long-term projects, companies can recognize revenue through either 1) ___________ or 2) ____________.

Method 1: Revenues are recognized on the ____________.

Method 2: Rarely used in the U.S., this method allows revenue recognition only ___________.

Percentage of Completion Method ; Completed Contract Method ; basis of the percentage of total work completed during the accounting period (i.e. recognized throughout the period of completion) ; once the entire project has been completed

(Slide 65 / 315)

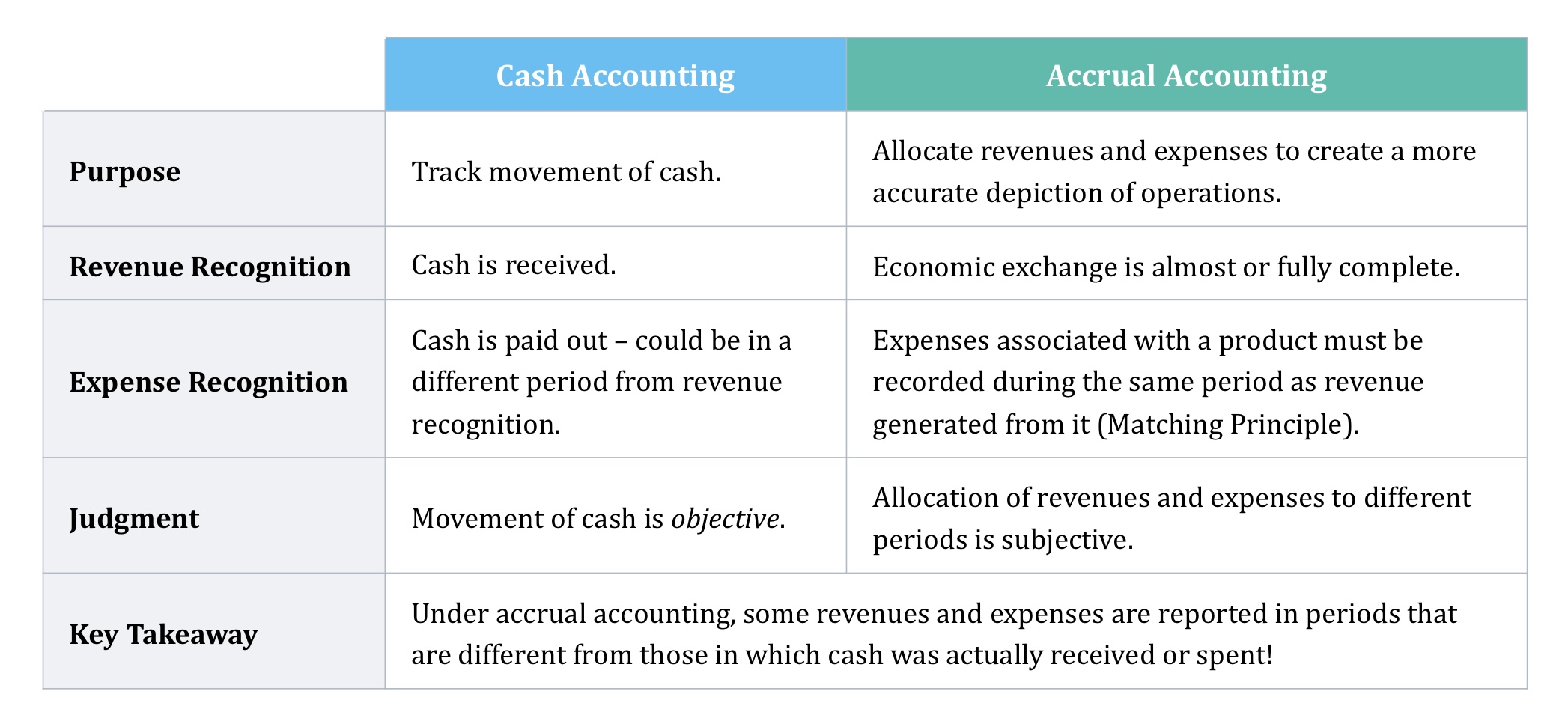

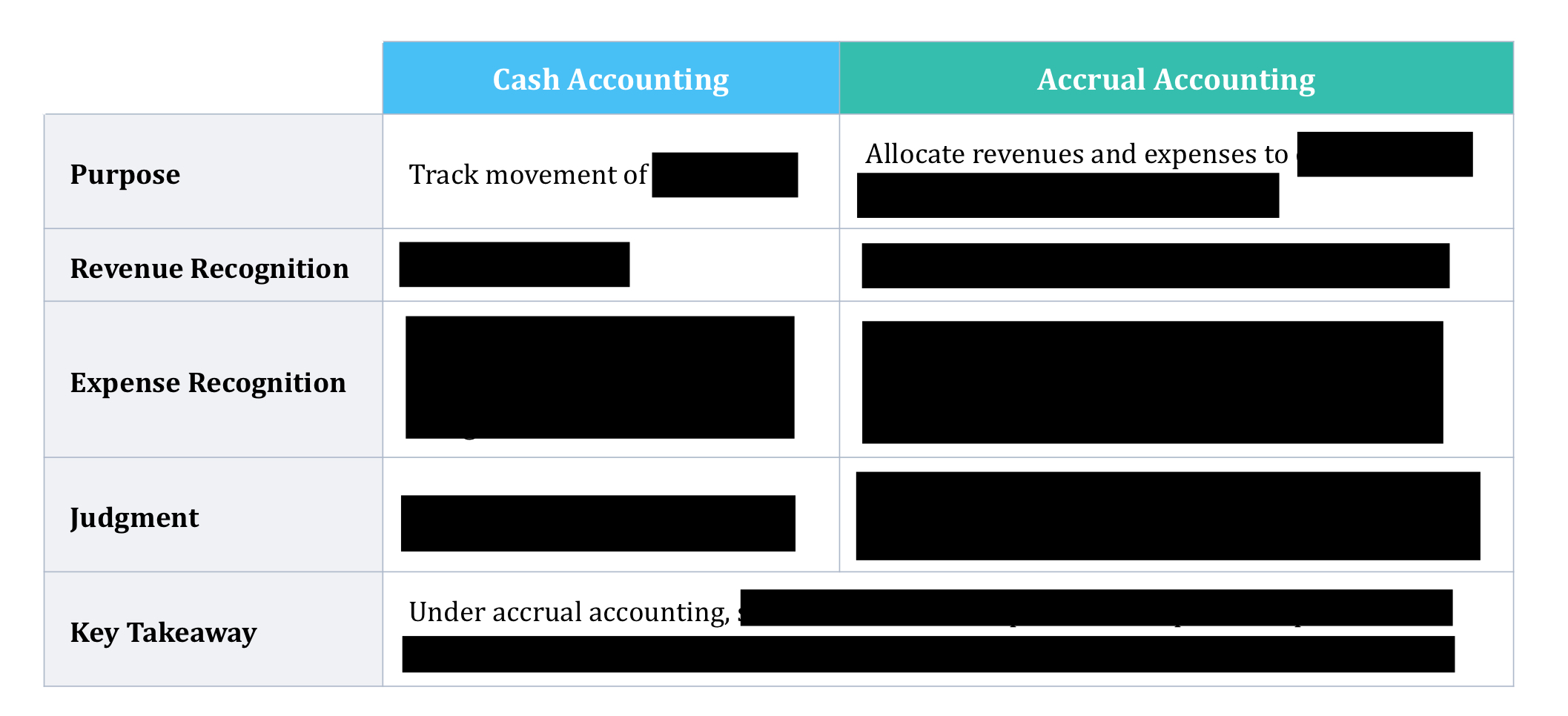

⭐️ Under accrual accounting, revenues are recognized and recorded when ____________ occurs, while expenses are recognized when ____________, not necessarily when ____________.

an economic exchange occurs ; the associated revenues are recognized ; cash is exchanged

(Slide 70 / 315)

What would happen if we just recognized expenses when they are incurred like revenue (i.e. why do we use accrual accounting and not cash accounting)?

By matching costs with revenues, the accrual concept strives to more accurately depict a company’s operating results (i.e. shows a more accurate picture of the company’s profitability).

Ex. If Boeing reported material costs when they were acquired on financial statements, it would show a company with high costs and no revenues (when we know that the materials will be used to manufacture planes that will earn revenue in the future).

(Slide 72 / 315)

What is the main disadvantage of accrual accounting?

Analysts cannot track objectively the movement of cash (i.e. the opposite of cash accounting).

Because of accrual accounting, revenue recognition can be ___________. This “wiggle room” creates potential for __________ in the form of ___________. Be suspicious of “shenanigans” in the 10-K footnotes.

subjective ; manipulation ; shifting revenues from one period to another

(Slide 77 / 315)