SUPA Econ Chapter 9 (Market Power/Failure and General Equilibrium)

1/80

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

81 Terms

Review Nice Assumption

No Market Power (Individuals have equal access to information and the market) | No Market Failure (Markets form quickly when needed and function quickly and effectively)

Consequences of Relaxing No Market Power

Market Power reduces efficiency two ways: Those with power have little incentive to exert themselves in the market competition, they have the power to “win” anyway. Those without power have little incentive to exert themselves because, try as they might, they are going to “lose” anyway (so they won’t get as good as they could be) Market power prevents Pareto Optimality (the state at which resources in a given system are optimized in a way that one dimension cannot improve without a second worsening.)

Consequences of Relaxing No Market Power 2

Market Power affects equity. Those with power get a bigger share of the social product (the pie) … that’s what they “win” Those without power get a smaller share of the social product (pie) … that’s what they “lose” Whether this is more or less “just” is a moral, not an economics question. But there is a redistribution, so equity is clearly affected. Very hard to solve (certainly not easily or efficiently): Can’t just be policed or exposed (civil rights)

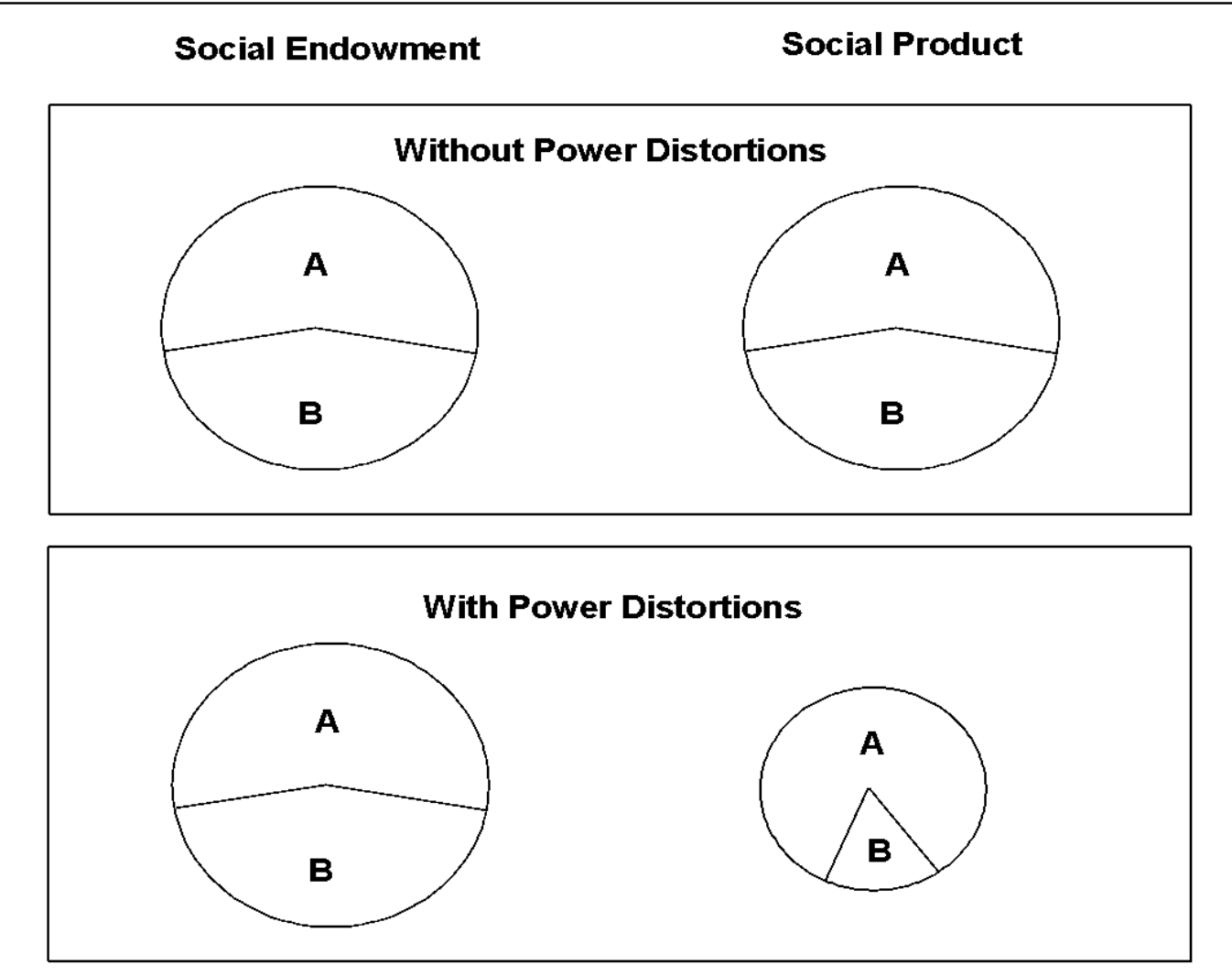

Distribution of Society’s Endowment and Distribution of Society’s Product With and Without Power Distortions

If A has Market Power, the pie is smaller, but A has a larger share

Exercising Market Power

Exercising market power is not productive. It is exploiting an advantage that you have over the market. If you have it, it is wonderful. There are costs, though. Smaller piece for others. Makes the system less efficient

Market Power vs. Just being better

Remember, Market Power is more than just being better than the other companies. It’s creating a barrier that others can’t duplicate or use (patents, steroids, etc.) Normally, “[u]sing the most effective technology to get ahead is exercising your creativity in pursuit of profit. The advantage can’t last because there are no barriers to entry. Others will figure out what you’re doing and mimic your process. To sustain your profit you have to be continuously creative. Profit-seeking is beneficial to the economy. It encourages innovation.” (Prof. Evensky)

Monopoly

A single seller controls the supply side (ex. Google)

Monopsony

A single buyer/employer controls the demand side (ex. coal mining town)

Oligopoly

collusion among a few sellers sharing control of the supply side as long as none of the colluders cheat. (ex. smartphone market dominated by companies like Apple and Samsung)

Oligopsony

collusion among a few buyers sharing control of the demand side so as long as none of the colluders cheat (ex. The fast-food industry. A small number of large buyers including McDonald's, Burger King, and Wendy's buys a huge amount of the meat produced by American ranchers.)

Sources of Market Power

Naturally Occurring Market Power and Artificially Created Market Power

Naturally Occurring Market Power

Naturally occurring market power does NOT come from distortions in the market process. They just happen.

___________ can create naturally occurring market power

Economies of scale

Changing Scale

changing the level of all inputs at once (e.g., doubling the number of workers, and the size of the factory, and the resources used, …)

If __________ significantly lowers the cost structure this represents economies of scale

increasing scale

Returns to Scale (sometimes called this)

If increasing scale significantly lowers the cost structure, then a BIG company can charge a very low price (and still make a profit [not a loss]). Competitors at a smaller scale and a higher cost structure can’t compete on price, so they can’t compete at all (ex. ?) … (and can be a barrier to entry.)

Another source of naturally occurring market power is

giftedness

Some gifts are ________ than others, and some of these enjoy a __________ than others.

more marketable, much larger market

To the degree you have a marketable gift that others don’t…

they can’t compete with you

Naturally Occurring Market Power- Labor Market Examples

Elasticity of input substitution for the gift he or she brings to the market. Own price elasticity of demand for the product his/her factors and gift are supplying in the product market.

What could go wrong with gifts?

Market tastes change. Substitutes emerge Gifts diminish with age.

Social norms can

help one group maintain market power over another

Social constructs and economic consequences

a nexus/connection between the social sciences

Rent generating power can come from

social or political institutions (or both)

The return to market power is called a

"rent”

The term “rent” here harkens back to Adam Smith’s assertion in The Wealth of Nations that…

“landlords, like all other men, love to reap where they never sowed, and demand a rend even for its (the land’s) natural produce.”

As Smith uses the term, rent is not a return to the landlord’s productive contribution

It is a return to the landlord’s power over the land, and thus his ability to demand a share of the product that comes from that naturally productive land: a rent

Following this usage, in modern economics,

rent is a return, not to a productive contribuion, but to market power

How can you tell if a return is a rent?

Like profit, rent is a return beyond opportunity cost (beyond a normal return) But unlike profit, one who enjoys a rent as long as one has the power to eliminate competitors

How can you tell if a “distributive share” is a rent?

If you can take a “share” away without changing incentives in the market…it’s a rent. For example, ceteris paribus (independent of wealth effects), if you cut pro athletes’ salaries in half, most would continue in their current roles because, thanks to their gifts, they earn far beyond a normal return on their labor and human capital, far more than their opportunity cost. They enjoy a rent.

Artificially Created Market Power

Not all market power comes “naturally”. Sometimes, people “get”/seek market power.

Why would someone seek market power?

Because it pays a rent

Seeking market power for the rent it returns is appropriately called

“rent seeking” (coined by Anne Kruger in an American Economic Review article Vol. 64, No. 3, Jun., 1974)

A complementary term is

“rent maintenance”

Using resources in pursuit of a power advantage (ex. Lobbyists) is

rent seeking

Using resources to sustain a power advantage (ex. Donations to Congress) is

rent-maintenance

A key distinction between naturally occurring market power and artificially created market power is:

The former is a free gift of nature. The latter requires using resources to get or maintain the market power advantage and can be created by gov’t or group action (Examples: Unions, Patents, or Insider Trading)

The fact that seeking or maintaining artificially created market power requires

using resources adds to the inefficiency of market power

Naturally occurring market power causes disincentives that lead to inefficiency:

Society loses some of the energy, creativity and imagination of those on the “upside” of power because they think: “Why try so hard? I’ll ‘win’ anyway”. Society loses some of the energy, creativity, and imagination of those on the “downside” of power because they think: “Why try so hard? I’ll ‘lose’ anyway.”

So potentially productive resources are used to

produce nothing but power

Artificial market power can be created through…

political institutions, but social institutions can also factor into our perceptions of what is appropriate for certain genders or racces

Not only may social forces alter your own perceptions about what you may become,

they may also affect those who hire/admit you. This is a powerful, yet almost invisible constraint that yields artificial market power for the privileged

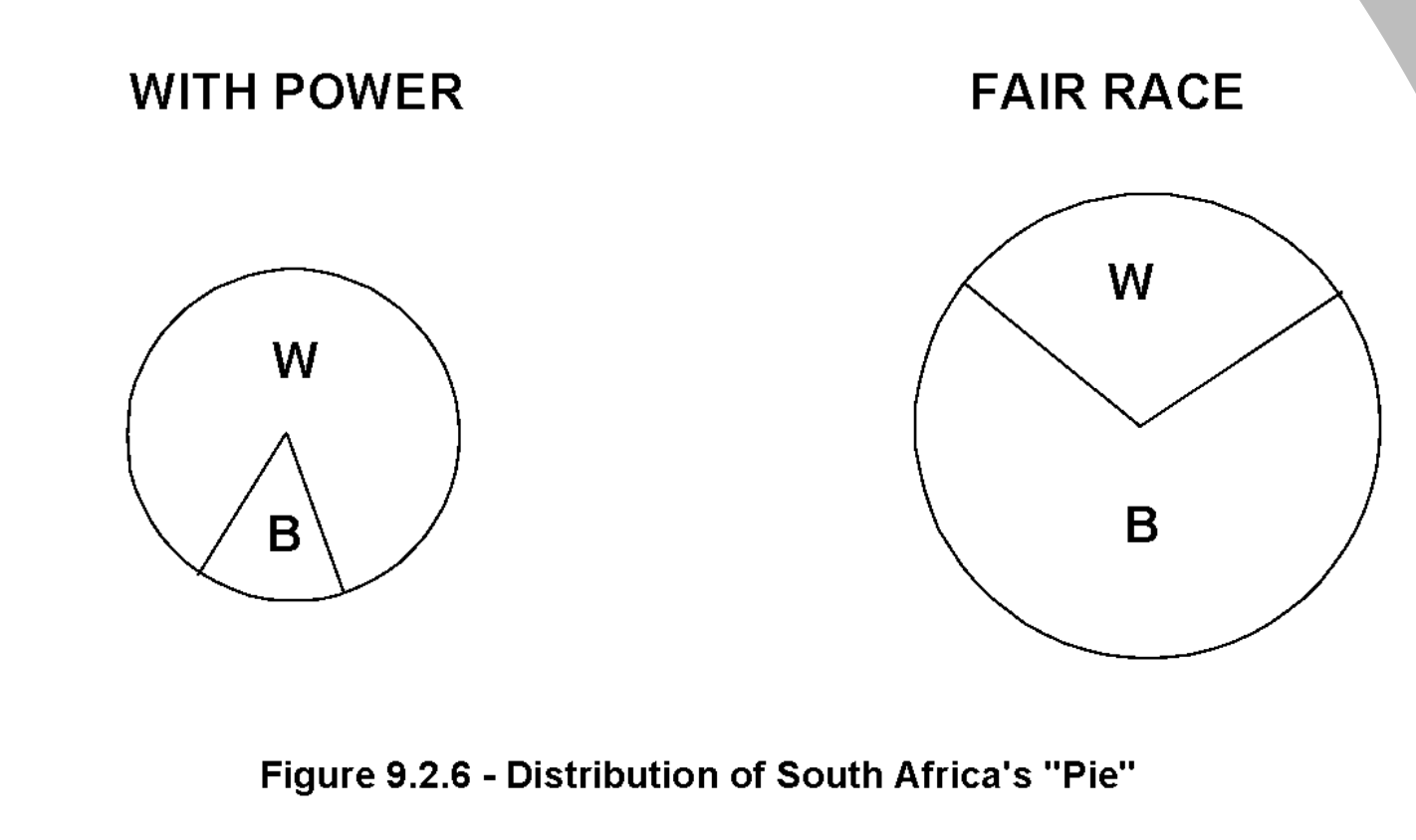

In Lize Venter’s South Africa, resources that could have been used to nurture people building schools, hospitals, and so on …went instead to buying bullets, batons, and police vehicles …in order to oppress people

so that the white minority could maintain power and enjoy huge rents

What did the white community gain from its power?

A larger share of a smaller pie. Their gain was at the greater society’s expense

Women’s Sphere and Men’s Sphere (Historically)

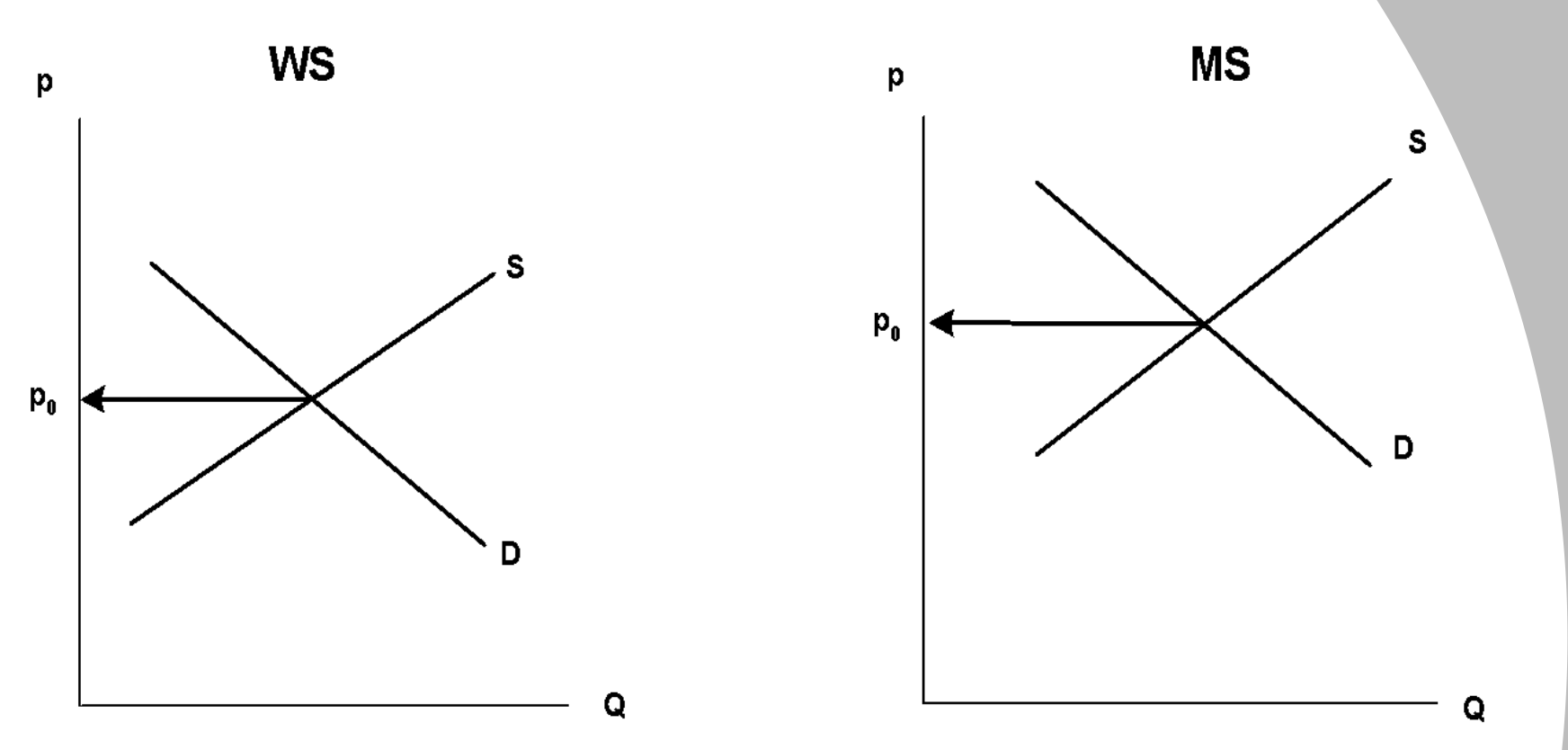

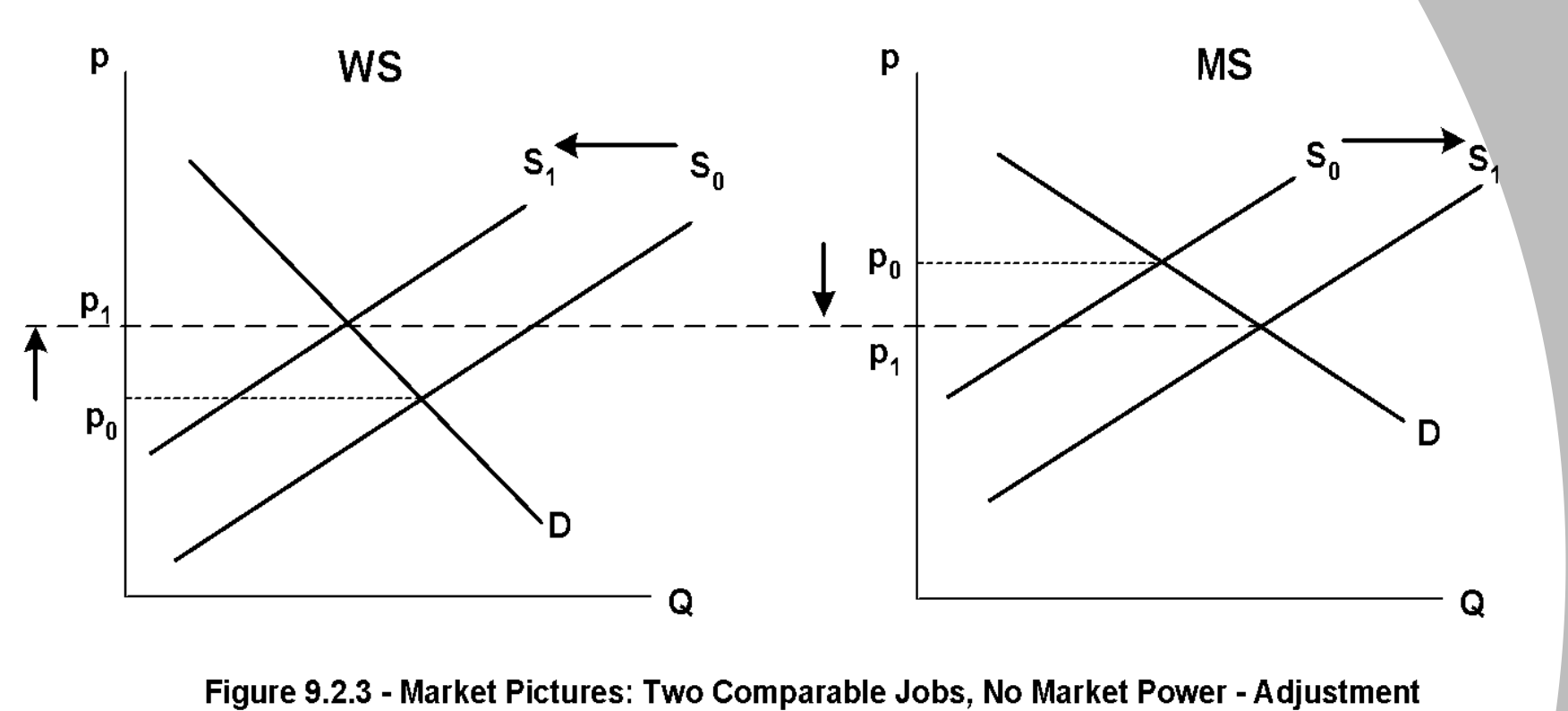

We see this because we have relaxed our nice assumptions of “no market power", where we presumed that everyone had equal access to markets.

When there is more artificial market power,

the market is less efficient. Pareto Optimality has Not been reached.

Women leave the lower paying jobs to enter the higher paying fields formerly dominated by men. As a result, supply drops for the ‘Women’s sphere’ (WS) jobs. and increase for the jobs in the ‘Men’s sphere’ (MS). This continues until the wages start to balance our at P1.

Market Power can be used to

prevent competitors from entering a market, Therefore, exercising that Market Power (and keeping others out) allows those with power to make Rent

Rent is the

reward for market power, but it makes the market less efficient

If the market doesn’t form, or can’t coordinate well,

we have a case of market failure

A “pure”public good is

Non-excludable, provide it to anyone and you are providing it to everyone because no one can be excluded, non-rivalry (aka Shared Consumption), however much you provide to anyone is available to everyone…you can’t control the size of the shares. (ex; National Defense, PBS, NPR)

Problem of Public Goods

Since a public good is non-excludable and non-partitionable, Once it’s provided to anyone, everyone else gets to enjoy all its benefits without having to pay for it, so it leads to a Free Rider Problem

Can more than one person enjoy it at the same time? (No)

If one person consumes, consumption by others is limited

Can more than one person enjoy it at the same time? (Yes)

Multiple people can enjoy and not detract from the consumption of others

Can people (non-payers) be kept out? (No)

If provided, no one can be excluded - all get it

Can people (non-payers) be kept out? (Yes)

People can be excluded

Free Rider Problem

The initial provider bears the full burden of the cost and no one else has to contribute since they can “ride along for free”. No private individual or firm is going to provide under this condition… so even if it’s good for the public the market won’t meet that need

Externalities

A positive or negative effect of a private activity on nominally uninvolved individuals.

Externalities are a

cost or benefit that private individuals or firms don’t take into account when making their activity decisions

Externalities are

external to the concerns of these private factors and, therefore, not a part of their considerations as they make choices

Externality examples

Positive - Nice music in the park | Negative - Second hand smoke

Source of the Externality Problem

Failure to assign or enforce property rights

Externality Analysis

A firm which pollutes has a consequence to others, but its effect is external to its own assessment of the cost of the activities. No market forms…and so no market coordination signal is generated (missing signal is the price)

Externality as Market Failure

Due to a failure to define or enforce property rights, no market forms, and so no price signal is generated to coordinated choice, no way to quantify the external effects of the activity

Since private individuals or firms only consider their own private costs, or benefits when making decisions

The presence or an externality means they don’t take into consideration the full costs or benefits of their choices on society

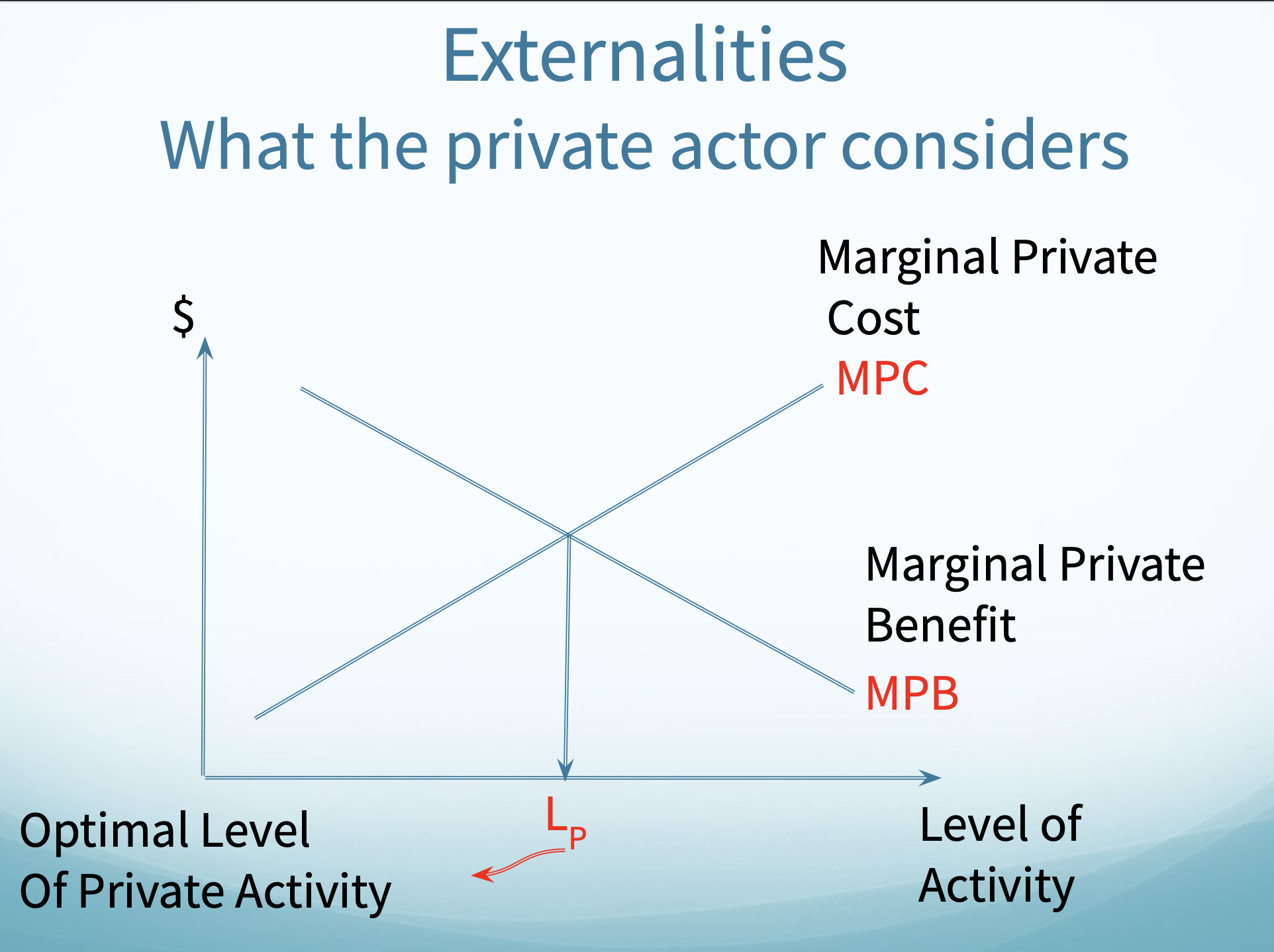

Externality Graph

MPC = Marginal Private Cost; MPB = Marginal Private Benefit; Lp = Optimal Level of Private Activity

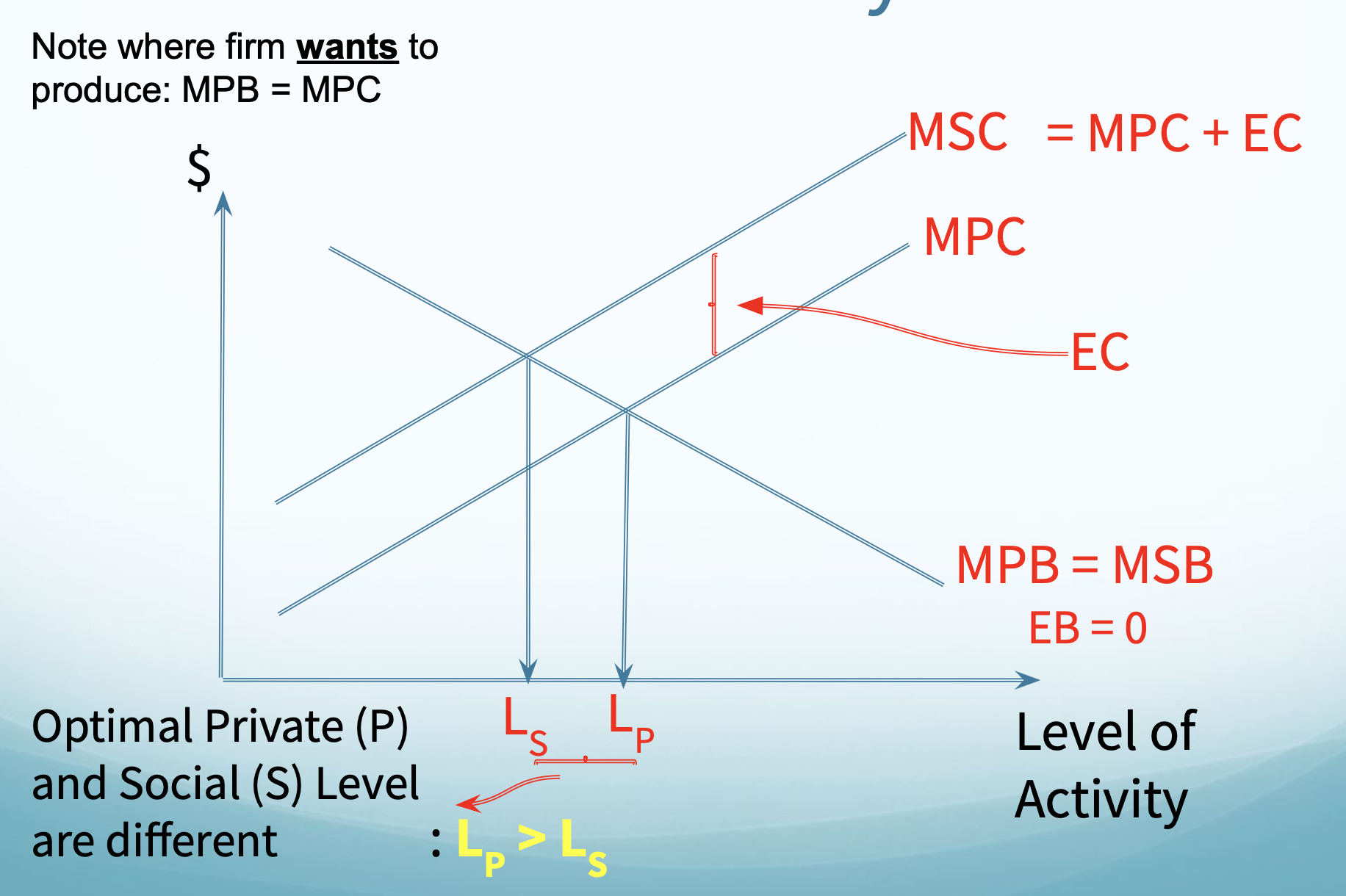

Negative Externalities create

external costs

External Costs

Are social costs that the individual or firm doesn’t take into account, so they are external to the individual’s or the firm’s decision making

When private individuals or firms ignore the full effect of their behavior, not taking externalities into account…

their private calculations understate the full impact of their choices on society

To measure the full social effect of each successive unit of an activity

we add the external effect to the private effect

For Negative Externalities

Marginal Social Cost: MSC = MPC + (M)EC

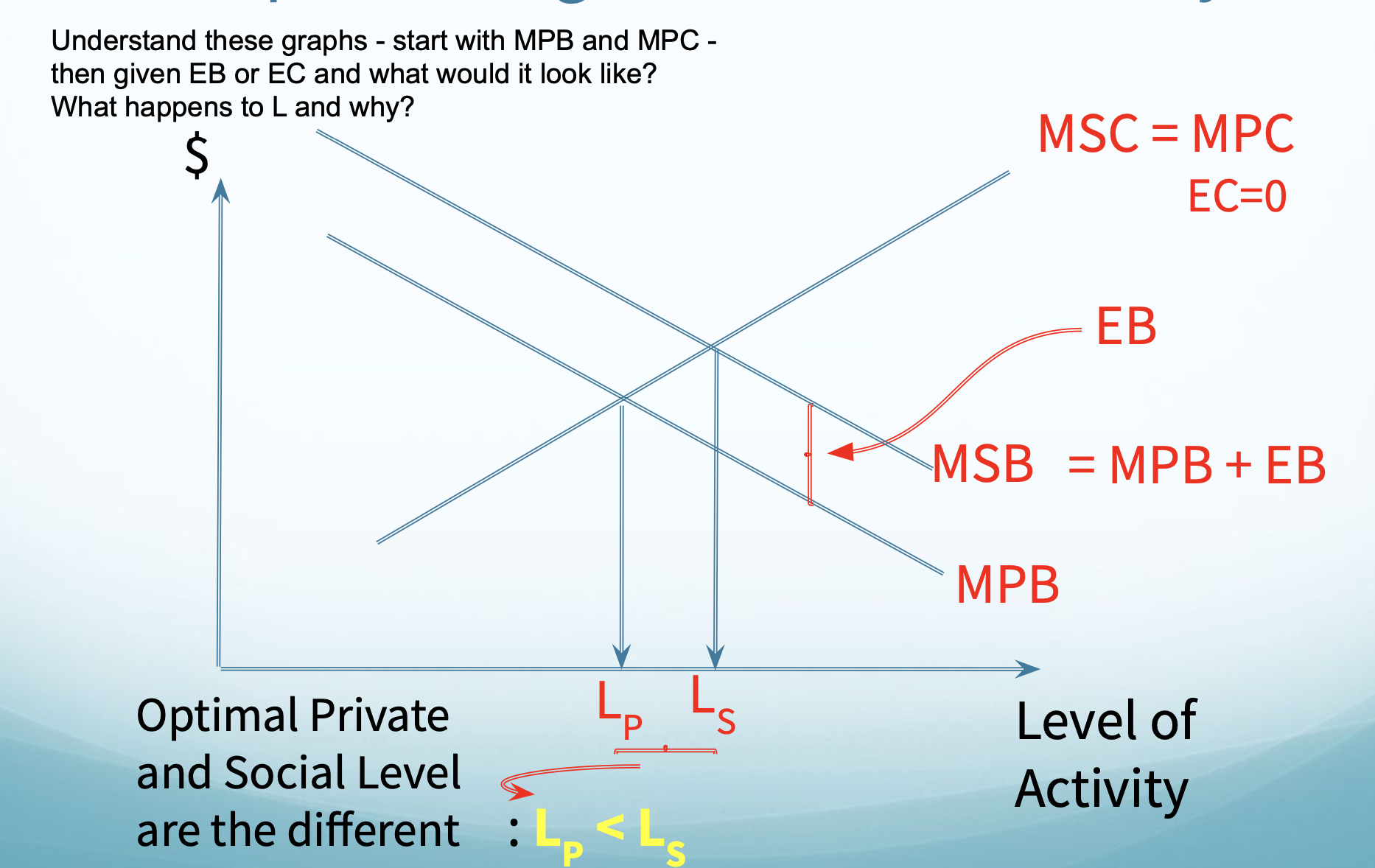

For Positive Externalities

Marginal Social Benefit: MSB = MPB + (M)EB

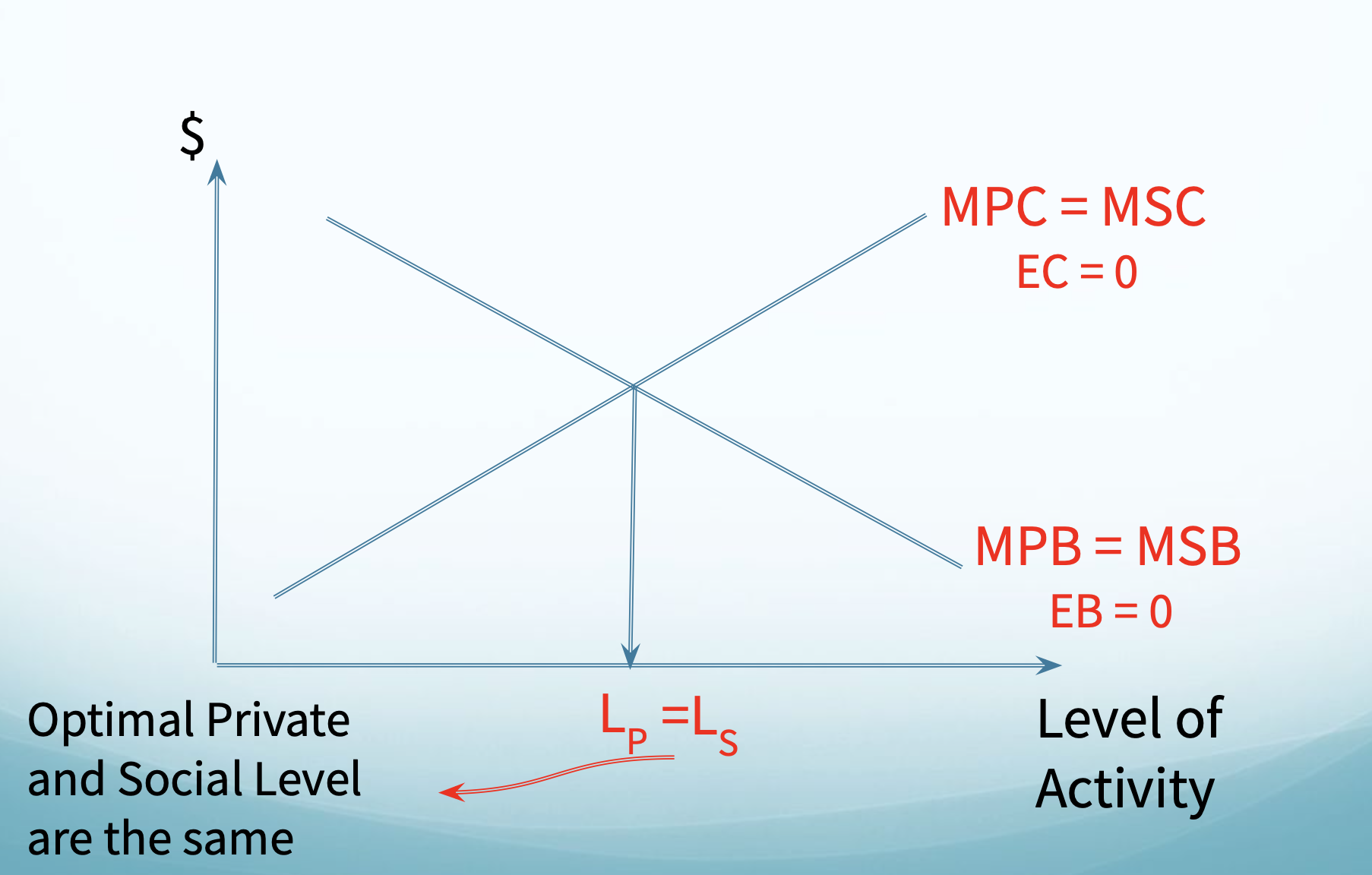

In the absence of any externalities:

EC = 0 so MSC = MPC and EB = 0 so MSB = MPB

Since society as a whole must consider all costs and benefits when determining an optimum,

from a societal point of view, one should produce where MSB=MSC

Absence of Externalities Graph

Optimal Private and Social Level are the same

Representing a Negative Externality

Lp > Ls means that, due to ignoring the negative external effects, the firm is overdoing its activity because it is not considering the full costs of its activity. This is socially inefficient

Representing a positive externality

Lp < Ls

Positive externality

Lp < Ls means that the firm is underdoing its activity because it’s not considering the full social benefits of its activity and that’s socially inefficient

Externality as Market Failure

Due to a failure to define or enforce property rights, no market forms and so no price signal is generated to coordinate choices and this leads to social inefficiency a less than Pareto Optimal market outcome

Risk Externalities

Creating an unintended risk for others (ex, drunk driving), Unintended consequences

Firms and individuals

act in self-interest, but unintended costs/benefits affect others, Market failure is why this happens