4 - Moral Hazard - The Value of Information (Unfinished)

1/46

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

47 Terms

What does the variable z denote

Information about effort or other factors that influence the outcome (e.g. oil price, weather, flipping a coin etc)

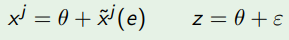

Equations for the market value of company j (2)

What does x̃ʲ(e) stand for

Non-verifiable effect of CEO's effort on firm j's value

What does θ stand for

Non-verifiable market conditions affecting all firms

What does z stand for

Noisy but verifiable measure that is informative about θ

Example of z

The performance of other companies

Utility of a risk-neutral principal

B(x-w) = x-w

Utility of a risk averse agent

U(w)-v(e)

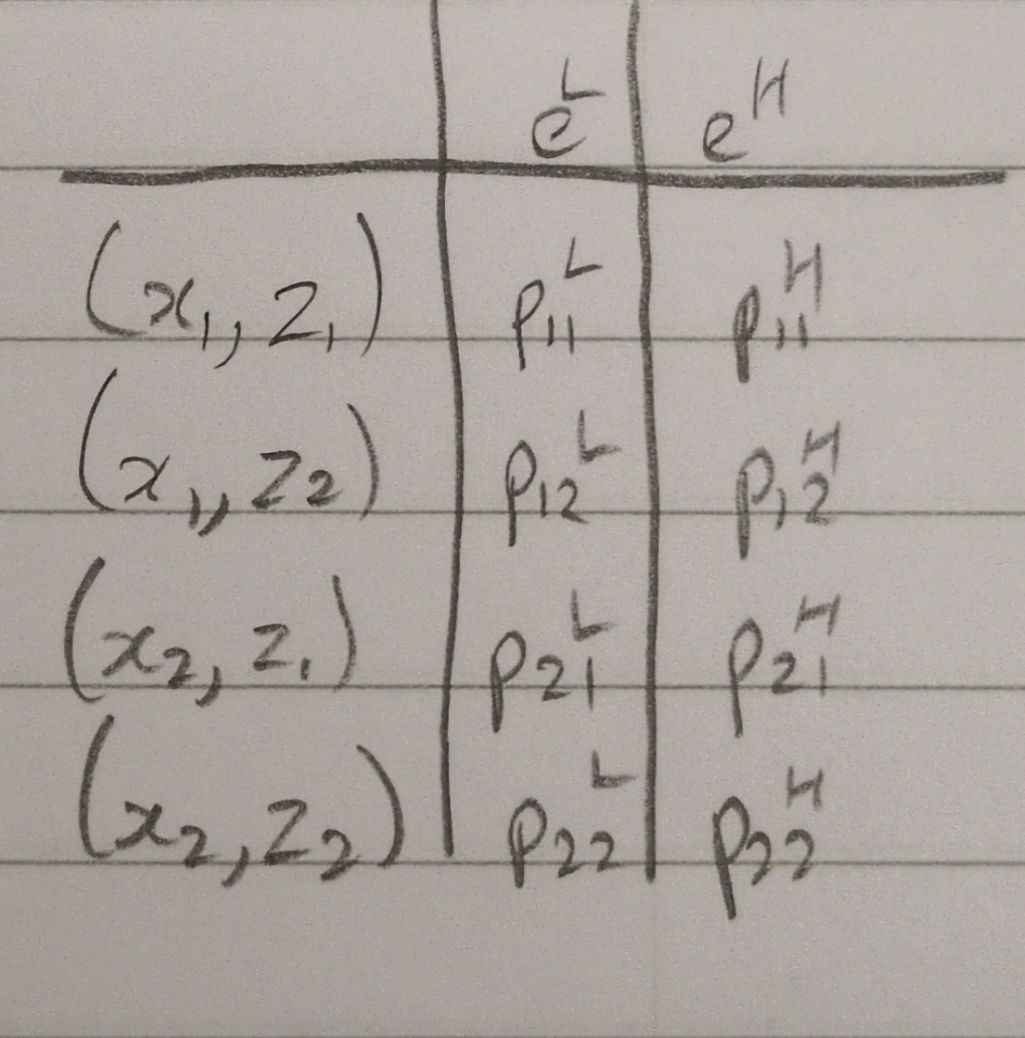

How is the probability of (xᵢ, zₖ) if e=eᴴ notated

pᵢₖᴴ

How is the probability of (xᵢ, zₖ) if e=eᴸ notated

pᵢₖᴸ

Probability table for (xi,zk) when e is eH or eL

How are wages notated when adding the additional variable z

wᵢₖ = w(xᵢ, zₖ)

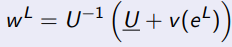

How can low effort be implemented in this model

A fixed wage

What does the agent do with effort cost if the wage is fixed

The agent minimises effort cost

What property does the IR constraint have when there is a profit-maximising fixed wage

The IR constraint is binding

What is the profit-maximising fixed wage when implementing low effort in this model

When solving the principal’s maximation problem for high effort, what is the IR constraint

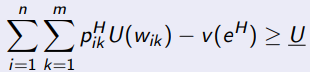

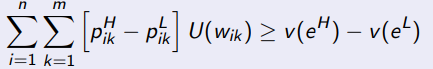

When solving the principal’s maximisation problem for high effort, what is the IC constraint

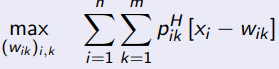

When solving the prinicipal’s maximisation problem for high effort, what are you maximising

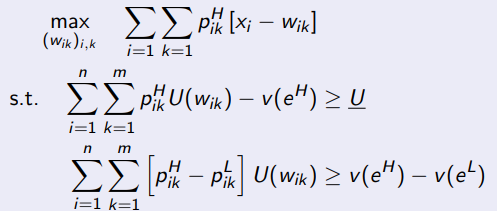

What is the principal’s maximisation problem with high effort

What is the difference with the principal’s maximisation problem for high effort now that z has been introduced?

It is the same problem except that the probabilities and wage are now dependent on i and k

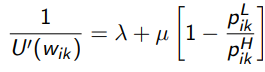

What is the first order condition for the optimal wage schedule for high effort

When does the optimal schedule depend on the realisation zk

If for some i and some k≠l, wik≠wil

What is the likelihood ratio in this model

LRik = pikL / pikH

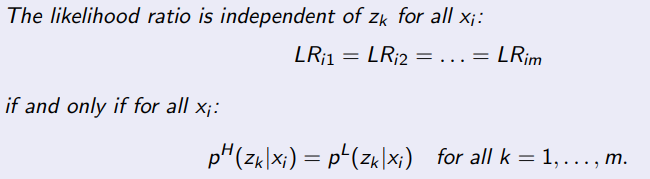

When is the signal z useless

If for all xi, LRi1 = LRi2 = … = LRim

When is the likelihood ratio independent of zk for all xi and LRi1 = LRi2 = … = LRim?

What does pH(zk|xi) stand for

The conditional probability of signal zk, given effort is eH

What is the value for pH(zk|xi)

pikH / ∑mpilH

What does pL(zk|xi) stand for

The conditional probability of signal zk, given effort is eL

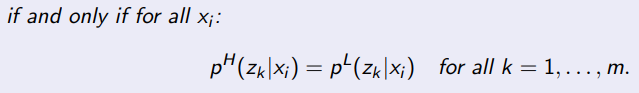

Lemma’s condition

Interpretation of Lemma’s condition

Suppose we observe xi, Lemma’s condition is satisfied if for both levels, the distribution of signals zk are the same, conditional on xi

Example of Lemma’s condition being satisfied

Given firm j’s performance is xij, we expect the same results of an audit, no matter what effort the CEO has chosen (So an audit would be useless)

When does the optimal wage schedule for high effort not depend on z

If for some i,k: pH(zk|xi)≠pL(zk|xi)

When the optimal wage schedule for high effort depends on z, how can we learn additional information about the effort

We can learn additional information about the effort from z even if x has already been observed

When does the optimal wage schedule for high effort not depend on z

If for all i,k: pH(zk|xi) = pL(zk|xi)

When the optimal wage schedule for high effort does not depend on z, how can we learn additional information about the effort

All the information about the effort that is contained in z, is already contained in x

When the optimal wage schedule does not depend on z, what is x called

A sufficient statistic for z with respect to e

When solving for the optimal wages, what is most efficient when using the utility equations (for example when U(w)=√w)

Keep it in terms of U and not w (Eg. U1=√w1, U2=√w2, and solve with these)

When a certain z leads to effort not making a difference to the probability of outcome, what happens to agency cost

The agency cost is reduced as including weather information reduces the cost of implementing high effort

Equation for the performance of a company

p = a + δo + u

What does a stand for in the equation for the performance of a company

Effort

What does o stand for in the performance of a company equation

Some observable factor (oil price, exchange rates, industry performance)

Equation for optimal compensation

y = α + β(p-δo)

What represents observable luck

δo

What does β>0, mean for incentives in the optimal compensation equation

You are incentivised to keep p-δo>0

When the market condition is the worse one, how can the difference in probablities of the low outcomes for high and low effort

The high effort reduces the probability of the low outcome by the difference (Assuming pH<pL)

Equivalent condition

Conditional on xi, the distribution of z is identical for eH and eL