Chpt 1: Role of Financial Markets and Institutions

1/47

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

48 Terms

Financial market

a market in which financial assets (securities) such as stocks and bonds can be purchased or sold.

Funds are transferred in this when one party purchases financial assets previously held by another party.

Financial markets tranfer funds from…

those who have excess funds to those who need funds.

Surplus units

participants who receive more money than they spend (such as investors)

Deficit units

Participants who spend more money than they receive (such as borrowers)

Securities

represent a claim on the issuers

Debt Securities

debt incurred by the issuer

also called credit or borrowed funds

Equity Securities

Represent equity or ownership in the firm

Accommodating Corporate Finance Needs

The financial markets serves as the mechanism whereby corporations (acting as defcit units) can obtain funds from investors (acting as surplus units).

Accommodating Investment Needs

Financial institutions serves as intermediaries to connect the investment management activity with the corporate finance activity.

Primary Market

Facilitate the issuance of new securities

Secondary Markets

Facilitate the trading of existing securities, which allows for a change in the ownership of the securities

Liquidity

The degree to which securities can be easily be liquidated (sold) without a loss of value

if a security is illiquid, investors may not be able to find a willing buyer for it in the secondary market and may have to sell the security at a large discount just to attract a buyer

Securities can be classified as…

Money market securities

Capital market securities

Derivative securities

Money Market Securities

Facilitate the sale of short-term debt securities by deficit units to surplus units

Debt securities that have a maturity of one year or less

Capital Market Securities

Facilitate the sale of long-term securities by deficit units to surplus units

What are capital market securities?

Bonds

Mortgages

Mortgage-backed Securities

Stocks

What’re bonds?

Long-term debt securities issued by the Treasury government agencies, and corporations to finance their operations

What’re Mortgages

Long-term debt obligations created to finance the purchase of real estate

What’re mortgage-backed securities

Debt obligations representing claims on a package of mortgages

What’re stocks?

Represent partial ownership in the corporations that issued them

Derivative Securities

Financial contracts whose values are derived from the values of underlying assets

What’s speculation?

Allow an investor to speculate on movements in the value of the underlying assets without having to purchase those assets

What’s risk management

Financial institutions and other firms can use derivative securities to adjust the risk of their existing investments in securities

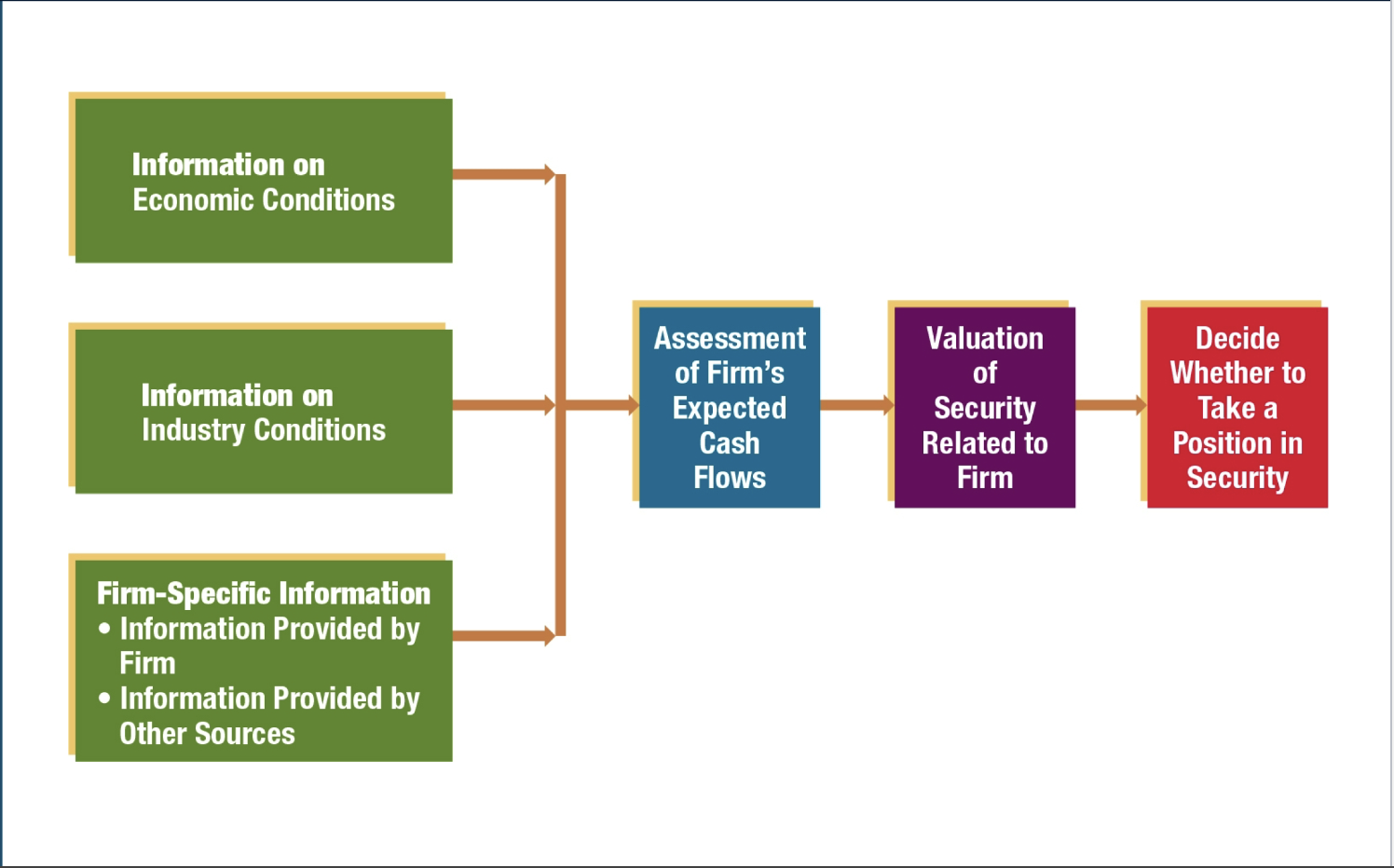

Impact of information of valuation

Estimate future cash flows by obtaining information that may influence a stocks future cash flow

use economic or industry information to value a security

Use published opinions about the firms management to value a security

Impact of Behavioral Finance on Valuation

Various conditions can affect investor psychology. Behavioral finance can sometimes explain the movements of a securities price.

Behavioral Finance

The application of psychology to make financial decisions

Uncertainty Surrounding Valuation of Securities

Limited information leads to uncertainty in the valuation of securities

Securities Act of 1933

Was intended to ensure complete disclosure of relevant financial information on publicly offered securities and to relevant fraudulent practices in selling these securities

Securities Act of 1934

Extended the disclosure requirements to secondary market issues

Sarbanes-Oxley Act of 2002

Required that firms provide more complete and accurate financial information

Financial markets vary across the world in terms of…

Degree of financial market development

Volume of funds transferred from surplus to deficit units

International Integration of Financial Markets

Under favorable economic conditions, the international integration of financial markets allow governments and corporations easier access to finding from creditors or investors in other countries to support their growth.

Role of Foreign Markets

International financial transactions normally require the exchange of currencies. The foreign exchange market facilitates this exchange.

Financial institutions are needed to resolve the limitations caused by __________ such as limited information regarding the creditworthiness or borrowers

market imperfections

Role of depository institutions

Depository institutions accept deposits from surplus units and provide credit to deficit units through loans and purchases of securities

Role of depository institutions

Offer liquid deposit accounts to surplus units

Provide loans of the size and maturity desired by deficit units

Accept the risk on loans provided

Have more expertise in evaluating creditworthiness

Diversify their loans among numerous deficit units

What are some Role of Depository Institutions?

Commercial Banks

Savings Institutions

Credit Unions

Commercial Banks

The most dominant type of depository institution

Transfer deposit funds to deficit units through loans or purchase of debt securities

Federal Fund Market- facilitates the flow of funds between depository institutions

Savings Institution

Also called thrift institutions and include Savings and Loans (S&L’s) and Savings Banks

Concentration on residential mortgage loans

Credit Unions

Nonprofit organizations

Restrict business to CU members with a common bond

What’re some Non-depository Institutions?

Finance Companies

Mutual funds

Securities firms

Insurance companies

Pension Funds

Finance Companies

Obtain funds by issuing securities and lend to individuals and small businesses

Mutual Funds

Sell shares to surplus units and use the funds received to purchase a portfolio of securities

Securities Firms

Provide a wide variety of functions in financial markets (Broker, underwriter, dealer, advisory)

Insurance companies

Provide the insurance policies that reduce the financial burden associated with death, illness, and damage to property.

Charge premiums and invest in financial markets

Pension Funds

Manage funds until they are withdrawn for retirement

Systemic Risk

The spread of financial problems among financial institutions and across financial markets that could cause a collapse in the financial system