U2 Vocab – AP Macro

1/31

Earn XP

Description and Tags

Unit 2 AP Macro Carney

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

32 Terms

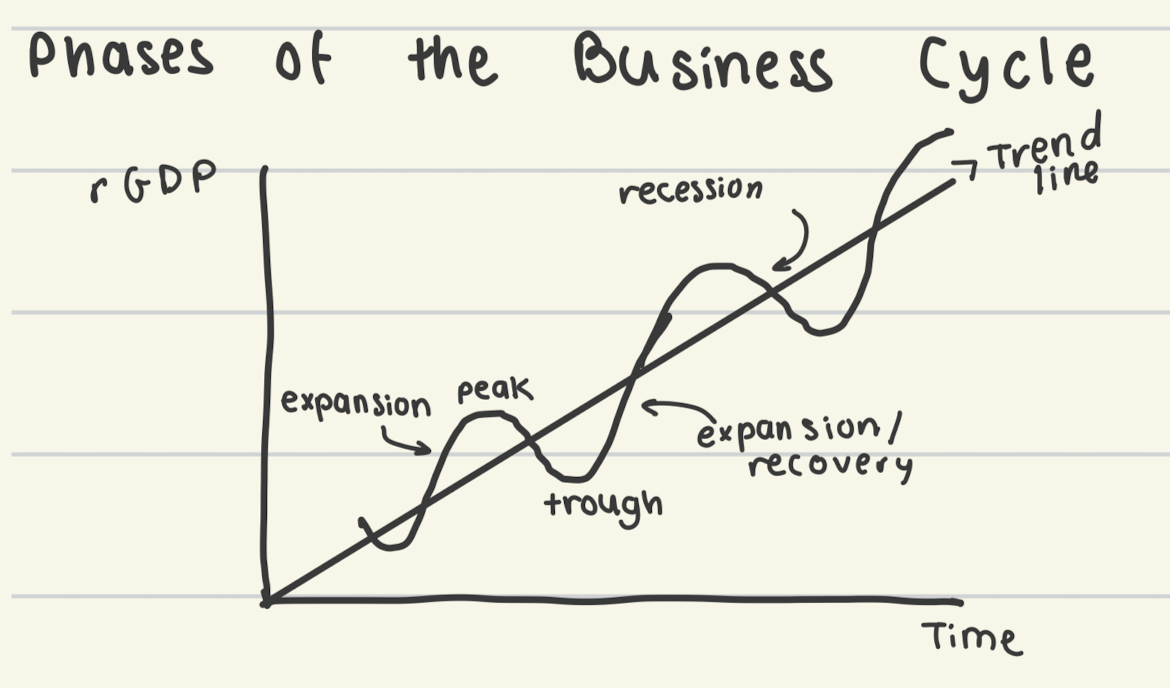

business cycle (components)

(+ disinflation is when it slows rate of increasing)

recession

periods of economic downturns when output and employment falling

economic depression

very deep and prolonged economic downturn

economic growth

an increase in the maximum possible economy output (leads to bring able to afford more material goods)

gross domestic product

measures total value of final goods/services created/provided by an economy over a year

intermediate goods

brought from firm by firm to be inputs for product of final goods/services (one person’s intermediate could be someone else’s final! selling lettuce at store vs using for a taco truck)

final goods

goods sold to the final / end user; end product

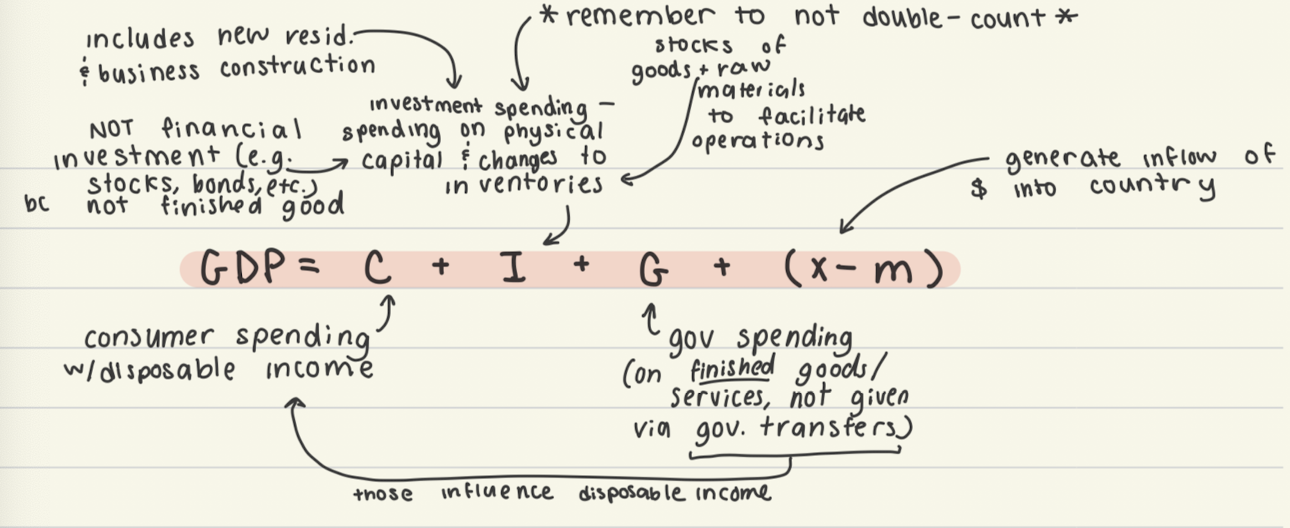

expenditure approach

GDP = C + I + G + (x-m)

C = Consumer spending

I = Investment spending

G = Goverment spending

(x-m) or Xn = net exports

does not count purchase of secondhand goods, stocks/bonds, or illegal items not in legal market because they do not represent new production

income approach

addition of wages, interest, rent, profit

does not include income / profits earned by US citizens abroad, transfer payments (e.g. Social Security, interest payments)

value-added approach

how much value was added at each step of the process of production for the final good (addition of value added [price sold for; don’t double-count] of each good)

nonmarket transactions

transactions that do not occur in a (legal) market; do not count towards GDP

government purchases

counts for the G in the expenditure equation

government spending on finished goods and services; does not include money given to citizens via government transfers (social security, unemployment, etc. becomes part of consumer spending as disposable income)

disposable personal income

counts for the C in the expenditure equation

the amount of money that a person/household has to spend after taxes are deducted

labor force

LF = E + U

the amount of people in an economy aged 16+ who are either employed (including subsection of underemployed) or unemployed

unemployment rate

UR = U/LF * 100%

the percent of the labor force that is unemployed

labor force participation rate

LFPR = LF/[total population] * 100%

please note that the labor force only includes employed people and those currently looking for a job (unemployed)

frictional unemployment

people who are temporarily between jobs

me terms – these people are choosing unemployment in order for better opportunities (due to individual choices; e.g. looking for better pay than minimum wage)

structural unemployment

involves mismatches between job seekers and job openings; applicant skills don’t fit needed workers / the industry has changed to have different needs (e.g. automation means people to sew certain clothing is not needed)

me terms – more so up to individual businesses/industries; typically not an economy-wide issue

cyclical unemployment

people not working because firms do not need labor due to lack of demand / economic downturn; due to the business cycle

me terms – think recession, depression, downturn in sales

discouraged workers

people who have given up looking for a job due to poor state of the job market but would otherwise (in different job market conditions) be working

not considered in labor force therefore a part of why unemployment rate may understate true rate

underemployed workers

workers who are working part-time jobs because they are unable to find full-time jobs (think: Bill (maybe))

not considered in labor force therefore a part of why unemployment rate may understate true rate

full-employment real output

maximum level of economic output that an economy can sustainably produce when all available factors of production (including labor) used efficiently, but not stretched beyond capacity; occurs at natural rate of unemployment

natural rate of unemployment

rate at which inflation typically remains stable, consisting of sum of frictional and structural unemployment (long-run equilibrium that central banks aim for)

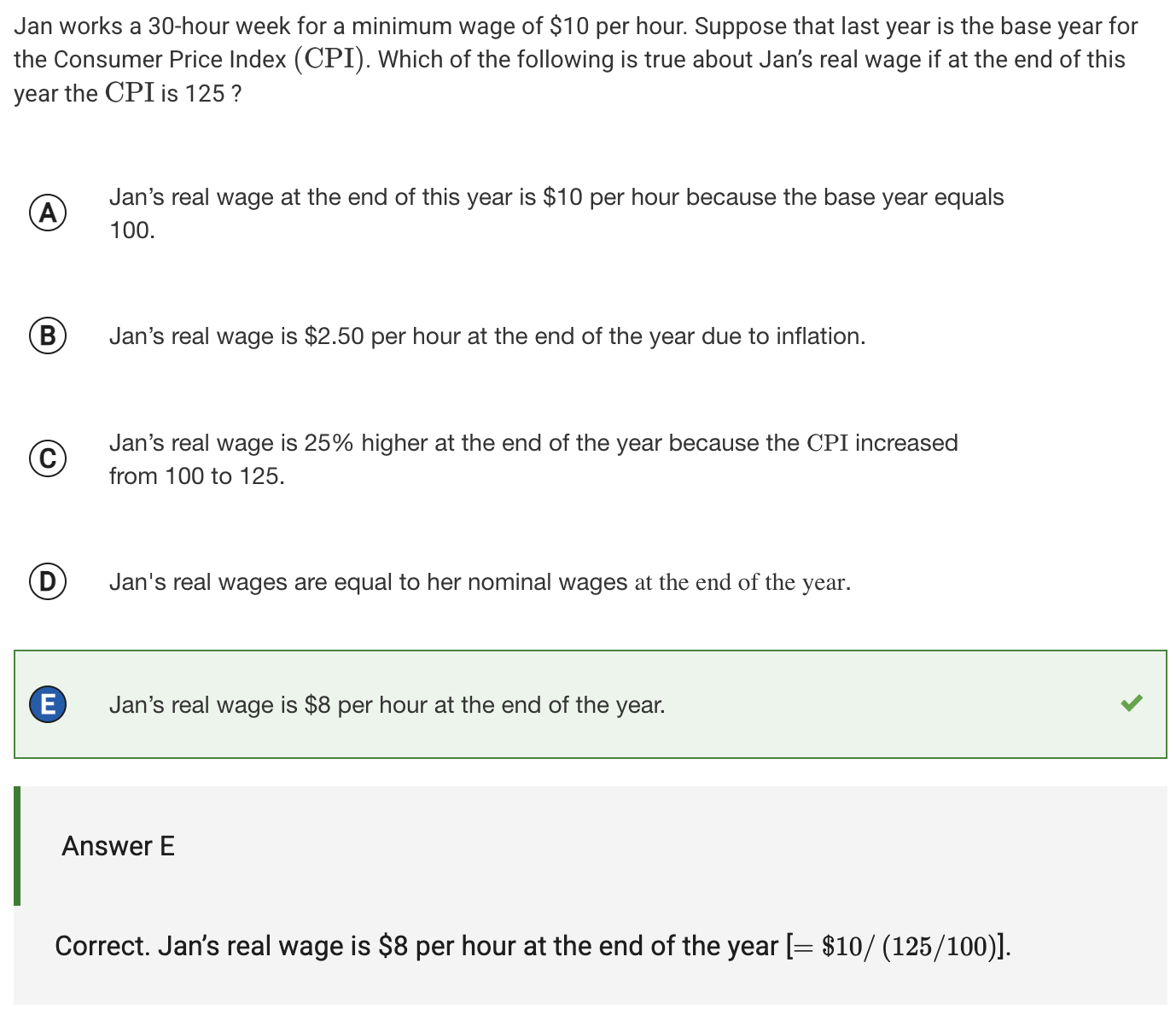

Consumer Price Index (CPI)

CPI = (current yr/base yr) * 100%

measure in change of price of goods/services that consumers most often buy

possible criticism that it’s on a fixed bundle and thus doesn’t properly take into account peoples’ switches to substitutes; possibly not representative because city-based

inflation

increase in aggregate price level of goods/services in the economy; expected but can cause issues if different than expected

deflation

decrease in aggregate price level of goods/services in economy

inflation rate

the annual change in percent (%) of aggregate price level

real wages

the purchasing power of one’s wages compared to a base year (use CPI as a comparison)

(APC example in image)

nominal GDP

GDP in current value of currency

real GDP

GDP taking into account price changes (as inflation is expected and nominal GDP includes rises in prices via inflation)

doesn’t address uneven wealth distribution

GDP deflator

GDP deflator = nGDP/rGDP * 100%

measure of the percent change

nGDP = nominal GDP

rGDP = real GDP

percent change equation

(current yr - base yr) / (base yr) * 100%