SIE EXAM - CHAPTER 11

1/53

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

54 Terms

Public Offerings

public issuing of a security

pros

-unlimited number of investors (both retail and institutional)

cons

-regulatory costs

-time costs

-disclosure (Sec. Act. 1933)

Private Placements

institutional investors providing start-up capital to new companies through non-public offering.

pros

-less costly & faster

-less regulation/disclosure

cons

-limited type and # of investors

Initial Public Offering (IPO)

when an issuer offers securities to the public for the first time

Follow-On Offering

an issue of stock that comes after a company has already issued an initial public offering (IPO). A follow-on offering can be diluted, meaning that the new shares lower a company's earnings per share (EPS), or undiluted, if the additional shares are preferred.

-still a primary (market) distribution

FINRA Rule 2269

requires written disclosure to customers for trades in any security in which a firm is participating in the distribution or is otherwise financially interested.

Combined (Split) Offering

some shares are offered by the issuer by being newly created and in a primary offering and increase # of outstanding shares

$ => issuing company

remainder are offered by selling shareholders in a secondary offering

$ => selling shareholders

Underwriter

a broker-dealer that helps corporations or municipalities raise capital.

-assumes risk by buying the new issue of securities and reselling it to the public

Underwriting Syndicate

a group of investment banking firms formed to spread the risk associated with the purchase and distribution of a new issue of securities

-written agreement = syndicate letter or agreement among underwriters

Firm-Commitment (Acting as Principal) Underwriting

if a underwriter/syndicate agrees to purchase the entire offering from the issuer and absorb any securities that remain unsold

Best-Efforts (Acting as Agent) Underwriting

the underwriter/syndicate agrees to sell as much of the new offering as they're able, unsold portion returned to the issuer

Best-Efforts-All-or-None

underwriter acts as agent for the issuer and attempts to sell a minimum amount at the offering, if the minimum is not met then all sales that were made are cancelled and money returned to the subscribers

Best-Efforts-Mini-Maxi

minimum threshold of sales that must be met for the offering to avoid being cancelled, once the minimum is met, additional sales can only be made up to a predetermined maximum amount

Standby Agreements

Syndicate agrees to buy any shares that are not purchased by existing stockholders in a rights offering.

Preemptive Rights Offering

Existing shareholders have right to buy new common stock at a price below market value before offering is made public

Market-Out Clause

Escape clause sometimes written into FIRM COMMITMENT underwriting agreements which essentially allows the underwriters to be released from their purchase commitment if material adverse developments affect the securities markets.

Shelf Registration

When a firm makes its public disclosures as a regular offering but it then the issues the registered securities as it needs capital or the markets are favorable over a period of three years

Selling Group

Group of dealers appointed by the syndicate manager of an UNDERWRITING GROUP, as AGENT for the other underwriters, to market a new or secondary issue to the public.

Underwriting Spread

The difference between the public offering price of a new issue and the proceeds received by the issuer

Consists of:

-Manager's fee

-member's/underwriter's fee

-concession

Payments for market making

FINRA rule prohibits a member firm or any person who is employed by member firm from accepting any payment or other compensation from an issuer of a security or any affiliate for:

-publishing a quote (including indications of interest)

-acting as a market maker in a security

-submitting an application in connection with market-making activity

Securities Act of 1933 - Registration

requires registration statement to be filed with the SEC

Securities Registration Process

1) Pre-Registration Period

2) Cooling-Off (waiting) period

3) Post-Effective Period

Pre-Registration (Pre-Filing) Period

-issuer prepares its registration statement

-due diligence begins

-no discussion with customers

-ends on the date the registration is filed with SEC

Registration Statement

required info:

-character of the issuer's business

-balance sheet created within 90 days prior to filing

-financial p/l statements for latest year and previous 2

-amount of capitalization and use of the proceeds of the sale

-funds paid to affiliated persons or business of the issuer

-shareholdings of senior officers, directors, and underwriters, and identification of individuals who hold at least 10% of the company's securities

Prospectus

-required alongside registration statement

-abbreviated registration statement for investors

No Guarantees (Section 23 of Sec. Act. of 1933)

SEC doesn't guarantee truthfulness, accuracy or completeness of information contained in registration statement

Cooling-Off Period

20 days:

In this time you can't solicit sales, but you can take indications of interest, do due diligence, and have a prelim prospectus

-SEC reviews documents and determines completeness and no misleading statements.

-sends deficiency letter to issuer if found incomplete or misleading

preliminary prospectus (red herring)

An abbreviated prospectus that is distributed while the SEC is reviewing an issuer's registration statement. It contains all of the essential facts about the forthcoming offering except the underwriting spread, final public offering price, and date on which the shares will be delivered.

Omits from statutory prospectus

-offering price

-underwriting discounts/commissions and discounts to dealers

-amount of proceeds to be received by the issuer

-conversion rates or call prices

-other matters that are dependent on the offering price

Blue Sky Laws

State laws that regulate the offering and sale of securities for the protection of the public.

-established under Uniform Securities Act

Three Methods of State Securities Registration

1) Notification (Filing) - larger issues

2) Coordination w/ SEC filing

3)Qualification of state requirements

Due Diligence Meeting

A meeting at which an issuing corporation's officials and representatives of the underwriting group present information on and answer questions about a pending issue of securities. The meeting is held for the benefit of brokers, securities analysts, and institutional investors.

Effective Date

end of cooling-off period and beginning of post-effective period

-20 days after filing typically

Post-Effective Period

Period in a registration statement process where contracts can be finalized and securities can actually be sold

-POP set by underwriters

-firm's registered representatives (RRs) contact prelim prospectus clients, provide final prospectus and ask for purchase decision

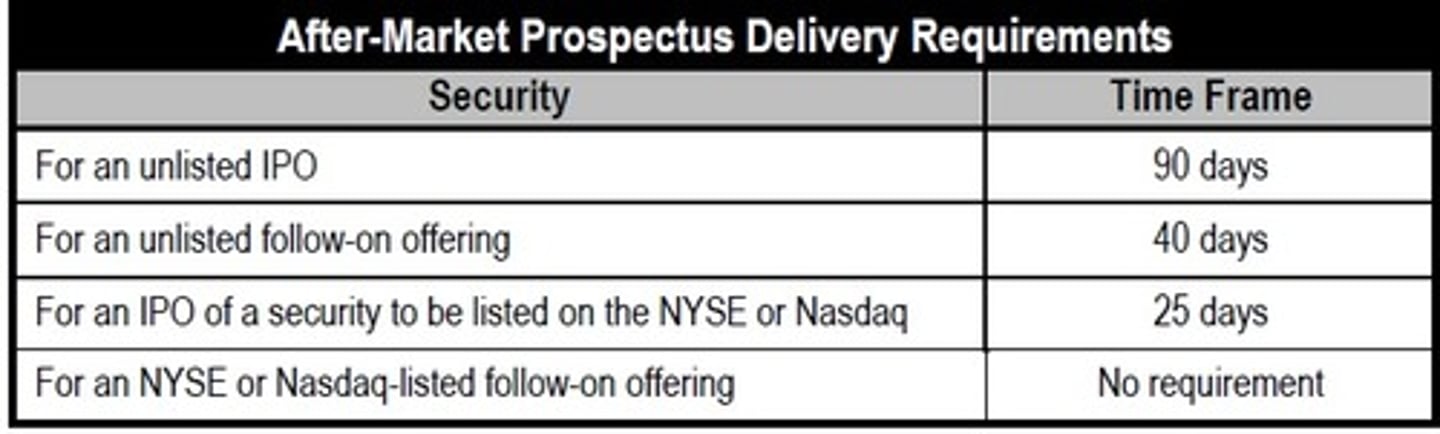

After-Market Prospectus Delivery Requirements

Tombstone

an advertisement announcing a public offering

Statutory Prospectus

complete prospectus

condensed from of the registration statement that includes:

-risk factors, use of proceeds

-dividend policy

-industry and other data

-capitalization and selected consolidated financial data

-management's discussion and analysis of financial condition and results of operations

-business and management

-executive and director compensation

-principal and selling stockholders

-shares eligible for future sale

-underwriting conflicts of interest and legal matters

Mutual Fund Summary Prospectus

summary prospectus used as stand-alone tool for mutual funds to inform investors

-must inform of available statutory prospectus

must include:

-investment objective

-costs

-principle investment strategies, risks, and performance

-name of investment adviser as well as name, title and length of service of up to 5 portfolio managers

-purchase, redemption, and tax info

-financial intermediary compensation information

Free Writing Prospectus

Any type of written, electronic, or graphic offer that describes the issuing corporation or its securities and includes a legend indicating that the investor may obtain the prospectus at the Securities and Exchange Commission's Web site.

-doesn't meet standards of statutory prospectus

Offering Memorandum

a document describing a target company's important features to potential buyers for a private placement

Securities Exempt from Registration Requirements of Sec. act. of 1933

-US govt and us govt agency securities

-municipal securities

-securities issued by non-profit

-short-term corporate debt instruments with max maturity of 270 days

-securities issued by domestic banks and trust companies

-securities issued by small business investment companies

Regulation D

Private placement

-issuer must believe buyer is sophisticated investor

-buyer must have access to same financial info as prospectus

-issuer must form lock-up agreement with buyer that they cannot quickly sell

-sold to no more than 35 non-accredited investors

Accredited Investor

-financial institutions, large tax-exempt plans, private business development companies

-directors, exec officers, general partners of issuer

-individuals who either have a net-worth of $1mil (not including primary residence) or gross income of at least $200k ($300k with spouse) for each past two years

Rule 144

A regulation that provides for the sale of restricted stock and control stock. Filing with the SEC is required prior to selling restricted and control stock. The number of shares that may be sold is limited

-required holding period (issuer=6months, non-reporting=1year, no req for control stock)

-filing requirement within 90 days if sale greater than 50k shares or >$5k

-volume limit of 1% of total shares outstanding or 4 week average trading volume

Private Investment in Public Equity (PIPE)

private placement offering after IPO by distributing restricted securities to a small group of accredited investors.

Rule 144A

An exemption to the holding period and volume restrictions of Rule 144 for qualified institutional buyers (QIBs)

Qualified Institutional Buyer (QIB)

must pass 3 part test to qualify:

1)must be insurance company, registered investment company/adviser, small business development company, private or public pension, certain bank trust funds, corporations, partnerships, business trusts, and certain non-profits

2)must be purchasing for its own account or another QIB

3)buyer must own and invest at least $100 million of securities of issuers that are not affiliated with the buyer

Rule 145

A regulation covering mergers, acquisitions, substitutions, transfers of assets that also exempts stock splits and stock dividends from the registration requirements of the Securities Act of 1933

Rule 147 and 147A

SEC rule that provides exemption from the registration statement and prospectus requirements of the 1933 Act for securities offered and sold exclusively intrastate.

-at least 80% business, assets, or revenue within state

-most employees/real property within state

-resale to outside of state restricted for 6 months

Primary Market of Municipal Bonds

exempt from registration rules of Sec Act 1933

-still under antifraud rules (applies to all securities)

Municipal Securities Rulemaking Board (MSRB)

Issuing General Obligation (GO) Bonds

backed by taxes, must meet 2 requirements:

-Voter approval

-debt ceiling limitations

Issuing Revenue Bonds

backed by user fees generated by project

-requires feasibility study

--assess whether project will bring in necessary revenue to cover bond

New Issue Underwritings

after requirements are met, continues process of issuance

-selecting underwriter

-municipal advisor

Responsibilities of Syndicate Manager (Rule G-11)

must maintain records of all activity

-settlement date

-allotment of securities and sale prices

-name of syndicate members and percentages of liability

Underwriting Documentation

-notice of sale

-legal opinion (assures investors of legal right to issue bonds)

-official statement (primary client disclosure doc)

Electronic Municipal Market Access (EMMA)

Centralized online tool for locating key information about municipal securities. Presented for retail, non-professional investors.