Chapter 9 - Behind the Demand Curve: Consumer Choice

1/79

Earn XP

Description and Tags

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

80 Terms

The Substitution Effect

The change in the price of a good is the change in the quantity of the good demanded as the consumer substitutes the good that has become relatively cheaper for the good that has become relatively more expensive. People will often substitute for cheaper goods when the price of another goes up.

The Income Effect

A change in the price of a good is the change in the quantity of that good demanded that results from a change in the consumers purchasing power when the price of the good changes.

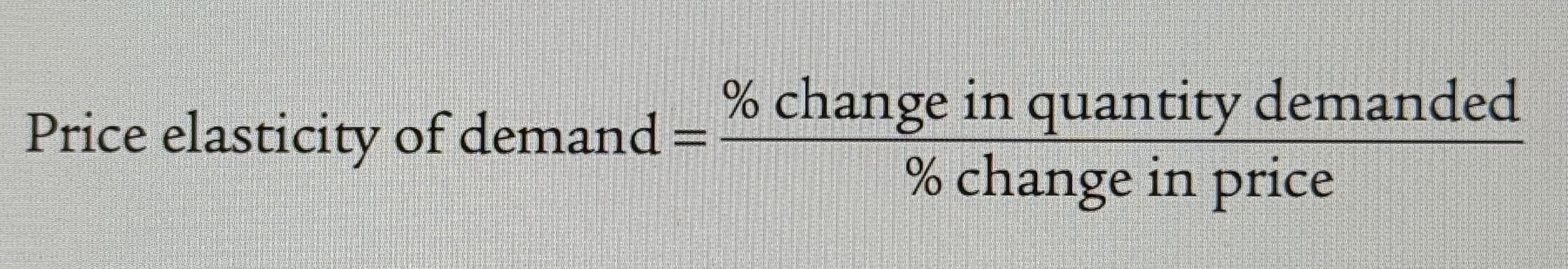

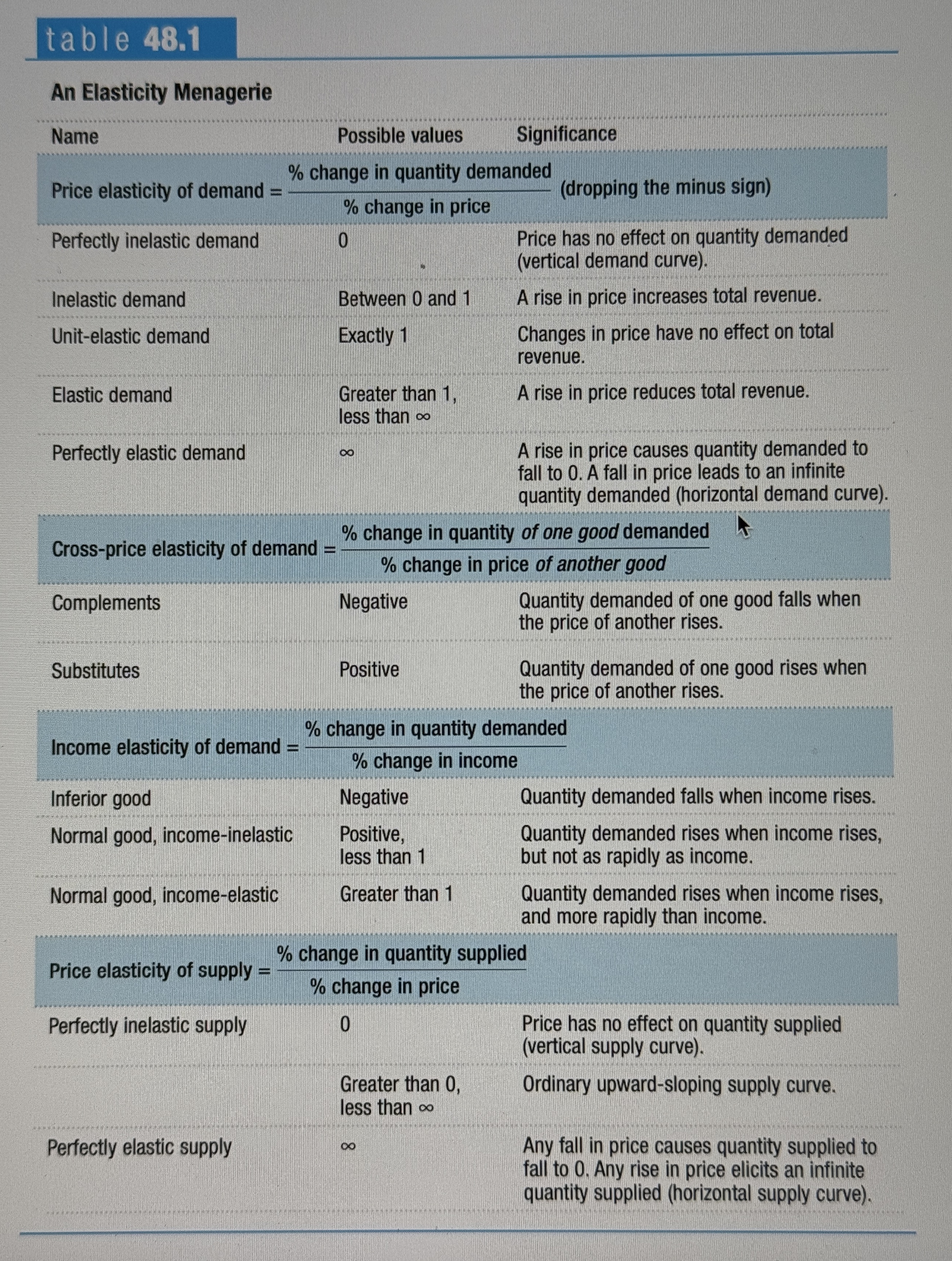

Price Elasticity of Demand

The ratio of the percent change in the quantity demanded to the percent change in the price as we move along the demand curve (dropping the minus sign).

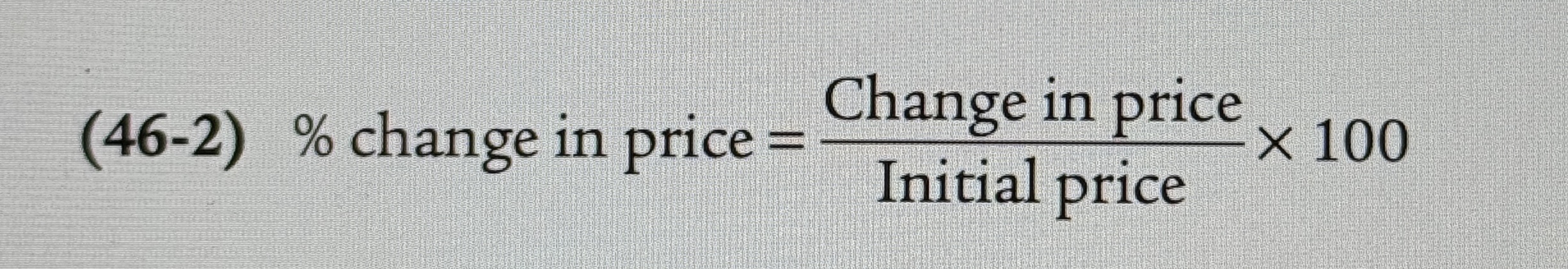

% Change in Price

Ex.

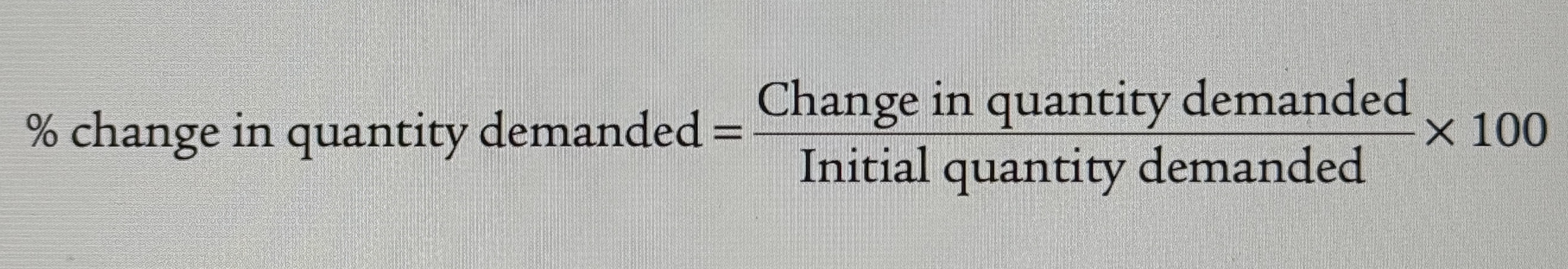

% Change in Quantity Demanded

Ex.

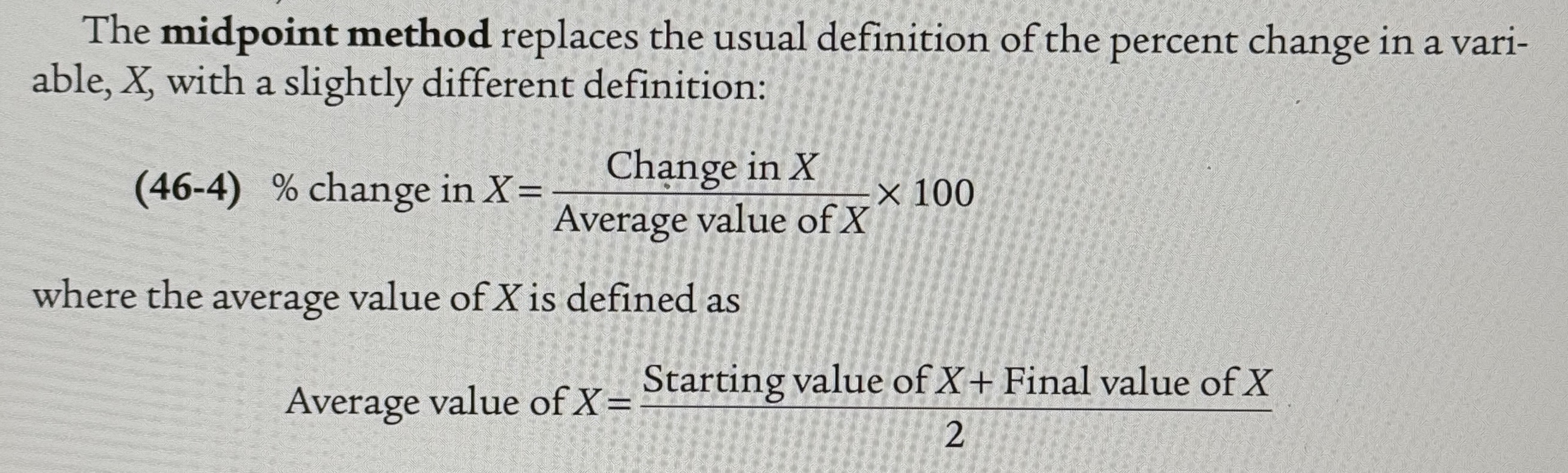

The Midpoint Method

A technique for calculating the percent change. In this approach, we calculate changes in a variable compared with the average, or midpoint, of the initial and final values.

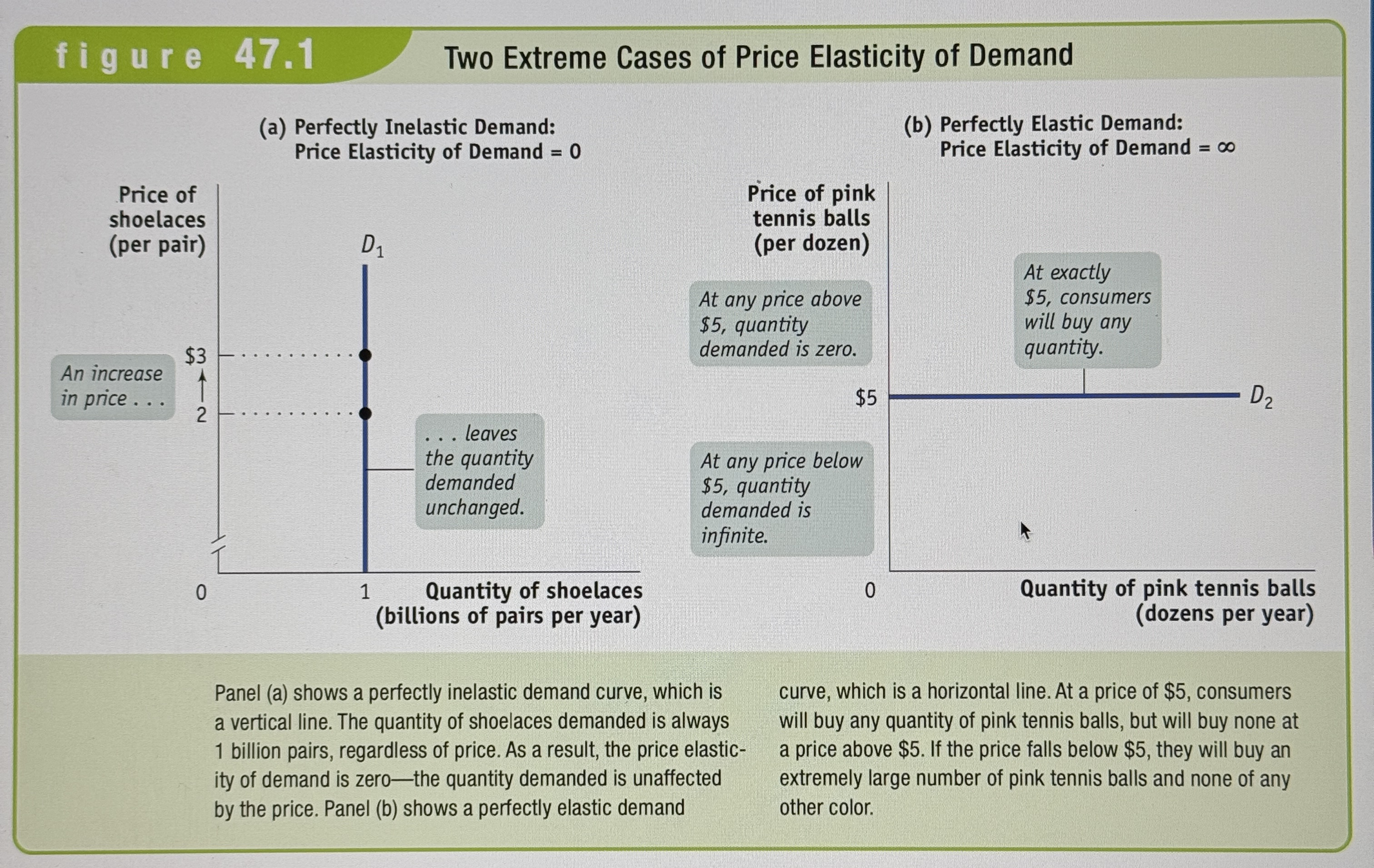

Perfectly Inelastic

Demand when the quantity demanded does not respond at all to the changes in price level. When demand is perfectly inelastic, the demand curve is a vertical line.

Perfectly Elastic

Demand when any price increase will cause the quantity demand to drop to zero. When demand is perfectly elastic, the demand curve is a horizontal line.

Two Extreme Cases of Price Elasticity of Demand

Ex.

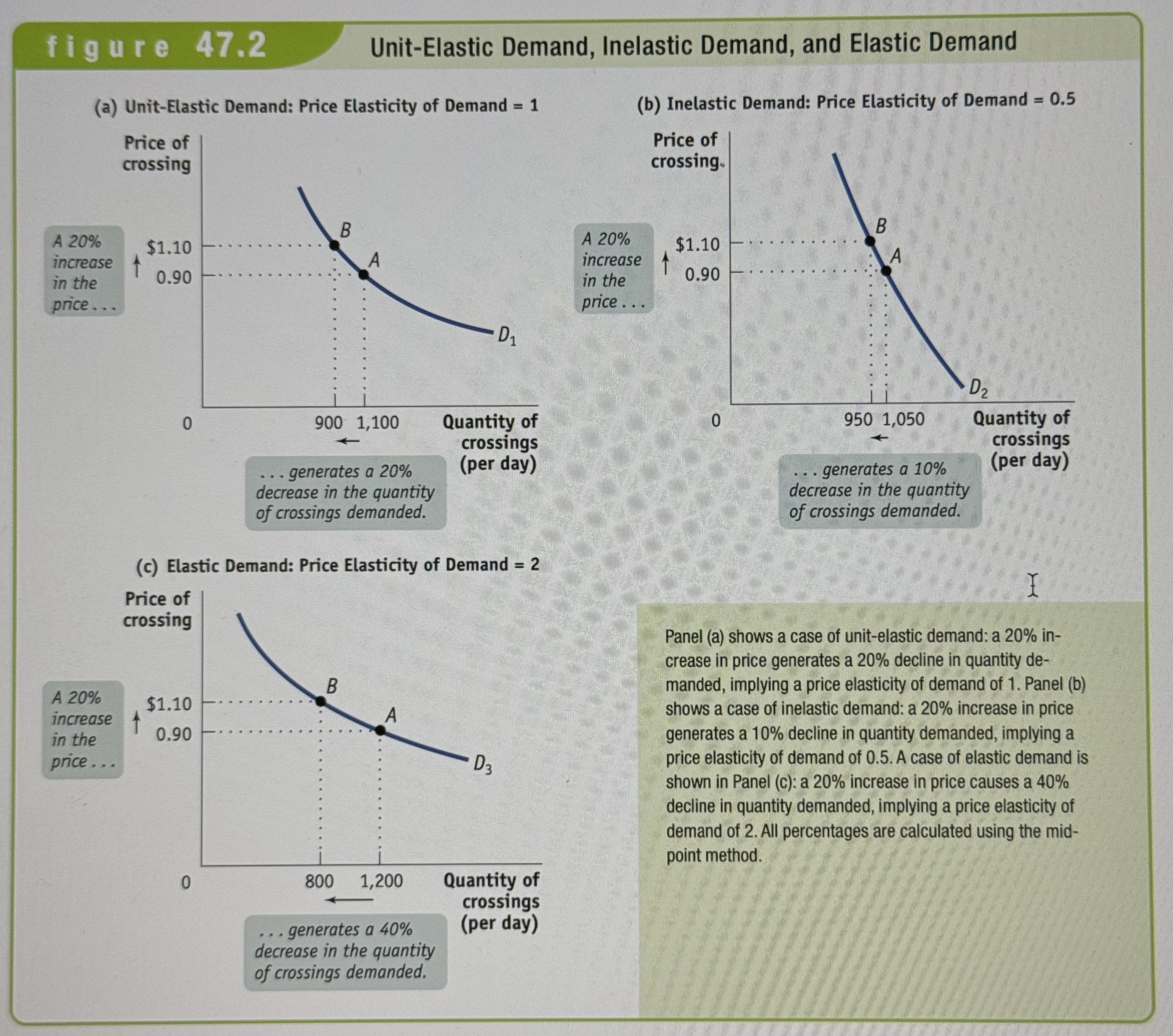

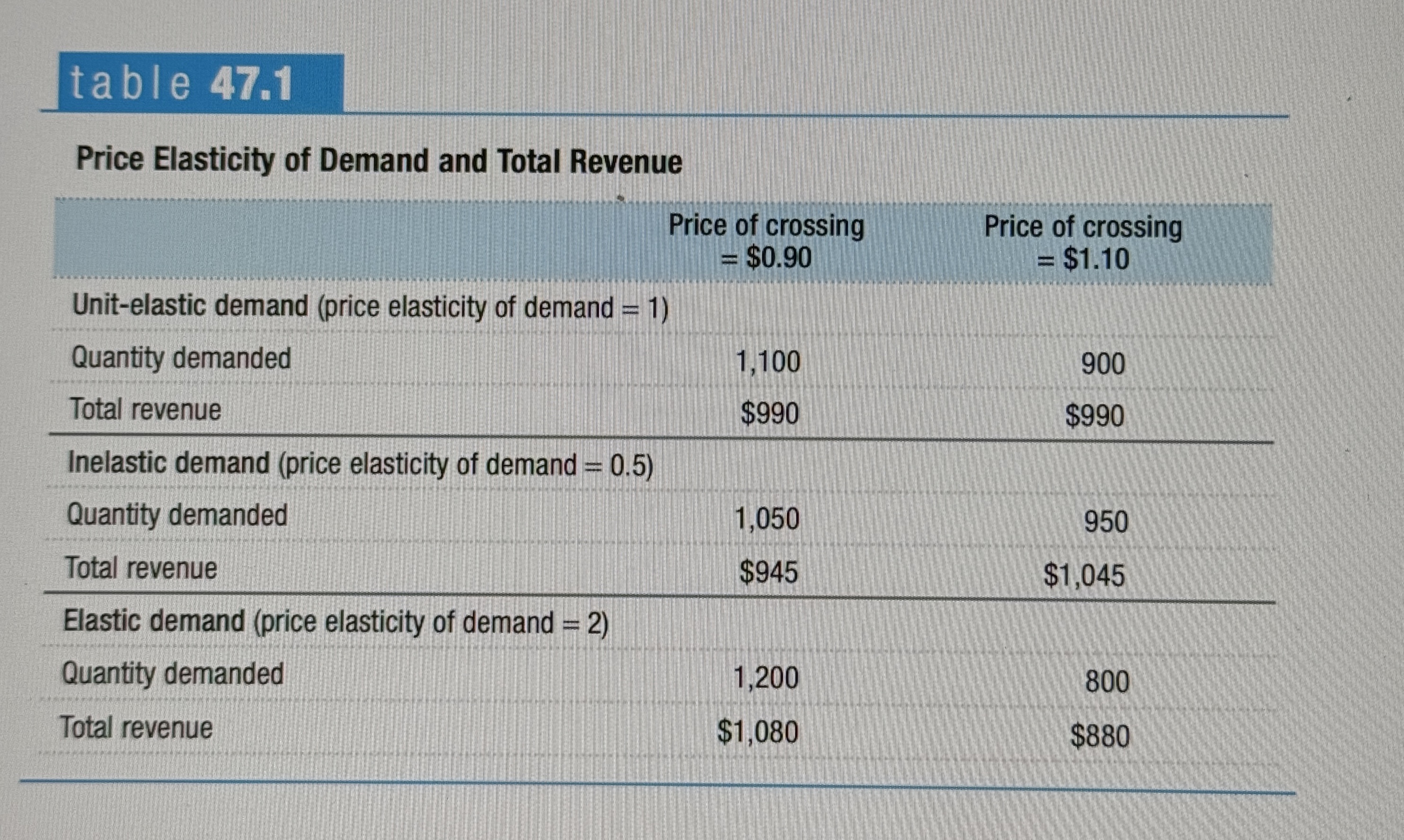

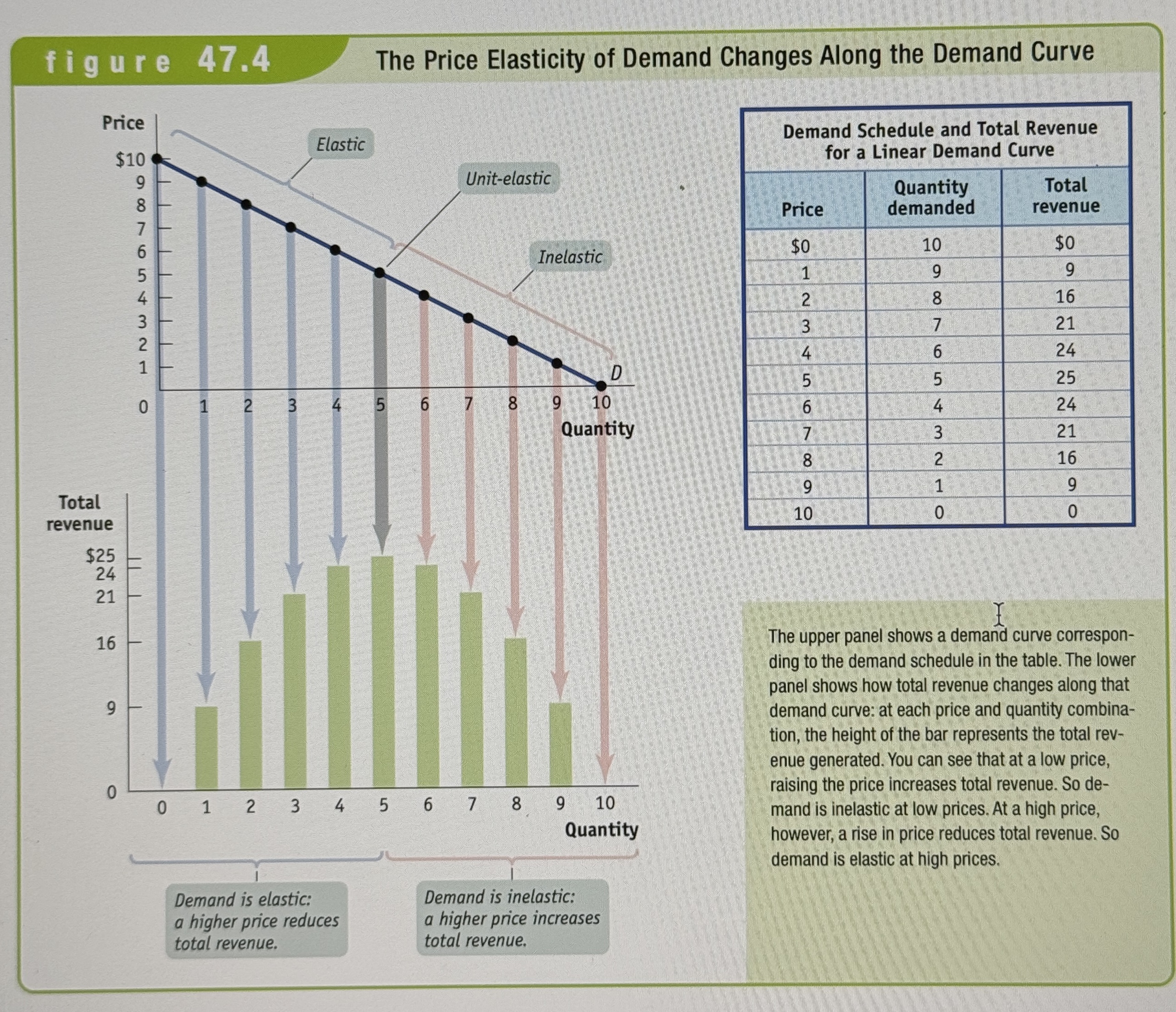

Elastic, Inelastic, and unit-elastic

Demand is elastic if the price elasticity of demand is greater than one, inelastic if the price elasticity of demand is less than one, and unit-elastic if the price elasticity of demand is exactly one.

Unit-Elastic Demand, Inelastic Demand, and Elastic Demand

Ex.

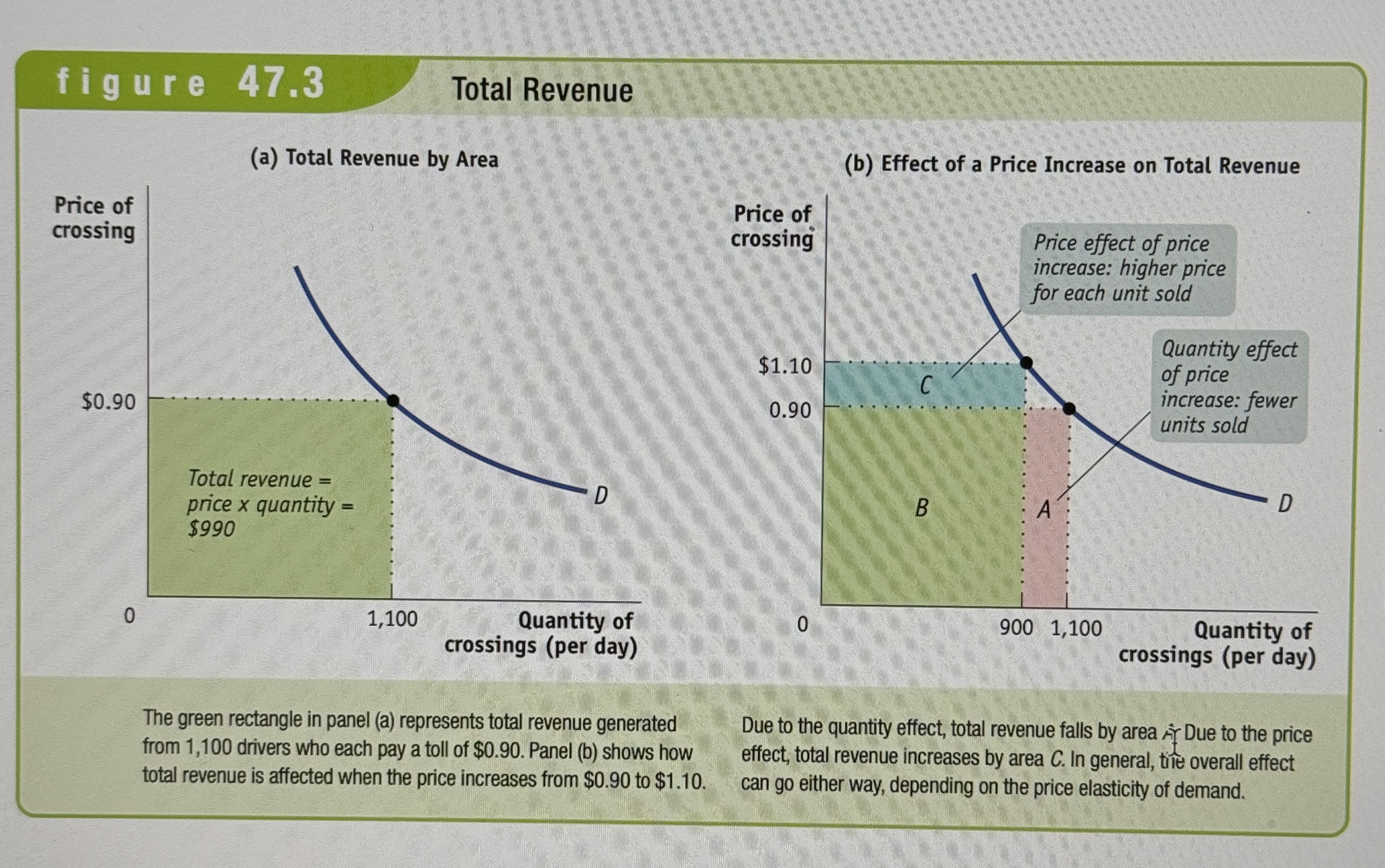

Total Revenue

The total value of sales of a good or service. It is equal to the price multiplied by the quantity sold.

Total Revenue Graph

Ex.

Price Elasticity of Demand and Total Revenue

Ex.

The Price Elasticity of Demand Changes Along the Demand Curve

Ex.

What factors determine the price elasticity of demand?

Whether close substitutes are available

Whether the good is a necessity or a luxury

Share of income spent on the good

Time

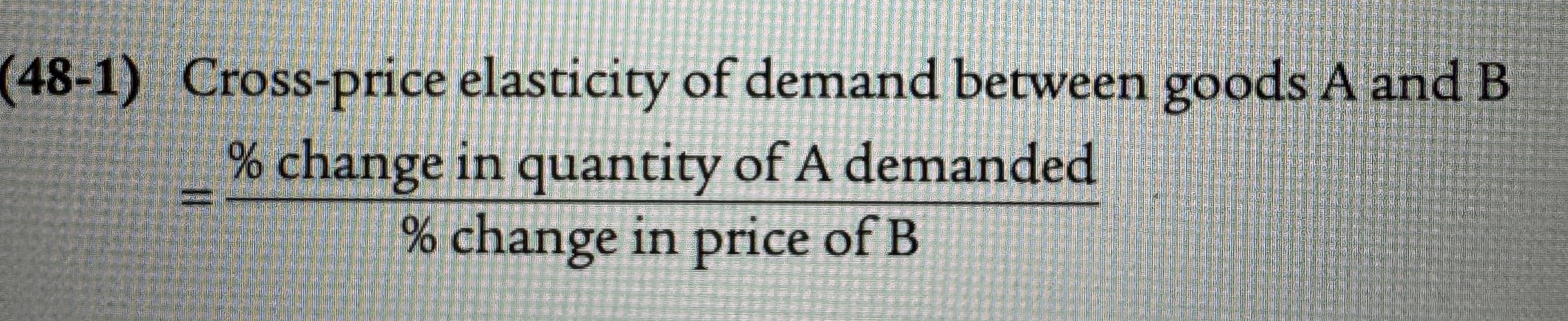

Cross-Price Elasticity of Demand

This type of elasticity between two goods measures the effect of the change in one goods price on the quantity demanded of the other good. It is equal to the percent change in the quantity demanded of one good divided by the percent change in the other goods price.

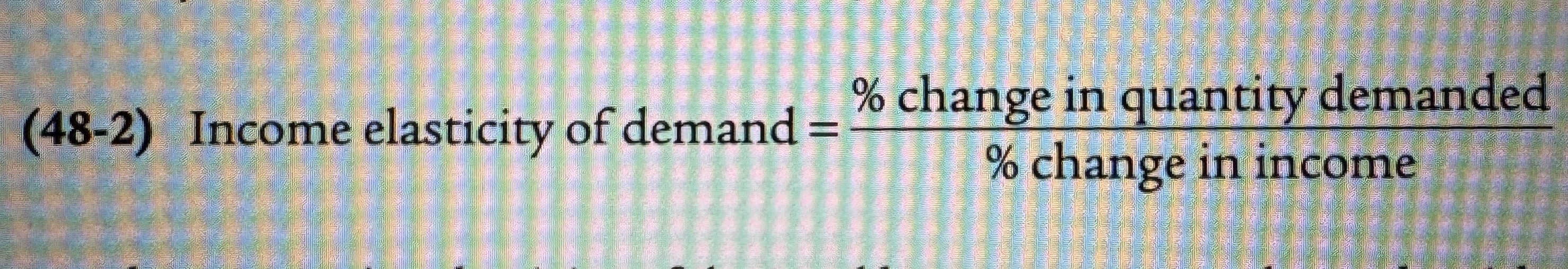

Income Elasticity of Demand

The percent change in the quantity of a good demanded when a consumers income changes divided by the percent change in the consumers income.

Income-Elastic

The demand of a good is income-elastic if the income elasticity of a demand for that good is greater than one.

Income-Inelastic

The demand of a good is income-inelastic if the income elasticity of a demand for that good is positive but less than one.

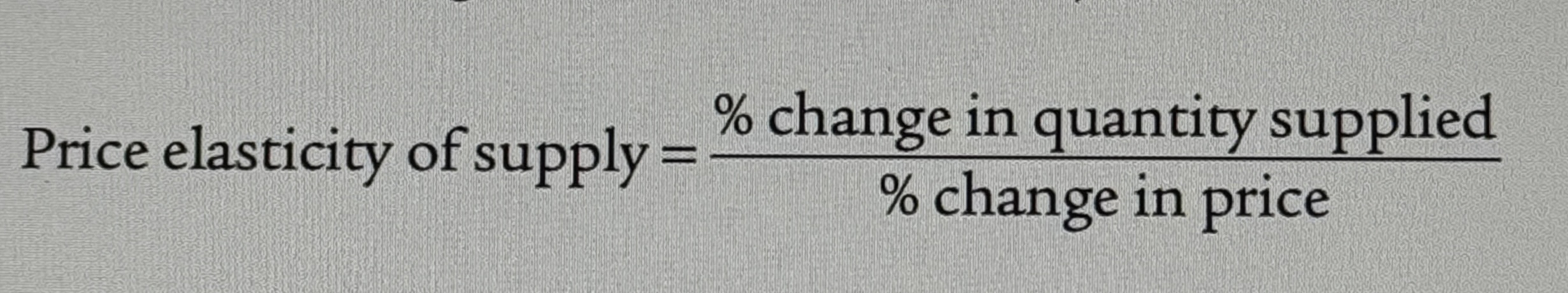

Price elasticity of supply

The price elasticity of supply is a measure of the responsiveness of the quantity of a good supplied to the price of that good. It is the ratio of the percent change in the quantity supplied to the percent change in the price as we move along the supply curve.

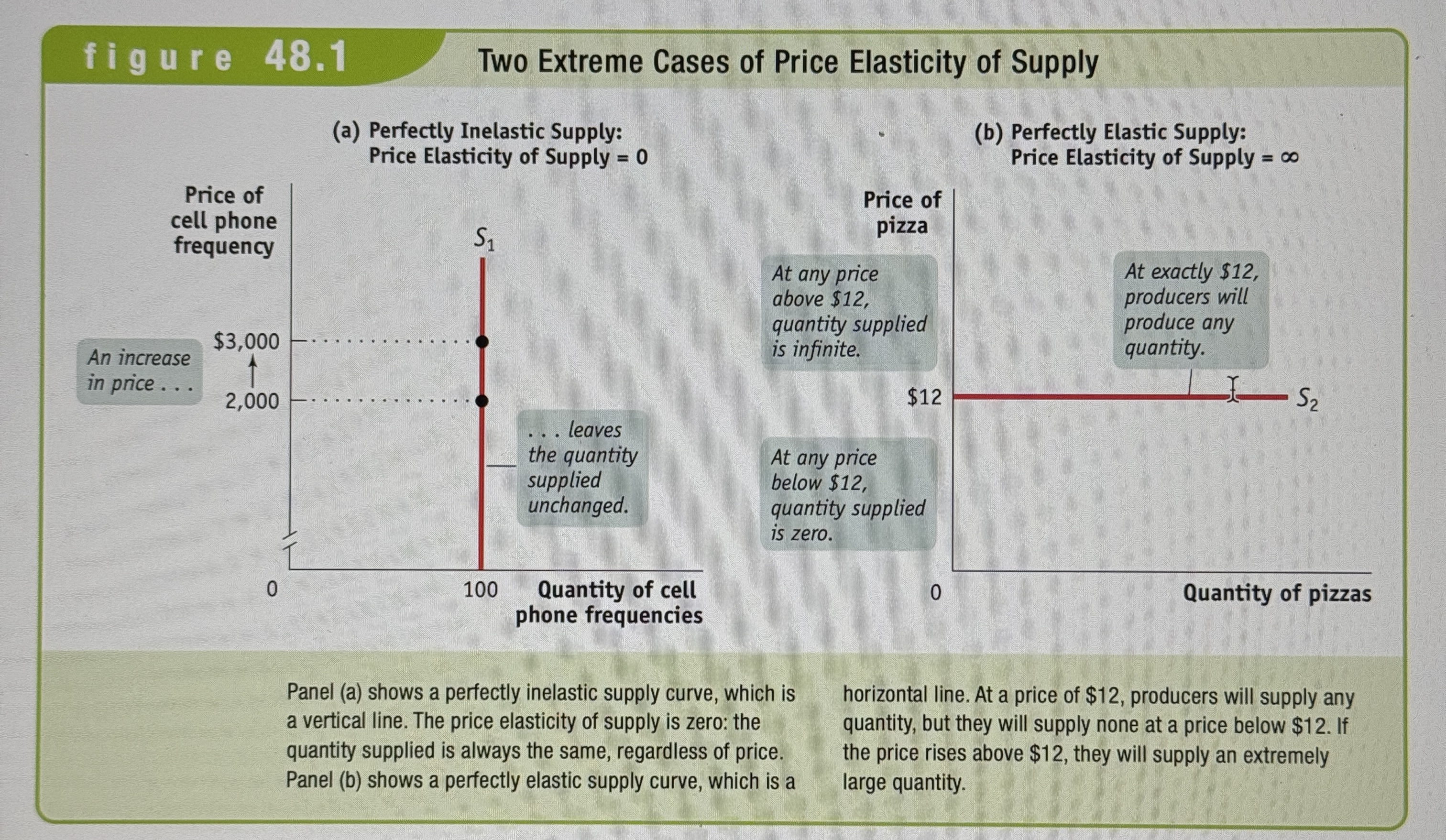

Perfectly inelastic supply

There is perfectly inelastic supply when the price elasticity of supply is zero, so that changes in the price of the good have no effect on the quantity supplied. A perfectly inelastic supply curve is a vertical line.

Perfectly elastic supply

There is perfectly elastic supply if the quantity supplied is zero below some price and infinite above that price. A perfectly elastic supply curve is a horizontal line.

Two Extreme Cases of Price Elasticity of Supply

Ex.

What factors determine the price elasticity of supply?

The availability of inputs

Time

An Elasticity Menagerie

Ex.

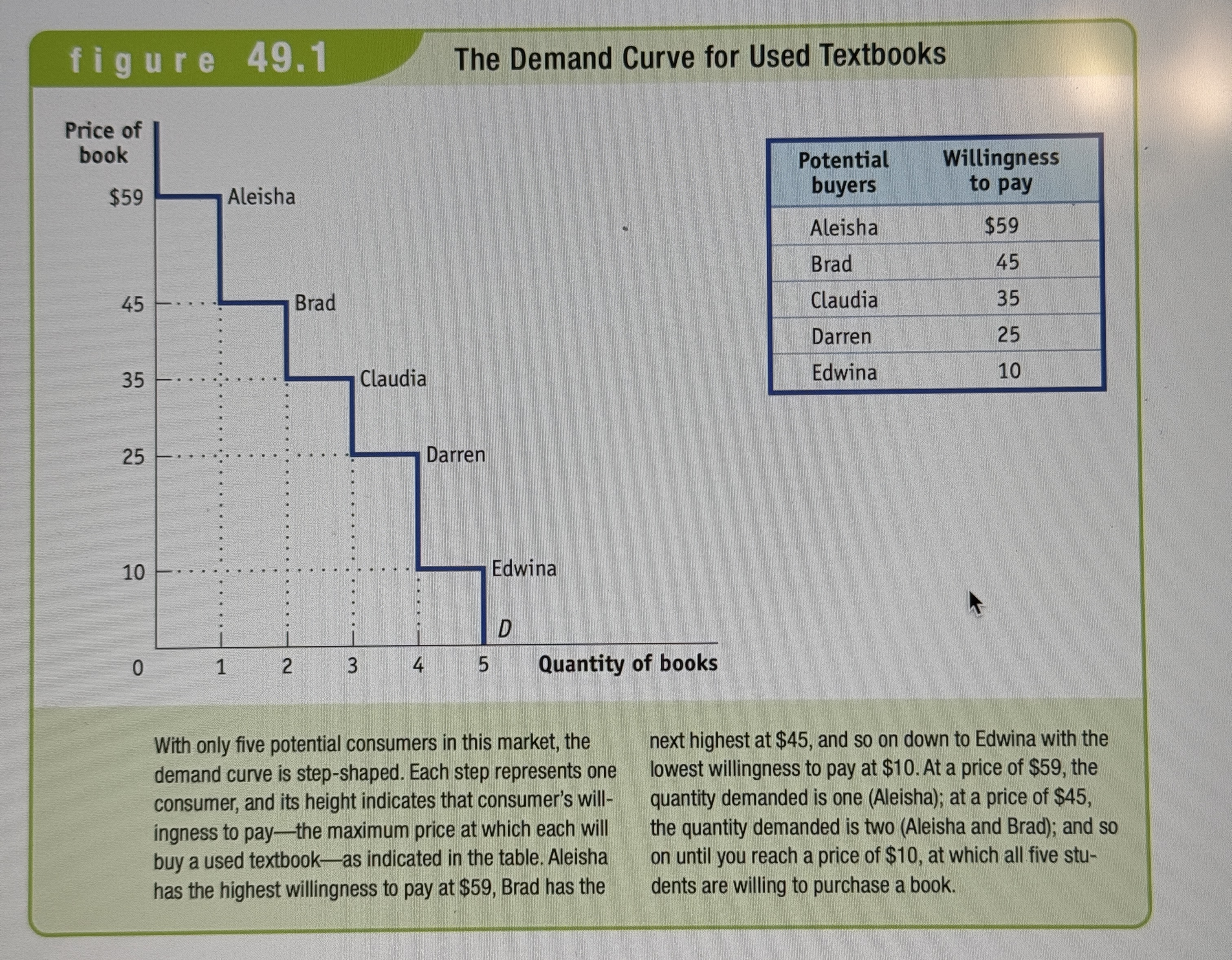

Willingness to pay

A consumers willingness to pay for a good is the maximum price at which he or she would buy that good.

The Demand Curve for Used Textbooks

Ex.

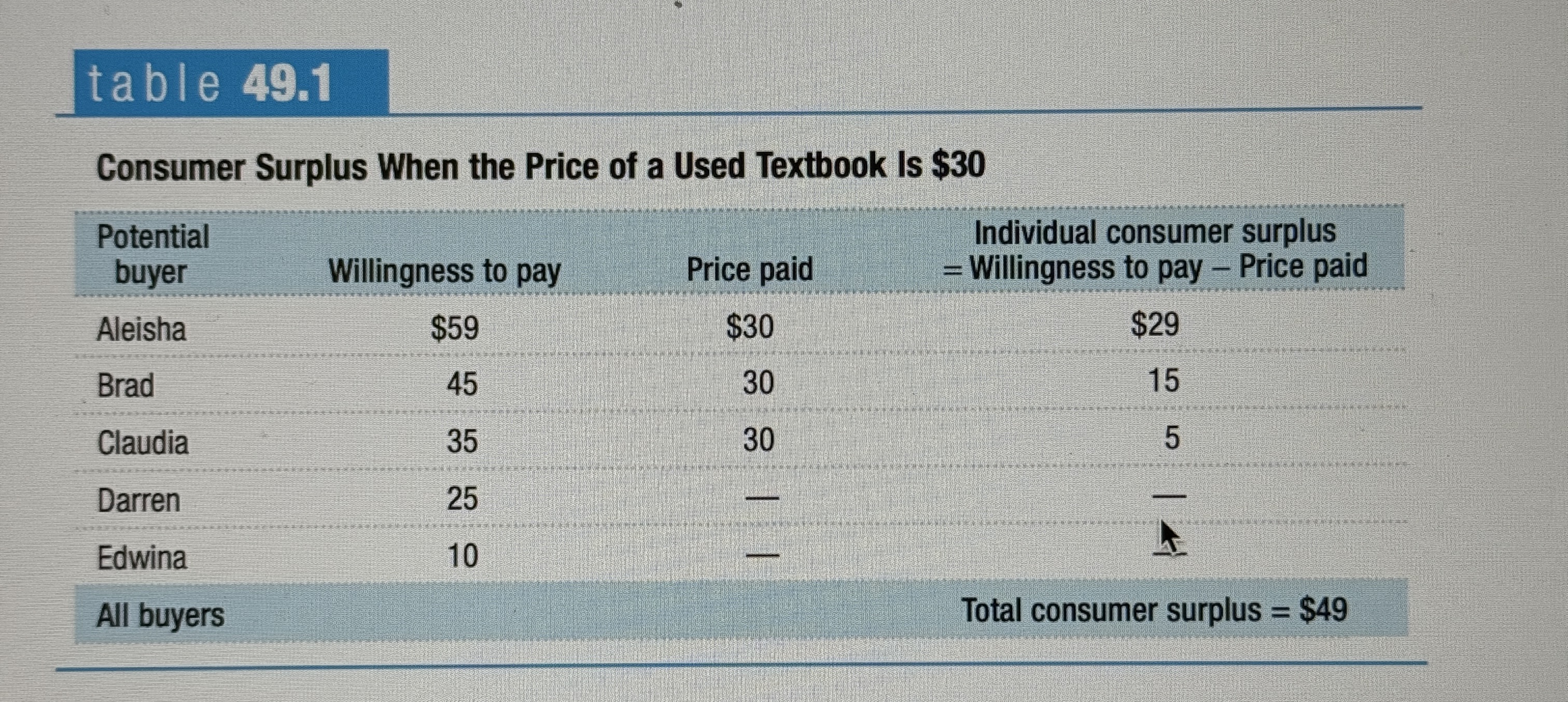

Consumer Surplus When the Price of a Used Textbook Is $30

Ex.

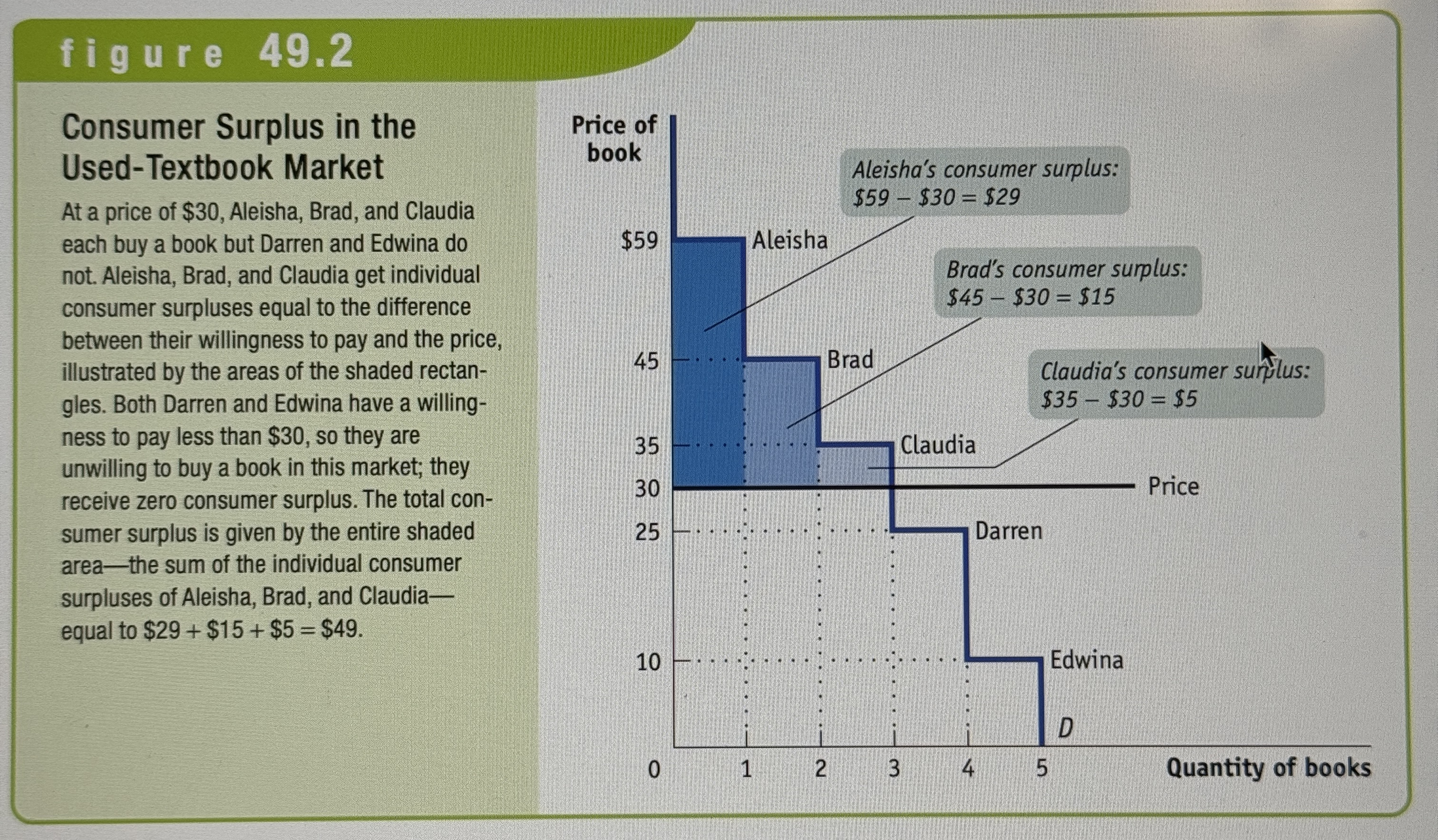

Individual consumer surplus

The net gain to an individual buyer from the purchase of a good. It is equal to the difference between the buyers willingness to pay and the price paid.

Total consumer surplus

The sum of the individual consumer surpluses of all the buyers of goods in a market.

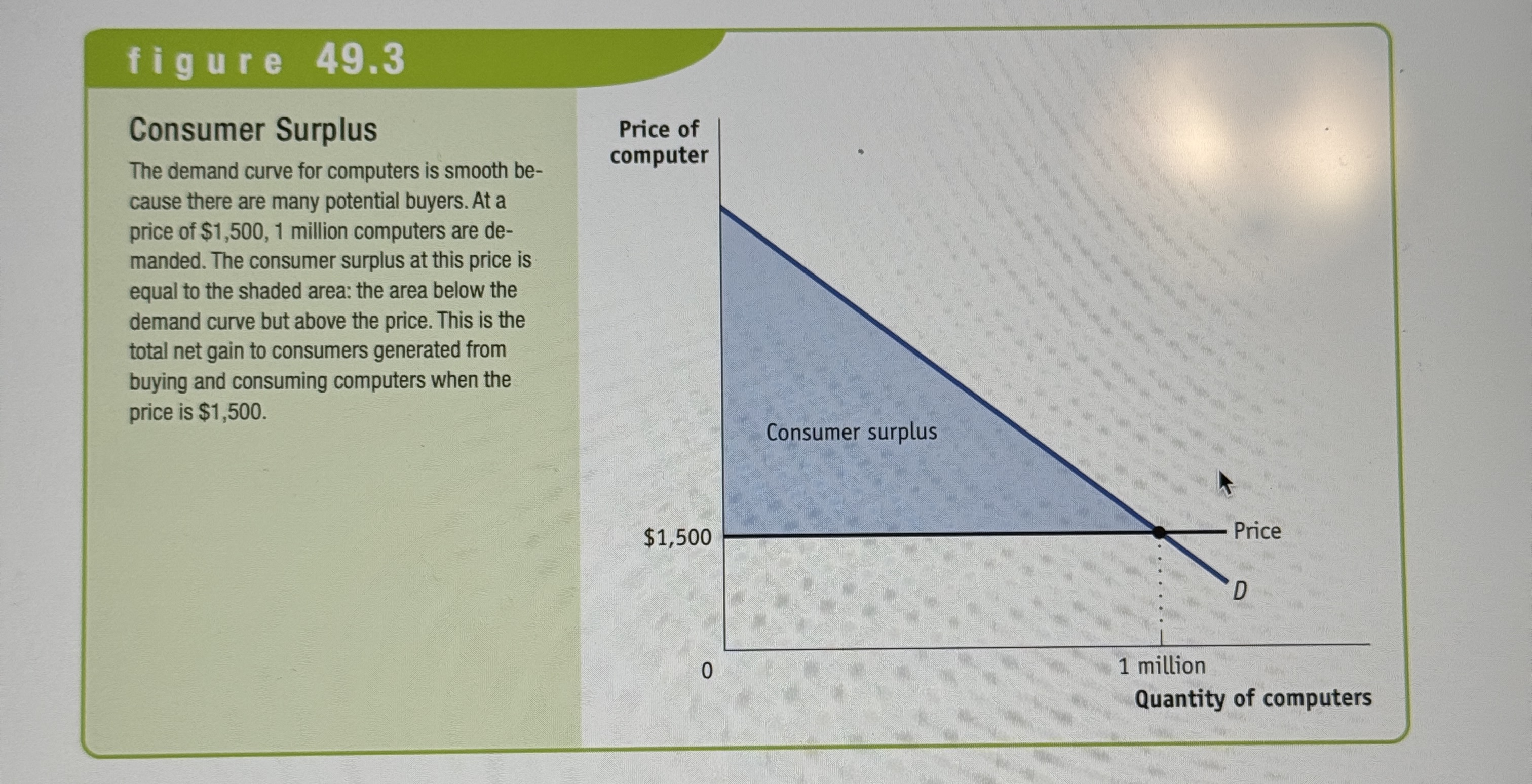

Consumer surplus

The term is often used to refer to both individual and total consumer surplus.

Consumer Surplus in the Used-Textbook Market

Ex.

Consumer Surplus Graph

Ex.

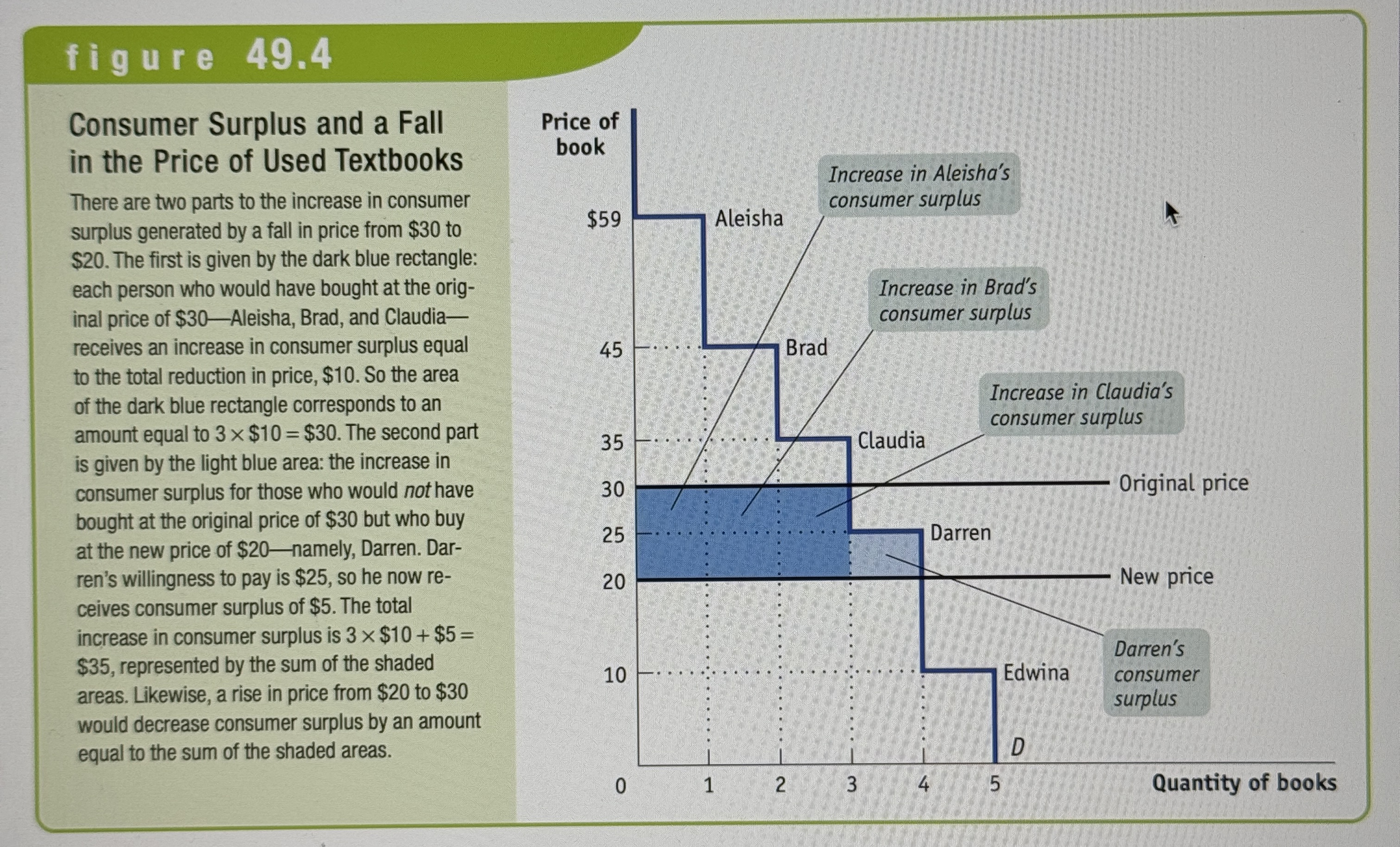

Consumer Surplus and a Fall in the Price of Used Textbooks

Ex.

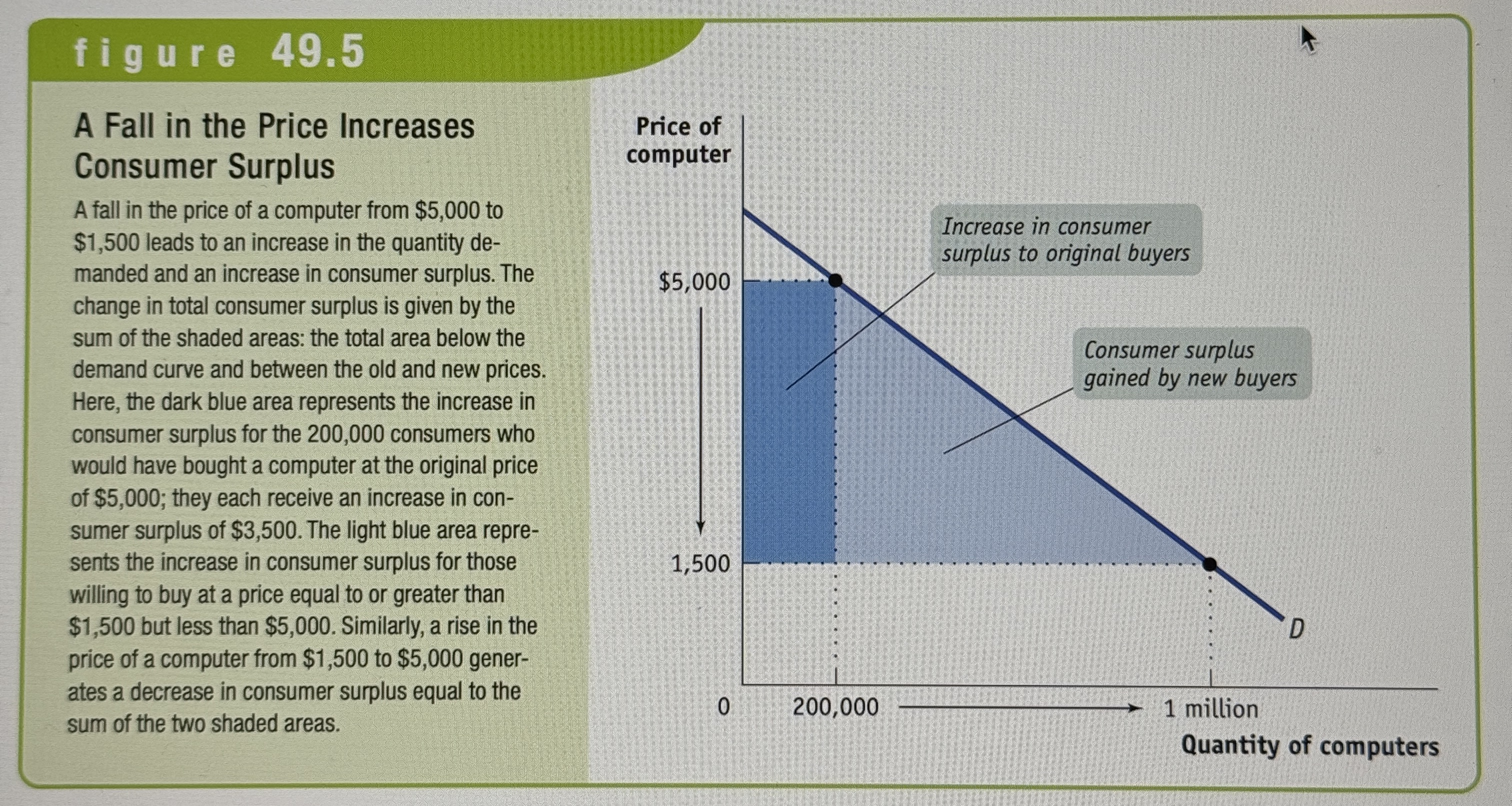

A Fall in the Price Increases Consumer Surplus

Ex.

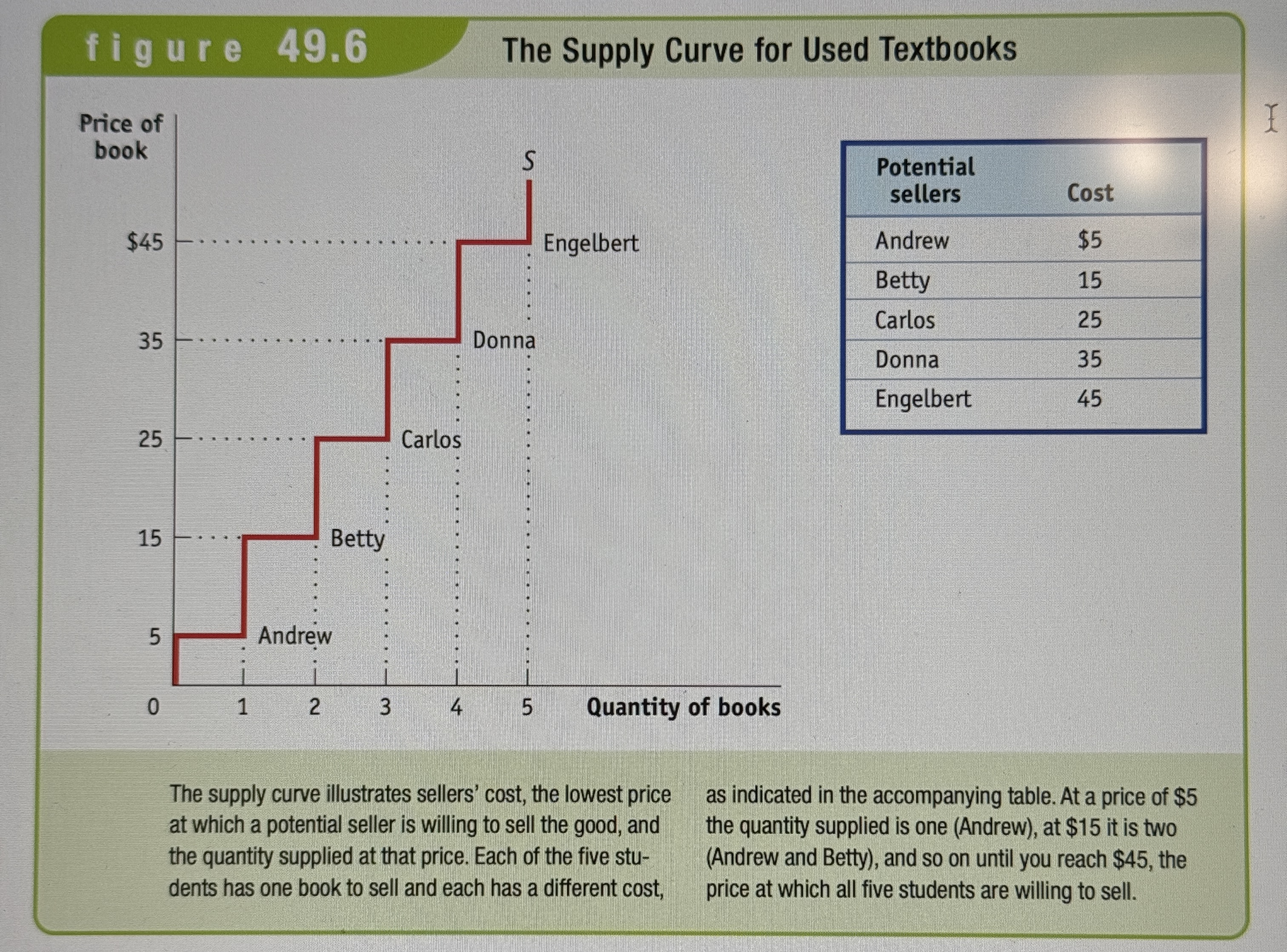

The Supply Curve for Used Textbooks

Ex.

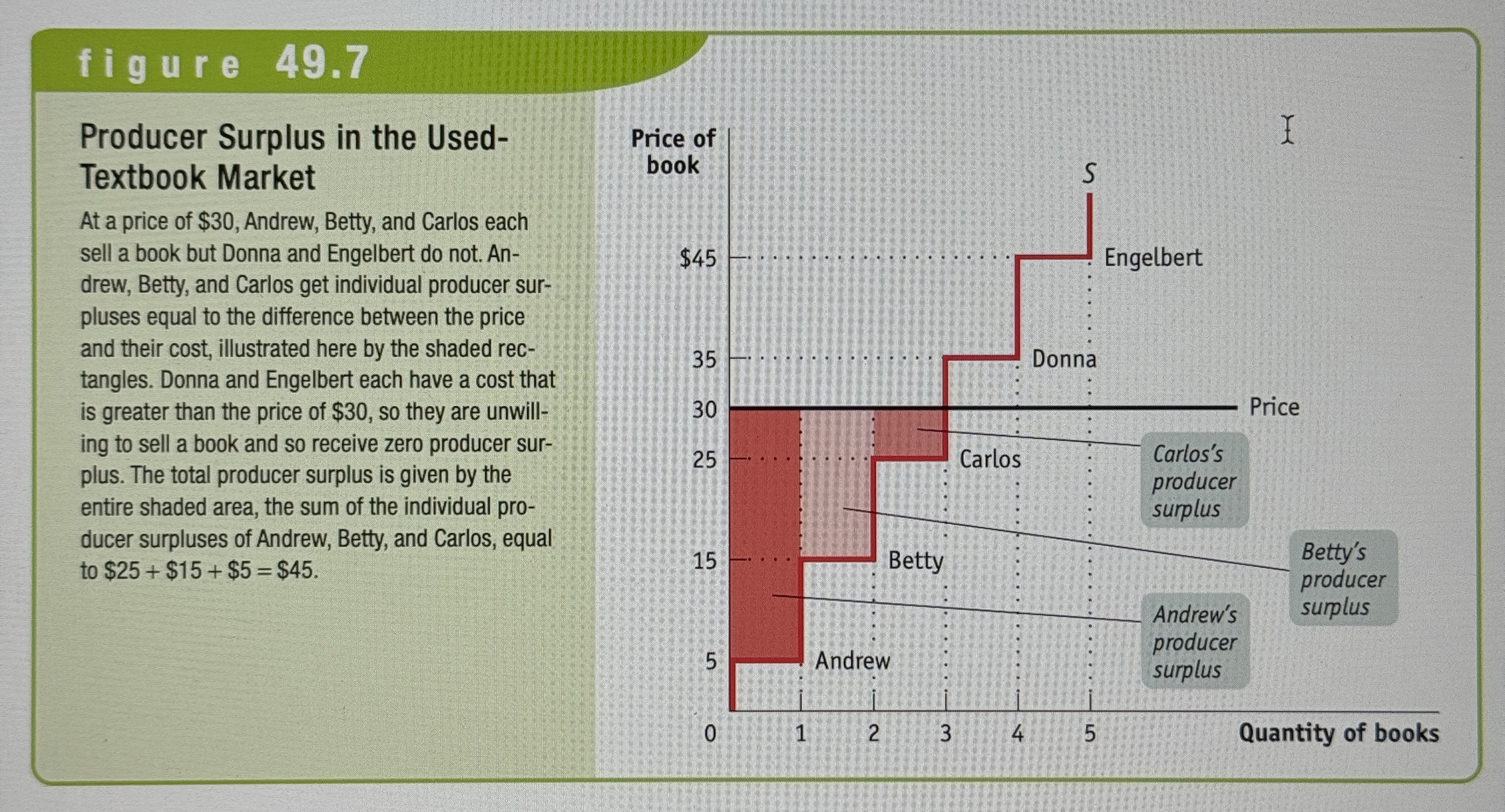

Sellers Cost

The lowest price at which a seller is willing to sell a good.

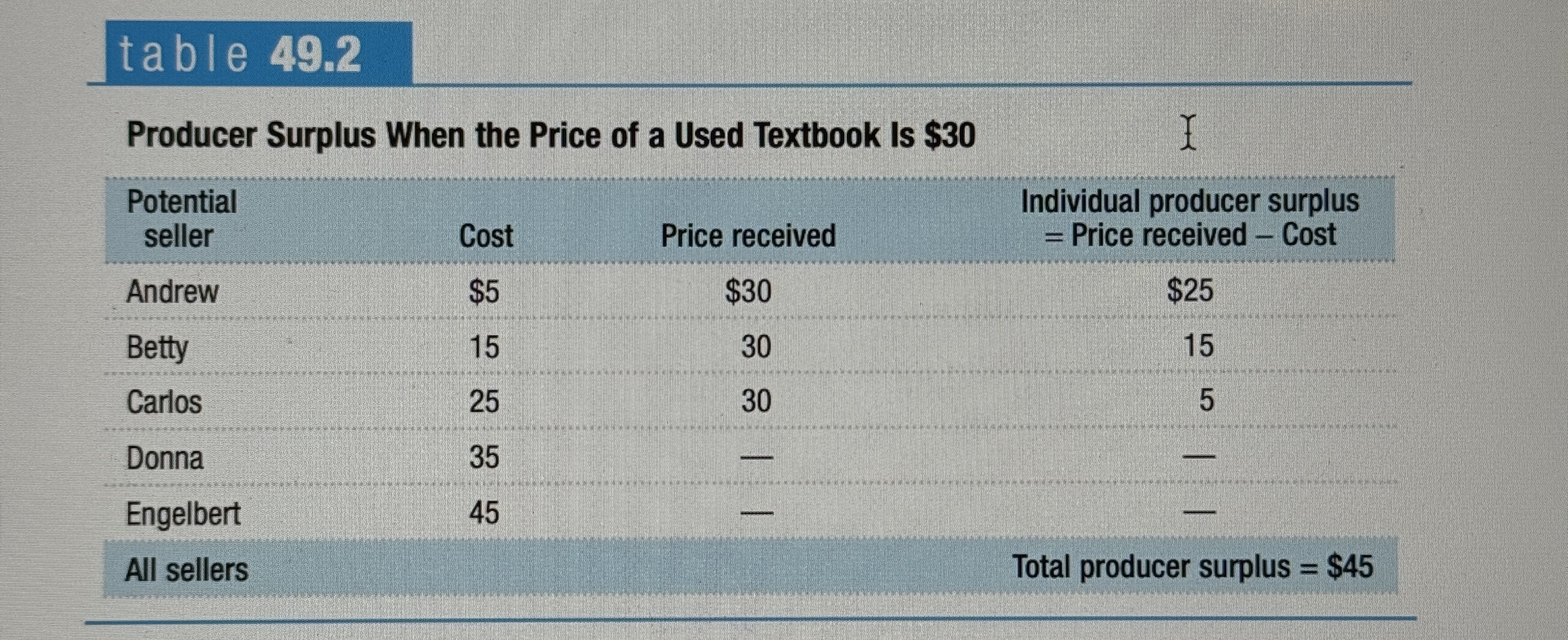

Individual Producer Surplus

The net gain to an individual seller from selling a good. It is equal to the difference between the price and the sellers cost.

Total Producer Surplus

In a market it is the sum of the individual producer surpluses of all the sellers of a good in a market.

Producer Surplus

Often used to refer to both the individual and the total producer surplus.

Producer Surplus When the Price of a Used Textbook Is $30

Ex.

Producer Surplus in the Used-Textbook Market

Ex.

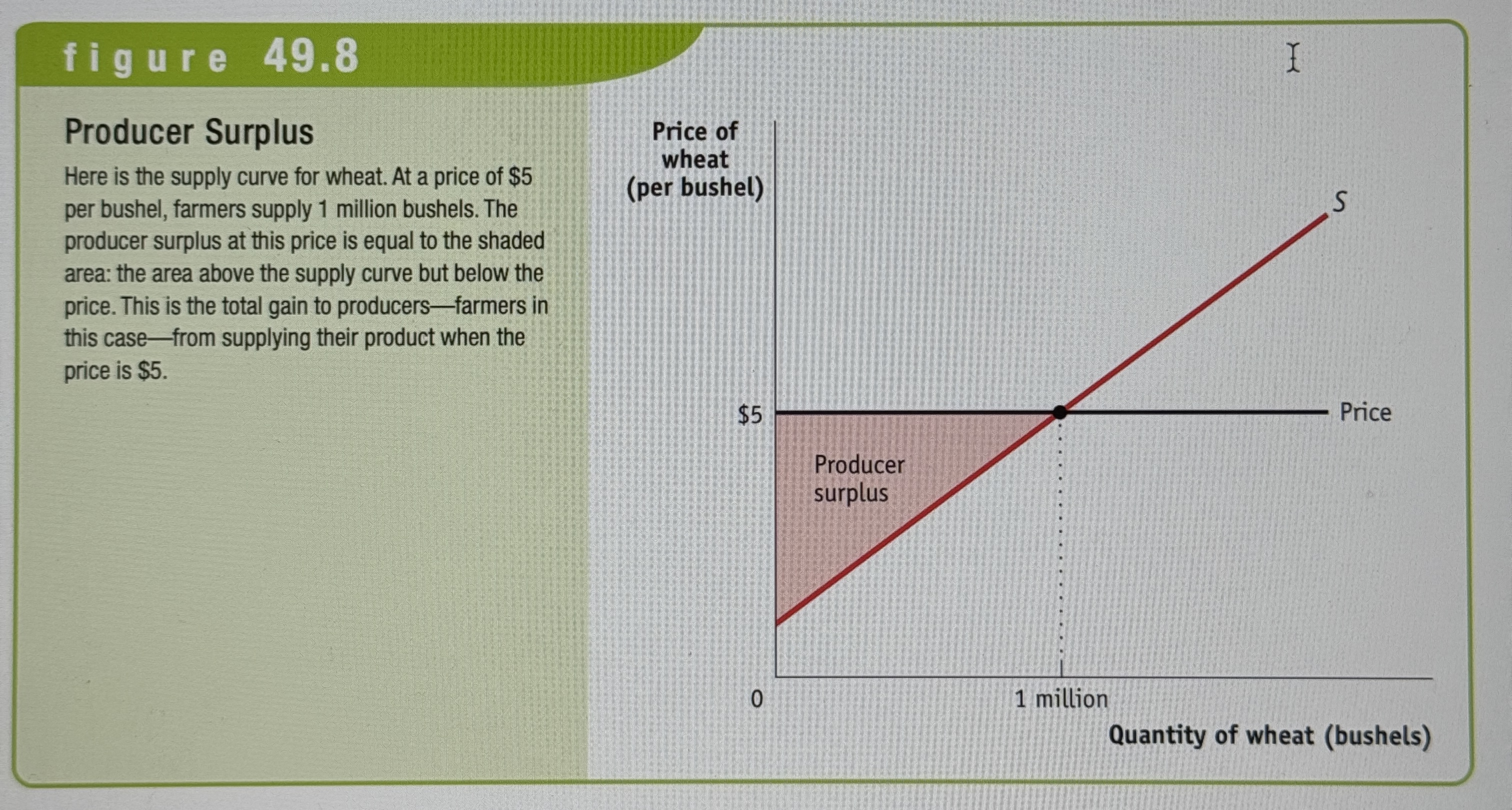

Producer Surplus Graph

Ex.

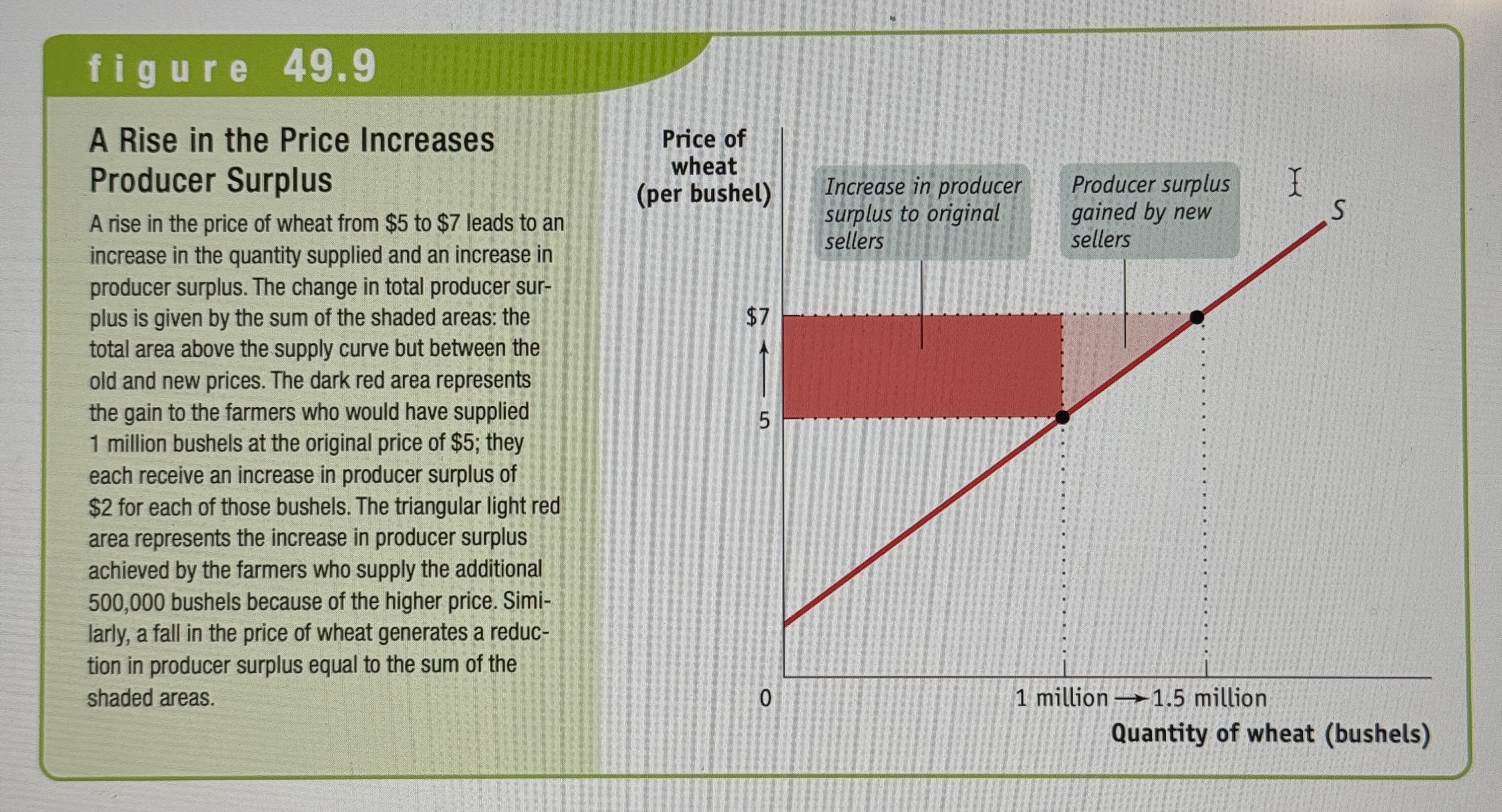

A Rise in the Price Increases Producer Surplus

Ex.

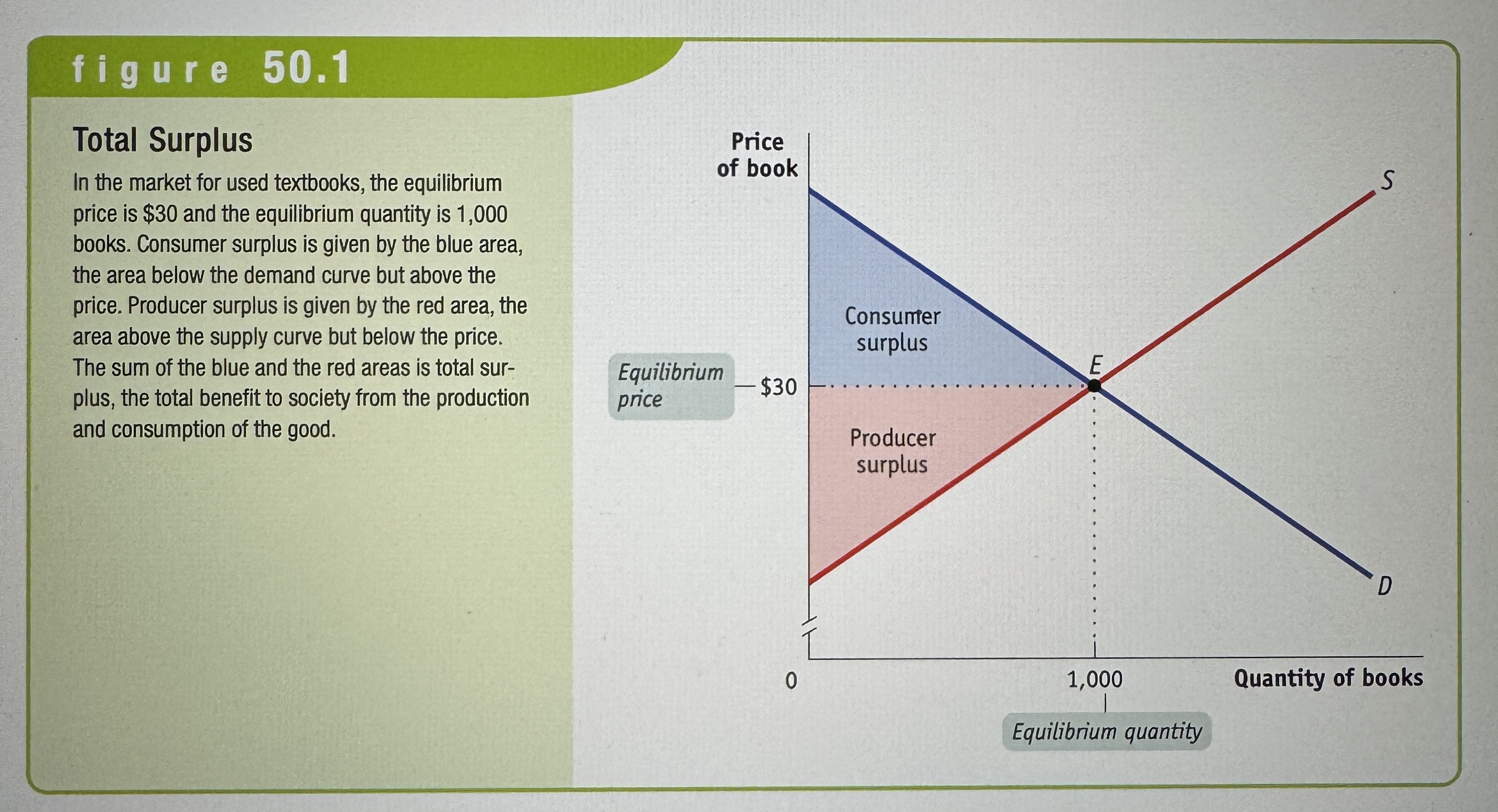

Total Surplus

The total net gain to consumers and producers from trading in a market. It is the sum of producer and consumer surplus.

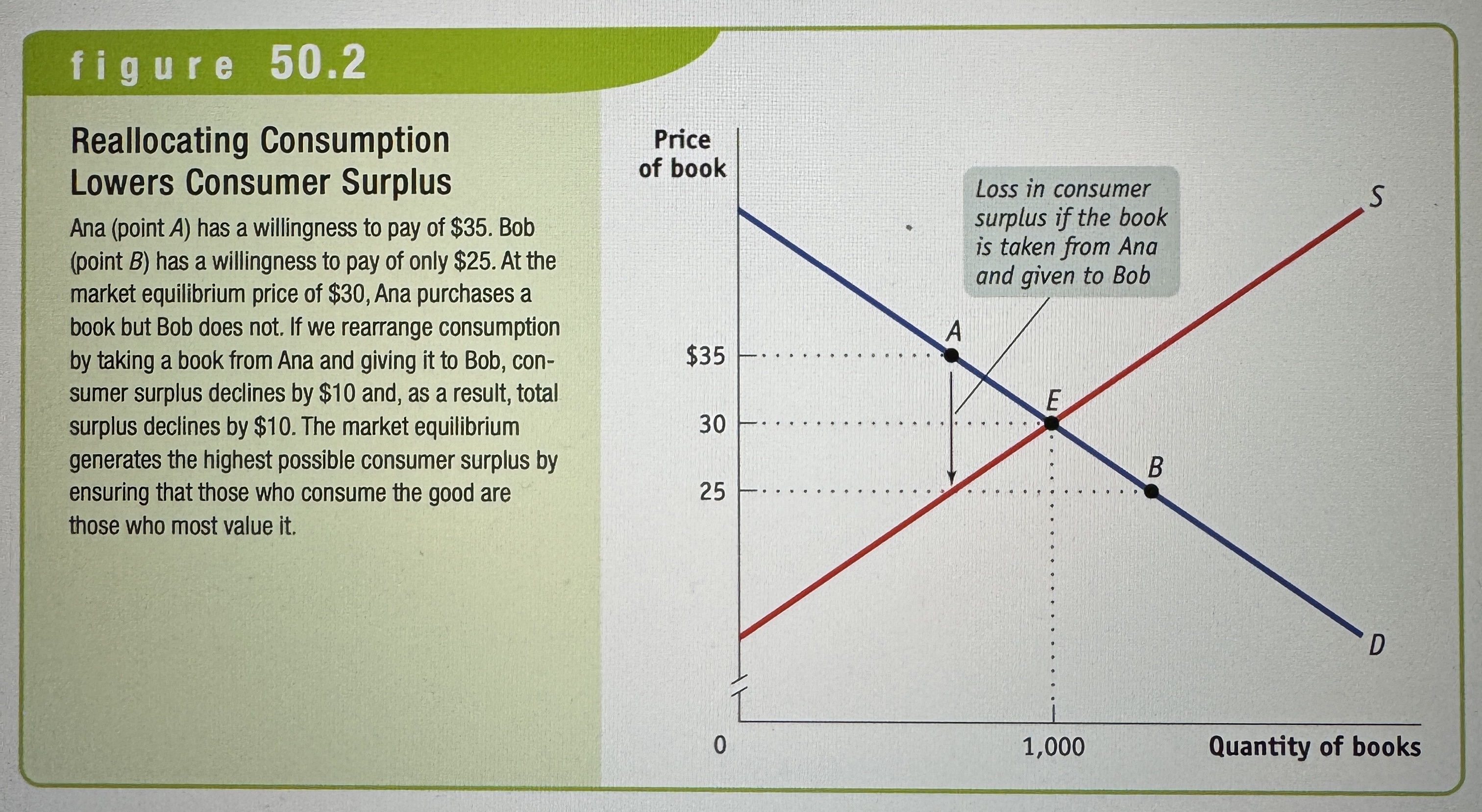

Reallocating Consumption Lowers Consumer Surplus

Ex.

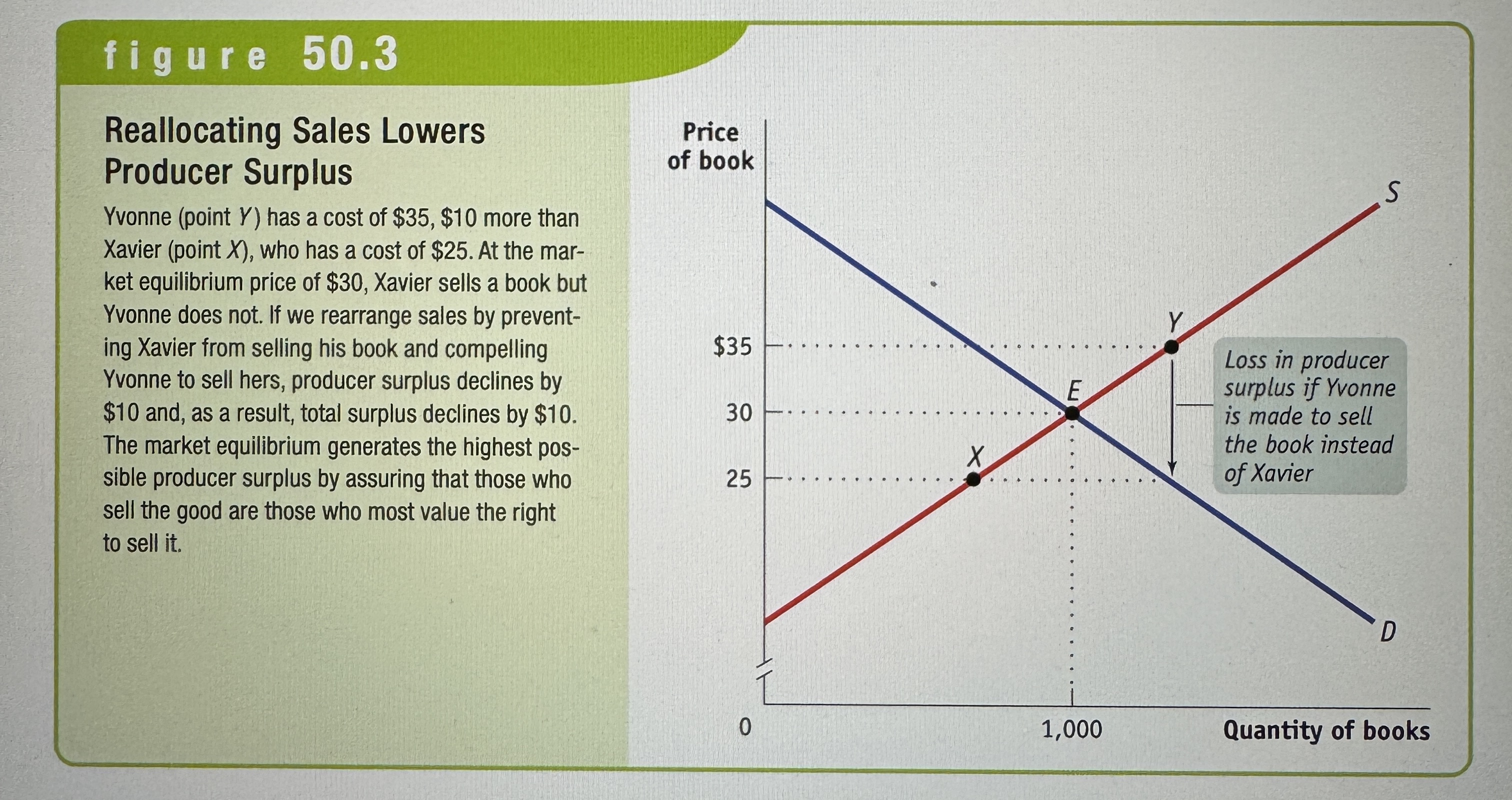

Reallocating Sales Lowers Producer Surplus

Ex.

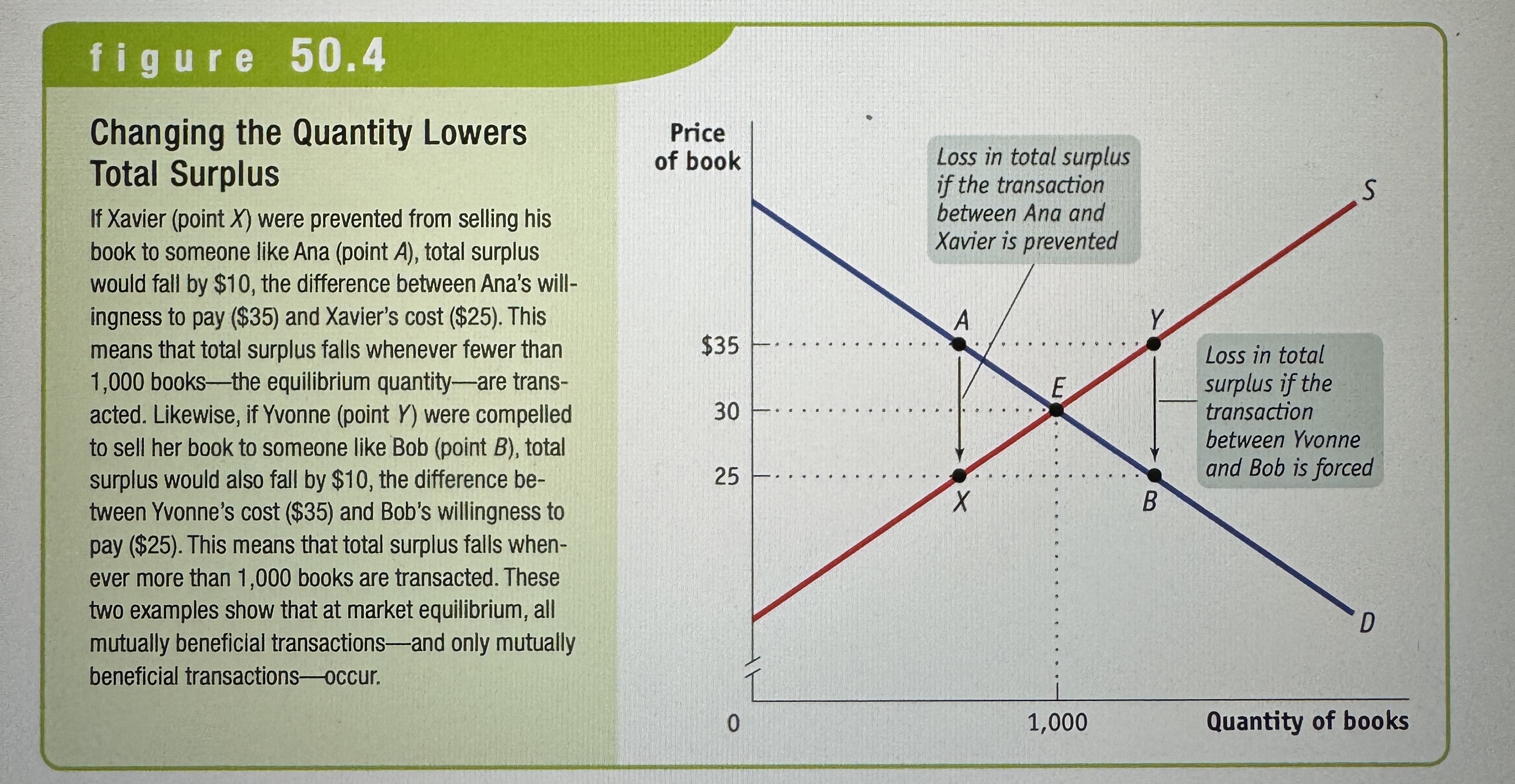

Changing the Quantity Lowers Total Surplus

Ex.

Progressive Tax

A tax that rises more than in proportion to income.

Regressive Tax

A tax that rises less than in proportion to income.

Proportional Tax

A tax that rises in proportion to income.

Excise Tax

A tax on sales of a particular good or service.

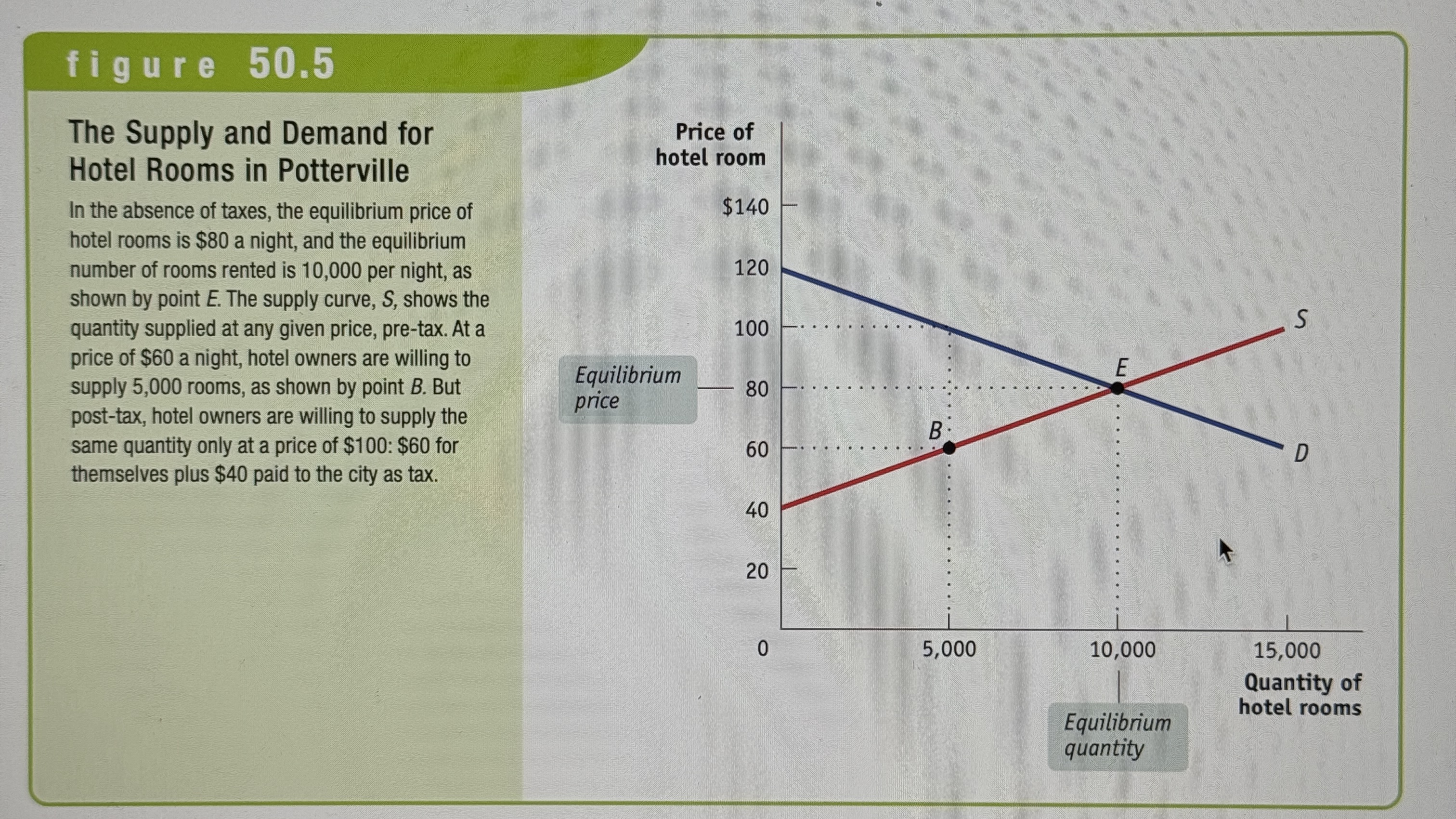

The Supply and Demand for Hotel Rooms in Potterville

Ex.

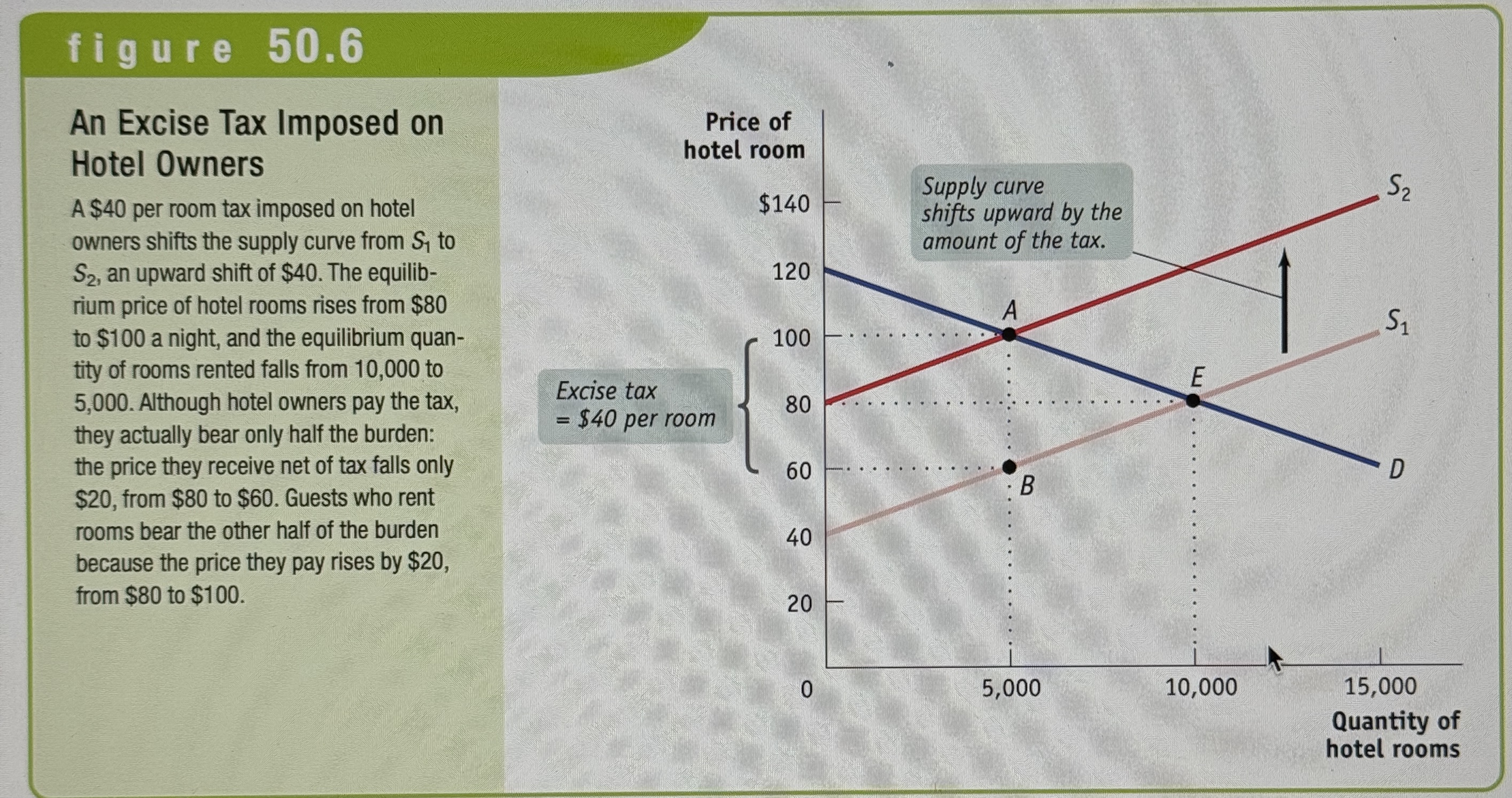

An Excise Tax Imposed on Hotel Owners

Ex.

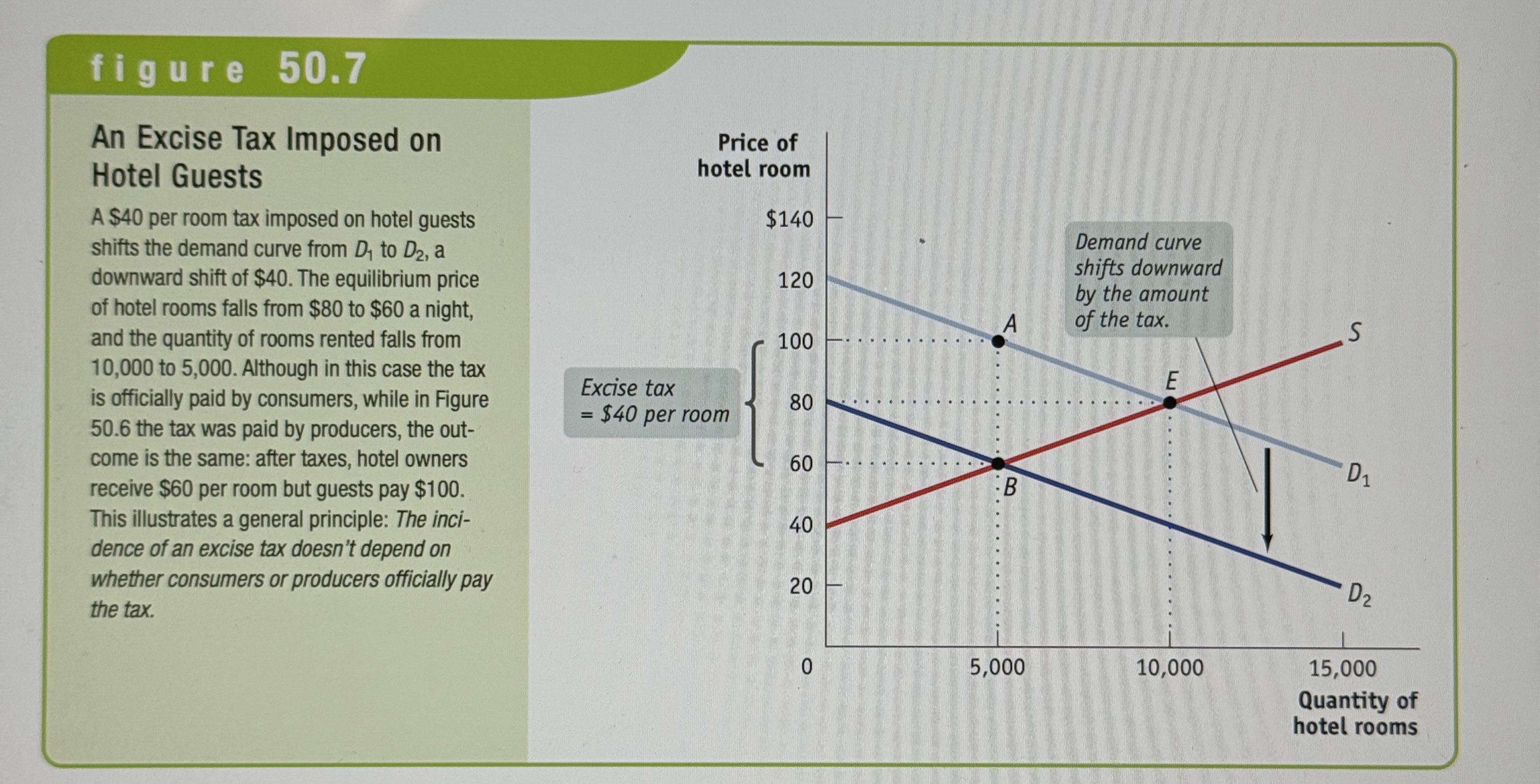

An Excise Tax Imposed on Hotel Guests

Ex.

Tax Incidence

The distribution of the tax burden.

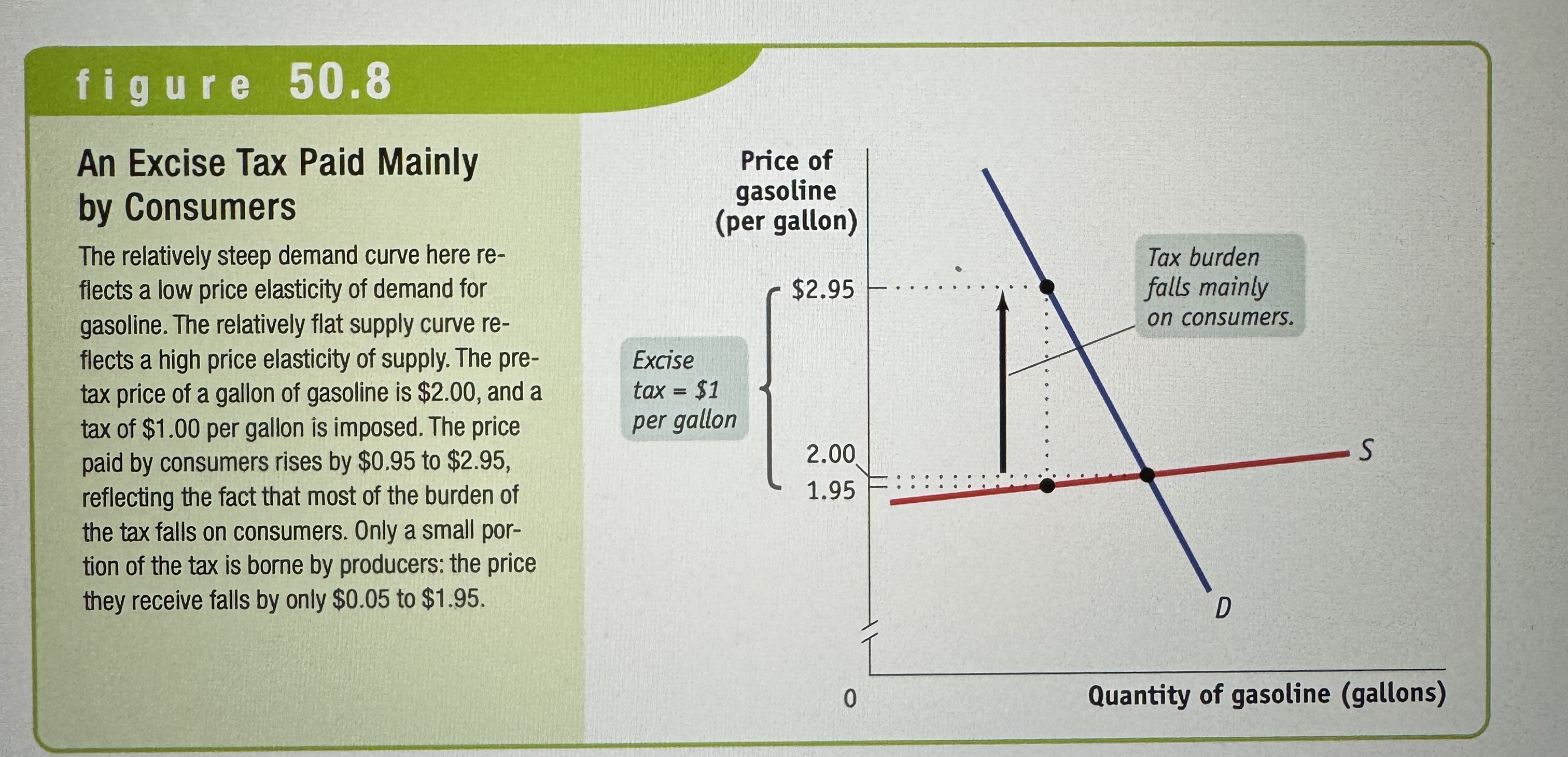

An Excise Tax Paid Mainly by Consumers

Ex.

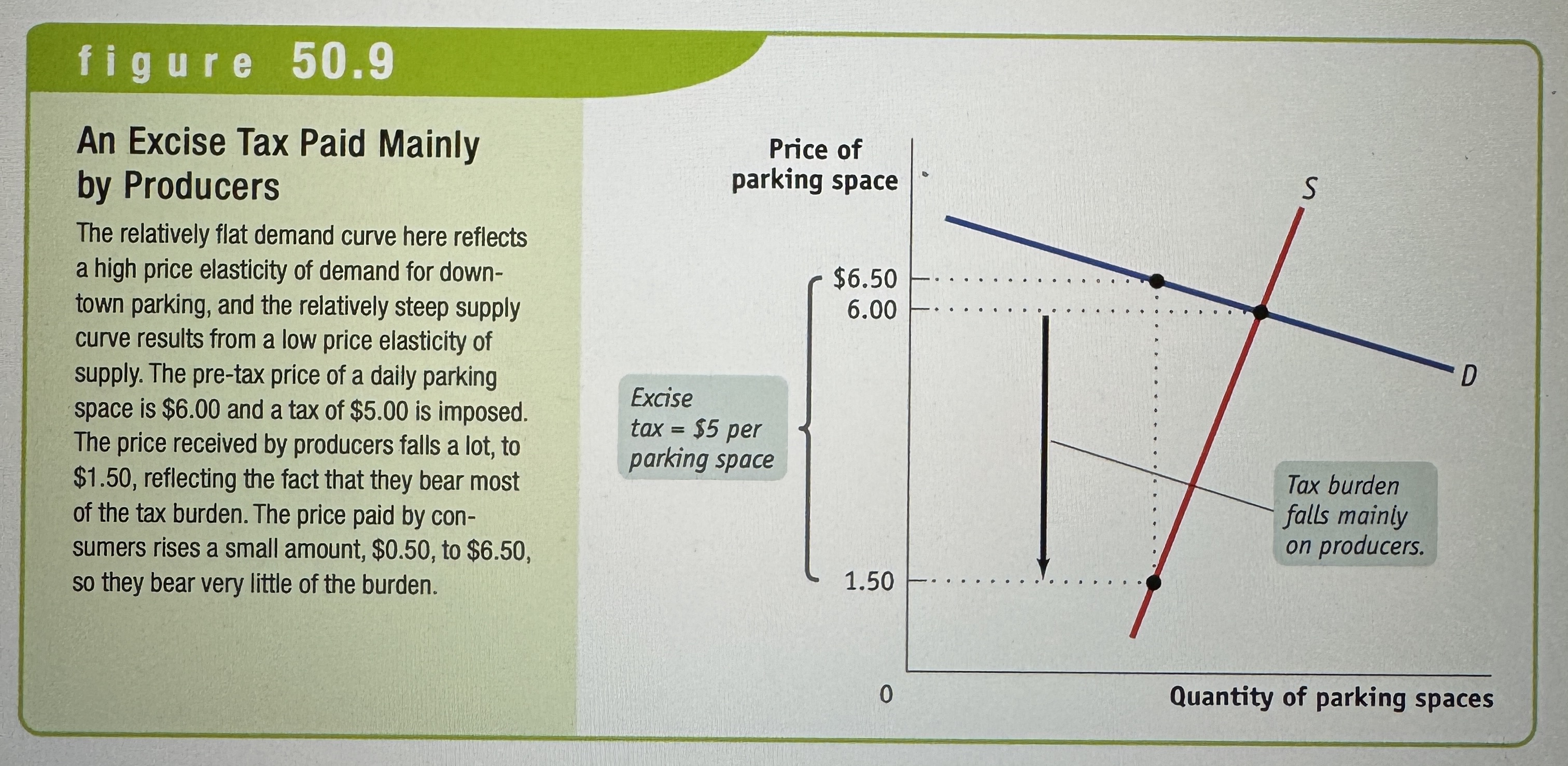

An Excise Tax Paid Mainly by Producers

Ex.

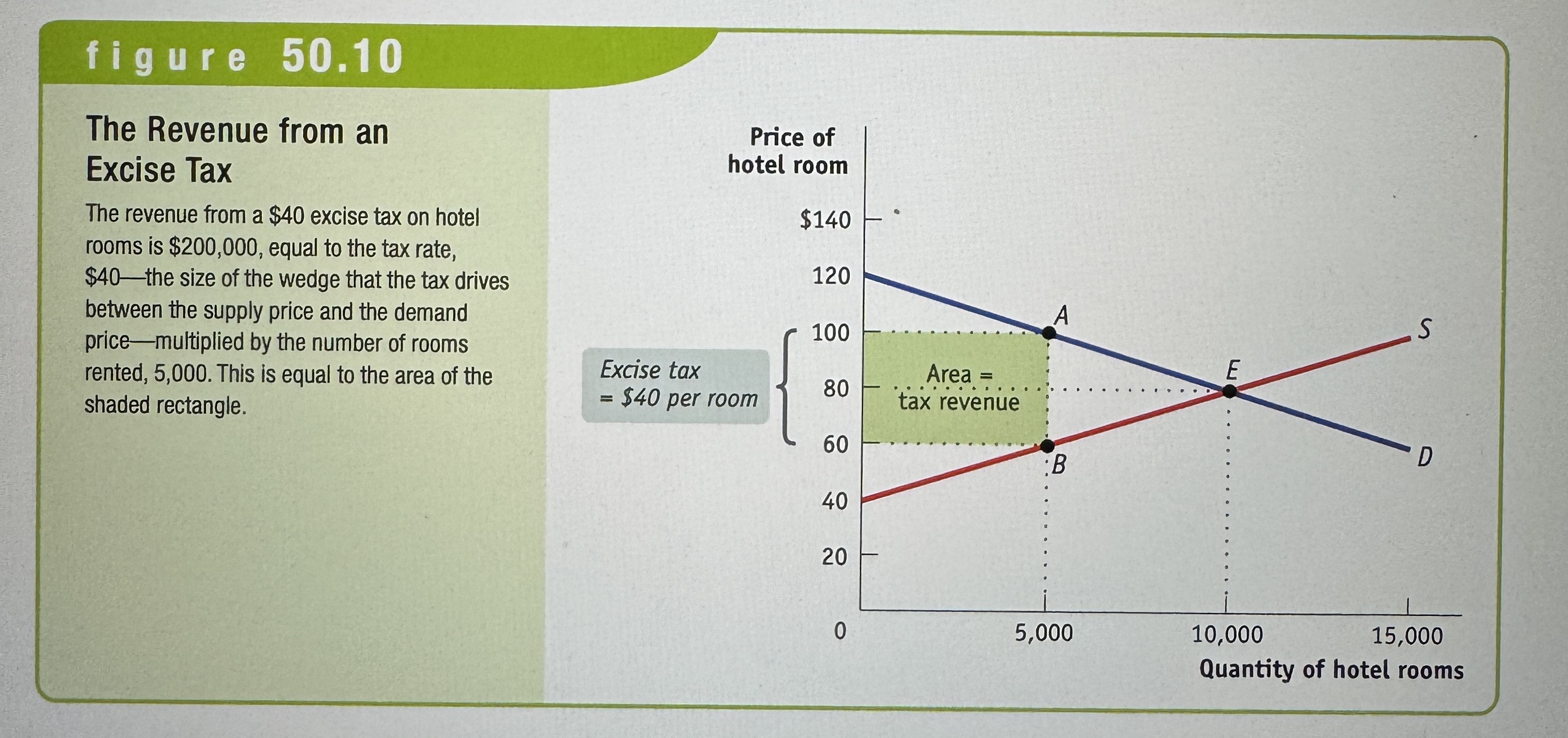

The Revenue from an Excise Tax

Ex.

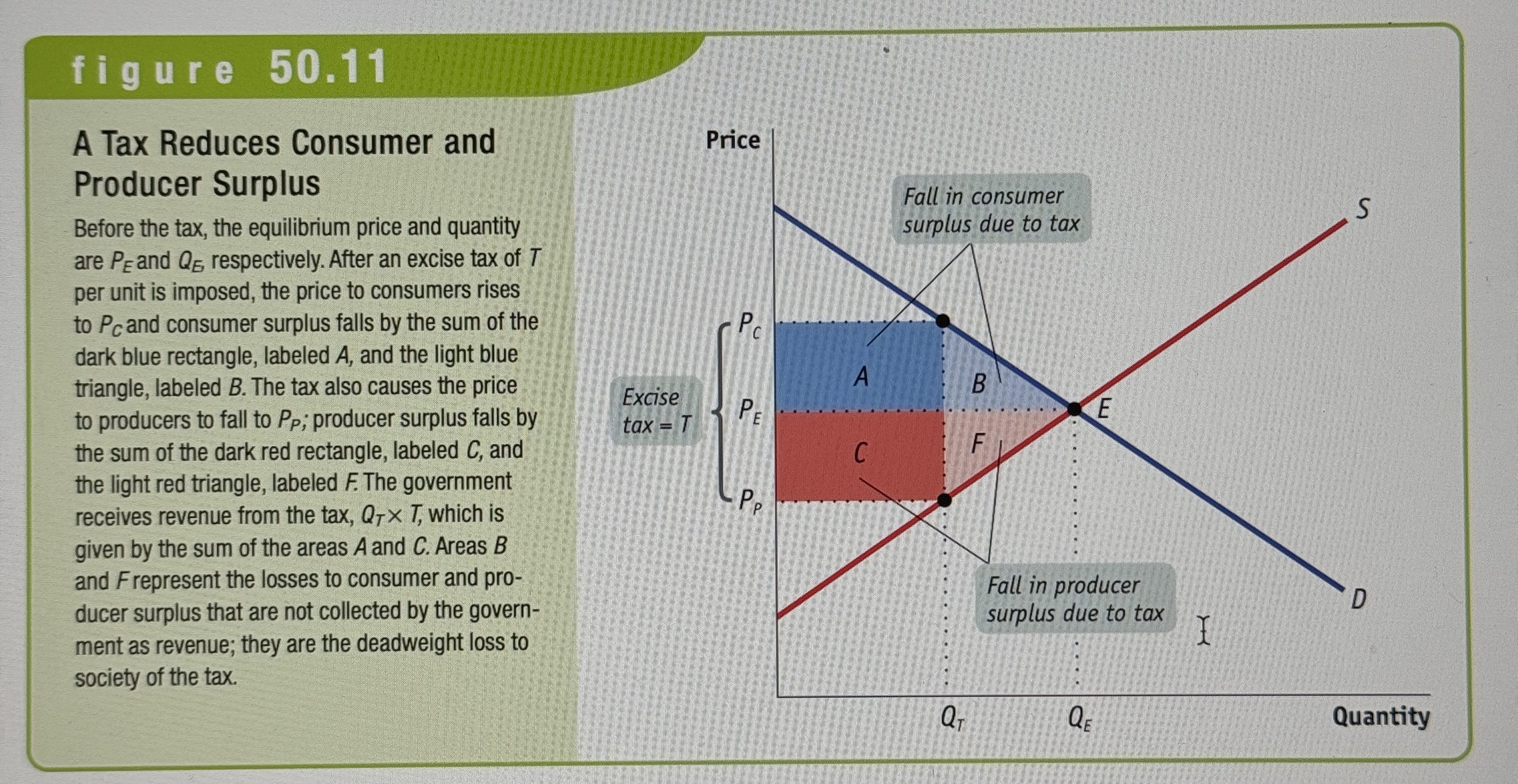

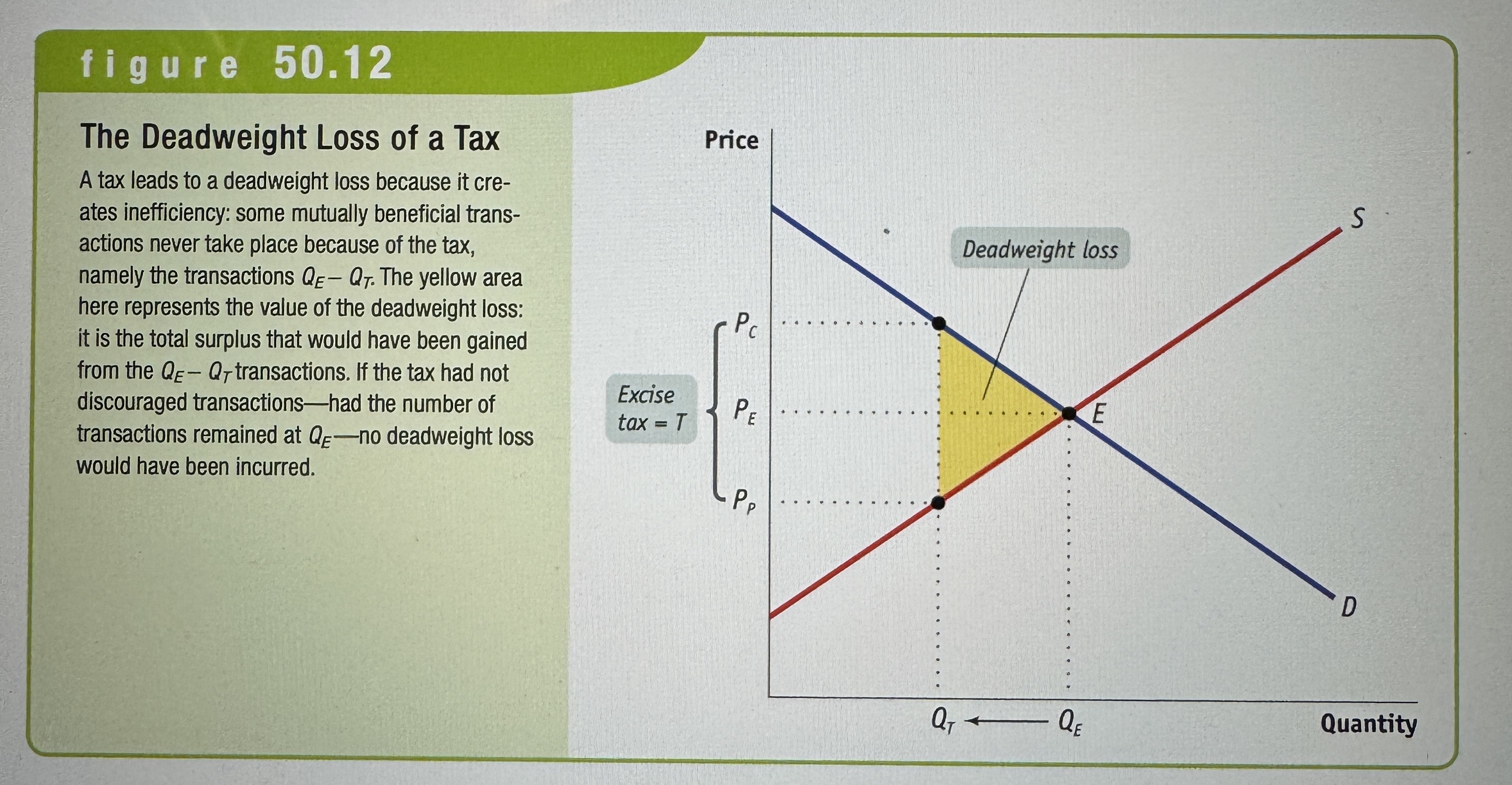

Deadweight Loss

From a tax, it is the decrease in total surplus resulting from the tax, minus the tax revenue generated.

A Tax Reduces Consumer and Producer Surplus

Ex.

The Deadweight Loss of a Tax

Ex.

Administrative costs

The resources used by governments to collect the tax, and by taxpayers to pay or to invade it, over and above the amount collected.

Lump-Sum Tax

A tax of a fixed amount paid by all taxpayers.

Utility

A measure of personal satisfaction

Util

A unit of utility

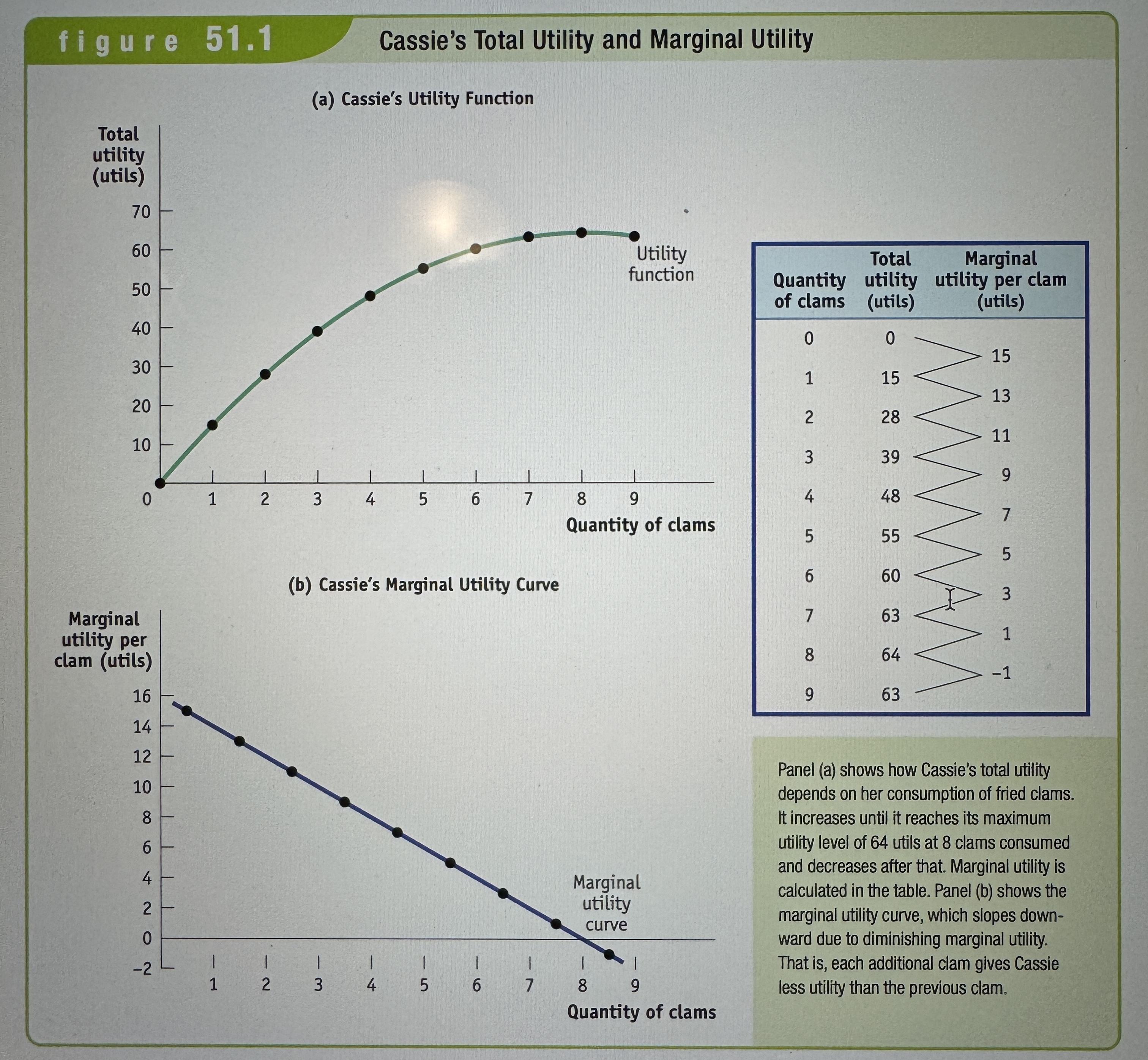

Cassie's Total Utility and Marginal Utility

Ex.

Marginal utility

The marginal utility of a good or service is the change in total utility generated by consuming one additional unit of that good or service. The marginal utility curve shows marginal utility depends on the quantity of a good or service consumed.

The principle of diminishing marginal utility

States that each successive unit of a good or service consumed adds less to total utility then does the previous unit.

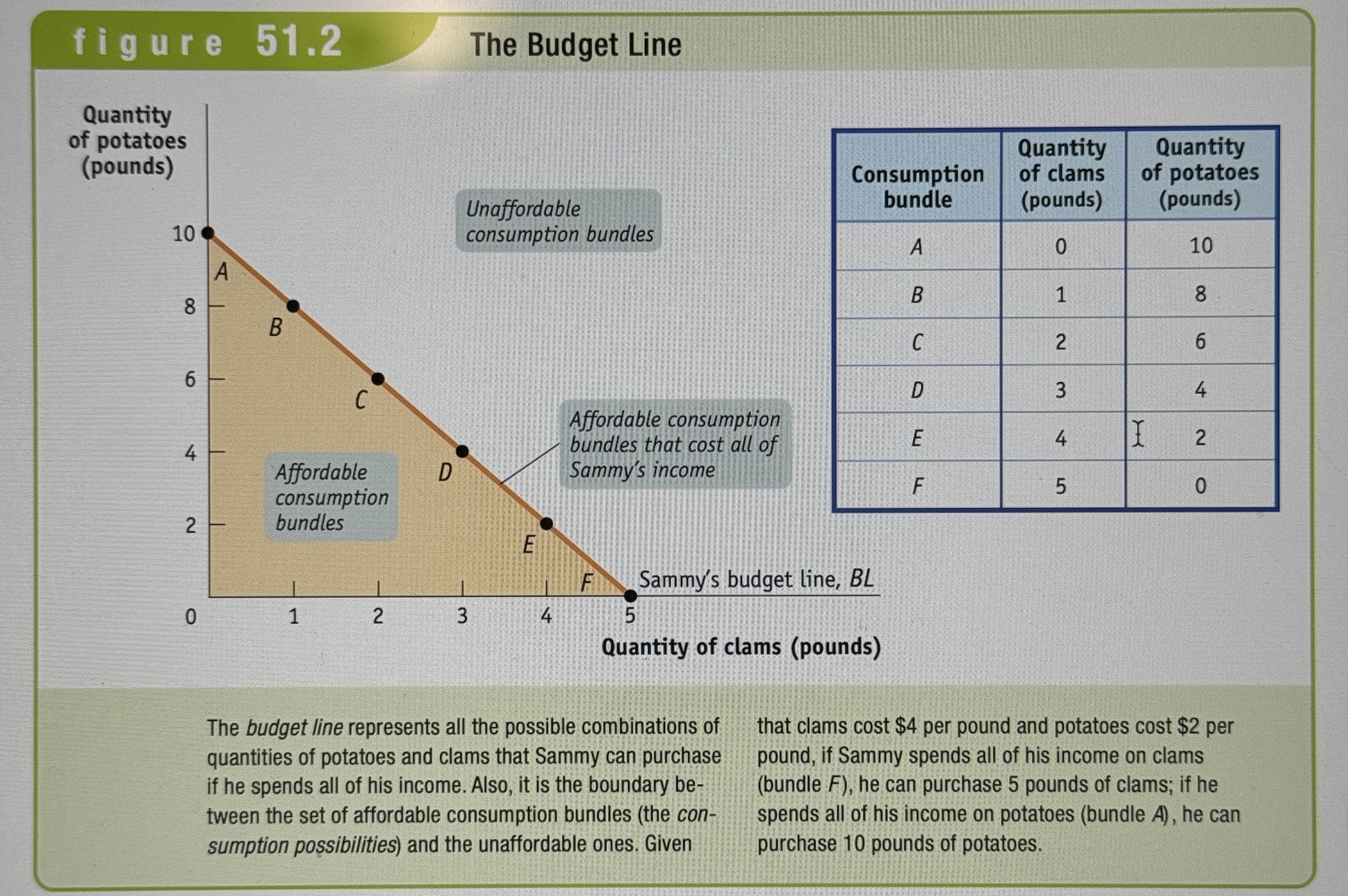

Budget Constraint

Limits the cost of a consumers consumption bundle to no more than the consumers income.

Consumption possibilities

Is the set of all consumption bundles that are affordable, given the consumers income and prevailing prices.

Budget line

Shows the consumption bundles available to a consumer who spends all of his or her income.

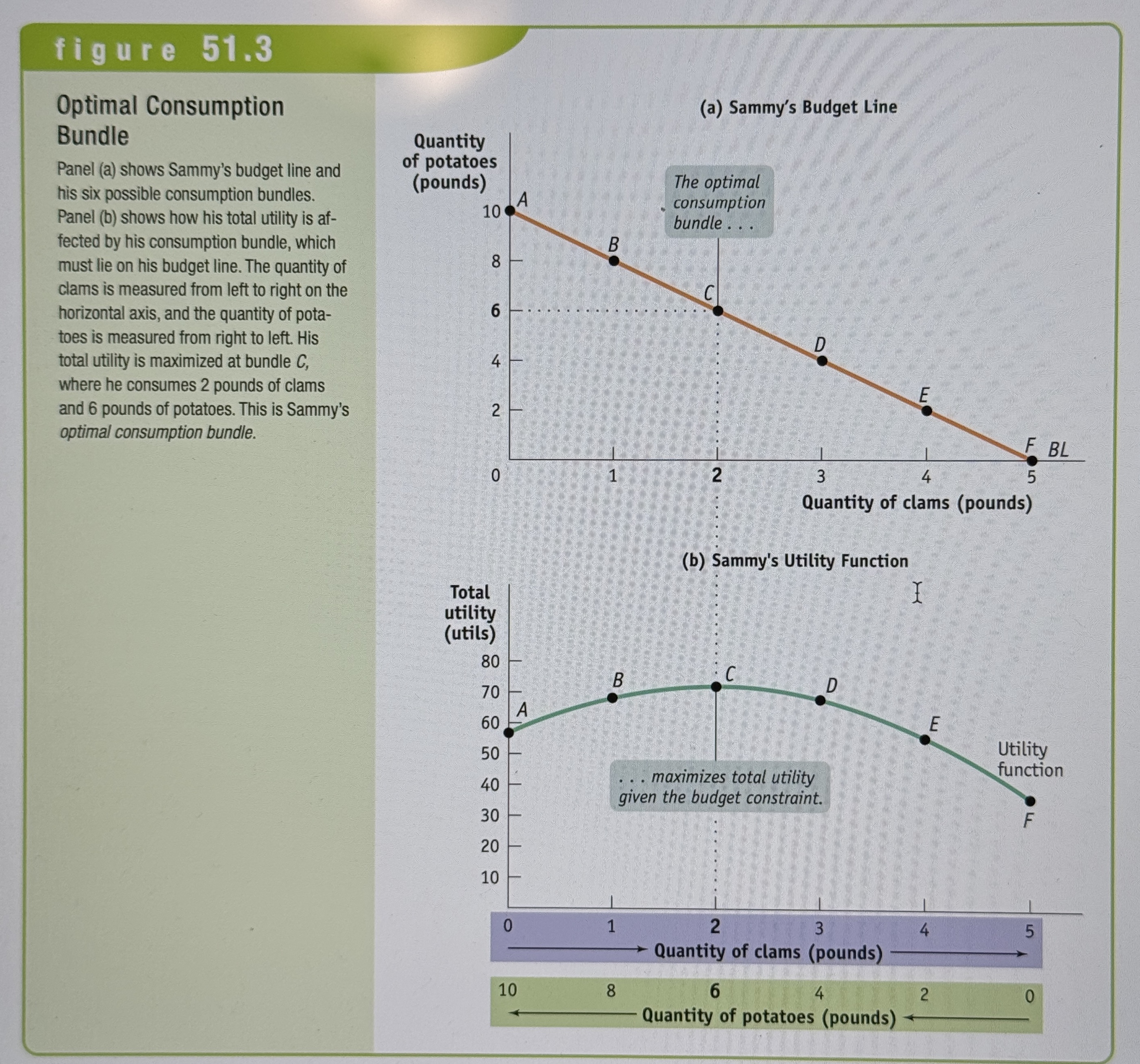

The optimal consumption bundle

The consumption bundle that maximizes the consumers total utility given his or her budget constraint.

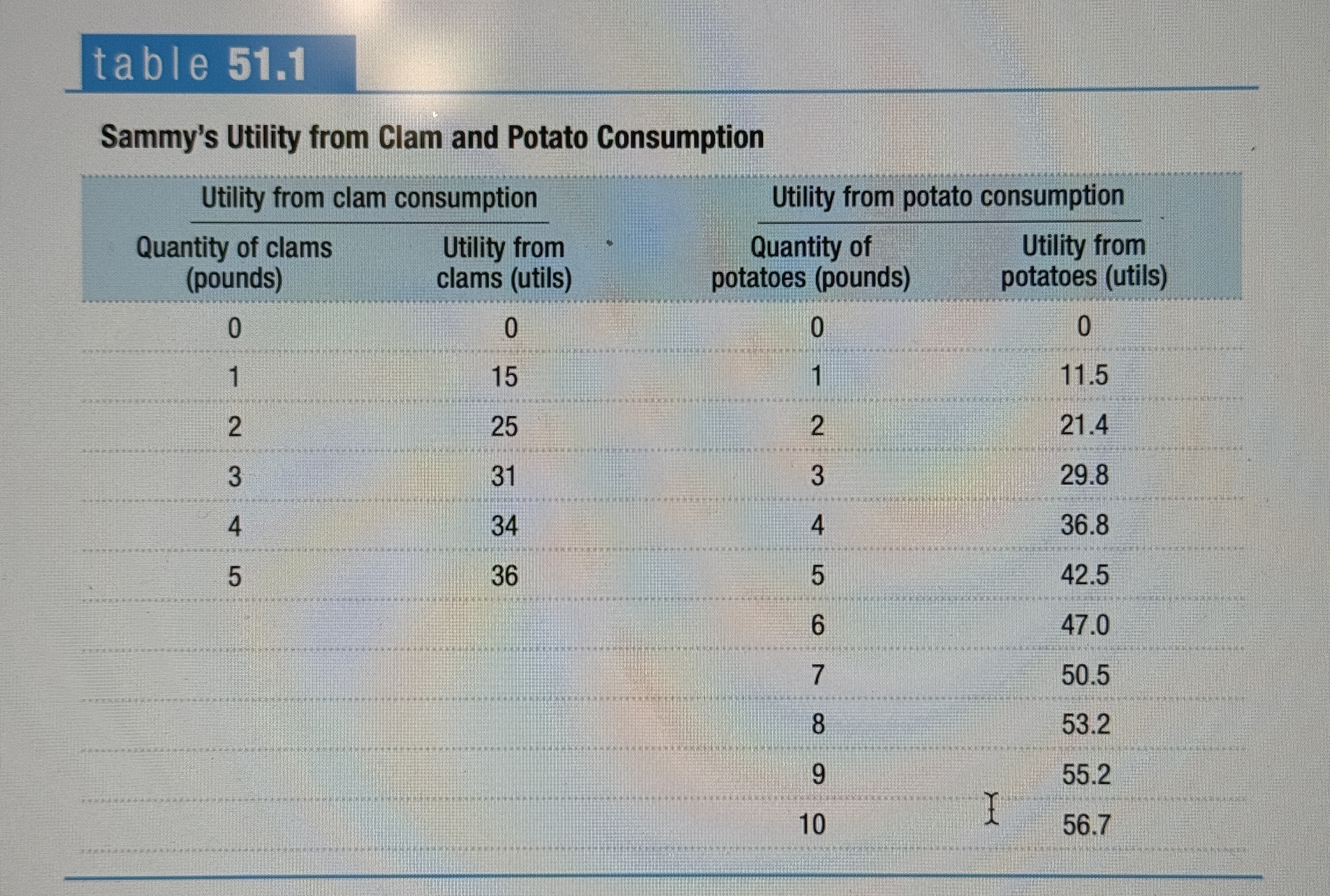

Sammy's Utility from Clam and Potato Consumption

Ex.

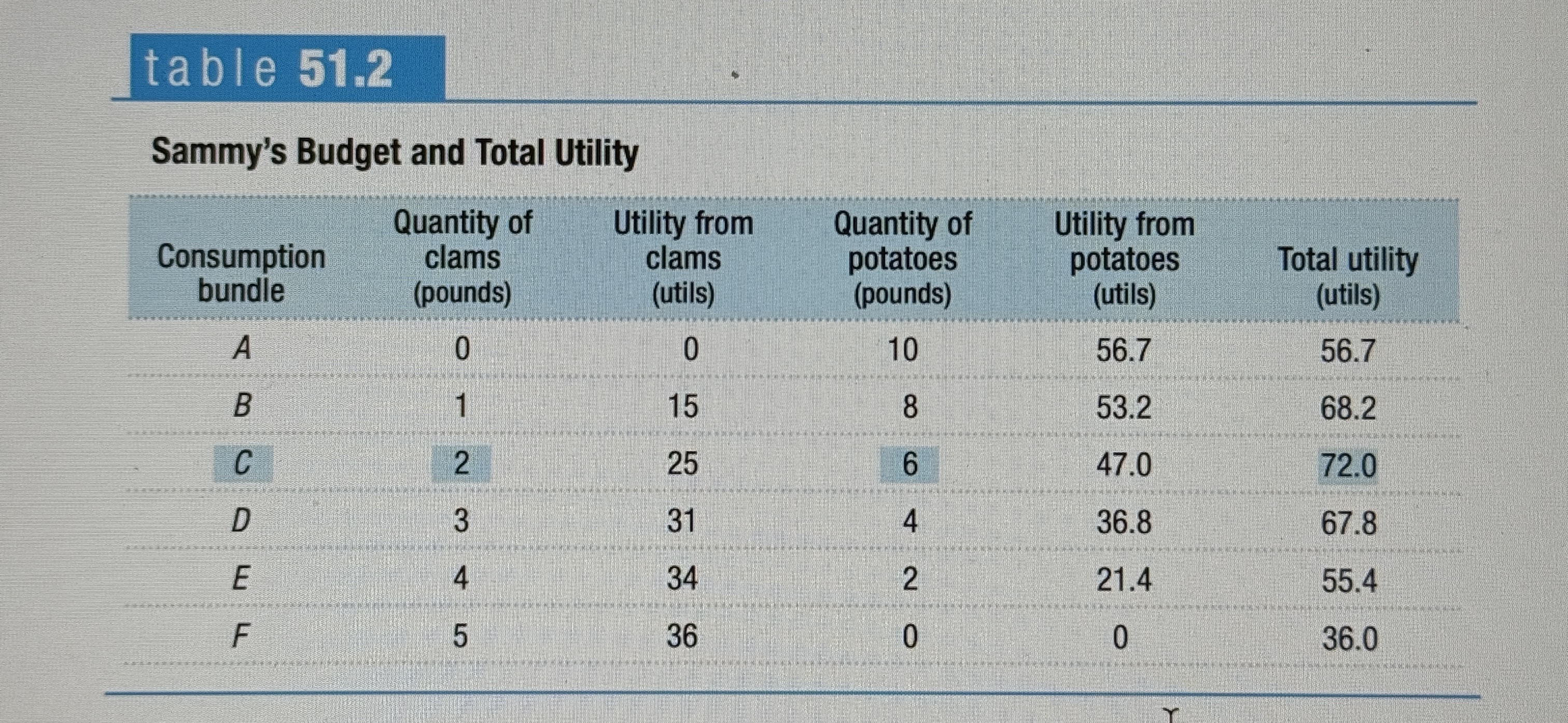

Sammy's Budget and Total Utility

Ex.

Optimal Consumption Bundle

Ex.

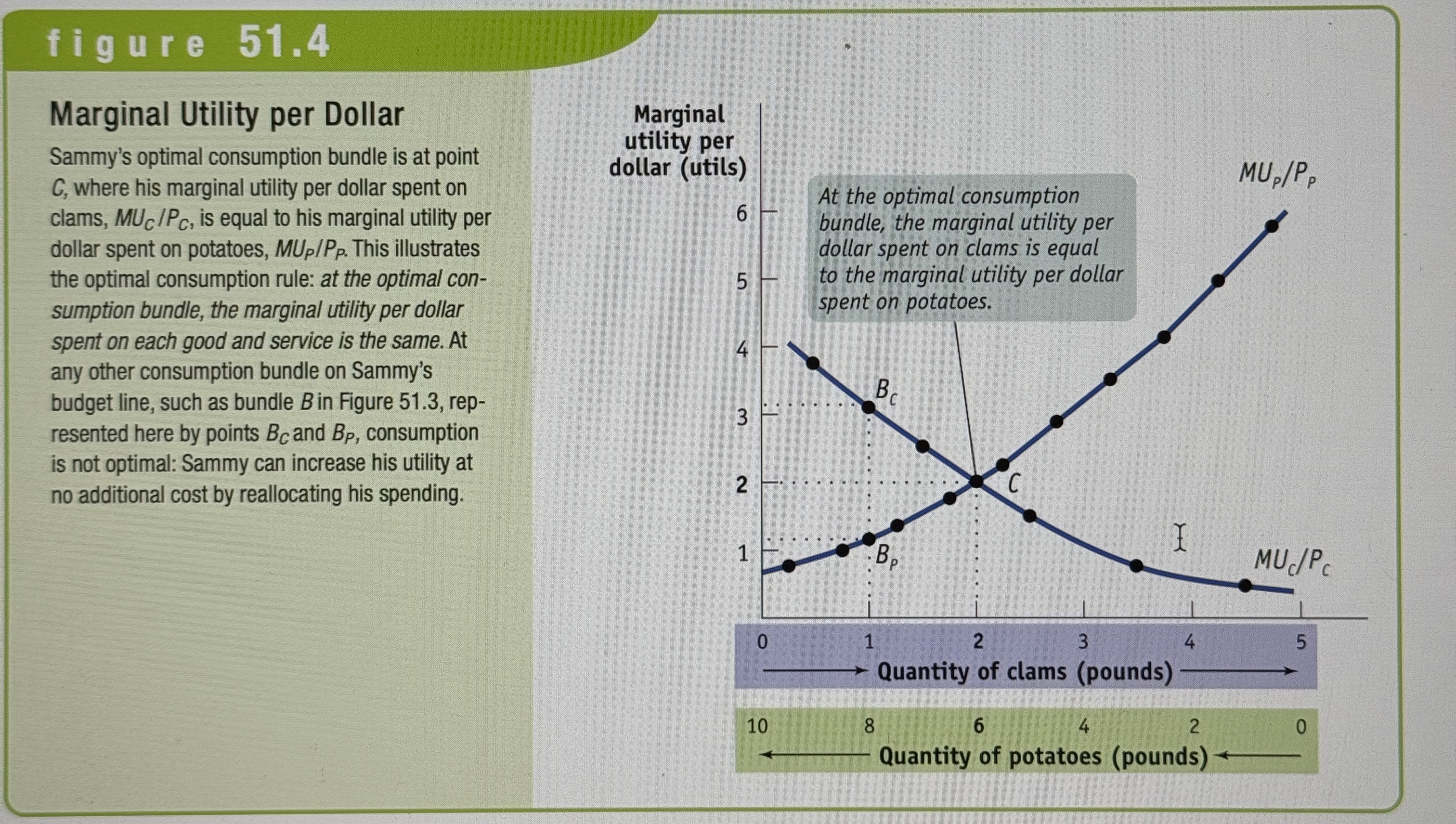

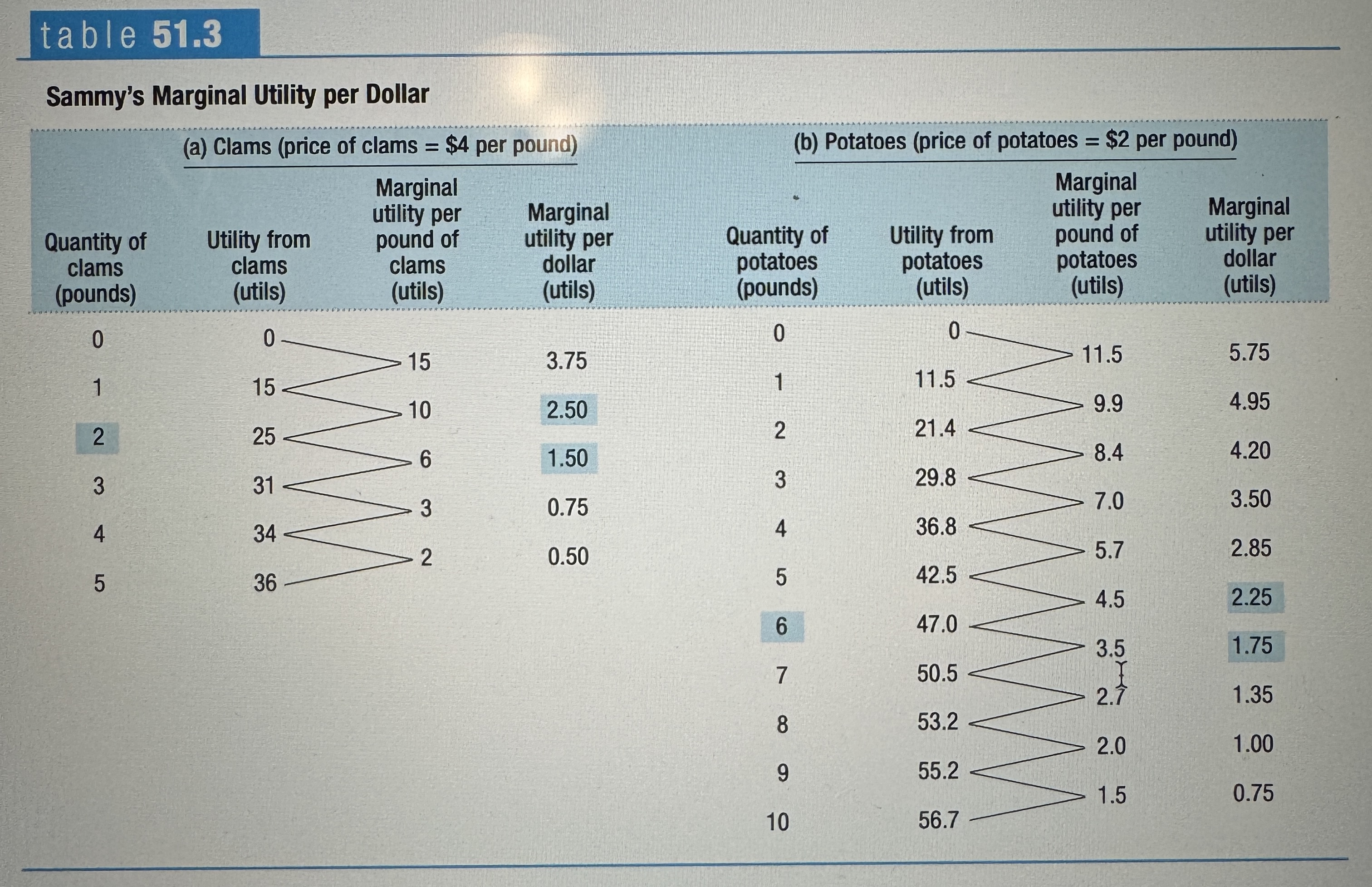

Marginal Utility Per Dollar

The marginal utility per dollar spent on a good or service is the additional utility from spending one more dollar on that good service.

Sammy's Marginal Utility per Dollar

Ex.

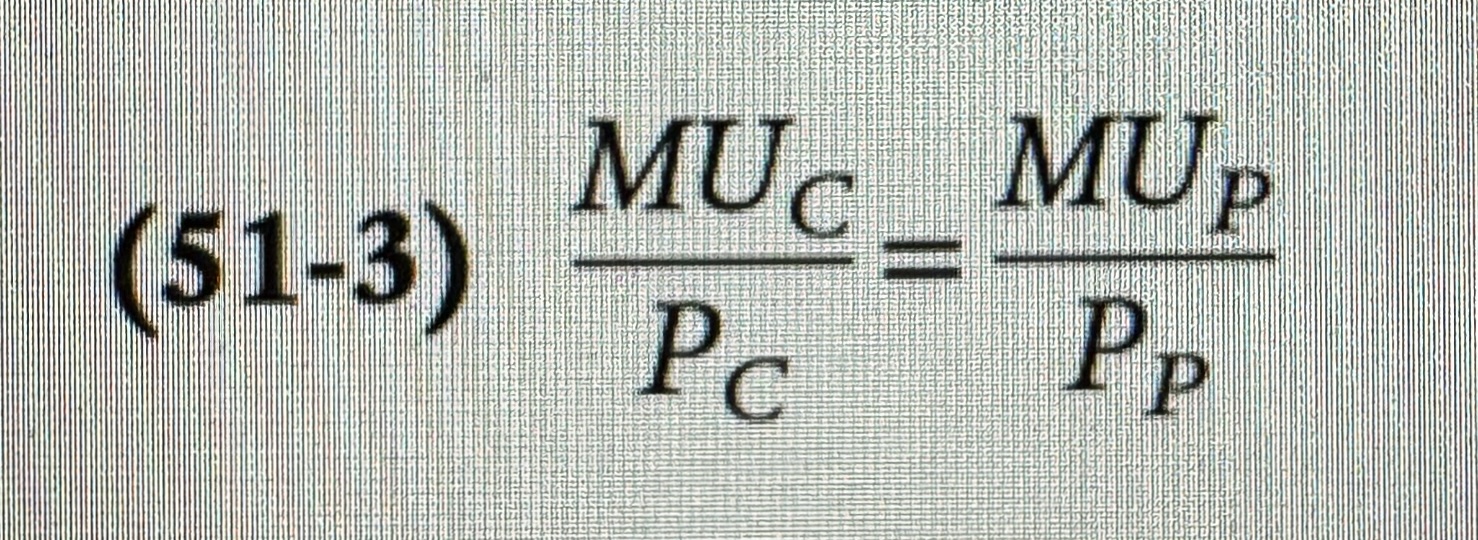

Optimal Consumption Rule

States that in order to maximize utility, a consumer must equate the marginal utility per dollar spent on each good service in the consumption bundle.