Chapter 2: Budgeting Basics (Ramsey Classroom)

1/24

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

25 Terms

35%

Americans that actually use a budget

Components of a budget

income, giving, saving, spending

Budgeting process

can be done on an app as well as with paper and pencil, but the app may be better.

four walls

food, shelter/utilities, clothing, transportation

categorizing you budget

Use as many categories as necessary to make your personal budget

monthly budget

Your guide to income and

spending for the month.

marriage and budgeting

in a marriage both partners should sit together and have a budgeting meeting

Budgets

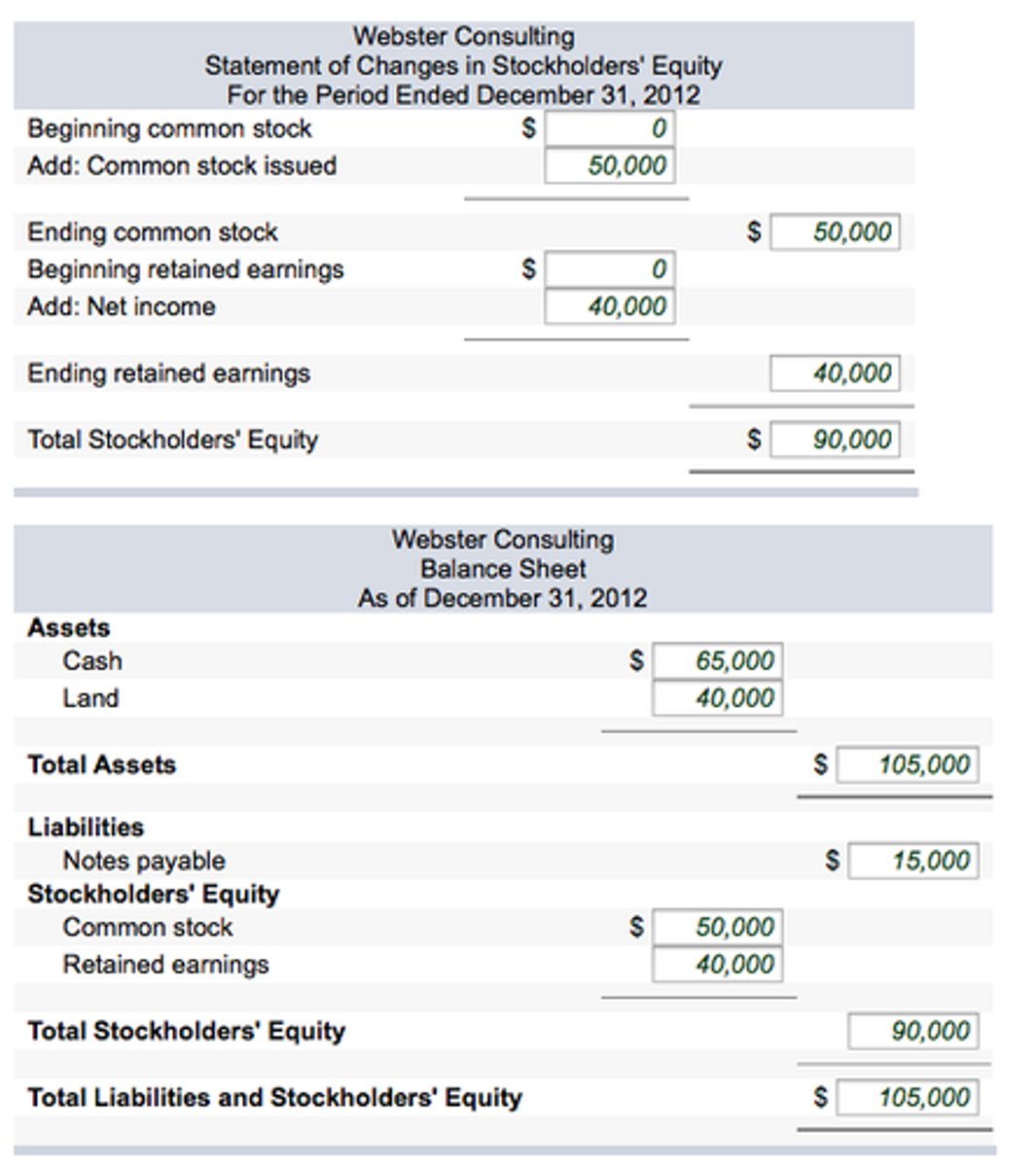

detailed quantitative plans through which managers decide how to allocate available money to best accomplish company goals

Cash Flow Statement

a cash flow statement reflects on how you budgeted and spent your money after the month is over. Reflecting on your cash flow in and out over a certain period of time is critical to budgeting. A summary that shows total income and spending for a given time period.

3 months

It usually takes this long for your budget to begin working well.

Money Personality

How you feel about money that directly affects how you develop your money plan and your attitude towards budgeting.

debt stress

46% of Americans report feeling stressed out by their debt.

four types of expenses

intermittent (various times throughout the year in lump sums), fixed ( expected to occur from month to month), variable (change from month to month), discretionary (expenses for things you don't need)

net income (take home pay)

what a person earns after payroll taxes and other deductions taken out.

income

money received, especially on a regular basis, for work or through investments.

financial accountability

keeping proper financial records and communicating the financial status of the operation appropriately to a trusted friend or counselor

spend

A budget give you permission to...

giving

First priority in your budget

Adjusting the budget

adjust your budget to overspending in one category by moving money from a remaining category to the over spent one.

commission

a percentage of the money received from a sale

envelop system

Series of envelopes that are divided into categories and are used to store cash for planned monthly expenses

Irregular income

Money received from gifts, odd jobs, part-time hourly jobs, and so on can be budgeted through a list format.

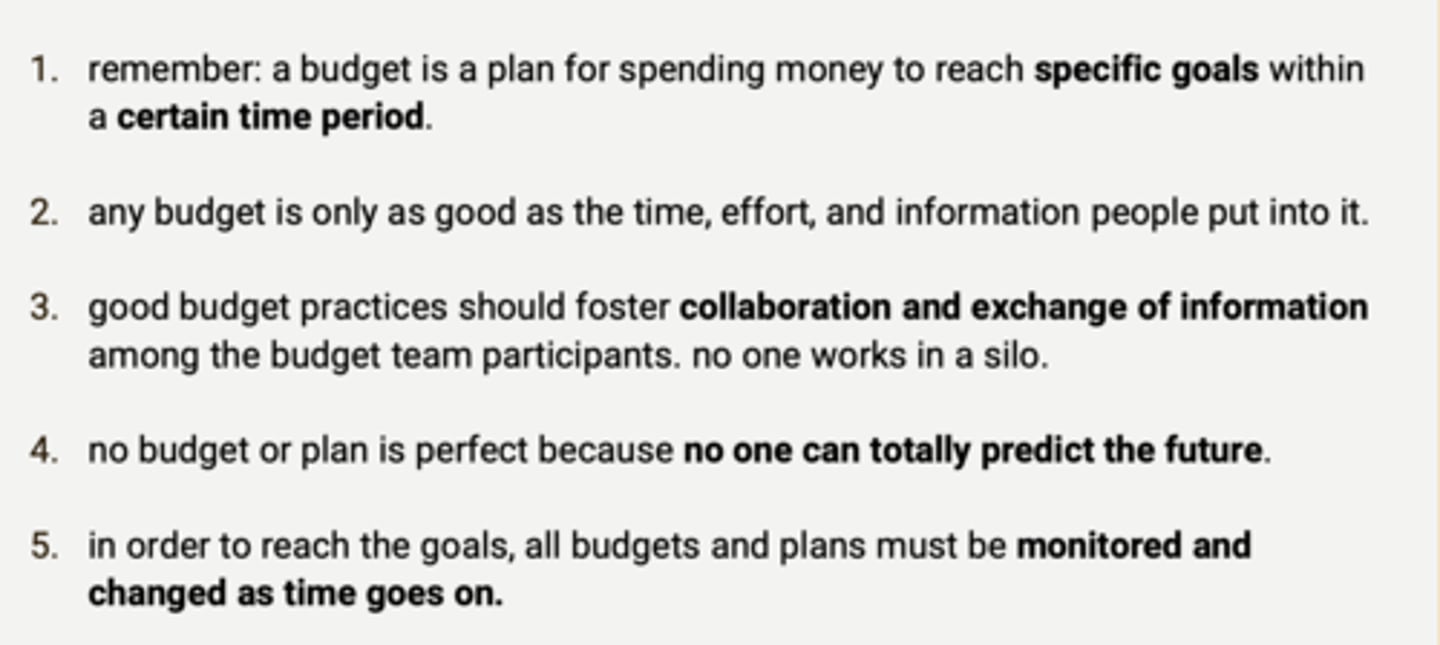

Successful Budgeting

1. Live on less than you make.

2. Find ways to grow your income.

3. Write a monthly budget: income, giving, saving, and spending.

4. Plan your spending and avoid impulse or unnecessary spending.

5. Stay out of debt.

6. Pay yourself first by saving.

7. Use gifts and income wisely.

It must be well planned, realistic, flexible, clearly communicated

Zero-Based Budget

A cash flow plan that assigns an expense to every dollar of your income, where in the total income minus the total expenses equals zero. Cash flow plan that assigns an expense to every dollar of one's income: total income - total expenses = zero.

unexpected expense

An unforeseen cost. (accidents or emergencies)