Economics Paper 2 - Macroeconomics - Past Paper Questions

1/54

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

55 Terms

International trade that takes place with no restrictions is known as

Free trade

What is the name given to a country’s exports and imports of services?

Invisible trade

What is meant by the term unemployment?

People are willing and able to work/actively seeking work but cannot find employment

What is meant by the term trade-off?

The choice between two objectives, where for one objective to increase the other must decrease

Calculate, to two decimal places, the rate of unemployment for a country which has a labour force of 72 million of which 8 million are unemployed.

= 11.11%

Explain one reason why the quality of domestic goods might have resulted in this increase in the current account deficit for Mexico.

If the quality of domestically produced goods is poor compared to imported foreign goods (1) then fewer consumers will buy these goods (1). Imports are likely to increase which contributes to the current account deficit of $5.082bn (1).

Australia has referred India to the World Trade Organization (WTO) because of the $725m subsidies it pays to its sugar cane farmers. Analyse why the Indian Government might have given subsidies to its sugar cane farmers.

• Subsidies are financial support from a government to lower the production costs of domestic firms

• In this case, the Indian Government is providing a production subsidy of $725m to the farmers of sugar cane

• Subsidies will lower the price of Indian produced sugar cane and increase sales

• Financial support in the form of subsidies can help to protect local jobs

• Subsidies can also help to encourage agricultural output of sugar cane by encouraging an increase in supply

• Subsidies can help to improve competiveness against firms in other countries such as Australia that may not receive government assistance

To improve the standard of living, which one of the following is a government likely to reduce?

A Welfare payments

B Subsidies for housing

C Education

D Indirect taxes

D Indirect taxes

State one method of government intervention that should lead to the protection of the environment

• taxation

• subsidy

• regulation

• fines

• pollution permits

• government provision of parks

What is meant by the term relative poverty?

The standard of living is below (1) the typical living standards in that society

In Manchester, UK, over 350,000 motorists have been issued with parking fines of £30. This gave the local government of Manchester additional revenue of £10.4m in one year. (e) Explain one advantage for a local government, such as Manchester, of issuing parking fines.

One advantage is that this can raise a large amount of revenue (1). The parking fines have raised £10.4m which could be used to improve public services (1) This can lead to increased economic growth in the Manchester area (1).

A recent report estimates 23% of gross domestic product (GDP) in Greece is from revenue that goes unrecorded by the government. (f) Explain one possible reason why a large percentage of Greece’s GDP might be unrecorded.

One reason is that not all income from earnings is declared/the hidden economy (1). Some people under declare their earning from jobs such as taxi driving (1). This reduces the amount of Greece’s GDP which is accurately recorded (1).

A new report from New Zealand Kiwifruit Growers Incorporated showed a serious shortage of seasonal workers. This could slow down the kiwifruit industry’s predicted growth. The report showed that the industry will require an additional 7,000 seasonal workers if it is to double in size by 2027. Revenue from the sale of kiwifruits was predicted to increase from NZ$2.1bn in 2017 to NZ$4bn by 2027. At the start of the 2018 season, the industry was short of 1,200 workers with 70% of the crop still to be picked.

With reference to the data above and your knowledge of economics, assess the ways a country such as New Zealand could reduce the shortage of seasonal workers.

Seasonal workers are employed at particular times of the year when demand for labour is higher than usual

• Seasonal employment is often associated with industries such as agriculture, tourism and construction

• The New Zealand Government could use supply-side policies to try and encourage the recruitment of more seasonal workers into the kiwifruit industry

• This can be done by offering financial incentives to firms for training and hiring the long term unemployed in the area to work on the kiwifruit farms

• The New Zealand Government could ensure that there are lower income tax rates to encourage working rather than relying on welfare benefits

• The New Zealand Government may offer financial incentives for the kiwifruit growers to invest in more capital intensive farming methods which remove the need for labour

• However, supply-side policies can take a very long time to be effective

• Training and the hiring of new workers may take a long time and the industry needs 1,200 workers immediately to pick the remaining 70% of the crop

• Many workers may prefer to remain unemployed due to the seasonal nature of the industry, preferring more stable employment

• There is a financial cost to the government of offering any incentives to the kiwifruit industry which could be spent on other areas of the economy

• It could be argued that the shortage of workers should be resolved by the kiwifruit industry rather than the government and the shortage could be due to poor wages or working conditions

a) A fiscal surplus occurs when (1)

A a country exports more than it imports

B government revenue is greater than government expenditure

C a country imports more than it exports

D government expenditure is greater than government revenue

B government revenue is greater than government expenditure

(b) In an exchange rate system without government intervention, a rise in the exchange rate is known as (1)

A appreciation

B devaluation

C depreciation

D revaluation

A appreciation

The rate of inflation in Cyprus decreased from 3.1% in September to 3% in October. (c) Explain one reason why low and stable inflation is a macroeconomic objective for a country such as Cyprus.

One reason is for business/consumer confidence (1). If prices of goods and services are stable at 3% (1) this can help consumers/firms plan for their future spending (1).

In November 2018, the South African Monetary Policy Committee decided to increase interest rates by 0.25% to 6.75%. This decision affected the currency of South Africa, the Rand. (d) Analyse the likely impact of an increase in interest rates on the currency of South Africa.

• Changes in the interest rates in South Africa will affect whether people will want to deposit money in South Africa

• If South Africa has higher interest rates relative to other countries it will become more attractive to deposit money in South Africa

• This is often referred to as hot money

• Savers will get a better rate of return from saving in South African banks – now 6.75%

• Therefore demand for the South African Rand will rise causing an appreciation of the currency

US President Donald Trump introduced lower business taxes in the hope of making the US more competitive globally. In 2017, business taxes in the US were 35% and a new lower rate of 21% was introduced in 2018. Donald Trump has plans to lower this to 15% in the future.

(e) With reference to the data above and your knowledge of economics, assess the likely effectiveness of lower business taxes in stimulating investment in a country such as the US.

• Business tax is a direct tax on the profit of a firm

• Cuts in business taxes can help provide a firm with additional funds to expand its factors of production

• Lower business taxes can also provide an incentive to firms to increase investment thereby increasing output

• This is likely to result in increasing GDP and employment

• The US has already lowered business taxes from 35% to 21% and has plans to reduce this further to 15%

• This could result in firms setting up in the US rather than other countries such as Mexico who have a business tax of 30% thereby increasing productive capacity and total output from the increased investment

• However, MNCs might be attracted to countries in Figure 3 such as Canada and Ireland which have lower business taxes compared to the US

• Lowering business taxes by such a large percent may result in less tax revenue for the US government rather than any increase in investment if firms do not locate in the US

• Less government revenue may result in less government investment

• There is no guarantee that firms will reinvest the additional capital into expansion and could just give the saving in taxes to shareholders in the form of dividends

The annual rate of inflation in Kenya was 5.7% in September 2018 and fell to 5.53% in October 2018.

(b) Analyse how monetary policy could be used to further reduce the rate of inflation in Kenya.

• Monetary policy is the use of interest rates and the money supply to achieve price stability

• An increase in interest rates may help to reduce the amount that consumers and firms borrow as the cost increases to take out loans, mortgages and to spend on credit cards

• Higher interest rates may also encourage some consumers to save more thus reducing spending within the Kenyan economy

• This may result in less demand-pull inflation within the Kenyan economy

• A rise in interest rates may also increase the exchange rate in Kenya making imports cheaper for both consumers and firms

• This may also help to reduce cost-push inflation in Kenya

Kenya is the third largest exporter of cut flowers in the world, accounting for 1.3% of its GDP. Kenya’s main airport has a terminal dedicated especially to the transport of flowers and vegetables. The Kenyan flower industry has created many employment opportunities. Around 100,000 people are employed directly on the flower farms and over 500,000 people benefit indirectly from this industry. Over half of Kenya’s 127 flower farms are concentrated around Lake Naivasha due to the large amount of water needed to grow the flowers. Some environmental campaigners have expressed concerns over the impact that the flower industry could have on the lake.

(c) With reference to the data above and your knowledge of economics, evaluate the likely benefits for Kenya of the globalisation of its flower industry. (12)

AO2 and AO3

• Globalisation is the increased integration and interdependence of economies

• The flower industry is an important contributor to Kenya’s GDP and provides employment opportunities for many with over 100,000 people employed in this industry

• Higher levels of employment could result in an increase in living standards for the flower farmers and other employees who are indirectly employed at places like the airport

• Due to exports from the flower industry, there should be greater tax revenue for the Kenyan Government, an increase in AD and lower unemployment

• Globalisation could result in Kenyan workers in the flower industry having a greater choice of goods and services from the wages they earn on the flower farms

AO4

• However, the flower industry may cause damage to the environment from the use of water to grow the flowers which could result in lower standards of living for the workers and the local environment near Lake Naivasha

• The cost of this would have to be paid for by the Kenyan Government

• There could be environmental damage from the aircraft when the flowers are flown abroad which has to be paid for by society

• There could be greater dependence on the flower industry and if global demand falls for flowers then many of the benefits from globalisation will not be achieved

• The revenue from the flower industry may not filter down to the workers if the farms are owned by foreign investors

• Often there are poor working conditions, including low pay and long hours, especially in the agricultural sector

• The overall impact will depend upon how sustainable the flower industry is and if the benefits are shared by all members of the Kenyan economy

(a) What is calculated by using the consumer price index (CPI)? (1)

A Redistribution of income

B Inflation rate

C Economic growth

D Exchange rate

B Inflation rate

(b) The sale or transfer of public sector assets to the private sector is known as (1)

A monetary policy

B public expenditure

C privatisation

D fiscal policy

C privatisation

(c) What is meant by the term boom?

A phase in the economic cycle (1) with the highest levels of economic activity/with the highest levels of employment (1).

(d) What is meant by the term shoe leather costs?

The costs to firms and consumers of searching for the lowest prices (1) when inflation is high/prices are rising rapidly (1).

(e) Calculate the price in Indian Rupees (INR) of machinery which costs $150 000 when the exchange rate is $1 = 70.66 INR. You are advised to show your working. (

150 000 x 70.66 INR (1) Award 1 mark for the correct answer. = 10 599 000 INR (1)

In November 2018, China launched its first ever anti-dumping investigation against Australia over the export of Australian barley.

(g) Explain one reason why a country such as Australia might export its products below the cost of production.

One reason is to get rid of surplus goods (1). Australia may have produced too much barley in one year (1). Reducing the price may result in higher demand for Australian barley in China (1).

Vietnam has progressive income tax rates that range from 5% to 35% depending on income.

(h) Analyse how a reduction in direct taxation is likely to affect the standard of living in a country such as Vietnam.

• Direct taxes are government charges imposed on income and wealth

• Lowering direct taxes such as income tax rates will result in employees keeping more take home pay

• This increases disposable income from employment and gives an incentive to work rather than live on benefits

• Increased income could be spent on more/better quality goods and services, thereby increasing standard of living in Vietnam

• With greater disposable income being spent within the Vietnamese economy, output and employment may increase

(b) Which one of the following is likely to result from an increase in free trade? (1)

A Increased prices

B Increased choice for consumers

C Decrease in standards of living

D Decrease in market opportunities for business

B Increased choice for consumers

(c) State one macroeconomic objective.

Award 1 mark for one correct objective.

• Economic growth

• Low and stable inflation

• Low unemployment

• Surpluses or equilibrium on current account

• Redistribution of income

• Protection of the environment

(d) What is meant by the term revaluation?

When the price of a currency in a fixed exchange rate system (1) is officially increased against other currencies (1) OR When a government fixes (1) new higher exchange rate (1)

India set a target for its fiscal deficit of 3.3% of its GDP for the year ending March 2019.

(e) Explain one reason why the Indian Government’s fiscal deficit is likely to stimulate economic growth

One reason is that the government can spend more within the economy (1), this overspend can be used to invest in the public services such as infrastructure (1), and this can create jobs within the Indian economy stimulating economic growth (1).

In 2017, the tertiary sector contributed 69.3% to Germany’s GDP and the secondary sector contributed 30.1%. In comparison, the primary sector only accounted for 0.6% of GDP.

(f) Explain a typical trade pattern for a developed country such as Germany.

Developed countries such as Germany export valuable manufactured goods (1) such as cars and electrical goods (1) and import cheaper primary products such as tea and sugar (1).

(a) Which one of the following policies is most likely to reduce the rate of inflation? (1)

A Lower interest rates

B Increased money supply

C Higher government spending

D Higher taxation

D Higher taxation

(b) In an exchange rate system with no government intervention, a decrease in the exchange rate is known as (1)

A appreciation

B devaluation

C depreciation

D revaluation

C depreciation

In 2018, the annual rate of inflation in Egypt was 16% in September and 17.7% in October.

(c) Explain one likely impact of this change in inflation on the current account of the balance of payments for a country such as Egypt.

One impact is a fall in demand for Egyptian exports (1). Inflation of 17.7% makes domestic goods more expensive (1) so other countries may not buy Egyptian goods resulting in a deficit on the current account (1).

The demand for the US$ changed following the publication in 2019 of the latest US growth rate report.

(d) Analyse the impact of currency speculators on the supply and demand of the currency for a country such as the US.

• Currency speculators have an impact on the exchange rate of a country due to supply and demand factors • Speculators will buy more currency if they believe that the exchange rate of the US$ will rise in the future. • The increase in demand for the currency causes the value of the exchange rate to rise compared to other currencies. • Conversely, the value of the exchange rate may fall if speculators sell a currency if they believe that the exchange rate will fall. • This causes a fall in the value of the currency due to an increase in the supply available. • The impact of speculators is often that their actions bring about what they predict will happen.

In Western Australia, single-use plastic bags were banned in July 2018 but fines were not enforced. However, from 2019, under new regulations, any shops providing customers with the banned plastic bags may face prosecution, with fines of up to AUS$5 000. The government is relying on shoppers to report retailers that break the rules. The Environment Minister Stephen Dawson said the ban is well supported by the community. He said “Taking plastic bags out of litter is a significant step towards protecting our environment”.

(e) With reference to the data above and your knowledge of economics, assess the likely effectiveness of regulation to protect the environment in a country such as Australia.

AO2 and AO3

• The use of regulation could be an effective way to reduce usage especially as the fine of AUS$5 000 is very high • This could stop retailers issuing plastic bags to customers thereby reducing the chance of plastic bags ending up in litter • Most consumers and retailers will want to follow the regulations and will therefore not use plastic bags • This is supported by the Environment Minister who states that this is a popular policy with many people

AO4

• However, banning plastic bags by regulation and issuing fines does not mean its consumption will completely reduce demand • The plastic bags have been banned since 2018 but no fines have been given out for using the plastic bags • The effectiveness will also depend upon shoppers reporting retailers for giving out plastic bags • There needs to effective policing of the ban for it to work properly

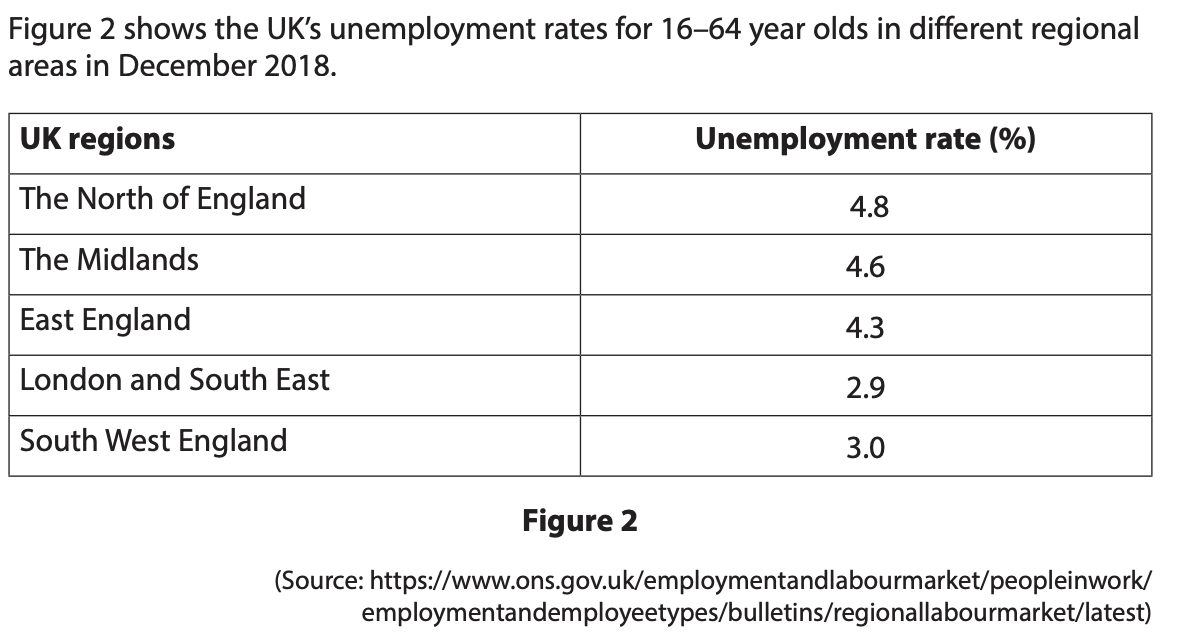

(b) With reference to the data in Figure 2 and your knowledge of economics, analyse one possible reason why rates of unemployment vary in the different regional areas of the UK.

• Unemployment occurs when people of working age are able and willing to work but cannot find employment • The different regional rates could indicate that the UK is suffering from structural unemployment in the different regions • The rates of unemployment are highest in places such as the North of England (4.8%) and the Midlands (4.6%) • The UK has suffered from a decline in the secondary sector of the economy and has moved more towards tertiary • There could be a lack of skills and experience amongst the unemployed making it harder to find employment in certain areas of the UK • This therefore has resulted in different rates of unemployment in different parts of the UK

(b) Which one of the following is an example of a supply-side policy to increase output? (1)

A Increasing income tax

B Increasing interest rates

C Increasing the school-leaving age

D Increasing business taxes

C Increasing the school-leaving age

The number of unemployed people in Spain reached 4 million in February 2021. This was a rise of 44,436 people from the previous month and was the highest level since May 2016. This was the fifth monthly increase in unemployment. The sectors most affected included tourism and commerce. The only sector that made a recovery was construction.

(e) With reference to the data above and your knowledge of economics, assess the likely benefits of lowering taxes to reduce unemployment for a country such as Spain.

AO2 and AO3

• Taxes can be either direct or indirect • Lowering direct taxes such as income tax results in workers keeping more of their income from paid employment • Workers can then spend more on goods and services increasing consumption in the Spanish economy particularly in sectors such as tourism and commerce • Lowering indirect taxes such as VAT results in the price of goods and services falling which can lead to an increase in demand • These measures result in firms raising output and having to employ more workers to meet the increase in consumption • These new workers in turn have more to spend creating the incentive for firms to hire more workers • Unemployment should therefore be reduced in the Spanish economy

AO4

• However, taxes are the main source of income for the Spanish Government so reducing taxes could result in a fiscal deficit if this policy is unsuccessful • If consumer confidence is low, cutting taxes may not increase consumer spending as people prefer to save instead • There is no guarantee that people will spend the tax cuts on Spanish produced goods and could purchase imported goods resulting in a negative impact on the current account • The tax cuts could be inflationary if demand outstrips supply • It will all depend on the type of unemployment Spain is suffering from. Tax cuts are likely to be ineffective if Spain has structural and seasonal unemployment • There are currently 4 million unemployed so the effectiveness of reducing taxes may depend upon a range of factors within the Spanish economy

(d) Describe one impact of economic growth on the productive potential of a country.

The productive potential will increase (1) due to greater investment in capital goods (1) OR The productive potential will increase (1) as firms invest more from greater profits (1)

In September 2017, the growth rate of the gross domestic product (GDP) in the UK was 0.4%, a slight increase of 0.1% on the previous quarter.

(g) Explain one reason why economic growth is a key macroeconomic objective for a country such as the UK.

One reason is because economic growth can improve living standards for the population (1). Growth of 0.4% leads to people having higher levels of income (1). This can lift people out of poverty in the UK (1)

(c) What is meant by the term interest rate?

The cost to borrowing, the reward for saving

(d) Describe one impact on consumers of a decrease in interest rates.

The cost of borrowing has become cheaper (1) therefore more consumers take out loans to buy products (1)

In January 2018, Australia had an unemployment rate of 5.5%.

(h) Analyse how the Australian government might reduce unemployment by using fiscal policy.

• Fiscal policy (expansionary) is when the government increases government expenditure and/or reduces taxation • Increased government expenditure could be in the form of new infrastructure projects such as transport links or employing more public sector workers such as teachers • This should increase overall demand within the Australian economy • This results in firms raising output and having to employ more workers • Incomes will also rise resulting in further output and employment growth within the Australian economy • Unemployment should therefore be reduced in the Australian economy

(c) State one way businesses can damage the environment.

• Visual pollution • Noise pollution • Air pollution • Water pollution

(d) What is meant by the term supply-side policy?

Policies designed to increase the productive capacity of the economy (1) by influencing aggregate supply (1) OR Government measures (1) designed to increase aggregate supply in the economy (1)

(c) Explain one method of government intervention that could be used to protect the environment.

Use of taxation (1) A tax on polluting goods such as cars increases the cost to the consumer (1) There should be a reduction in car use and less pollution created (1)

(d) Analyse the possible impact of unemployment on an economy

• Unemployment represents a loss of output and therefore less GDP for a country • This could reduce standards of living for the population and increase poverty in the long run • The government will receive less tax revenue as there will be fewer workers in employment paying direct and indirect taxes • The government will have to pay out more in unemployment benefits to support the unemployed person whilst they are looking for a job • There is great pressure on the unemployed person as unemployment can cause social problems such as stress and health-related problems

(c) What is meant by the term central bank?

The monetary authority that manages a country’s money supply (1) and interest rates/banking system (1)

(b) Which of the following is used as a measure of economic growth? (1)

A ILO

B CPI

C GDP

D FDI

C GDP

(c) State one reason why a government wants to reduce poverty and inequality.

Award 1 mark for one reason • To meet basic needs • To raise living standards • For ethical reasons

(d) What is meant by the term infrastructure?

The systems/structures such as the transport network (1) needed for the operation of an economy (1)

In May 2018, South Korea’s unemployment rate for people aged 15–29 increased to 11.6%. In several global competitiveness reports South Korea has recently been criticised for having too many rules and regulations. Experts have advised the South Korean Government to reduce some employment regulations for service sectors such as finance, transport and tourism in order to create more jobs.

(g) With reference to the data above and your knowledge of economics, assess the effectiveness of deregulation in reducing unemployment in South Korea.

AO2 and AO3

• Deregulation is a supply-side policy of making markets more competitive by removing barriers such as regulations • Regulations such as labour laws often create additional costs for firms which makes them less competitive in comparison to firms abroad • Experts have advised the government to reduce regulation in markets such as finance and transport • Removing labour market regulations such as a reduction in the minimum wage may result in the tourism sector reducing its overall labour costs and therefore being able to employ more workers • This may result in a reduction in the 11.6% rates of 15-29 year olds • Removing competition laws in the finance sector may also result in more firms entering the market and therefore employing workers and thereby reducing unemployment in South Korea

AO4

• However, deregulation may just result in firms saving on labour costs but not employing anymore workers • Reducing the minimum wage may result in less people willing and able to work thereby increasing unemployment rather than reducing it • Regulations are designed to protect workers, the environment and consumers so any removal of them may result in negative consequences for South Korea and lower standards of living • There are other supply-side policies such as lower income tax to encourage working which might be more effective in reducing unemployment • The overall effectiveness will depend on a range of economic factors within the South Korea economy not just the level of regulation

(b) Monetary policy would involve changes in which one of the following? (1)

A Government spending

B Interest rates

C Taxation

D Balance of payments

B Interest rates