unit 4 econ final review

1/31

Earn XP

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

32 Terms

imperfect competition

- monopolies

- oligopolies

- monopolistic competition

- monopsonies

monopoly

- single seller

- unique good, no substitutes

- price maker

- high barriers to entry

- ads

price maker

firm can manipulate the price by changing the quantity it produces

natural monopoly

natural for only one firm to produce because they can produce at the lowest cost

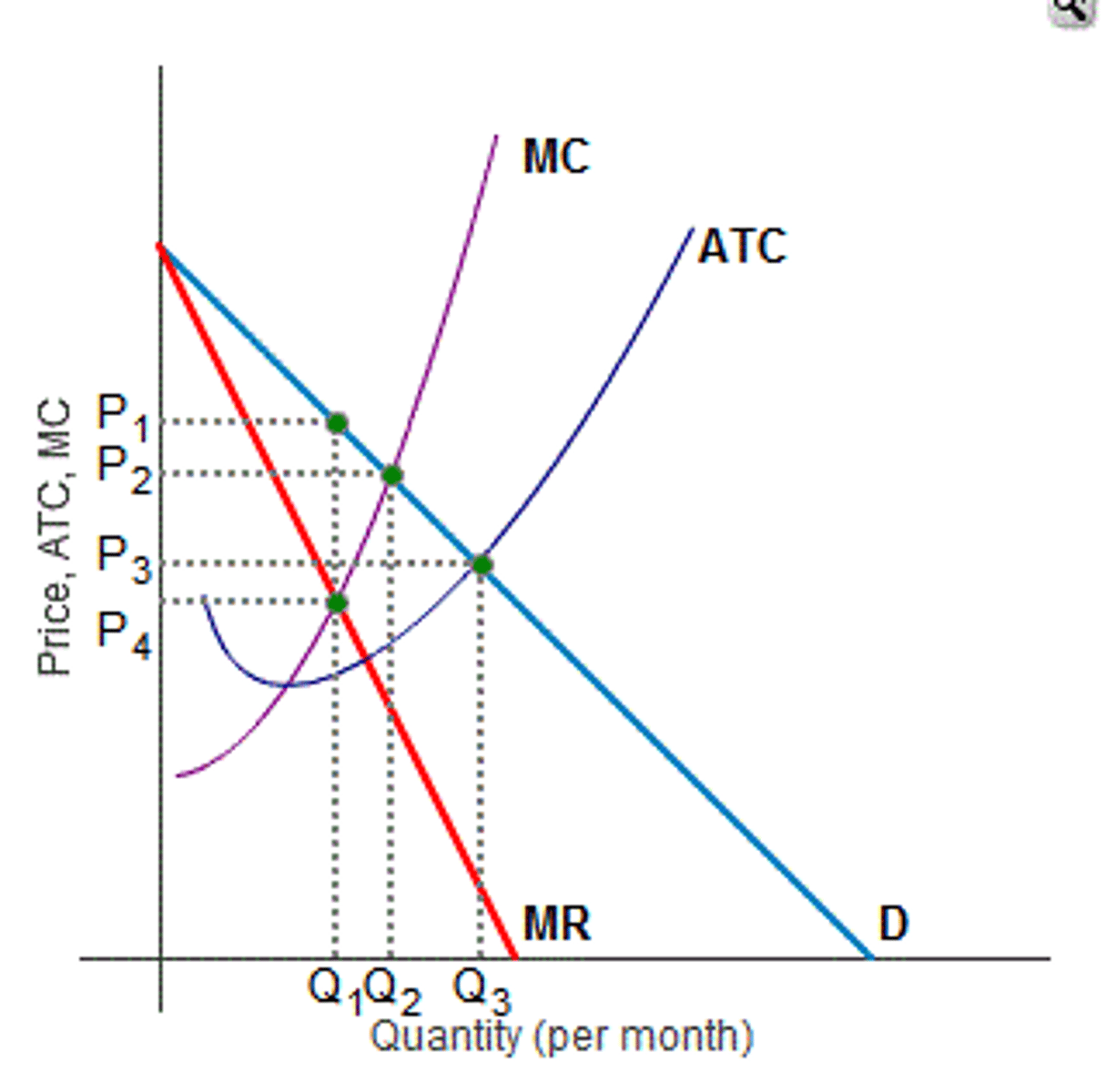

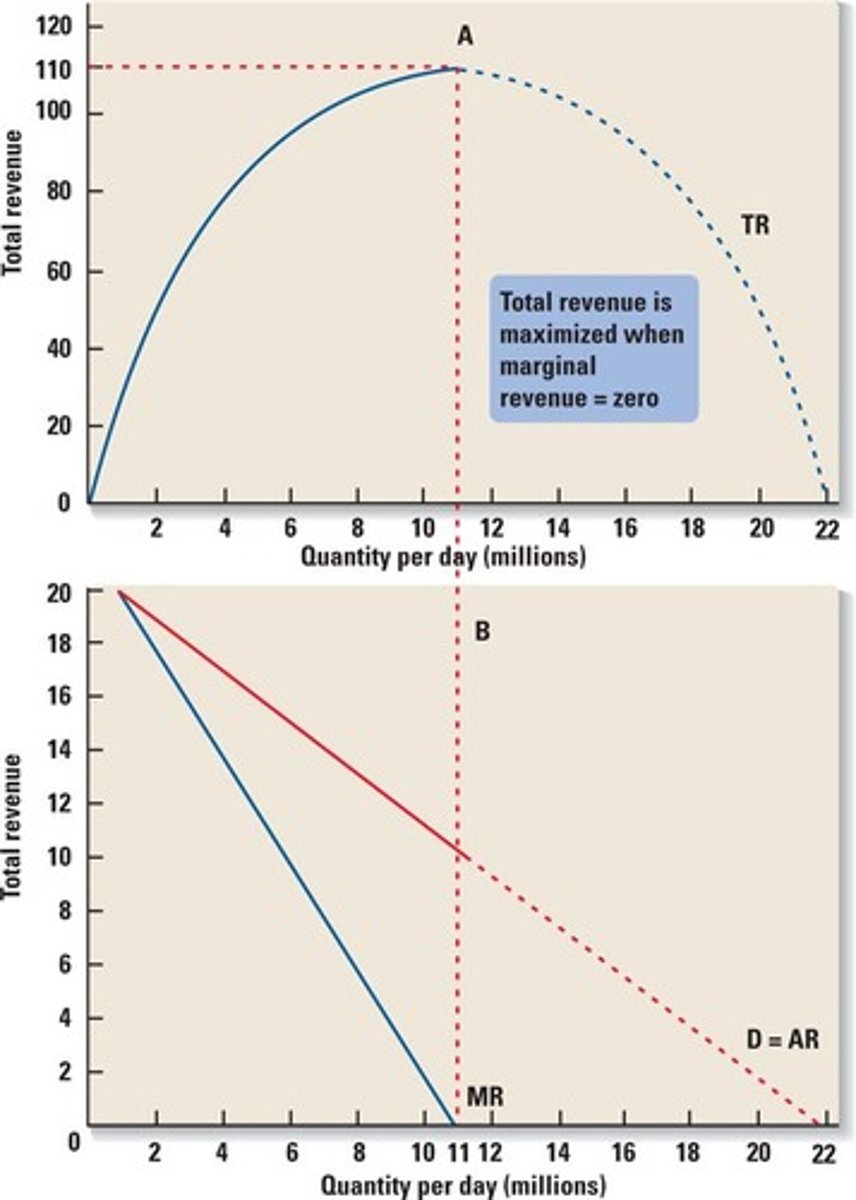

imperfectly competitive firms graph

- downward sloping demand curve (to sell more, prices must be lowered)

- MR ≠ P

TR at peak

MR = 0

elastic range

monopoly only produces in what range of elasticity

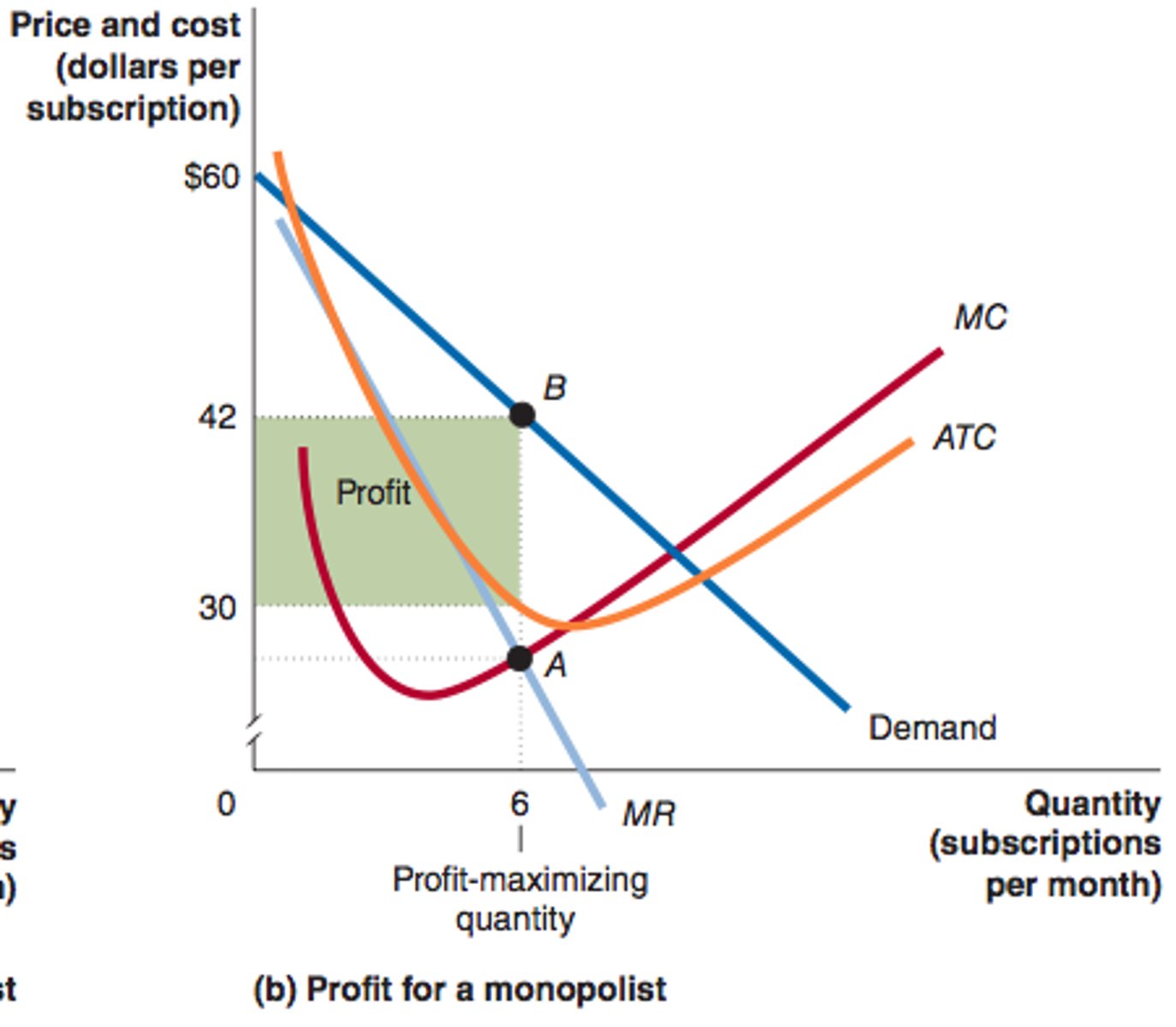

monopolists production

produces where MR = MC (quantity) but charges the price consumers are willing to pay, identified by the demand curve

why monopolies are inefficient

- charge higher price

- don't produce enough (not allocatively efficient)

- produce at higher costs (not productively efficient)

- little incentive to innovate

- they have little external pressure to be efficient

at MR = MC

- monopolist produce less and charge a higher price

- decreases CS and increases PS

reasons to regulate monopolies

- keep prices low

- makes monopolies efficient

how to regulate monopolies

- price controls: price ceilings

- taxes don't work bc taxes limit supply

where to put price ceiling

- socially optimal price

- fair return price/ break even

unregulated monopoly production

B (point on demand curve that's above MR = MC point)

socially optimal

- allocative efficiency

- where MC = D on graph

fair return

- no economic profit

- where ATC = D on graph

regulating natural monopoly

price ceiling to get socially optimal quantity would cause the firm to make a loss and require a subsidy

price discrimination

selling the same products to different buyers at different prices

price discrimination conditions

- have monopoly power

- segregate market

- consumers can't resell product

price discrimination results

- several prices

- more profit

- no CS

- higher socially optimal quantity

monopolistic competition

- large number of sellers

- differentiated products

- some control over price

- low barriers to entry

- ADVERTISING

- not efficient

- D > MR

nonprice competition

- branding

- service

- location

- advertising: increase demand and make it inelastic

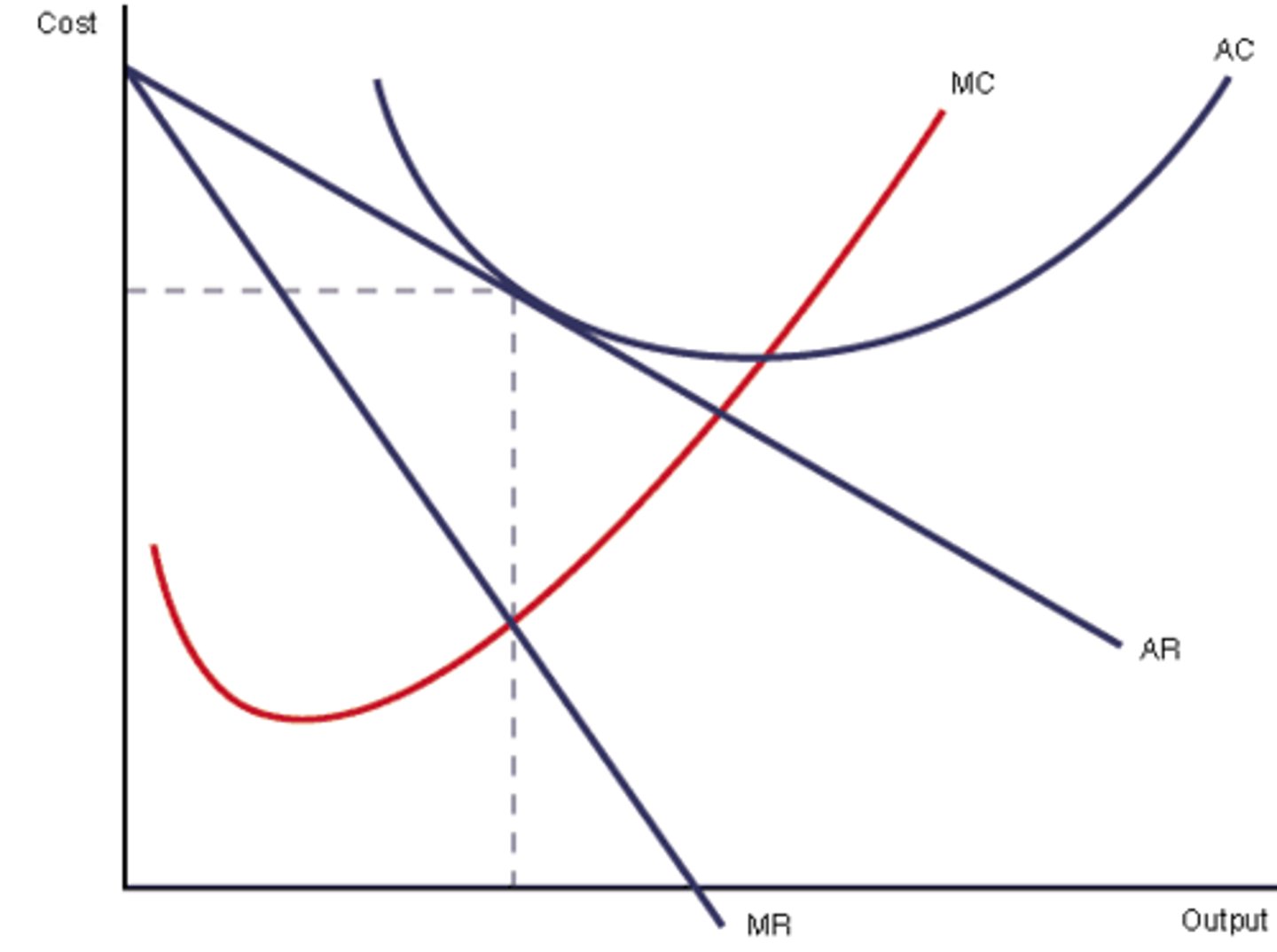

long run monopolistic competition

- new firms will enter, driving down the demand for firms already in the market

- firms enter until there is no economic profit

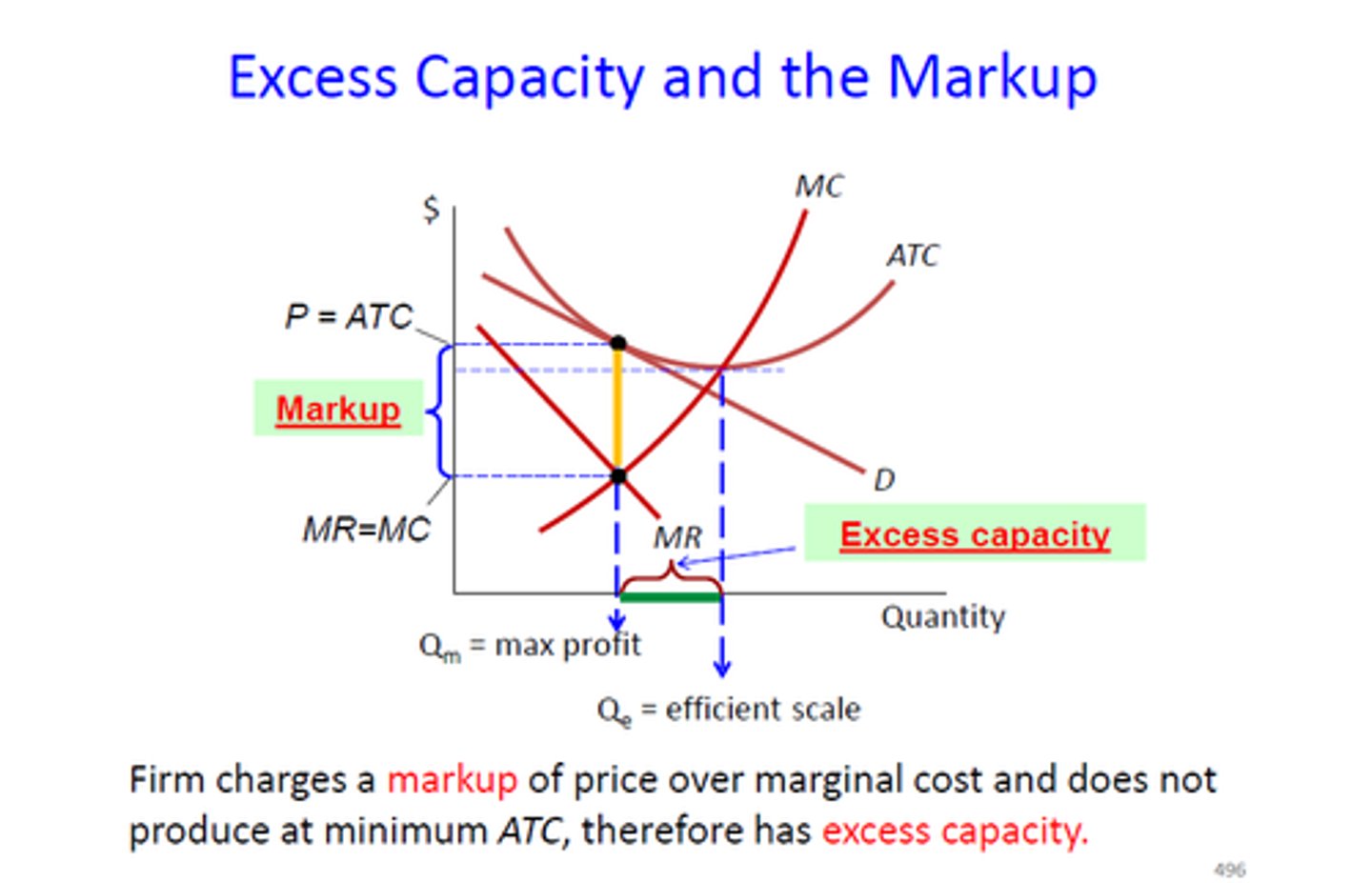

- equilibrium: quantity where MR = MC up to P = ATC

- excess capacity

short run profits

- new firms enter = more substitutes, less market shares for existing firms

- demand for each firm falls

short run losses

- firms exit = less substitutes, more market shares for remaining firms

- demand for each firm rises

monopolistically competitive efficiency

- not allocatively efficient (P ≠ MC)

- not productively efficient (production ≠ minimum ATC)

excess capacity

- firm can produce at the lowest costs (minimum ATC) but they decide not to

- gap between minimum ATC output and profit maximizing output

oligopoly

- few large producers

- identical or differentiated products

- high barriers to entry

- price maker

- interdependence (strategic pricing)

- collude to gain profit

oligopoly barriers to entry

- economies of scale

- high start up costs

- ownership of raw materials

game theory

- study of how people behave in strategic situations

- helps firms in an oligopoly maximize profit

dominant strategy

best move to make regardless of what your opponent does

collusion

- act of cooperating with rivals in order to "rig" a situation

- results in the incentive to cheat

- gains profit

- firms act as a monopoly and share the profit