AP Macroeconomics module 31

1/12

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

13 Terms

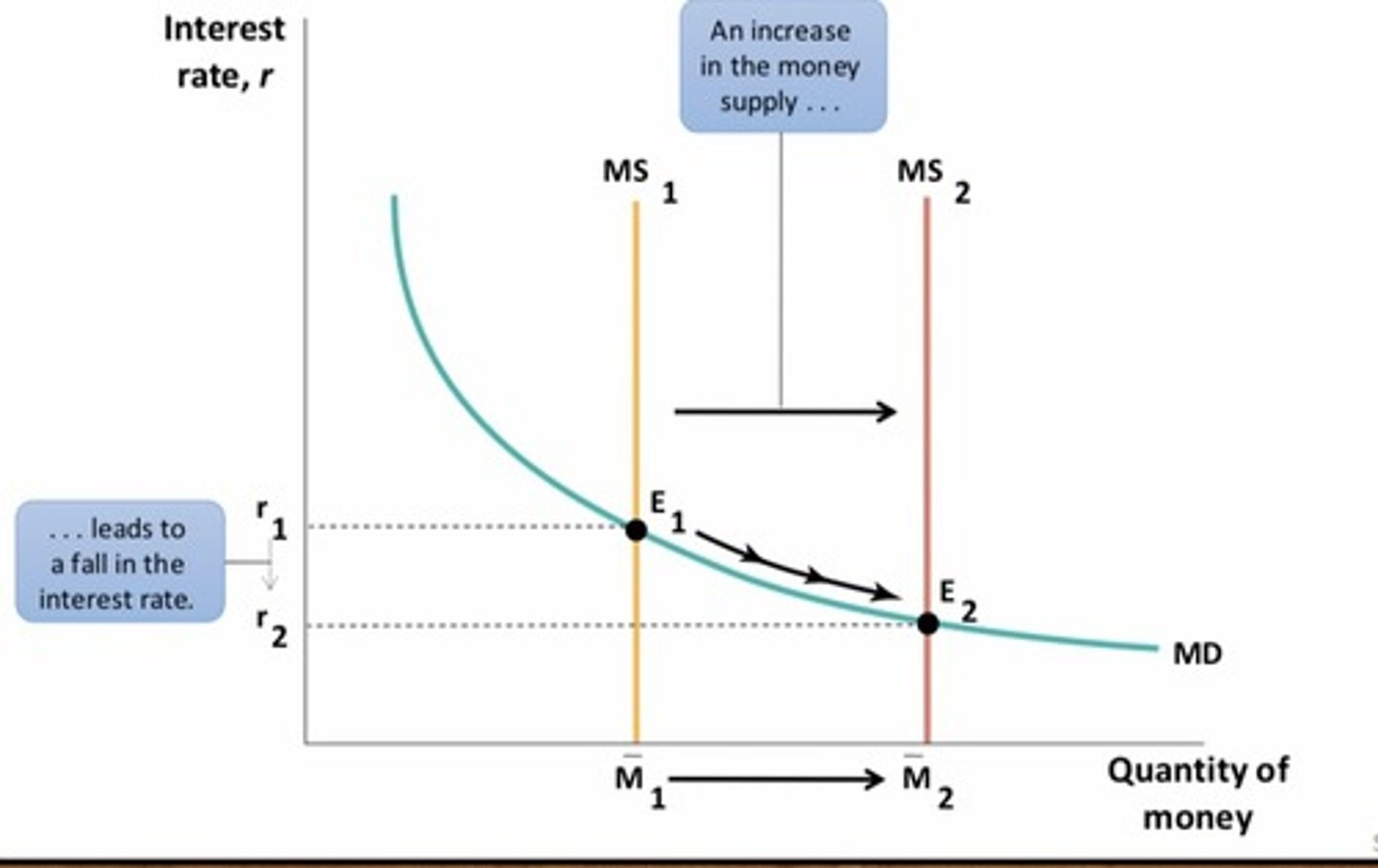

An increase or decreasing the money supply...

the Federal Reserve can set the interest rate.

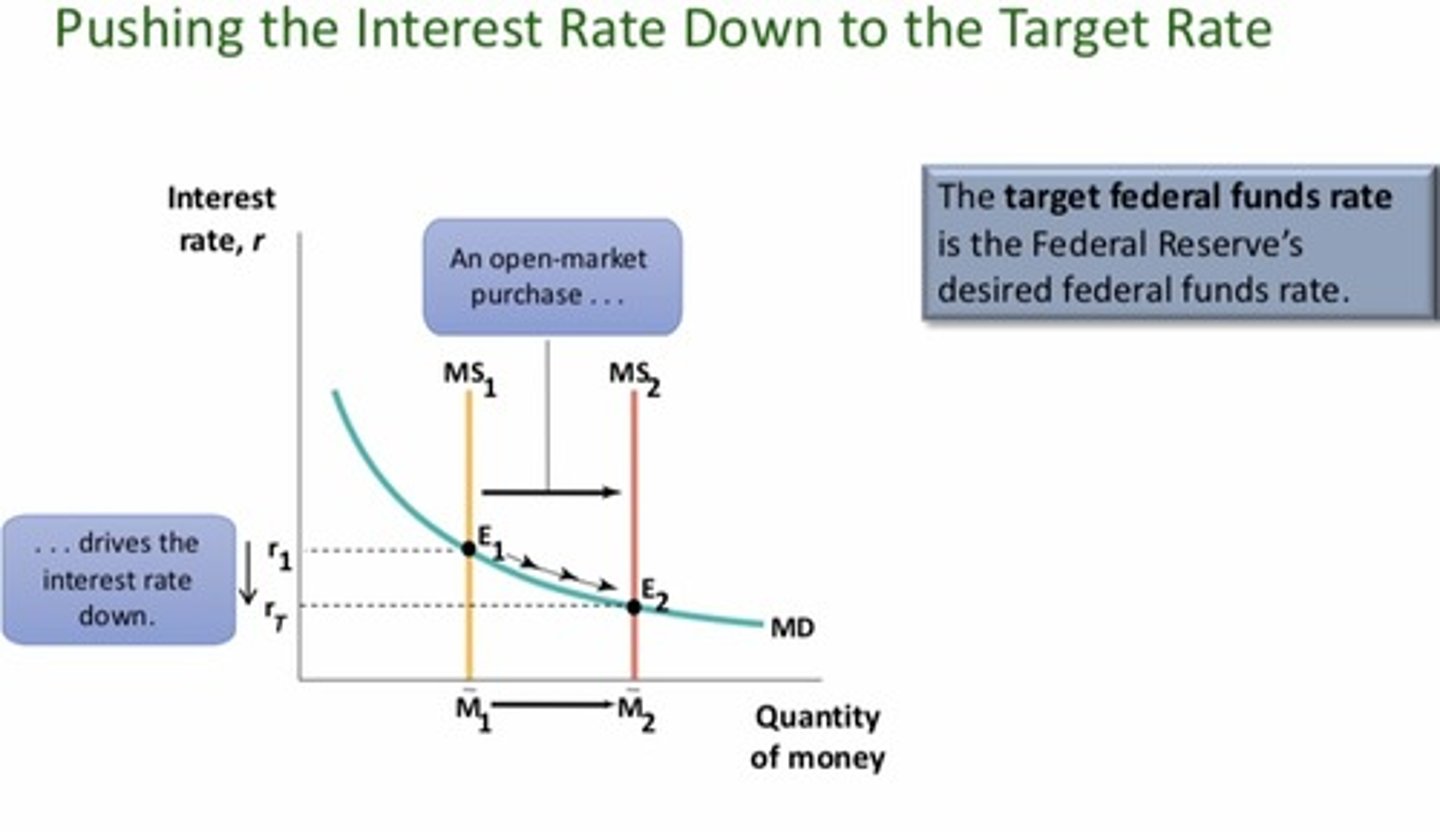

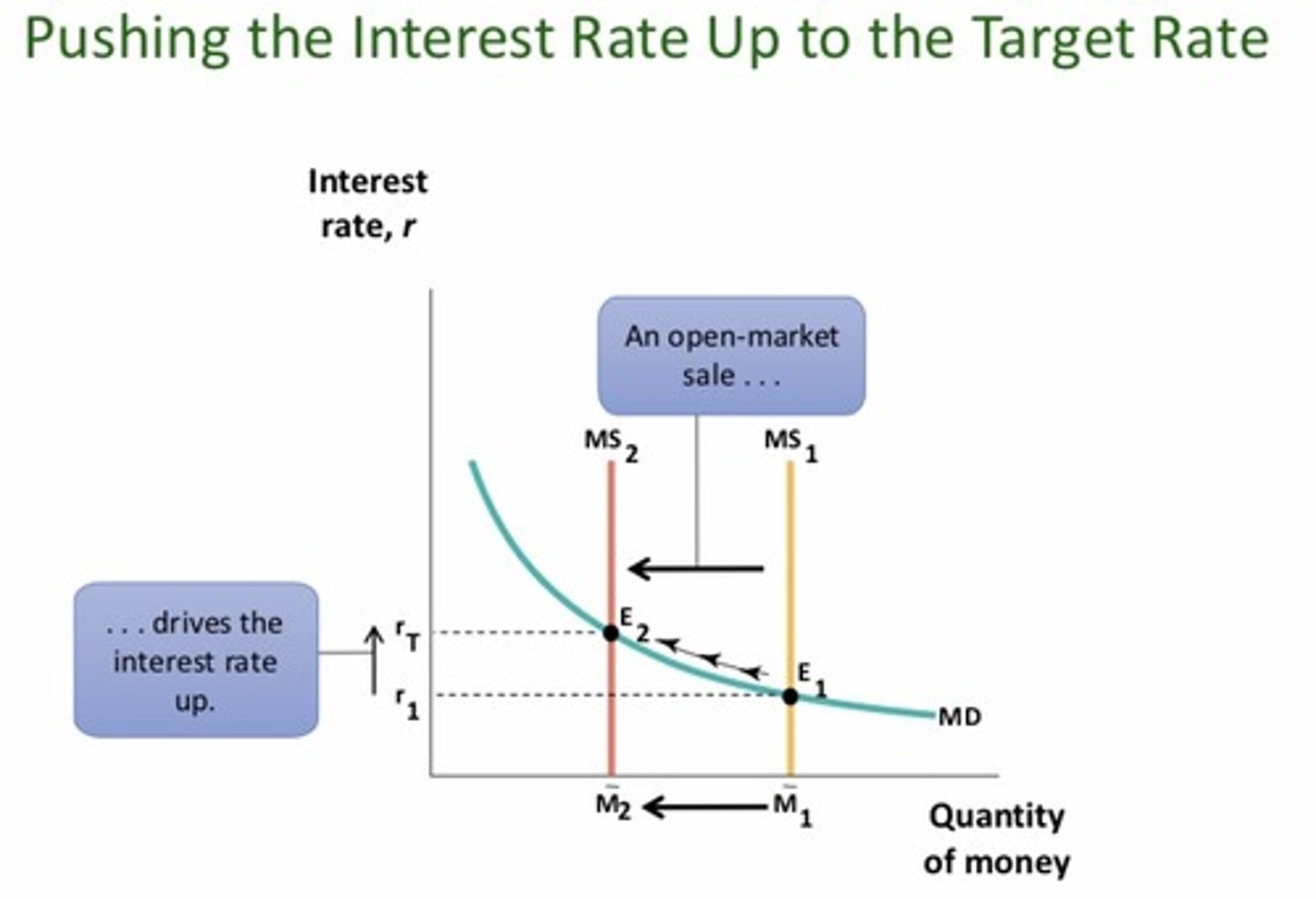

In practice, the Federal Open Market Committee sets a target federal funds rate.

-The Open Market Desk then adjusts the money supply through open-market operations.

- The Open Market Desk is facilitated at the New York Fed

The effect of an increase in the money supply on the interest rate

Setting the federal funds rate: Pushing the interest rate down to the target rate

Setting the federal funds rate: pushing the interest rate up to the target rate

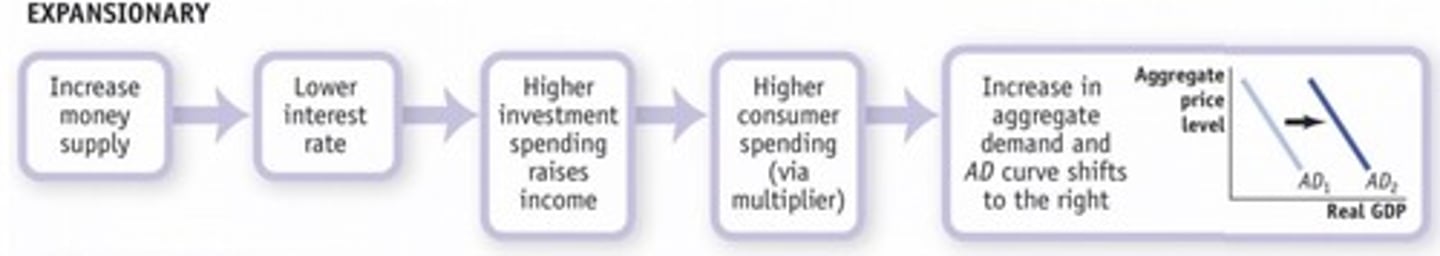

expansionary monetary policy

monetary policy that increases aggregate demand

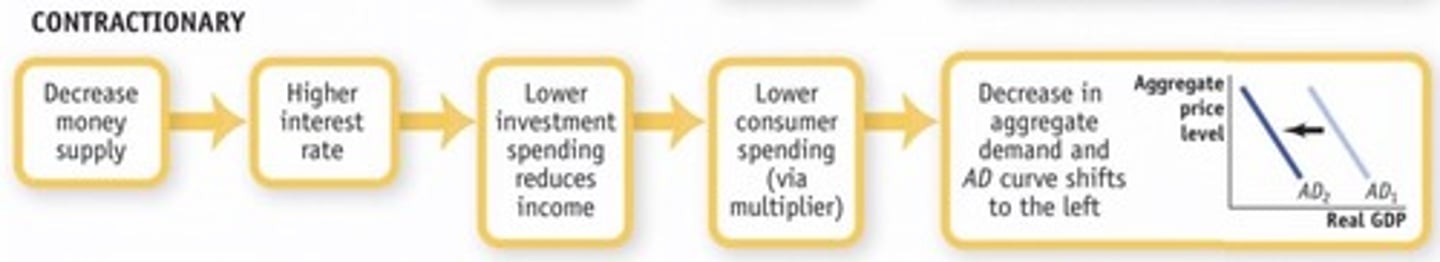

contractionary monetary policy

monetary policy that reduces aggregate demand

Policy makers try to fight recessions, but they also try to ensure...

Price stability

Taylor rule for monetary policy

a rule that sets the federal funds rate according to the level of the inflation rate and either the output gap or the unemployment rate

Taylor Rule Equation

Federal funds target rate= 1+(1.5 x inflation rate) + (0.5 x output gap)

Monetary policy is the...

monetary policy that increases aggregate demand

inflation targeting

occurs when the central bank sets an explicit target for the inflation rate and sets monetary policy in order to hit that target

The Federal Reserve and other central banks try to stabilize the economy by...

limiting fluctuations of actual output around potential output, while also keeping inflation low but positive