Accounting 211

1/53

Earn XP

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

54 Terms

accounts receivable

amounts due from customers for credit sales

direct write-off method

Record bad debt expense when an account is determined to be uncollectible

Allowance method

matches estimated loss from uncollectible accounts receivable against the sales they helped produce

allowance for doubtful accounts

a contra-asset account that reduces accounts receivable. It has a normal credit balance.

note receivable

a promise to pay a specified amount of money at a future date.

principal of a note

amount promised to be repaid

maturity date

day the note must be repaid

Note is honored

cash received in full (with interest)

when a note term runs over two periods

Note is dishonored

accounts receivable and interest recorded

factoring (selling) receivable

Accounts receivable are sold to a bank and the seller is charged a factoring fee

pledging of receivables

Borrowing money by pledging receivables as a security for a loan. Borrower discloses pledging in notes to the financial statement.

cost of plant assets

Normal, reasonable, and necessary costs in preparing an asset for its intended use. If an asset is damaged during unpacking, the repairs are not added to its costs. Instead, they are charged to an expense account.

machinery and equipment

Cost include purchases price, taxes, transportation, insurance, while in transit, installation, assembly, and testing

Building

the costs of a purchased building include its purchase price, real estate fees, taxes, title fees, and attorney fees.

land improvements

additions to land that have limited useful lives. Examples are parking lots, driveways, and lights

land

has an indefinite (unlimited) life and costs include real estate commission,s clearing, grading, and draining

lump-sum purchase

plant assets purchased as a group for a single lump-sum price. We allocate the cost to the assets acquired based on their relative market (or appraised) values.

depreciation

process of allocating the cost of plant asset to expense while it is in use

salvage value

estimate of the assets’ value at the end of its useful life

useful life

length of time a plant asset is to be used in operations

straight-line depreciation

charges the same amount of depreciation expense in each period of the assets’ useful life

asset book value

computed as the asset’s total cost minus accumulated depreciation

units of production formula

deprecation expense= depreciation per unit * units produced in period

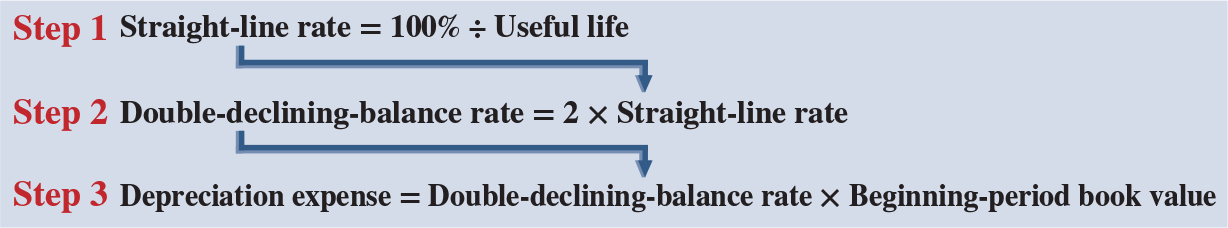

double- declining balance depreciation

chargers more depreciation in early years and less depreciation in later years

natural resources

assets that are physically consumed when used. examples are standing timber, mineral deposits, and oil and gas fields

intangible assets

nonphysical assets (used in operations) that give companies long-term rigts, privileges, or competitive advantages

amortization

intangible assets with limited useful lives require amortization it is similar to depreciation and uses the shorter of legal life or useful life of the intangible for straight-line amortization

patent

exclusive right to manufacture and sell a patented item or to use a process for 20 years

copyright

the exclusive right to publish and sell a musical, literary, or artistic work during the life of the creator plus 70 years

franchises or licenses

rights to sell a product or service under specified conditions

trademark or trade (brand) name

A symbol, name, phrase, or jingle identified with a company, product, or service

Goodwill

The amount by which a company’s value exceeds the value of its assets and liabilities (net sales). Goodwill is only recorded when an entire company or business segment is purchased. Not amortized, but tested for impairment.

right-of-use asset (lease)

rights the lessor grants to the lessee under terms of the lease

leasehold improvements

improvements to a leased (rented) property such as partitions, painting, and storefronts. The lessee amortizes these costs over the life of the lease or the life of the improvements, whichever is shorter.

unearned revenues

amount received in advance from customers for future products or services; to record cash received in advance.

short-term note payable

a written promise to pay a specified amount on a stated future date within one year.

gross pay

total compensation an employee earns before deductions such as taxes.

payroll deductions

amounts withheld from an employees gross pay, either required or voluntary

FICA-SOCIAL SECURITY TAXES PAYABLE

withholdings to cover retirement, disability, and survivorship

Employee federal income taxes payable

federal income tac withheld from each employees paycheck

employee voluntary deductions

voluntary withholdings for things such as union dues, charitable giving, and health insurance.

warranty

a seller’s obligation to replace or fix a product or service that fails to perform as expected within a specified period. Warranty expense is a recorded in the period when revenue from the sale of the product or service is reported.

contigent liability

a potential liability that. depends on a future event arising from a past transaction or event. An example is a pending lawsuit.

Types of Intangibles

patents, copyrights, Franchise and Licenses, Trademarks /Tradenames, Goodwill, Right-Use-Asset, Leasehold Improvements, Software, noncompete covenants, customer lists

Interest formula (assumed to have 360 days)

Principle of the note Annual Interest rate * Time in Function

Plant Assets

Machinery and Equipment, Building, Land improvements, Land, and lump-sum purchase

Straight-line deprecation

Depreciation Expense Cost-salvage value/ Useful life

Double declining forumla

straight line deprication after change in accounting estimate

book value-revised salvage value/ revised remaining useful life

credit card sales

accounts receivable, sales, cash

sales using bank credit card

cash, credit card expense, sales

bad debts forumla

sales * rate

allowance for doubtful accounts formula

Accounts receivable * Rate