ECON 11 - LE 3

1/69

Earn XP

Description and Tags

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

70 Terms

Characteristics of Perfect Competition

Many buyers and many sellers

The goods offered for sale are largely the same

Firms can freely enter or exit the market

They are price takers - take the price as given

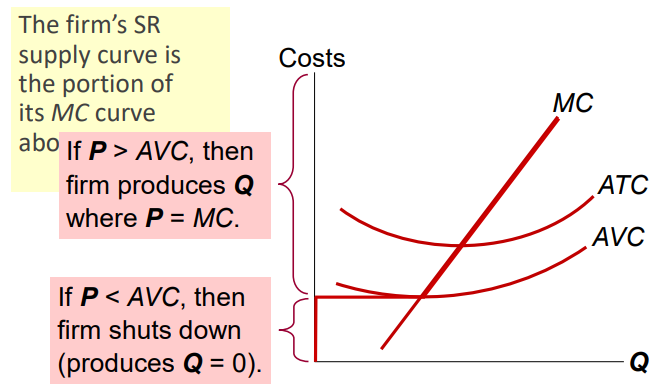

Shutdown

A short-run decision not to produce anything because of market conditions

Shut down if :

Total Revenue (TR) < Variable Cost (VC)

Total Revenue (TR) / Quantity (Q) < Variable Cost (VC) / Quantity (Q)

P < Average Variable Cost (AVC)

Fixed Cost (FC) should not matter in the decision to shutdown

Sunk Cost

A cost that has already been committed and cannot be recovered

Fixed Cost (FC) is a sunk cost

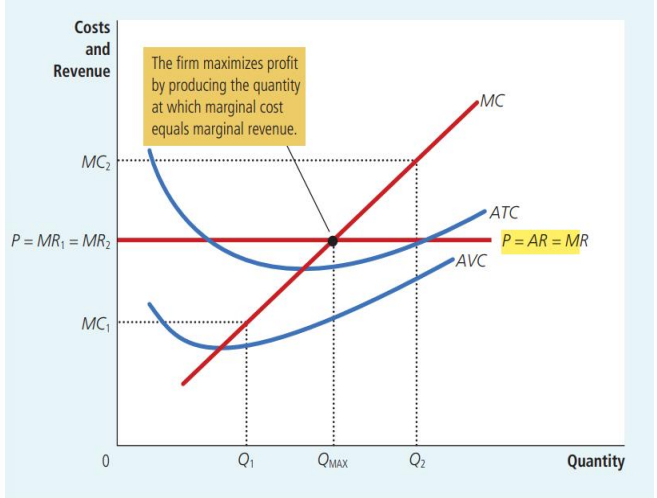

Profit Maximization for Competitive Firm

MR = MC

If MR > MC, then increase Q to raise profit.

If MR < MC, then reduce Q to raise profit.

A Firm’s Long-Run Decision to Exit

If firm exits the market,

Revenue falls by TR

Cost fall by TC

Firm should exit if TR/Q< TC/Q

Exit if P < ATC

New Firm’s Decision to Enter the Market

A new firm will enter the market if its profitable to do so

TR > TC

Enter if P > ATC

The Zero-Profit Condition

Zero economic profit occurs when P = ATC

Since firms produce where P = MR = MC, the zero-profit condition is P = MC = ATC

Monopoly

A firm that is the sole seller of a product without close substitute

Has market power

Arises due to barriers to entry

A single firm owns a key resource

The govt gives a single firm the exclusive right to produce the good

Natural monopoly

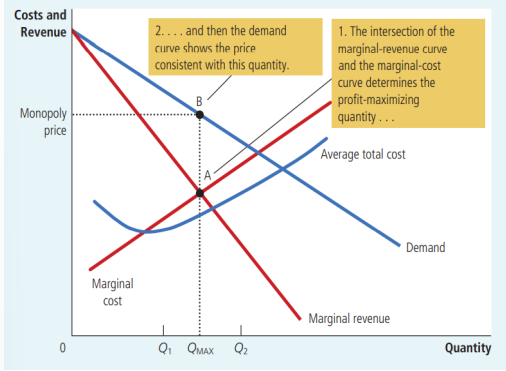

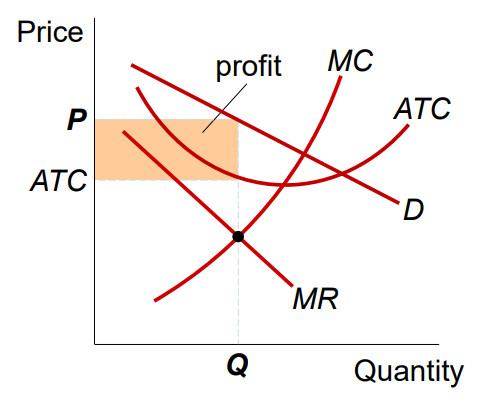

Profit Maximization of Monopoly

P > MR = MC

Profit = (P - ATC ) x Q

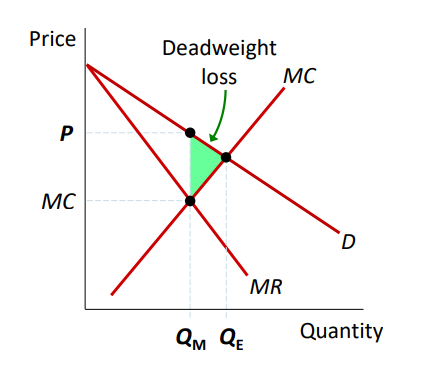

Welfare Cost of Monopoly

Deadweight loss exists because P > MC

Price Discrimation

Business practice of selling the same good at different prices to different buyers

Willingness to pay (WTP) is used in Price Discrimination

A firm can increase profit by charging a higher price to buyers with higher WTP.

Arbitrage will limit a monopolist’s ability to price discriminate.

Public Policy towards Monopolies

Increasing Competition with Antitrust Laws

Regulations

Public Ownership

Doing Nothing

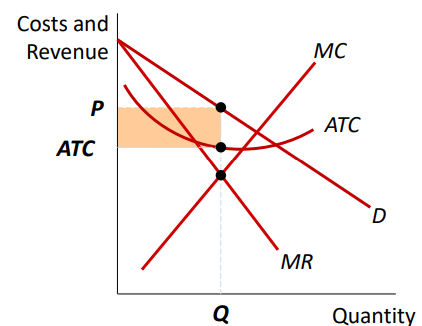

Monopolistic Competition

Many firms sell products that are similar but not identical

Monopolistically Competitive Firm with Gains

To maximize profit, they produce Q where MR = MC

The firm uses the D curve to set P

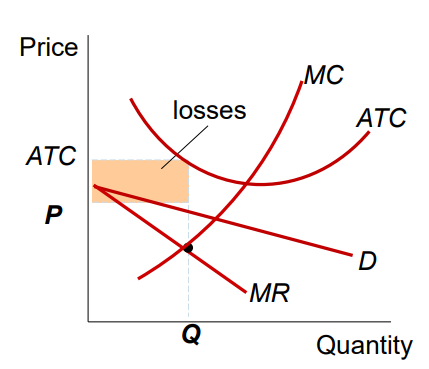

Monopolistically Competitive Firm with Losses

P < ATC

They can minimize their losses.

Oligopoly

Only a few sellers offer similar or identical products

Collusion

An agreement among firms in a market about quantities to produce prices to charge

Cartel

A group of firms acting in Unison

Nash Equillibrium

A situation in which economic participants interacting with one another each choose their best strategy given the strategies that all others have chosen

Output & Price Effects for Oligopoly

Output Effect

P > MC, selling more output raises profits

Price Effect

Raising production increases market quantity, which reduces market price and reduces profit on all units sold

Macroeconomics

The study of the behavior of the economy as a whole. It examines the forces that affect firms, consumers, and workers in the aggregate.

Business Cycle

Short term fluctuations in output, employment, financial conditions, and prices.

Economic Growth

Longer-term trends in output and living standards

Central Questions of Macroeconomics

Why do output and employment sometimes fall, and how can unemployment be reduced?

What are the sources of price inflation, and how can it be kept under control?

How can a nation increase its rate of economic growth?

Objectives of Macroeconomics

Output

High level and rapid growth of output

Employment

High Level of employment with low involuntary unemployment

and Stable Prices

Instruments

Monetary Policy:

Buying and selling bonds

Regulating financial institutions

Fiscal Policy

Government Expenditures

Taxation

Gross Domestic Product

The measure of the market value of all final goods and services produced in a country during a year.

Gross National Product

Total income earned by a nation’s permanent residents

Net National Product

The total income of nation’s residents (GNP) minus losses from depreciation

National Income

Total income earned by a nation’s resident in the production of goods and services

Personal Income

The income that households and noncorporate business receive

Disposable personal income

The income that households and noncorporate businesses have left after taxes and other obligations to the government.

Nominal GDP

Measured in actual prices

Real GDP

Calculated in constant and invariant prices

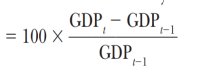

Growth Rate

GDP Deflator

The difference between Nominal GDP and Real GDP

= (Nom, GDP / Real GDP) x 100

Potential GDP

Represents the maximum sustainable level of output that the economy can produce.

Determined by the economy’s productive capacity.

Tend to grow steadily.

Recession

Period of significant decline in total output, income, and employment, usually lasting more than a few months and marked by widespread contractions in many sectors of the economy.

Depression

A severe and protracted downturn

Trough

Lowest point of an economic contraction

Peak

The highest point of an economic contraction

Expansion

Point between the trough and peak

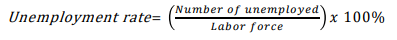

Unemployment Rate

The percentage of the labor force that is unemployed

Natural Rate of Unemployment

The normal rate of unemployment around which the unemployment rate fluctuates.

Cyclical Unemployment

The deviation of unemployment from its natural rate. Happens when workers are laid off

Discouraged Workers

Individuals who would like to work but have given up looking for a job

Labor Force

The total number of workers

= Employed + Unemployed

Labor-Force Participation rate

the percentage of the adult population that is in the labor force

= (Labor Force / Adult Population) x 100

Frictional Unemployment

Results because it takes time for workers to search for the jobs that best suit their tastes and skills

Structural Unemployment

Results because the number of jobs available in some labor markets is insufficient to provide a job for everyone who wants one

Consumer Price Index

Measures the trend in the average price of goods and services bought by consumers

Inflation rate

Percentage change in the overall level of prices from one year to the next

Policy Instrument

Economic Variable under the control of government that can affect one or more of the macroeconomic goals

Fiscal Policy

Denotes the use of taxes and government Expenditures

Monetary Policy

Conducted by the government through managing the nation’s money, credit, and banking system