3.5 labour market

1/43

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

44 Terms

what impacts the demand for labour

No. of firms (if there is a boom more will be hiring but in a recession firms close - less hiring)

Profit

Pricing - employer NI, min wage ,

tastes/trends - derived demand

substitutes - machinery, AI , capital

Legislations - degree , qualifications , Visas

Explain the statement : “The derived demand for labour is derived from the demand for the good or service being produced”

the demand for workers (labour) isn't for the workers themselves, but because those workers are needed to produce goods or services that consumers want to buy; if demand for cars rises, so does the demand for car factory workers, illustrating that labour demand is indirect and dependent on the final product's demand.

elasticity of demand for labour

Measures how responsive demand for labour is to a change in the wage rate

factors impacting the elasticity of demand for labour

Substitutability – how easy it is to substitute between capital and labour

Ratio of labour costs to total costs – the more significant the cost of labour to a firm’s costs the more elastic

Elasticity of demand for the product – firms will be more able to absorb a wage rise if the demand for the good is price inelastic

Time – always increases elasticity

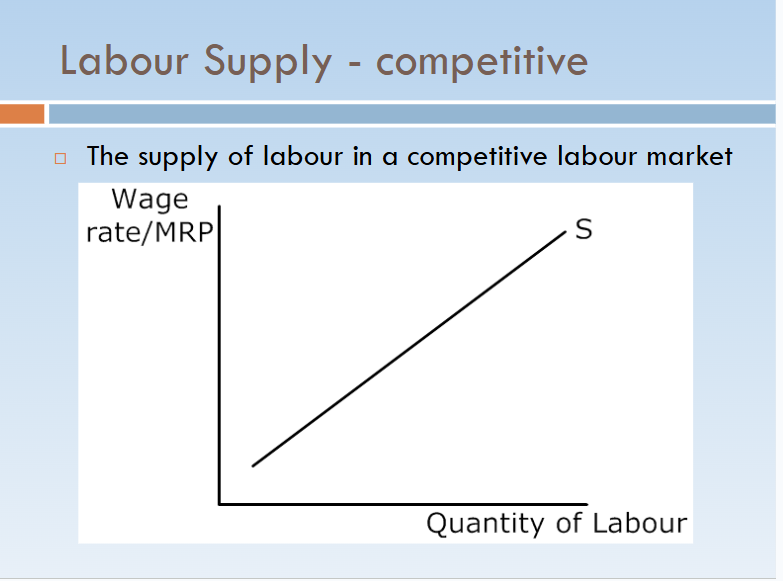

labour supply

how many workers (households) are willing to work at a given wage rate

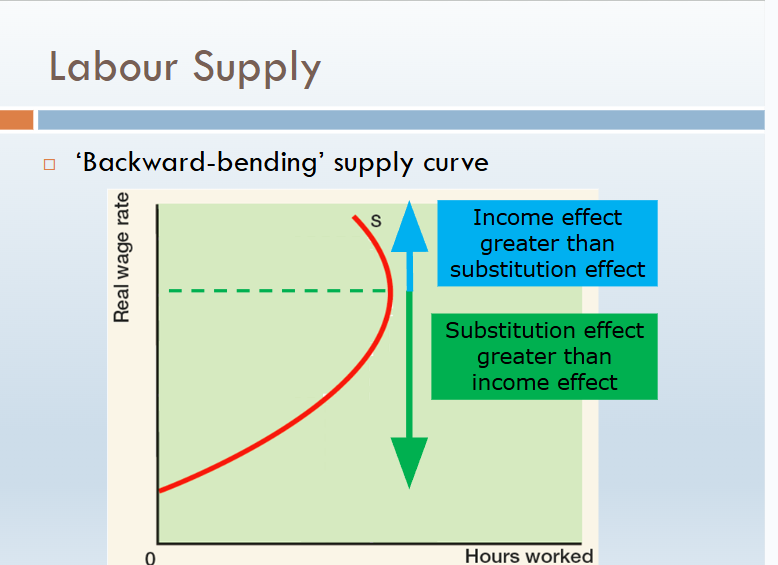

how will individuals react to a rise in the wage rate?

Income effect:

As wages rise, people feel better off and therefore may not feel a need to work as many hours

Substitution effect:

As wages rise, the opportunity cost of leisure rises (the cost of every extra hour taken in leisure rises) so more hours are worked.

explain the factors which could influence the supply of labour to a particular occupation

Skills, qualifications & training

High training costs or long qualification periods → barriers to entry → fewer eligible workers → restricted labour supply.

Immigration

Relaxed immigration rules → inflow of foreign workers → larger labour pool → increase in labour supply.

Wages

Higher wages → greater financial incentive → opportunity cost of leisure rises → more workers willing to offer labour → increase in labour supply.

discuss the impact of trade unions

Trade unions

Stronger unions → higher wages and improved conditions → occupation more attractive → increased labour supply (though entry restrictions may limit numbers).

geographical mobility on the labour supply

Geographical mobility

High housing costs or relocation barriers → workers unable to move → reduced responsiveness to vacancies → lower labour supply in certain areas.

explain the concept "geographical immobility of labour"

Geographical immobility of labour refers to the difficulty workers face in moving between different locations to take up employment.

Explain the factors which could cause geographical immobility of labour

High housing costs

Expensive housing in high-employment areas → workers unable to afford relocation → reduced willingness to move → geographical immobility of labour.

Family and social ties

Commitments to family, schools and community → high non-financial cost of moving → workers choose to stay → geographical immobility.

Information failure

Lack of awareness of job opportunities elsewhere → workers unaware of benefits of moving → limited relocation → geographical immobility.

what could the government do to combat geographical immobility of labour

Housing subsidies / relocation grants

Financial support for moving costs → lower short-run cost of relocation → workers more willing to move → reduced geographical immobility.

Investment in transport infrastructure

Improved rail and road links → commuting becomes cheaper and faster → workers can access jobs without relocating → effective geographical mobility increases.

Regional development policies

Government investment in deprived areas → job creation locally → reduced need to migrate → imbalance between regions falls.

explain the concept "occupational immobility of labour"

Occupational immobility of labour refers to the difficulty workers face in moving between different jobs or occupations.

It occurs when workers lack the necessary skills, qualifications, or experience required for other occupations,

(structural unemployment)

explain the factors which could cause occupational immobility of labour

High training and retraining costs

Courses are expensive and time-consuming → high opportunity cost of retraining → workers remain in current occupation → immobility increases.

Qualification requirements / professional barriers

Strict licensing or qualifications (e.g. doctors, lawyers) → legal barriers to entry → workers unable to switch occupations → occupational immobility.

Hysterisis / recession

A recession → long-term unemployment rises → workers’ skills deteriorate or become outdated → employability falls → workers struggle to move into new occupations → occupational immobility persists even after recovery.

how to combat occupational immobility of labour

Subsidised Training

Govt funds training → workers gain new skills → move into growing industries → occupational immobility ↓ → productivity ↑

2. Apprenticeships/Vocational Education

Hands-on industry skills ↑ → fills skill gaps → labour more flexible → immobility ↓ → economic growth ↑

labour market competitive

labour supply

unemployment UK

UK unemployment was 5.1% in late 2025, the highest level since early 2021, showing the labour market has cooled, potentially making occupational immobility more of an issue for jobseekers struggling to move sectors.

skills mismatch

In 2022, 2.3 million (≈6.6%) of working‑age people in the UK had skills that could suit a job outside their current occupation — indicating some capacity for mobility, but also a skills mismatch problem that contributes to immobility

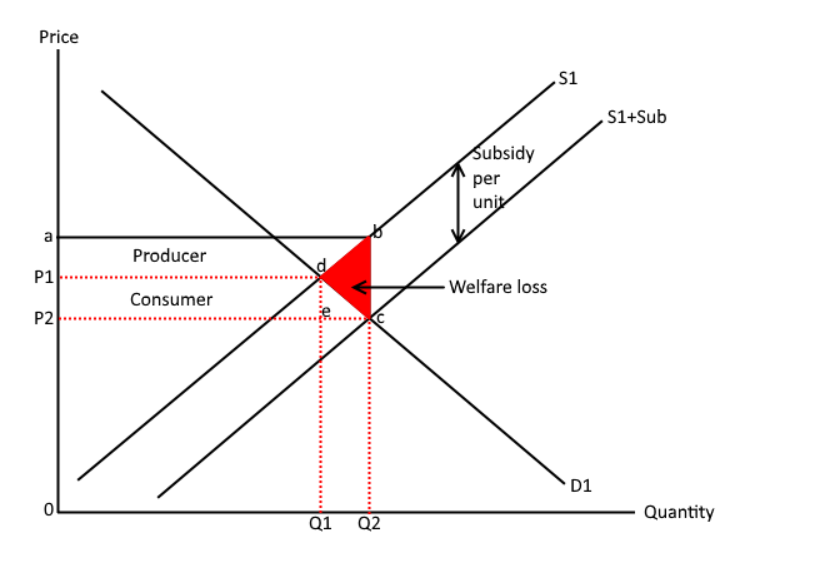

subsidy

This can be shown on the diagram above as the subsidy lowers costs of production causing supply to increase from S1 to S1+Sub. As a result of this, price decreases from P1 to P2 and quantity increases from Q1 to Q2. This is because the introduction of a subsidy means that firms are more incentivised to produce more of the good/service and those firms that weren’t currently in the market are more incentivised to join the market.

trade unions and income inequality

higher costs for firms -> lower profits -> lower dividends

greater bargaining power -> higher wages -> can strike if not awarded wage increases (e.g. 2015 tube strike, £300m lost)

trade unions and wages

this only occurs in certain industries. Currently, unionised workers earn 5% more than non-unionised workers

NHS monopsony power reduced in 2023, workers recieved 5% pay rise

BUT

Less than 5% of farmers are in trade unions and 23% of the wider working population are in trade unions

Compensating wage differentials

Some jobs involve unpleasant, risky, or unsociable conditions

→ fewer workers are willing to supply labour at a given wage

→ labour supply is relatively inelastic

→ firms must offer higher wages to compensate

→ results in higher pay for undesirable jobs.

💡 Examples: night shifts, dangerous work

productivity wage differentials

Workers with higher productivity generate more output per hour

→ this increases their marginal revenue product

→ firms can justify paying higher wages without raising unit costs

→ wages are higher in occupations with high productivity levels

→ creates wage differentials between workers.

💡 Often paired with capital-intensive industries

monopsony on wage differentials

A monopsonist is a dominant employer in a labour market

→ faces the entire upward-sloping labour supply

→ sets wages below competitive equilibrium

→ workers receive lower wages than in competitive markets.

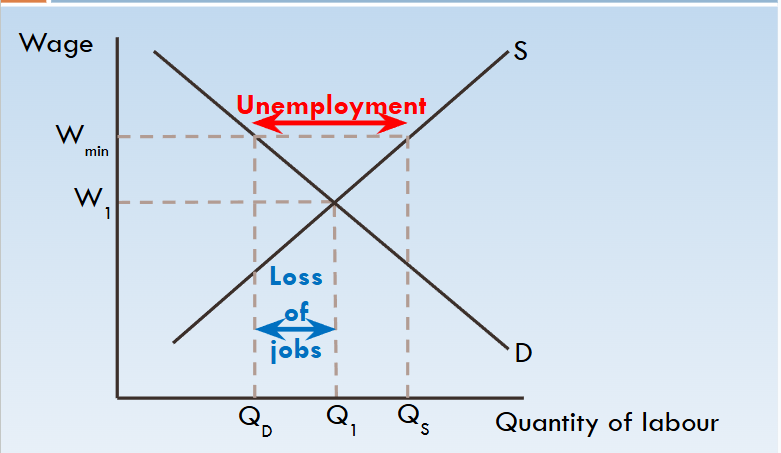

Reasons for Minimum wage

reduce poverty

reduce gap between rich and poor

incentive to work - higher productivity - higher output . The NMW is designed to improve incentives for people to start looking for work – thereby boosting the economy's labour supply.

controls monopsonist employers

the government can benefit fiscally (higher tax revenue)

reasons against minimum wage

it can raise costs for firms - real wage unemployment (wage higher than competitive wage)

Youth will lose out the most

firms may shut down “shut-down point”

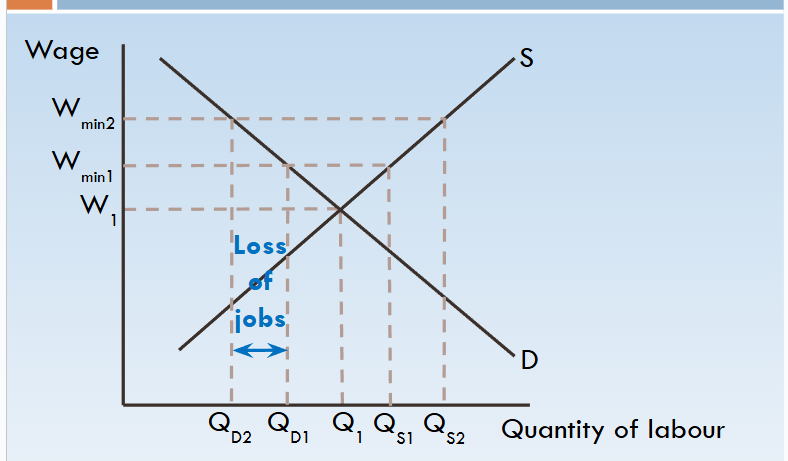

draw a minimum wage diagram

increase in minimum wage

how does a rise in national minimum wage impact consumers

A rise in the National Minimum Wage (NMW)

→ increases wage costs for firms employing low-paid workers

→ raises average and marginal costs of production

→ firms pass on higher costs to consumers through higher prices

→ leads to cost-push inflation

→ consumers face a fall in real purchasing power.

BUT - many goods and services are likely to be unaffected

Firms which don’t employ low wage workers will be unaffected

Goods with inelastic PED will not pass on much increase in price

a rise on minimum wage on workers

A rise in the NMW

→ increases the wage floor

→ low-paid workers receive higher hourly pay

→ increases gross and disposable income

→ improves living standards

→ reduces in-work poverty.

(can also increase AD,spending,less need for gov spending on benefits - synoptic depth)

what could be negative about a rise of the national minimum wage on employment/workers

BUT - potential loss of jobs from the rise

The greater costs to businesses causes less demand for workers

However, if raised gradually impact on jobs may well be minimal (employers have time to adjust)

how could a rise in national minimum wage impact productivity

Higher minimum wages → increase job satisfaction and financial security → reduce labour turnover → workers invest more in firm-specific skills → increases labour productivity → improves long-term employability of workers.

a rise of minimum wage on producers

Rise in labour costs

Rise in costs will reduce profitability (P=R-C)

Particularly relevant to firms where labour costs are a significant proportion of total costs - e.g. hospitality, retail

Diagram - rise in cost (could be just AC or MC & AC) and impact on profit

BUT - greater spending in the economy could create extra demand

E.g. a restaurant may have more customers as a result of lower paid workers earning more

Diagram - rise in AR/MR countering rise in AC

how would a rise in the minimum wage impact the current account

Higher costs worsen competitiveness - bad for exports; Rise in AD could lead to more spending on imports

Increased work incentive could raise LRAS →increasing competitiveness

how would a rise in the minimum wage impact inflation

Fall in SRAS → cost push inflation, rise in AD from increased spending power→ demand pull inflation

Increased work incentive could raise LRAS → delationary

national minimum wage

The UK government has announced that the National Living Wage will rise from £12.21 to £12.71 per hour in April 2026

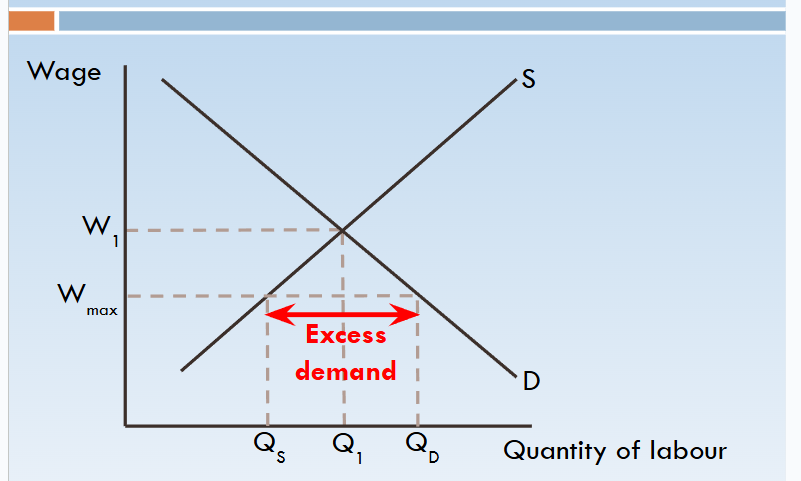

maximum wage

maximum wage discussion

A wage ceiling above which wages cannot be set

Main reasoning is to help narrow gap between the pay of the richest and poorest in a company

Typically this involves a maximum ratio gap between the highest and lowest paid

maximum wage on worker wages

A rise in wages

A maximum wage ratio would limit the ability of CEOs to raise their own wages without raising the wage of their lowest paid employees

A company paying the NLW in the UK of £11.44 (as of April 2024) would have a maximum CEO salary of around £475,000.

For CEOs wanting to earn more than this, it creates an incentive to pay their lowest paid workers more

BUT - Companies could simply outsource low paid work so that they no longer count as employees - this could worsen job conditions and security

maximum wages on incentives to work

Reduced work incentive for the highest paid workers

Top paid workers could earn more in other countries (or other industries if an industry based salary cap)

Potential brain drain effect on talented managerial staff

BUT

A greater incentive to take up lower paid work

The bigger the gap between unemployment benefits and the lowest paid jobs, the bigger the incentive for unemployed people to take up work

An increase in pay for the lowest earners would increase this incentive

maximum wages on inequality

Reduction in the gap between the richest and poorest workers

A maximum wage ratio prevents the difference between rich and poor workers going beyond a set level

The impact would be particularly relevant to multinational companies where CEO has increased at a rapid rate in recent decades

BUT - the richest could find pay loopholes to ensure higher pay without counting towards a wage ratio - e.g. payment through other means such as shares, expenses, etc.

Explain the influence that the government has on wages via its setting of wages in the public sector

The government is a major employer (e.g. NHS, teachers, civil service), so the wages it sets directly affect a large proportion of workers.

Higher public sector pay may push up private sector wages as firms compete to attract and retain labour.

Lower or frozen public sector wages can suppress overall wage growth and reduce wage inflation in the economy.

Wage decisions are influenced by government objectives such as controlling inflation, reducing the budget deficit, or improving recruitment and retention in key services.

Explain how the strengths of trade unions will influence the government's freedom to set public sector wages

Strong trade unions have greater bargaining power, reducing the government’s freedom

public pressure and strikes to negotiate higher wages

This may force the government to increase public sector pay, raising government spending.

Union strength therefore determines how far the government can control wage growth in the public sector without industrial action.