lecture 12 Trade in Energy, OPEC and the IPE of Climate Change

1/35

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

36 Terms

Two Interrelated Crises

russia’s invasion of ukraine

climate crisis

game plan

Game Plan

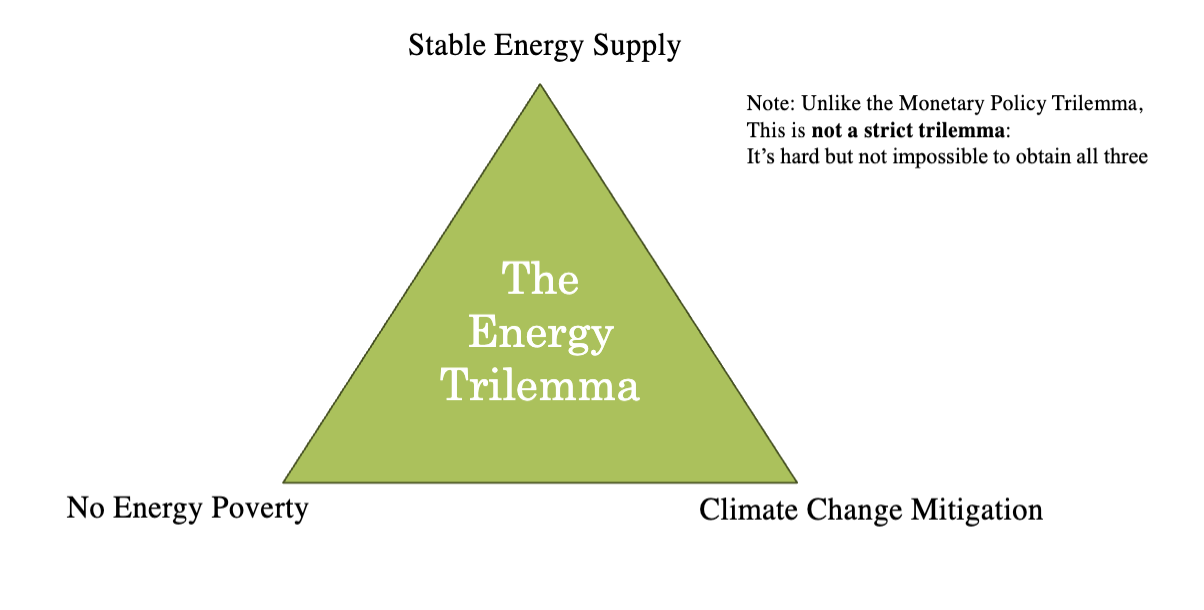

The Energy Trilemma

Oil Institutions: OPEC and the IEA

ClimateChange:

International Institutions

Domestic Interests and Institutions

3 Common EconomicClimatePolicies

The Energy Trilemma

its logically possible to achieve all three but its hard

Stable Energy Supply

Energy is a good that is more fundamental to our economies and lives than almost any other. We need it to:

Power production

Fuel most forms of transportation

Heat our homes

Supply Electricity to our homes

Abundance of reliable, cheap energy fuels economic development

allows more production

Lack of reliable, cheap energy can cause deep economic crises

Global Sources of Energy

mostly comes from fossil fuels

gas, oil, and coal = chunk of our energy

Global Trade in Energy

this energy is trade

huge flows of imports and exports

russia and middle east is a major supplier to europe

Institutions Governing Energy Policy

no overarching institutions like the WTO how to coordinate this trade in energy

•No ONE institution or agreement governing energy policy

Main Institution Oil Exporters: Organization of Petroleum Exporting Countries (OPEC)

Main Institution Oil Importers: International Energy Agency (IEA)

founded in response to OPEC

A lot of others related to energy:

UNFCCC (global climate change framework, more on that later)

IRENA (International RenewableEnergy Agency)

IAEA (International Atomic Energy Agency)

World Bank

increase lending for switch to green the economy

OPEC History

First half 20th Century: Oil production dominated by the “Seven Sisters”

Now: Exxon, Shell, BP, Chevron

1960: 5 countries (Saudi Arabia, Iraq, Iran, Kuwait, Venezuela) form OPEC to“ stabilize prices” and “ensure a fair return on capital for investors”

because before for exploitative

= trade union to negotiate with oil companies

more negotiation as a group rather then individuals

1970s: OPEC asserts power, oil embargo

From 1980s: Mandatory production quotas for members to keep supply steady and prices high

= OPEC becomes a “cartel”

small number of companies to try to manipulate the price on how they produce v how they charge

2016: OPEC+ (coordination with Russia and others)

coordinate with 10 other countries

OPEC Oil Embargo 1973

this started stagflation

By 1973: OPEC’s production of oil at over 50% world share

1973: Yom Kippur War

Arab members of OPEC impose an oil embargo on US & Netherlands and cut production

they refused to export oil

Result: Price of imported oil to US quadruples, double-digit inflation

high unemployement = bring monetarism and brings down keynesianism

Oil Cartel and Oil Prices

OPEC negotiates to curb production through quotas, keep prices high for everyone

•E.g. oil price drop after 2008 financial crash –OPEC countries jointly reduce output

BUT: coordinated output cuts hard to maintain –Prisoners’ Dilemma

everyone has a incentive to drill more oil and not cut

Some argue that Saudi Arabia –OPEC’s biggest producer –tries to uphold discipline through tit-for-tat

if you break the quota saudi arabia will break the quota

reciprocity

enforcing through multiple interactions

OPEC Today

13 member countries + 10 others with opec +

Still accounts for more than half of world’s crude oil

looks at opec when theres inflationary and energy crisis

Shale boom in US and Canada has undermined OPEC’s influence in North America

us produces alot by fracking

less on a influence on the US then it did in the 90s and 80s

The IEA: An Organization for Oil Consumers

Created 1974 under OECD framework (= only developed country members)

only members of the OECD

Goal: Reliable energy supply, avoid future oil shocks

Measures:

Emergency stocks & collective oil emergency response Promote energy efficiency and diversification

countries release oil stocks to try to counteract some of the price shocks that came with sactions (russia v ukraine)

Research into energy markets & consulting

(today) Promote Clean Energy Transition

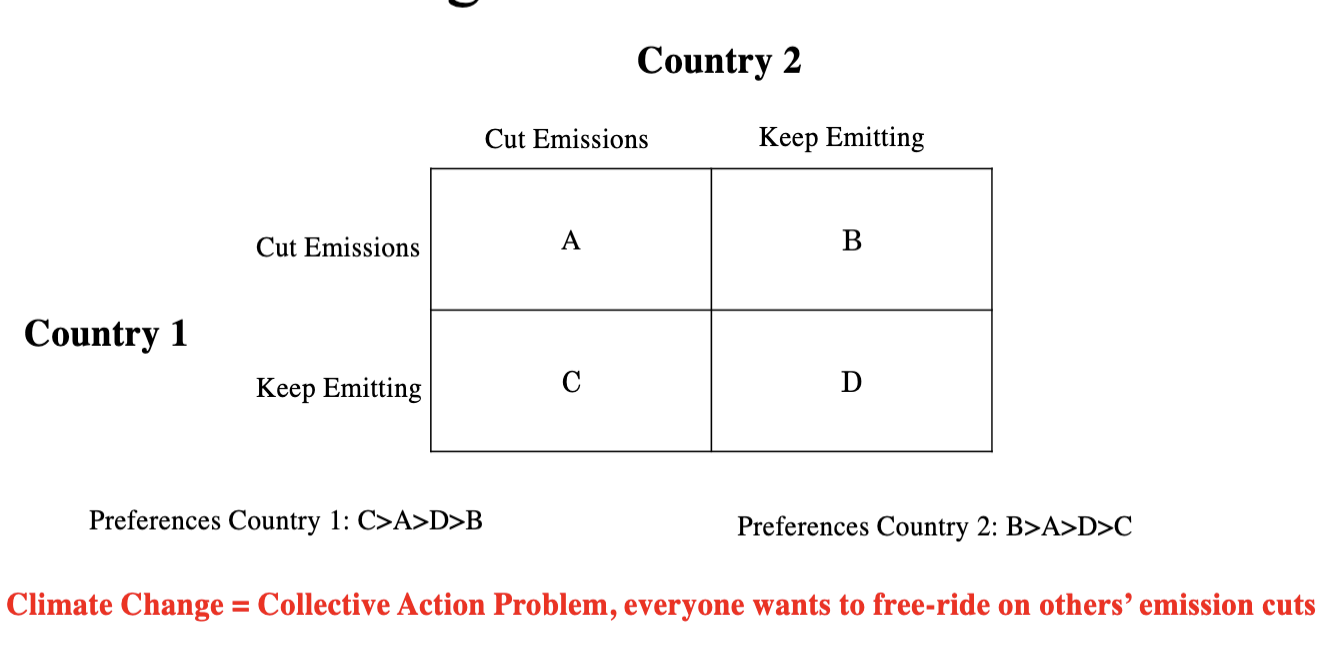

Climate Change as Prisoners’ Dilemma

nash equilibrium: D

when no changes

Pareto optimality

Pareto optimality is the state at which resources in a given system are optimized in a way that one dimension cannot improve without a second worsening

colonialism and climate change

should we hold them rlly accountable if previously colonialized?

International Climate Negotiations

pre paris video

1992: countries agree on UNFCCC (United Nations Framework Convention on Climate Change)

Conference of the Parties (COP) held every 2 year

framework of yearly meetings

1)nations try to limit climate change to a extend that is manageable

2) we all have responsibility but differentiated by econ dev

COP 29 held in Baku this November

1997: Kyoto Protocol

Set limits for developed countries to make cuts

not for developing!!!!!!!!!!

US never ratifies, Canada pulls out

Emerging economies (China, India) grow rapidly but have no obligations under Kyoto

did the EU meet its obligations?

yes!!

A New Model: The Paris Agreement

More politically palatable:

Everyone has todo “something”

got rid of clear division where only developed had to cut

Countries themselves decide how much: Nationally Determined Contributions(NDCs)

but you can decide how ambitious you are

before hand kyoto had clear targets

Designed to allow US President to circumvent Congress

us refused to ratify the kyoto and prob would refuse under kyoto! So it means the pres can sign and doesn’t have to put it as a vote

(Some) Climate Finance

developed provides some money to the developing world

Core issues today:

Stock-take last year: How have countries done sofar? (result: not enough)

2.7 degrees warmer

Phasing out of fossil fuels

cop 28 was the first time actually mentioned fossil fuels

and transition out “phase out”

Climate finance, including“Loss and damage” fund

developing can draw on a fund when experiencing climate related disasters

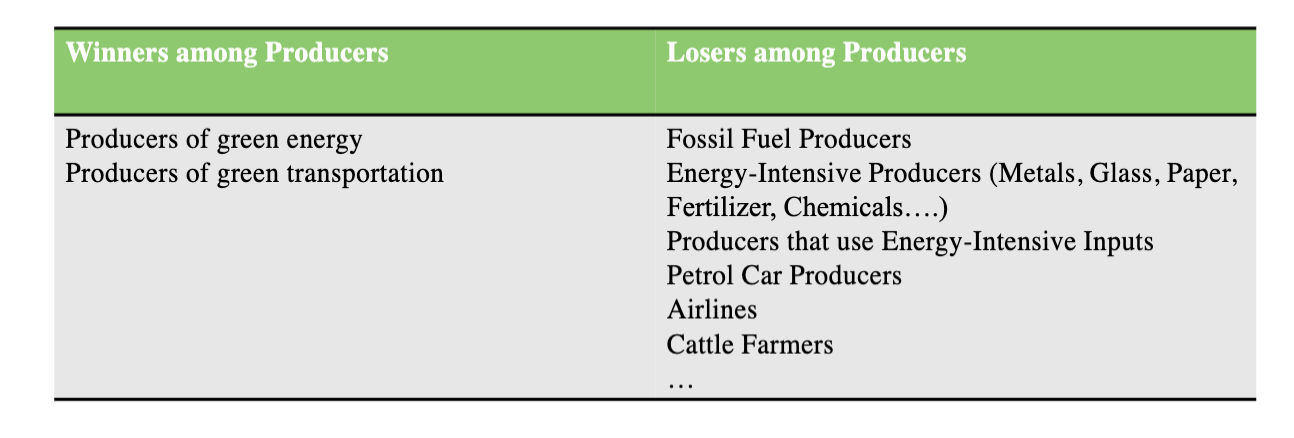

Domestic Interests

Climate action requires that we restrict GHG-intensive activities through higher prices, bans, quotas..

In the long run, we all win from policies to mitigate climate change, but in the short-medium run:

cattel farms: land and water intensive

Domestic Collective Action Problems

The costs of effective climate action are acute and concentrated = easy for industry to organize and lobby

Domestic Collective Action Problems

The benefits of effective climate action are diffuse, they benefit everyone in the world = most (young) citizens benefit, but easy to free-ride off others’ climate protests

but not as much as lobbying on the industrial side

Domestic Collective Action Problems

Two outcomes that can arise from collective action problems:

1.Climate action is stopped/watered down due to force full lobbying

2.The costs of climate action are born by CONSUMERS, not BUSINESSES

1.E.g. The German Energy Transition largely paid for by energy taxes on households, not businesses

A Related Problem: Energy Poverty

When the price of GHG-intensive products rises, not all households can:

Pay to insulate their homes

Pay for an electric car

Install solar panels and heat pumps

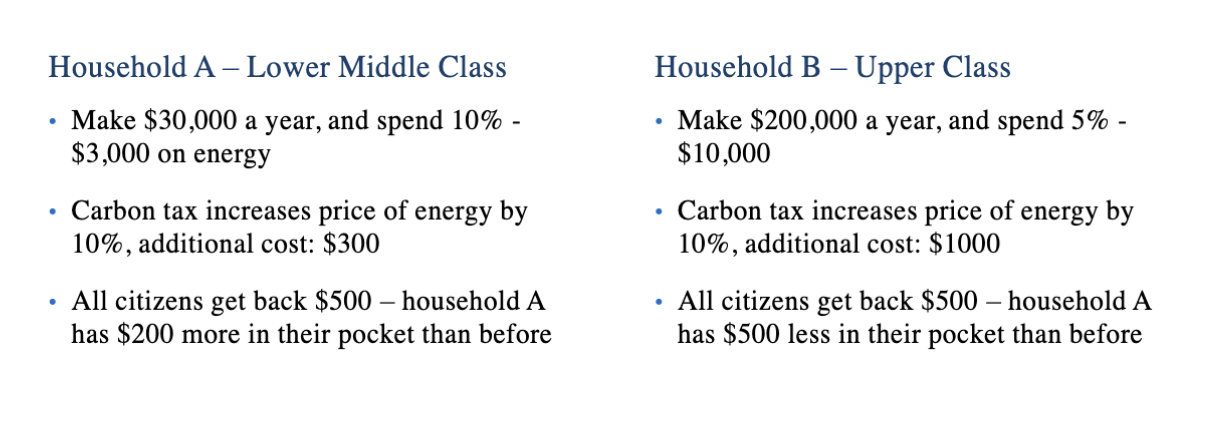

Problem: The poorest households spend the biggest income share on energy

3 Common Policy Approaches

1.Carbon Taxes

2.Emission Trading

3.Green Industrial Policy

Carbon Taxes

Put a tax on carbon to “price in” the negative effect of climate change (Pigouvian tax)

What do you do with the tax revenue?

Pay for energy transition

Pay for adaptation, loss and damage of climate change

Use the money for something else

Canada and Switzerland: Rebates (Lump Sum = everyone gets the same back)

tax everyone take the money, take the total sum, and divide by tax payers and give the same amount of back to everyone.

still creates incentives, because your behavior does not affect your rebate

only the worst polluters worse off in the end

can be progressive –poorer households get back more

Problem: people tend to underestimate their rebates and overestimate the costs of carbon taxes

you don’t rlly look at how much you get back (rebates)

you look more at what you have to pay for taxes

= more unpopular

Carbon Taxes How are Lump Sum

Rebates Progressive?

poorer spend more on energy

poorer gets more money back on rebates

richer spend more —> less or non back

Emissions Trading: how do carbon markets work

cap and trade

more incentive for innovation and reduce emissions as fast as they can

more they cut —> fewer permits they need to buy

historically underpriced carbon —> less incentive to decarbonize

lots of permits—> started horting the permits, and lowered cap —> to make supply less = incentivize decarbonization

The world’s largest carbon market: European Emissions Trading System (ETS)

set up for the kyoto obligations

Globalized Trade = Carbon Leakage (?)

High price of carbon => companies shift production to countries with lower carbon prices

Evidence of existence of carbon leakage is mixed: so far, seems limited, but we don’t know what would happen at higher carbon prices

3 possible solutions to carbon leakage:

1.Global price on carbon (very, very hard to negotiate)

2.Tariffs on foreign goods at the border to “level the playing field”

3.Give free permits/tax breaks to companies that export/compete against energy-intensive imports

The EU Carbon Border Adjustment Mechanism

Initially, EU gave away free ETS permits to companies to “level the playing field” in import-competition and exports

Problem: Lots of free permits limit incentives to decarbonize•New solution: Instead of free permits for import competition, CBAM: tariff on products from countries that do not have equivalent carbon prices

Companies liked the idea of the CBAM AND free permits

Companies did not like the idea of paying for permits when CBAM introduced

instead of free ones

Note: This may incentivize countries that are dependent on EU market to also put a price on carbon

pos effect on other countries

why not free permits and tariffs?

WTO: What is Allowed?

You CAN impose trade measures to prevent climate change –exceptions for environmental protection in GATT Article XX

BUT those measures can’t be arbitrary or discriminatory:

YouCAN impose a CBAM

YouCAN put tariffs only on products from countries without carbon pricing

You CAN’T impose a CBAM and ALSO give your industry free permits

Sorry, European Industry, you can’t have it all

“Big Green Push”: Green Industrial Policy

Some argue that green industries should be treated as “infant industries”

Green transition requires large-scale investment in low-carbon technologies

Changes to public and private infrastructure:

charging networks for EVs,

pipelines for green hydrogen

smart grids in energy networks...

Green industrial policy has political benefits:

Instead of imposing costs on polluters, you give incentives and subsidies to green industries

Building up your green industries creates jobs

Green industrial policy fosters industries that will lobby in favor of climate action

US Inflation Reduction Act 2022

instead of taxing pollutions you give tax credits (subsidies) to those who invest in green energy (both companies and consumers)

Introduces Tax Incentives, Grants, Loan Guarantees

Tax credits (=subsidies) for companies investing in clean energy, transport and manufacturing

Tax credits for consumers to make EVs, solar panels, heat pumps etc. more affordable

WTO Rules and the US IRA

problem

only gives subsidies to those made in the USA

violates the national treatment principle

Many of the tax breaks are only applicable to locally produced goods (or goods produced by “trade partners)

E.g.consumers get a tax break for EVs produced in the US, but not in the EU

Limits of State Capacity

Definition State Capacity: “ability and effectiveness of a government or state in performing its functions and responsibilities, including policy-making, implementation, and service delivery, to meet the needs of its citizens” (Peters, 2018)

Green transitions require money and good governance:

Make and incentivize major investments

Monitor and enforce climate laws

Monitor the effective use of climate subsidies and climate aid

Build resilient infrastructure and disaster response

Many developing countries lack the state capacity to effectively implement a green transition

International Climate

Finance

“financing that seeks to support mitigation and adaptation actions that will address climate change”

Under UNFCCC, developed countries are supposed to provide and mobilize funds for developing countries’ climate action

In Paris, developed countries reaffirmed commitment to mobilize $100 billion per year until 2020

2022 exceeded $100 bn for first time ($118bn)

In Baku, they just agreed to increase that to $300 billion per year until 2030. Developing countries called this “a joke,” -trillions are needed

A New Supply Challenge: Raw Materials

Energy transition depends on critical raw materials used in batteries, low-carbon power generation and electricity grids

we will have to electrify alot of things

almost all are processed in china

china might leverage west dependence

Danger of disruptions –countries (and companies) have started to invest in lowering their dependence:

recycling, at-home processing, substitution

Watch out for global fights over raw materials: