AP Macroeconomics: Key Graphs and Shifters Explained

1/6

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

7 Terms

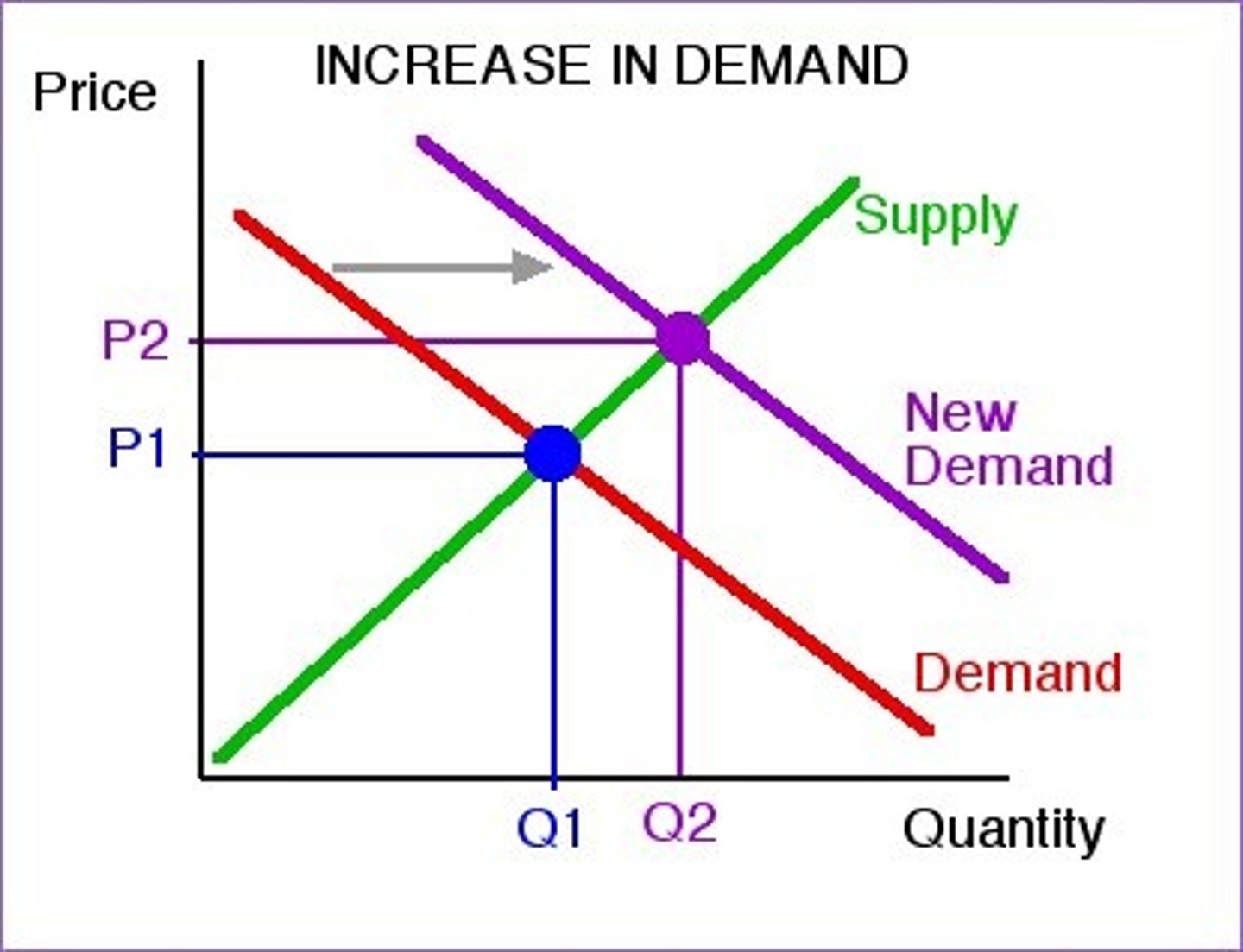

Shifters of Demand

1. Tastes and Preferences

2. Related goods and services (price of)

3. Income

4. Buyers (number of)

5. Expectation of price

TRIBE

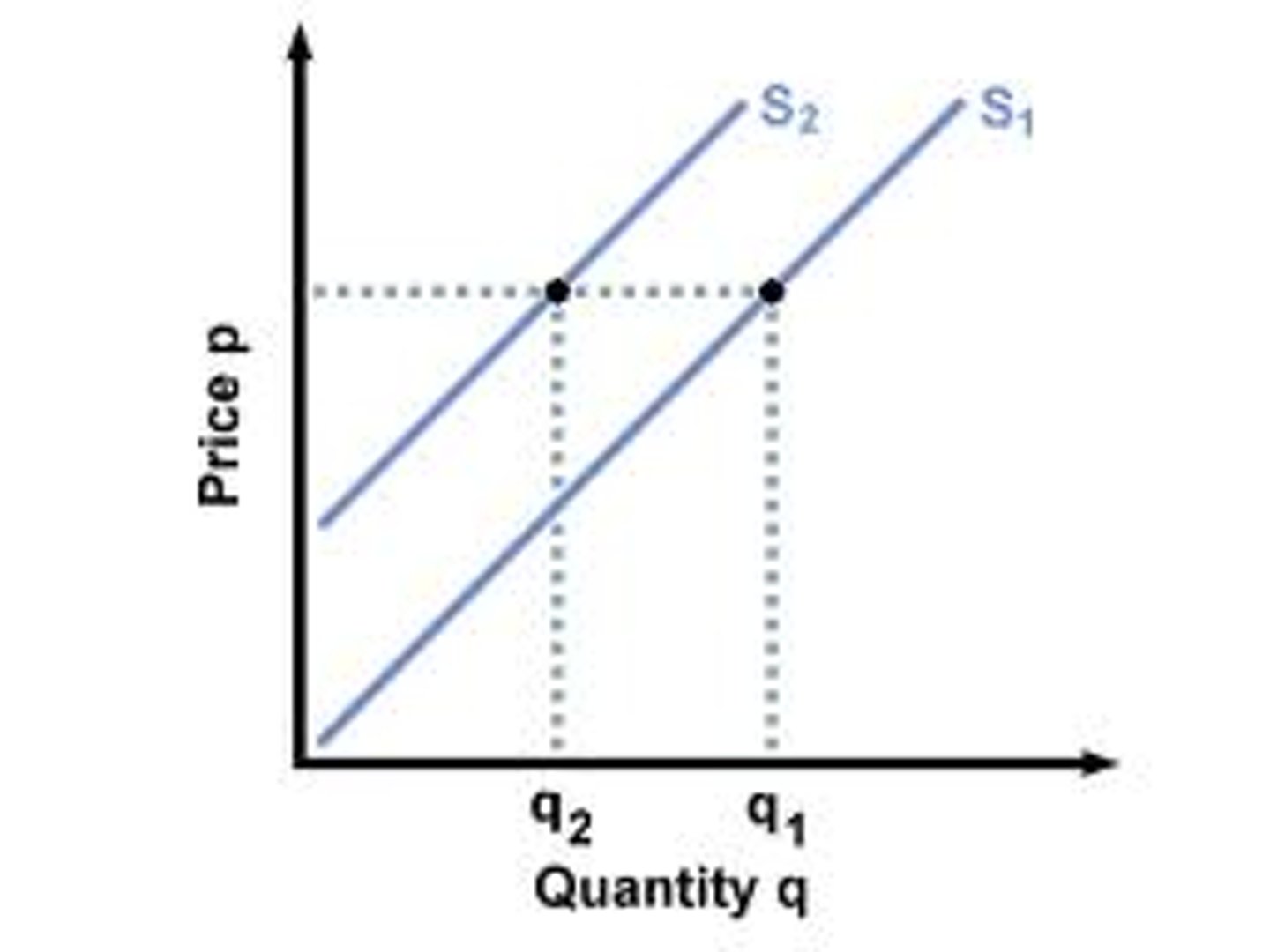

Shifters of Supply Curve

1. Resource cost

2. Other goods' prices

3. Taxes, Subsidies, Government regulation

4. Technology (productivity)

5. Expectations of the Producers

6. Number of firms

ROTTEN

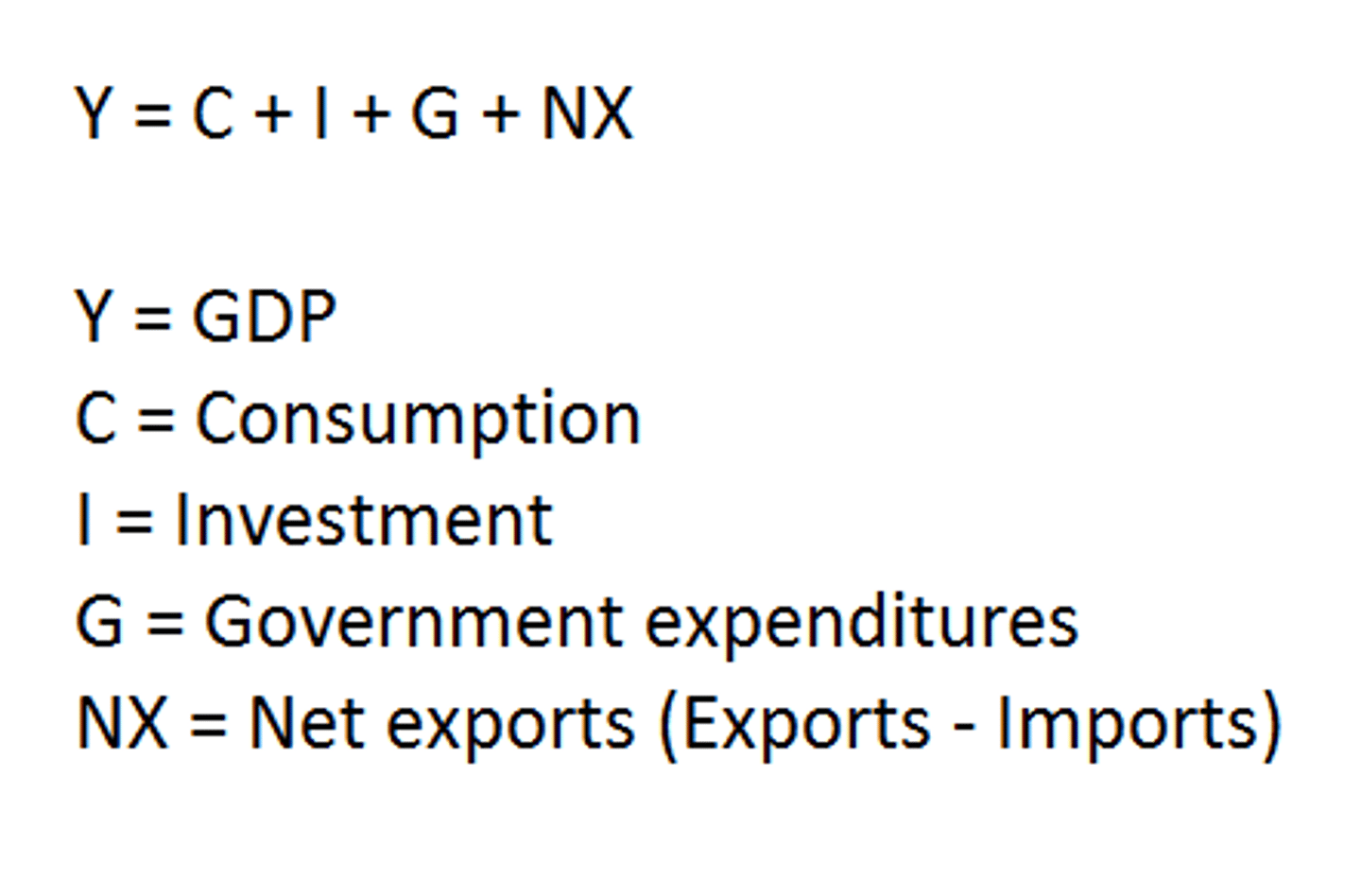

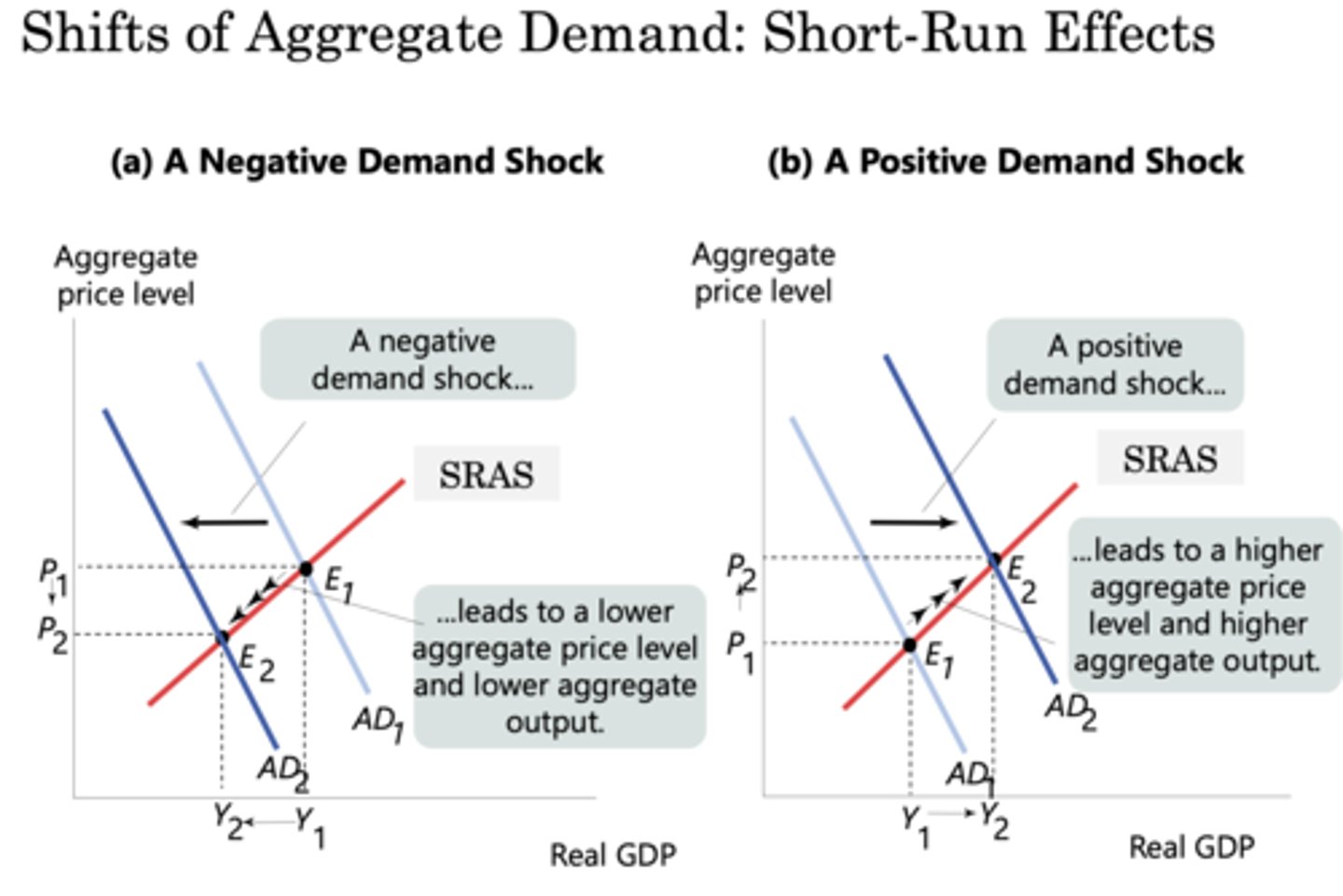

Shifters of aggregate demand curve

1. C: Consumer Spending

2. I: Investment Spending

3. G: Government Spending

4. Xn: Net Exports (Exports-Imports)

C+I+G+Xn

Shifter of Short Run Aggregate Supply

1. Productivity Changes

2. Input Price Changes

3. Expected Changes in Inflation

PIE

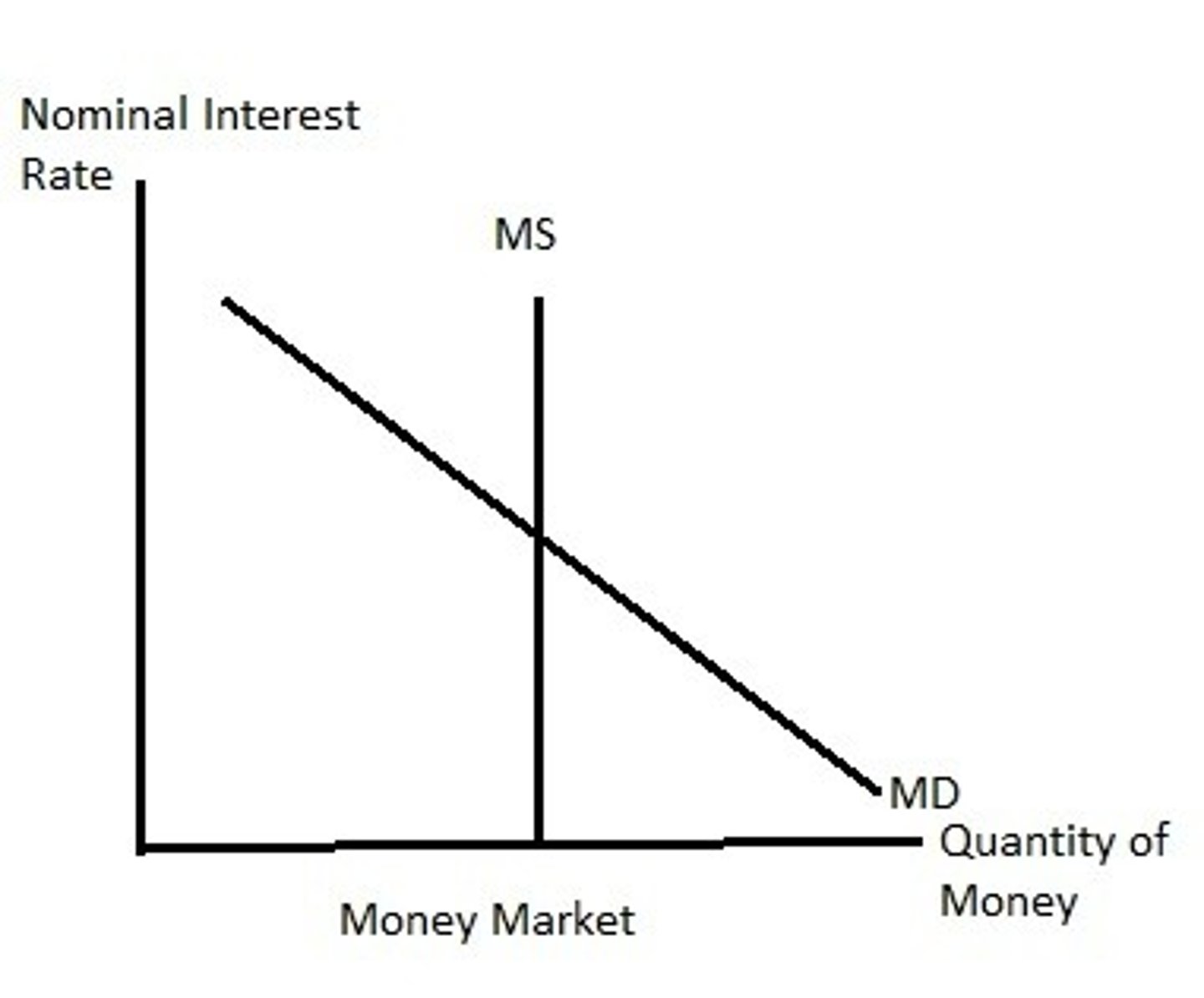

Shifters of Money Market Graph

1. change in the nominal interest rate will simply cause movement along the money demand curve

2. Money demand can shift in response to changes in real output (real GDP) or in the price level (inflation)

3. Money supply will not shift unless there is a change in central bank policy targeted at the money supply

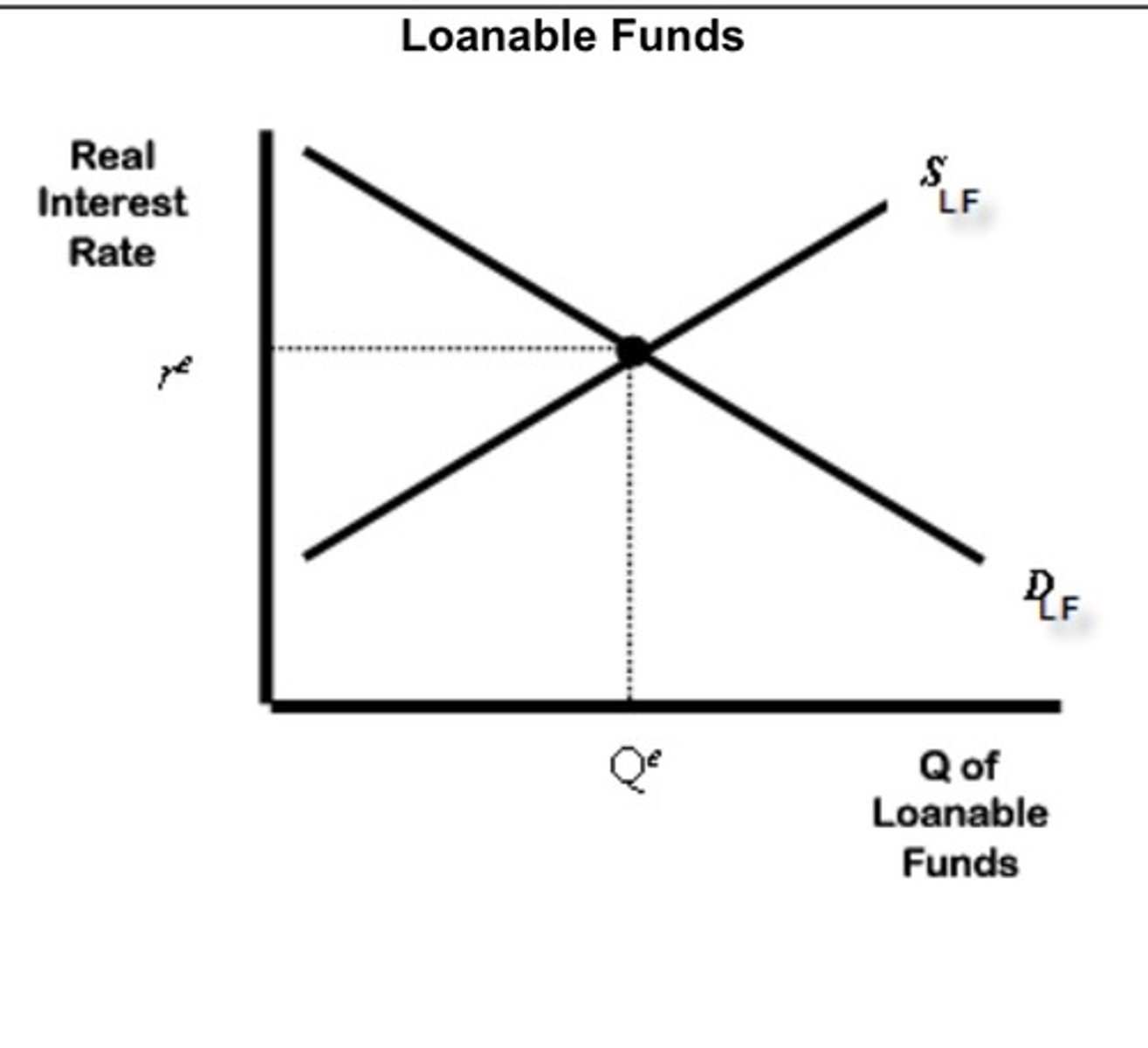

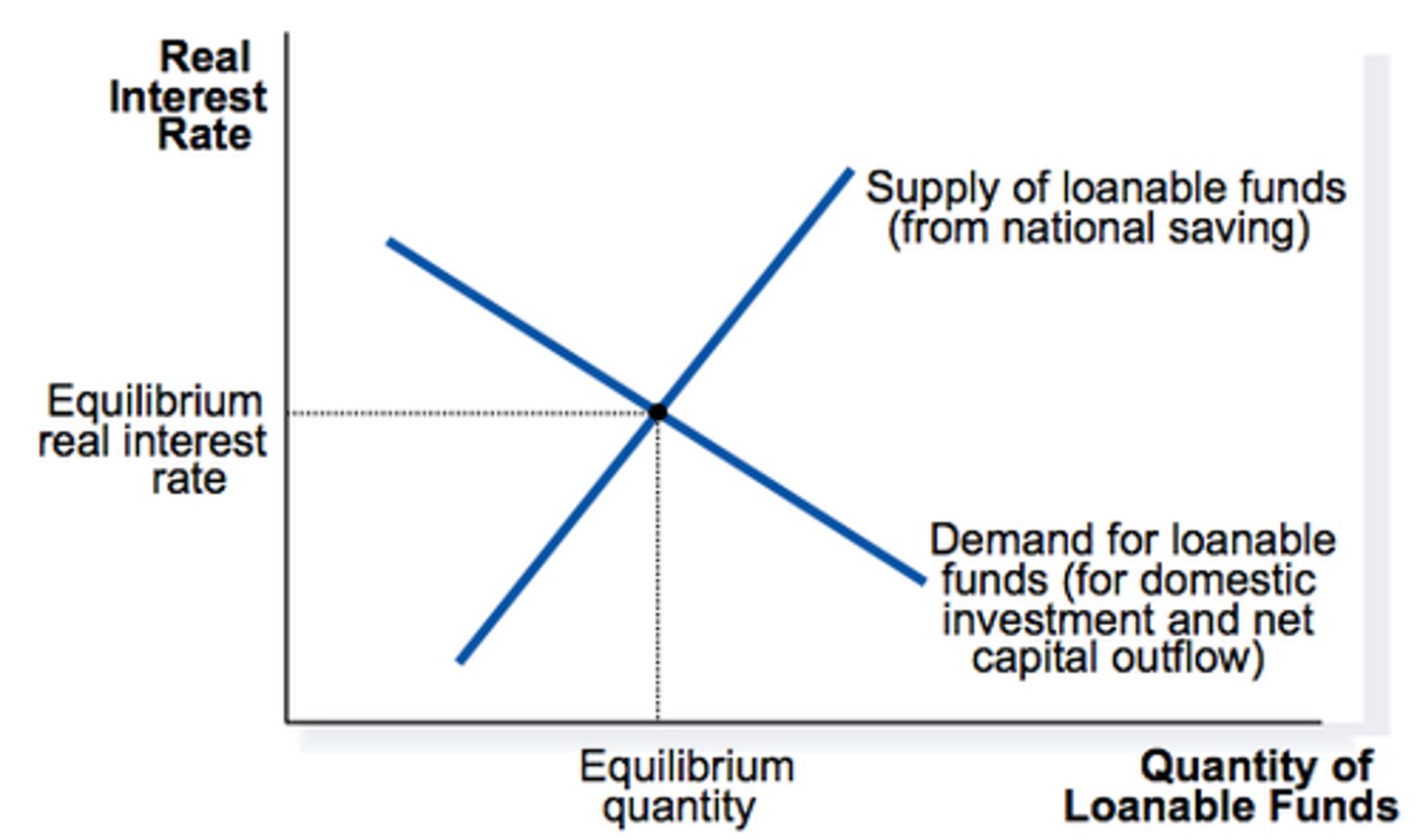

Shifters of Demand of Loanable Funds

1. All Borrowing, Lending, Credit

2. Deficit Spending

3. Expectations of Future Economic Conditions

Shifters of Supply of Loanable Funds

1. Monetary Policy

2. Saving in the Economy

3. Foreign Exchange Changes