Reading

1/48

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

49 Terms

Accounting

preparing financial stateents showing income and expenditure, assets and liabilities. It is known as the language of business because it provides financial information to investors, creditors, and management.

Types of accounting

There are several branches of accouns including financial accounting, managerial accounting, tax accounting, and forensic accounting.

Financial statements

are formal records of the financial activities and position of a business. The three main types of financial statements are the cash flow statement, income statement, and balance sheet

Cash flow statement

a statement giving details of money coming into and leaving the business, divided into day-to-day operations, investing and financing. helping assess liquidity and solvency—how well the business generates and uses cash.

Components of cash flow statement

Operating activities- Cash from core operations (sales receipts, payments to suppliers) 2. Investing activities - Cash from buying or selling long-term assets (e.g. equipment). 3. Financing activities - Cash from owners and creditors (issuing shares, repaying loans).

Income statement

a statement showing the difference between the revenues and expenses of a period ts main purpose is to measure profitability and evaluate financial performance.

Components of income statement

Revenue - Income from selling goods or services 2. COGS- Direct costs of producing goods sold 3. Gross Profit- Revenue minus COGS/ 4. Operating Expenses - Costs of running the business (e.g. wages, rent)/// 5. Net Income - Final profit after all expenses are deducted from revenue

Balance sheet

a statement showing the value of a business's assets, its liabilities, and its capital or shareholders' equity. The balance sheet shows what a company owns, what it owes, and the shareholders’ investment at a specific point in time.

Main components of balance sheet

Assets- Resources owned by the company (e.g. cash, inventory, property)// 2. Liabilities - Amounts the company owes (e.g. loans, accounts payable)//// 3. Shareholders’ Equity- Owners’ claim after liabilities, including common stock and retained earnings

total equity

all the money belonging to the company's owners

intangibles, net

assets whose value can only be turned into cash with difficulty (e.g. reputation, patents, trademarks, etc.)

additional paid-in capital

capital that shareholders have contributed to the company above the nominal or par value of the stock

Accrued expenses

expenses such as wages, taxes and interest that have not yet been paid at the date of the balance sheet

Total, receivables, net

money owed by Customers for goods or services purchased on credit

accounts payable

money owed to suppliers for purchases made on credit

Prepared Expenses

money paid in advance for goods and services

Retained earnings

profits that have not been distributed to shareholders

Property/ Plant/ Equipment/ Total – gross

tangible assets such as offices, machines, etc.

Good well, net

the difference between the purchase price of acquired companies and their net tangible assets

Total liabilities

the total amount of money owed that the company will have to pay out

A clearing system

A clearing system is an arrangement where banks settle debts by netting all transactions over a period and paying only the final balances between accounts.

comperative parity method

choosing to spend the same amount on advertising as one's competitors

word of mouth advertising

free advertising, when satisfied customers recommend products to their friends

viral marketing

trying to get consumers to forward an online marketing message to other people

market differentiate

making a product (appear to be) different from similar products offered by other sellers, by product differences, advertising, packaging, etc.

market skimming

setting a high price for a new product, to make maximum revenue before competing products appear on the market

market penetration

the strategy of setting a low price to try to sell a large volume and increase market share

A market leader

aims to maintain its dominant position by protecting or increasing market share through innovation, cost efficiency, and strong marketing.

A market challenger

tries to gain market share by aggressively competing with leaders or followers using lower prices, better products, or improved services.

A market follower

avoids direct competition and instead imitates or adapts successful products while keeping costs low.

A market nicher

focuses on a small, specialized segment with a clear unique selling proposition to achieve profitability.

Introduction stage

The product is newly launched, so sales grow slowly and profits are low or negative due to high advertising and promotion costs. Companies may use high prices (market skimming) or low prices (market penetration) to enter the market.

growth stage

Sales increase rapidly as more customers accept the product. Profits rise, economies of scale are achieved, and competitors enter, often leading to price reductions.

Maturity stage

The market becomes saturated, sales stabilize, and competition is intense. Companies focus on brand loyalty, product improvements, promotion, or price cuts to maintain market share, often with lower profits.

Decline stage

Sales and profits fall due to new technologies or changing consumer tastes. Firms may withdraw the product or reduce investment and focus on more profitable products.

Push strategy

Goods are produced and distributed based on demand forecasts. Products are pushed through the supply chain in advance, often leading to higher inventory levels.

Pull strategy

Production and distribution are driven by actual customer orders. Products are made as needed, which reduces inventory and waste

Kaizen

A Japanese management approach meaning continuous improvement, which focuses on reducing waste through small, ongoing changes suggested by workers themselves rather than expensive new technology.

Cell production

A production method where work is organized into small, self-contained units (cells), each responsible for part of the product, improving efficiency, teamwork, and employee motivation.

The quaternary sector

includes information and knowledge-based services such as computing, ICT, consultancy, research and development, and more broadly education, media, libraries, and cultural activities.

Franchising

A business model in which a company allows independent operators to sell its products or services using its brand and business system

Joint venture

A partnership where two or more companies create a new business together, sharing investment, risks, and profits.

High-context cultures

managers are perceived as authority figures, employees often show respect through deference and formal behavior. Team members are less likely to voice opinions, challenges decisions or take initiative without permission, as they wish to avoid losing face. This cultures allow fast decisions but limit the communication and innovation

Low-context culture

managers are approachable and employees are encouraged to take part in decision-making. Employees expect equality and feel comfortable when sharing ideas, asking questions or taking responsibility. This cultures promote openess and engagement but may delays urgent decisions or creates ambiguity in final responsibility

Linear-active cultures

are logical and task-focused. People plan carefully, do one thing at a time, follow rules, and value individual responsibility.

Multi-active cultures

are relationship-focused and emotional. People multitask, change plans easily, rely on relationships, and value hierarchy over rules.

Reactive cultures

focus on harmony. People listen more, avoid confrontation, communicate indirectly, and seek mutual solutions.

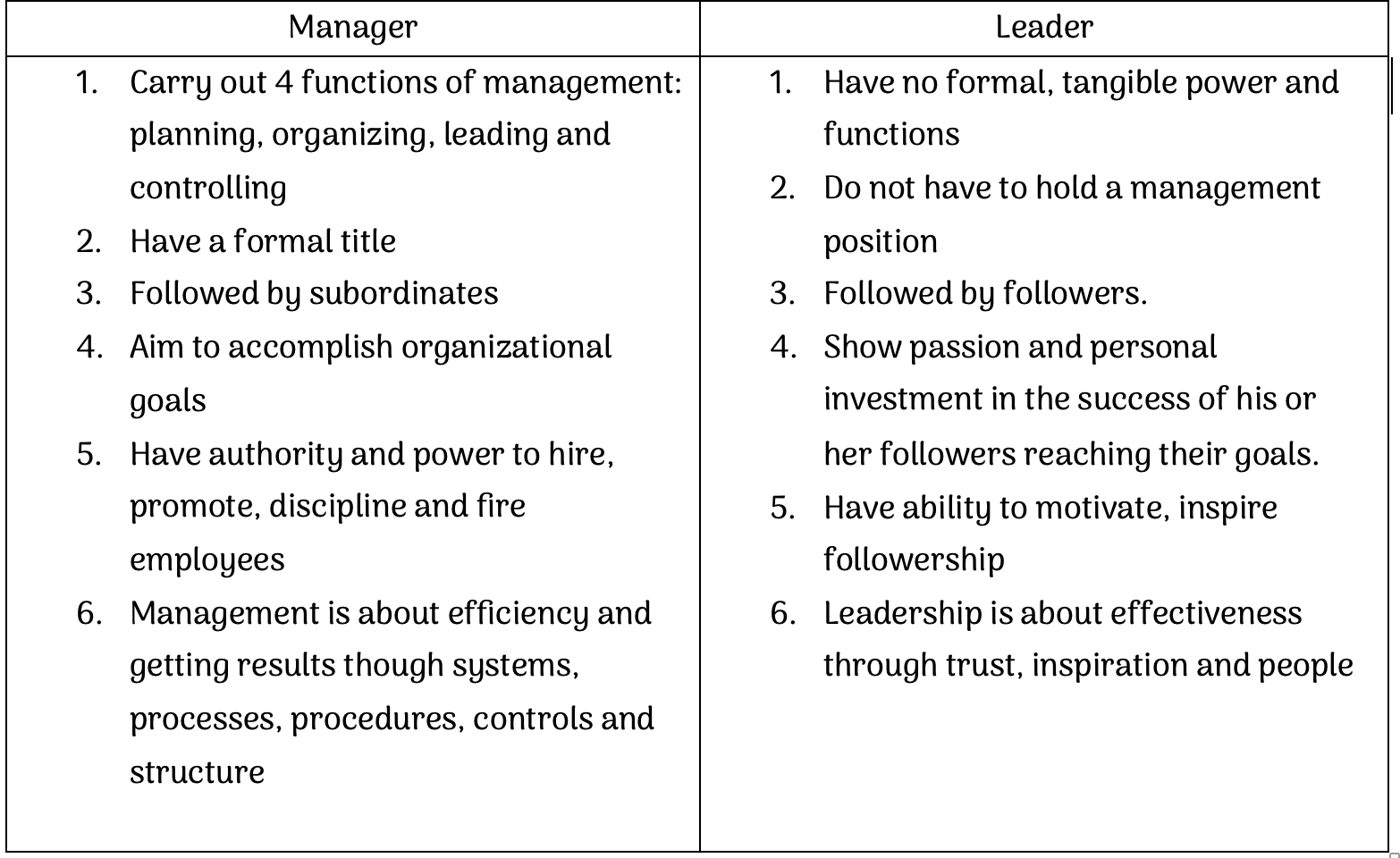

Manager and leader