IB Economics HL - Midterm | Quizlet

1/103

Earn XP

Description and Tags

Chapter 3: Demand (HL-ONLY section) Chapter 8: Government intervention (micro) Chapter 10: Rational Producer Behavior (micro) Chapter 11-12: Market power/structures (micro) Chapter 17: Demand-side policies (macro)

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

104 Terms

Rational producer behavior

Firms wanting to maximize profits (cost, revenue, profits)

Market power

Ability of firm to raise market price of a good or service above MC, influencing market outcomes by restricting output to increase price without loosing their share

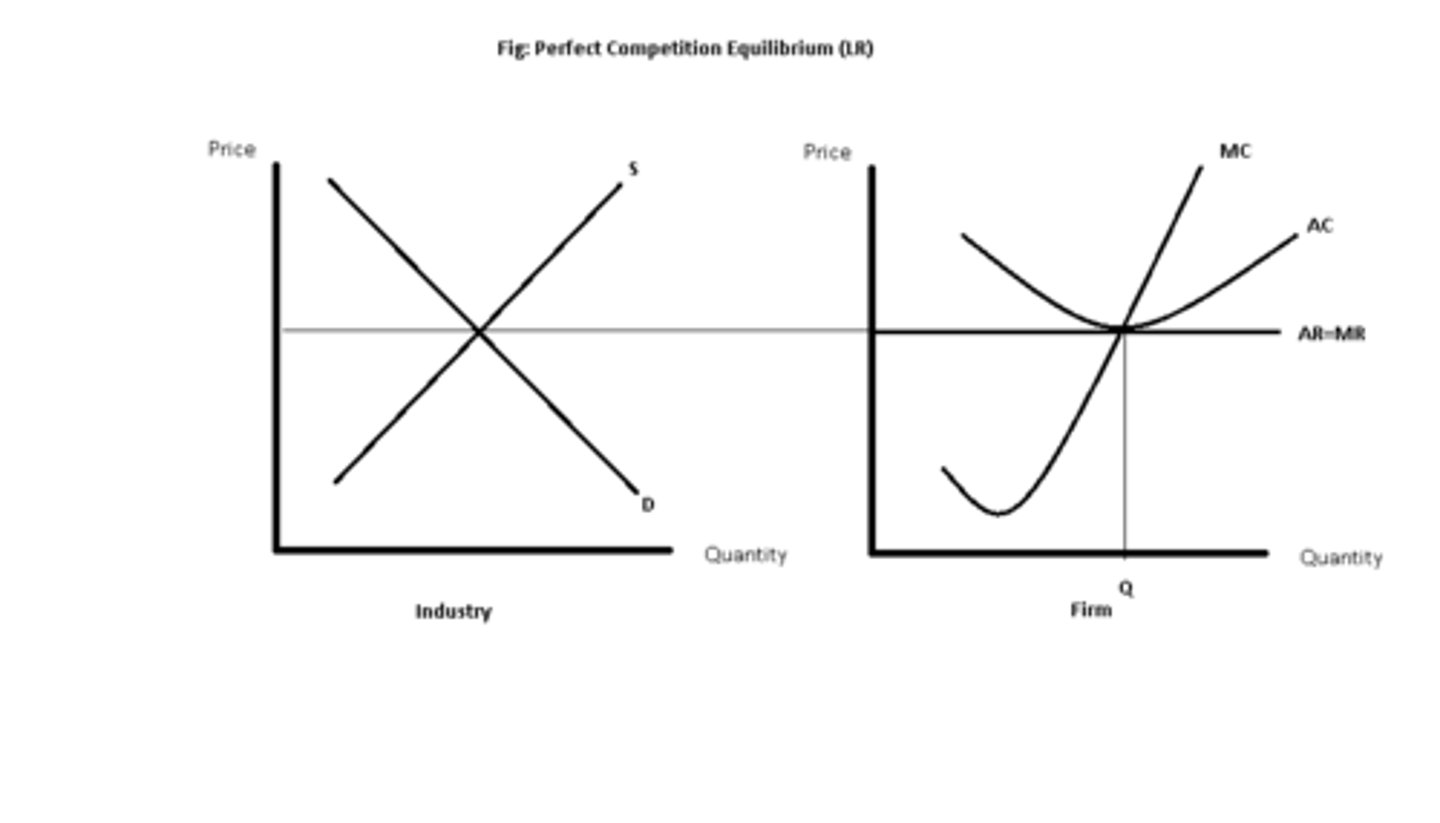

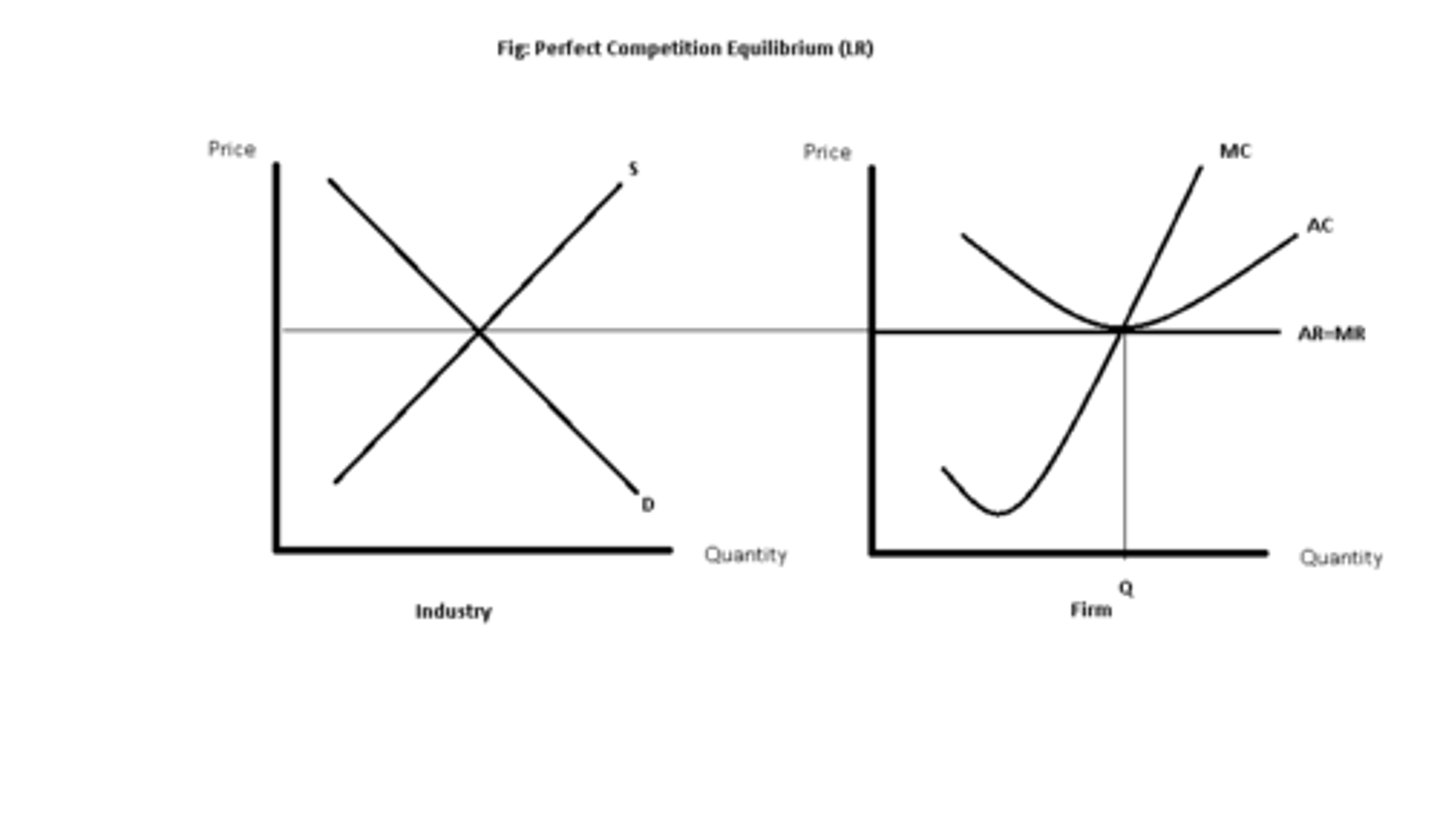

Perfect competition

- Many firms

- Firms are small relative to industry size (price takers)

- No product differentiation

- No barriers to entry

- Invisible hand has power

- Only short-run abnormal profits/losses

- Long-run normal profits

- No market failure

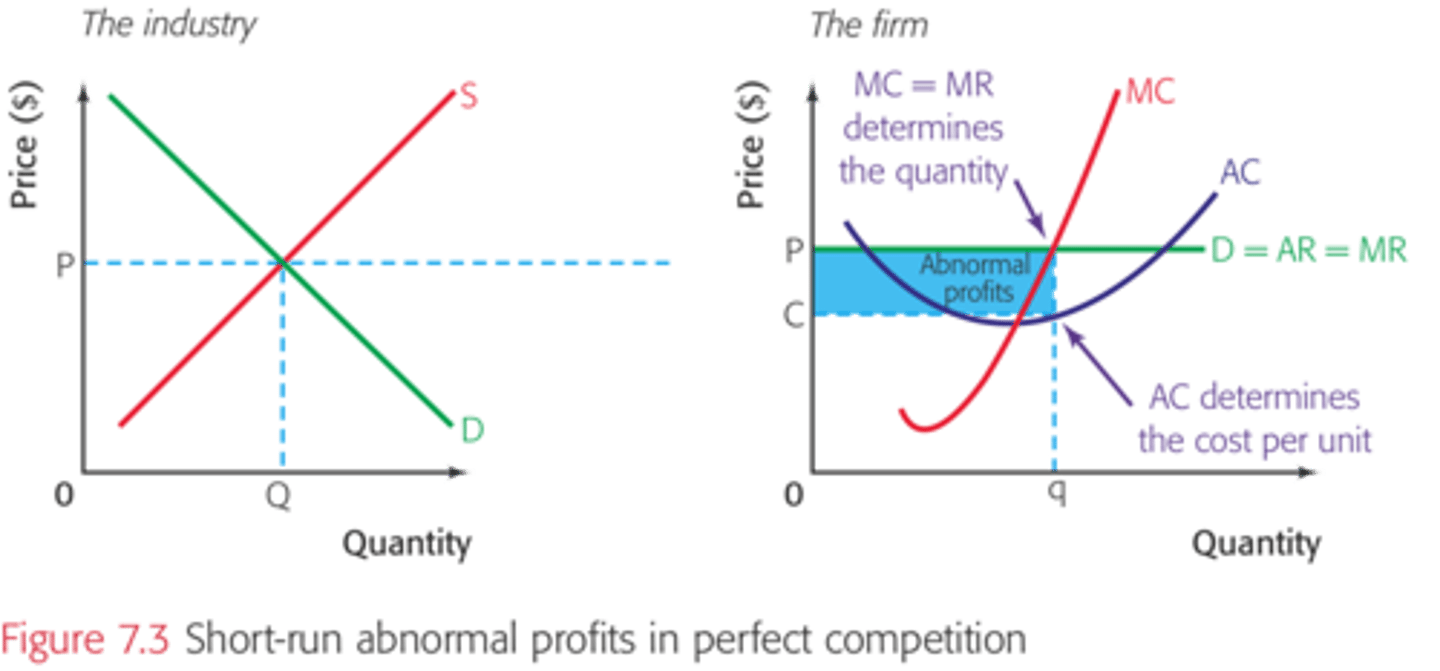

Perfect competition making abnormal profits

Short-run only

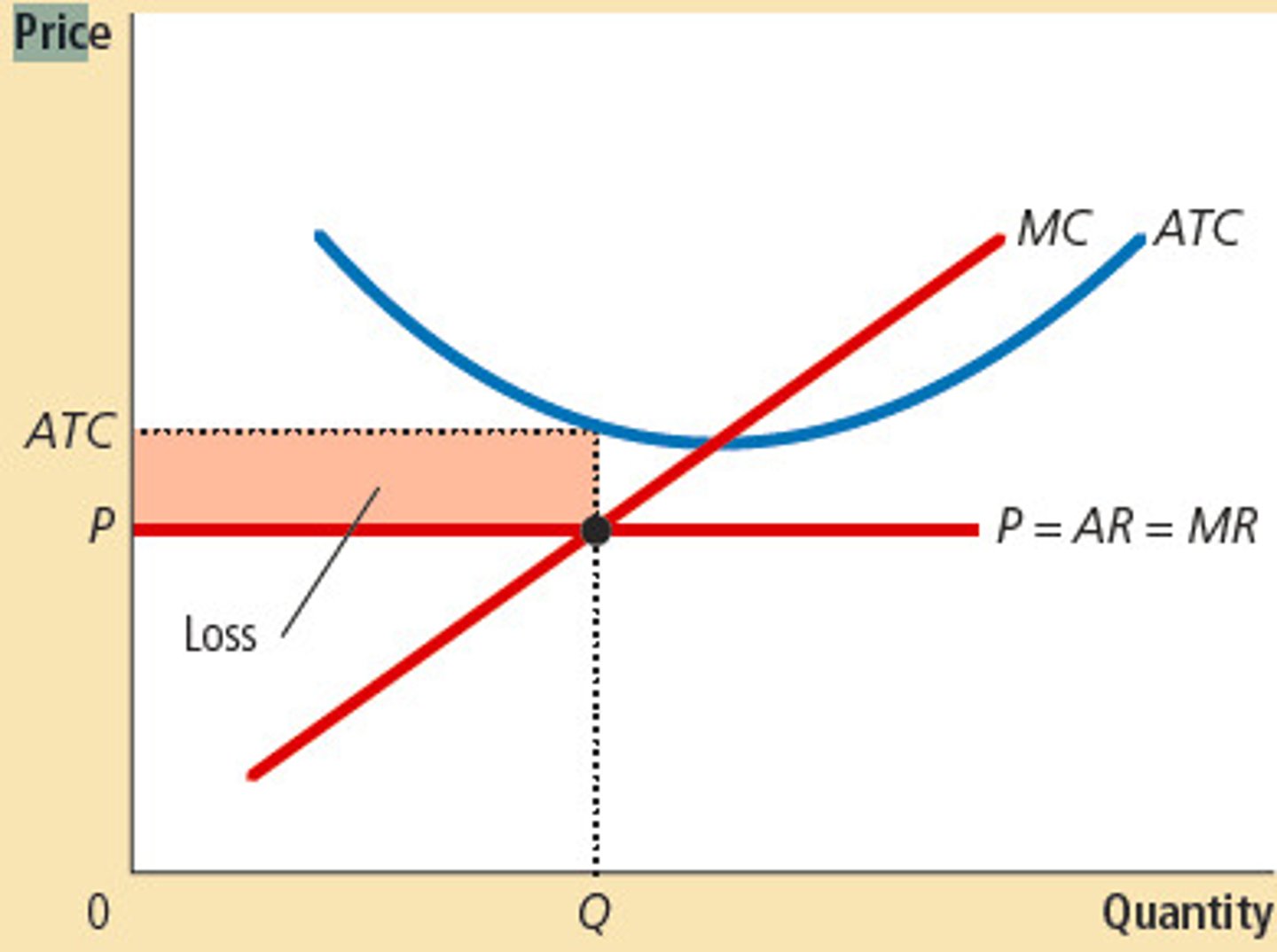

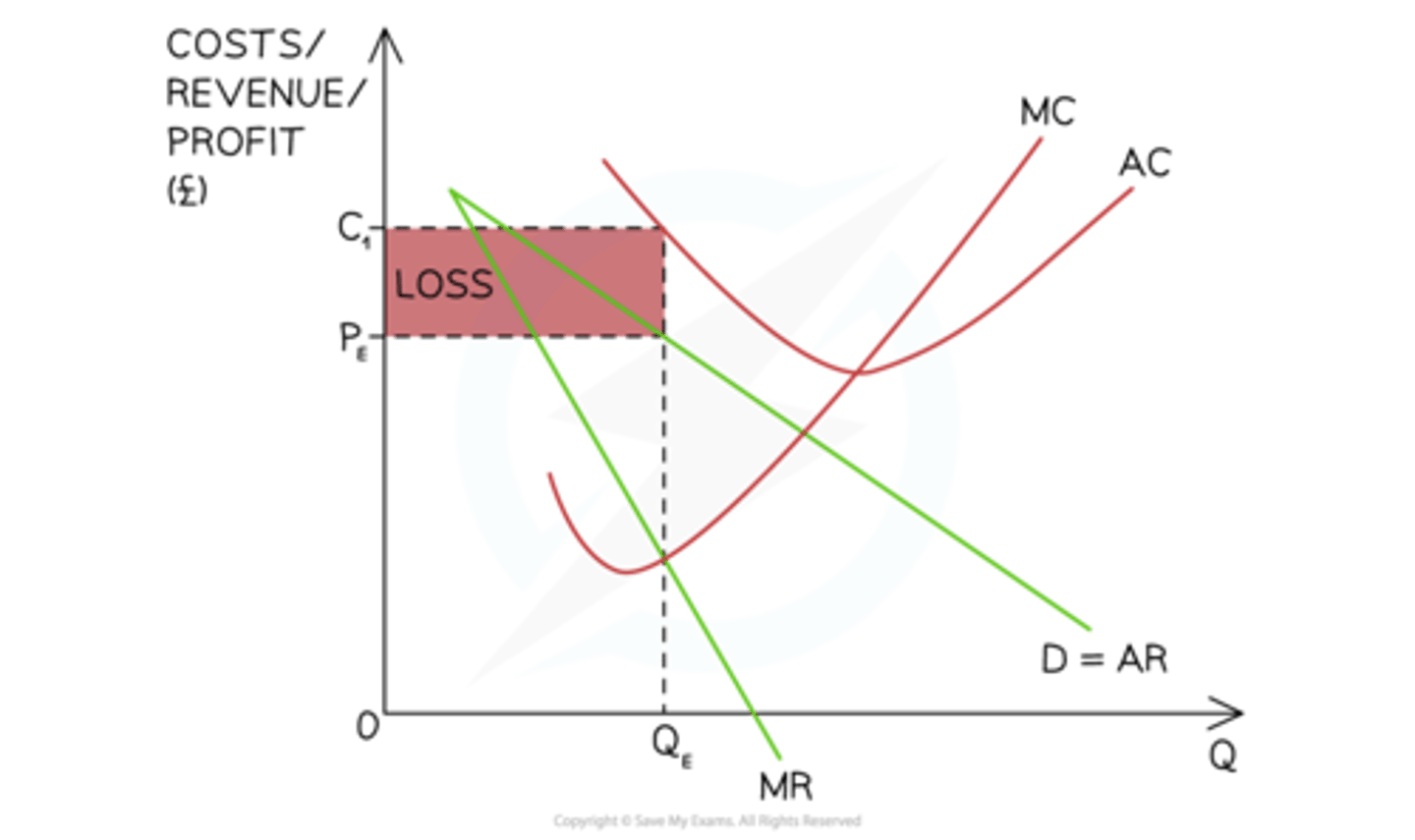

Perfect competition making losses

Short-run only

Perfect competition making normal profits

Long-run

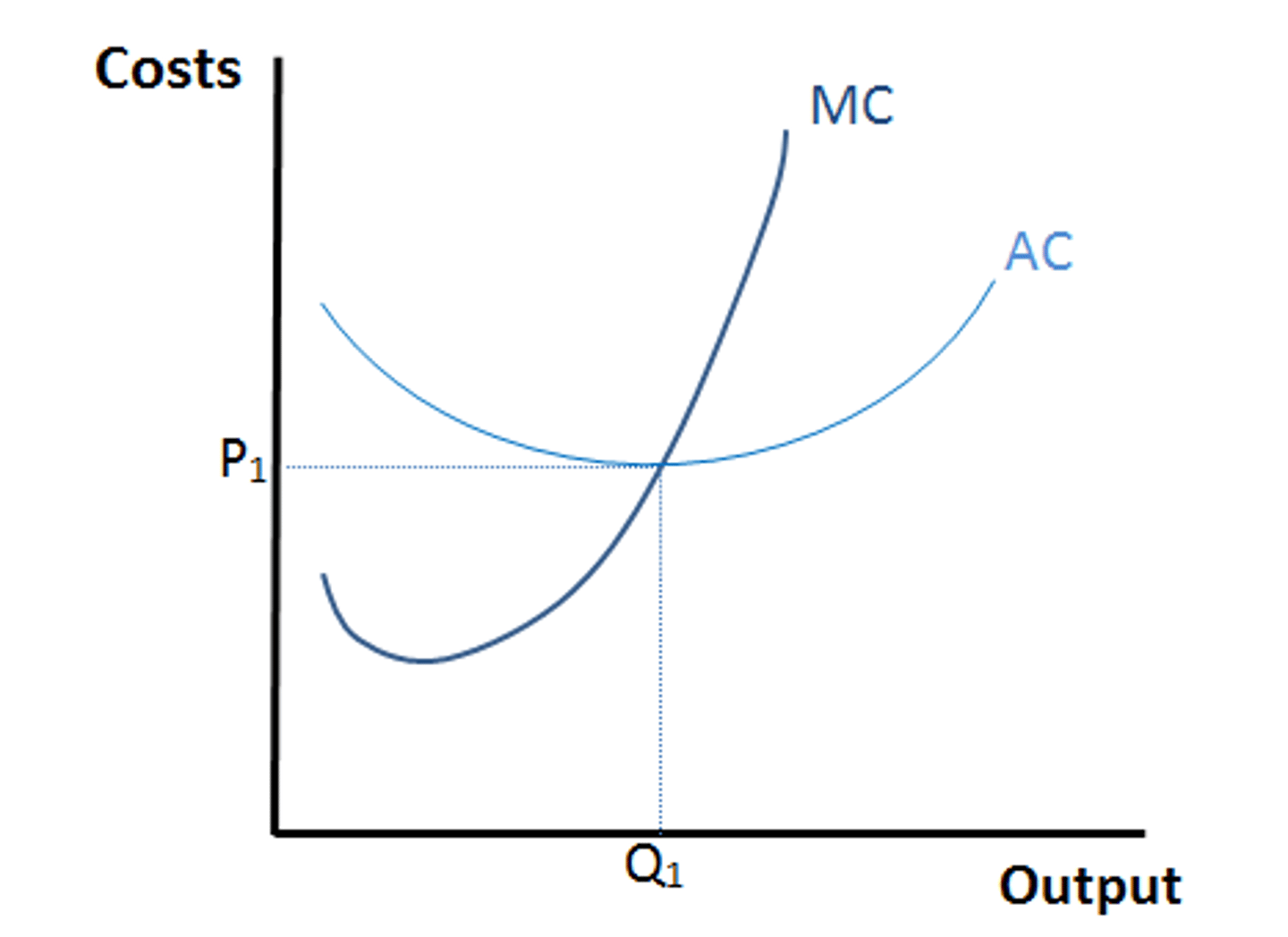

Productive efficiency in perfect competition

Firm produces at lowest possible unit average cost (MC=AC)

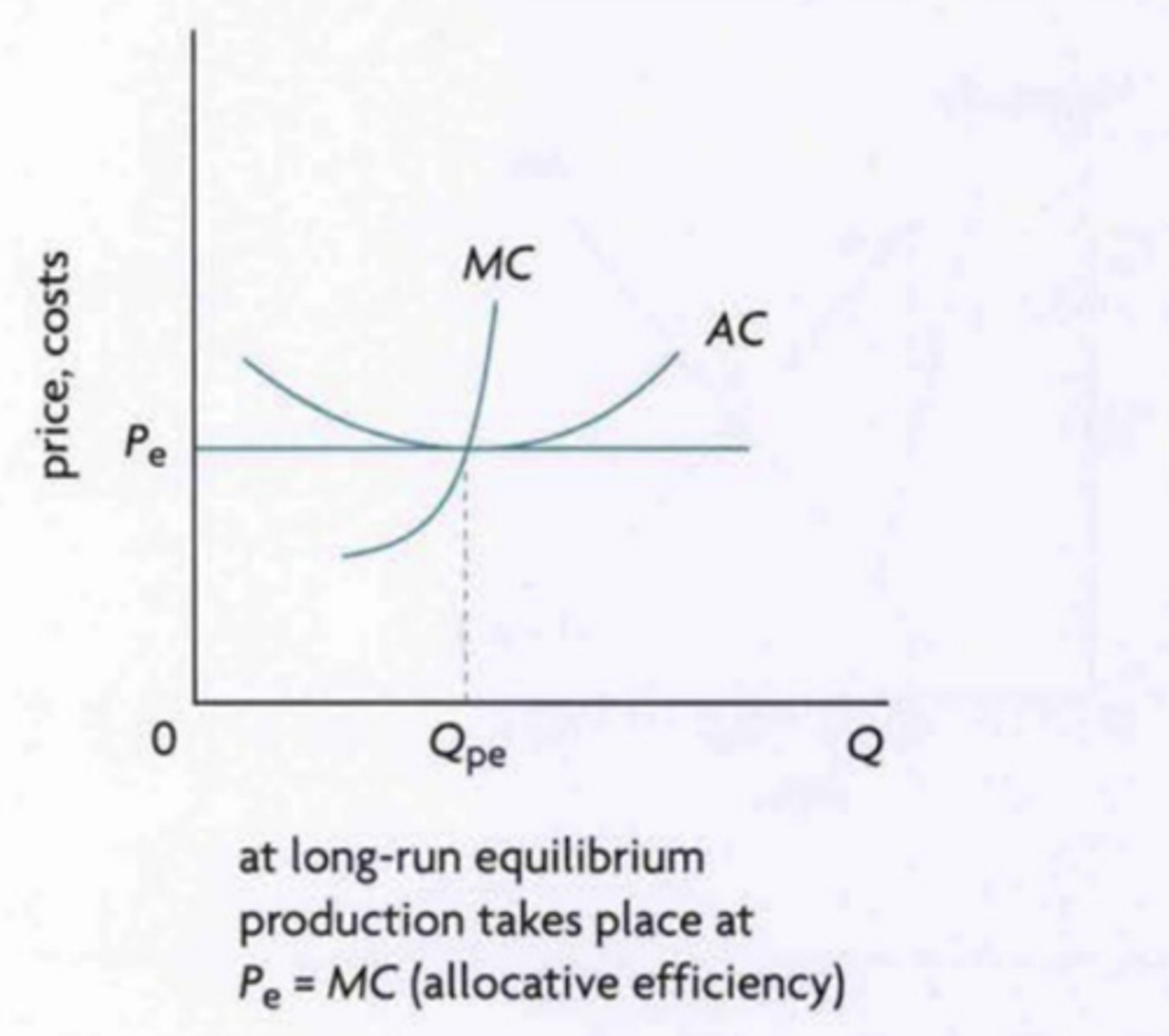

Allocative efficiency in perfect competition

Socially optimum level of output where suppliers produce optimal mix of goods/services required by consumers

Monopolistic competition

- Many firms

- Few firms have little market power

- Product differentiation

- No barriers to entry/exit

- Perfect information

- Only short-run abnormal profits/losses

- Long-run normal profits

- Market failure

Monopolistic competition making abnormal profits

Short-run only

Monopolistic competition making losses

Short-run only

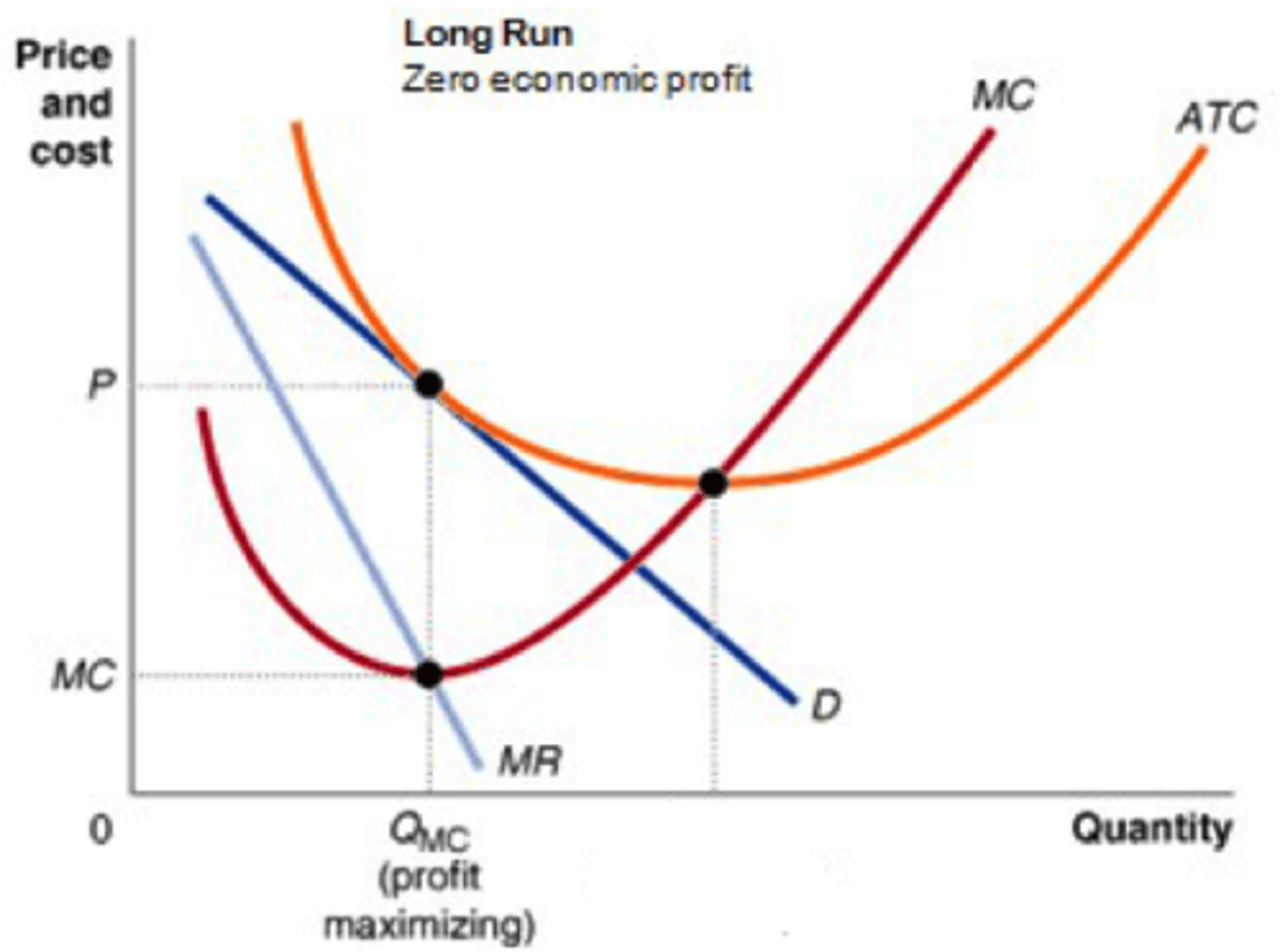

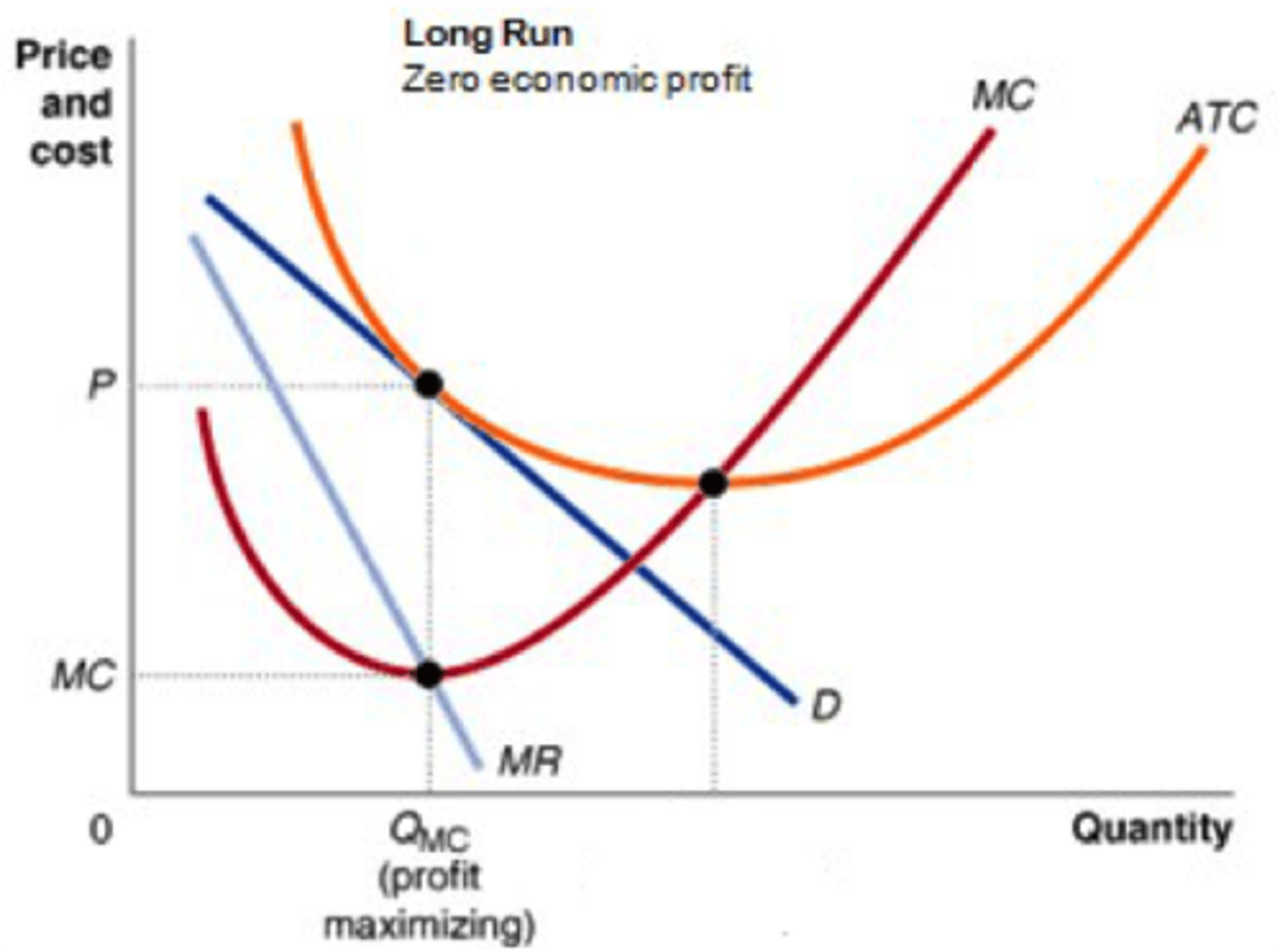

Monopolistic competition making normal profits

Long-run

Productive efficiency in monopolistic competition

MC=AC

Allocative efficiency in monopolistic competition

MC=AR

Monopolies

- One firm with power (firm=industry)

- Barriers to entry

- Abnormal/normal profits, losses (long/short-run)

Factors of how monopolies maintain position/market power efficiently

Economies of scale, natural monopolies, legal barriers, brand loyalty, anti-competitive behavior

Economies of scale

Factors that cause a firm's average cost per unit to fall as output rises (specialization, division of labour, bulk buying, financial economies, transport economies, large machines, promotional economies)

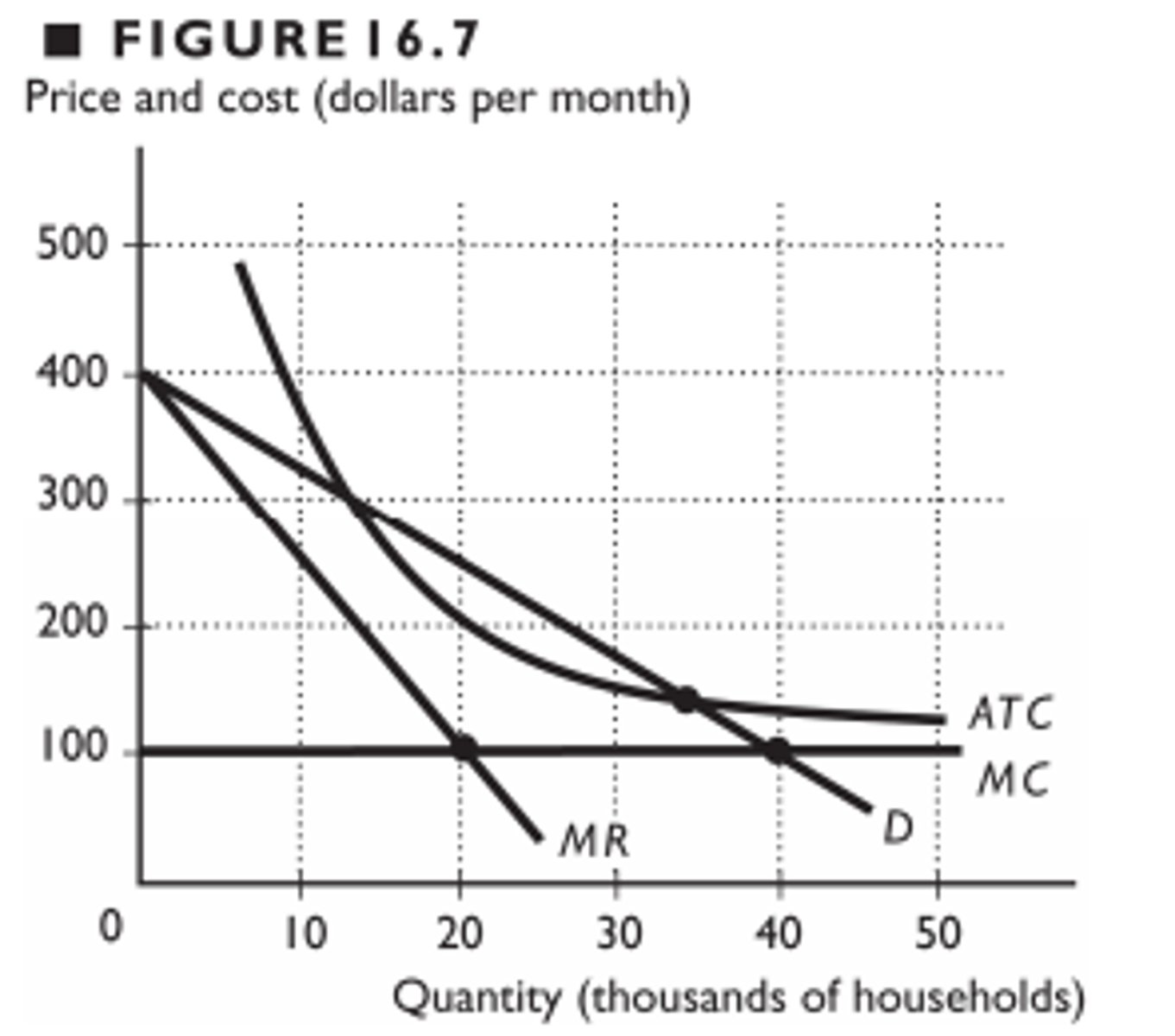

Natural monopoly

A market that runs most efficiently when one large firm supplies all of the output

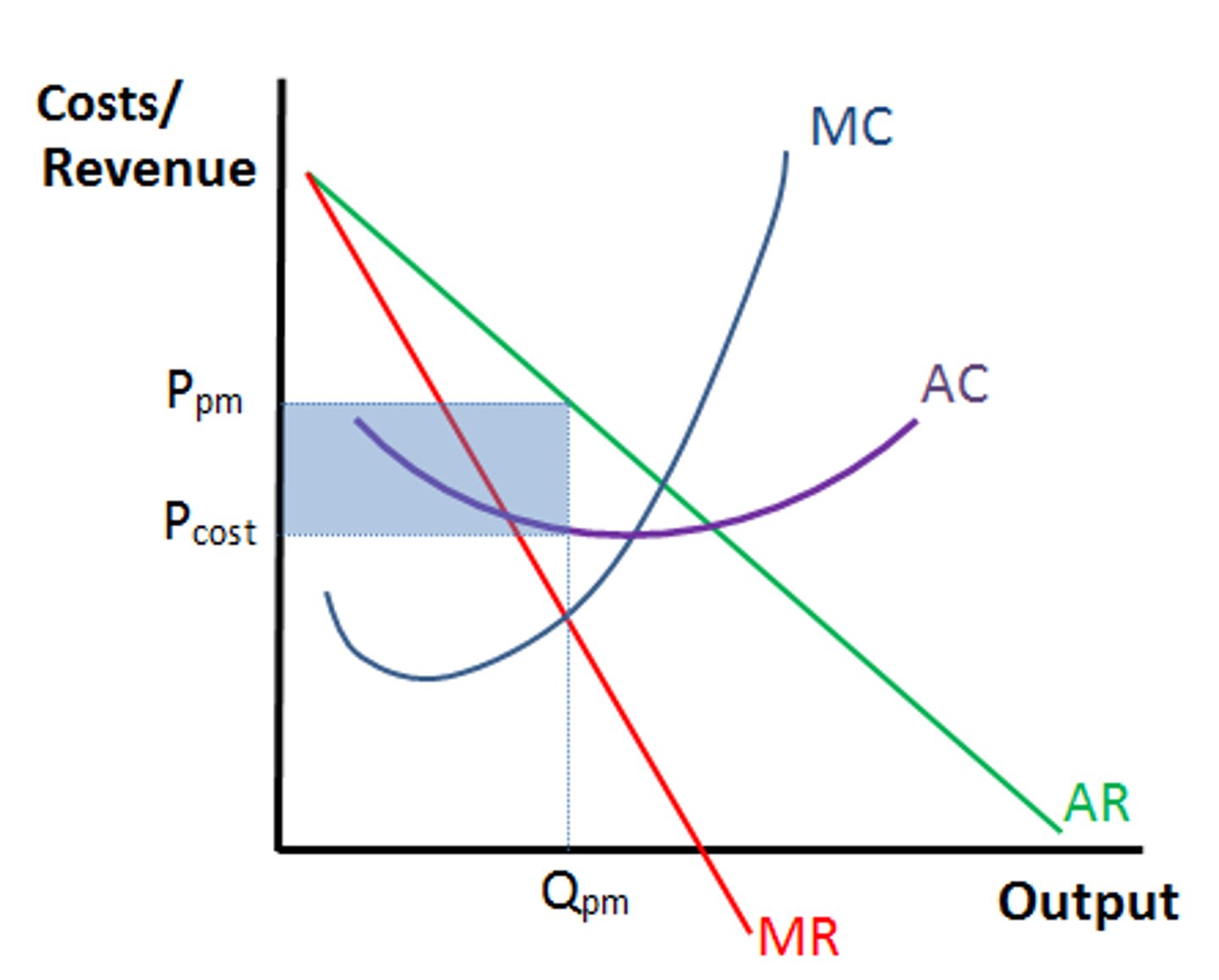

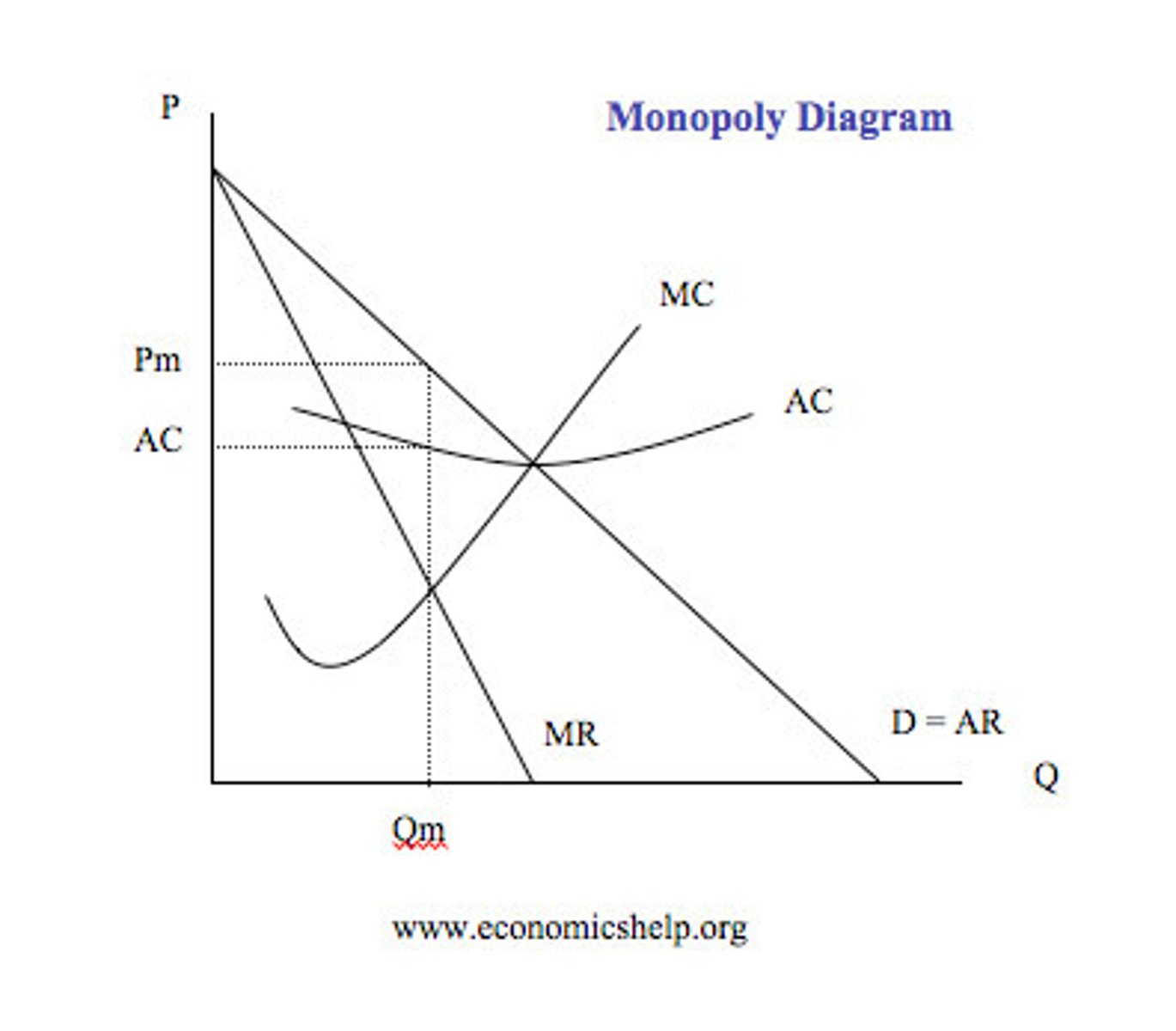

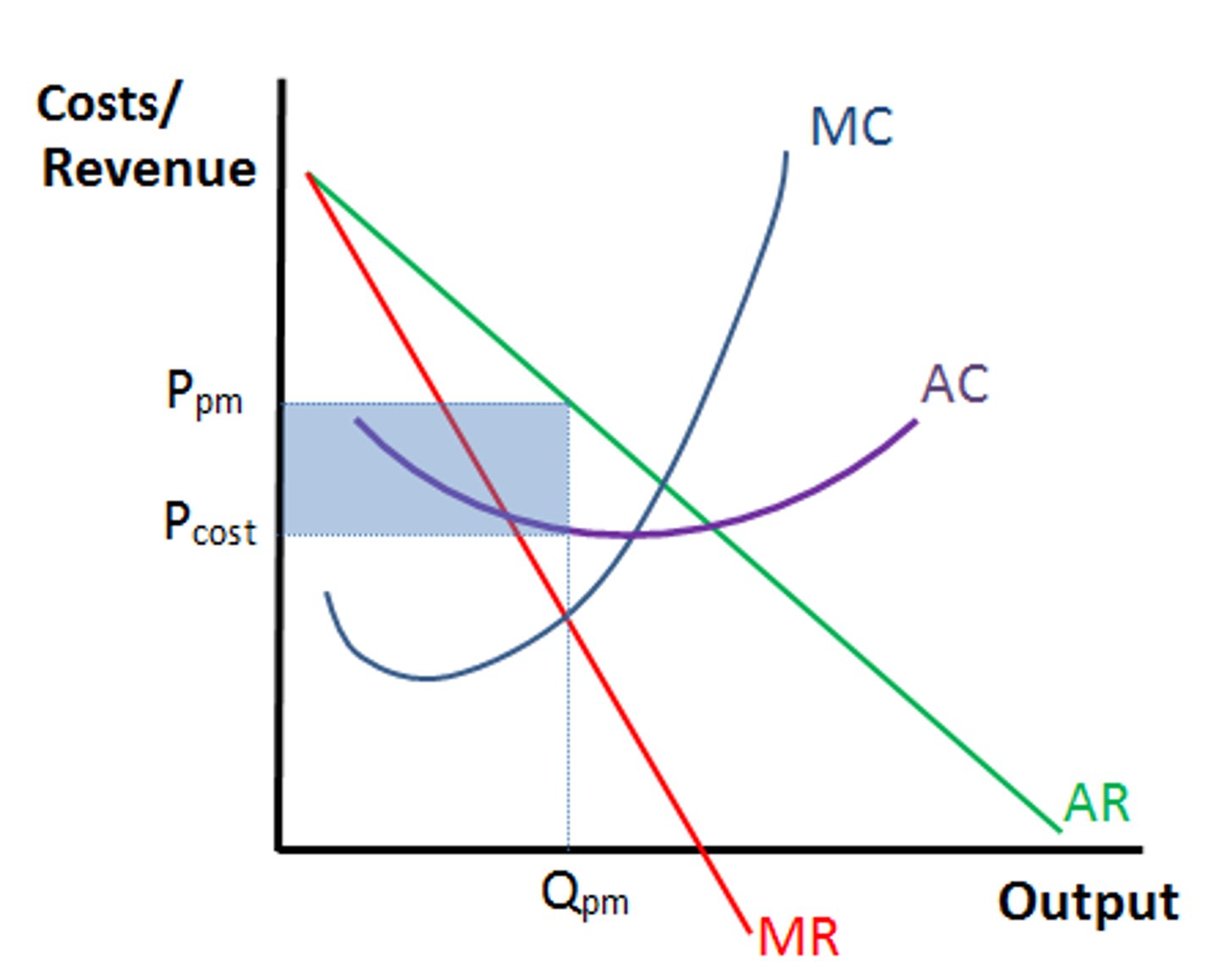

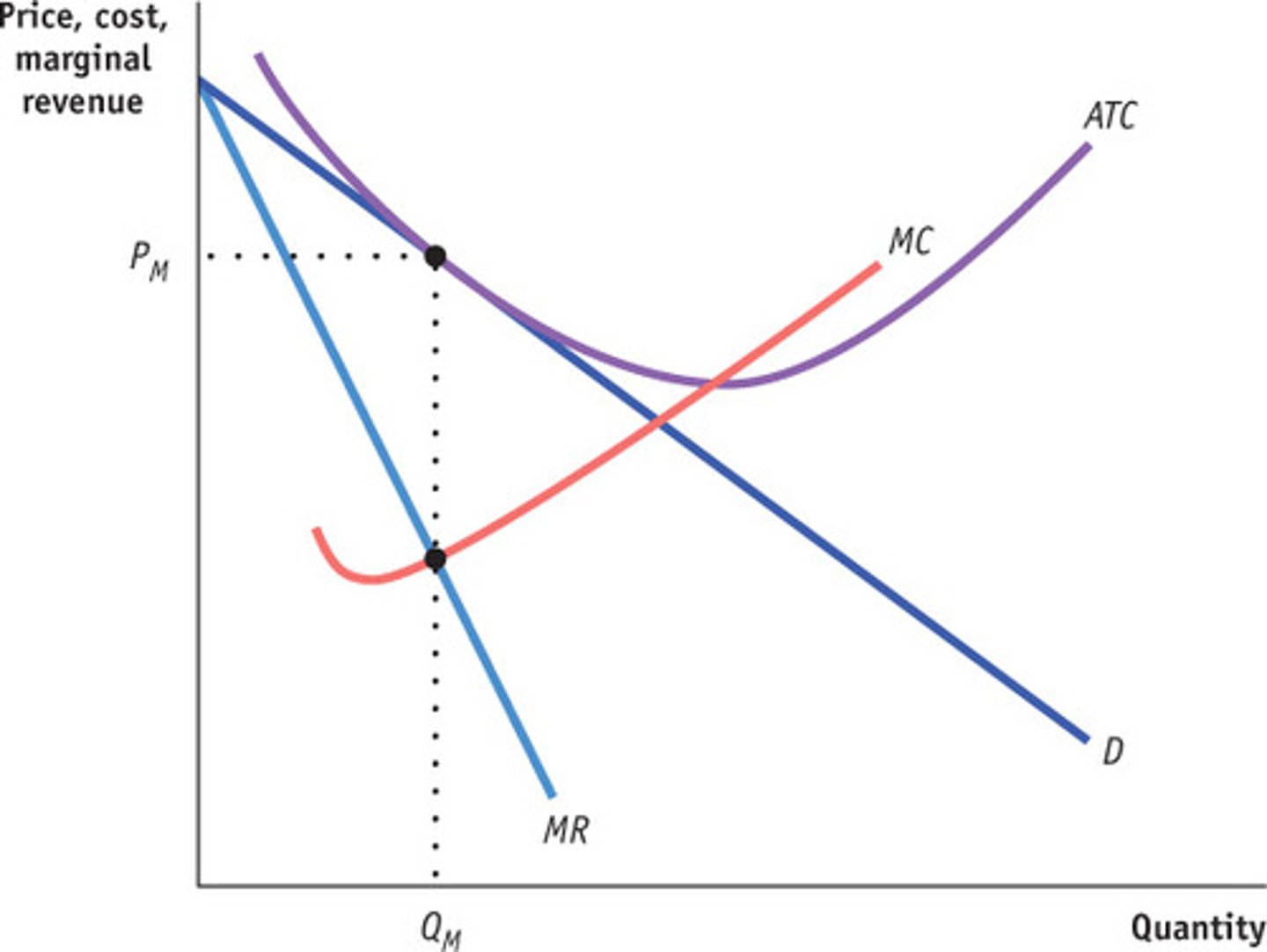

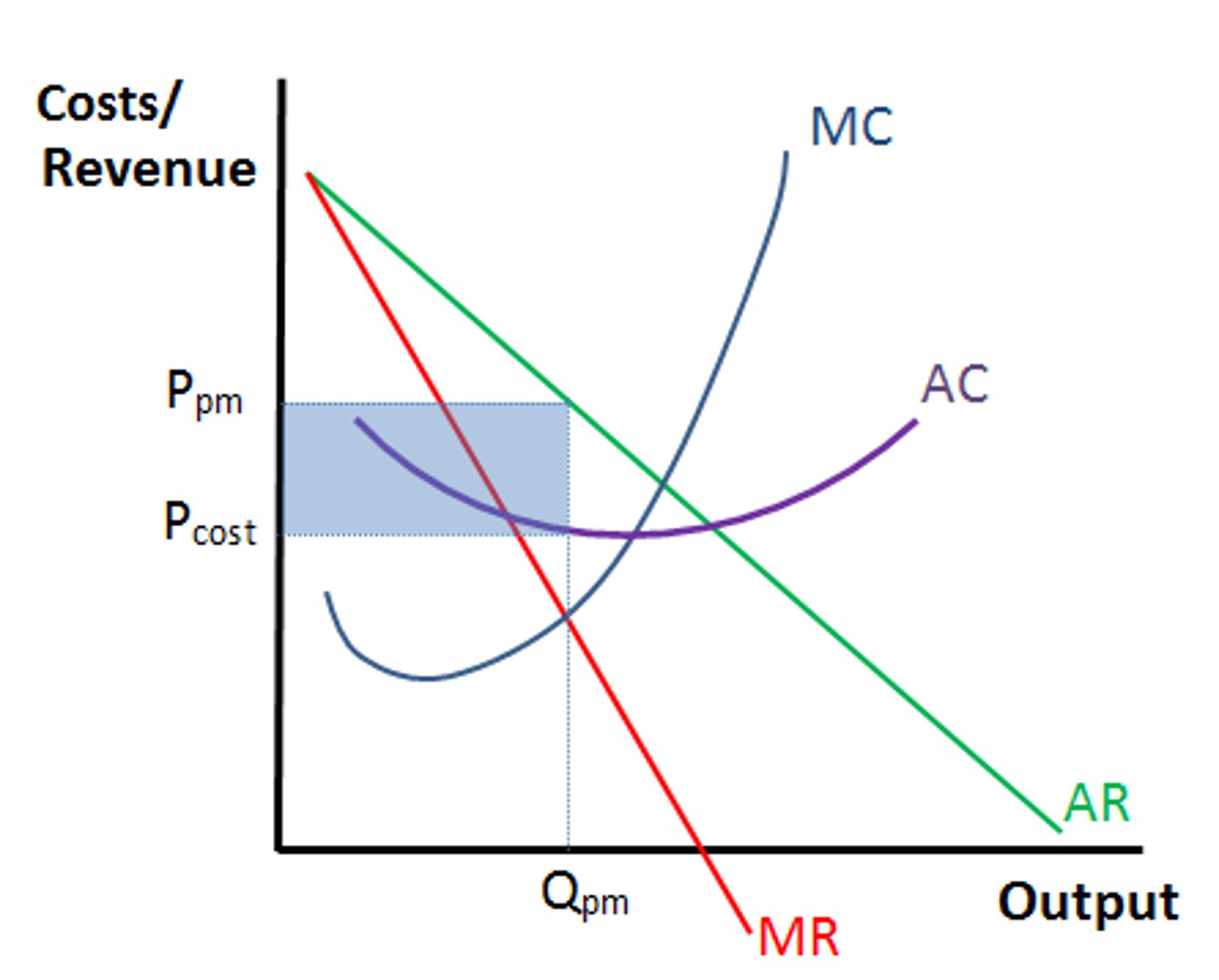

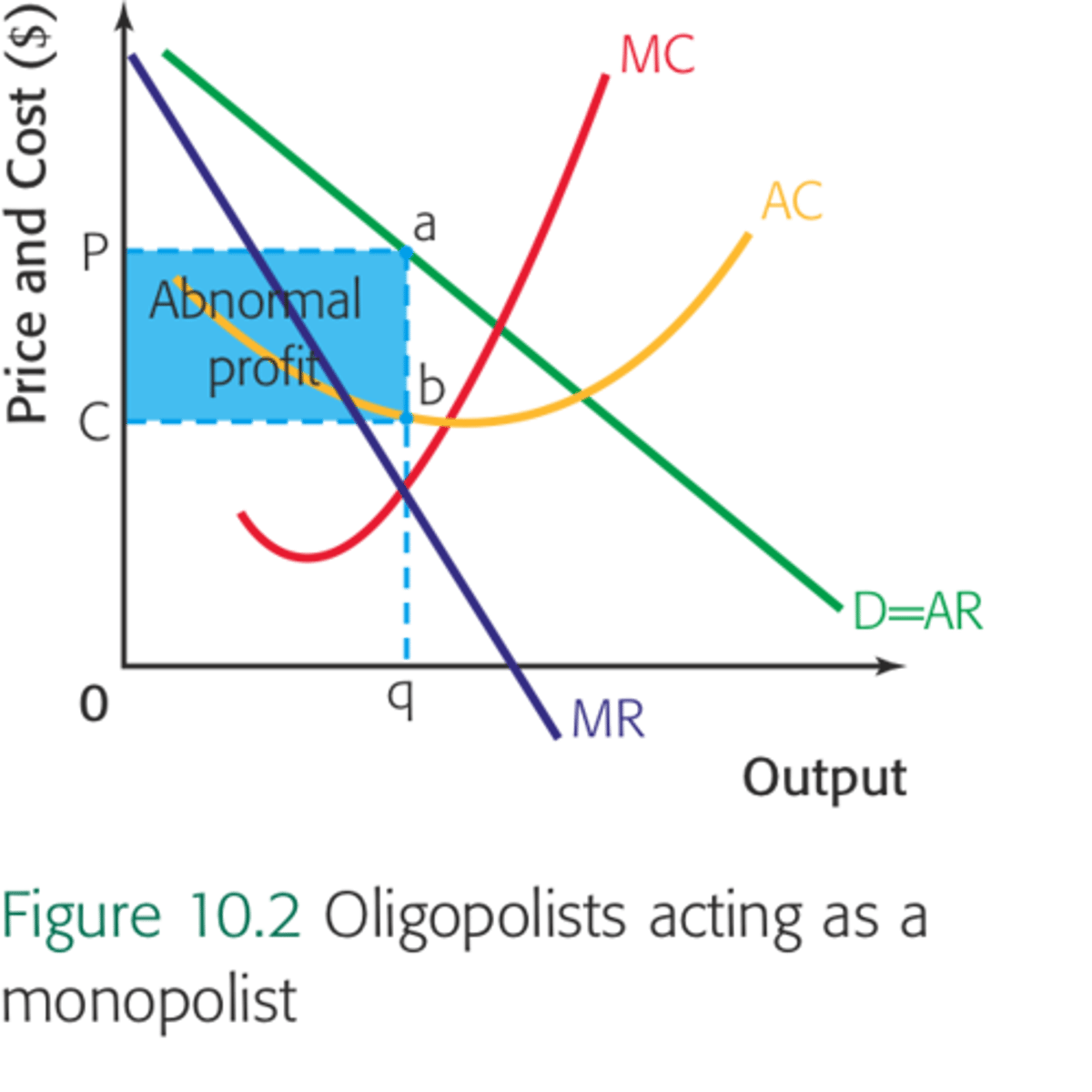

Monopolies making abnormal profits

AC below profit-maximizing quantity (MC=MR)

- MC crosses the lowest point at AC

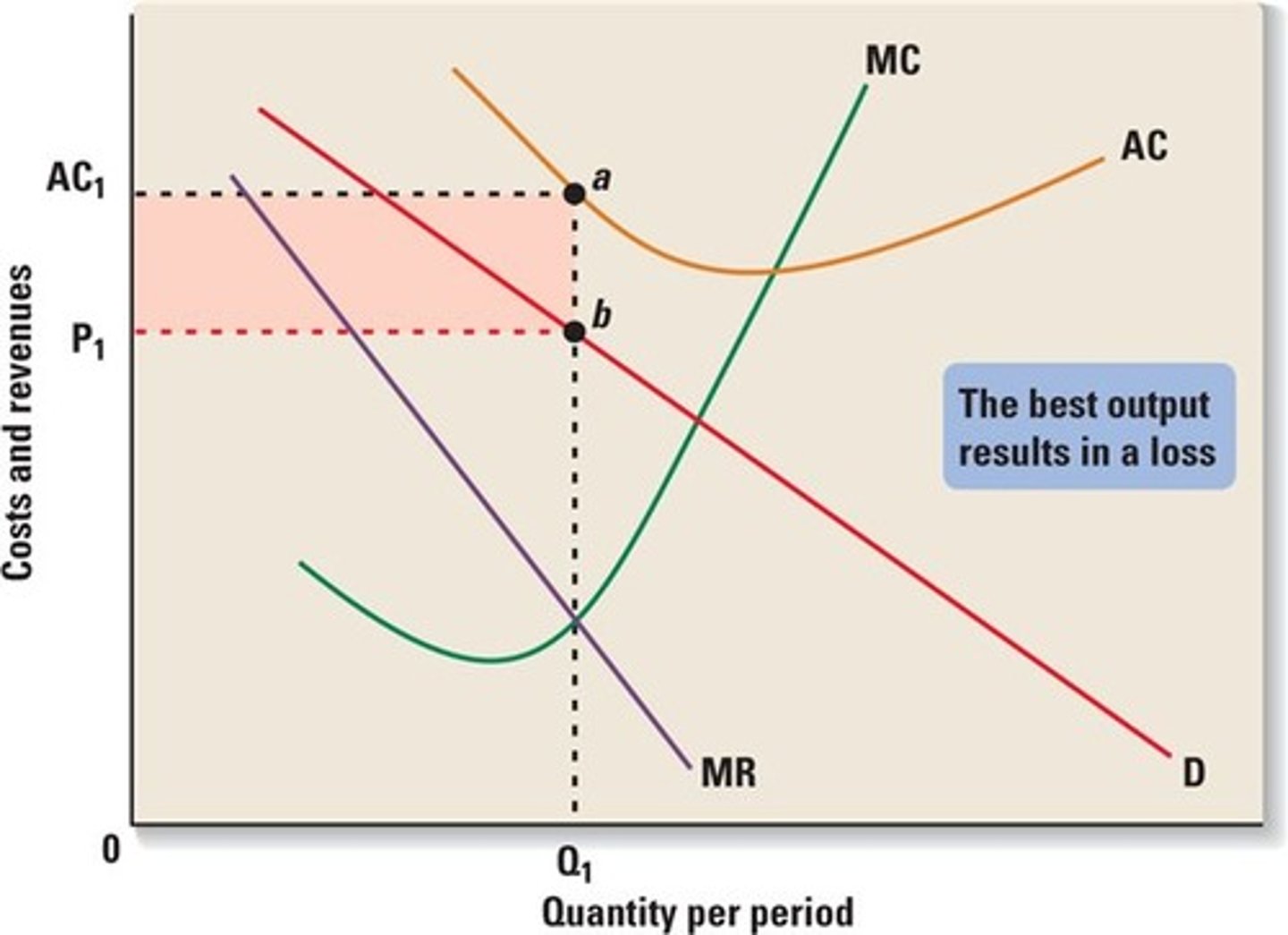

Monopolies making losses

AC above profit-maximizing quantity (MC=MR)

Monopolies making normal profits

Productive/allocative efficiency in monopolies

MC=D=AR=P

Advantages of monopolies

- Substantial economies of scale: More possible to change price (lower) than in perfect competition

- High levels of investment: Abnormal profits used for R&D, benefitting quality of products and consumers in long-run

Disadvantages of monopolies

- May restrict output

- Charge high price w/ less economies of scale (brings lower output)

- Unfair high profits for low-income firms

- Anti-competitive

- No productive/allocative efficiency

- Can act against public interest

Oligopolies

- Few firms dominate the industry

- Concentration ratio (CRx) --> higher percentage = more concentrated market power of the firms

- Barriers to entry

- Product differentiation

Collusive oligopolies

When firms in market collude to charge the same prices for their products in effect of monopolies (dividing profits), offering price ridgity--> ex. cartel

Non-collusive oligopolies

When firms don't collude so they are aware of firms' actions and reactions when deciding on pricing (game theory applied)

Competition in oligopolies

- Non-price competition (brand names, packagings, special features, adverts, etc.)

- Used to make demand less-elastic

Reasons why governments intervene

- Output/price/distorted resource allocation

- Less consumer choice

- Productive inefficiency

- Allocative inefficiency

- Abnormal profits exploiting firms/consumers

How governments intervene

- Regulation (taxes, incentives, etc.)

- Legislation (laws/rules to follow)

Economic costs

Explicit costs + implicit costs

Explicit costs

Direct, out-of-pocket monetary payments made for business expenses (salary, rent, etc.)

Implicit costs

Indirect, non-purchased, or opportunity costs of resources provided by the entrepreneur (Potential investment, time, etc.)

Fixed costs

Costs that remain constant as output changes

Variable costs

Costs that vary with the quantity of output produced

Total costs

Fixed costs + variable costs

Marginal costs

Cost of producing one more unit of a good

Average costs

Total costs / output

Law of diminishing marginal returns

As more of a variable resource is added to a given amount of a fixed resource, marginal product eventually declines and could become negative

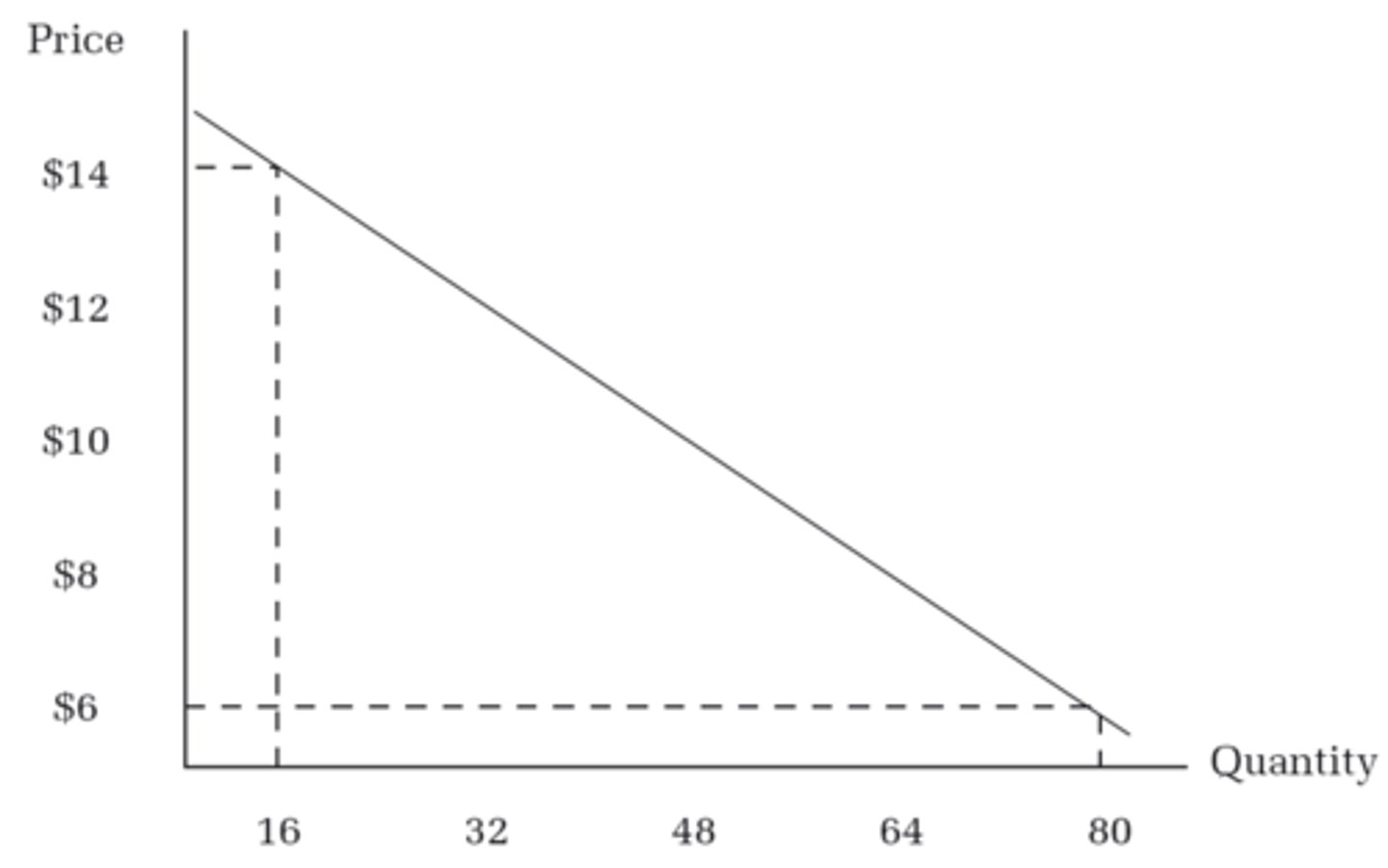

TR (Total Revenue)

P x Q (price times quantity)

AR ( Average revenue)

TR / q --> (pxq) /q (total revenue over quantity)

MR (Marginal Revenue)

∆TR / ∆Q (change in total revenue over change in quantity)

TC (Total Cost)

Total fixed costs + Total variable costs

or

Average Cost * Quantity

AFC (Average Fixed Cost)

TFC/Q (total fixed cost/quantity)

AVC (Average Variable Cost)

TVC / Q (total variable cost/quantity)

ATC or AC (Average Total Cost)

TC / q (total cost over quantity)

MC (Marginal Cost)

change in TC / change in q (change in total cost over change in quantity)

TFC (Total Fixed Costs)

Total Costs - Total Variable Costs

TVC (Total Variable Costs)

Total Costs - Total Fixed Costs

Profit

TR - TC (total revenue - total costs)

Demand

Quantity of goods/services that consumers are willing/able to purchase at different prices in a given time period

Non-price determinants of demand

- Income (normal/inferior goods)

- Price of related goods (substitutes/complements/unrelated goods)

- Tastes and preferences

- Future price expectations

- Number of consumers

Income effect

When the price of a product falls, people have an increase in their "real income" (reflects amount that their income will buy), so people will be likely to buy more of the product (increasing demand)

Substitution effect

When the price of a product falls, people will still gain the same amount of satisfaction (utility) from the product before, but are paying less for it (ratio of satisfaction to price improved)

Perfect information

Assumption that consumers make decisions acting on their own interests, and have access to all relevant information

Bounded rationality

Notion that the rationality of consumers is limited by the information that they have, knowing they don't have the time or abilities to weigh all options

Bounded selfishness

Humans not always acting in their own self-interest as assumed by Neoclassical

Bounded self-control

Illustrating the natural tendency to give in to temptation

Availability bias

Recent information tending to over-influence people's decision-making

Anchoring bias

Fixating on information as a reference point to influence future choices/decisions

Framing bias

Tendency of presentation of information influencing choices

Social conformity/herd behavior

Consumers naturally wanting to fit in, where decisions made by others exert a powerful influence on choices

Status quo/inertia bias

Consumers when faced with many choices would rather prefer to maintain status quo by doing nothing

Loss aversion bias

Humans feeling more losses than gains

Hyperbolic discounting

Tendency of humans to prefer smaller/short-term rewards over larger/later rewards

Choice architecture

Theory that decisions made are heavily influenced by how choices are presented to us

Nudge theory

Choice architecture being carefully designed to gently encourage (nudge) people to voluntarily choose the option that is "better" for them, where consumers maintain their sovereignty

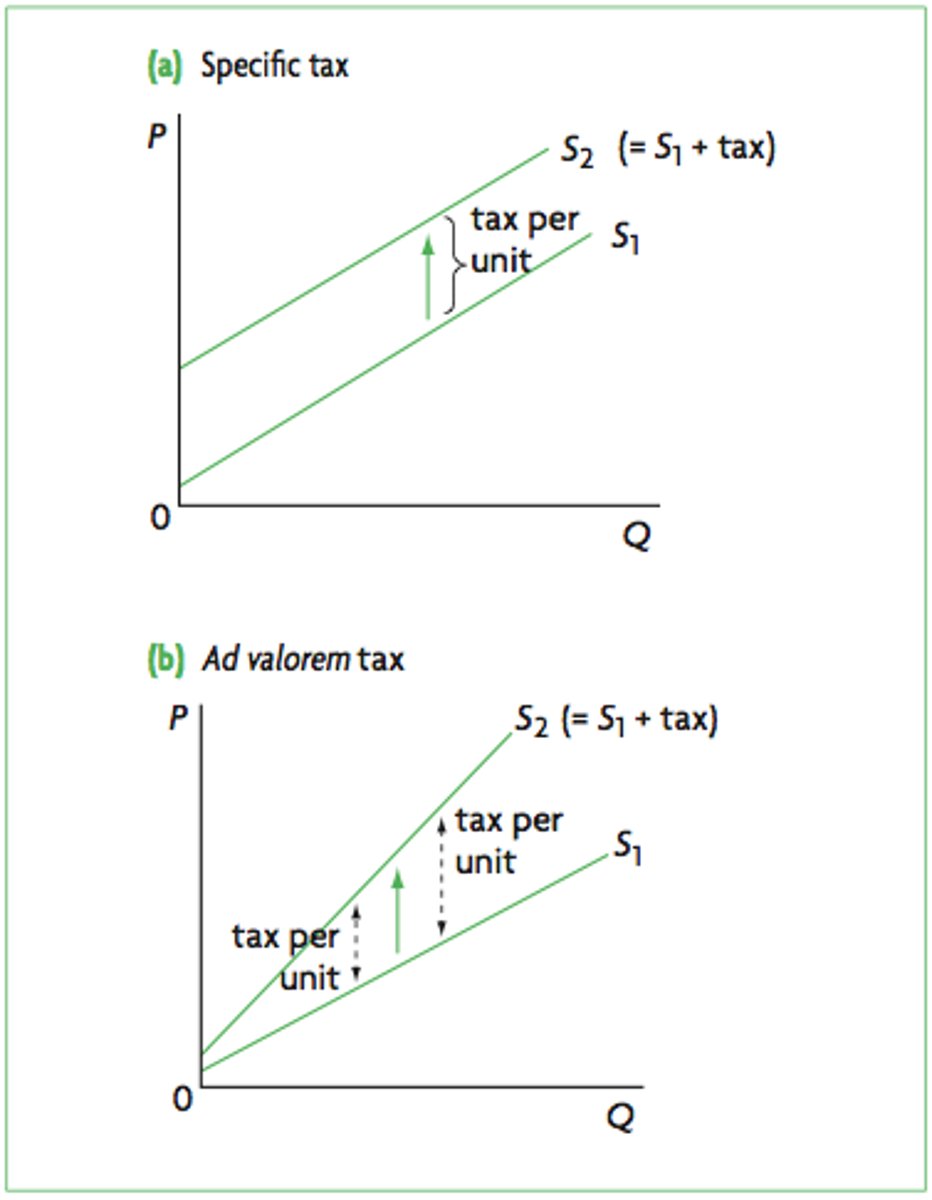

Indirect tax

Tax imposed upon expenditure, raising the firms costs/shifting supply curve upwards (ex. VAT, goods and services tax, sales tax, etc.), where burdens depend on the elasticity of supply/demand

PED = PES, indirect tax burden is..

Shared equally between consumers/producers of the product

PED > PES, indirect tax burden is..

Greater on the producers than consumers of the product

PES > PED, indirect tax burden is..

Greater on the consumers than producers of the product

Subsidy

Amount of money paid by the government to a firm per unit of output

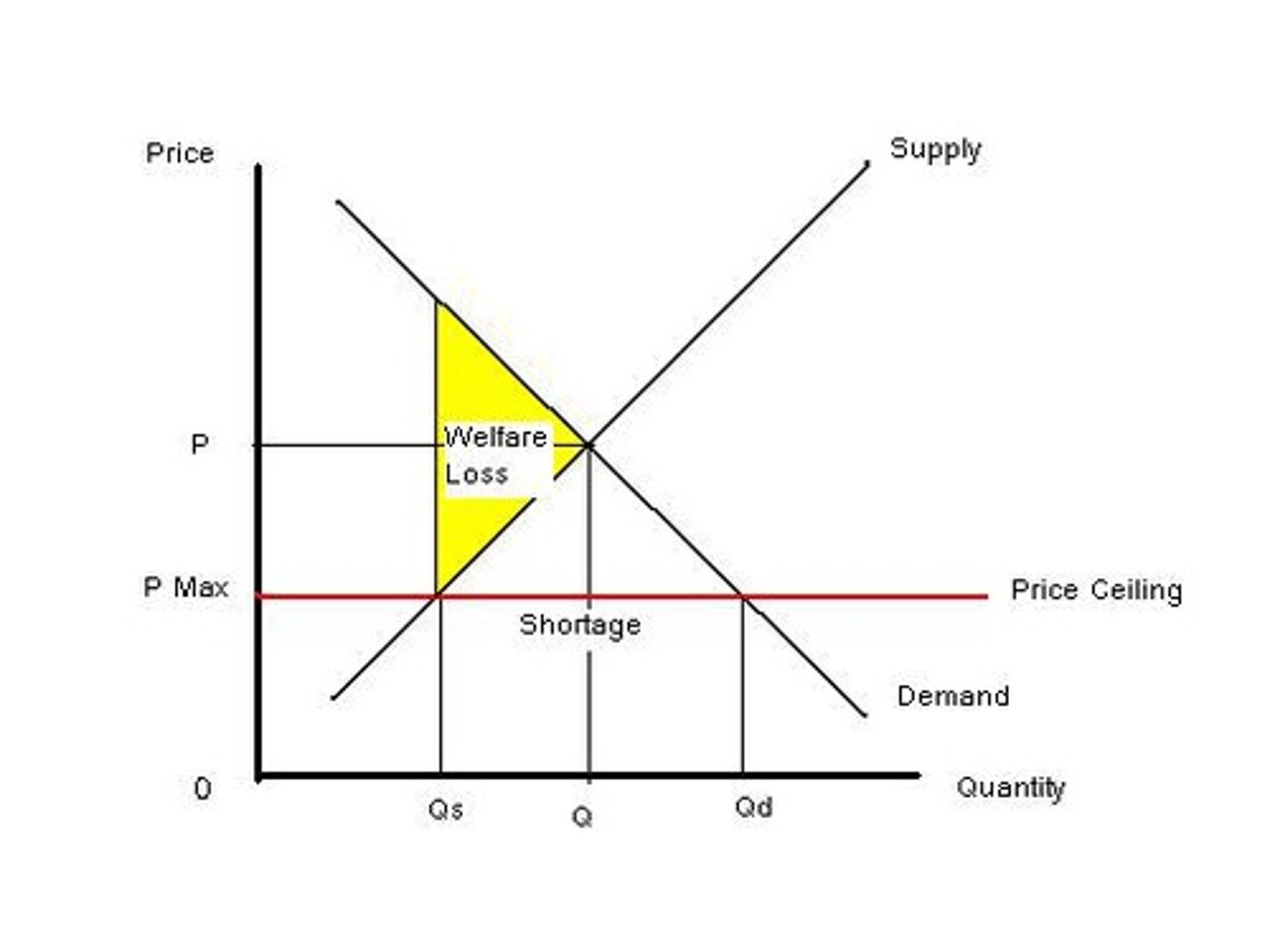

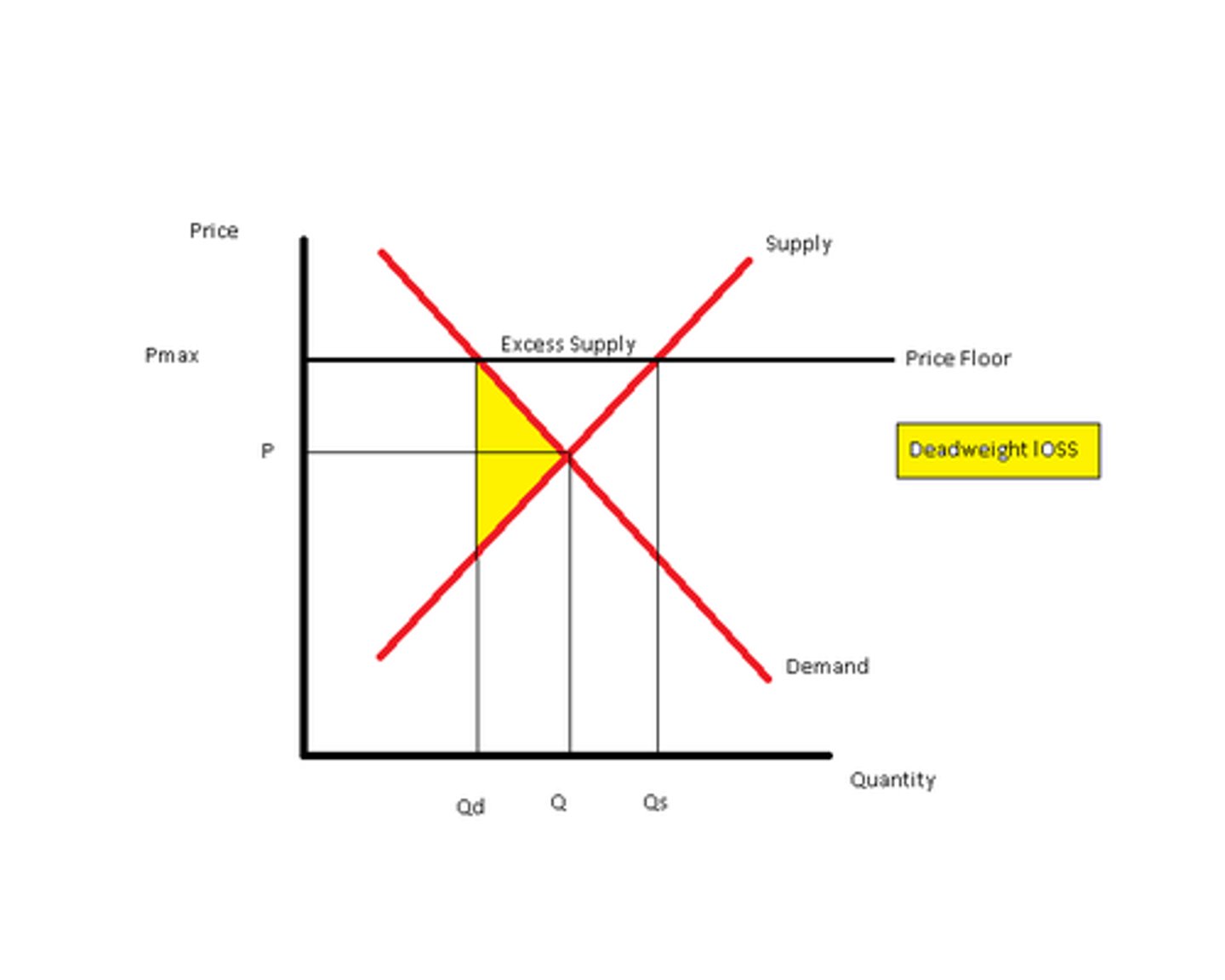

Price ceilings

Situation where the government sets a maximum price below the equilibrium price, preventing producers from raising the price above it (usually on a necessity/merit good) + excess demand

Price floors

Situation where the government sets a minimum price above the equilibrium price, preventing producers from reducing the price below it (usually for minimum wage, prevent fluctuations) + excess supply

Fiscal policy

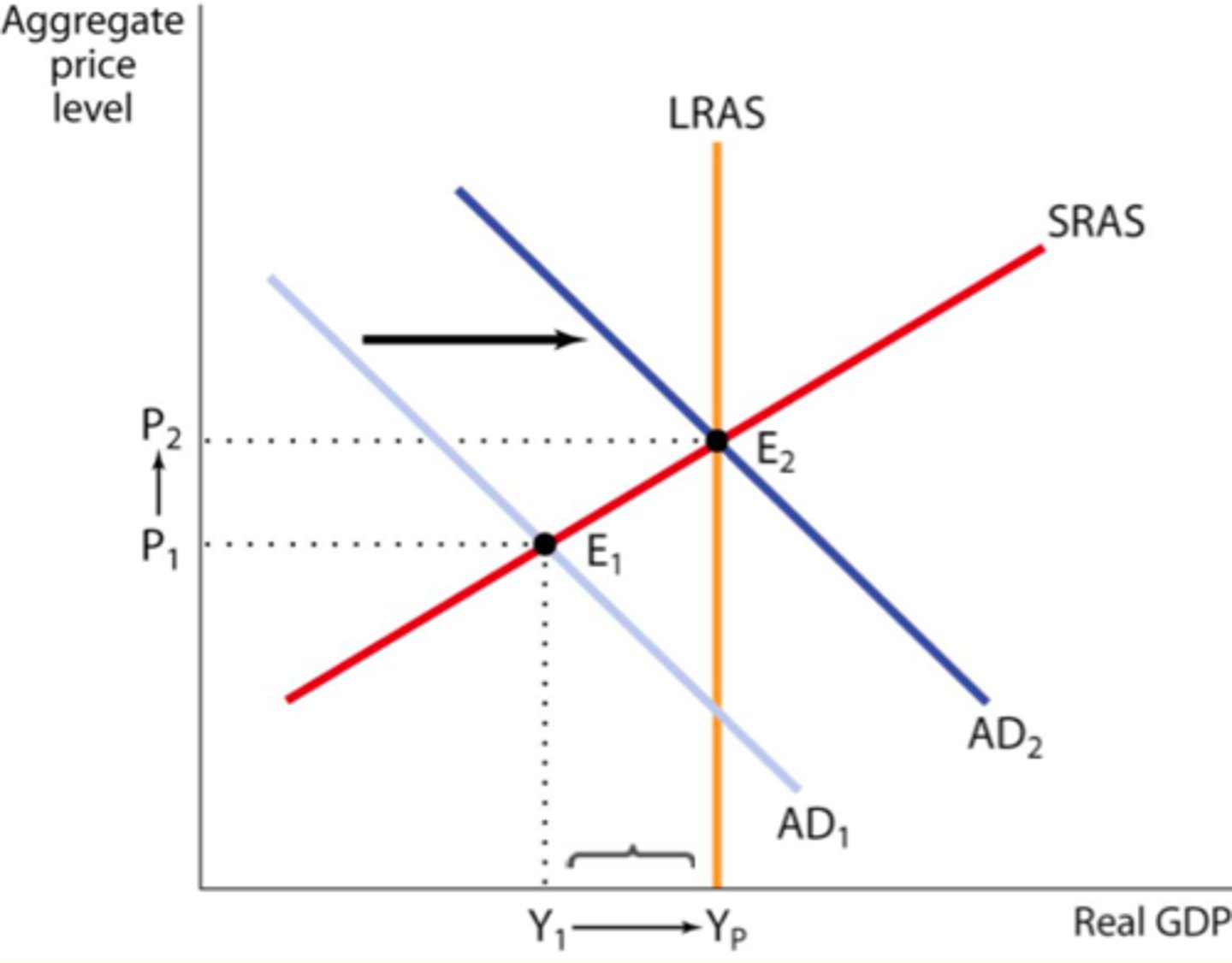

Set of a government's policies relating to expenditure and taxation rates, using expansionary to increase AD, and contractionary/deflationary to decrease AD

Aims of fiscal policy

- Maintain a low/stable rate of inflation

- Low unemployment rate

- Stable economic environment for long-term growth

- Reduce fluctuations of business cycle

- Achieve external balance between export/import revenue/expenditure

Expansionary fiscal policy

Form of Keynesian demand management where the government wants to encourage consumption, investment, and spending (increasing AD)

Pros of fiscal policies

- Effective in long run with dealing with a deep recession

- Used to target specific sectors of the economy

Cons of fiscal policies

- Time lags

- Political pressure

- Sustainable debt

- Effect on net exports

- Crowding-out effect

- Inability to achieve specific targets

Costs of high government (national) debt

- Crowding out of private investments (firms have no access to investment + decrease in investment)

- Benefit/service expenditure cut (as interest increases)

- Fall in output/income (deflationary)

- Decrease ability of government to respond to emergencies

Multiplier effect

Increase in aggregate demand resulting in proportionately larger increase in national income (injections into circular flow that are multiplied through the economy as people receive shares of the income and spend part of what they receive)

Multiplier formula

1/(1-mpc) OR 1/(mps+mpm+mrt)

Monetary policy

Set of official policies governing the supply of money and level of interest rates in an economy

Aims of monetary policy

- Maintaining low/stable rate of inflation

- Low unemployment rate

- Stable economic environment for long-term growth

- Reduce fluctuations in business cycle

- Achieve balance between export revenue/import expenditure

Expansionary monetary policy

Increasing money supply by increasing consumption and investment (loose monetary policy)

Pros of monetary policy

- Relatively quick to place

- No political intervention

- No crowding-out

- Make smaller changes

Cons of monetary policy

- Time lags

- Ineffective when interest rates are low

- Low consumer/business confidence

Credit creation

When commercial banks lend money to customers/individuals/businesses by making loans based on deposits that customers have made with them

Minimum reserve requirement

Percentage of deposits that commercial banks are legally required to hold in reserve by the central bank to meet cash requirements of depositors

Money multiplier formula

1/(minimum reserve requirement)

Tools to control money supply by government

- Minimum reserve requirements (larger min=smaller multiplier effect)

- Open market operations (buying and selling of gov securities in open market by central bank) (ex. reducing money supply by selling gov securities to insitutions, reducing money banks can lend, falling in supply and increasing cost of borrowing/interest rates)

- Changes in central bank minimum lending rate (ex. raising the rate reduces AD)

- Quantitiative easing (introducing new money into supply by central bank, so expansionary)

-

Nominal rate of interest

Rate of interest available in market, not allowing for inflation

Real rate of interest

Rate of interest adjusted for inflation

Total revenue formula

Price x Quantity

Tax revenue formula

Tax per unit×Quantity traded

Consumer expenditure formula

Price paid by consumers×Quantity traded

Producer revenue formula

Price received by producers×Quantity traded

Total subsidy cost formula

Subsidy per unit×Quantity traded

Producer revenue (with subsidy) formula

(Market price+Subsidy)×Quantity traded

Consumer expenditure (with subsidy) formula

Market price×Quantity traded