AP Macroeconomics Unit 3: National Income and Price Determination

1/32

Earn XP

Description and Tags

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

33 Terms

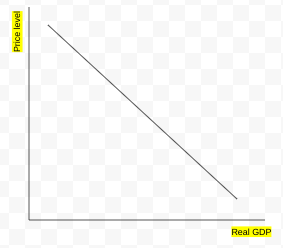

Aggregate Demand

All goods in an economy buyers can buy at different price levels. There is an inverse relationship due to inflation and deflation.

AD = C + I + G + Xn

Why AD is downwards sloping

The Wealth Effect: A high price level reduces the amount of goods people can will buy and vice versa.

Interest Rate Effect: When price level increases, banks charge high interest rates to make a profit. This deters people from getting a loan, decreasing AD.

Foreign Trade Effect: When price levels in the U.S. increase, foreign buyers shift their spending somewhere else, and domestic buyers buy foreign goods. This decreases net exports.

Shifters of Aggregate Demand

Consumer spending (income, expectations, taxes)

Investment spending (real interest rates, expectations, technology, business taxes)

Government spending

Net exports (exports-imports, exchange rates)

The Multiplier Effect

A “chain reaction” where spending is magnified in an economy.

What can you do with your money?

Spend it and save less

Save it and spend less

Marginal Propensity to Consume

How much people consume rather than save when disposable income changes.

MPC=change in consumption/change in income

Remember, 1-MPC=MPS.

Marginal Propensity to Save

How much people save rather than spend when disposable income changes.

MPS=change in savings/change in income

Remember, 1-MPS=MPC.

Spending Multiplier

The maximum impact spending has on the economy.

1/MPS or 1/(1-MPC)

Tax Multiplier

A diminished version of the spending multiplier. People will do one round of savings after any effect on taxes.

MPSx1/MPS, MPC/MPS, or Spending multiplier-1

Total change in GDP

Multiplier x change in amount of money

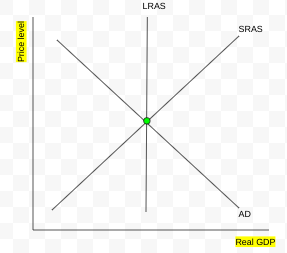

Aggregate supply

All goods and services that firms are willing to produce at different price levels.

There are two types: short run and long run.

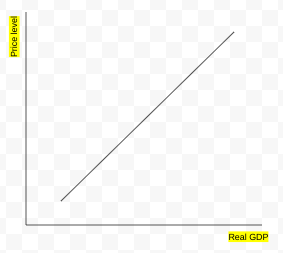

Short run Aggregate Supply (SRAS)

A downwards sloping curve representing AS in the immediate vicinity. Wages and resources are held as sticky (hard to change).

Shifters of SRAS

Using the acronym R.A.P:

Resource Prices (prices of resources, supply shocks, expectations)

Actions of the Government - not government spending (taxes, subsidies, regulations)

Productivity (technology)

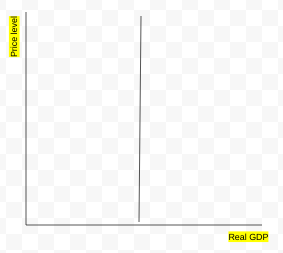

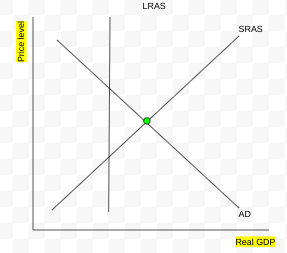

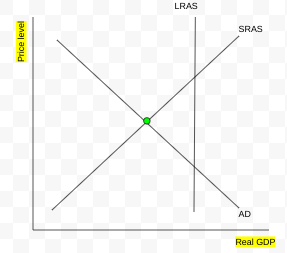

Long Run Aggregate Supply

Where the economy’s potential output is at full employment. A vertical curve with flexible wages and resource prices.

Shifters of LRAS

The same shifters as the PPC (change in resources and/or technology)

Full employment

When the economy’s unemployment is at the natural rate of unemployment. There is no cyclical employment, and all resources are used efficiently.

Inflationary gap

When current output is greater than potential output (UR<NRU, short run equilibrium at right)

Recessionary gap

When current output is less than potential output (UR>NRU, short run equilibrium at left)

The economy can only be in three places at any point in time:

Full employment

Negative output gap (recessionary)

Positive output gap (inflationary)

Stagflation

A stagnant economy, plus inflation.

Essentially, when a negative supply shock occurs.

What causes inflation?

Demand-pull: When demand for products increases, price levels increase due to bidding.

Cost-push: Higher production costs will increase resource prices, increasing price levels.

Autonomous consumption

The “required spending” consumers spend every year, regardless of income (groceries).

Disposable income

Income after taxes.

Dissaving

When disposable income is less than autonomous consumption

Fiscal policy

Government-backed policies with the aim of stabilizing the economy.

There are two types: contractionary and expansionary.

Each has their own subcategory: discretionary and nondiscretionary.

Discretionary fiscal policy

Lawmaker-made policies that change AD through gov’t spending/taxes. One major downside is the time it takes to pass such a law.

Non-discretionary fiscal policy (automatic stabilizers)

Permanent laws in place that work to stabilize the economy. For example, the Progressive Tax System, unemployment benefits, and welfare.

Contractionary fiscal policy

Fiscal policy with the intention of slowing down the economy (reducing inflation and GDP).

Expansionary fiscal policy

Fiscal policy with the intention of reducing unemployment and stimulating short-run economic growth (recovery from a recession).

The Progressive Income Tax System

An automatic tax system that doles out taxes depending on one’s income. When the GDP is low, the tax burden is low, promoting AD (and vice versa).

In the long run…

Inflationary gap - SRAS decreases due to increased resource prices and wages

Recessionary gap - SRAS increases due to decreased resource prices and wages

Real GDP on the graph

rGDP represents employment. When the equilibrium shifts right, rGDP increases and employment increases and vice versa.

Fiscal policy lags

The downside of discretionary fiscal policy. They are:

Recognition lag

Administrative lag

Operational lag