Concepts of Auditing Lecture 1 Ch 1

1/24

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

25 Terms

Independence

Includes two categories - independence of mind and independence of appearance

Independence of appearance

the avoidance of circumstances that would cause a reasonable and informed third party, having knowledge of all relevant information, including safeguards applied, to reasonably conclude that the integrity, objectively, or professional skepticism of a firm or a member of the attest engagement team has been compromised

Independence of mind

the state of mind that permits the performance of an attest service without being affected by influences that comprises professional judgment, thereby allowing an individual to act with integrity and exercises objectivity and professional skepticism

Material

The omission of an item in a financial report is material if, in light of surrounding circumstances, the magnitude of the item is such that it is probable that the judgment of a reasonable person relying on the report would have been changed or influenced by the inclusion or correction of the item

Types of Services

assurance service - The broad range of information

enhancement services that are provided by certified public

accountants (CPAs).attestation - increase the reliability of information

Other Assurance Services—Putting information into a form

or context that facilitates decision making.

Non assurance services

tax services

management consulting services

Attest

to bear witness to; certify; declare to be correct, true, or genuine;

declare the truth of, in words or writing, especially affirm in an official capacity

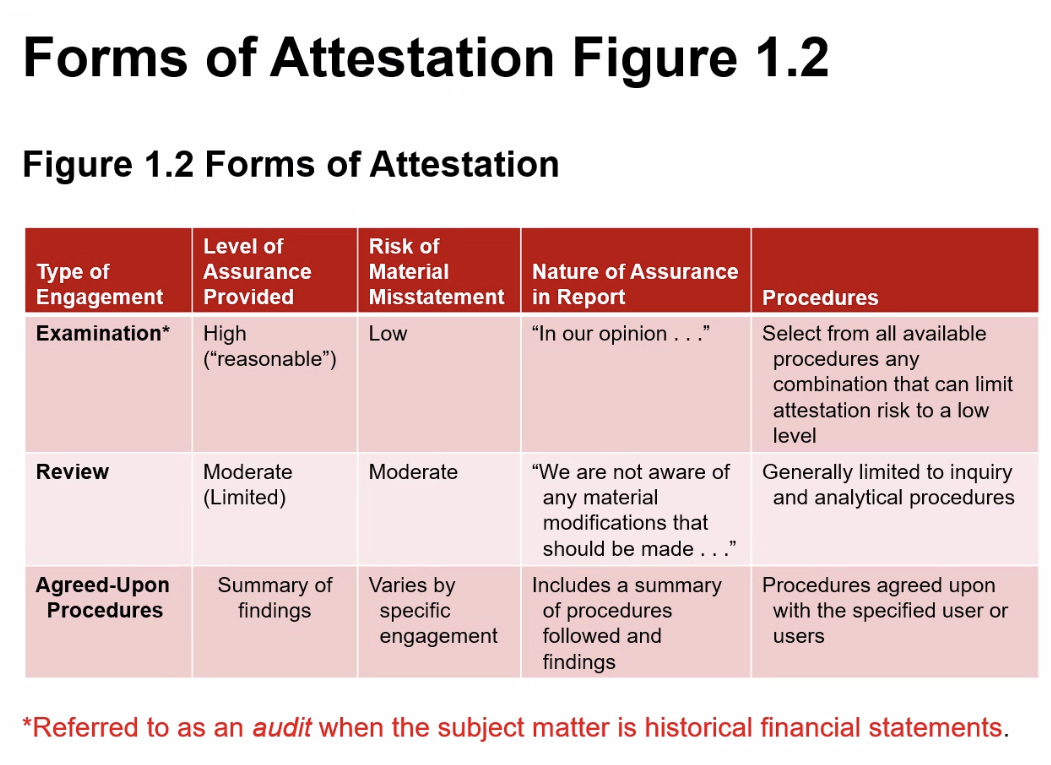

Attest Engagement

To attest to information means to provide assurance as to its

reliability.An examination, review, or agreed-upon procedures

engagement performed under the attestation standards related

to subject matter or an assertion that is the responsibility of

another party

Forms of Attestation

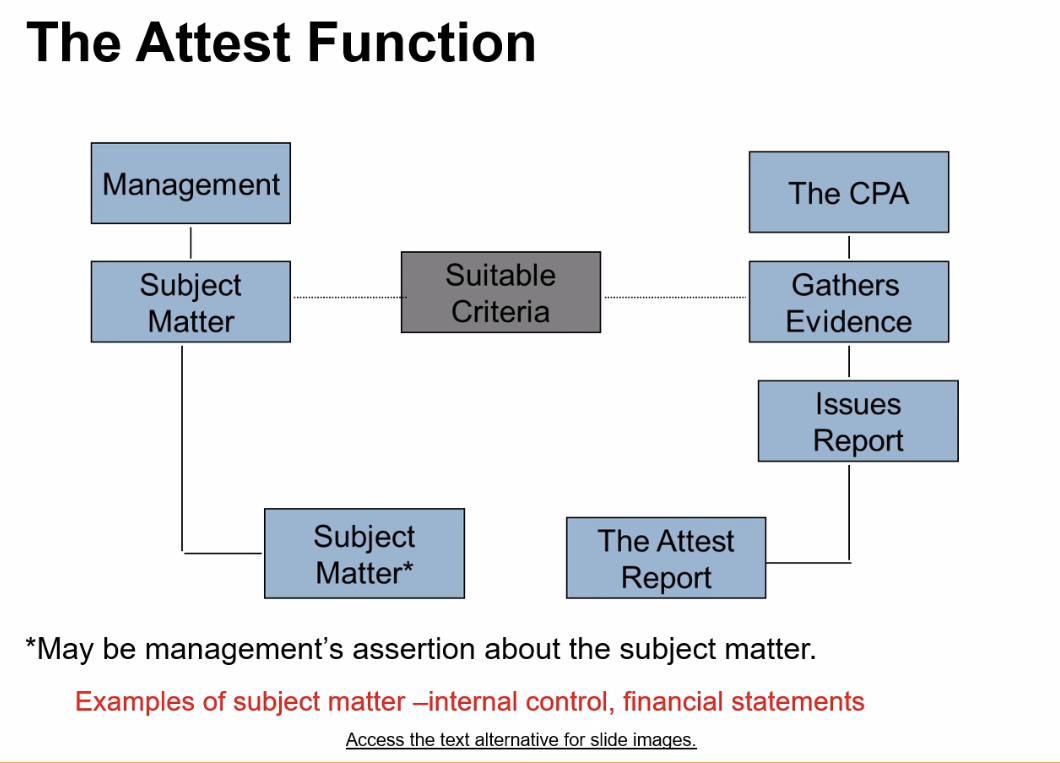

The attest function

Suitable criteria

Standards established or developed by groups of experts.

Example: Internal control audit – standards established by

the Committee of Sponsoring Organizations (COSO)

framework.Example: Financial statement audit – for a financial

statement audit suitable criteria are referred to as the

“applicable financial reporting framework.” In the U.S. this

is typically Generally Accepted Accounting Standards.

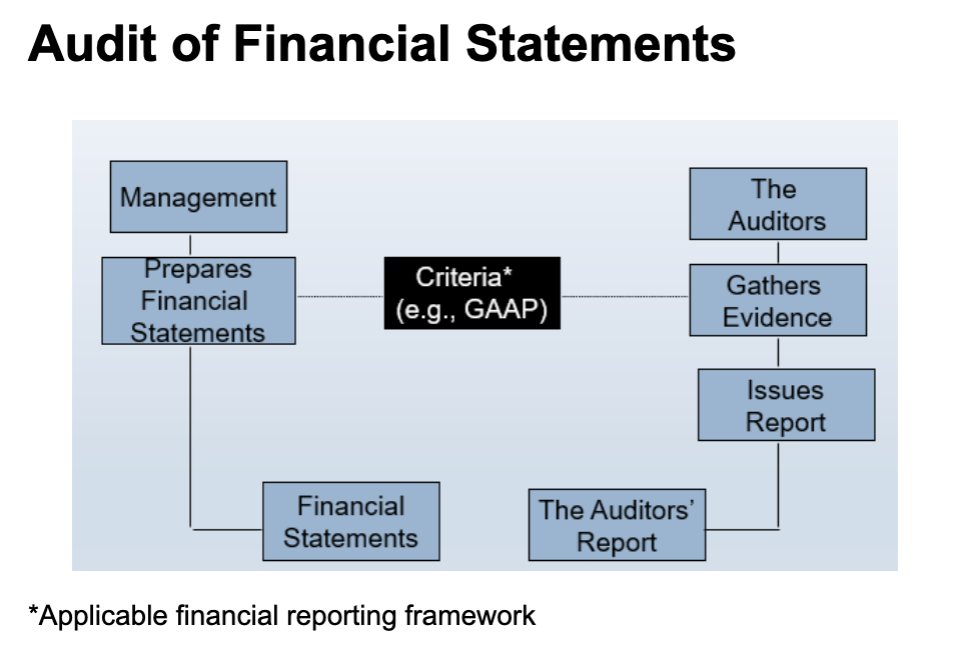

Audit of Financial Statements

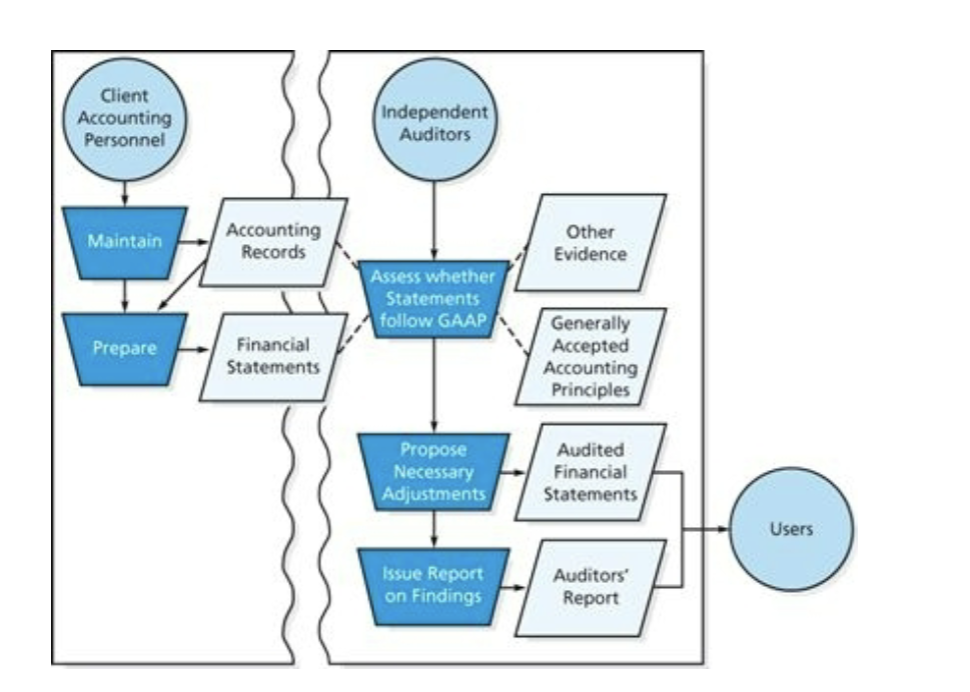

Financial Statement Audit

Auditors gather evidence and provide a high level of

assurance (referred to as reasonable assurance) that the

financial statements follow GAAP, or some other

appropriate accounting framework.Audit involves searching and verifying accounting records

and examining internal and external evidence.Sufficient evidence is gathered to issue an audit report that

states the auditors’ opinion.

Audit Evidence

Evidence focuses on whether financial statements are presented in

accordance with GAAP; examples:

Balance sheet.

All included assets and obligations exist.

Includes all assets and obligations.

Assets and obligations are properly valued.

Income statement.

Sales actually occurred.

Sales have been recorded at appropriate amounts.

Recorded costs and expenses are applicable to period.

All expenses have been recognized.

Financial statement amounts.

Accurate, properly classified and summarized.

Notes are informative and complete.

How an audit works

What creates the demand for audits?

Audits lend credibility to information by reducing information risk,

the risk that information is materially misstated.

Financial statement misstatements arise due to--

Accidental errors.

Lack of knowledge of accounting principles.

Unintentional bias.

Deliberate falsification (fraud).

Audits do not directly address business risk, the risk that a

company will not be able to meet its financial obligations due to

economic conditions or poor management decisions.

United States v. Arthur Young—Supreme Court described the

auditors’ role as being that of a public watchdog, requiring both

total independence and complete fidelity to public trust.

Other types of audits and auditors

Types of audtis

Compliance Audits.

Example: IRS audit of taxpayer’s return.

Operational Audits.

Example: Effectiveness of operations of receiving department of a manufacturing company.

Integrated Audits.

Example: Assurance on both the financial statements and

effectiveness of internal control over financial reporting.

Types of auditors

Internal Auditors.

Government Accountability Office Auditors.

Tax Auditors.

AICPA’s Traditional Role

Establish Standards.

Research and Publication.

Continuing Professional Education.

Self-Regulation.

Note: Much of the standards setting and regulation roles

relating to public companies (referred to as “issuers”) has

been taken over by the SEC and the PCAOB

Establishes Standards—Examples

AICPA Auditing Standards Board:

Issues official pronouncements on auditing and attestation

matters for nonpublic companies (“nonissuers”).Statements on Auditing Standards (SASs).

Statements on Standards for Attestation Engagements

(SSAEs), which provides guidance for attesting to information

other than financial statements such as financial forecasts.Accounting and Review Services Committee.

Issues Statements on Standards for Accounting and

Review Services (SSARS) which are standards for

compilations or reviews, not audits of financial statements.

Professional Regulation

Regulations of Individual CPAs.

Code of Professional Conduct – ethical rules for C PAs.

Requirements for regular membership in A ICPA.

Regulation of Public Accounting Firms:

Peer reviews of a firm’s accounting and auditing practice must

follow AICPA Peer Review Program.CPA firms not registered and inspected by the PCAOB are subject

to peer reviews administered by the State CPA Societies under the

direction of the AICPA Peer Review Board.The AICPA National Peer Review Committee administers peer

reviews of CPA firms registered and inspected by PCAOB.Center for Audit Quality works to foster high-quality performance.

State Boards of Accountancy

Issue CPA certificates.

All boards require successful completion of CPA

examination.Education and experience requirements vary.

National Association of State Boards of Accounting

(NASBA)Other Parties

FASB.(Financial Accounting Standards Board)

Sets GAAP for entities other than federal, state and local governments.

GASB.(Government Accounting Standards Board)Sets accounting standards of financial accounting for state and local government entities.

FASAB (Federal Accounting Standards Advisory Board)

Sets accounting standards for the US government.

IFAC. International Federation of Accountants

Sets international accounting standards.

PCAOB Role

Adopt auditing, attestation, quality control, ethics, and

independence standards relating to the preparation of audit

reports for SEC registrants.

Oversee and discipline CPAs and CPA firms that audit public

companies (issuers), including:

Register firms.

Perform inspections of firms.

Conduct investigations and disciplinary proceedings of firms.

Sanction registered firms.

Securities and Exchange Commision (SEC)

Agency of the US government.

Oversight responsibility for the PCAOB.

Objectives:

Protect investors and public by requiring full disclosure of

financial information by companies offering securities for sale to

the public.Prevent misrepresentation, deceit, or other fraud in the sale of

securities

Registration and Regulation of the Sale of Securities by the SEC

Registration statements:

Qualify securities for sales.

Contains audited financial statements.

Makes SEC major user of financial statements.

Periodic reporting requirements, for example, Form 10-Ks,

Form 10-Qs, etc.Regulation S-X.

Sets forth basic accounting regulation.

Types of Professional Services

Attestation and Assurance.

Tax.

Consulting.

Accounting.

Personal Financial Planning.

Litigation support.

Fraud Investigation

Industry Specialization

Firms with detailed knowledge and understanding of a

client’s industry.

Helps firms.

Be more effective at collecting and evaluating audit

evidence.Make valuable suggestions to improve client’s operations.

Provide client consulting services.