Economics Final Exam

1/132

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

133 Terms

Adam Smith’s Invisible Hand

The theory that society benefits the most when everyone acts in their best interest by acting voluntarily in the market.

Scarcity

The basic, fundamental problem of economics

Economics

Solving the problem of scarcity

Trade-offs

Sacrificing one benefit to gain another

Markets

Places where buyers and sellers exchange goods and services

Thinking at the margin

Making decisions based on additional costs and benefits

Marginal cost

The cost of producing/consuming one more unit

Marginal benefit

The benefit gained from producing one more unit

Good

Tangible Item that can be purchased

Service

Action done for others that can be purchased

Factors of production

Resources used to make goods

Natural Resources

Land, water, oil

Human Resources

Labor/workers

Capital Resources

Tools, machines

Entrepreneur

Risk-taker who starts a business

Marginal Utility

Extra satisfaction from one more unit

Human Capital

Skills and education

Opportunity Cost

Best alternative given up

Scarcity

Limited resources

Choice

Selecting one choice

The Law of Diminishing Marginal Utility

Each additional unit gives less satisfaction

Traditional Economy

Economic system where customs and religion dictate the economy

Command Economy

Economic system where a central government decides the economy

Market Economy

Economic system where the economy is decided by unrestricted competition between businesses (no government).

Mixed Economy

A mix of market and command economy

Specialization

Focusing on one task/product

Division of Labor

Splitting work into tasks

Voluntary Exchange

Trade where both sides benefit

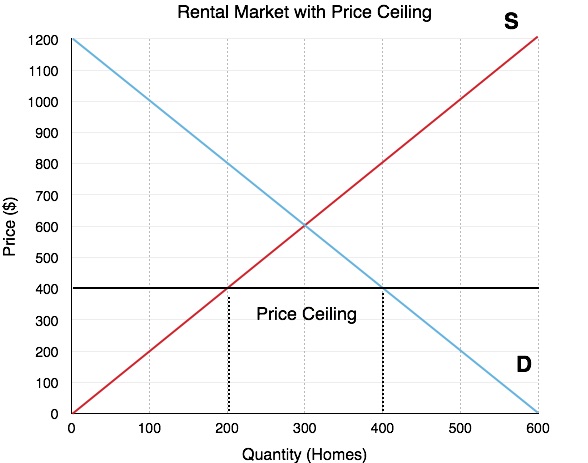

Price Ceiling

A maximum price limit set below equilibrium to keep things affordable.

Price Floor

A minimum price limit set to protect producers.

Equilibrium

Any price where quantity demanded = quantity supplied

Supply

The amount of a good or service that producers are able and willing to sell at all prices.

Demand

The amount of a good or service that people are able and willing to buy at all prices.

Perfect Competition

A large number of firms all produce the same product

Monopolistic Competition

Many producers, similar products

Oligopoly

Few producers, very similar products

Monopoly

One producer, unique product

Absolute Advantage

the ability to produce something more productively than someone else

Comparative Advantage

the ability to produce something with a lower opportunity cost than someone else.

Collusion

A secret agreement between businesses to manipulate the market for their mutual benefit.

Cartel

Formal agreement between competing firms to collude

Negative Externality

An extra cost of production that is not paid for by the producer or consumer (pollution from factory)

Positive Externality

An extra benefit of production that is not paid for by the producer or consumer (view of neighbor’s garden)

Debit Card

a type of payment card that allows consumers to make purchases by directly accessing the funds in their checking accounts

Credit Card

a card that borrowing money that is accompanied by interest and sometimes fees

M1 Money Supply

Liquid assets ready for spending

M2 Money Supply

Savings and time deposits, money that is not easy to access

FDIC Ensured Bank Deposits

insurance to protect your money in the event of a bank failure. Your deposits are automatically insured to at least $250,000

CDs

a savings account that holds a fixed amount of money for a fixed period of time, such as six months, one year, or five years, and in exchange, the issuing bank pays interest.

Mutual Funds

financial vehicle that pools money from many investors to collectively buy a diversified portfolio of securities (stocks, bonds, etc.) managed by professionals

Stocks

a small piece of ownership in a company that gives you a claim on its earnings and assets

Bonds

a debt security representing a loan made by an investor (lender) to a borrower, usually a corporation or government, for a fixed period

Sole Proprietorships

A business owned by one person

Partnerships

A business owned by 2+ people

Corporations

legally established entity that can enter into contracts, own assets and incur debt, as well as sue and be sued (owned by shareholders)

Franchises

a business model where one company licenses its brand, products, and proven system to another person, allowing them to open and run a similar business

Silent Partner

An investor who has no role in management

Board of Directors

the elected, high-level governing body of an organization, representing shareholders (owners) to oversee management, set strategy, ensure legal compliance, and protect stakeholder value

Unlimited Liablility

business owners are personally responsible for all business debts and obligations

CEO

Chief executive of the company

LLC - Limited Liability Company

a popular business structure that protects owners (called "members") from personal responsibility for business debts

Labor Force

The total number of people who are employed or looking for a job - not including retired, -16, or discouraged workers

Outsourcing

a business strategy where a company hires an external third-party provider to perform tasks, functions, or create goods

Offshoring

the practice of relocating business processes or production to another country

Affirmative Action

a set of policies designed to actively counteract past and present discrimination by creating opportunities in education and employment for historically disadvantaged groups, like women and minorities, ensuring they have fair access to roles and resource

Right-to-work Laws

state-level statutes prohibiting union security agreements, meaning employees in unionized workplaces cannot be forced to join a union or pay dues as a condition of employment

Wage Gap

the persistent difference in average earnings between different demographic groups

Market Failure

when a free market fails to efficiently allocate resources

Externality

Extra costs or benefits of production that are not paid for by the producer or the consumer

Occupational Safety and Health Administration

a U.S. government agency within the Department of Labor that ensures safe and healthy workplaces by setting and enforcing safety standards

US Patent and Trademark Office

is the federal agency under the Department of Commerce and is responsible for granting U.S. patents and registering trademarks.

FTC

a U.S. government agency established to protect consumers and maintain fair competition by preventing deceptive, unfair, and anti-competitive business practices

EPA - environmental protection agency

uses economics to develop cost-effective environmental policies

Eminent Domain

the government's power to seize private property for public use

Public Goods

a product or service that is both non-excludable (people can't be prevented from using it) and non-rivalrous

Upton Sinclair - The Jungle

A book that exposes the appalling working conditions in the meat-packing industry

In-kind benefits

non-cash goods or services provided to individuals, often by governments or employers, to meet specific needs like food, housing, or healthcare, instead of direct money

Cash Transfers

direct payments, often from governments, made to eligible groups of people.

Income Redistribution

the government's process of shifting wealth and income from higher earners to lower earners

Excise Taxes

an indirect tax levied on the production, sale, or consumption of specific goods, services, or activities to reduce purchasing of it

Regressive Tax

Tax takes a larger percentage of income from the poor

Individual Income Taxes

a mandatory financial charge levied by a government on the wages, salaries, investments, and other forms of income earned by individual citizens or households

Corporate Income Taxes

a direct tax levied by federal and state governments on the net profits of corporations, which are separate legal entities from their owners.

Sales Taxes

a consumption tax on the sale of goods and services (varies by state)

Luxury Taxes

a government-imposed surcharge or excise tax levied on goods and services considered non-essential, high-end, or extravagant, rather than necessities

Tax Incidence

determines who ultimately bears the economic burden of a tax

Property Taxes

A tax on real estate collected locally and used to fund services like schools, emergency services, and infrastructure

Payroll Tax

a tax paid on the wages and salaries of employees to finance social insurance programs like Social Security, Medicare, and unemployment insurance

Estate Taxes

a tax on an individual's right to transfer property at their death

Paystub

a pay stub (or pay slip/wage statement) is a document provided by an employer with each paycheck that details an employee's gross earnings, itemized deductions, and final net pay for a specific pay period

W2

United States federal tax document used by employers to report an employee's annual wages and the amount of taxes withheld from their paycheck to the IRS and the Social Security Administration (SSA)

Benefits Received

a theory of taxation stating that individuals should pay taxes in proportion to the benefits or services they receive from the government, similar to buying a product

Inflation

the rate at which the general price level of goods and services in an economy rises over time, causing the currency's purchasing power to fall

GDP

the total monetary value of all final goods and services produced within a country's borders during a specific time period

Nominal GDP

the total monetary value of all final goods and services produced in a country within a specific time period, measured at current market prices, without adjusting for inflation or deflation

Real GDP Per Capita

a country's total economic output (Real GDP) adjusted for inflation and divided by its population

Frictional Unemployment

Individuals who are not working because they are “between jobs”

Structural Unemployment

Technological advances have made their jobs unnecessary

Seasonal Unemployment

Job is not needed during that time of year

Cyclical Unemployment

Economy is in decline and their former employers cannot afford to pay them. (unnatural)