Chapter 14-16

1/35

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

36 Terms

Aggregate Demand (AD)

Total spending on goods and services in a period of time at a given price level (Price level vs real GDP)

inverse relationship (lower average price level = high average demand)

Long Run Aggregate Demand (LRAD)

AD = C + I + G + (X - M) where C is consumption, I is investment, G is government spending, X is exports, and M is imports.

Non-price determinants of Consumption:

TWICED

NPDC: Income Taxes

higher income = higher consumption

higher income tax = lower consumption (less disposable income)

NPDC: Wealth

Higher house prices or stock value = higher consumption.

NPDC: Interest Rates

higher interest rates = less borrowing -> lower consumption

lower interest rates = higher consumption (ceteris paribus)

NPDC: Consumer Confidence

Higher consumer confidence leads to higher consumption.

NPDC: Debt

easy to borrow money + low interest = higher debt willingness + consumption

Non-price determinant of investments

IB-TBD

NPDI: Interest

higher interest rate = lower investments

NPDI: Business Confidence

optimistic about future = higher investments

NPDI: Technology

increase in tech = higher investments

NPDI: Business Taxes

higher taxes = reduced post-tax profits = lower investments

NPDI: Corporate indebtedness

easy to borrow money + low interest = higher debt willingness + investment

Non-price determinants of Government Spending:

economic + political priorities

commitment to support industry = higher spending

correct market failure = higher spending

Non-price determinant of net exports: Imports

higher domestic income = higher imports

higher exchange rate = higher imports

lower restrictions on trade = higher imports

lower inflation rates of foreign partners = higher imports

Non-price determinant of net exports: Exports

increased foreign incomes = higher exports

higher exchange rate of currency = lower exports

lower restrictions on trade = higher exports

higher inflation rate = lower exports

Aggregate Supply (AS)

Total amount of goods and services produced by all industries at every price level.

Short Run Aggregate Supply (SRAS)

period of time where FoP do not change; fixed price of labour, positive relationship between price level and real GDP.

Non-price determinant of SRAS: Cost of Resources

wage rates (increase in wages = increase in cost of FoP -> lower AS)

cost of raw materials (higher costs = lower AS)

dependent on how widely used the material is

price of imports (increase in price = higher cost of production -> lower AS)

Non-price determinant of SRAS: Government Intervention

subsidies (increased subsidies = higher AS)

taxes (increased taxes = lower AS)

regulations (more regulations = lower AS)

Non-price determinant of SRAS: Supply Shocks

natural disasters or wars = less supply

Long Run Aggregate Supply (LRAS)

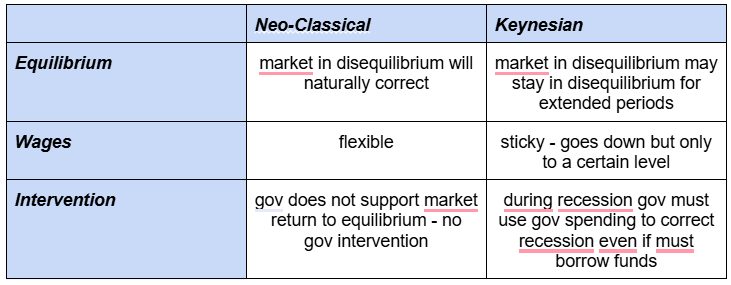

keynesian and neo-classical views

Neo-classical view of LRAS

Belief in market efficiency and minimal government intervention

LRAS = perfectly inelastic

full employment level

independent of price level

Keynesian view of AS

3 phases:

1. AS is perfectly elastic

spare capacity

increase output without high costs

2: approaching potential output

use up spare capacity

FoP more scarce

FoP cost more

rising price levels

3: full capacity

impossible to increase output

AS perfectly inelastic

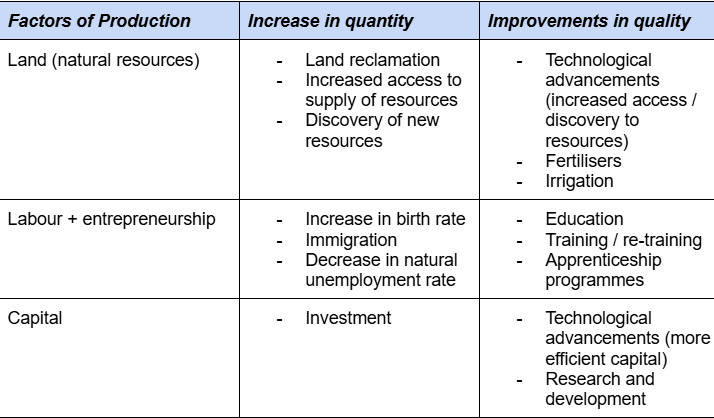

Non-price determinants of LRAS:

Change in quantity or quantities of FoPs

Technological improvements

Increase in efficiency

Changes in institutions

Factors influencing quality / quantity of FoPs:

Short run equilibrium

State when AD meets AS; no incentives for price or output to change, no inflation/deflation

Long run equilibrium (neo-classical)

When AD equals LRAS, indicating an economy at full employment.

Recessionary Gap

Equilibrium level of real output is less than potential output due to decreased AD.

Inflationary Gap

Equilibrium level of real output exceeds potential output due to increased AD.

Stagflation

inflation but no economic growth

Long Run Equilibrium:

short run = inflationary and recessionary gaps exists

long run = equilibrium point must return to LRAS (full employment)

Long run equilibrium (Keynesian)

Economy at equilibrium below full employment levels due to AD

AS = perfectly elastic -> spare capacity + unused FoP

Shifts in AD

first shift -> no change in price, only change in output

second shift -> slight inflationary pressure, increased price + output

third shift -> purely inflationary shift, only change in price, no change in output

Neo-classical vs Keynesian equilibrium