Efficiency and Market Structures (Theme 3 CC2)

1/39

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

40 Terms

Market Structure

The characteristics and degree of competition within a market, which determines the firm's behaviour.

Differentiated Product

A product produced by a firm that has some unique or distinguishable characteristics compared to similar products of other firms.

Homogenous Product

A good or service that is identical regardless of which firm produces it

Dilution

When the market has a higher amount of firms competing against each other within it, leading to the market becoming diluted and a greater share of price takers.

Heterogeneous Product

Products which have similar but not identical characteristics, parts, and physical appearance. It can be easily identified from other, similar products.

Mothball

Point where a firm stops using a piece of equipment or a building but keeps it in good condition so that it can readily be used again.

Contribution

The difference between average revenue and average variable costs. If a product is sold for £10, and the avc totals £6, the remaining £4 goes to cover the fixed costs. Once enough units have been sold to cover the fixed costs, once they're paid off selling extra units generates £4 pure profit.

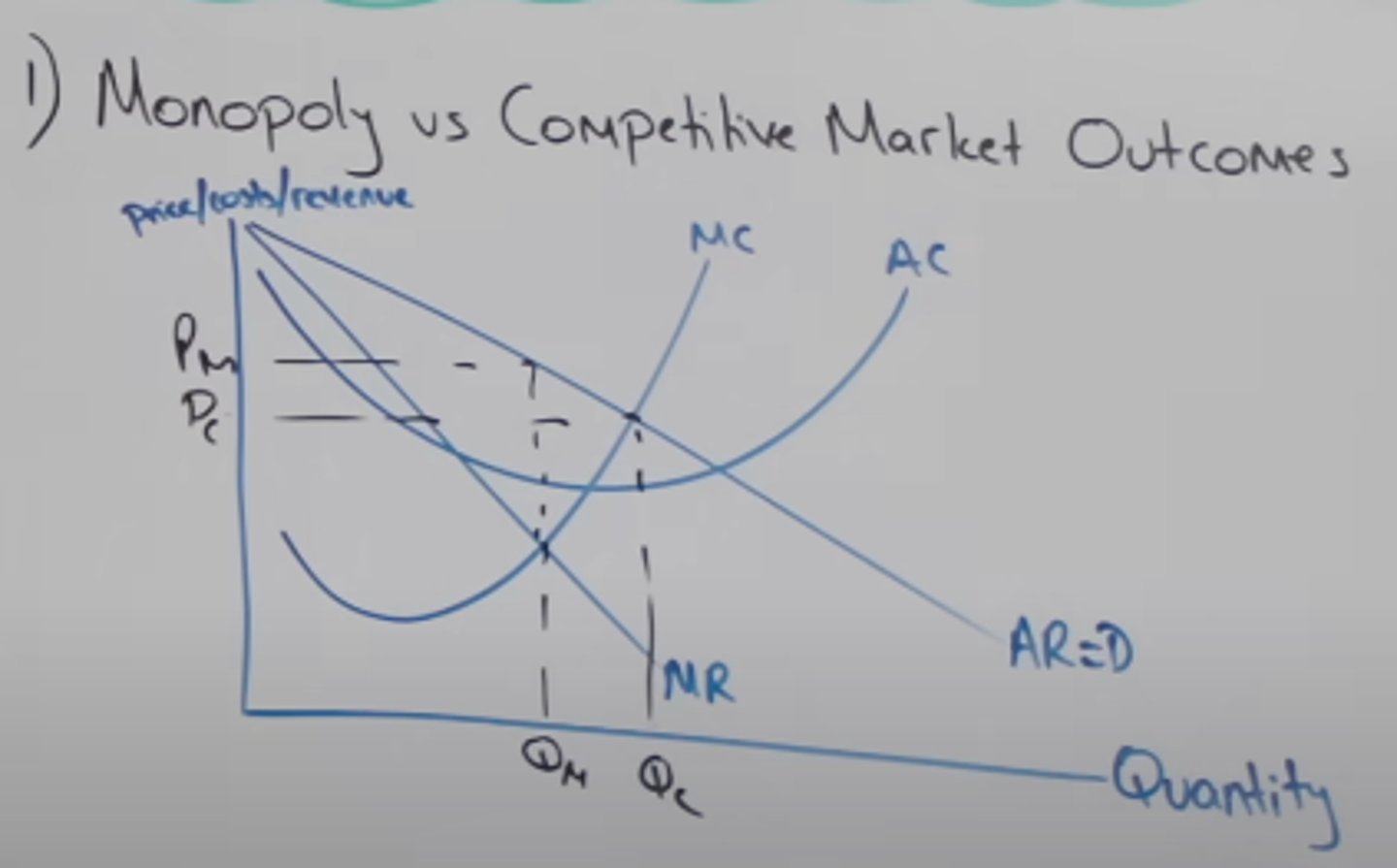

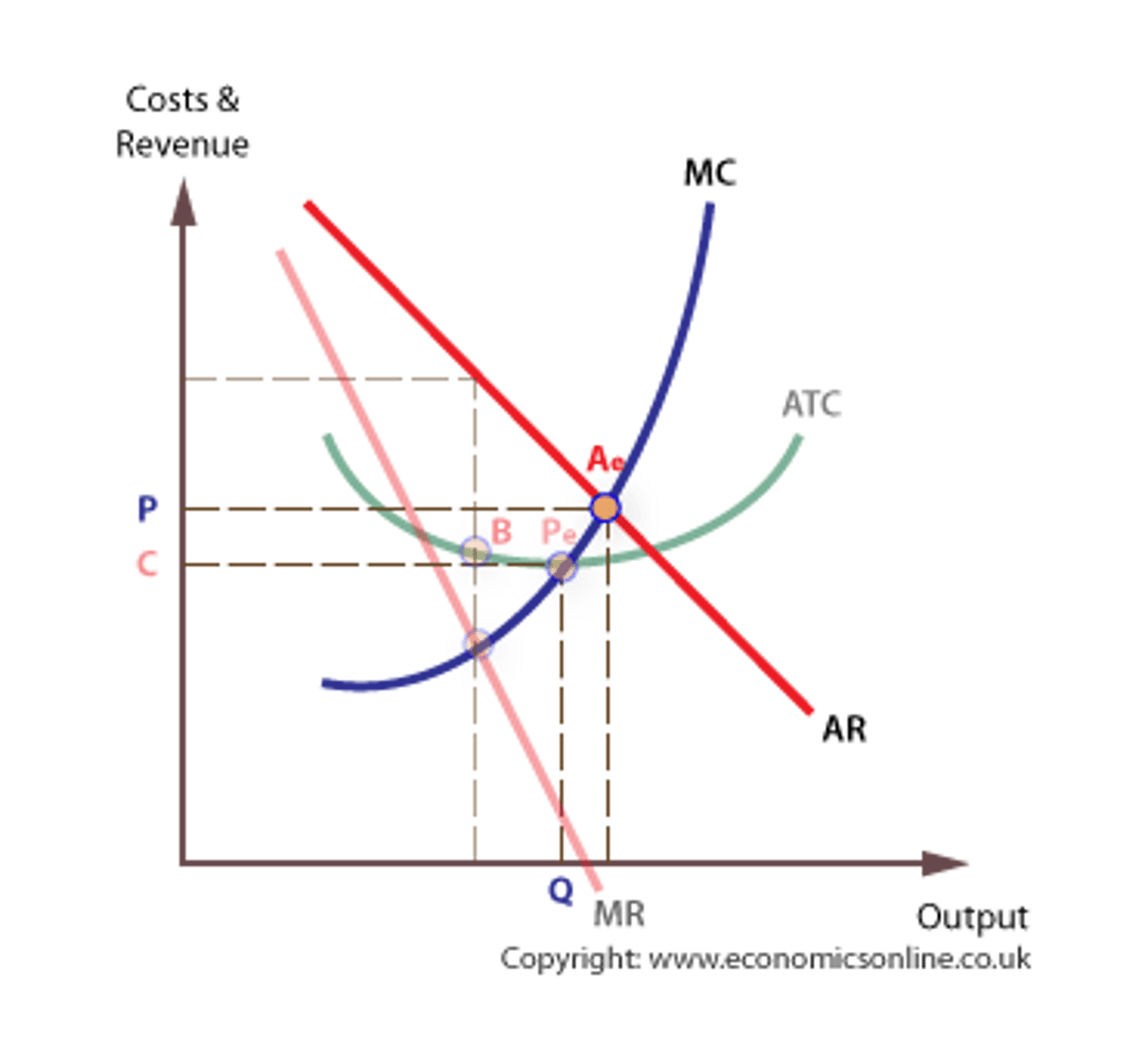

Allocative Inefficiency

This occurs where the marginal social cost of producing a good is not equal to the marginal social benefit of the good to society. In different words, it occurs where the marginal cost of producing a good (including any external costs) is not equal to the price that is charged to consumers, meaning that consumer/producer surplus and economic welfare is not maximised.

Productive Efficiency

a situation in which a good or service is produced at the lowest possible cost for the firm which is at the minimum ATC. When MC=AC

Monopoly

A market where the firm is the industry, one firm is supplying all output to the industry without competition, due to high barriers to entry.

Pure Monopoly

A market structure in which one firm sells a unique product, into which entry is blocked, in which the single firm has considerable control over product price, and in which nonprice competition may or may not be found.

Monopoly Power

The ability of a monopoly to dictate what takes place in a given market. Legally defined as having 25% or more of the market share. As the monopolist faces a downwards sloping demand curve, they can only influence the price or quantity sold of a good, not both. Examples include Google Search which controls 92% of global search engines, recommending products attributed to google or Durex in the UK condom market.

Natural Monopoly

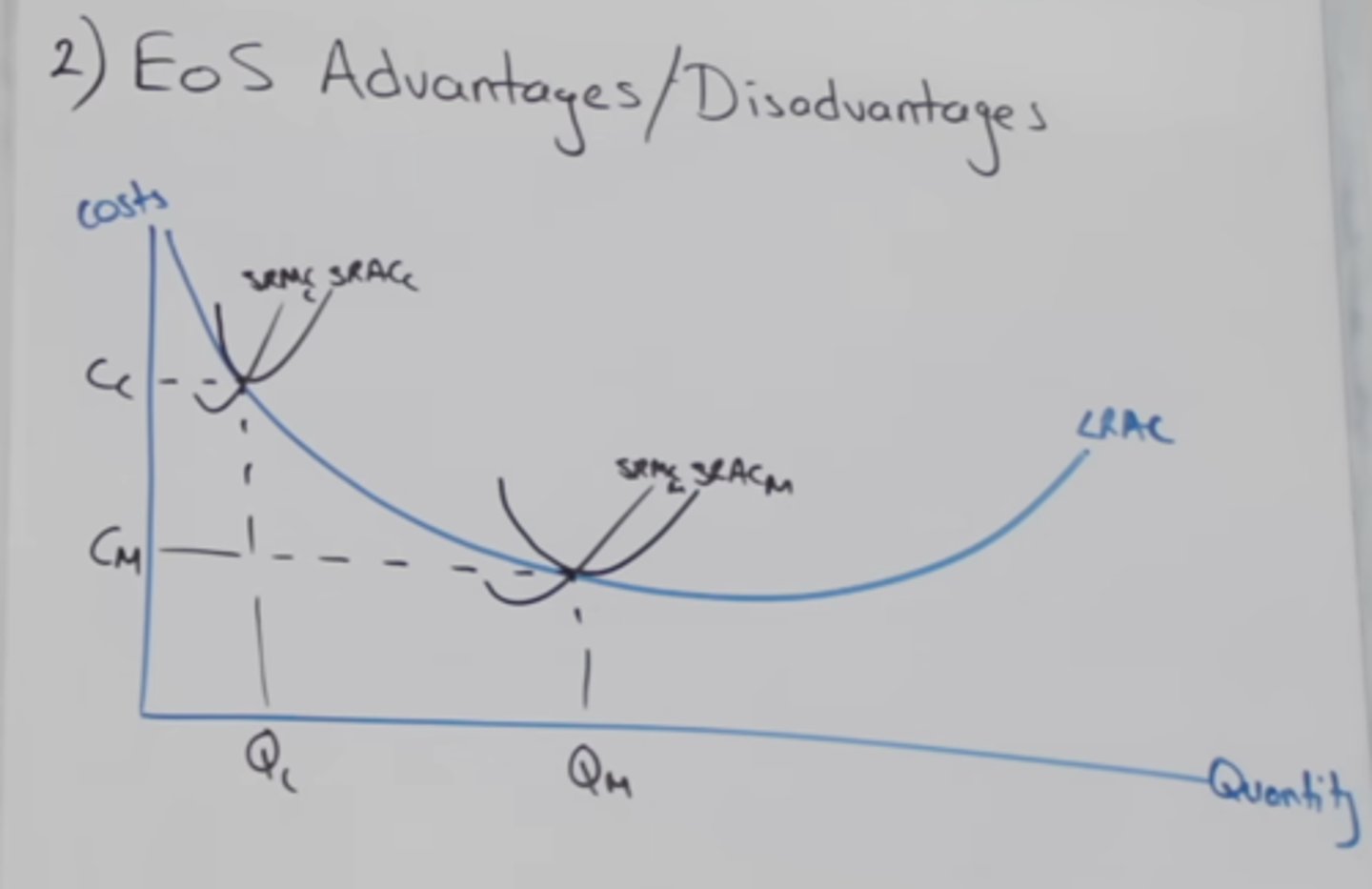

A monopoly that arises because a single firm can supply a good or service to an entire market at a smaller cost than could two or more firms due to their significant economies of scale. Examples include UK water companies and Network Rail who have to operate with very high fixed infrastructure costs.

Allocative Efficiency

When the value that consumers place on a good/service equals the cost of the resources used in production. This always exists in perfect competition. When MC=AR

Shutdown condition

AR=AVC

Breakeven condition

AR=AC

Barrier to entry

anything that keeps new firms from entering an industry, defined as a cost to enter an industry borne by a firm, but isn't borne by firms already in the industry.

Patents

BTN: The exclusive rights to make or sell products, provides firms with a monopoly power in the market and prevents other firms from entering. Examples include major pharmaceutical companies who demand patents in order to cover the high costs of R&D without having their findings stolen or mimicked.

Entry limit pricing

BTN: A situation where a firm will keep prices lower than they could be, moving away from profit maximisation in the short run, in order to deter new entrants and preserve their market share in the long run.

Sunk Costs

BTN and BTX: A disincentive to enter an industry, as there are very high start up costs which may be irrecoverable if a firm chooses to leave the market in the long run. These include the cost of making staff redundant, rent and capital costs alongside contractual obligations.

Trade Barrier / Protectionism

BTN: A tariff or quota which acts as a barrier for international competition from entering domestic markets.

Creative destruction

The hypothesis that the creation of new products and production methods simultaneously destroys the market power of existing monopolies. This is because the higher BTNs that monopolies impose lead to firms trying to develop new innovations to get round them.

Economies of scale

BTN: When a firm in a market can produce a good with such lower LRAC and can reach the MES far sooner, firms on the outside realise they'll have to sell large volumes at a potential loss, discouraging entering the industry.

Reputational Damage

BTX: The loss of the positive image of a company or consumer confidence in a product as a result of discontinuing certain popular policies or product, such as green energy investment.

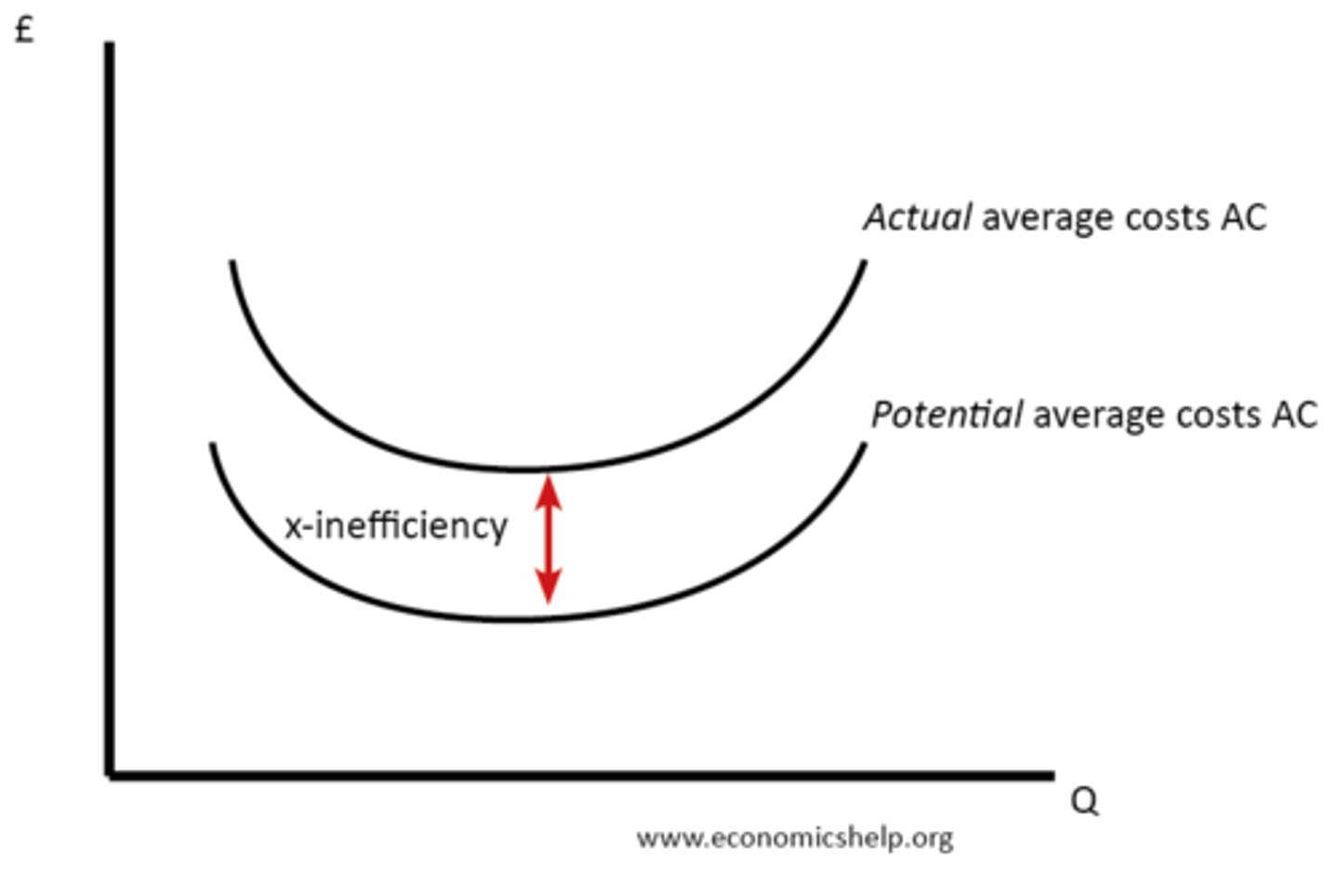

X-inefficiency

When a monopolist has little incentive to control costs due to large profits being earned as a result of high BTNs resulting in a lack of competition. This means that AC is higher than necessary, as a result of complacency.

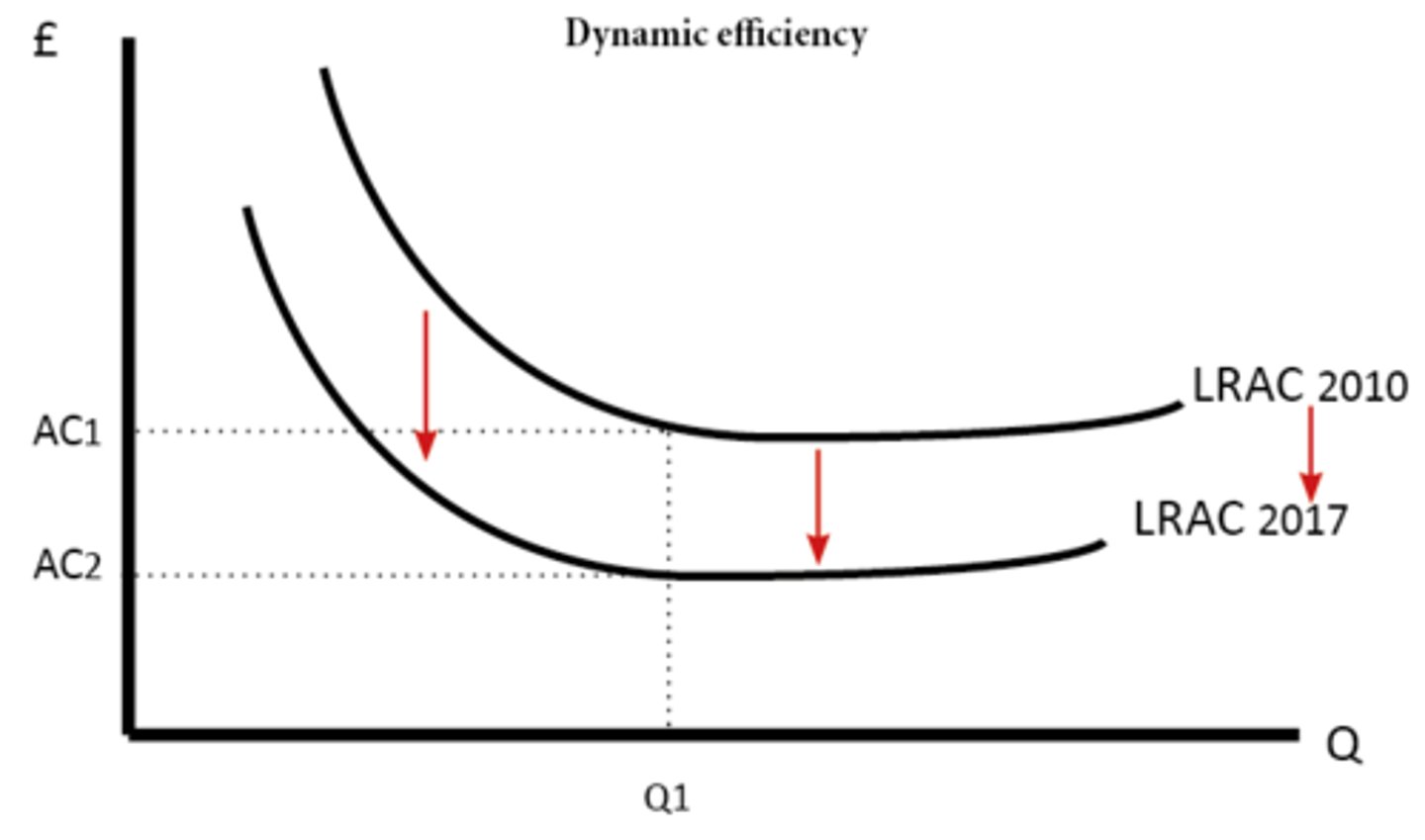

Dynamic efficiency

occurs in the long run, where firms become more efficient over time. Meaning that LR super-normal profits are invested into new technologies and processes which may lower its LRAC.

Static inefficiency

A condition which happens when a firm is both allocatively and productively inefficient, associated with the welfare loss due to the presence of a monopoly; the loss can be summarised as the production of too little output sold at too high a price

Principal Agent Problem

A problem caused by directors pursuing their own interests rather than the interests of the principals (Shareholders) who hired them. Directors will be able to get away with this as they have an information advantage, allowing them to pay themselves more or give better holidays, resulting in x-inefficiency.

Cross-Subsidisation

A business practice where revenue from profitable activities is used to support loss-making ones. Examples include bus services making a profit in urban areas, which support bus services in rural areas. Often seen as a benefit of monopolies.

Price discrimination

The business practice of selling the same good at different prices to different customers for reasons other than cost, based off of PED and consumer surplus.

Dynamic Pricing

Adjusting prices continually to meet the characteristics and needs of individual customers and situations

First degree price discrimination

Charging each individual customer a different price based on their willingness to pay for the same product in order to leave no consumer surplus. Examples include Amazon in 2005 who used cookie information to market identical goods at different prices.

Market seepage

Preventing consumers from buying in one sub-market and selling in another, such as a student buying a ticket, then reselling it at a higher price, condition to ensure that price discrimination works.

Cost-benefit analysis

Used to evaluate price discrimination - Do the costs of admin or employing labour to check ticket types outweigh the benefits of practicing the price discrimination.

Third degree price discrimination

Practice of dividing consumers into two or more groups, such as on age, with separate demand curves and charging different prices to each group based off how elastic their demand is.

Monopolistic Competition

A market structure where a large number of small firms produce differentiated products, where there are low barriers to entry or exit. Examples include UK barbers, clothing market and bars/nightclubs.

Natural monopoly

A market structure where even just one firm struggles to exploit economies of scale, due to high fixed costs.

Monopsony

A market structure in which there is only a single buyer of a good, service, or resource, with many sellers, or where the firm has significant buying power.

Perfect Competition

The degree of competition in which there are many sellers in a market and none is large enough to dictate the price of a product. Examples include the TukTuk industry in India and Thailand where many independent sellers are offering buyers the same product at the same price or the FOREX market.

Expropriation

Term used to describe the taking away of consumer surplus by monopoly outcomes, shown through the diagram by the difference between the competitive and monopoly markets in price. The DWL is shown by the triangle between the two equilibriums.