AP Macro Unit 5

5.0(4)Studied by 188 people

0%Unit Mastery

0%Exam Mastery

Build your Mastery score

Supplemental Materials

Card Sorting

1/41

Earn XP

Description and Tags

Last updated 11:09 PM on 12/19/22

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

42 Terms

1

New cards

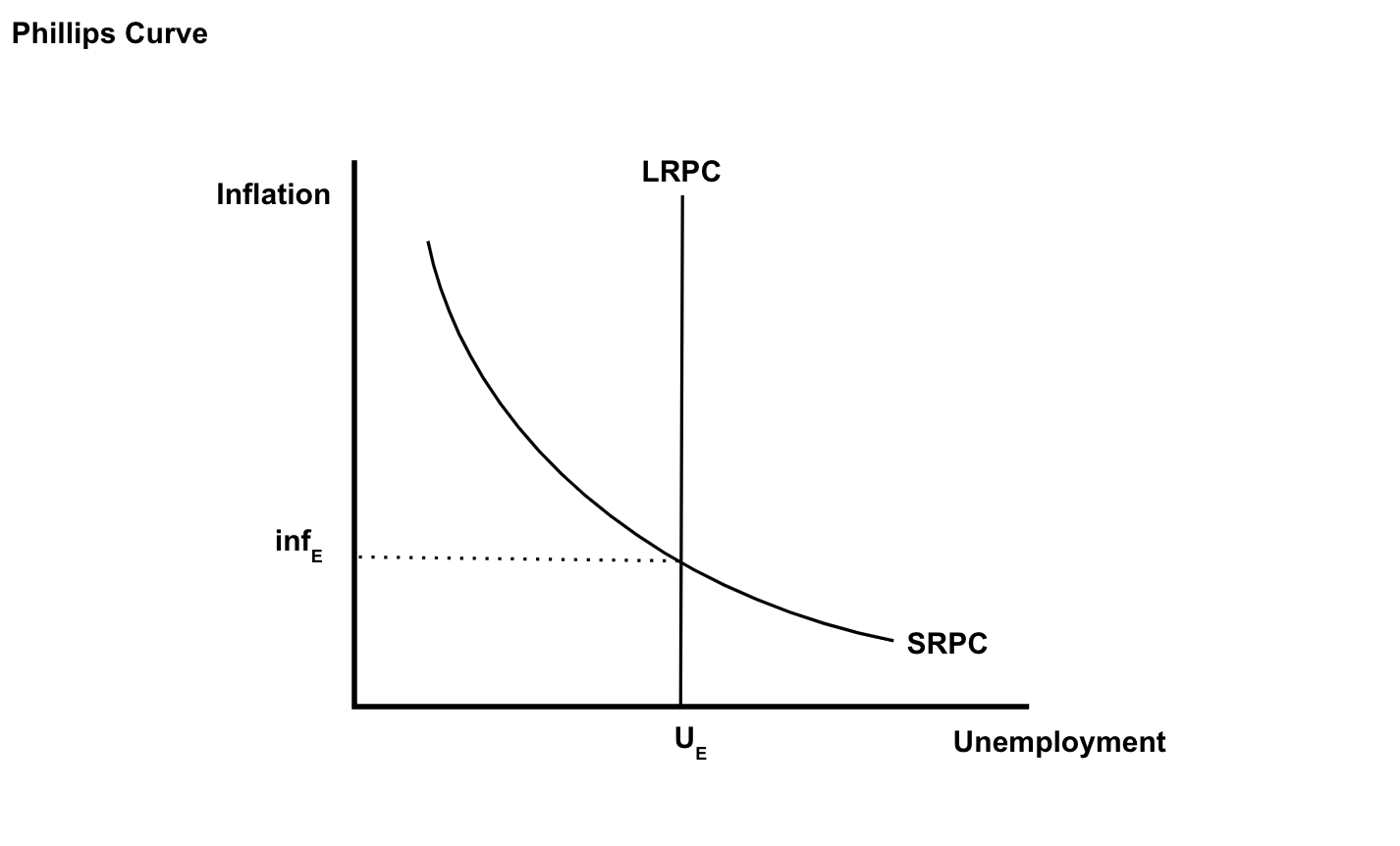

The Phillips Curve

shows the tradeoff between inflation and unemployment

→ in general, there is an inverse relationship unemployment and inflation

→ in general, there is an inverse relationship unemployment and inflation

2

New cards

Short Run Phillips Curve

when the economy is overheating, there is low unemployment but high inflation

→ higher expected inflation shifts SRPC to the right

→ higher expected inflation shifts SRPC to the right

3

New cards

What happens when AS falls causing stagflation?

increase in unemployment and inflation

4

New cards

Short Run v. Long Run

in the long run, there is no trade off between inflation and unemployment

→ the LRPC is vertical at the Natural Rate of Unemployment

→ the LRPC is vertical at the Natural Rate of Unemployment

5

New cards

When AD increases/decreases

point on SRPC moves along the curve

6

New cards

When SRAS increases/decreases

whole SRPC curve shifts

7

New cards

Quantity Theory of Money

money supply and price level in an economy are in direct proportion to one another

8

New cards

M \* V *= P* \* Y

M = money supply

V = velocity

P = price level

Y = quantity of output (Real GDP)

\

→ assume the velocity is relatively constant because people’s spending habits are not quick to change, and that output (Y) is not affected by the quantity of money because it is based on production, not the value of the stuff produced

V = velocity

P = price level

Y = quantity of output (Real GDP)

\

→ assume the velocity is relatively constant because people’s spending habits are not quick to change, and that output (Y) is not affected by the quantity of money because it is based on production, not the value of the stuff produced

9

New cards

What happens in the long-run when the central bank increases the money supply?

→ short-run spending eventually leads to higher resource prices and inflation

→ if inflation is bad enough, banks don’t lend and the economy tanks

→ MS↑, nominal interest rates↓, investment spending↑, AD↑, SRAS↓, PL↑, demand for money↑

→ if inflation is bad enough, banks don’t lend and the economy tanks

→ MS↑, nominal interest rates↓, investment spending↑, AD↑, SRAS↓, PL↑, demand for money↑

10

New cards

Budget Deficit

when annual government spending and transfer payments are greater than tax revenue

11

New cards

Budget Surplus

when annual government spending and transfer payments are less than tax revenue

12

New cards

The National Debt

the accumulation of all the budget deficits over time

→ if the government increases spending without increasing taxes they will increase the annual deficit and the national debt

→ if the government increases spending without increasing taxes they will increase the annual deficit and the national debt

13

New cards

Neutrality of Money

money has no real effect on equilibrium

14

New cards

Expansionary Monetary Policy in the short-run

real output↑, price level↑, interest rates↓

15

New cards

Expansionary Monetary Policy in the long-run

real output no change, price level↑, interest rates indeterminate

16

New cards

Contractionary Monetary Policy in the short-run

real output↓, price level↓, interest rates↑

17

New cards

Contractionary Monetary Policy in the long-run

real output no change, price level↓, interest rates indeterminate

18

New cards

Automatic stabilizers in a recessionary gap

AD↑, real GDP↑, PL↑, budget towards deficit, national debt↑

19

New cards

Automatic stabilizers in an inflationary gap

AD↓, real GDP↓, PL↓, budget towards surplus, national debt↓

20

New cards

Tax cuts and government spending increases

AD↑, real GDP↑, PL↑, towards deficit, national debt↑

21

New cards

Government spending cuts and tax increases

AD↓, real GDP↓, PL↓, towards surplus, national debt↓

22

New cards

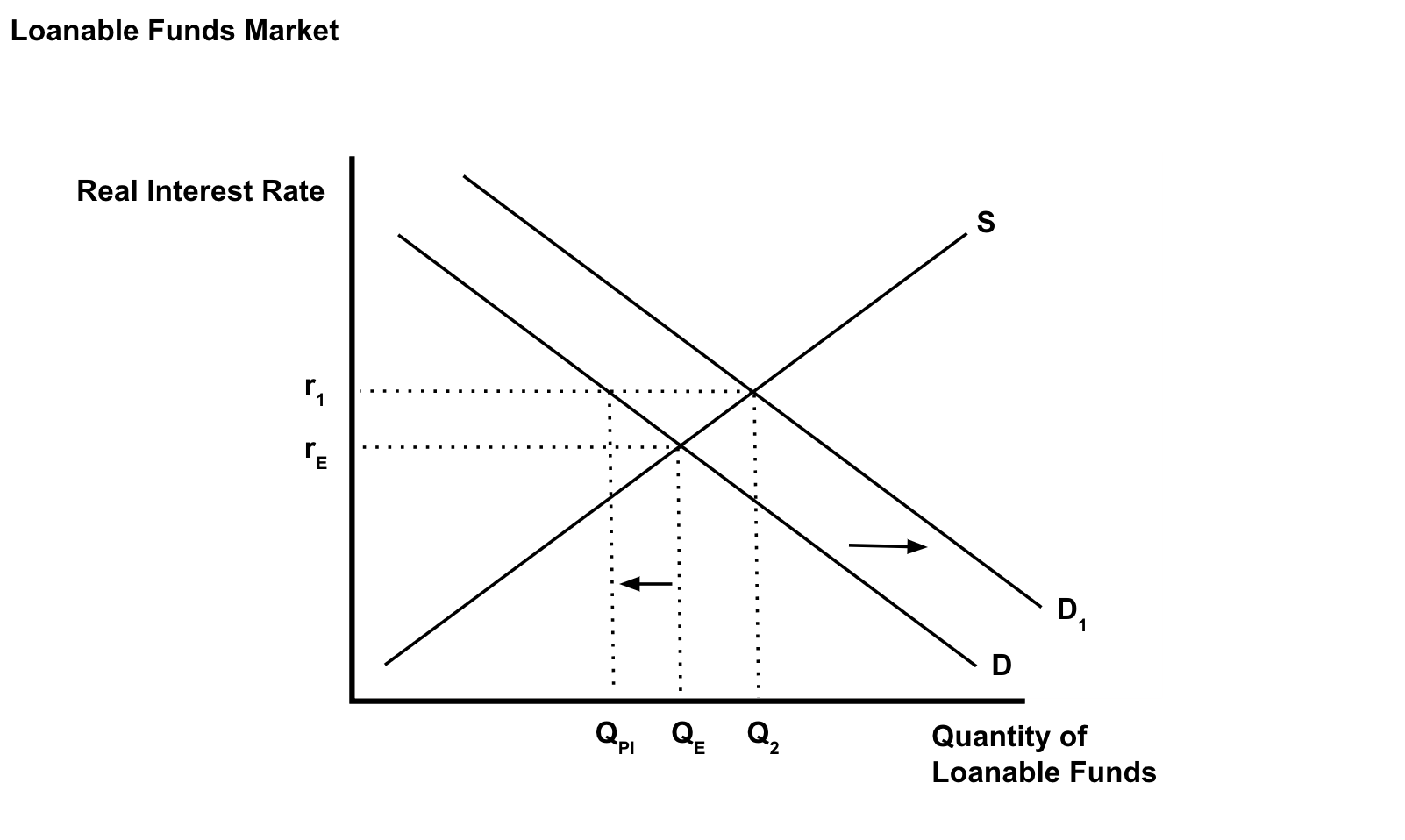

What is the long-run impact of higher real interest rates?

less economic growth because investment falls, less capital stock

23

New cards

Assume the government increases government spending -- what will happen to the demand for loanable funds, the real ir, and private domestic investment?

→ demand increases

→ real interest rate increases

→ private investment decreases

→ real interest rate increases

→ private investment decreases

24

New cards

Crowding Out

the adverse effect of government borrowing on interest-sensitive private sector spending

25

New cards

Which monetary policy would help accommodate or reinforce a contractionary fiscal policy?

sell bonds, increase reserve ratio, or increase discount rate

→ ir↑, bond prices↓

→ MS↓, bank reserves↓

→ quantity of loanable funds demanded by private sector↓

→ AD↓

→ ir↑, bond prices↓

→ MS↓, bank reserves↓

→ quantity of loanable funds demanded by private sector↓

→ AD↓

26

New cards

Which monetary policy would help accommodate or reinforce an expansionary fiscal policy?

buy bonds, decrease reserve ratio, or decrease discount rate

→ ir↓, bond prices↑

→ MS↑, bank reserves↑

→ quantity of loanable funds demanded by private sector↑

→ AD↑

→ ir↓, bond prices↑

→ MS↑, bank reserves↑

→ quantity of loanable funds demanded by private sector↑

→ AD↑

27

New cards

Real GDP Per Capita

the real GDP divided by the population

28

New cards

Growth Rate

the change in real GDP per capita over time

29

New cards

Why do some countries have more economic growth?

( 1 ) Economic System

( 2 ) Rule of Law

( 3 ) Capital Stock

( 4 ) Human Capital

( 5 ) Natural Resources

( 2 ) Rule of Law

( 3 ) Capital Stock

( 4 ) Human Capital

( 5 ) Natural Resources

30

New cards

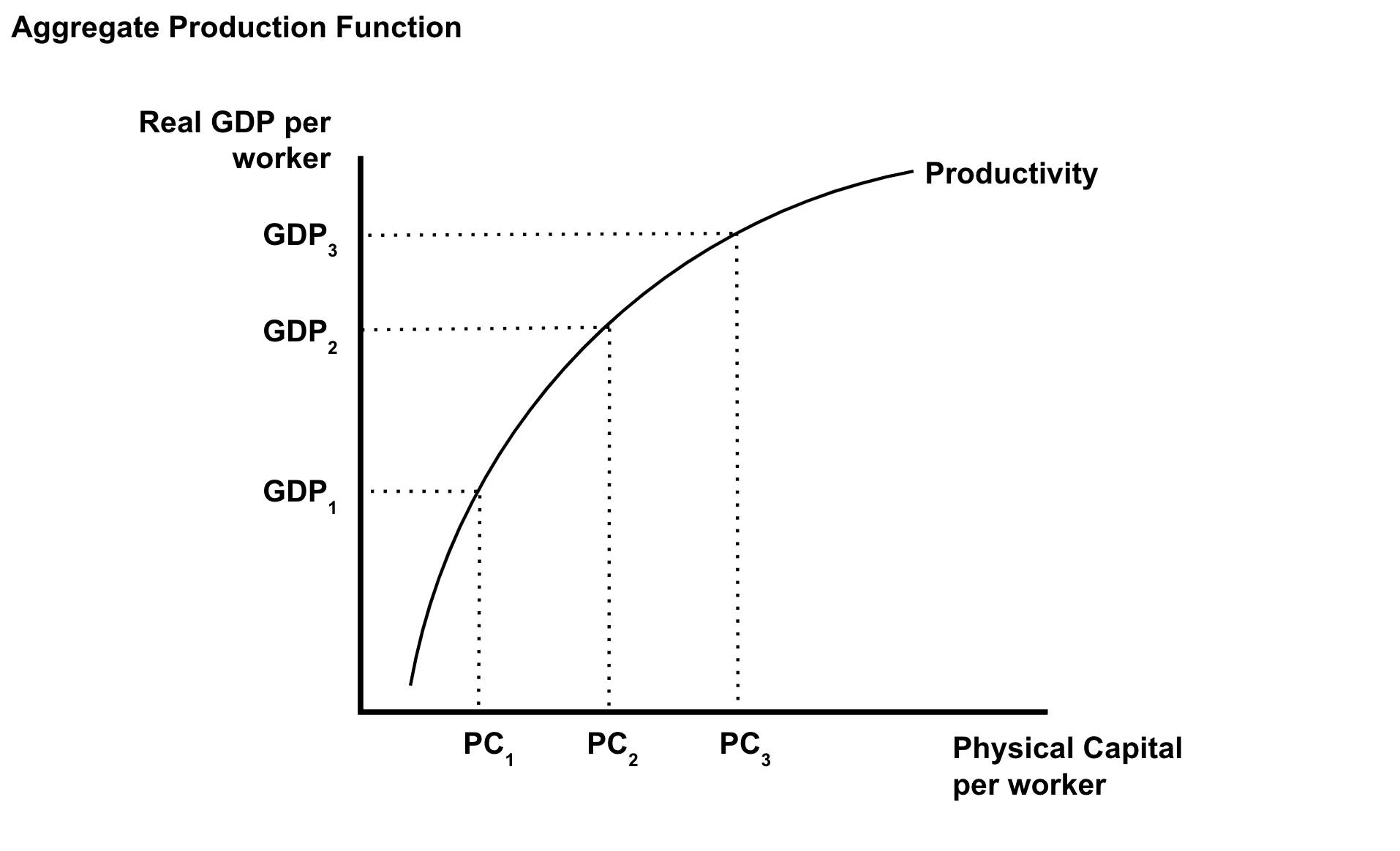

Productivity

output per unit of input

31

New cards

Capital Stock

machinery and tools purchased by businesses that increase their output

32

New cards

What government policies most likely result in long-run economic growth?

( 1 ) Education/training spending

→ increases human capital

( 2 ) Infrastructure spending

→ increases physical capital

( 3 ) Production/investment incentive programs

→ increases physical capital

→ increases human capital

( 2 ) Infrastructure spending

→ increases physical capital

( 3 ) Production/investment incentive programs

→ increases physical capital

33

New cards

Supply-side Fiscal Policies

government policies designed to increase production by reducing business taxes and/or regulations

34

New cards

Why are Supply-side Fiscal Policies controversial?

( 1 ) Providing tax breaks to businesses might disproportionately benefit the wealthy

( 2 ) It assumes that corporations will spend tax cuts on investment rather than pay out shareholders

( 2 ) It assumes that corporations will spend tax cuts on investment rather than pay out shareholders

35

New cards

Aggregate Production Function

36

New cards

What Shifts the Long-Run Phillips Curve?

anything that changes the natural rate of unemployment (LRAS)

37

New cards

Velocity of Money

the average number of times a dollar is spent and respent

38

New cards

When the economy is at full employment, why will an increase in the money supply have no effect on real output in the long-run?

an increase in money supply doesn’t change the amount of physical capital in the economy or the real output that can be produced

39

New cards

Difference Between the Budget Deficit and the National Debt

a budget deficit is the amount that the government overspends in a year, while the national debt is the total accumulated debt over the years from deficit spending

40

New cards

How does the existence of a large national debt affect government spending in the future?

future spending falls because the government must pay interest on the debt and will not have funds for alternative uses

41

New cards

What influences productivity?

( 1 ) Technology

( 2 ) Amount/quality of physical capital

( 3 ) Amount/quality of human capital

( 2 ) Amount/quality of physical capital

( 3 ) Amount/quality of human capital

42

New cards

What happens in the long-run when lower interest rates lead to more investment?

AD, SRAS, and LRAS shift to the right