Investment Appraisal Intro

1/3

Earn XP

Description and Tags

Financial manager primary goal is to maximize shareholders wealth. In doing so, financial manager focus on three specific tasks: Capital budgeting Capital structure Working capital management

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

4 Terms

Capital Budgeting

the process of planning and managing firm’s long-term investments

- Identifying investment opportunities

- Valuing the cost (cash outflow) and benefit (cash inflow) to decide investment opportunity or not

- When evaluating an investment opportunity identifying the timing of the cash flow is also important

- Often firm shortlist investment opportunities based on the nature of the firm’s business

Capital Structure

the mixture of long-term debt and equity maintained by a firm

Ø What proportion of long-term debt and equity the firm will use to finance its investment opportunities.

Long-term debt: when firm borrow longer than one year to

finance its long-term investment.

Equity: the amount of money the shareholders invest into the

firm by buying its shares.

Ø In capital structure financial manager focuses on answering

two questions –

1. How much should the firm borrow?

2. What are the least expensive sources of funds for the firm?

Working Capital Management

managing a firm’s short term assets and liabilities

Ø Short-term assets: inventories, cash, account receivables.

Ø Short-term liabilities: account payables, accrued expenses,

tax payable.

Ø manager focuses on how to manage day-to-day business

activities by ensuring that firm has sufficient resources to continue its operations.

e.g. cash on the till so that there is available change when

customers pay in cash.

Ø the firm can avoid costly interruptions.

Ø if the firm did not pay it suppliers on time then supplier might

not supply before receiving money which might cause

disruption in the production and lost labour hours

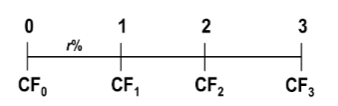

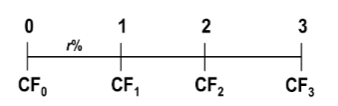

Time line of cash flows

Tick marks at the end of the periods

- Time “0" is today

- Time “1" is the end of period 1

+CF indicates positive cash flow

–CF indicates negative cash flow

8 / 39