AP MACRO EXAM PREP

1/54

Earn XP

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

55 Terms

Economics

The social science that studies how individuals and societies allocate scarce resources to satisfy unlimited needs and wants.

Scarcity

A fundamental economic problem of having seemingly unlimited human wants in a world of limited resources.

Opportunity Cost

The value of the next best alternative that is forgone when a choice is made.

Production Possibility Curve (PPC)

A graphical representation that shows the maximum possible output combinations of two goods that can be produced with available resources.

Productive Resources

The inputs used in the production of goods and services, including land, labor, capital, and entrepreneurship.

Absolute Advantage

The ability of a party to produce more of a good or service with the same amount of resources than another party.

Based on raw data before calculations

Comparative Advantage

The ability of a party to produce a good or service at a lower opportunity cost than another party.

There will typically be 2 products that both countries produce. When doing opp cost, put cost of one product over the other product (undesired/desired)

EX: If Country A can produce 10 apples or 5 oranges, its opportunity cost of producing one orange is 2 apples. Conversely, if Country B can produce 8 apples or 4 oranges, its opportunity cost of producing one orange is 2 apples as well.

Law of Supply

Price & Supply = DIRECT relationship

as price increases, supply increases and vice versa.

Law of Demand

Prices & Demand = INVERSE relationship

As the price of a good decreases, the quantity demanded increases, and vice versa.

Equilibrium Price

The price at which the quantity demanded equals the quantity supplied.

Elasticity vs Inelasticity

Elasticity: Demand moves “freely” →CHOICE

Inelasticity: Demand does NOT move → NO CHOICE

Terms of Trade

The ratio at which one good can be exchanged for another, which must be mutually beneficial for both parties involved.

“Middle-ground” between opportunity costs

Artififical P Factor Models

These are theoretical frameworks that attempt to define and quantify the impact of price factors on the supply and demand in a market, often used to assess market efficiency.

Price Floor: UNofficial price ABOVE “E”; QD<QS = SURPLUS

Price Ceiling: BELOW “E”; QS < QD = SHORTAGE

Exact Amount

Difference between QD and QS

Determinants of Supply and Demand

Factors that influence the quantity of a good or service that producers are willing to supply and consumers are willing to purchase.

Supply: 1) changes in # of suppliers, 2) changes in tech, 3) changes in resource quality/availability, 4) changes in govt regulations, 5) expected future prices

Demand: 1) changes in consumer income (normal: brand name vs inferior: off-brand), 2) changes in consumer preferences, 3) changes in prices of related goods (substitute & complementary goods → INVERSE demand & DIRECT demand), 4) changes in population, 5) expected future prices.

What are the main problems in economy?

Increase in UNemployment %

Inflation %

3 Economic Theories

Classical/Austrian-School:

Free-market, Markets will self-correct, laissez-faire, concerned about LONG-RUN (Long-Run Self-Adjustment → LR Self-Adjustment)

Keynesian:

GOVERNMENT to fix economy, birth of deficit spending AKA increase in national debt, Great Depression, concerned about SHORT-RUN

Monetarism:

Aggregate Demand (AD)

Total/national Demand for ALL finished goods & services

How does AD SHIFT?

GDP! (ΔC/I/G/X/-M)

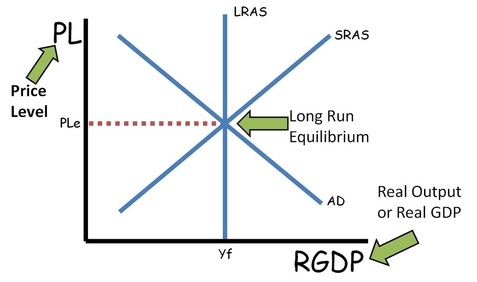

What is an AS/AD model?

LRAS = Long-Run Aggregate Supply

SRAS = Short-Run Aggregate Supply

AD = Aggregate Demand

Yfe = Full employment

Long-Run vs Short-Run EQUILIBRIUM

LR Equilibrium = AD, SRAS, LRAS all in the MIDDLE/line up to Yfe

SR Equilibrium = NOT in the middle (AD crosses on SRAS middle)

OUTput vs INflationary Gap

OUTput gap = LEFT gap from equilirbium

INflationary gap = RIGHT gap from equilibrium

Fiscal Policy

OUTput gap = EXPANSIONARY fiscal policy (INCREASE Govt Spending OR DECREASE taxes)

INflationary gap = CONTRACTIONARY fiscal policy (DECREASE Govt Spending OR INCREASE taxes)

INCREASING G > DECREASING Taxes (Multiplier is BIGGER)

Fiscal Policy Formulas

MPC (marginal propensity to consume) = ΔC/ΔY → $Spent/$Given OR Have

MPC + MPS (marginal propensity to save) ≡ 1

G(x) (Govt Multiplier) = 1/1-MPC

T(x) (Tax Multiplier) = MPC/1-MPC

Can an increase in Govt spending change the NATURAL rate of unemployment?

NO; There will ALWAYS be a NATURAL rate of unemployment

How to find MPC from table:

find ΔY & ΔC from base values” AKA don’t worry about the thousands

EX:

ΔY ΔC

18 (,000) 19(,000)

22 (,000) 22(,000)

26 (,000) 25(,000)

ΔY = 8; ΔC = 6

→ 6/8 → MPC = 0.75

Do other countries’ income affect others?

YES!

If the countries are trading with each other, GDP is affected

EX:

Japan’s Income DECREASED, Demand for IMPORTS DECREASED → U.S.’ Aggregate Demand DECREASES for EXPORTS, GDP DECREASES

What do you do when both EXPANSIONARY & CONTRACTIONARY policy are applied?

Find the difference between the multiplied values

EX:

(-) $100B in G & (-) $100B in Taxes; MPC: 0.8, MPS: 0.2

G(x) = 1/0.2 = 5

T(x) = 0.8/0.2 = 4

$500B - $400B = $100B

Government DECREASED $100B

Aggregate Supply (AS)

TOTAL supply of G&S in an economy aka EVERY PRODUCER COMBINE

How does AS move?

NORMAL Supply shifts

LRAS (Long-Run Aggregate Supply)

@FULL employment/Efficient & MAX capacity (similar to PPC curve)

NOT temporary (will take long)

CHANGES if ECONOMY changes:

↑/↓ Capital

↑/↓Labor Force Size (ppl)

↑/↓Tech

↑/↓Human Capital (degree)

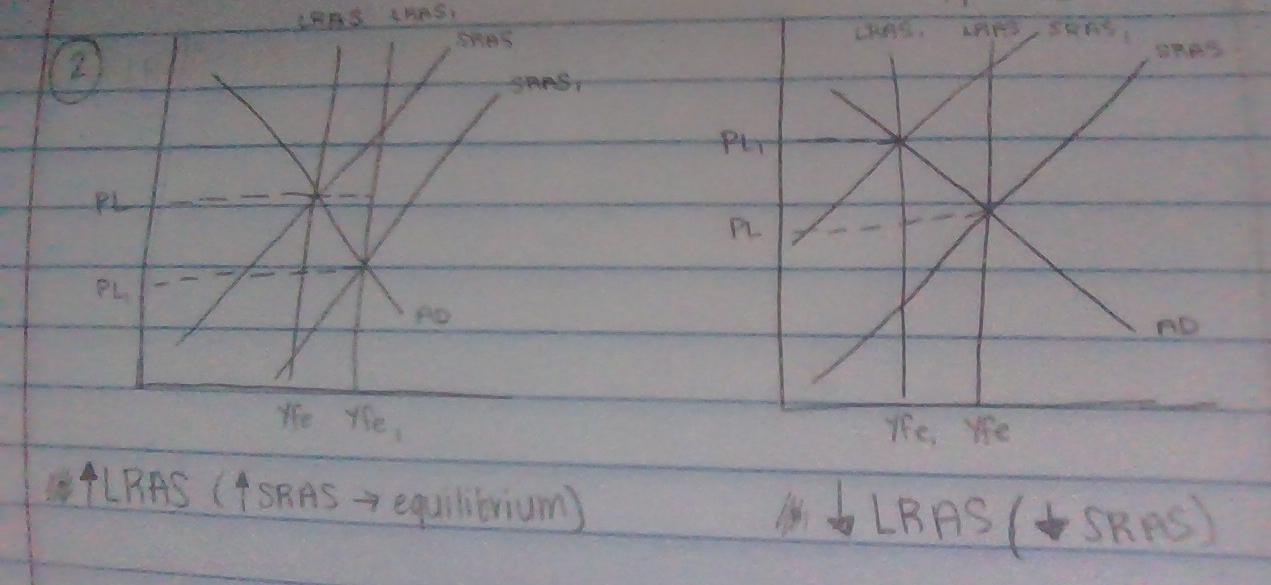

What happens when ↑/↓ LRAS?

↑ LRAS (↑ SRAS → equilibrium → ↓PL)

↓ LRAS (↓ SRAS → equilibrium → ↑PL)

SRAS (Short-Run Aggregate Supply)

TEMPORARY

typically from ↑ UNemployment % OR ↑ Inflation %

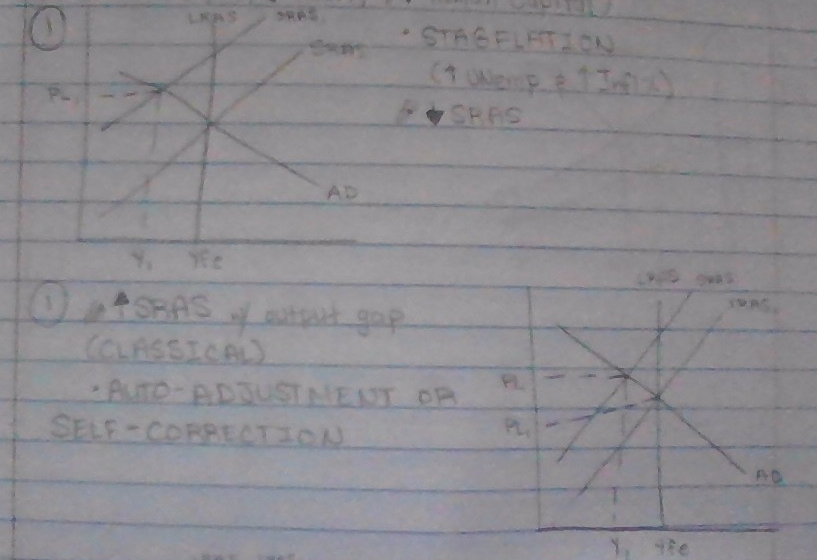

What happens when ↑/↓ SRAS

↓ SRAS → STAGFLATION (↑UNemp & ↑ Infl)

ALSO called (-) supply shock

↑ SRAS → Auto-Adjustment/Self-Correction

When given a table of SAVINGS

CALCULATE MPS!!

EX:

Savings: 2,000 → 2,200

Disposable Income: 10,000 → 12,000

(2,200-2,000)/(12,000-10,000) = 0.1 (MPS) → MPC = 0.9

When do I multiply or divide the multiplier?

MULTIPLY:

Finding TOTAL Δ AD or MAXIMUM Δ

DIVIDE:

Finding MINIMUM Δ AD

Automatic Stablizers

mechanisms built into budget that keep economy from going from 100% → 0% (EX: tax rate, welfare, UNemployment insurance/$$)

FISCAL policies

When PL ↓…

Nominal wages ↓

Monetary Policy

Central bank actions to control money supply and interest rates (to fight UNemployment & Inflation)

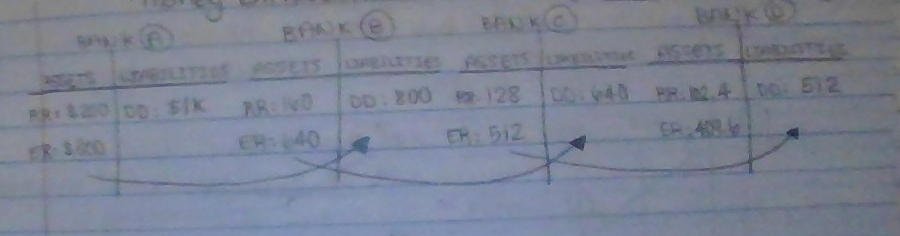

Money Multiplier

mm = 1/Reserve Ratio

Multiply: to find MAXIMUM change in Money Supply (MS)

Divide: to find MINIMUM change in Money Supply (MS)

Expansionary vs Contractionary Monetary Policy

Expansionary: INCREASES MS —> DECREASE interest rates —> INCREASES PL (price levels)

BUY bonds in O.M.O (open market operations), DECREASE discount rate & reserve requirement

Contractionary: DECREASES MS —> INCREASE interest rates —> DECREASES PL (price levels)

SELL bonds in OMO, INCREASE discount rate & reserve requirement

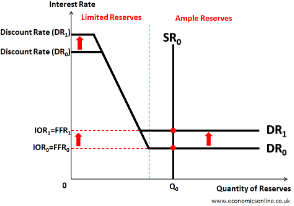

Limited Reserves

banks are REQUIRED to have a reserve requirement (RR%) and/or excess reserves (ER)

What are bonds?

Temporary loan to a firm/government to earn i% (interest rates) OVERTIME (money will GROW/SLOW)

Relationship between bonds and i%

INVERSE!! As interest rates RISE, bond prices FALL and vice versa

M0 - M3

M0 (monetary base/money base): CASH & deposits @FED (federal reserve/central bank)

M1: M0 + savings acct

M2: M1 + SMALL deposits ($ < 100K)

M3: M2 + LARGE deposits (100K +)

MOST liquid to LESS liquid

Fractional Reserve Banking

KEEP fraction of $, REST is loaned with i%

Bank to bank loan each other EXCESS RESERVES

RR (required reserve): percentage of money deposited in acct

“NEW” $: bonds, NOT cash; MS will change by 100%

“OLD” $: CASH; MS will change by MAXIMUM $ - original

Liabilities: OWED $

Assets: OWNS $

Loanable Funds Market

THEORY

LFS (Loanable Funds Supply) shifts when:

↑/↓ household savings

↑/↓ business profit

↑/↓ Govt surplus

↑/↓ foreign invest

LFD (Loanable Funds Demand) shifts when:

↑/↓ household consumption

↑/↓ business spending

↑/↓ Govt spending

↑/↓ foreign demand

Affects BOTH r% (real interest rates) & $ of loans

#1 Example of LFM (Loanable Funds Market)

Govt crowding out

Real = …

nominal i% - expected inflation = real (adjusted for inflation)

↑/↓ Capital Formation/Shock

↑/↓ Long-run growth = ↑/↓ investment

Ample Reserves

keep reserves @ FED/earn i%; RR = 0% {post 2008 econ. crisis)

Shift Demand?

↑/↓ IOR (interest on reserves): interest rates that FED pays banks to KEEP reserves

↑ IOR = ↓ Demand (EXPANSIONARY)

↓ IOR = ↑ Demand (Contractionary)

Δ (X-M) =

Δ AD

↑ X/ ↓M = ↑ AD

↓ X/ ↑M = ↓ AD

F.O.R.E.X.

currency exchange/global transactions happen every milisecond

Exchange Rate

the price of 1 nation’s currency in terms of another

SIMPLER WORDS: How much of their $ will my $ buy?

2 Different Types of Currency Value

1) Appreciation (+): currency is STRONGER, ↓ X (- AD)/↑M OR ↑ r (real interest rates) —> inflow

2) Depreciation (-): currency is WEAKER, ↑X (+ AD)/ ↓M OR ↓ r —> outflow