Unit 4 ; The Financial Sector, Money, and Monetary Policy

5.0(2)

Card Sorting

1/44

Earn XP

Description and Tags

Last updated 4:08 AM on 2/21/23

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

45 Terms

1

New cards

Identify the reasons why our money has value

It is accepted by other people for goods and services.

It holds it’s value, stability with predictable levels of inflations

It holds it’s value, stability with predictable levels of inflations

2

New cards

Describe functions of money

Medium of exchange

Store of Value

Unit of accounting

Store of Value

Unit of accounting

3

New cards

Explain the definitions of money used in the U.S. (M1, M2)

M1 = physical money (cash and coins), checkable deposits (aka demand deposits or checking accounts), travelers checks

\

M2= M! + savings accounts, money market accounts, time deposits under $100,000.

\

M3= M2 + time deposits over $100,000.

\

M2= M! + savings accounts, money market accounts, time deposits under $100,000.

\

M3= M2 + time deposits over $100,000.

4

New cards

Explain the concept of near monies

M2 and M3 are both near monies because they have a definite intrinsic value but cannot be immediately spent, must be liquidated to spend.

Benefit is better interest growth.

Benefit is better interest growth.

5

New cards

Define the variables in the equation of exchange. (MV = PQ)

MV = PQ (both must be equivalent to eachother)

\

M = money supply (M1)

V = velocity of money, how many times a dollar moves in the economy

\

P = average price level

Q = Quantity of output of all goods and services

\

M = money supply (M1)

V = velocity of money, how many times a dollar moves in the economy

\

P = average price level

Q = Quantity of output of all goods and services

6

New cards

Explain how changes in the money supply are translated into changes in nominal GDP, prices and output.

When money supply grows, interest rates drop, investment and consumption go up (AD)

When AD increases GDP, Price, and Output all go up. Reserve effect of AD decreases

When AD increases GDP, Price, and Output all go up. Reserve effect of AD decreases

7

New cards

Explain the fractional reserve system (how banks “create money”)

When money is deposited to banks they lend a portion of it out (excess funds) and hold a portion to be available to cover withdrawals (required reserves)

This occurs over and over effectively multiplying the amount of money deposited.

This occurs over and over effectively multiplying the amount of money deposited.

8

New cards

Explain the process by which banks create or destroy money and the factors that affect the increase or decrease in the money supply

By holding onto money as reserves and not lending it, its not multiplied out

Banks can also purchase treasury securities (bonds) from the Fed which also takes money out of the supply. Works in reverse too.

Banks can also purchase treasury securities (bonds) from the Fed which also takes money out of the supply. Works in reverse too.

9

New cards

Define the required reserve ratio, required reserves, excess reserves, and deposit expansion multiplier

__Required Reserves Ratio__: % of every dollar a bank must hold and not lend

__Required Reserve__: Amount of money held that cannot be lent

__Excess Reserve__: Amount of money that can be lent out

__Deposit Expansion Multiplier__: 1/RR is the expected amount of money to be grown through fractional reserve banking

__Required Reserve__: Amount of money held that cannot be lent

__Excess Reserve__: Amount of money that can be lent out

__Deposit Expansion Multiplier__: 1/RR is the expected amount of money to be grown through fractional reserve banking

10

New cards

Tools of the Fed

Adjusting __reserve requirement__ - (very powerful) but will allow for change to multiplier effect

Adjusting the __Discount Rate__ - Interest charged to banks that borrow money from the Fed, signals to banks if it’s a good time to loan more $

__Open market operations__ - Used often, buying and selling of government securities (bonds)

Adjusting the __Discount Rate__ - Interest charged to banks that borrow money from the Fed, signals to banks if it’s a good time to loan more $

__Open market operations__ - Used often, buying and selling of government securities (bonds)

11

New cards

Discuss the motive for holding assets as money

Very stable in value, not increasing but also not dropping during economic downturns.

Real estate does grow over long time amounts but does occasionally drop temporarily

Real estate does grow over long time amounts but does occasionally drop temporarily

12

New cards

Identify the factors that cause the demand for money to shift and explain why the shift occurs

1. Changes to price levels (cost more/ less to buy stuff)

2. Changes to income levels

3. Changes to interest rates (encourage or discourage borrowing → spending)

4. Changes in wealth of assets

5. Changes in future expectations

13

New cards

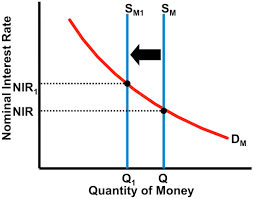

Explain how interest rates are determined in the money market

14

New cards

Explain how interest rates affect monetary policy

The Fed examines the economic status to try to correct problems (unemployment or inflation) then adjust the money supply to impact interest rates to stimulate or contract AD.

15

New cards

Explain the relationship among the real interest rate the nominal interest rate and the inflation rate. This is known as the Fisher Equation

Nominal is what we see on a daily basis in banks, there is inflation in this rate

Real excludes inflation and used on loanable funds graph by banks to determine their own interest rates

Fisher equation: Nominal Interest Rate - Inflation Rate = Real Interest Rate

Real excludes inflation and used on loanable funds graph by banks to determine their own interest rates

Fisher equation: Nominal Interest Rate - Inflation Rate = Real Interest Rate

16

New cards

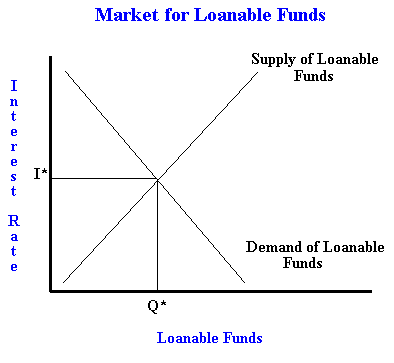

Explain loanable funds money

Used to show how bans determine the interest rates.

Bases on Supply (saver) and demand (debtors/borrowers)

Equilibrium is the interest rate

Bases on Supply (saver) and demand (debtors/borrowers)

Equilibrium is the interest rate

17

New cards

What is crowding out within loanable funds and how can monetary policy correct this

Result of expansionary FISCAL POLICY that increases interest rates (high Gov’t demand on loanable funds). Private investment drops (bad for GDP and future growth)

Expansionary Monetary (adding money into the economy) will lower the interest rates back down and encourage private investment (with cheaper interest rates)

Expansionary Monetary (adding money into the economy) will lower the interest rates back down and encourage private investment (with cheaper interest rates)

18

New cards

Define Financial Sector

The part of the economy made up of institutions (like banks) that focus on pairing lenders and borrowers.

19

New cards

Define Assets

Any item of economic value that can be converted into cash. Something owned

20

New cards

Define Liabilities

A legal or financial obligation that must be paid back. Something owed

21

New cards

Define Liquidity

The ease in which asset can be converted into medium of exchange. Cash and money in checking accounts is very liquid. A car or a home is not.

22

New cards

Three Functions of Money

1. A Medium of Exchange -Money can easily be used to buy goods and services. Dont have to barter

2. Unit of Account - Money measured the value of goods and services and measures value

3. Store of Value - Money allows you to store purchasing power for the future

23

New cards

Types of Money; Commodity Money

Something that performs the function of money and has an alternative use (ex: mark in prison)

24

New cards

Types of Money; Fiat Money

Something used for exchange but has no other important use (ex: $20 bill)

25

New cards

What is the transaction demand for money?

People demand money to make everyday purchases. This is not affected by the interest rate

26

New cards

What is the asset demand for money?

When people demand as a liquid asset because they prefer it to other non-liquid assets like bonds

27

New cards

Interest rates ↑, then quantity of money demanded ______

↓

28

New cards

Interest rates ↓, then quantity of money demanded ______

↑

29

New cards

Shifters of Money Demand

1. Changes in prices level - Inflation requires consumer o hold more cash for financial transactions

2. Changes income - Sustained economic growth in the economy leads to an increase in the demand for money

3. Changes in taxation that affects personal investment - Government policies such as changing the capital gains tax would change the demand for money

30

New cards

Shifters of Money Supply

1. Reserve ratio- the percent of deposits that bank must hold in reserve (the % they can NOT loan out)

1. To increase money supply, decrease the reserve ratio

2. To decrease money supply, increase the reserve ratio

2. Discount Rate - The interest rate that the FED charges commercial banks

1. To increase money supply, decrease discount rate

2. To decrease money supply, increase discount rate

3. Open Market Operations - when the FED buys or sells government bonds (securities)

1. To increase money supply, the FED buys bonds

2. To decrease money supply, the FED sells bonds

31

New cards

Unexpected inflation causes the demand for money to _ and the interest rate to _ .

Unexpected inflation causes the demand for money to INCREASE and the interest rate to INCREASE.

32

New cards

If the supply of money increases, the interest rate will _ and investment will _

If the supply of money increased, the interest rate will DECREASE and investment will INCREASE

33

New cards

True or False: When the interest rate is high, the opportunity cost of holding money increases so the quantity of money demanded will decrease.

True

34

New cards

True or False: The money supply includes all assets like cash, demand deposits, bonds, and real estate.

False

35

New cards

True or False: Monetary policy is when the central banks changes the interest rates by changing the money supply

True

36

New cards

What is the Federal Reserve and what does it do?

The Fed is the central bank of the US and it regulates commercial banks and adjust the money supply to adjust interest rates to meet economic goals. This is called Monetary Policy

37

New cards

Money Multiplier Equation

1/ Reserve Requirement

\

Ex: Assume reserve requirement is .10. If the Fed buys $10 billion worht of bonds money supply will increase by $100billion

(1/.10) \*10 =100

\

Ex: Assume reserve requirement is .10. If the Fed buys $10 billion worht of bonds money supply will increase by $100billion

(1/.10) \*10 =100

38

New cards

What is bond maturity?

A borrower issues a bond that must be paid back by a certain amount of time. That time is its maturity. A bond can be sold early at an agreed upon price.

39

New cards

Define Fractional Reserve Banking

Process where banks hold a portion of deposits in reserve and loan the rest of the money out.

40

New cards

Define excess reserves

The amount banks are legally free to loan out. Excess reserves and required reserves make up total reserve.

41

New cards

Define demand deposits

Banks deposits that can be withdrawn at anytime (ex: checking accounts)

42

New cards

Define Owner’s Equity

The amount of money owners have put into a company or bank. It doesn’t need to be held in reserve

43

New cards

Shifters of Demand for Loanable Funds

1. Changes in perceived business opportunities

2. Changes in government borrowing

44

New cards

Shifters of Supply for Loanable Funds

1. Changes in private savings behavior

2. Changes in public savings

3. Changes in foreign personal investment

4. Changes in expected profitability

45

New cards

What happens to the real interest rate if the government runs a deficit?

Demand increases so interest rate increase