Chapter 12: Managing Employee Benefits

0.0(0)

Card Sorting

1/39

Earn XP

Description and Tags

Study Analytics

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

40 Terms

1

New cards

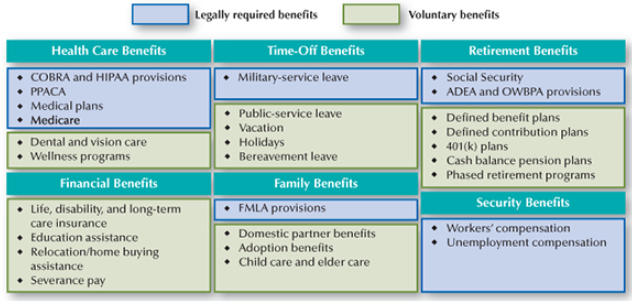

Types of Benefits

2

New cards

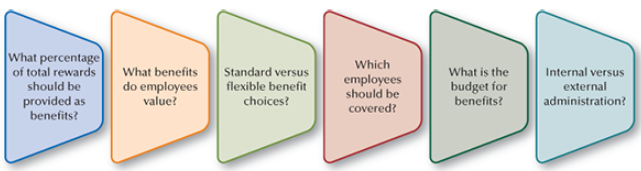

Benefit Design Decisions

3

New cards

Flexible Benefit Plan

A program that allows employees to select the benefits they prefer from options established by the employer

4

New cards

Adverse Selection

A situation in which only higher-risk employees select and use certain benefits

5

New cards

Open Enrollment

A time when employees can change their participation level in various benefit plans and switch between benefit options

6

New cards

Third-Party Administrators (TPAs)

Vendors that provides enrollment, recordkeeping, and other administrative services to organizations

7

New cards

Self-Service

Technology that allows employees to enroll in and change their benefit choices, track their benefit balances, and submit questions to HR staff members and external benefit providers

8

New cards

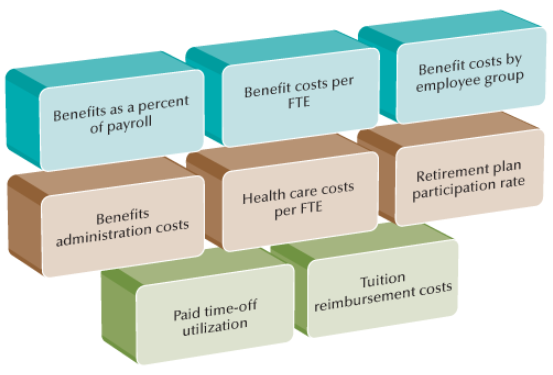

Frequently Used Benefit Metrics

9

New cards

Legally Required Benefits

* **Social Security Act of 1935:** Provides old age, survivor’s, disability, and retirement benefits

* Funded by both employees and employers through a tax on employees’ wages or salaries

* Amount of wages subject to tax is reviewed and increased periodically

* **Medicare:** Government-operated health insurance for Americans aged 65 and above and for some citizens with disabilities

* Funded by a tax on employers and employees

* Long-term viability of funding is in question

* Funded by both employees and employers through a tax on employees’ wages or salaries

* Amount of wages subject to tax is reviewed and increased periodically

* **Medicare:** Government-operated health insurance for Americans aged 65 and above and for some citizens with disabilities

* Funded by a tax on employers and employees

* Long-term viability of funding is in question

10

New cards

Workers’ Compensation

Security benefits provided to workers who are injured on the job

11

New cards

Concepts Under Workers’ Compensation

* **No-Fault Insurance:** Injured worker receives benefits even if the accident was the worker’s fault

* **Exclusive Remedy:** Workers’ compensation benefits are the only benefits injured workers may receive from the employer to compensate for work-related injuries

* **Exclusive Remedy:** Workers’ compensation benefits are the only benefits injured workers may receive from the employer to compensate for work-related injuries

12

New cards

Unemployment Compensation

Established as part of the Social Security Act of 1935. Provides a minimum level of benefits for workers who are out of work. Each state operates its own system, so benefits differ by state

* Out-of-work and actively-looking employees can receive up to 26 weeks of pay at the rate of 50 - 80% of normal pay

* Out-of-work and actively-looking employees can receive up to 26 weeks of pay at the rate of 50 - 80% of normal pay

13

New cards

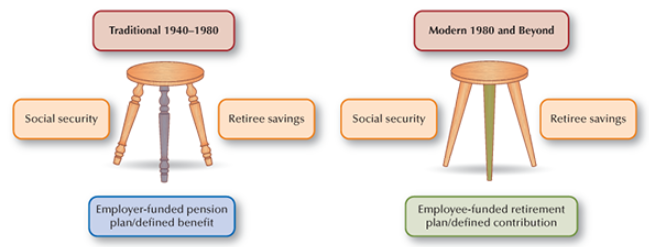

The 3-Legged Stool of Retirement Income

A model showing the three sources of income to fund an employee’s retirement

14

New cards

Vesting

A right that gives employees a benefit that cannot be taken away

15

New cards

Portability

A pension plan feature that allows employees to move their retirement benefits from one employer to another

16

New cards

Retirement Plan

A program established and funded by the employer and/or employees to fund employees’ retirement years. Organizations are not required to offer this to employees beyond contributions to Social Security

17

New cards

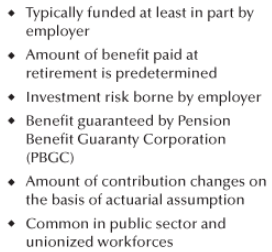

Defined Benefit Plan

Employees are promised a pension amount based on age and years of service

18

New cards

Defined Contribution Plan

Employer and/or employee makes an annual payment to an employee’s retirement account

19

New cards

401(k) Plan

Allows for a percentage of an employee’s pay to be withheld and invested in a tax-deferred account

* **Auto-enrollment:** Employee contributions are started automatically when an employee is eligible to join the plan

* **Auto-escalation:** Automatic increases of 1% a year

* **Auto-enrollment:** Employee contributions are started automatically when an employee is eligible to join the plan

* **Auto-escalation:** Automatic increases of 1% a year

20

New cards

Employee Retirement Income Security Act (ERISA)

Ensures that private pension plans and other plans governed by this act meet minimum standards. Requires plans to periodically provide participants with information about plan features, funding, and benefit accrual amounts

21

New cards

Age Discrimination in Employment Act (ADEA)

A 1986 amendment to this act states that most employees cannot be forced to retire at a specific age

22

New cards

Older Workers Benefit Protection Act (OWBPA)

Enacted as an amendment to the ADEA. Requires equal treatment for older workers in early retirement or severance situations. Sets specific criteria that must be met if older workers are asked to sign waivers promising not to sue for age discrimination in exchange for severance benefits during layoffs

23

New cards

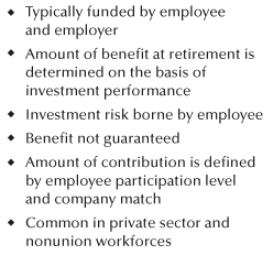

Patient Protection and Affordable Care Act (PPACA)

Provisions were phased in over several years, culminating in universal coverage in 2014. Includes many important provisions intended to provide affordable health care for all citizens

24

New cards

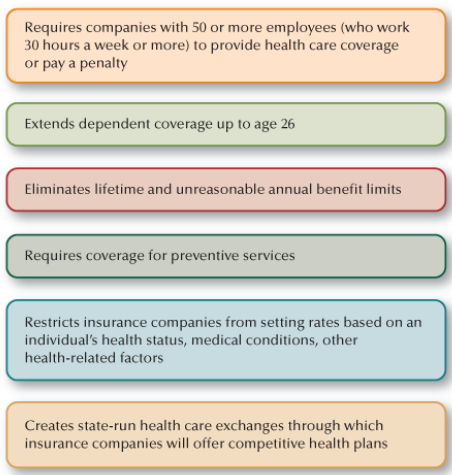

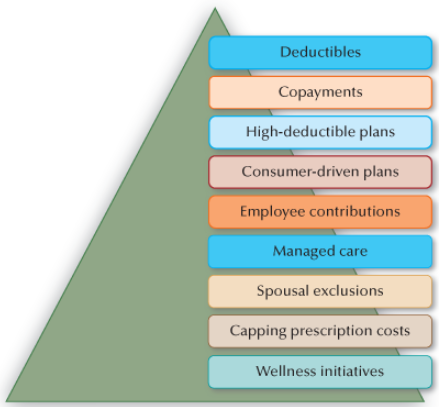

Health Care Cost Control Measures

25

New cards

Deductible

Money paid by an insured individual before a health plan pays for medical expenses

26

New cards

Copayments

Portion of medical expenses paid by an insured individual for medical treatment

27

New cards

Health Spending Account

A tax-favored savings plan to provide funds for paying medical expenses. These plans are subject to a number of regulations and limits and are available only to individuals in high-deductible health care plans

28

New cards

Consumer-Driven Health (CDH) Plan

A health plan that provides employer financial contributions to employees to help cover their health-related expenses

29

New cards

Managed Care

Consists of approaches that monitor and reduce medical costs through restrictions and market system alternatives. Emphasize primary and preventive care, the use of specific providers that charge lower prices, restrictions on certain kinds of treatment, and prices negotiated with hospitals and physicians

30

New cards

Well-Being

The overall level of employee physical, mental, financial, and social wellness

31

New cards

COBRA Provisions

Stands for Consolidated Omnibus Budget Reconciliation Act. Requires that most employers with 20 or more full-time and/or part-time employees offer extended health care coverage to certain groups of plan participants. These qualified beneficiaries are as follows:

* Employees who voluntarily quit or are terminated

* Widowed or divorced spouses and dependent children of former or current employees

* Retirees and their spouses and dependent children whose health care coverage ends

* Any child who is born or adopted by a covered employee

* Other individuals involved in the plan such as independent contractors and agents/directors

* Employees who voluntarily quit or are terminated

* Widowed or divorced spouses and dependent children of former or current employees

* Retirees and their spouses and dependent children whose health care coverage ends

* Any child who is born or adopted by a covered employee

* Other individuals involved in the plan such as independent contractors and agents/directors

32

New cards

Qualifying Events

An event that causes a plan participant to lose group health benefits

* Examples: reduction in work hours, divorce, death

* Examples: reduction in work hours, divorce, death

33

New cards

HIPPA Provisions

Allow employees to switch their health insurance plans when they change employers. Require employers to:

* Provide privacy notices to employees

* Carefully store sensitive employee personal information

* Not disclose employee health information without authorization

* Provide privacy notices to employees

* Carefully store sensitive employee personal information

* Not disclose employee health information without authorization

34

New cards

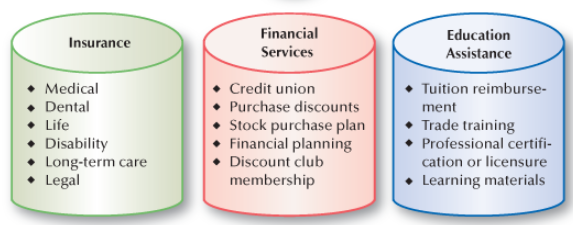

Common Types of Financial Benefits

35

New cards

Family and Medical Leave Act (FMLA)

Enacted in 1993. Provides for unpaid leave. Covers:

* All federal, state, and private employers with 50 or more employees who live within 75 miles of the workplace

* Employees who have worked at least 12 months and 1,250 hours in the previous year

* All federal, state, and private employers with 50 or more employees who live within 75 miles of the workplace

* Employees who have worked at least 12 months and 1,250 hours in the previous year

36

New cards

FMLA Requirements

Requires employers to allow eligible employees to take a maximum of 12 weeks of unpaid, job-protected leave during any 12-month period for the following situations:

* Birth of a child and care for the newborn within one year of birth

* Adoption or foster care placement of a child

* Caring for a spouse, child, or parent with a serious health condition

* Serious health condition of the employee

* Military family members who must handle the affairs for military members called to active duty

* 26 weeks leave to care for a military servicemember injured while on active duty

* Birth of a child and care for the newborn within one year of birth

* Adoption or foster care placement of a child

* Caring for a spouse, child, or parent with a serious health condition

* Serious health condition of the employee

* Military family members who must handle the affairs for military members called to active duty

* 26 weeks leave to care for a military servicemember injured while on active duty

37

New cards

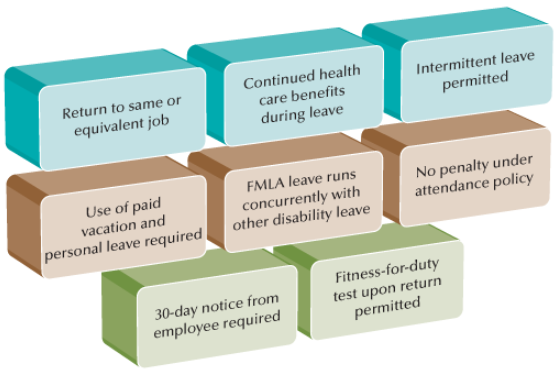

Guidelines Regarding FMLA Administration

38

New cards

Family-Care Benefits

* Adoption and fertility benefits

* Child-care assistance

* Elder-care assistance

* Child-care assistance

* Elder-care assistance

39

New cards

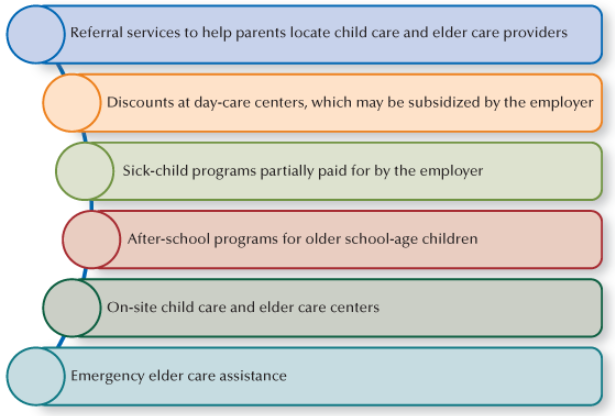

Child Care and Elder Care Programs

40

New cards

PTO Benefits

* Vacation and holiday leave

* Leaves of absence

* Family leave

* Sick leave

* PTO plans

* Employee-paid group benefits

* Leaves of absence

* Family leave

* Sick leave

* PTO plans

* Employee-paid group benefits