Unit 6: Credit

1/37

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

38 Terms

Good Debt

debt that will improve your financial situation over time. (ex: mortgages, student loans, etc)

Bad Debt

debt that will not help improve your financial situation over time. (credit cards, personal loans, etc.)

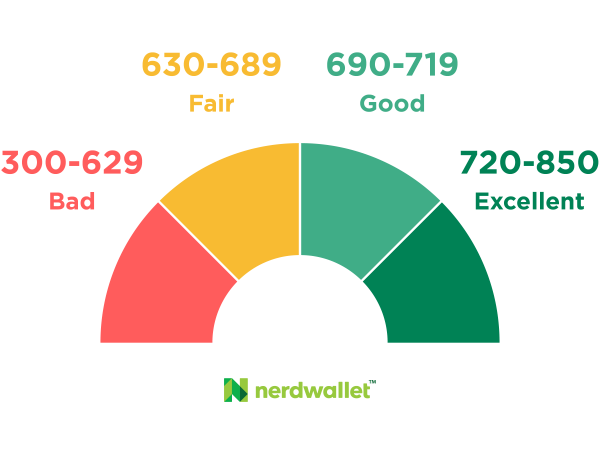

Credit Score

this score shows how likely you are to pay loans back. The higher the better!

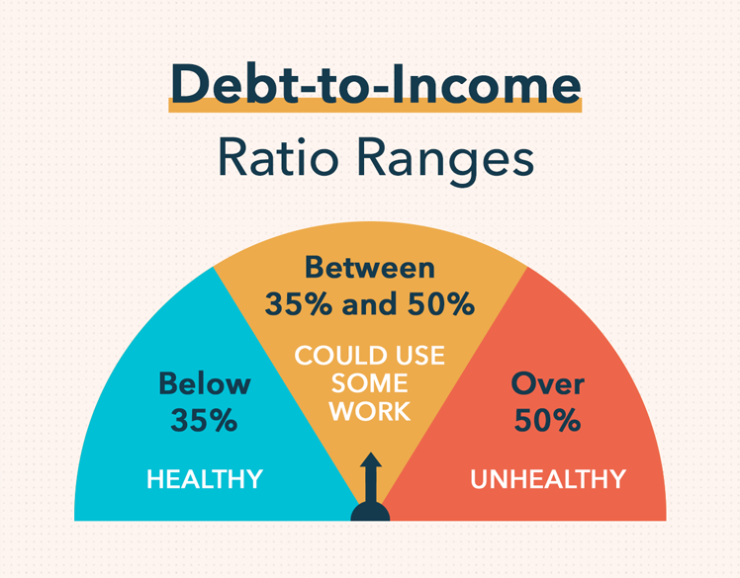

Debt to income ratio

monthly debt should only be 1/3 of your gross income

Debt Management

way to get out of your debt through financial planning and budgeting

Snowball Debt Strategy

Debt management strategy that involves paying off the debts with the smallest amounts due first.

High Rate/Avalanche Debt Strategy

Debt management strategy that involves paying off the debts with the highest interest rates first.

Cash

dollars and coins

Credit Cards

card that lets you have a line of credit where you can buy things now but must pay back the loan later

Reward Points

points earned through purchases that you can redeem

Debit Cards

card that withdraws money out of your checking account as you use it

Auto-pay

$ automatically transferred each month to pay for recurring bills (ex: power bill, insurance, etc)

Peer to Peer Payment Apps

mobile apps like Venmo, Paypal, etc.

Cryptocurrency

digital currency where transactions are secured using cryptic codes and are overseen by a group of peers instead of a bank or government.

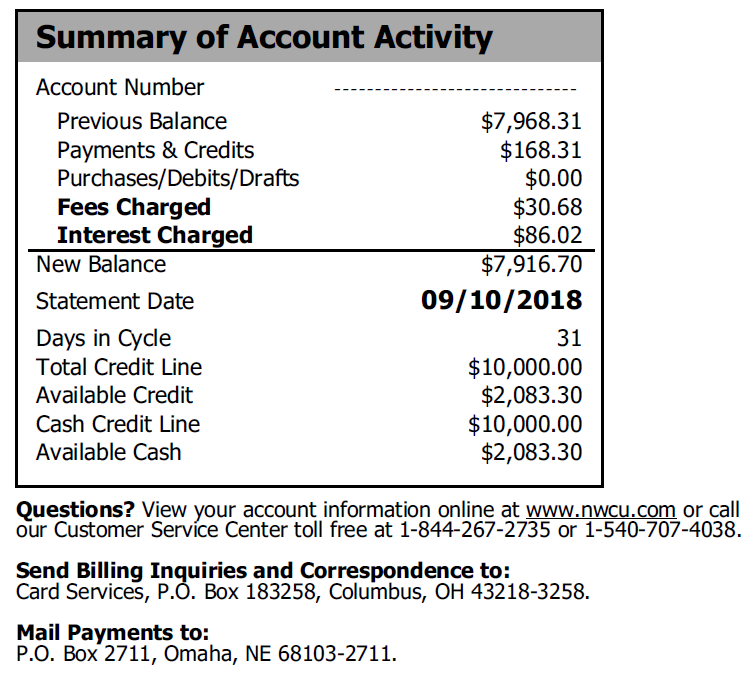

Previous (with banking)

last month (ex: previous balance-last month’s balance)

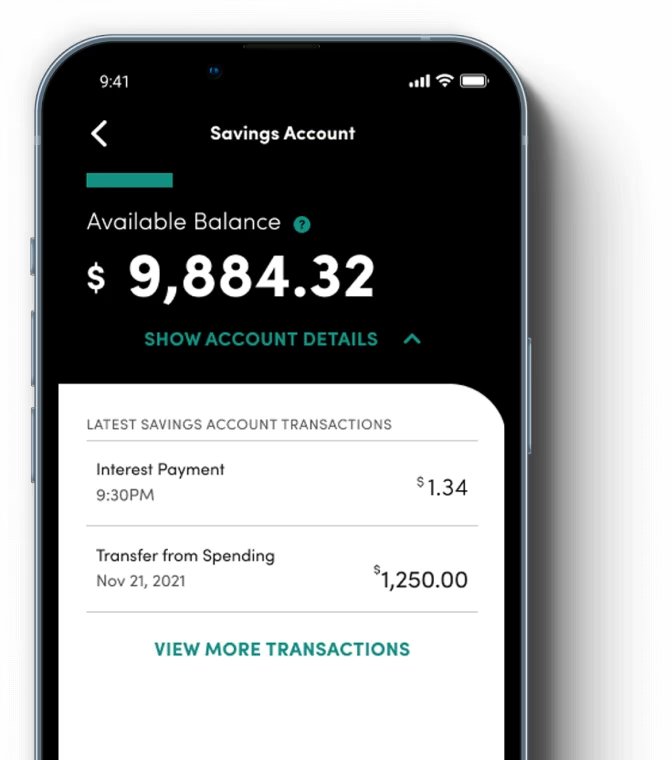

Balance (in banking)

How much money you currently have in your bank account OR how much total money you owe on your loan

Transaction

act of moving money in or out of your account

Checking Account

bank account that allows you to easily deposit and withdraw money for everyday transactions

Direct Deposit

when money like your paycheck is directly deposited into your checking or savings account

Savings Account

bank account made for the purpose of holding your savings and collecting interest for you.

Overdraft Fee

fee paid when you try to spend more $ than you have in your account

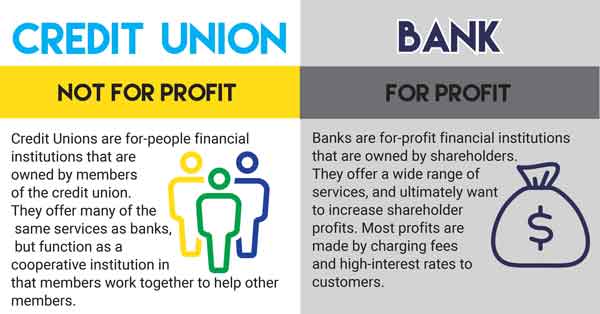

Credit Union

non-profit institution similar to a bank but owned by its own members

Savings and Loan

similar to banks but focus on mortgage loans

Pawn Shops

a store where you can sell items or bring items to use as collateral for a loan

Fixed Interest

when the interest rate stays constant

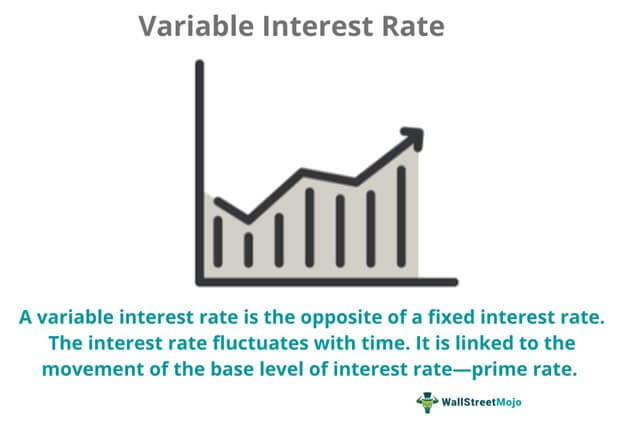

Variable Interest

when the interest rate fluctuates according to market changes

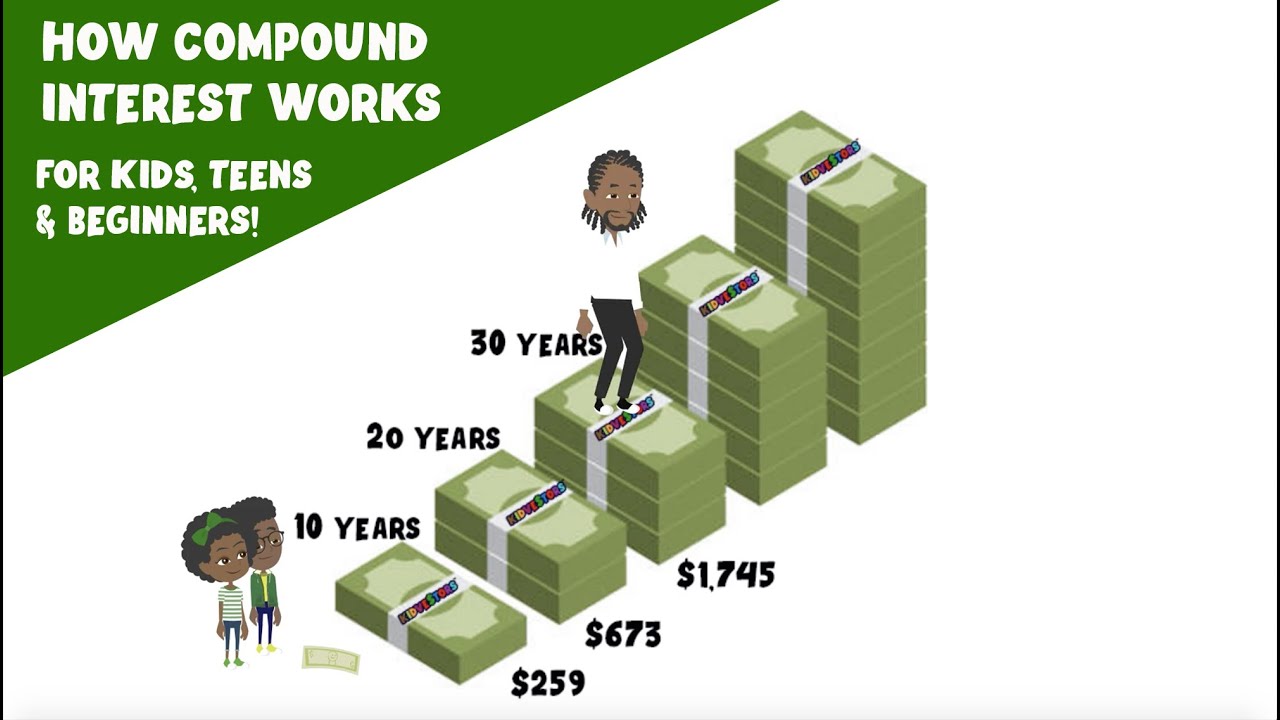

Compound Interest

when you earn interest on your savings and on the interest you have already earned

Coverage

what your insurance policy covers

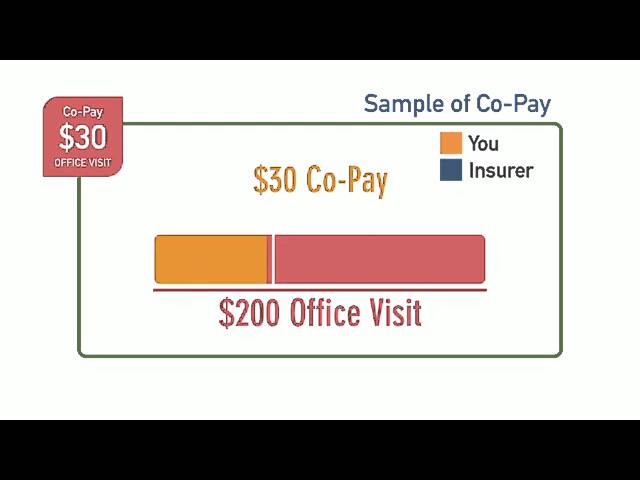

Co-pay

what you personally pay to go to the doctor. Insurance pays for the rest of the doctor visit. Ex: co-pay = $40 but real visit cost = $120

Premium

Amount you pay regularly for your insurance policy.

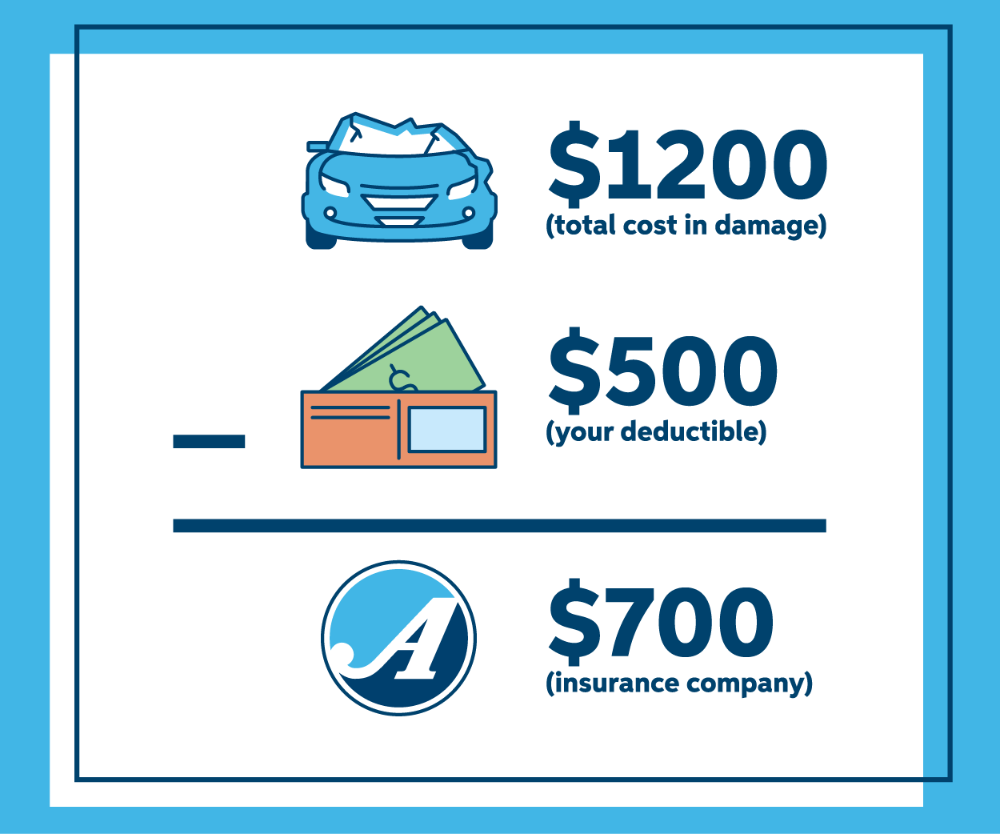

Deductible

How much you pay on your bill before insurance pays

Estate Planning

preparation done ahead of time for one’s death

Last Will and Testament

legal document created to express how you want your assets, property, etc divided

Executor

the person who handle’s the estate of the deceased and makes sure the will is followed

Beneficiary

Any person who receives something from a will or $ from a life insurance policy

Durable Power of Attorney

the person who you trust to speak/act for you if you become incapacitated.

Living Will

will that instructs doctors what to do when you can no longer make medical decisions for yourself

Estate

all the property and money someone owns