FSA: Long Lived Assets

0.0(0)

Card Sorting

1/35

There's no tags or description

Looks like no tags are added yet.

Last updated 8:36 PM on 8/26/23

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

36 Terms

1

New cards

Subsequent expenditures are capitalized, i.e., included as part of the recorded value of the asset on the balance sheet if they are

expected to provide economic benefits beyond one year into the future

2

New cards

Subsequent expenditures are expensed if they are

not expected to provide economic benefits in the future

3

New cards

In instances when a company constructs an asset or acquires an asset whose preparation for use takes a long period of time, the borrowing costs incurred directly related to the construction (including those incurred prior to the readiness of the asset for use) are

capitalized as part of the cost of the asset.

4

New cards

If a loan is taken for the purpose of constructing a building, the interest cost on the loan during the time of construction would

be capitalized as part of the building’s cost

5

New cards

Under IFRS (but not US GAAP), the income that is earned on temporarily investing the borrowed monies will

decrease the amount of borrowing costs that is eligible for capitalization

6

New cards

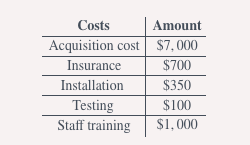

A company purchased and installed new equipment while incurring the following costs:

\

The total cost of the equipment that will be shown on the company’s balance sheet is *closest* to:

1. $7,450.

2. $8,150.

3. $9,150.

\

The total cost of the equipment that will be shown on the company’s balance sheet is *closest* to:

1. $7,450.

2. $8,150.

3. $9,150.

2

\

Total capitalized costs = $7,000 + $700 + $350 + $100= $8,150

\

Total capitalized costs = $7,000 + $700 + $350 + $100= $8,150

7

New cards

Accent Hotel reported a refurbishment cost of $100,000 during the year. If you knew that the hotel makes refurbishments for 20% of its rooms every year, how should the $100,000 be treated on the financial reports of the hotel?

1. It should be fully expensed.

2. It should be fully capitalized.

3. Only 20% of the amount should be capitalized.

1. It should be fully expensed.

2. It should be fully capitalized.

3. Only 20% of the amount should be capitalized.

2

\

The amount should be fully capitalized because the rooms are supposed to benefit the hotel for more than one single period; specifically five years.

\

The amount should be fully capitalized because the rooms are supposed to benefit the hotel for more than one single period; specifically five years.

8

New cards

Intangible assets, such as patents purchased in situations other than business combinations, are recorded at

their fair value (equivalent to the purchase price) when acquired

9

New cards

If several intangible assets are acquired as part of a group, each asset's purchase price is allocated based on its

fair value

10

New cards

The costs of internally developed intangible assets are generally

expensed when incurred

11

New cards

a company that has internally developed intangible assets such as patents, copyrights, or brands through expenditures on research and development (R&D) or advertising will recognize a XXX amount of assets than one that has obtained intangible assets through an external purchase

lower

12

New cards

For intangible assets developed internally, IFRS requires that expenditures on research (or during the research phase of internal projects) be

expensed

13

New cards

a company that expenses its expenditure instead of capitalizing it will have XXX profitability in the first year but XXX profitability in subsequent years, indicating a XXX trend

lower

higher

favorable

higher

favorable

14

New cards

the shareholders’ equity for a company that XXX expenditure will be higher in the earlier years because initially higher profits will result in higher retained earnings

capitalizes

15

New cards

XXX the expenditure also results in greater amounts being reported as cash from operating activities

Capitalizing

16

New cards

Deferred tax liability

The tax expense based on F/S will be higher than taxes payable based on taxable income

17

New cards

what is the revaluation mode?

an alternative to the cost model that is used for the periodic valuation and reporting of long-lived assets

18

New cards

Under the revaluation model, the carrying amounts are

the fair values at the date of revaluation less any subsequent accumulated depreciation or amortization

19

New cards

what does the revaluation model make possible in regard to costs?

values of long-lived assets to increase to amounts that are higher than their historical costs

20

New cards

under the revaluation model, if the carrying amount of an asset class is initially decrease, the decrease is recognized in

profit or loss on the I/S

21

New cards

under the revaluation model, if the carrying amount of an asset class is initially increases, the increase is recognized in

profit or loss

22

New cards

Under the revaluation model, an increase above the reversal amount will not be recognized in the XXX. Instead, it will be directly allocated to XXX in a XXX

income statement

equity

revaluation surplus account

equity

revaluation surplus account

23

New cards

an asset is said to be impaired when

its carrying amount is greater than its recoverable amount or fair value

24

New cards

Under IFRS, an impairment loss is recognized if the

carrying amount exceeds the recoverable amount of the asset

25

New cards

Under IFRS, the recoverable amount is defined as

the higher of the asset’s fair value minus costs of disposal and its value in use

26

New cards

value in use is a

discounted measure of expected future cash flows

27

New cards

Under US GAAP, an asset’s carrying amount is considered unrecoverable when

it exceeds the undiscounted expected future cash flows

28

New cards

Under US GAAP, if the carrying amount is considered unrecoverable, the impairment loss is measured as

the difference between the asset’s fair value and the carrying amount

29

New cards

IFRS rule for reversals of impairments of long-lived assets:

does not permit the revaluation to the recoverable amount if the recoverable amount exceeds the previous carrying amount

30

New cards

US GAAP, rule for reversals for assets held for use:

once an impairment loss has been recognized for assets held for use, it cannot be reversed

31

New cards

US GAAP, rule for reversals of assets held for sale:

if the fair value increases after an impairment loss, the loss can be reversed

32

New cards

average age of a company’s asset base =

accumulated depreciation / by depreciation expense

33

New cards

average remaining life =

net PPE / depreciation expense

34

New cards

IFRS allows companies to value investment properties either using a

cost model or a fair value model

35

New cards

36

New cards