Chapter 18: Working capital management – cash control

1/8

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

9 Terms

What are the three main motives for holding cash?

What are the risks of holding insufficient cash?

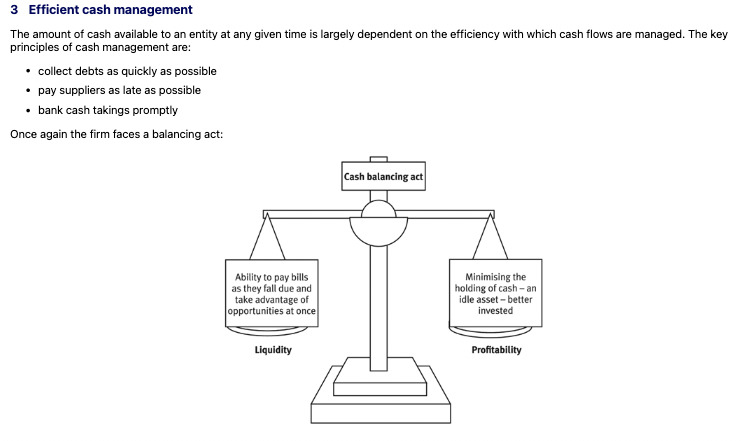

What are the key principles of efficient cash management?

What is the cash balancing act in efficient cash management?

What is a cash forecast (or cash budget)?

What are the main purposes of a cash forecast?

What are the two techniques for creating a cash forecast?

What is a receipts and payments forecast?

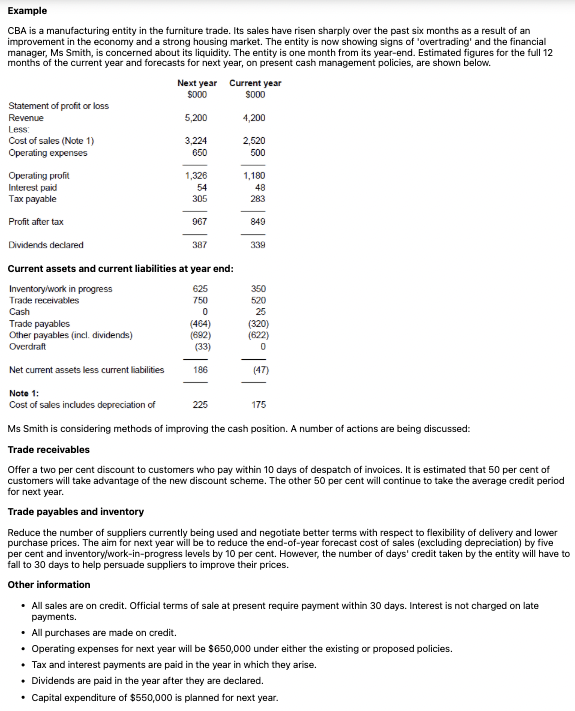

Why do cash receipts and payments differ from items in the statement of profit or loss?

What is the first step in preparing a cash forecast?

What is the format of a cash forecast pro-forma?

What is Step 2 of preparing a cash forecast?

What is Step 3 of preparing a cash forecast?

Required

(a)Provide a cash flow forecast for next year, assuming:

(i)the entity does not change its policies and

(ii)the entity's proposals for managing trade receivables, trade payables and inventory are implemented.

In both cases, assume a full twelve-month period, i.e. the changes will be effective from day one of next year.

(b)As assistant to Ms Smith, write a short report to her evaluating the proposed actions. Include comments on the factors, financial and non-financial, that the entity should take into account before implementing the new policies.

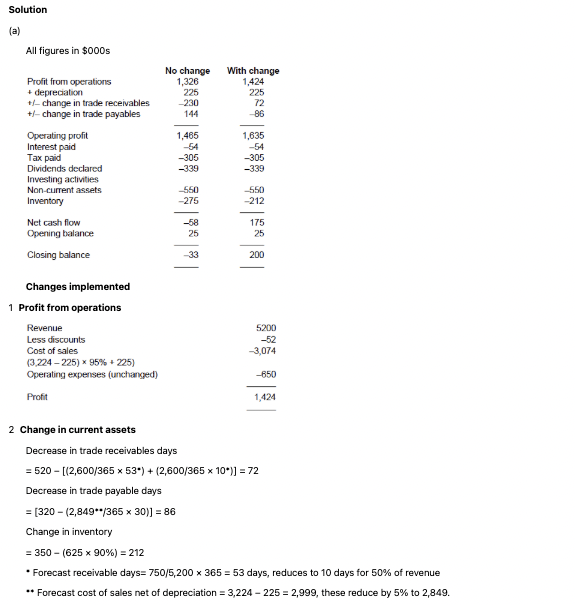

Solution

(b) Report

To: Ms Smith

From: Assistant

Subject: Proposed working capital policy changes

The answer should be set out in report format and include the following key points:

Comment that cash flow is improved by almost a quarter of a million pounds if the proposed changes are made.

Problems appear to have arisen because trade receivables and inventory control have not been adequate for increased levels of turnover.

Liquidity: current ratio was 0.95:1 (all current assets to trade and other payables), will be around 1.2:1 under both options. Perversely, ratio looks to improve even if the entity takes no action and causes an overdraft. This is because of high receivables and inventory levels. Moral: high current assets do not mean high cash. Cash ratio is perhaps a better measure.

Receivables' days last year was 45, forecast to rise to 53 on current policies despite 'official' terms being 30. Entity could perhaps look to improve its credit control before offering discounts.

Trade payables' days were 46, forecast to rise to 52. Are discounts being ignored? Are relationships with suppliers being threatened?*

Dramatic increase in inventory levels forecast: 50 days last year, 71 days forecast this year. If change implemented, inventory will still be 67 days.*

Operating profit percentage forecast to fall to 25.5% from 28.1% if no changes made. Percentage will fall to 27.4% if changes implemented; a fall probably acceptable if cash flow improved and overdraft interest saved.

Non-financial factors include relationships with customers and suppliers.

Other financial factors, is increase in turnover sustainable?

*Using cost of sales figures including depreciation.

What key questions should be asked when interpreting a cash forecast?

Why are spreadsheets useful for cash forecasting?

What is 'what-if' analysis in cash forecasting?

How can spreadsheet models support consolidation of cash forecasts?

What might prompt a business to take action to improve a cash forecast situation?

What questions should be considered when reviewing a poor cash forecast?

What are two main causes of forecast cash deficits?

What actions can improve a poor short-term cash forecast?

How should management deal with forecast cash surpluses?

What are appropriate ways to use long-term cash surpluses?