HC Ch 9: RCM: billing, coding, and collections

1/25

Earn XP

Description and Tags

Final

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

26 Terms

what are the cash management fundamentals?

accounts receivable, accounts payable, collections, and patient billing

what are accounts receivable?

money owed to the organization for services provided

what are collections?

systematic approach to secure payments for services rendered

what are accounts payable?

financial obligations the organization owes to others

what is patient billing?

key process for ensuring timely service reimbursement

what is the billing and coding process?

patient care → documentation → coding → claim submission

what do each of the processes entail?

patient care: initial medical encounter and service delivery

documentation: recording diagnoses and procedures performed

coding: translating services into standardized codes

claim submission: sending billable information to payers

what is the patient care phase?

patient encounter: the medical office visit is the foundation of the billing process

information gathering: provider collects vital medical information from the patient

service delivery: medical care, treatments, and procedures are performed

care conclusion: medications, prescriptions, and referrals are provided as needed

what is medical records management?

EMR

EHR

what is the difference between EMR & EHR?

EMR: digital version of paper charts in a single practice, contains patients medical history, limited to one practice location, facilitates accurate coding

EHR: comprehensive patient records across providers, broader than EMR systems, accessible by multiple providers

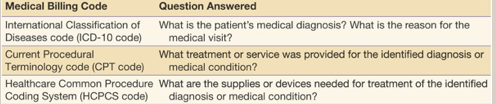

What is the ICD-10 coding system?

it contains about 70,000 diagnosis codes, significantly more detailed than previous version

international classification of diseases: standardized coding system for diagnoses and medical conditions

diagnostic purpose: identifies the patients diagnosis or reason for medical consultation

evolving system: updates regularly as healthcare industry identifies new conditions

CPT coding system

maintained by the American medical association - CPT codes are essential for proper reimbursement

current procedural terminology: standard codes for medical services, procedures, and treatments

treatment identification: specifies procedures performed for diagnosed conditions

code matching: CPT and ICD codes must align in terms of medical necessity

HCPCS Coding system

Healthcare common procedure coding system: codes for supplies, equipment, and non physician services

transportation services: includes ambulance and medical transportation coding

medical supplies: covers durable medical equipment like wheelchairs and crutches

situational usage: not required for all patient visits or encounters

What are the billing code relationships?

ICD-10 - diagnosis

CPT - procedure

HCPCS - supplies

DRG - inpatient stay

what are DRGs?

diagnosis related groups - used by medicare and others to calculate inpatient reimbursement, patients are categorized into groups with similar resource utilization

resource calculation: assigns balue to providers inpatient resources

severity-based: higher acuity requires more resources

applied post discharge: finalized after hospital stay completion

what is the claims preparation process?

thorough preparation minimizes claim denials and accelerates payment

charge master reference: consult organizations established service list with prices

claims scrubbing: internal review to verify claim accuracy

clean claim creation: error-free claims ready for submission

claims submission process

capture all charges: record all medical visit activities and associated costs

final review: verify all medical billing codes for accuracy

submit to payer: send claim to insurance provider in required format

await response: monitor for acknowledgment of claim receipt

What is the EOB and Superbill?

explanation of benefits: insurance company’s response to a claim

summarizes diagnosis and treatment

lists charges for services

shows amounts covered by insurance

indicates patient responsibility

superbill: detailed service record for direct patient billing

lists of diagnoses and treatments

includes provider charges

details supplies and related costs

used when patients bill insurers directly

what does the accounts receivable management entail?

submit claims: initiate billing process for services rendered

monitor payments: track incoming revenues from all payers

manage denials: address rejected claims promptly

resubmit claims: correct and reprocess denied claims

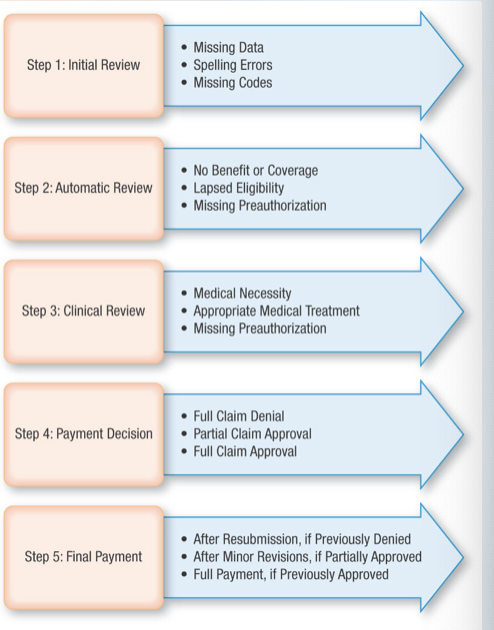

what is claims adjudication?

the process by which insurers evaluate and make final payment decisions on claims - this process ensures claims meet payer requirements before payment

submission methods: electronically or manually

decision outcome: claims may be approved, partially approved, pending additional information, or denied

what is the adjudication process flow?

claims submission: provider sends complete claim to insurer

claims review: insurer evaluate claim against policy guidelines

determination: decision made on payment amount

payment processing: approved claims proceed to payment

What are the adjudication review stages? (3)

initial review: check for data errors in patient, providers, diagnosis or treatment information

automatic review: verify patient policy coverage for claimed medical services

clinical review: examine medical necessity and preauthorization requirements

what are the adjudication outcomes?

full approval: claim meets all requirements and proceeds to payment

partial approval: some services approved while others denied

denial: payment refused after documentation review

pending: additional information needed before decision

how do you improve claims processing?

performance analysis: track key metrics for continuous improvement

denials management: document and streamline appeals processpatient access: improve registration and eligibility verification

technology upgrades: implement advanced billing and coding systems

what are the collections processing fundamentals?

documented collections process: establish clear procedures for payment collection and follow up

collections aging schedule: track accounts receivable by time intervals since billing

patient accounts receivable: measure average collection time for outstanding reimbursement

performance monitoring: regularly assess collection efficiency and identify improvement areas

what are the receivables management impact?

revenue support: patient services revenue directly funds organizational projects and initiatives

payer mix analysis: breakdown of payer types reveal revenue stream diversity

payer performance: historical data shows claim acceptance rates and payment timeliness