Spending and Output in the Short Run

1/27

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

28 Terms

The Keynesian Model

Building block for current theories of short-run economic fluctuations and stabilization policies

In the short run, firms meet demand at preset prices

Firms typically set a price and meet the demand at that price in the short run

Firms change prices when the marginal benefits exceed the marginal costs

What has Technology reduced?

menu costs

bar codes and scanners reduce costs of changing prices in the store

online surveys

Planned Aggregate Expenditure (PAE)

total planned spending on final goods and services

Actual spending equals planned spending for

Consumption

Government purchases of final goods and services

Net exports

4 Components of PAE

Consumption (C) by households

Investment (I) is planned spending by domestic firms on new capital goods

Government purchases (G) are made by federal, state, and local governments

Net exports (NX) equals exports minus imports

PAE Formula

PAE = C + IP + G + NX

2 Dynamic Patterns in the Economy

Declines in production lead to reduced spending

Reductions in spending lead to declines in production and income

Consumption Expenditure

Accounts for two-thirds of total spending

Powerful determinant of planned aggregate expenditure

Includes purchases of goods, services, and consumer durables, but not new houses

Rent is considered a service

C depends on disposable income: the after-tax amount of income that people are able to spend, (Y – T)

Consumption Function

An equation relating planned consumption (C) to its determinants, notably disposable income (Y –T)

C = C + (mpc) (Y – T),

where C is autonomous consumption

marginal propensity to consume (mpc) is the increase in consumption spending when disposable income increases by $1

0 < mpc < 1

(Y – T) is disposable income

Output plus government transfers minus taxes

Main determinant of consumption spending

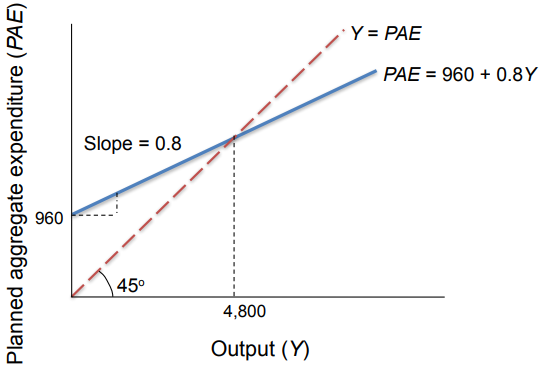

Short-Run Equilibrium

the level of output at which planned spending is equal to output

no change in output as long as prices are constant

can be written Y = PAE

Output Greater then Equilibrium Example

Suppose output reaches 5,000 – Planned spending is less than output – Unplanned inventory increases – Businesses slow down production – Output goes down

Suppose output is only 4,500 – Planned spending is more than total output – Unplanned inventory decreases – Businesses speed up production – Output goes up

Income-Expenditure Multiplier

shows the effect of a one-unit increase in autonomous expenditure on short-run equilibrium output

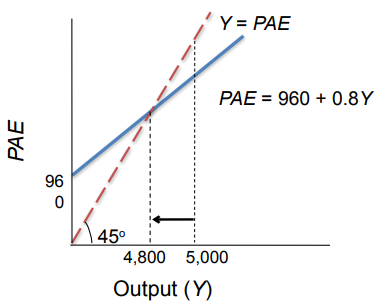

Income-Expenditure Multiplier Example

Initial planned expenditure = 960 + 0.8Y

New planned expenditure = 950 + 0.8Y

The 10-unit drop in C implied a 10 unit drop in autonomous expenditure

Equilibrium changed from $4,800 to $4,750

A $10 change in autonomous expenditures caused a $50 change in output

Multiplier = 5

The larger the MPC, the greater the multiplier

Stabilisation Policy

Government policies that are used to affect planned aggregate expenditure, with the objective of eliminating output gaps

Expansionary policies increase planned expenditure

Contractionary policies decrease planned expenditure

Fiscal policy uses changes in government spending, transfers, or taxes

Monetary policy uses changes in the money supply

The Tools of Fiscal Policy

Government spending - Direct effect on PAE

Taxation - Indirect effect on PAE

Transfer payments - Indirect effect on PAE

Discretionary Fiscal Policy

Government decisions to change:

Government spending (G) - Direct effect on PAE

Net taxes (T) - Indirect effect on PAE

Both change the government deficit (G – T)

Government Spending

part of planned spending

changes will directly affect planned aggregate expenditures

Government Spending Example

Suppose planned spending decreases $10 from Y = 960 + 0.8Y to Y = 950 + 0.8Y

Equilibrium Y decreases from $4,800 to $4,750

Recessionary gap is $50

Stabilization policy indicates a $10 increase in government spending will restore the economy to Y* at $4,800

US Military Spending

Decreased sharply after World War II

Peaks for wars and Reagan military build-up

Added demand helped end the Great Depression

Recessions associated with declines

Increases can help stimulate the economy

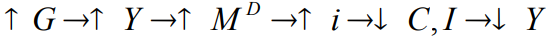

Crowding-Out Effect

The tendency of an increase in government expenditure to increase the rate of interest, and reduce consumption and investment by the private sector

Occurs when PAE is affected by changes in interest rates

What does the Strength of the Crowding-Out Effect depend on?

The responsiveness of consumption and investment to interest rate changes

For any given interest rate the crowding-out will be stronger the greater the resulting decline in consumption and investment

The responsiveness of the demand for money to interest rate changes

What is PAE influenced by?

changing total taxes and/or transfer payments

the effect is indirect, channelled through the effects on disposable income

lower taxes or higher transfers increase disposable income

increases in disposable income lead to higher C

Net Taxes (T) Formula

total taxes - transfer payments - government interest payments

Supply-Side Effects of Fiscal Policy

Fiscal policy may affect potential output as well as potential spending

Investment in infrastructure increases Y*

Taxes and transfers affect incentives and can change potential output, Y*

Government Deficit

the difference between government spending and net taxes (G - T)

What do Large and Persistent Budget Deficits cause?

reduced national saving which means less investment and therefore less growth

What are the 2 Limits of Fiscal Policy Flexibility?

The legislative process requires time

Change in fiscal policy may be slow

Competing political objectives

National defence

Entitlements such as Medicare and income support

Automatic Stabilisers

Automatic changes in the government budget deficit which help to dampen fluctuations in economic activity

What do Automatic Stabilisers do?

increase government spending or increase taxes when real output declines

built into laws so no decision is required

unemployment compensation, progressive income tax