Fiscal Policy

1/34

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

35 Terms

What is Fiscal Policy?

Changes to government spending or taxation

What are the 2 types of government spending?

Current Spending

Capital Spending

What is current spending?

Spending on public services, e.g. road maintenance or NHS wages

What is capital spending?

Spending on infrastructure, e.g. new bridges, or opening new schools

What are direct taxes?

Taxes paid directly from the individual to the government

income tax

corporation tax

stamp duty

What are indirect taxes?

Tax that is levied on goods and services, passed onto consumers through price increases

VAT

Excise duty

2 types of Indirect Tax: Ad Valorem and Specific

What is Ad Valorem Tax?

Tax set as a percentage of the price of the good

e.g. VAT at 20%

What is Specific Tax?

A fixed amount of tax on a good

e.g. £1 for every litre of petrol

What are progressive taxes?

Taxes that increase in value with income

e.g. income tax brackets

What are Proportional taxes?

Taxes that take the same proportion from all taxpayers incomes

e.g. National Insurance contributions

What are Regressive Taxes?

Taxes that take a larger proportion of income from taxpayers as their income falls

e.g. excise duty

What is a government budget deficit?

When government expenditure exceeds tax revenue

What is a government budget surplus?

When government tax revenue exceeds government expenditure

What is a government balanced budget?

When government spending = tax revenue

What is a cyclical budget deficit?

A temporary budget deficit depending on the economic cycle

During a recession it is high

Caused by automatic stabilisers

Why is the cyclical budget deficit high in a recession?

As government spending increases, in order to boost AD and cover JSA

Government reduces income tax to stimulate spending

What is a structural budget deficit?

Doesn’t depend on the economic cycle

Difference between tax revenue and government spending

What is national debt?

Total amount of money which the government borrowed, and what they owe to 3rd parties

How can a budget deficit lead to demand-pull inflation?

Government spending increases

AD increases

Economy is near or at full capacity, so demand exceeds supply

Firms increase their prices

What are 2 causes of a budget deficit?

Automatic Stabilisers

Discretionary Policy

What are automatic stabilisers?

Automatic response by the government or economy to a change in economic conditions

Incomes fall —> so government receives less income tax revenue

More unemployed —> more spending on welfare benefits (JSA)

However the JSA benefits stabilise the economy, as peoples incomes don’t fall to zero when unemployed

What is Discretionary Policy and how does it cause a Budget Deficit?

A deliberate change in policy from the government

Budget deficit can occur as

Gov may reduce tax brackets, so they receive less income tax

Gov may make it easier to get JSA or increase the value JSA

Gov may increase spending on building schools, hospitals etc

What is expansionary fiscal policy?

Reduced taxation and increased government spending

Used to boost AD and economic activity during a recession

Creates a budget deficit

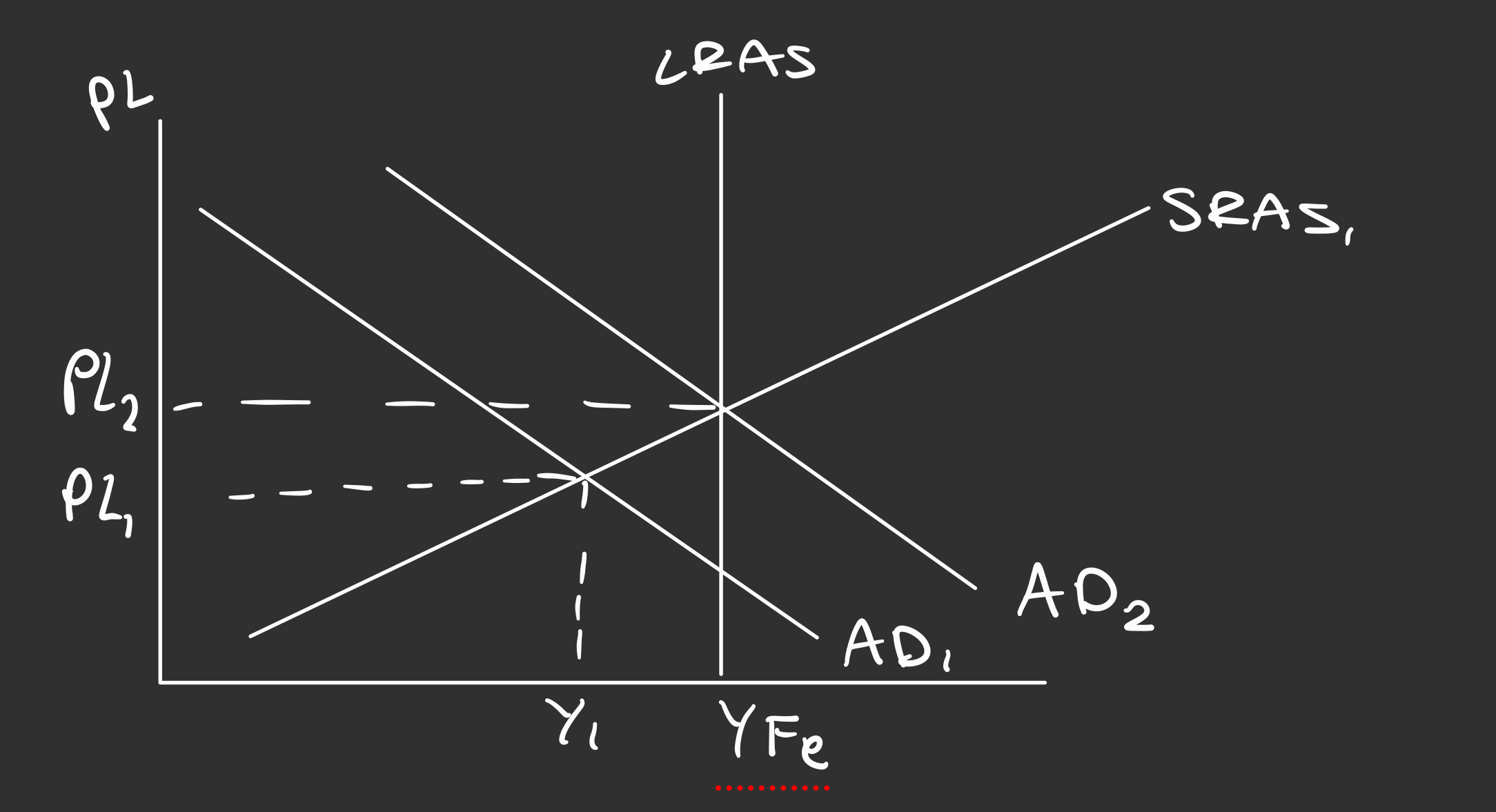

What is a diagram for expansionary fiscal policy?

Shows a shift right of AD, and an extension in the SRAS curve

What are benefits of expansionary fiscal policy?

Economic growth

Reduced unemployment as demand for labour increases

‘Crowding In’

What is ‘Crowding In’?

Higher government spending = Increased investment in private sectors

Firms expect the economy to grow due to injections from the government

Therefore they invest in machinery, technology etc

What are drawbacks of expansionary fiscal policy?

Overstimulation

‘Crowding Out’

What is overstimulation?

When aggregate demand increases rapidly that the supply can’t increase quickly enough to match the increased demand

This creates demand-pull inflation

Business costs rise as workers being made to work harder so want pay rises

What is ‘Crowding Out’?

Private sector firms buy government bonds, so the government has money to spend

So instead of saving their money with the bank, the private sector firms use it to buy government bonds

This reduces the supply of money in the ‘loanable funds market’ meaning that less money is available to lend out.

This increases interest rates

What is contractionary fiscal policy?

The increase in tax levels and reduced government spending

Reduces the Budget Deficit

AD falls and economic activity contracts

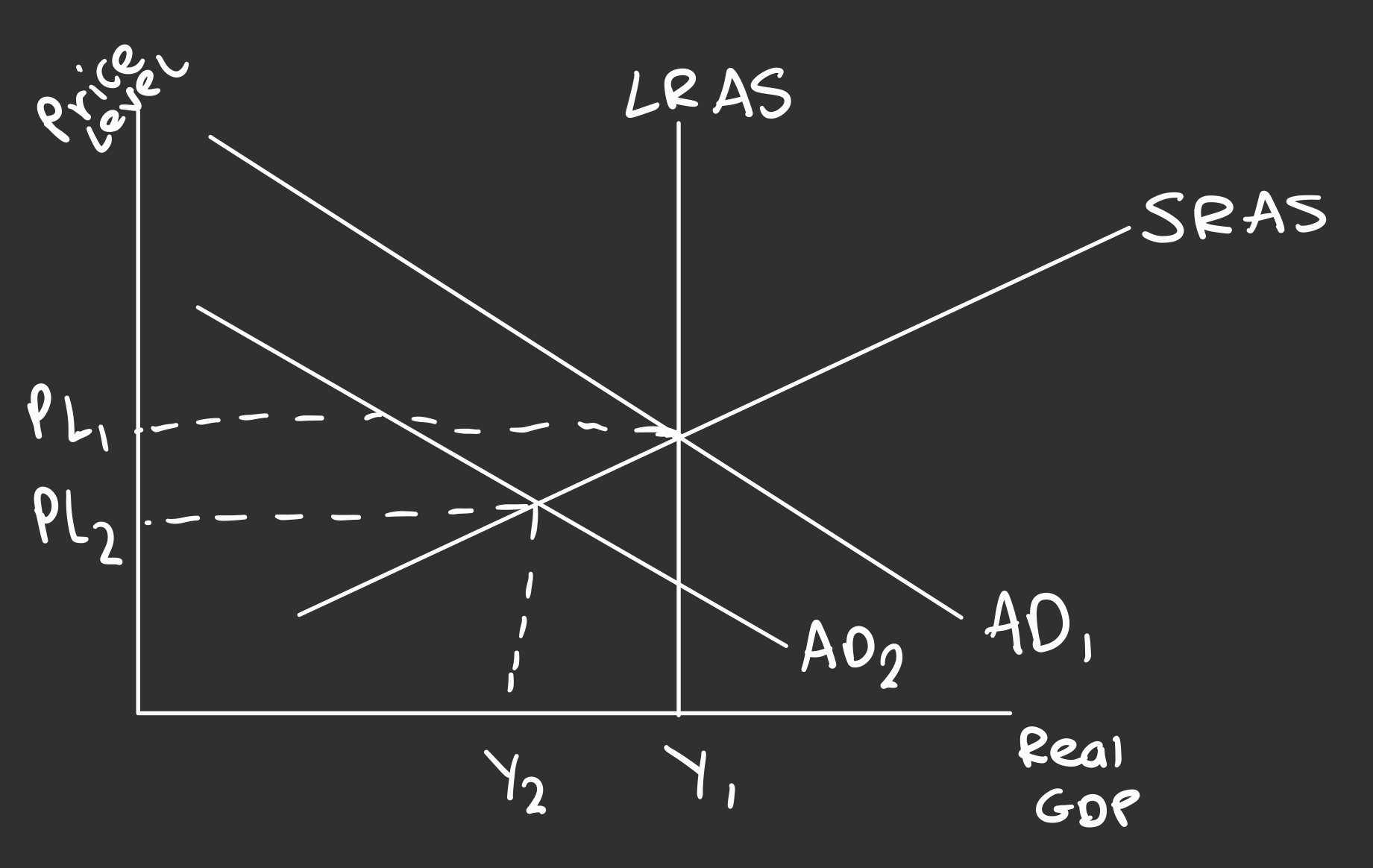

What is the diagram for contractionary fiscal policy?

AD shifts left, SRAS contracts and Price Level falls

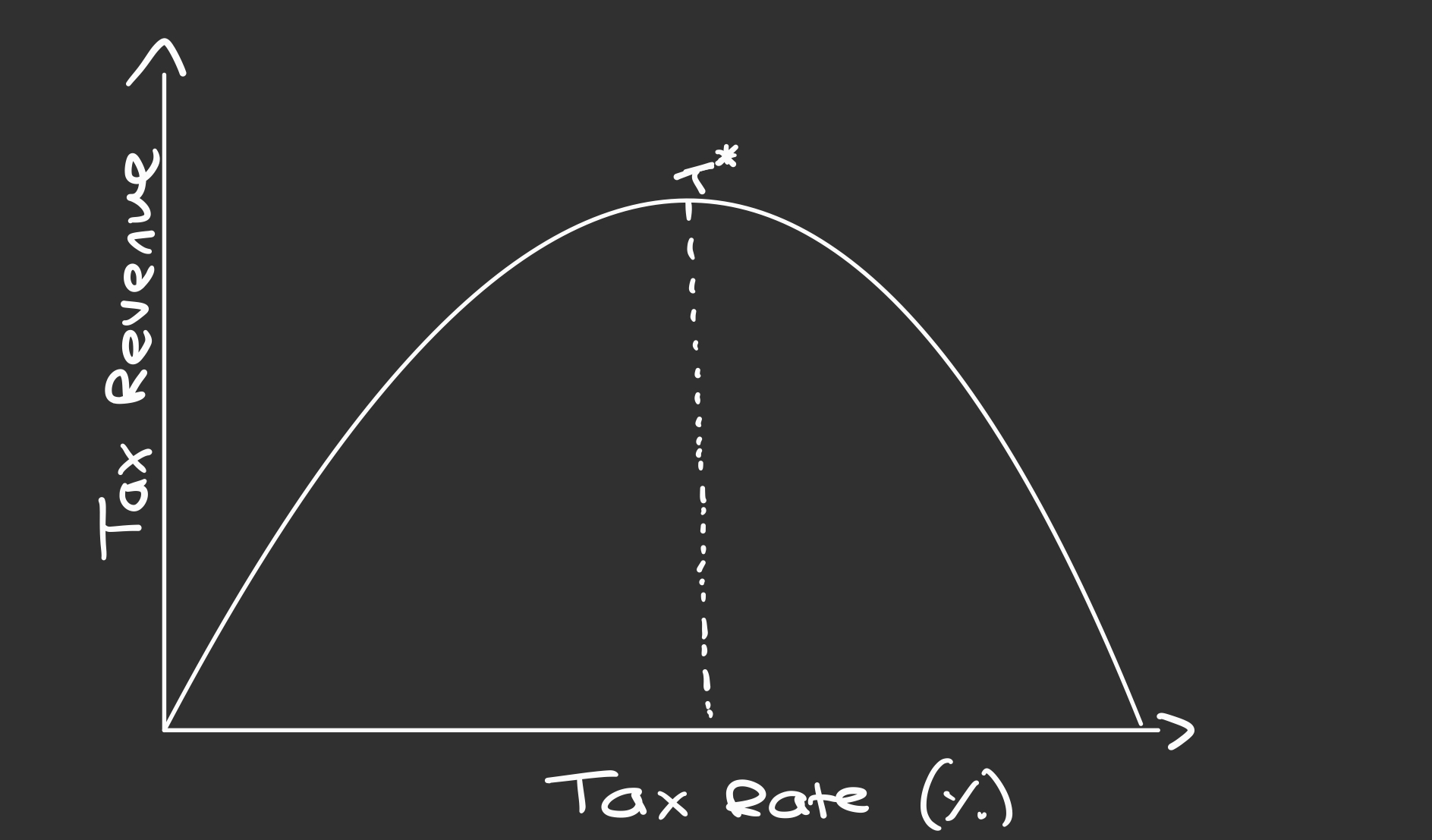

What is the Laffer Curve?

What does the Laffer Curve show?

When tax rates are very low, tax revenue is also very low

However, when tax rates are very high, tax revenue is very low

In between, is the maximum tax rate that maximises revenue

Why is tax revenue low when tax rates are high?

Increased tax avoidance or evasion

Individuals may leave to other countries

High tax rates for low income workers may disincentivise working (voluntary unemployment)

Evaluate use of decreasing on macroeconomic objectives