Chapter 9 - Real Estate

1/93

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

94 Terms

The “bundle of rights” included in the legal ownership of land

Possession, Disposition, Enjoyment, Exclusion, Control

Actual Notice

Evidence of ownership provided by physical possession

Constructive Notice

Evidence of ownership provided by the recording of public documents; serves notice to the world as the true owner

30 years

Length of time in Florida that the root of title extends back from the recording of a claim

Chain of Title

A timeline of recorded documents linking past owners from the root of title to the present day

Title Plant

A compilation of public records containing copies of all real estate documents, arranged according to the date of recording in the public record

Title Search

A search of all documents that may affect title to property, where notations are made indicating such affect

Abstract

A date-order compilation with a caption page of all documents that may have an effect on the title to property being investigated

Opinion of Title

An attorney’s legal opinion as to the quality of title, based on a review of title history

Title Defects (Cloud on Title)

Claims or other factors that could cause a title to property to be declared invalid

Mortgagee’s (Lender’s) Title Insurance

Title insurance that protects the lender by paying the unpaid balance of the loan if the borrower should lose title to the property as a result of a defect

Mortgagor’s (owner’s) Title Insurance

Title insurance obtained by a property owner wishing to provide protections against issues in title

Lender’s Title Insurance (transferable to new lender) Note: Owner’s title insurance is NOT transferable

Title insurance that is transferable

Alienation of Title (can be voluntary or involuntary)

Transfer or conveying of ownership from one party to another

Voluntary transfer of title

Deed or Will (upon death of owner)

Testate

A person who died and left a will, voluntarily transferring title according to their wishes

Intestate

A person who dies without a will

Decendent

A person who died

Involuntary transfer of title

Descent and distribution, Escheat, Eminent domain, Adverse possession

Descent and Distribution

Title transfer determined by law to an individual’s heirs upon death when the individual died without a will

Escheat

Reversion of property to the state if someone dies without a will and has no known heirs

Eminent Domain

The government’s right to take private property for public benefit through a process called condemnation

Adverse Possession

Involuntary method by which an owner may lose title to another person who has taken control of the property

Conditions for adverse possession

Open, adverse, hostile, and exclusive possession of the property for a period of 7 continuous years and pay taxes for those 7 years.

“Slept on his rights”

An owner who failed to eject a trespasser, losing title to the hostile claimant by involuntary alienation

Deed

The document that is used to voluntarily convey ownership from one party to another

Requirements for a valid deed

In writing

Names of all parties

Legal description of the property

Legal rights being conveyed

Consideration (good or valuable)

Signed by a competent grantor and two witnesses

Granting clause

Delivery & acceptance

Grantor (signature required)

The party who voluntarily transfers (conveys) ownership

Grantee (signature not required)

The party who voluntarily receives ownership

The point at which title has been transferred

When the deed is voluntarily delivered to, and voluntarily accepted by, the grantee (does not have to be acknowledged or recorded)

Premises (granting) Clause

The only legally necessary clause in a deed

The items stated in a granting (premises) clause

Names of the parties

Words of conveyance

Consideration

Date of transfer

Legal description of the property

Habendum Clause (to-have-and-to-hold” clause)

The clause in a deed that specifies the bundle of legal ownership rights being conveyed

Reddendum Clause

The clause in a deed used in a remainder estate to reserve a right in the title, not the land

Warrants (or deed covenants)

The promises made by a grantor to the grantee giving assurances as to the quality of title

Warrant of Seisin

The promise by the grantor to the grantee that he or she owns and has the legal right to convey the property

Warrant of Quiet Enjoyment

The assurance given by the grantor to the grantee that no one will be able to make a claim against the ownership of the property

Warrant of Further Assurance

The promise given by the grantor to take whatever action is necessary to protect and defend the title forever

Warrant Against Encumbrances

The assurance given by the grantor that there are no encumbrances against the property other than those disclosed in the deed and that the grantor is responsible for liens or claims not listed in the deed

Covenant of Warranty Forever

The assurance given by the grantor that the grantee will be able to enjoy possession and uninterrupted use of the property

Quitclaim deed

The type of deed that contains no warrants (or covenants) of any kind, conveying any interest in the grantor may have in the property, if any

Bargain and Sale Deed

The type of deed that contains only one warrant, the warrant of seisin, stating that the grantor is the true owner of the property and has the legal right to convey it

General Warranty Deed

The type of deed that provides the best protection to the grantee that promises that the grantor is the true owner, has the right to sell, and will warrant and defend the title against any and all claims forever

Common uses for a quit claim deed

Cure defects or clouds on the title

Transfer of a spouse’s interest to the other spouse in a divorce action

General Warranty Deed

The type of deed given in a real estate sales contract if no deed type is specified

Quitclaim Deed

Deed that provides the least protection to the grantee and the fastest method of transfer

Personal Representative’s Deed

Deed used to convey the property of an individual who died intestate (without a will)

Guardian’s Deed

Deed used to convey the property of a minor by a grantor on the minor’s behalf

Committee’s Deed

Deed used to convey property owned by a mentally incompetent person

Master Deed

Deed used by a developer to convey land to a condominium association that can convey the individual units

Unit Deed

Deed that conveys individual condominium units from an association to the public

Cloud on Title

Term used to describe a property with a defective title

Suit to Quiet Title

Court action taken to resolve a dispute regarding a claim to title

30 years (as defined by MARTA to eliminate claims-in-antiquity)

The period by which outstanding claims to title must have been exercised to establish root of title in Florida

Police Power

The government’s right to restrict the use of land to protect the health, safety, or welfare of the citizens

Escheat

The right of the state to acquire ownership of property when an owner dies intestate (no will) and no lawful heirs can be located

Eminent Domain

The right of a local, state, or federal government to take private property for public use

Condemnation Proceeding

The negotiating process by which the local, state, federal government, railroads, and public utilities can take a private owner’s property for public use

Property Taxation

The power of local governments to levy taxes on private property, which if not paid, may result in an unpaid tax lien on the property that may be foreclosed in court

Police Power

The power of the government that is exercised by zoning, building codes, and health codes

The four types of governmental limitations on private property rights

Police power, Eminent domain, Taxation, and Escheat (“PETE”)

Deed Restrictions (usually recorded by the developer or builder on multiple properties at the same time)

The most common form of private limitations on property ownership

Easement

Limited right of access or use of someone else’s property for a specific purpose; an encumbrance that affects the owner’s rights and the property’s value

Easement in Gross

Easement most commonly illustrated by a utility company that gives one party the right of access to a property owner’s real estate; does not “run with the land”

Easement Appurtenant

Easement involving two or more parcels of property and “runs with the land” and will be binding on future owners

Easement by Necessity

Easement appurtenant where land is subdivided in a manner that creates a landlocked parcel, where the law assumes the owner has a legal right of access that will be imposed by the courts

20 or more years of continuous and uninterrupted use of a portion of another person’s property

Easement by prescription in Florida; once established by a court, creating public access

Encroachment

Unauthorized physical intrusion onto another’s property

Lessor

The owner (or landlord) of a leased property

Lessee

Renter of leased property

Items required for a valid lease agreement

Competent parties

Names and signatures of lessor and lessee

Consideration

Term of the tenancy

Legal description of the property

Net Lease (or triple net lease)

Lease in which the tenant pays a fixed rent plus all or a portion of the operating costs including insurance and maintenance; typically used for commercial and industrial leases

Gross Lease

Lease in which the tenant agrees to pay a fixed rental amount and the landlord pays all expenses related to the property including taxes, insurance, and maintenance; used for most residential leases.

Percentage Lease

Lease in which the tenant pays a monthly base rent plus a percentage of the annual or monthly gross sales of goods sold on the premises; commonly used in retail centers and malls

Lease-Option

Lease with an option to purchase within a specified time frame under specific conditions; typically a portion of the rent may be applied to the purchase

Graduated Payment or Step Up Lease

Lease containing specified rent adjustments (usually increased) at pre-determined times in the lease

Sale-Leaseback

Lease Where the owner sells the property to an investor with a condition that the new owner immediately leases it back to the seller, therefore freeing up the equity as cash

Assignment (the lessee becomes the assignor and the person receiving the rights becomes the assignee)

The transfer of leasehold rights of all of the leased space for the remaining period of time by the lessee, where the person receiving the rights pays rent directly to the landlord

Sublease or Sandwich Lease (the person subleasing becomes the sublessee and makes payments through the original lessee, the sublessor)

The transfer of less than 100% of the leased space or for a shorter period of time than the entire remaining lease period by the lessee where the lessee remains responsible for rent payments

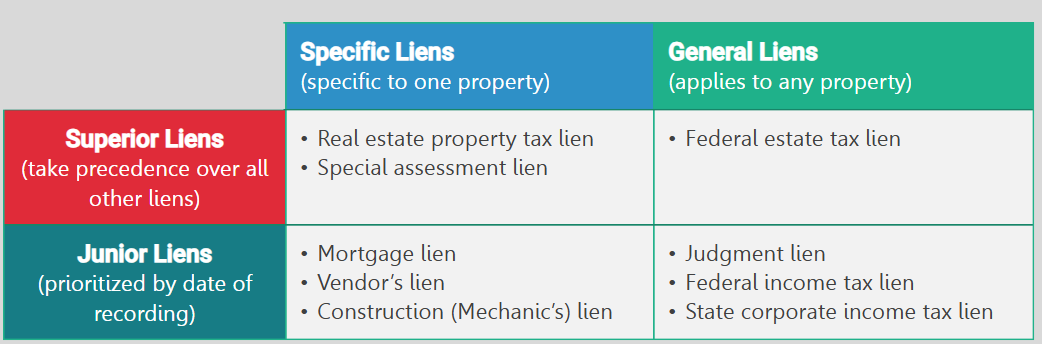

Lien (can be voluntary, such as a mortgage lien, or involuntary, such as a tax lien)

Financial claim against property by a creditor or unit of government that is used to secure the payment of a debt or obligation owed by the property owner

Superior Lien

Involuntary lien that takes precedence over other liens and are paid first in the event of a foreclosure; imposed by law without the owner’s consent

Junior Lien

Lien that is typically paid based on the date of recording, but always has lower priority than superior liens

Specific Lien

Classification of a lien that is specific to one property

General Lien

Classification of a lien that applies to any property the person may own

Real Estate Property Tax Lien

Type of superior lien owed by a property owner that is created January 1 of each year

Special Assessment Lien

Superior lien owed by a property owner that is assessed by local government for improvements such as road paving, sidewalks, and sewers

Mortgage Lien

Junior lien that is given by a borrower as a pledge of property as security for repayment of a loan

Judgment Lien (a type of general lien where the lawsuit may have had nothing to do with real property)

Junior lien imposed when a party is entitled to collect damages awarded by a court as the result of a lawsuit

Construction Lien (also referred to as a mechanic or materialmen’s lien)

Junior lien entitled to a builder or contractor who has not been paid money that is due for materials or labor used to build or improve a property

Federal Income Tax Lien

Junior lien placed against a property or individual for nonpayment of federal income taxes

Construction Lien (the lien dates back in priority to the date on which the first materials were delivered of labor was first performed on the property)

Junior lien where the lien date may be earlier than the date the lien was filed

Foreclosure

Method of enforcement for a lien

Lis Pendens

Notification of a pending lawsuit against a property owner

Summary of liens