Statutory Controls on Contract Terms

1/13

Earn XP

Description and Tags

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

14 Terms

Unfair Contract Terms Act 1977

regulates B2B

For act to apply, bs. must be attempting to limit their ‘business liability’: S.1(3)

Act is aimed at preventing businesses from taking unconscionable advantage of one another

If businesses are of equal bargaining power, the law is likely to take the ‘Freedom of contract’ approach:

Parties know their businesses well and they are the best judges of what should bind them, so courts stay out of it

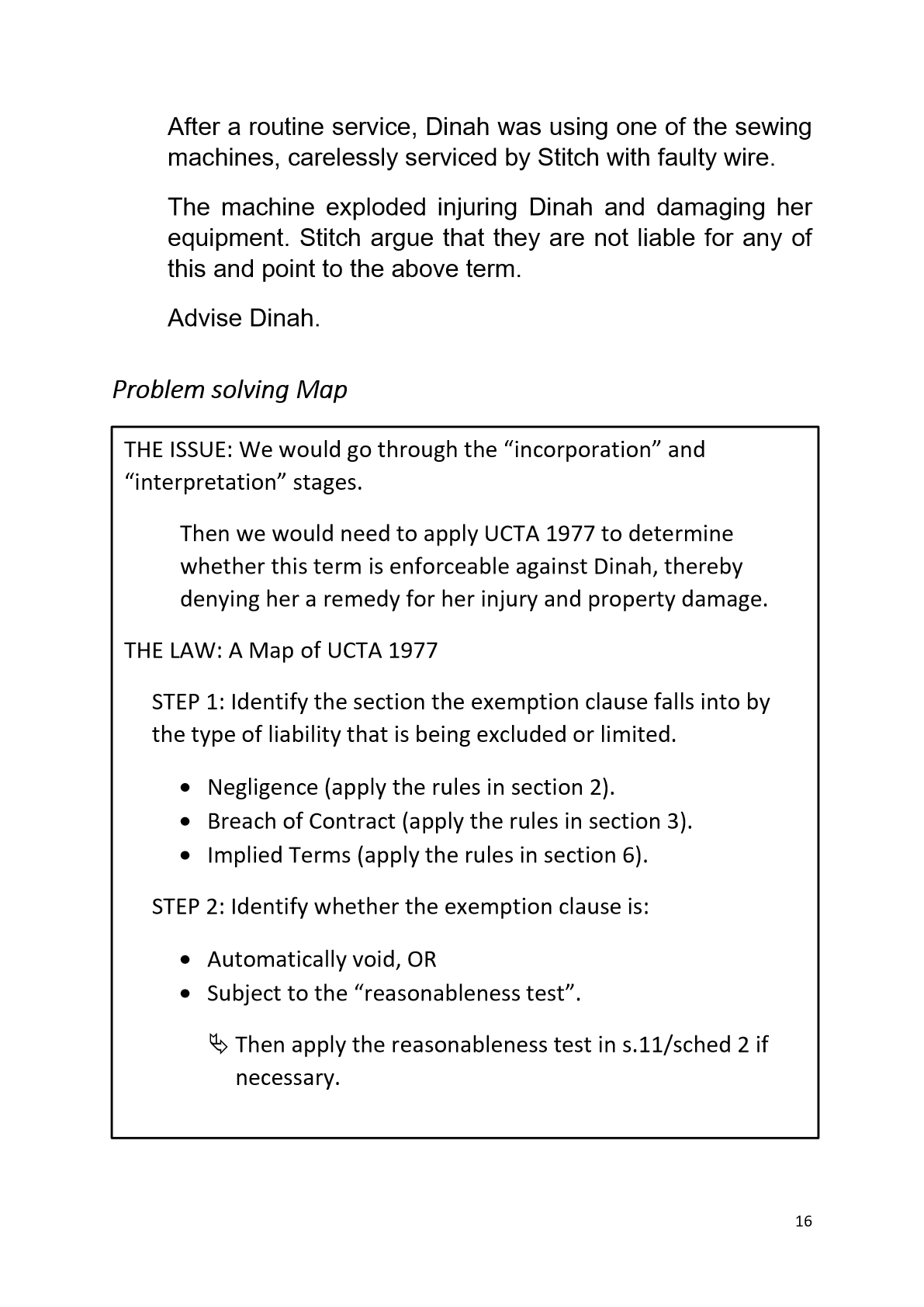

In a problem question, identify the section the exemption clause falls into by the type of liability that is being excluded or limited

Negligence (apply rules in section 2)

Breach of contract (apply section 3 rules)

Implied terms (apply section 6 rules)

Then identify whether the exemption clause is:

Automatically void OR

subject to the ‘reasonableness test’

Then apply the reasonableness test in s.11/sched 2 if necessary

Identify which section applies to the term: Section 2 UCTA 1977

Section 2 UCTA 1977

Regulates attempts to use a contract to exclude liability from negligence:

S.2(1) “A person cannot by reference to any contract term or to a notice… exclude or restrict his liability for death or personal injury resulting from negligence”

Terms that fall within this are automatically void

S.2(2) In the case of other negligently caused loss or damage, terms are valid if they pass the test of reasonableness

Identifying which section applies to term: Section 3 UCTA 1977

Section 3 regulates attempts to exclude liability for loss caused by breach of contract

A party cannot:

Use a term of the contract to exclude or restrict their liability for breach of contract

unless the term satisfies the reasonableness test

Include a term allowing them to give “a contractual performance substantially different from that which was reasonably expected”

unless the term satisfies the reasonableness test

Include a term that allows them to offer no performance at all

unless it satisfies the reasonableness test

Section 3 only applies where one party has agreed to the other’s “written standard terms of business”

Identifying which section applies to terms: Section 6 UCTA 1977

Regulates attempts to exclude implied terms in sale of goods contracts

Some implied terms can be excluded from the contract, but only if it is reasonable to do so

The implied terms in these contracts are that goods are of a certain quality, are fit for their purpose, and correspond to a given description

Identifying which section applies to terms: Section 8 UCTA 1977

A contracting party is not allowed to exclude liability or remedy for a pre-contractual misrepresentation

unless it satisfies the reasonableness test

Applying the “reasonableness test” where necessary

reasonableness test

S.11: The party seeking to rely on the clause must prove the term was:

“A fair and reasonable one to be included having regard to the circumstances which were, or ought reasonably to have been, known or in the contemplation of the parties when the contract was made.”

The courts will look at the term and all relevant factors in schedule 2 and s.11(4) to decide whether a term is reasonable

If a term is held to be unreasonable, that term cannot be enforced against the other party

Schedule 2 factors

when deciding whether a term is reasonable, the courts have regards to the factors in sched 2 of UCTA which are:

Bargaining strength

The more equal the parties bargaining strength, the more reasonable the term is likely to be

Inducement

Courts consider whether other party received an inducement to agree to the term

A lesser price would make an exemption of liability more reasonable

Choice

Courts consider availability of other means of meeting the customer’s requirements

If there was an opportunity to contract without a similar term, the term is more likely to be reasonable

Transparency

Court will look at whether the other party knew or ought to have reasonably known of the term

Was the term fairly brought to the other’s attention or was it hidden away in a raft of small print?

Manufacture to order

If goods were manufactured bespoke for the customer, exclusion of liability is more likely to be reasonable

Section 11(4) provides guidance to the courts when they are assessing whether a limitation clause is reasonable

Court should consider the resources a business has to meet the liability

A term limiting liability may be seen to be more reasonable if they are a small company with limited resources and need to limit their liability

The court should consider how far it was open to a party to protect themselves through insurance

The Consumer Rights Act 2015

B2C - trader and consumer contracts

‘Trader’ - person or company ‘acting for purposes relating to that person’s trade, business, craft, or profession:’ S.2

‘Consumer’ - individual ‘acting for purposes that are wholly or mainly outside that individual’s trade, business, craft, or profession’: S.2

2 parts:

Implied terms

identifies terms implied into consumer contracts for sale of goods, supply of services

regulates attempts by traders to exclude those terms

Unfair terms

Regulates exclusion of negligence liability s.65

renders non-binding any term defined as ‘unfair’: CRA s.62

Glaser v Atay [2024] EWCA Civ 1111 is case law that adheres to the CRA. This case emphasised that fairness and balance was needed in contract terms

Part 1 of CRA: Implied Terms: Supply of Goods contracts

S.9: Goods must be of satisfactory quality

what a reasonable person would consider satisfactory

Satisfactory quality includes:

state and condition and factors like safety, durability, free from minor defects, appearance and finish

S.10: Goods fit for particular purpose

if a consumer makes known to trader any particular purpose for which the goods are required, goods must be reasonably fit for that purpose

S.11: Goods must be as described

S.31: Exclusions and restrictions

Any term purporting to exclude or restrict right to a remedy, or impose an onerous condition on their enforcement, will not be binding

Implied Terms: Supply of Services contracts

s.49: Service to be performed with reasonable care an skill

s.50: Information given by trader about the trader or service before the contract IS INCLUDED as a term of the contract

^If taken into account by the consumer when deciding to enter into the contract

s.51: Reasonable price and no more to be paid for services

Only applied where contract does not fix the price to be paid

s.52: Service performed within a reasonable time (if no time is fixed in contract)

s.57: Exclusions and restrictions

Prohibitions on excluding or restricting liability under these implied terms

any term that excludes or restricts a right to a remedy (including making a remedy subject to an onerous condition i.e. one that has more obligations than benefits) is not binding on the consumer

Part 2 of CRA: Unfair Terms

Applies where there is a contract between a trader and a consumer (not just sale and supply contracts)

Renders void any term that excludes liability for death or personal injury resulting from negligence

Renders void any term assessed as ‘unfair’

e.g. a term that imposes onerous obligations upon failure to fulfil a contractual obligation

Term allowing trader to dissolve contract whenever they like, on any basis, when the contract does not give the same option to the consumer

Unfair Terms: the unfairness test s.62(4)

“A term is unfair if, contrary to the requirement of good faith, it causes a significant imbalance in the parties’ rights and obligations under the contract to the detriment of the consumer.”

2 relevant parts to this:

absence of good faith

significant imbalance

In assessing fairness, s.62(5) tells courts to consider:

Nature of subject matter of contract, and

All relevant circumstances existing when the term was agreed

Would the consumer have entered the contract if they were fairly treated?

Did the trader deal openly and fairly with the consumer or was the term a consumer “trap”?

Was the term brought fairly to the consumer’s attention?

ParkingEye v Beavis [2015] UKSC 67

Beavis overstayed in a retail car park: free for 2 hours, but PE imposed £85 for overstaying

B argued this was an ‘unfair term’ but was unsuccessful

Was it contrary to good faith? No

PE notified consumer of charge via prominent notices all over the car park

Consumer therefore freely agreed by leaving their car there

Significant imbalance? No

Legitimate justification for parking charge - PE needed to make profit and regulate the flow of spaces in the car park

£85 charge was a proportionate way of protecting PE’s interests

Unfair Terms: Schedule 2 ‘grey list’ of terms

Sched 2 contains list of terms that are prima facie unfair under the Act

The list is non-exhaustive': s.63

Example of a term in the grey list:

“A term which has the object of effect of requiring a consumer who fails to fulfil his obligations… to pay a disproportionately high sum in compensation

Unfair Terms: the “core terms” exception: s.64

Court will not assess a term for unfairness if it:

Identifies the main subject matter of the contract, or

relates to the appropriateness of the price payable under the contract for the goods or services supplied

Before the court will exclude a core term from assessment for fairness, the term must be “transparent and prominent”

if the term is on the “grey list” the court can assess it for unfairness regardless of whether it’s a core term