Empirical Marketing IBEB

1/66

Earn XP

Description and Tags

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

67 Terms

What are the four “First Principles” of marketing?

They are (1) All Customers Differ, (2) All Customers Change, (3) All Competitors React, and (4) All Resources Are Limited.

Why is “All Customers Differ” (MP#1) a fundamental assumption in marketing?

Because customers have diverse needs, preferences, and life experiences, no single offering can satisfy everyone in the long run. Firms that ignore these differences risk being outperformed by competitors that tailor their offerings. Over time, niche or even one-to-one marketing strategies can become essential to stay relevant. This principle underpins segmentation, targeting, and positioning (STP). Without addressing customer heterogeneity, firms often lose market share to more specialized competitors.

What are some common causes of customer heterogeneity?

Five major sources are (1) individual differences, (2) life experiences, (3) functional needs, (4) self-identity or image, and (5) marketing activities directed toward them.

What does “latent customer heterogeneity” mean?

Latent heterogeneity refers to unobserved differences in customer needs or desires that have not yet manifested in the market.

How do companies manage customer heterogeneity?

A common framework involves three steps: segmenting the market, targeting the most attractive segments, and positioning the firm’s offerings (STP). First, marketers identify distinct customer groups with shared needs. Next, they decide which segments to pursue, based on attractiveness and the firm’s competitive strengths. Finally, they craft a positioning strategy that highlights how their offering best meets the targeted segment’s needs. This ensures the firm addresses differing requirements effectively.

What is factor analysis, and when is it used in marketing?

Factor analysis is a data-reduction technique that identifies a smaller set of latent factors behind a larger set of correlated variables (like customer needs or preferences). It helps condense a big list (e.g., 20+ survey questions) into a few underlying dimensions such as “quality” or “price-sensitivity.” Marketers often use it to cluster related attributes or to design simpler segmentation bases. It simplifies analysis without losing key patterns.

What is cluster analysis, and why is it important for segmentation?

Cluster analysis is a statistical method to group individuals (or items) so that members within each group are more similar to each other than to those in other groups. In segmentation, it helps identify homogenous customer segments based on shared preferences or behaviors. Marketers then label and describe each cluster to better understand how to position products for them. It is particularly useful before deciding which segments to target.

Why is “All Customers Change” (MP#2) critical for marketers?

Because customers’ needs and preferences evolve over time due to factors like aging, new life events, or changing trends. A strategy that works today may lose effectiveness as customer lifestyles or market conditions shift. Firms must constantly monitor how existing customers move through “acquisition,” “expansion,” and “retention” stages (the AER approach). They also need to adapt their offerings, messages, and channels to match these evolving customer profiles. Ignoring customer change leads to missed opportunities and potential defection.

What is a typical framework for managing customer dynamics?

One approach is the AER framework (Acquisition, Expansion, Retention). First, managers assess how and why new customers enter (acquisition). Next, they look at opportunities to increase value through cross-selling or upselling (expansion). Finally, they address churn risks and put retention strategies in place to keep valuable customers. This cyclical view recognizes that customers’ needs and buying behaviors change across different stages of their relationship with the firm.

How does the lifecycle approach differ from dynamic customer segmentation?

A lifecycle approach places customers into generic stages (e.g., introduction, growth, maturity, and decline) based on time or life events, assuming everyone in a similar stage has similar needs. Dynamic segmentation recognizes that even customers who arrived at the same time may evolve differently and thus have different needs. Dynamic methods look for actual changes in behavior or preferences over time. It is a more precise way to adapt marketing strategies than broad, generic lifecycles.

What is “lost customer analysis,” and what does it accomplish?

Lost customer analysis involves reaching out to customers who have stopped buying (or closed accounts) to learn the reasons behind their defection. Marketers can then fix systematic issues that caused churn and possibly win them back with tailored offers. If customers aren’t ideal for the firm, the company may revise its acquisition strategy to avoid similar mismatches. It provides direct insights into how to improve retention and product/service quality.

What is RFM analysis, and how is it used?

RFM stands for Recency, Frequency, and Monetary value—three key indicators of past customer behavior. Marketers rank customers based on how recently they purchased, how often they purchase, and how much they spend. By segmenting on these measures, firms can prioritize marketing efforts on those most likely to respond or remain loyal. It’s a simple, popular method in direct marketing to identify high-value customers (and to guide future campaigns).

Define Customer Lifetime Value (CLV) in simple terms.

CLV is the net present value of the future financial contributions from a customer throughout their relationship with the firm. It considers how much profit a customer will bring over time, minus acquisition and retention costs, adjusted by a discount factor. Marketers use CLV to identify which customers are worth further investment and to allocate resources more efficiently. It is a cornerstone of customer-centric accounting.

Why is overspending or underspending on acquisition/retention both risky?

Underspending might mean losing out on profitable new customers or failing to keep valuable ones, leading to missed revenue. Overspending, on the other hand, can burn budget on customers who are unlikely to yield a return on investment. Because each marketing dollar has a diminishing return, balance is crucial. CLV-based decisions help firms figure out the “sweet spot” for these investments. Ultimately, the goal is to optimize total profit, not just short-term gains.

What does “All Competitors React” (MP#3) imply for a firm’s strategy?

It warns that any successful move a firm makes may be imitated or countered by competitors, undermining the advantage. Firms therefore need sustainable competitive advantages (SCAs) that are hard to replicate. These SCAs might come from strong brands, unique offerings, or deep customer relationships. Predicting and planning for competitor responses helps maintain leadership. Ignoring competition can quickly erode market position.

What is a Sustainable Competitive Advantage (SCA)?

An SCA is an advantage that meets three conditions: (1) customers care about it, (2) the firm does it better than competitors, and (3) it is difficult to copy or substitute. Common marketing-based SCAs include strong brands, innovative offerings, and unique customer relationships. SCAs must be continually nurtured, since competitors will try to narrow or copy them. When effectively maintained, an SCA can protect a firm’s profits for an extended period.

What are the three major marketing-based sources of SCA, sometimes called “BOR” equity?

They are (1) Brand equity, (2) Offering equity, and (3) Relationship equity. Brand equity involves the added value from a strong brand name or image in consumers’ minds. Offering equity focuses on the product or service performance and its perceived price-value trade-off. Relationship equity arises from personal connections, trust, and loyalty built through ongoing interactions. These three can reinforce each other and create powerful barriers to competitor imitation.

How do brand equity, offering equity, and relationship equity differ?

Brand equity emphasizes a buyer’s perception of and emotional ties to the brand (awareness, status, associations). Offering equity is about the actual product benefits relative to cost—essentially the “value” or utility. Relationship equity stems from the depth and quality of personal or organizational bonds, including trust, customer service, and loyalty programs. Depending on the product category, each source can be more or less important. Strong firms often build all three for maximum defense against rivals.

Why do many product innovations fail despite being technically sound?

Common reasons include a mismatch with consumer needs, poor positioning, inadequate launch strategies, or a lack of a clear differential advantage over existing solutions. Sometimes the pricing or distribution is off, or competitors respond more quickly than anticipated. Firms must not only develop great products but also ensure the launch plan and marketing message align with real consumer demands. Even the best idea can flop if it fails to connect properly in the market.

What does the “innovation radar” suggest about how firms can innovate?

The innovation radar reminds us that innovation isn’t only about new products; it can involve changing who the customer is, how a product is delivered, or where it is sold. It can also encompass internal processes, supply chain approaches, or even business models. By identifying different “dimensions” of innovation, firms spot more opportunities to create unique value. True innovation might mean reinventing operations, marketing, or distribution channels, not just the product itself.

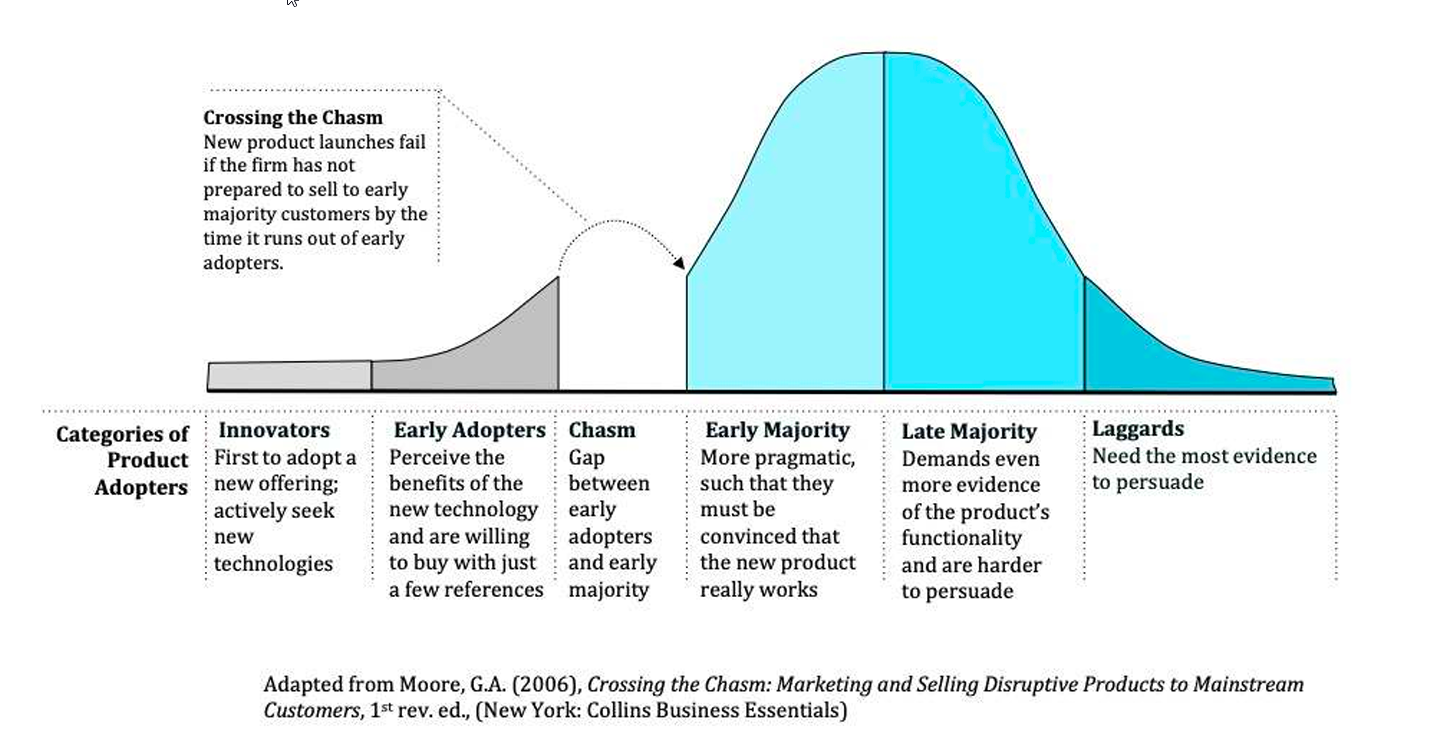

Why is understanding how customers adopt new products important?

Adoption patterns often follow stages: innovators, early adopters, early majority, late majority, and laggards. Each group requires a different marketing approach based on factors like risk tolerance, social proof, and observed product performance. Failing to plan for these segments can cause slow diffusion or missed sales. Marketers who know these patterns can optimize product launches and promotions to move through the adoption curve more effectively.

What psychological factors help or hinder new product adoption?

Psychological principles like social proof, authority, scarcity and fear of loss can also accelerate or impede adoption. If a product is too complex or doesn’t clearly offer a benefit, it’s less likely to catch on. Simplifying trial experiences and highlighting concrete advantages are key.

What is the difference between “red ocean” and “blue ocean” innovation strategies?

In a “red ocean” strategy, firms battle in existing market space with established rules and direct competition, often trying to gain incremental share. A “blue ocean” strategy, by contrast, aims to create entirely new market space, where competition is not yet defined or relevant. Blue ocean moves can offer much higher reward potential but carry more risk since the market is unproven. It often requires reshaping consumer perceptions or usage patterns. Examples include revolutionary offerings that redefine industry boundaries.

How do marketing experiments (like A/B tests) help evaluate offering strategies?

By randomly assigning different treatments (e.g., new ads, product features, or prices) to different groups, firms can observe which group performs better in real or simulated markets. This approach strengthens causal inferences because it controls for hidden biases, assuming proper randomization. It helps determine whether a new marketing initiative truly boosts sales, brand perceptions, or customer engagement. Good experiments provide evidence-based confidence in resource allocation decisions.

What stages is the industry lifecycle comprised of?

1. Early establishment of its range and boundaries 2. An innovation stage to set a “dominant design” 3. The shakeout stage, marked by economies of scale, such as that smaller players get forced out 4. Maturity, when firms focus on market share and cash flows 5. The decline stage when sales decay for the industry as a whole

What is the three step process of Lost Customer Analysis?

1. Set regular intervals for contacting lost customers to identify the cause of churn (choice models) and potential recovery strategies.

2. If the lost customer is not in the firm’s main target segment, firms could:

Change acquisition criteria

Evaluate an expansion to address loss of customers

3. If the lost customer is in the firm’s target market, firms should:

Fix the problem

Implement retention strategies to build brands and relations

What is an alternative empirical approach to CLV analysis?

Recurring Nerual Networks (RNN).

Same recency, frequency, and monetary value could be driven by unobserved variables. Customers with identical RFM can differ in CLV.

RNN allows us to model seasonality and individual-level differences accurately.

In which ways can a competitor displace a firm?

1. Technical innovations that provide competitors with a platform to launch a disruptive offering

2. Exploiting changes in customer’s desires due to cultural, environmental and other factors

3. Individual entrepreneurship that constantly seeks a better way to solve a problem

4. Copycats that improve the efficiency or effectiveness of an existing execution

What are the most common threats to external validity?

External validity fails when treatment effect is different outside the evaluation environment. - To secure external validity we want to be able to extrapolate estimates to other populations.

Common pitfalls:

Non-representative sample. This becomes an issue when coupled with segmentation if trial sample not representative of underlying population segment. Study of “heterogeneous treatment effects” in RCT

Non-representative program

Hawthorne effects

What are the most common threats to internal validity?

Internal validity holds when we can estimate the treatment effect of our specific sample. It fails when there are differences between treatment and control groups that affect the outcome and that we cannot control for.

Common pitfalls:

Failure of randomization

Non-compliance with experimental protocol

Attrition

What is the problem of “Crossing the chasm”?

A firm needs to cross the chasm between early adopters and the early majority before the firm runs out of early adopters. This is a common problem for product launches.

What are the different categories of product adopters?

Innovators

Early Adopters

Early Majority

Late majority

Laggards

What are the 5 product characteristics?

Relative advantage - Both economic but also status etc.

Compatibility - is it consistent with existing values and experiences

Complexity - how hard it is to use

Trialability - if it is possible to get a free trial to try the product etc.

Oberservability - how visible the results of an offering is to others

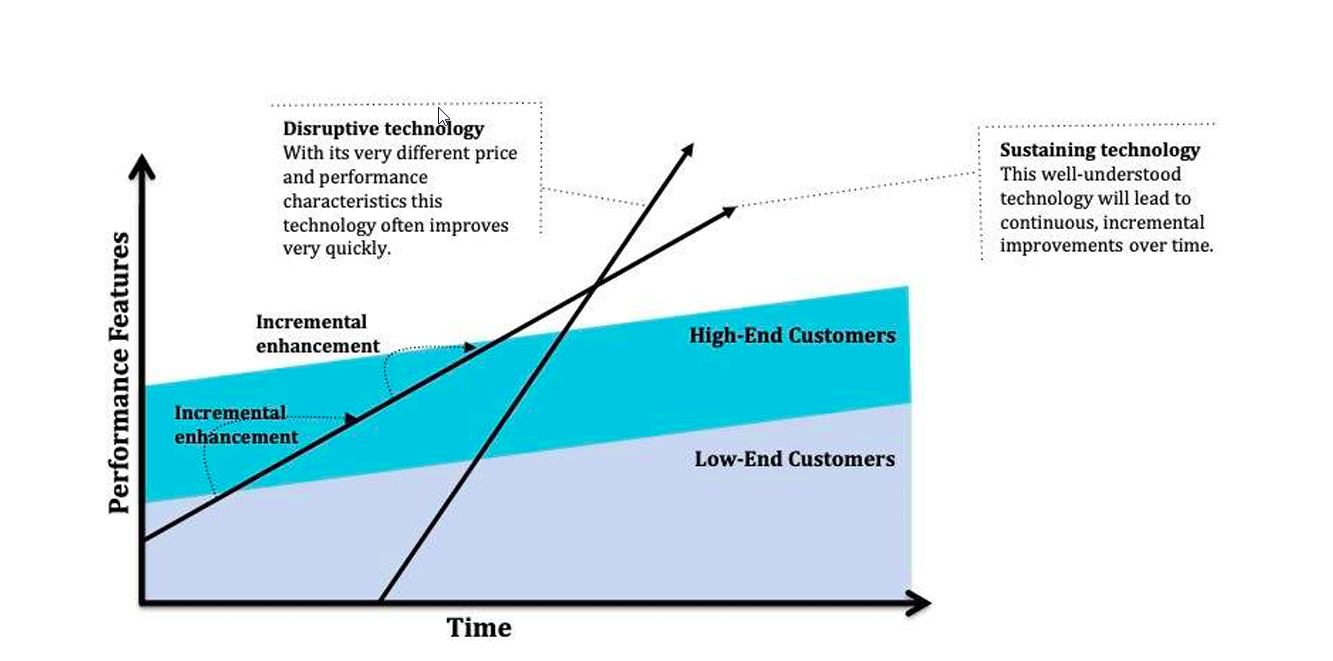

What are the two types of innovation?

Sustaining innovation - innovation that is continually happening on an incremental basis. Incumbents usually win battles for sustaining innovation.

Disruptive innovation - innovation that suddenly disrupts the industry, with highly different price and performance characteristics than existing offerings. New entrants usually win the battle of disruptive innovation.

Why do incumbants usually fail to create disruptive innovation? What is the solution?

They rely on the growth of their existing technologies, and don’t want to invest into lower-margin opportunities that they don’t know if customers want. Growth targets also make it more easily measureable to target larger markets relying on sustainable innovation.

Solution: Set up a parallel independent business focused on disruptive technologies.

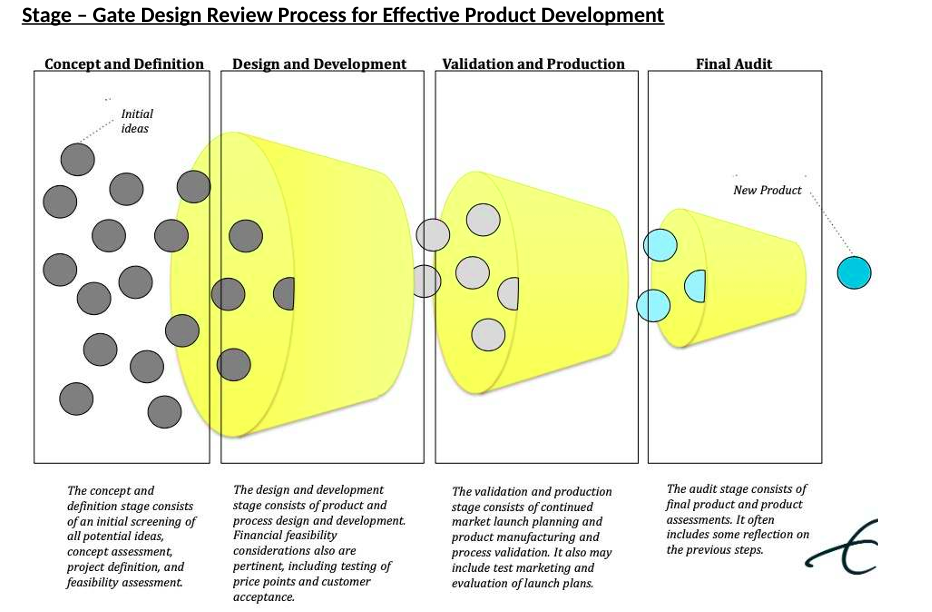

How does a stage-gate Development process work?

It divides the development process into multiple parts, where each project gets evaluated on multiple dimensions by independent evaluators.

It is most often used in structured new product development (NPD) environments—especially when organizations need a repeatable, methodical process to move from the early idea phase to a fully launched product.

What is a conjoint analysis and why is it beneficial?

It analyzes the tradeoffs in a product among a set of attributes in order to maximize the appeal to the consumer.

It is important because product superiority is the main reason for product success.

Largest predictor of new product success

Good designs are 5 times more likely to succeed than poor designs

What are the two main stages of conjoint analysis?

Conjoint design: Products are represented as bundles of attributes. The levels of each attribute define the product.

Conjoint analysis: Respondents rate several products by how willing they are to trade-off some attributes through a score of 1-10 or 1-100. Linear regression is then used to find the part-worth utilities.

What are part-worth utilities?

Numerical scores that measure how much each feature influences the customer's decision to select an alternative.

How do you calculate the importance on an attribute in a conjoint analysis?

Importance of Attribute = Attribute’s PW utility Range / sum (all Attributes’ range of PW utility)

Example: Importance Screen = 20 (i.e., 20 – 0) / (20 + 10 + 25) = 36,36%

What are the four main advantages of relationship equity?

Relational loyalty

Referral or word of mouth

Empathetic behavior

Cooperative behaviors

What are the two main stages of building relationship equity?

Building a strong foundation with the customer/partner. Having good customer-personell relations is the most important to succeed in this.

Offer loyalty programs and relationship marketing designed to generate specific relational outcomes across the firm’s customer portfolio to further the relationship equity.

How can relationship marketing(RM) programs be implemented?

Social RM programs: Use social engagement to convey the customer’s special status. E.g., by giving tickets to sporting events, etc.

Structural RM programs: Giving customer things they wouldn’t invest in themself, such as premium or customized packaging

Financial RM programs: Loyalty programs give discounts, giveaways, etc.

What are the three steps to building brand equity?

Building a high level of brand awareness

Linking the brand name to the brand’s points of parity and differences

Building a strong emotional connection or relationship between the customer and the brand.

What are Brand extensions?

Launch of new offerings by leveraging an existing brand, whether through a new line or category extensions. With brand line extensions, the new offering is in the same product category but targets a different segment of customers, usually with a slightly different set of attributes. With brand category extensions, the new offering instead moves to a completely different product category

What does resource slack mean?

Potentially utilizable resources a firm possesses that it could divert and redeploy to achieve organizational goals.

What is required for a segmentation to be valid?

It must be identifiable and stable:

•Identifiable: The segment represents a group of consumers that distinctly differs on key and targetable characteristics

•Stable: The key characteristics of consumers in this segment are not likely to rapidly change over time

What is factor analysis used for?

It is used to reduce a large number of variables by identifying a number of factors that explain the variation in a larger number of observed variables. We use these factors to summarize and interpret the preferences of our consumers. One way to identify possible latent variables is to look at the pairwise correlations between the variables.

What do the eigenvalue tell us?

It shows how much total variance is captured by the component/factor. An eigenvalue of 1 equals the variance carried by on standardized variable. This means that it contains more information than a single variable, only when it is above 1.

The rule of thumb is that eigenvalues above 1 are the only ones that are worth keeping.

What is a factor loading?

The correlation strength between an observed variable and the factor.

Rule of thumb: A factor loading greater than 0.3 implies that the variable and factor are associated.

Why are factor loadings valuable?

In order to evaluate a competitor’s market position. Factor scores can be computed for each competitor, indicating the competitor’s perceived market position.

Should a company focus on marketing to a sticky (high inertia) segment or a less sticky one?

A high inertia segment implies that there is a higher likelihood that the customer stays without any marketing. This means that it is usually best to focus merketing efforts towards the low inertia group, as they have a higher likelihood of being pushed into segments where they have a higher CLV.

What is a scenario-based experiment?

It uses hypothetical situations to assess how participants react to specific variables.

What are bases?

Variables that are used to group consumers into segments based on their shared characteristics or behaviors. These must be relevant to your market research and describe consumer behaviour, e.g. willingness to exit/voice concerns, company size, power, etc.

What are descriptors?

Variables that are used to describe the characteristics of each segment identified by the bases. They refer to broader demographic categories and describe the inherent characteristics of consumers, such as age, gender, etc.

How to calculate importance of variables?

By computing the percentage of total partworth utility associated with a certain category. So: U1 / (U1+U2+U3) × 100

What are the main sources of customer dynamics?

Individual level

Discrete life events

Typical lifecycle or maturation as people age

Product learning effects

Product market level

Product lifecycle

Environmental level

Changes in economy, government, industry or culture

What two elements affect willingness to pay?

Price and Utility

What are the two conditions for a segmentation to be valid?

It must be identifiable and stable.

What are the four key elements of marketing experiments?

Intervention

Outcome

Experimental Design/Assignment Mechanism

Control group/condition

What are some typical disadvantages of brand extensions?

• Often difficult to find a match between the image of the parent brand and the extension, on a dimension relevant to the consumer.

• Vertical extensions into lower-priced markets are dangerous because they undermine the image of the parent brand.

• Prototypical brands are more difficult to extend and may hurt the parent brand's image

What is latent loyalty?

Consumers have a positive atitude towards the brand but do not buy the company’s products.

What is the typical product lifecycle?

Introduction, Growth, Maturity, Decline.

What are the main sources of resource constraints?

1. A firm’s resource slack

2. The changes in the composition of a firm’s segments

3. Changes in the competitiveness of a firm’s product portfolio and landscape

4. The changes in the effectiveness of a firm’s current marketing activities

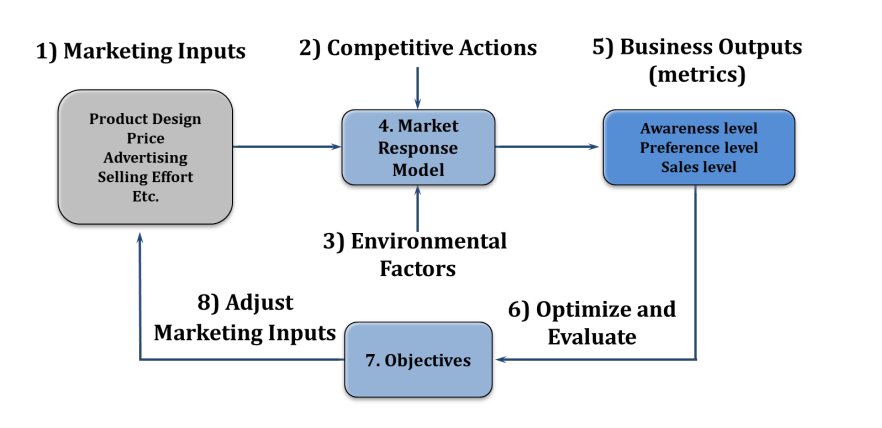

What are the main ways of dealing with limited resources in marketing?

Heuristic approach

Attribution approach

Response models

Experimental models

What is response model-based attribution?

Uses statistical/econometrics models to estimate where resources should be allocated, highly data driven and analytical.

What is the Heuristics based attribution approach?

Simple, easily communicated rules that anchor the budget, managers can then adjust the rules in light of each periods results.

E.g. %-of-sales spent on marketing

Fits small firms