Chapter 6- Accounting for Long-Term Operational Assets

1/38

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

39 Terms

Current (short-term) assets

Assets that will be converted to cash or consumed within one year or an operating cycle, whichever is longer.

ex. inventory or office supplies

Long-term operational assets

Assets used by a business to generate revenue; the condition of being used distinguishes them from assets that are sold (inventory) and assets that are held (investments).

ex. equipment or buildings

Long-term assets may be:

tangible or intangible

Tangible assets

Assets that can be touched, such as equipment, machinery, natural resources, and land.

Types of tangible assets

(1) Property, plant, and equipment, (2) Natural Resources

Property, plant, and equipment

Category of assets, sometimes called plant assets, used to produce products or to carry on the administrative and selling functions of a business; includes machinery and equipment, buildings, and land. The level of detail used to account for these assets varies

Depreciation

Decline in the value of long-term tangible assets such as buildings, furniture, or equipment. Accountants systematically recognize it as depreciation expense over the useful lives of the affected assets.

Land

not subject to depreciation

Natural resources

Mineral deposits, oil and gas reserves, and timber, mines, and quarries, are examples; they are sometimes referred to as wasting assets because their value depletes as the resources are extracted.

Considered inventories and are expensed as the cost of goods sold

Resource deposits generally have long lives

Intangible Assets

Assets that may be represented by pieces of paper or contracts that appear tangible; however, the true value of an intangible asset lies in the rights and privileges extended to its owners.

ex. patents

Types of intangible assets

(1) Identifiable useful lives, (2) Indefinite useful lives

Identifiable useful lives

patents and copyrights

May become obsolete or may reach the end of their legal lives

Amortization

Method of systematically allocating the costs of intangible assets to expense over their useful lives; also term for converting the discount on a note or a bond to interest expense over a designated period.

Indefinite useful lives

useful lives cannot be estimated

Examples: renewable franchises, trademarks, and goodwill

Costs are not expensed unless the value of the assets becomes impaired

Historical cost concept

Accounting practice of reporting assets at the actual price paid for them when purchased, regardless of estimated changes in market value.

Includes purchase price plus any costs necessary to get the asset to the location and condition for its intended use

The cost of an asset does not include:

payments for fines, damages, etc., that could have been avoided

Basket Purchase

Acquisition of several assets in a single transaction with no specific cost attributed to each asset.

The total price must be allocated among the assets required

Accountants commonly allocate the purchase price using the relative fair market value method

Relative fair market value method

Method of assigning value to individual assets acquired in a basket purchase, in which each asset is assigned a percentage of the total price paid for all assets. The percentage assigned equals the market value of a particular asset divided by the total of the market values of all assets acquired in the basket purchase

Depreciation expense

Portion of the original cost of a long-term tangible asset systematically allocated to an expense account in a given period.

Salvage value

Expected selling price of an asset at the end of its useful life.

Depreciable cost

Original cost minus salvage value (of a long-term depreciable asset).

Methods to recognize depreciation expense

Straight-line

Double-declining-balance

Units-of-production

Straight-Line Depreciation

Method of computing depreciation that allocates the cost of an asset to expense in equal amounts over its life.

The formula for calculating straight-line depreciation

(Cost–Salvage)/Useful Life

Book Value (Carrying Value)

Historical (original) cost of an asset minus the accumulated depreciation; alternatively, undepreciated amount to date.

Decreases net income but does not affect cash flow

Double-declining-balance depreciation

A Depreciation method that recognizes larger amounts of depreciation in the early stages of an asset’s life and progressively smaller amounts as the asset ages.

Recognizes depreciation expense more rapidly than the straight-line method

Accelerated depreciation method

A Depreciation method that recognizes depreciation expense more rapidly in the early stages of an asset’s life than in the later stages of its life

Steps for double-declining-balance method

Determine straight-line rate

Determine the double-declining-balance rate

Determine the depreciation expense

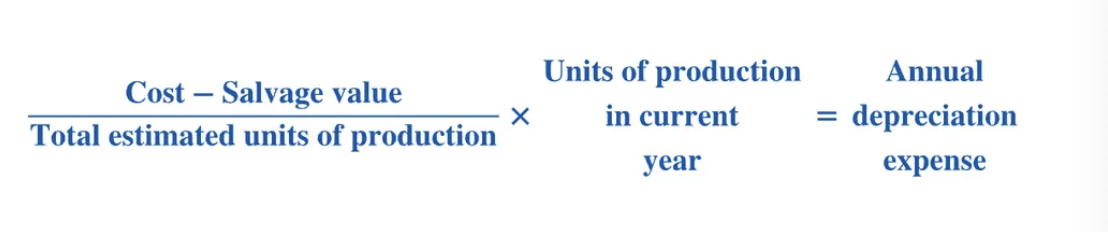

Units-of-production depreciation

Depreciation method based on a measure of production rather than a measure of time; for example, an automobile may be depreciated based on the expected miles to be driven rather than on a specific number of years.

Annual depreciation expense for units-per-production method

Annual depreciation expense is computed by multiplying the cost per mile by the number of miles driven

An asset cannot be depreciation below its salvage value

Maintenance costs

Costs incurred for repair or maintenance of long-term operational assets; recorded as expenses and subtracted from revenue in the accounting period in which incurred.

Capital expenditures

Substantial amounts of funds are spent to improve an asset’s quality or to extend its life.

Account for in two ways:

Improving the quality of service these assets provide

Extending life

Depletion

The process of expensing natural resources

The most common method used to calculate is the units-of-production method

Method of systematically allocating the costs of natural resources to expense as the resources are removed from the land.

Trademarks

a name or symbol that identifies a company or a product

Registered with the federal government and has an indefinite legal lifetime

Costs to incur, design, purchase, or defend a trademark are capitalized in an asset account called Trademarks

Patents

grant their owner an exclusive legal right to produce and sell a product that has one or more unique features

Patents issued by the US Patent Office have a legal right of 20 years

Companies may obtain patents through purchase, lease, or internal development

Costs capitalized in the Patent account are usually limited to the purchase price and legal fees to obtain and defend the patent

R&D costs that are incurred to develop patentable products are generally expensed in the period in which they are incurred

Copyright

protects writings, musical compositions, works of art, and other intellectual property for the exclusive benefit of the creator or persons assigned the right by the creator

Cost includes the purchase price and any legal costs associated with obtaining and defending the copyright

Copyrights granted by the federal government extend for the life of the creator plus 70 years

The cost of a copyright is often expensed early because future royalties may be uncertain

Franchises

grant exclusive rights to sell products or perform services in certain geographic areas

May be granted by governments or private businesses

Franchises granted by governments include federal broadcasting licenses

Franchises granted by private businesses include restaurant chains and brand labels

The legal and useful lives of a franchise are frequently difficult to determine → judgment is crucial

Goodwill

the value attributable to favorable factors such as reputation, location, and superior products

ex. A restaurant’s value lies in its popularity, not just in the chairs, tables, kitchen equipment, and building