EXAM 5 SECTION D

1/18

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

19 Terms

individual risk rating

Prospective

Experience Rating

Schedule Rating

Composite Rating

Retrospective

same renewal between single no cred experience credit

Retrospective vs Prospective Rating

Responsiveness

Retrospective → more responsive

Losses during policy period impact prem of _____ period

Prospective → less responsive

Chg prem only on _____

Stability of Prem

Retrospective → less stable

Prem chg not only _____ periods but also within same period

Uses _____ year data & _____ _____

Prospective → more stable

Prem don’t change within policy period

Sched rating → mod determined at start of policy term & doesn't change

Exp rating → uses multiple yrs of _____ & applies cred

Incentive for Risk Control

Retrospective → more immediate incentive

Reduced loss result in lower prem for same term

Prospective → less incentive

Exp rating → takes time before reduced loss impacts prem

Sched rating → uncertain if will be given sched _____

standard prem

= Manual Prem x Exp Mod Factor x Sched Mod Factor

experience history

______ Rating: gives credit or debit based on insured’s claims _____ on prior terms

Mod = % debit or credit

ISO CGL → pos is debit, neg is credit

+1 to get factor

NCCI → already in factor form!

stability responsiveness recent stable

Experience Rating → length of Experience Period

Balance ______ vs ______

Short period → more responsive to _____ losses

But less cred, less _____ mod factors

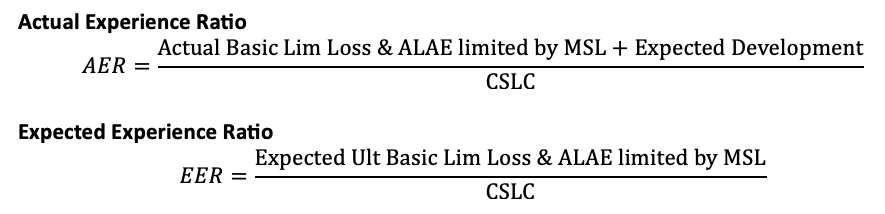

prem detrended CSLC EER LDF basic msl

ISO CGL Experience Rating

**CSLC = Expected Ult Basic Lim Loss&ALAE NOT limited by MSL

If no MSL, EER = 1!

STEPS

For each subline, calculate Basic Lim Expected Loss

BLEL = Expected LR x Basic Lim _____

For each subline & year, calculate CSLC

CSLC = BLEL _____ back to each year

Total CSLC → sum across all sublines & years

For each subline & year, calculated Expected Dev

Expected Dev = _____ x _____ x _____

***This LDF is more like % unreported

Sum to get Total Expected Dev (for AER num)

Actual Basic Lim Loss&ALAE limited by MSL

Cap each individual actual loss at _____ lim

Add ALAE and cap Loss&ALAE at _____ (Max Single Loss)

Sum to get part of AER num

Mod = Z x (AER - EER)/EER

Add 1 to get factor

z eer

ISO CGL Experience Mod

Mod = _____ x (AER - EER)/_____

*Add 1 to get factor

overly influencing freq sev expected impact cred

ISO CGL Experience Rating

Why cap losses at basic lim & MSL?

Prevent large individ claims from _____ _____ experience mod

Make plan more responsive to _____ than _____

Why does MSL inc as size of risk inc?

Larger risk = larger _____ loss

So less _____ loss of a given size will have on mod

MSL inc to allow for more _____

primary excess

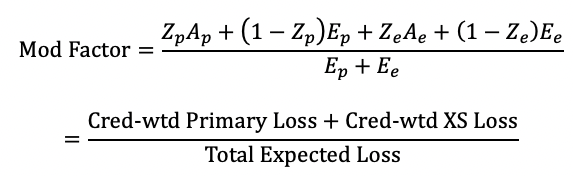

NCCI Experience Rating

Only use loss (no ALAE)

Split into 2 portions:

_____ → capped at C

_____

Cred-weigh each separately

A = actual loss

E = expected loss

Ze = W x Zp

*Sometimes will be given a stabilizing value

Add to both num & denom!

weighting ballast payroll capped payroll elr

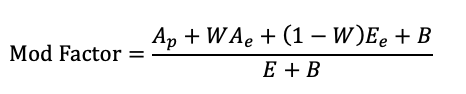

NCCI Experience Rating (another formula)

W = _____ Value

B = _____ Value → stabilizing value

For each class i:

Di = D-Ratio

ELRi = Expected Loss Rate

Expected Loss per $100 _____

STEPS:

Calculate Ap = actual loss _____ at C

Ae = A - Ap

Expected Loss for class i

Ei = (_____i/100) x _____i

Sum to get E = Expected Total Loss

Expected Primary Loss

Ep = sum(Di x Ei)

Expected XS Loss

Ee = E - Ep

subjectively experience

Schedule Rating: UW _____ assign credit/debit to individual risks

Based on risk chars NOT already reflected in _____ rating

composite rating

rating a policy w/ multiple coverages using a single exposure base

large ded policies

large employers purchase policies w/ large ded

insured retain more loss/risk

Calculations:

Use standard PP formula

Num → only use expected loss XS of ded!

XS Ratio = 1 - LER

Expected XS Loss = XS Ratio x Expected Ground-Up Loss

**PAY ATTENTION TO WHAT RATIOS APPLY TO!

Ground up, XS, loss below ded

incl/excl ALAE

incentive ulae reimbursement credit profit

Considerations of Large Deductible:

Claims Handling: who’ll be responsible for adjusting claims below ded

Insured → usually hire a TPA, less _____ to keep loss below ded

Insurer → higher _____

Application of Ded: loss only or loss+ALAE?

Ded Processing: if insurer pays all loss first, then seek _____ for below ded

Extra FE:

Cost to bill & process these amts

_____ risk in case insured unable to pay

Risk Margin: losses above large ded are difficult to est

Inc _____ margin to reflect higher risk

(b+ca)t lae taxes

NCCI Retrospective Premium

R = _____ H ≤ R ≤ G

R = Retro Prem → capped between H, G

b = Basic Prem

Profit & Expenses (excluding _____, _____)

Net insurance charge

A = Rept Loss (may or not incl ALAE)

May be capped by Per Occurrence Limit

C = Loss Conversion Factor

CA = converted loss

T = Tax Multiplier

e - (c-1)e(a) + ci

NCCI Retrospective Basic Prem

b = ______

e = Expense & Profits (excl Taxes)

CI = Converted Net Insurance Charge

**Often given as a ratio to STANDARD PREM!

expenses profits lae taxes net insurance charge

NCCI Retro Rating Basic Prem

Total _____ & _____

Excluding _____ & _____

_____ _____ _____ for limiting prem by max&min

e(a) c

Converted Net Insurance Charge: charge for limiting prem by max & min

CI = (Insurance Charge - Savings) x _____ x _____

downwards rept loss

How could retrospective prem change between adjustments?

Ex: At first adjustment, retro prem capped @ max prem

Can only develop _____

Will only dec if _____ _____ dec

Case reserve dec

Settled for less than current case reserves