2.2 aggregate demand

1/42

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

43 Terms

aggregate demand

total planned expenditure at a given price level

what is AD made up of

consumption + investments + government expenditure + net trade(exports - imports)

consumption

spending by households on consumer goods and services

why are consumer goods bought

for the utility they provide

what happens to consumption as disposable income increases

increase consumption

each £1 earned

is either consumed or saved

C + S = 1

marginal propensity

average proportion of the pound

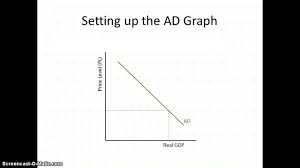

why is AD downwards sloping

as price level increases - decreas real Y(income) - less money - decrease soending - decrease consumption - decrease AD

why is the link between dispos Y and C unclear

households can also finance C through borrowing or use of savings

main determinants of C

disposable income

interest rates

consumer confidence

wealth effect

interest rates

the added price of money borrowed or saved

increase IR - increase saving - decrease C

increase IR - increase cost of borrowing- decrease C

increase IR - increase mortgage payment - decrease C

and vive versa

consumer confidense

increase confidence - i.e future job security - increase confidence to spend - increase C

increase confidence - increase borrowing - increase C

wealth effect

increase price of assets e.g house,shares,bonds - feel wealthier - increase C

use assets as collateral for borrowing

investment

total spending on capital goods in order to produce other goods and services - increasing productive capacity

i.e additions to capital stock

net investment

expands the economy by increasing capital stock it is additions not replacements.

gross investments

includes both net(new/additional) investment + replacement investment

factors influencing investment

rate of econ growth

business confidence

keynes and animal spirits

demand for exports

access to credit

influence of govt regulation

rate of econ growth

increase econ growth - encourage business to I - increase sales - increase GDP/econ growth - Increase I

this is the accelerator process

business confidence

increase business confidence - increase I

confidence is affected by businesses views on future profit + sales

Keynes and animal spirits

keynes beleived investments were partly determined by “animal spirits” i.e beleifs/instincts/hunches

decisions based on managers feeling about future economy

often “animal spirits” move collectively - herd mentality

this often result in I rising or falling significantly

demand for exports

if increase in d for uk x’s - may require increase in capacity - increase in I

interest rates

higher IR - higher cost of borrowing - investments would require higher profitabilty - decrease I

access to credit

if decrease in access to credit - decrease in I

influence of govt regulation

govt can influence business I

e.g fiscal policy - decrease corporation tax - increase I - however business may just increase dividends and not invest money which means loss for govt

govt offer incentives for businness to invest in certain areas

consequences of low rate of a capital investment

slows econ growth

weaker productivity growth - capital stock not improved - decreass in quality or quantity

impact on exports + net trade - need capacity to keep up with demand

capital stock

machinery/equipment already in place used to make other goods and services

3 types of government expenditure

current expenditure

capital expenditure

transfer payments

current expenditure

“day to day”, education health service etc

capital expenditure

investing in ifrastructure e.g new hospitals

transfer payments

transfer payments from taxpayer to specified group e.g. pensions,benefits,grants etc

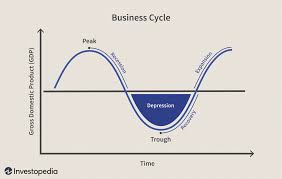

the trade cycle

a repeated cycle/pattern of variations in economic growth

what happens to G when economy is in a slump

Increase unemployment - increase benefits - increase G

what happens when economy is growing

Decrease unemployment - decrease benefits - decrease G

fiscal policy

when gov.t deliberatley change levels of G and taxation

net trade

refers to our trade balance(exports(x)-imports(m))

trade deficit

x<m net leakage from uk

trade surplus

x>m net injection into UK

main influences on the trade balance

real income

exchange rates

state of the worlds economy

degree and global protection

non-price factors

real income

real income increase - increase spending by households - increase spending on imports

exchange rates

SPICED:

Strong Pound Imports Cheaper Exports Dearer

generally if pounds appreciates(gets stronger) this will increase M’s and decrease X’s

vice versa if pound depreciates

state of the worlds economy

if world economy grows stronger(boom)- increase real income overseas- increase D for UK X’s

likewise if global recession - decrease D for UK X’s

degree and global protection

if UK’s main export markets e.g EU,USA imposed tariffs on imports then this will decrease uk X’s

brexit has increased barries for uk X’s

non-price factors

demand for X’s will be affected by:

quality

reliability

transport costs