Chapter 13 Equity Valuation

1/19

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

20 Terms

Book value

The net worth of common equity according to a firm's balance sheet

Liquidation value

Net amount that can be realized by selling the assets of a firm and paying off the debt

Replacement cost

cost to replace a firm's assets

Tobin's Q ratio

= market value of assets / replacement cost of assets

determines whether a company is under or over valued

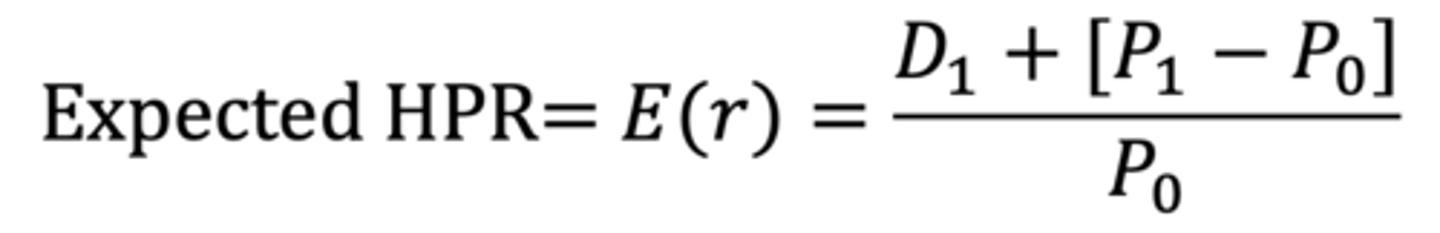

Expected HPR (formula)

intrinsic value

The present value of a firm's expected future net cash flows discounted by the required rate of return

Market capitalization rate

the market-consensus estimate of the appropriate discount rate for a firm's cash flows

Dividend Discount Model (DDM)

a model that values shares of a firm according to the present value of the future dividends the firm will pay

Constant Growth DDM

a form of the DDM that assumes dividends will grow at a constant rate

Dividend Payout Ratio

Dividends/Net Income; Fraction of earnings paid out as dividends

Plowback ratio or earnings retention ratio

the proportion of the firm's earnings that is reinvested in the business (and not paid out as dividends)

Sustainable growth rate

Growth rate of earnings and dividends if the firm reinvests a constant fraction of earnings and maintains both a constant return on equity and constant debt ratio

Present value of growth opportunities (PVGO)

net present value of a firm's future investments

Two-stage dividend discount model (DDM)

Dividend discount model in which dividend growth is assumed to level off to a steady, sustainable rate only at some future date.

Prices earnings multiple

The ratios of a stock's price to its earnings per share

PEG ratio (price-earnings growth)

Price-Earnings Ratio/Earnings Growth Rate

Earnings management

the practice of using flexibility in accounting rules to manipulate the apparent profitability of the firm

Multistage Growth Models

Allow dividends per share to grow at several different rates as firm matures

Market Value of Equity

Market price per share multiplied by the number of outstanding shares

Aswath Damodaran 5 Values that Matter

1. Revenue growth

2. Profitability

3. Reinvestment efficiency

4. Discount rate

5. Failure risk