(5) Measurement - Inflation

1/31

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

32 Terms

Economic growth

Ability of economy to produce increasing quantities of goods/services

The increase in real GDP or real GDP per capita over time

Long-run = rising productivity increases average standard of living

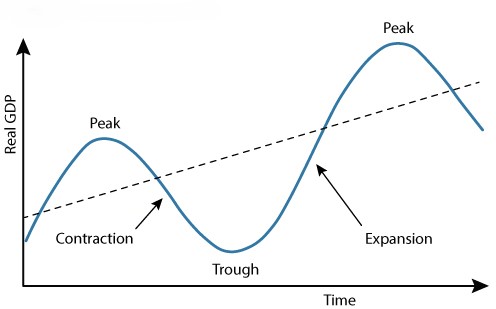

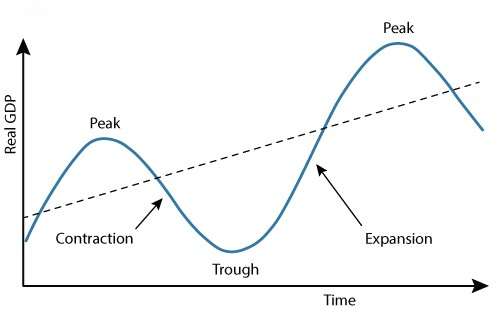

Business Cycle

Alternating periods of economic expansion and economic contraction relative to the long-term trend rate of economic growth

Real GDP per capita

A measure of average output per person, adjusted for inflation; the best indicator of living standards

(Real GDP/population)

Rule of 70

The number of years required for a variable (like GDP) to double = 70 ÷ annual growth rate

70 comes from a formula

Labour Productivity

The quantity of goods and services produced per hour of labour’

Determined by…

Increases in capital per hour worked

Technological change

Potential GDP

The level of real GDP the economy can produce at full employment (firms are producing at capacity

The Business Cycle - when economy EXPANDS

Production increases - more output

Unemployment decreases - businesses need people for output

Wage increases - attract and keep workers by offering higher wages

Consumer spending increases - people spend more because they earn more

Prices increases - consumers spend more (inflation)

The Business Cycle - when economy CONTRACTS

Production decreases - businesses produce fewer output

Unemployment increases - businesses need fewer workers

Wages decrease - businesses are doing less well

Consumer spending decreases - people spend less because they earn less

Prices decreases - consumers spend less (deflation)

Physical capital

The stock of equipment, buildings, and tools used to produce goods and services (manufactured goods)

Human capital

The knowledge and skills acquired through education, training, and experience from workers

Technological progress

Change in ability of firm to produce a given level of output with given input

Improvements in knowledge that enhance production efficiency and output

Financial system

The network of institutions that match savers’ funds with borrowers’ investment needs

Investment

Expenditure on new capital goods that add to future productive capacity

Public saving

Taxes minus government spending (T – G)

Private saving

Disposable income minus consumption

(national income - consumption - net taxes)

National saving

Sum of private and public saving; funds available for investment

Closed economy formula for GDP

Y = C + I + G

Investment in a closed economy

I = Y – C – G = national saving

Crowding out

A decline in private investment due to increased government borrowing or higher interest rates

Foreign direct investment

Investment by foreign firms in domestic capital or operations

Catch-up effect

The tendency for poorer countries to grow faster than richer ones when similar policies are adopted

Policies promoting growth

Increasing saving, investment, education, research, trade, and stable institutions

Institutions

Economic and political rules that shape incentives and govern behaviour

Recession

Significant decline in economic activity spread across the economy, lasting more than a few months, visible in industrial production, employment, real income and wholesale-retail trade

If an economy’s growth rate is 3.5% per year, its GDP will double in approximately:

B) 14 years

Which of the following contributes most to long-run economic growth?

C) Growth in labour productivity

Which of the following policies best encourages long-run economic growth?

B) Subsidising education and research

Which of the following is an example of crowding out?

B) Government borrowing raising interest rates, reducing private investment

The catch-up effect predicts that:

B) Poor countries will grow faster than rich ones, holding other factors constant

During expansions, inflation rate…

increases

exception: if expansion is due to rising productivity levels and an expansion of potential GDP

During contractions, inflation rate…

decreases

exception: if recession is caused by a supply shock

Unemployment rate will RISE even after a recession because…

firms delay hiring and more people re-enter the labour force to look for work as conditions improve.