1BB3 Macroeconomics Final Exam Study

1/102

Earn XP

Description and Tags

Covers all information from chapter 4-12 VIDEOS ONLY

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

103 Terms

Chapter 4: GDP

Market value of all final goods and services produced in a region in a given period during a year

Measures of how much stuff a country produces

Based off market value

Only legal things considered in this metric

Attempts to capture all things produced

Only accounts for final goods, this avoids double counitng

Chapter 4: Forms of GDP calculation

Income method: Adds incomes earned from production.

Expenditure method: Adds spending on final goods and services.

Chapter 4: GDP calculation, expenditure method

Y=C+I+G+NX

Adds

C consumption

I investment

G government spending

NX exports minus imports

To find

Y, total GDP

Chapter 4: Housing in the GDP

New housing included as investment spending the year it is built because it lasts a very long time and provides a flow of services each year

Sale of an existing home is NOT included as part of GDP, this just transfers asset nothing new is made

Chapter 4: Rent vs Owner in GDP

Both provide services to families

Both are included in consumption services

Owner occupied housing is a rare example of something included in GDP even if there is no market transaction, owner operated housing is included by estimated rental value

Chapter 4: Gross National Income (GNI) & Gross National Product (GNP)

Market value of all final goods and services produced by a country’s factors in given period

To be included in Canadian GNP, the factors of production used to make good or service must be Canadian owned

GNI and GNP are the same thing

Chapter 4: GDP vs GNI

Ford makes a car in Oakville that costs 30k

20k is cost of labor

10k is profit to ford

Canadian GDP increases by 30k, but GNI is only increased by 20k (labor cost)

GDP includes all goods or services produced in Canada

GNI includes all goods and services produced with Canadian owned factors of production, regardless of where it takes place

Chapter 4: GDP theory

Calculated by adding up price times quantity over all goods and services produced each year

GDP rises if prices rise or if we make more

Chapter 4: Nominal vs Real GDP

By holding prices constant in some “base” year and re calculating GDP, we arrive at real GDP

Once we have nominal GDP and real GDP, we can use these to calculate the overall price level in an economy

Chapter 4: GDP Deflator

Measure of the price level

Nominal GDP divided by Real GDP times 100

Inflation rate is the percentage change in the price level from one year to the next

Chapter 5: How unemployment is determined (CONCEPT)

Stats Canada divides the working non institutional civilian adult population into 3 mutually exclusive categories

Determined by phone survey

Unemployed is when you have no job BUT are looking for work

Chapter 5: Calculations related to employment/unemployment

Unemployment rate is the number of unemployed divided by labor force times 100

Labor force participation rate is labor force divided by adult population times 100

Employment rate is number of employed divided by adult population times 100

Employment rate is NOT equal to 100 minus the unemployment rate because of division factor

Chapter 5: Circle example of categorizing Canadians

Imagine the whole population as one big circle for this explanation

Outermost circle, whole population

Then one layer in is the adult population (15+)

Then another layer in is the non institutional civilian adult population (does not include prisoners, military, or hospital workers)

In the non institutional civilian adult population circle it gets split into three, employed, unemployed, and not in labor force

Chapter 5: Unemployment compensation

Benefits paid to workers who find themselves unemployed

Reduces the negative impact on family income in case of unemployment

Increases the opportunity cost of going to work

Cost of working:

Direct cost (lunch out, parking, gas)

Opportunity cost (not collecting E.I)

Chapter 5: Unemployment diagram

E.I Shifts the labor supply curve left changing equilibrium

Minimum wage above equilibrium wage is binding, market is not in equilibrium, but this is justified and reasoned which is why its done

Labor market: Firms are buyers, workers are sellers

Chapter 5: Calculating CPI

Consumer Price Index, measures the overall cost of goods and services for typical Canadian households

Begins calculation by deciding which goods are included in the “basket” then they find the cost of it

CPI is the cost in current year divided by cost in base year times 100

CPI is a measure of the overall price level of economy

Most used price index for reporting the inflation rate, the rate of change of the price level from one year to next

Chapter 5: Inflation with CPI

Inflation rate = (CPI this year − CPI last year) ÷ CPI last year × 100

Chapter 5: CPI vs GDP Deflator

Both measure of the price level

Different “basket of goods”, the GDP deflator is all goods produced in Canada while the CPI is all goods bought by typical households

Chapter 5: Unanticipated inflation example

Mortgage is a loan on a house, bank agrees on interest rate and loan term

Real interest rate is nominal interest rate minus inflation rate

A problem with unanticipated inflation is the unexpected transfer of wealth between borrowers and lenders

Inflation greater than expected, wealth moves from lenders to borrowers

Inflation less than expected, wealth moves from borrowers to lenders

Chapter 6: Per capita GDP, is it accurate for what we use it for?

Accounts for all goods and services produced in country

Higher per capita GDP typically means other development metrics improve

Used to see how a country is evolving over time

GDP per capita = GDP ÷ population

To find year over year do ((future-initial)/initial)x100

Chapter 6: Calculating average annual growth rate over a period

AAGR = (growth rate year 1 + growth rate year 2 + …) ÷ number of year

Chapter 6: Rule of 70

How many years does it take for real GDP per capita to double

Calculated by dividing 70 by growth rate in order to find doubling time

Chapter 6: Sources of growth

Labor productivity: Output per worker or hour worked

Increasing capital: Each worker hour has more access to capital to produce

Technological improvements: Directly increases output per worker for given amount of capital

Property rights: Ensures private firms are more likely to invest in a company converting to extra money for growth

Chapter 6: Closed economy GDP calculation

Y=C+I+G

No NX term here, so this must be a _____ economy

Chapter 6: Types of savings

Savings by households are private savings

S to p (private savings) = Y+TR-T-C

Earned income plus transfer payments minus taxes and collections

S to g (government/public savings) = T-TR-G

Taxes collected minus transfer payments minus government spending

Chapter 6: Government budget position

Budget surplus if T>G+TR

Budget deficit if T<G+TR

Government debt is an accumulation of past deficits

T = Taxes…G = Gov spending…TR = Transfer payments

Chapter 6: National income accounting identity

Y=C+I+G same as I=Y-C-G

Definition of savings is private and public combined

National savings equals investment, found through algebra

Typically, only equal in closed economy

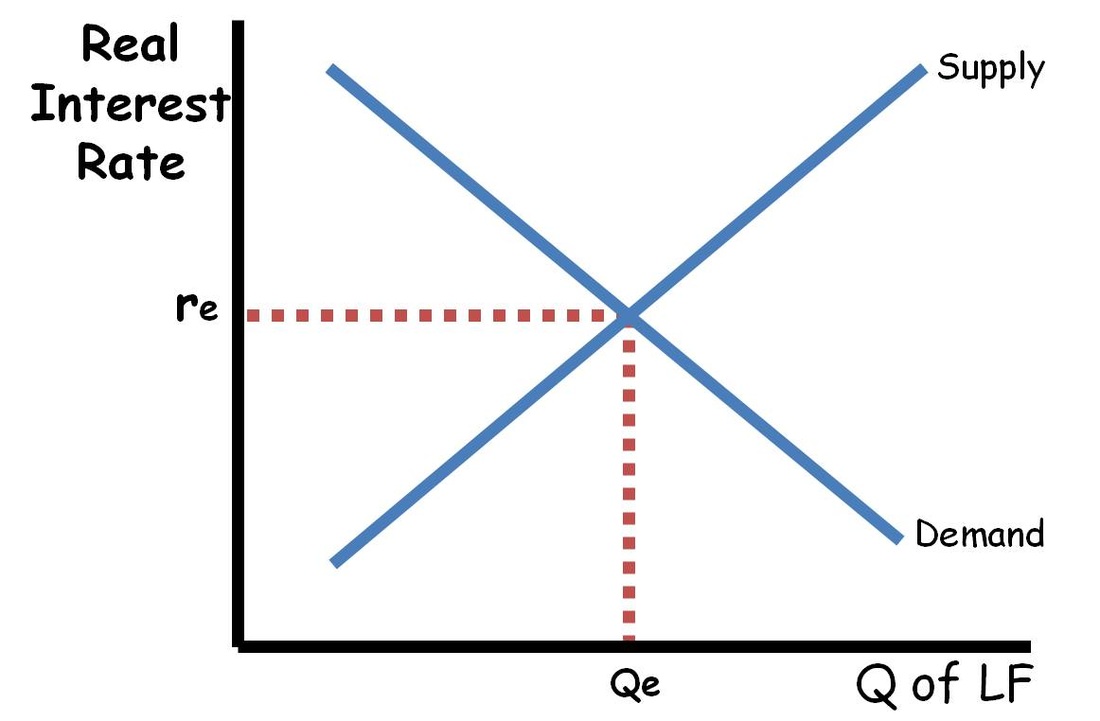

Chapter 6: Loanable funds diagram model

Supply and demand for loanable funds brings savers and borrowers together

Axis: Real interest rate on vertical axis and quantity of loanable funds on horizontal axis (measured in dollars)

Chapter 6: Reality vs course assumption

Reality: Households, governments, and firms all both borrow and save

Course assumption: All borrowing is done by firms who want to invest and all savings are done by households and governments whose income is greater than their current spending

For simplicity treat government borrowing as negative savings (makes model easier to understand)

Chapter 6: Demand for LF

Firms borrow to invest (purchase new capital)

Slope: higher interest rates means higher cost of borrowing, negative relationship between interest rate and investment (demand for LF)

Shift factors:

When firms need/want to purchase more capital at any given interest rate, demand for LF increases

When firms need/want to purchase less capital at any given interest rate, demand for LF decreases

Chapter 6: Supply for LF

Households and governments save when their inflow of funds is greater than their spending, they supply this saving to the market for LF

Slope:

Household’s, at higher interest rates, holding everything else constant, more savings now leads to higher consumption later… higher interest rates households are incentivized to save more

Positive sloped S curve due to private savings

Governments, no relationship between public savings and interest rate

Shift factors:

When households/governments save more at any given interest rate, supply of LF increases

When households/governments save less at any given interest rate, supply of LF decreases

Chapter 6: Market for LF diagram

Chapter 6: Analyzing and understanding shocks

Example 1

Uncertainty about the future causes firms to decrease investment in capital goods, demand curve shift left, if increase shift right

Look at vertical axis to see interest rate

Look at horizontal axis to see investment spending, ivestment spending equal to saving

Private savings go down because lower interest rate indicates so

Public savings feels no effect if focus is on firms

Example 2

The government decreases spending, holding taxes and transfers constant, this moves supply right due to government savings increasing

Remember that when one curve shifts, there is always movement along the other curve, it is HIGHLY unlikely both will move from one factor

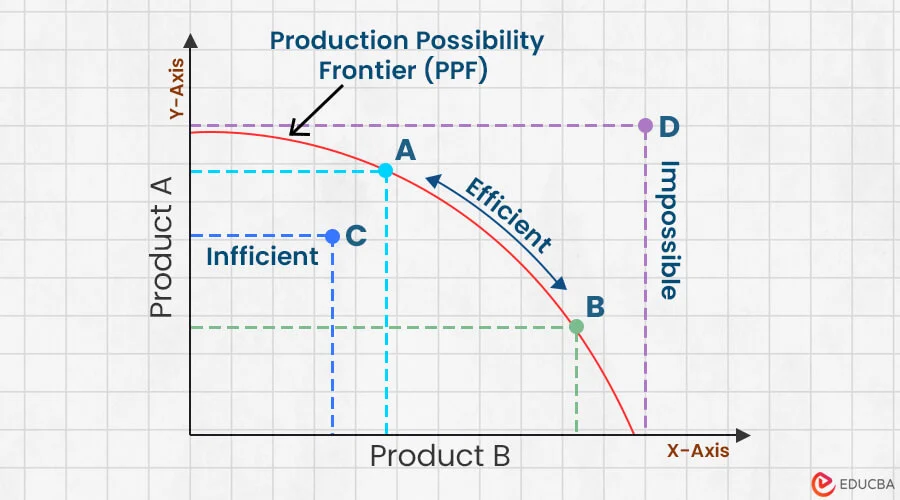

Chapter 7: Economic growth in the PPF diagram

(Production Possibility Frontier)

PPF: Consumer/capital goods diagram

Capital goods are machinery and robots, things used this year to produce goods and services

Technological growth pushes out PPF curve outwards

Closer to left of graph is more consumer goods, closer to right is more capital goods

This graph shows where society chooses to dedicate our production/consumption, this will affect the next year

Todays decisions affect tommorow’s possibilies

Chapter 7: PPF diagram

Chapter 7: Productivity

The quantity of goods and services a worker can produce in an hour

This is determined by physical capital, natural resources, human capital, and technological knowledge

Production function shows how we combine inputs to produce products

Chapter 7: Production function formula

Y = A x F(K,L,H,N)

Y is output

A is technology

K is physical capital

L is labor

H is human capital

N is natural resources

Chapter 7: Return to scale

If all inputs double, output doubles. Constant returns to scale.

If output more than doubles, increasing returns to scale.

If output less than doubles, decreasing returns to scale.For simplicity of course we will assume constant returns to scale

Chapter 7: Marginal product

Product = output

Marginal = extra

Marginal product is output produced with one extra unit of an input

Diminishing marginal product means the additional output produced by adding an extra unit of labor (19th unit) is smaller than the additional output produced by the unit of labor before (18th unit) (this explains the shape of the PPF diagram)

Chapter 7: Production function and policy

Anything that increases on the left side of equation raises left side

Policies

Protecting intellectual property incentive to increase A

Support of R&D incentive increases A

Subsidizing education increases in H or L

Chapter 8: Aggregate expenditure

Total planned spending on final goods and services in an economy

AE = C + I + G + NX

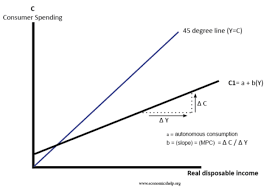

Chapter 8: Consumption

Spending by households on goods and services

Consumption function is the relationship between consumption and income

Marginal propensity to consume (MPC) is the fraction of change in income that is spent on consumption… slope of the consumption function

Chapter 8: Consumption function

Disposable income on horizontal axis and consumption spending on vertical axis

Vertical intercept dictates the piece of consumption that does not depend on disposable income

Things that shift curve up or down is net wealth, price level, interest rate, expectations

Consumption is positively related to disposable income

MPC tells us how much households increase consumption in response to 1 dollar increase in disposable income

Chapter 8: Consumption function diagram

Chapter 8: Aggregate expenditure simple model

Shows spending at various levels of GDP for a given price level where spending is given by C+I+G+NX

In equilibrium Y=AE

Chapter 8: Aggregate expenditure = real GDP

Horizontal is real GDP and aggregate expenditure is vertical

Will only be equal to real GDP at one value, at intercept

Output is the 45-degree line, if AE is higher or lower over time the gap will close until equilibrium is reached

Chapter 8: Conclusion thoughts

Inventories are the adjustment mechanism when spending does not equal output

If spending is higher than output inventories must be drawn down in order to fill the spending orders

If spending is lower than output inventories build up

Chapter 8: Autonomous spending

Planned spending independent of current income or GDP, determined by firms, government, or foreign buyers, such as investment, government purchases, and exports.

Chapter 8: Simple spending multiplier

Found by doing 1/(1-MPC)

When any autonomous component of spending rises by 1$, real GDP rises by multiplier

Chapter 8: Multiplier intuition

The 1 dollar increase in spending causes household income to rise by 1 dollar, people increase both consumption and savings, the higher consumption spending causes a further increase in income

Chapter 8: Shifts in aggregate expenditure

If autonomous consumption, investment, government spending, or net exports change, the AE curve shifts.

Inventories adjust to the gap between output and spending.

Y changes until the economy returns to macro equilibrium.

Chapter 8: Spending Multiplier – Concept

A change in government spending (ΔG = change in G) triggers multiple rounds of income and consumption:

Round 1: ΔG → initial increase in income

Round 2: MPC × ΔG → households spend part of Round 1 income

Round 3: MPC² × ΔG → households spend part of Round 2 income

Total change in income: ΔY = ΔG (1 + MPC + MPC² + …)

Chapter 8: Spending Multiplier – Formula & Reason

Total change in income ÷ initial change in spending:

ΔY / ΔG = 1 / (1 − MPC)

Reason: Each round of spending triggers more consumption.

The repeated rounds form an infinite geometric series because MPC < 1.

Chapter 8: Using AE to derive AD

Start with a point on AD (Y₁, P₁)

If P rises, planned spending falls

Drag a line down from AE equilibrium to see new Y

Repeat to trace the AD curve

AE diagram shows how changes in P affect Y and derive AD.

Chapter 8: Shifts in AD curve

Begins with a point on the initial AD curve

Suppose investment spending increases what happens to the AD curve

Increase causes shift out this shift causes shift in the AD curve

Chapter 8: Calculating Y and MPC – Closed Economy Example

Closed economy: NX = 0 → Y = C + I + G

Example: Y = 30 + 0.8(Y + 20 − 30) + 35 + 40

Simplify: Y = 105 + 0.8(Y − 10)

Solve: Y − 0.8Y = 105 − 8 → 0.2Y = 97 → Y = 485

MPC = 0.8 (from consumption function coefficient)

Chapter 8: Solving for Equilibrium Income (Y) – Concept

Start with Y = C + I + G (closed economy).

Plug in consumption as C = autonomous consumption + MPC × disposable income (Y − T + TR).

Add autonomous investment (I) and government spending (G).

Combine terms with Y on one side and constants on the other.

Solve for Y: Y = total autonomous spending ÷ (1 − MPC).

Key idea: The economy’s equilibrium income depends on total autonomous spending and how much households spend out of extra income (MPC).

Chapter 8: Consumption function deep dive

Slope of consumption function is the MPC

This function will shift if non income determinants of consumption change such as net wealth, price level, interest rate, expectations

e.g of function C=30+0.8(Y+TR-T) *30 is y int and 0.8 is slope

Solve for C+I+G to find slope of AE

Shifts in AD Curve:

Begin with a point on the initial AD curve

Suppose autonomous consumption spending increases, what happens to the AD curve

MPC times the increase in Y int is the horizontal distance change

Chapter 9: Overview

Aggregate demand and aggregate supply model

Involves 3 curves

Need to understand how slopes are determined

Need to understand what causes shifts

2 concepts of equilibrium

Automatic adjustment equilibrium

Many variables show up in this diagram

Real GDP and Price Level axis

Unemployment does not show up on diagram but it's a key part

Chapter 9: Slope of AD

The AD curve has a negative slope

Wealth effect, how consumption changes when price changes

Interest rate effect

International trade effect, deals with net export change to price lvl

Anything that causes any component on left side of Y=C+I+G+NX will cause curve to shift

Chapter 9: Aggregate Demand

Demand has to do with buyers

We have an equation that divides real output (GDP = Y) into categories according to who purchases the goods Y=C+I+G+NX

Chapter 9: Aggregate Supply

Supply has to do with production

Real GDP and price level from the production side of equation

Long run = economic growth = production function

Y= A*F (K, L, H, N)

Chapter 9: Long Run Aggregate Supply

Slope A, K, L, H, N do not depend on price

LRAS is vertical

Any change on left hand side variable will cause the LRAS curve to shift

Chapter 9: Short Run Aggregate Supply

In the long run, there is no relationship between P and Y on the supply slide, this is not true in the short run

Reasons for a positive relationship between P and Y on the supply side

Sticky wages

Menu costs

Shift factors

Short term supply shock

Expected price level

Chapter 9: Sticky wage theory

Nominal wages are “sticky” they are fixed in the short run, flexible in the long run (firms and workers usually agree to contract with fixed time period)

What firms and workers really care about is real wage, for firms when real wage rises they are worse off but workers are better off

Chapter 9: Real wages, Nominal wages, and “P”

Real wage = W ÷ P.

W is nominal wage. P is price level.

If P rises and W stays fixed, real wages fall.

Lower real wages make labor cheaper.

Firms hire more labor and produce more.

Y rises.

Chapter 9: Equilibrium

When SRAS and AD touch there is equilibrium

When SRAS, AD, and LRAS touch there is long ruin equilibrium

Long run equilibrium is also referred to as y hat, the potential real GDP

Chapter 9: Shocks on the AD AS model

AD

Slope of AD curve has to do with how consumption, investment spending, and net exports change

Increases in any components cause shift right, decrease causes shift left

AS

Supply shock that effects inputs into production that we think are temporary will cause shift

Oil cost can shift SRAS curve

Expected price level causes shifts

Chapter 9: Definitions

Recession, any time output is below potential (left side)

Expansion, any time output is greater than potential (right side)

Chapter 9: Away for LR equilibrium

If Y is below potential Y, economy is in recession which leads to unemployment rates being high which leads to excess labor supply which leads to workers willing to take lower wages which leads to production costs falling which leads to firms producing more which leads to SRAS shifts right

If y is above potential Y economy is in expansion which leads to unemployment rates low which leads to excess labor demand which leads to firms paying more wages which leads to production costs rising which leads to firms producing less which leads to SRAS shifts left

When economy not in LR equilibrium automatic function exists to push economy back to LR equilibrium

This mechanism works through labor markets, SRAS curve will shift, restoring long run equilibrium

Chapter 9: Dynamic AD AS Model

Used to explain economic fluctuations and long run growth.

Over time LRAS shifts right due to tech progress and growth in K and L.

LRAS pulls SRAS right as capacity expands.

Population and income growth raise C, I, and G.

Higher spending shifts AD right over time.

Chapter 10: What is money

Something that is regularly used to buy goods and services

Money does not equal income or wealth

Chapter 10: Functions of money

Must be a medium of exchange

Must be a unit of account - how we measure prices

Must store value - asset

Standard of deferred payment

Standard of deferred payment means money is used to settle debts in the future.

Chapter 10: Money in the Canadian economy

M=C+D

C is the currency in the hands of the public, not money in vaults but with the public

D is demand deposits, demand means payable on demand and is another term for chequing accounts

Money is an asset that is regularly used to buy goods and services, this does not include credit cards

Chapter 10: Money creation

Current banking system makes money come from thin air, this is because there are two main components to money, currency in hands of public and chequing accounts

If money were just a commodity, then banks would not have the ability to create money

Chapter 10: Reserves

Reserve ratio: the fraction of total deposits that the banking system holds in reserve

Reserves: the currency held in the bank vault waiting to be taken out

T account: Shows the total amount held at a point in time.

The numbers are actual balances, not how much they changed. Changes get shown by updating the balances, not by adding plus or minus signs.

Chapter 10: Money multiplier

The total amount of deposits the banking system generates with each dollar of reserves

Calculated as 1/reserve ratio

Chapter 10: More about money and deposits

1st way of thinking

How much does a bank need in reserve, if there is a given amount of deposits

2nd way of thinking

How much can the bank loan out, and how much in deposits can it support, for a given amount of reserves

Bank creates money through lending out excess deposits they take in

Textbook explanation is unrealistic, banks do not call up loans they simply slow loaning rate till reserve is built up

Chapter 10: Monetary policy

This is increasing and decreasing the money supply to achieve specific goals for economy

Primary tool is the open market operations > buying (selling) government bonds/securities from (to) the public

(brackets is whats actually happening)

Chapter 10: Open market operations, sale and purchase

Purchase

This causes bonds to go from public to BoC and then the bank gives people money, leads to increase in money supply

Sale

- This causes bonds to go from bank to public and then the people give the bank money, leads to decrease in money supply

Chapter 10: Interest rates

Prime rate, overnight rate, policy interest rate, bank rate

Prime rate is the commercial rate banks charge their best customers

Overnight rate is the rate commercial banks charge each other for 24 hour loans

Policy interest rate is the BoC target for overnight rate

Bank rate is the rate BoC charges commercial banks

Chapter 10: Course assumption

Assume the BoC can completely control money supply

Reality is they can not because households have control as to how much they choose to save and commercial banks can choose to keep excess reserves

Chapter 10: Quantity theory of money

The quantity of money in the economy determines the price level in the economy

Rate of growth of the money supply determines the inflation rate in the economy

Chapter 10: Velocity

Rate at which money changes hands/circulates

Divide spending by amount of current to find velocity

Chapter 10: Quantity equation

M*V=P*V

M is money, V is velocity, P is price level, Y is real GDP, P*Y is nominal GDP

Chapter 10: Quantity equation growth rates

Product rule

Chapter 10: Price level

Price level is nominal GDP over real GDP

Chapter 10: Barter economies

Double coincidence of wants – a major shortcoming of barter economies that for barter to occur, each person must want what the other person has

Chapter 11: Income/Money “decision tree”

Earn income (flow)

Save

Adds to wealth (stock)

Financial assets

Money

Non-monetary assets (stocks, bonds, etc.)

Physical assets

Consume

As income goes down the flow everything else receives a bit of the flow

Chapter 11: Money markets in the short run

Assume that the economy has only two financial assets, money and bonds

Assume that money does not pay interest, but bonds do pay interest

Opportunity cost of money is the interest you could earn by financial wealth in the form of bonds

At low interest rates, people hold more of their wealth as money, at high interest rate more is held in bonds

Chapter 11: Money market diagram

Demand for money has negative slope, higher interest rate means less quantity of money demanded

Money supply “set” by BoC (course assumption)

Change in money demand affects interest rate

Chapter 11: Money market diagram shocks

If income rises, consumption goes up which leads to money demanded curve shifting right

If banks conduct open market sale of bonds, public purchases bonds with money, resulting in money supply curve shifting left

Chapter 11: Monetary policy

Recession

High unemployment

BoC wants to shift AD out to the right

Expansion

Risk of coming inflation

BoC wants to shift AD into the left

Chapter 11: Monetary policy diagram

Supplying more money shifts AD curve right pulling out of recession

Supplying less money shifts AD curve left slowing spending pulling out of hasty expansion

Central banks want to help eliminate high unemployment and reduce risk of inflation

Can use monetary policy to shift AD to restore LR equilibrium sooner than waiting for automatic mechanisms to kick in

Chapter 12: Fiscal policy

Typically when we use this term we are referring to discretionary fiscal policy which is changes in government spending, taxes, or transfers designed to impact economic variables such as GDP, the unemployment rate, or the price level

In recession use expansionary fiscal policy and in expansion use contractional fiscal policy

Chapter 12: Automatic Stabilizers

“Automatic” in the sense that changes in taxes and transfers that kick in when income fluctuates

When GDP falls, income taxes falls and transfers rise which leads to income falling by less than if these taxes and transfers were not in place, thus mitigating the swings in aggregate demand that result from economic shocks

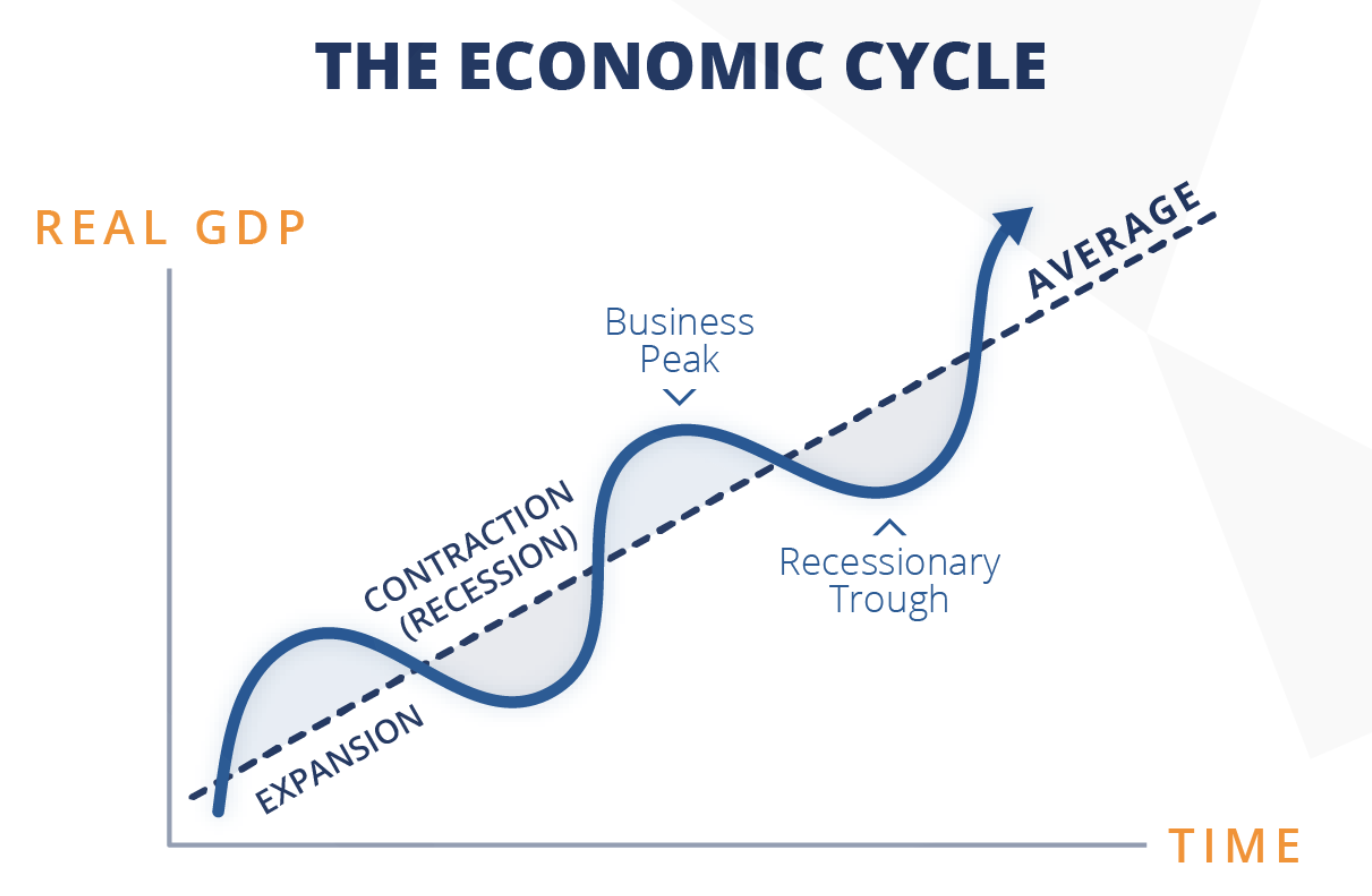

Chapter 12: Automatic stabilizers and the stylized business cycle

Wavy line on a 45-degree line gets tighter because of automatic stabilizers

Automatic stabilizers reduce fluctuations in AD

Can see this in either the stylized business cycle diagram or AD-AS diagram

Chapter 12: Stylized business cycle diagram

Make note of PEAK and TROUGH placement

Chapter 12: Spending multiplier

Simple Spending Multiplier = 1 / 1-MPC

When government spending rises by 1-dollar real GDP rises by SSM

Chapter 12: Simple Spending Multiplier Intuition

The 1 dollar increase in spending causes household income to rise by 1 dollar; people increase both consumption and saving which leads to the higher consumption spending causes a further increase in income