AP Microeconomics Graphs and Formulas

1/48

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

49 Terms

Allocative Efficiency Condition

P = MC, or more precisely, Marginal Social Benefit (MSB) = Marginal Social Cost (MSC)

Average Fixed Cost

AFC = Total Fixed Cost (TFC)

Average Product

AP = Total Product / Quantity of Input

Average Profit

Average Profit = Total Profit / Quantity

Average Revenue

Average Revenue = Total Revenue / Quantity

Average Total Cost

ATC = Total Cost (TC) / Quantity of Output (Q)

Average Variable Cost

AVC = Total Variable Cost (TVC) / Quantity of Output (Q)

Cross-Price Elasticity of Demand

Percentage Change in Quantity Demanded of Good X / Percentage Change in Price of Good Y

Distributive Efficiency Condition

MU_P / MU_C = F / C

Elasticity of Supply

Percentage Change in Quantity Supplied / Percentage Change in Price

Factor of Production Hiring Rule

Hire Until MRP = MFC

Gini Coefficient

Cumulative % of Income / Cumulative % of Families

Marginal Cost

MC = ΔTC / ΔQ

Marginal Product of Labor

MPL = ΔTP / ΔL

Marginal Revenue

MR = ΔTR / ΔQ

Marginal Revenue Product of Labor (MRPL)

MRPL = MPL × MRoutput

Optimal Combination of Resources Condition

w = MP_L / r

Optimal Consumption Rule

MU_X / P_X = MU_Y / P_Y

Price Elasticity of Demand

Percentage Change in Quantity Demanded / Percentage Change in Price

Price for a Competitive Firm

P = MR = AR

Production Efficiency Condition

w / r = MP_L / MP_K

Profit

Profit = TR - TC

Profit-Maximizing Output Level

MR = MC

Slope of the Total Product Curve

Slope = Change in Total Product / Change in the Number of Units of an Input

Socially Optimal Level of Output

MSB = MSC

Total Costs

Total Costs = Total Fixed Costs + Total Variable Costs, TC = TFC + TVC

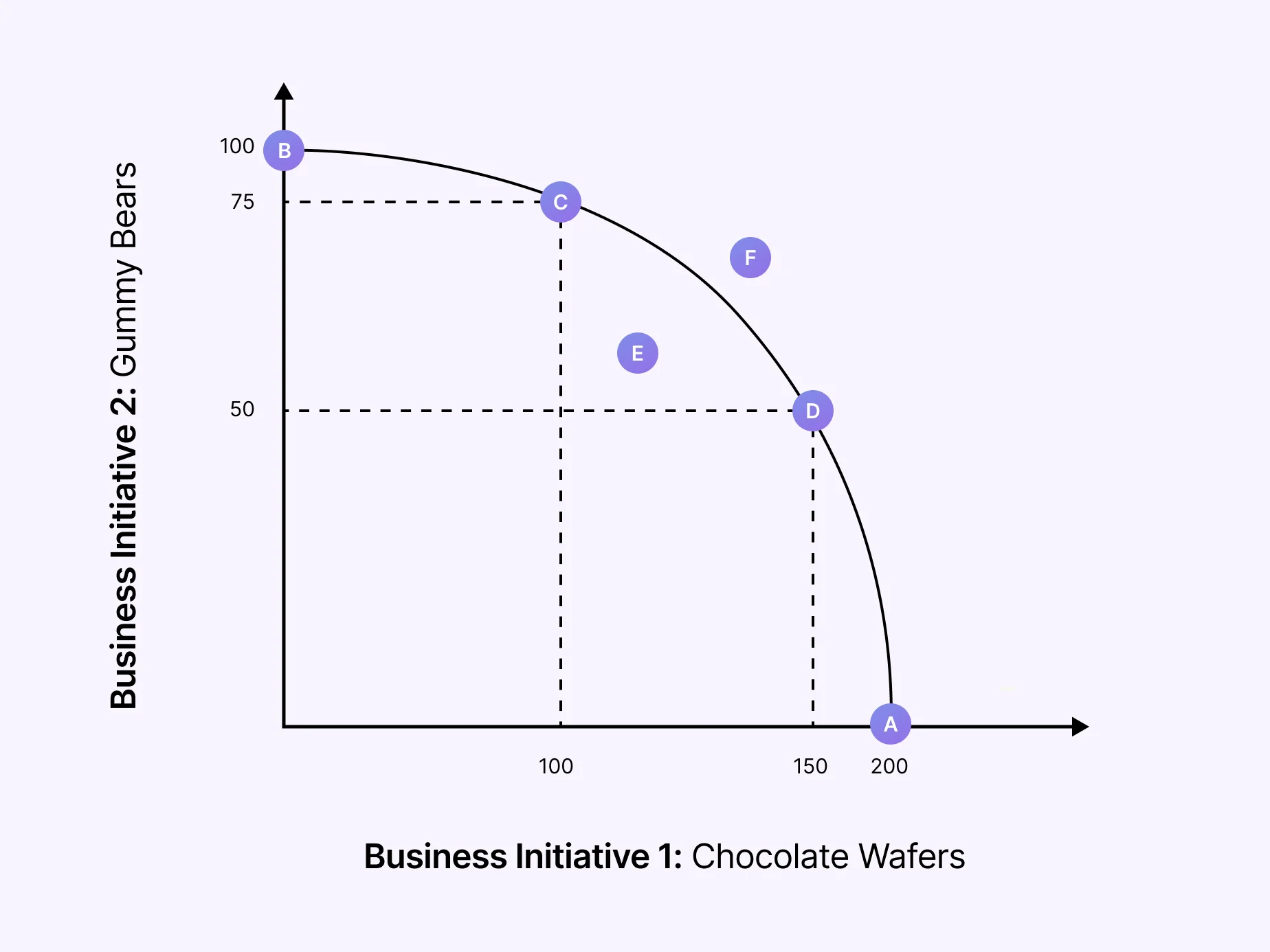

PPC with increasing opportunity cost

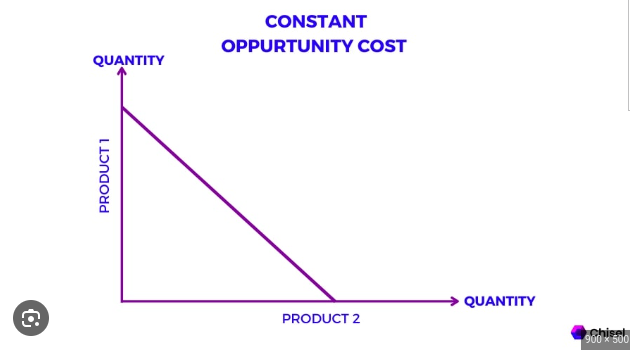

PPC with constant opportunity cost

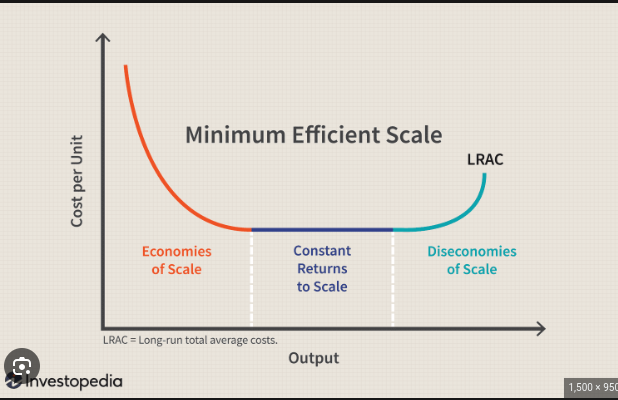

Long run average total cost curve

he LRAC illustrates the relationship between output and average cost when a firm can fully adjust all inputs. It represents the minimum average cost for each output level with the optimal input combination.

Shape of the LRAC Curve:

Downward Sloping (Economies of Scale): Initially, average costs fall as output rises, due to factors like specialization and spreading fixed costs.

Upward Sloping (Diseconomies of Scale): Beyond a certain point, average costs rise due to inefficiencies like poor coordination and communication.

Minimum Point: The lowest point on the curve shows the most efficient scale of production.

3. Key Concepts Related to LRAC:

Economies of Scale: Cost advantages from increased production, such as labor specialization and bulk purchasing.

Diseconomies of Scale: Rising costs from expanded production, due to management challenges and inefficiency.

Constant Returns to Scale: A situation where increasing production does not significantly affect average costs.

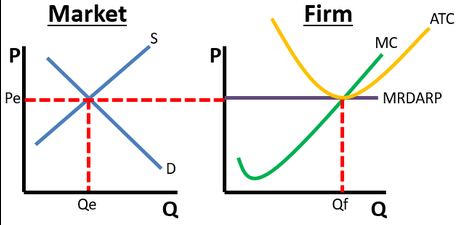

Perfect competition market and firm

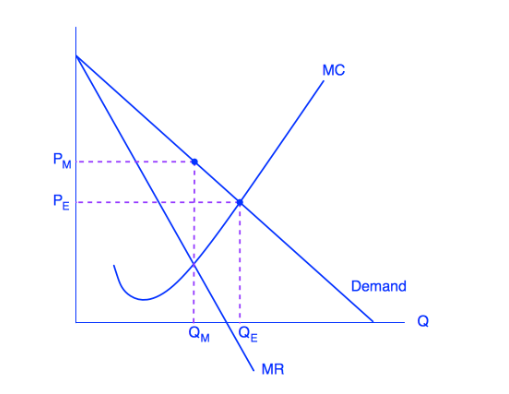

Non-price discriminating monopoly

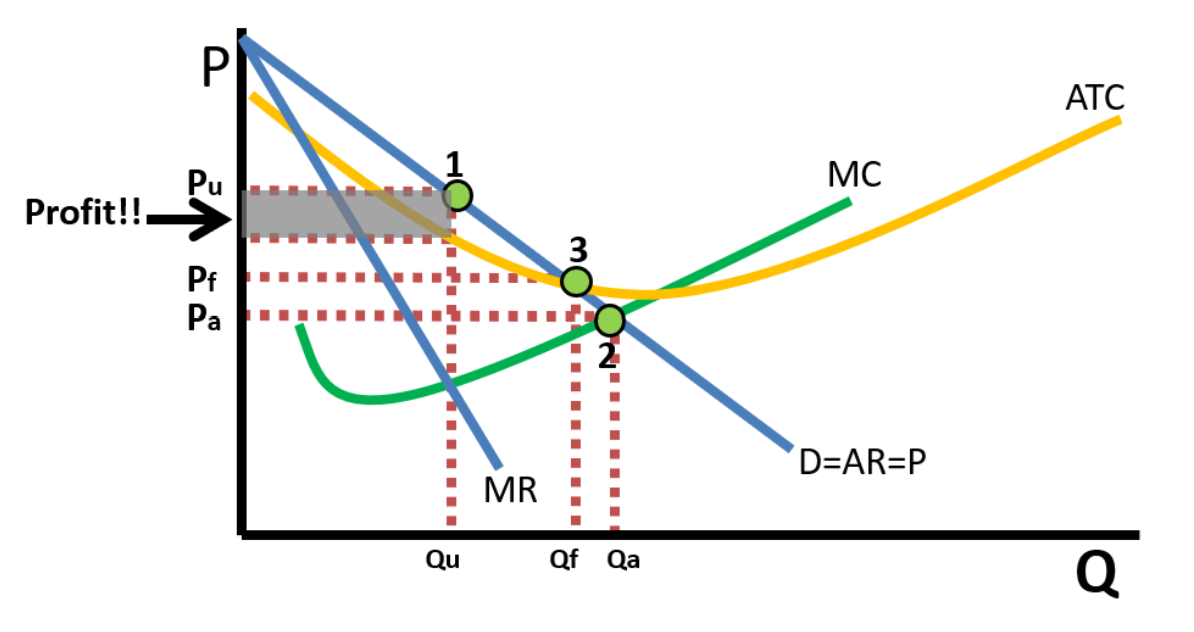

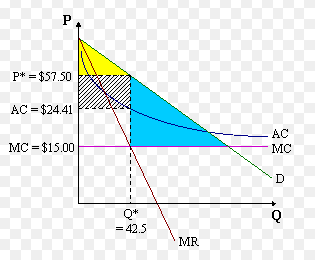

Monopoly making profit

1.The monopoly price and quantity Pu and Qu when if it is unregulated.

2.The allocatively efficient price and quantity. A government price ceiling here would cause the firm to incur a loss.

3. Fair return price. A price ceiling here would still be inefficient, but there would be less deadweight loss and the firm would break even so it would continue to operate in the long run.

4.If this is a monopolistically competitive market, firms would enter the market shifting MR and DARP left as this firms market share decreases.

**Monopolies have excess capacity and are not productively efficient (do not produce at the minimum of the ATC)

**Monopolies are not allocatively efficient (Price>MC) when they are unregulated.

**If a monopoly perfectly price discriminates, the MR merges with the DARP and they become allocatively efficient.

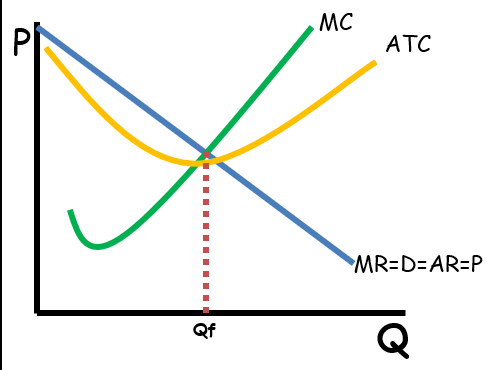

Monopolistic competition in the long run

1.Productive efficient point

(Minimum of ATC)

2.Allocative efficient point

(MC=P) quantity below

3.Actual output (MR=MC) and price (DARP above MR=MC at point 4)

5.Unit elastic portion of the demand curve (where MR equals zero at that quantity). Demand is inelastic below and elastic above this point.

•Deadweight loss is in the triangle between points 2,3, & 4.

•If the firm is making a profit (the ATC is lower than price), firms will enter the market giving each existing firm a smaller share of the market. That shifts DARP and MR to the left.

•If the firm is incurring a loss (ATC higher than price), the opposite occurs as firms exit the market.

Natural monopoly

Price discriminating monopoly

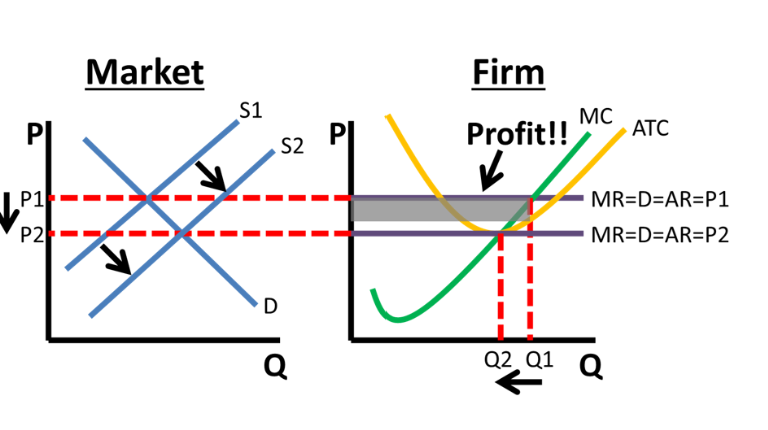

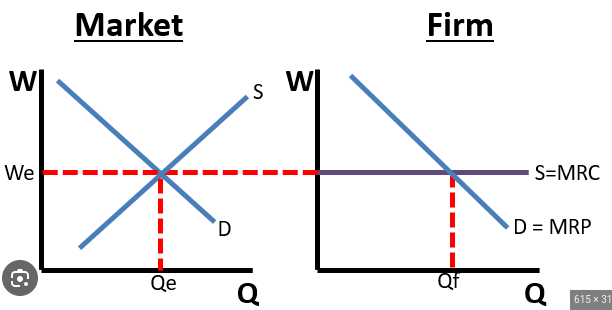

Perfect competition resource market and firm

Industry – When the supply of labor in the industry decreases (shifting supply to S2) the wage increases and the quantity of workers decreases

•Firm – The increase in the wage shifts the firm’s labor supply curve (MRC) upward. As a result, they hire fewer workers (Q2)

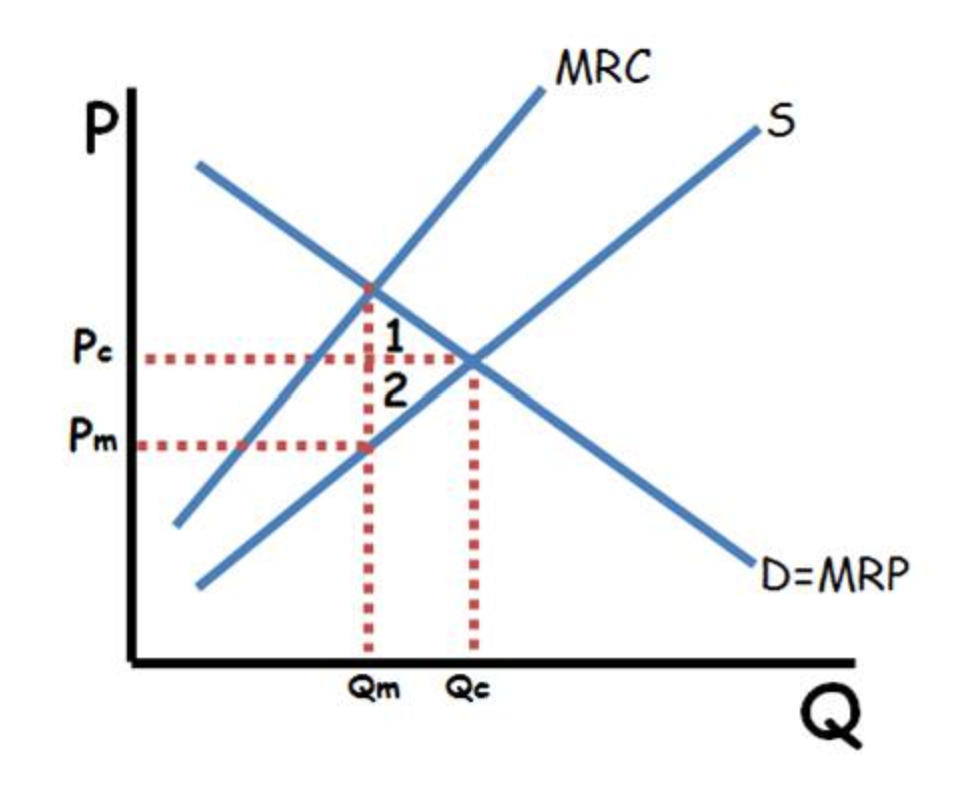

Monopsony Factor Market

Firm still hires the quantity where MRC=MRP

•Pm is the wage all workers are paid and Qm is the number the firm hires.

•Pc and Qc is the wage and number of workers hired if this were a competitive market. A monopsony hires fewer worker and pays lower wages than a competitive market.

•The MRC is higher than the wage (supply) because the firm must raise the wage for all of their workers when they hire more.

•1 and 2 are deadweight loss.

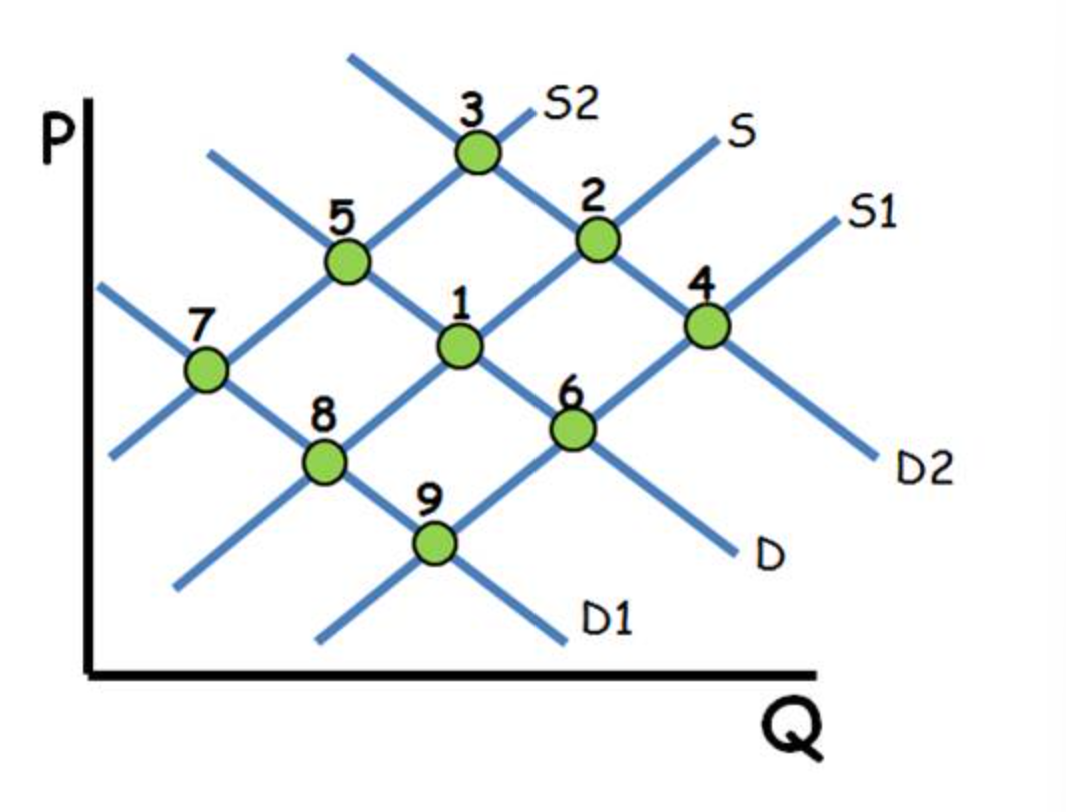

Supply and Demand

Single Shifts

•Demand ↑=P ↑ Q ↑: Point 1 to 2

•Demand ↓=P ↓ Q ↓: Point 1 to 8

•Supply ↑= P↓ Q↑: Point 1 to 6

•Supply ↓= P ↑ Q↓:Point 1 to 5

Double Shifts

•When 1 axis shows an increase then decrease with each shift, that axis is indeterminate.

•Demand ↓ Supply ↓

P Indeterminate Q ↓:Point 1 to 8 to 7.

•Demand ↑ Supply ↑

P Indeterminate Q ↑: Point 1 to 2 to 4.

•Demand ↑ Supply ↓

P ↑ Q Indeterminate: Point 1 to 2 to 3.

•Demand ↓ Supply ↑

P ↓ Q Indeterminate: Point 1 to 8 to 9

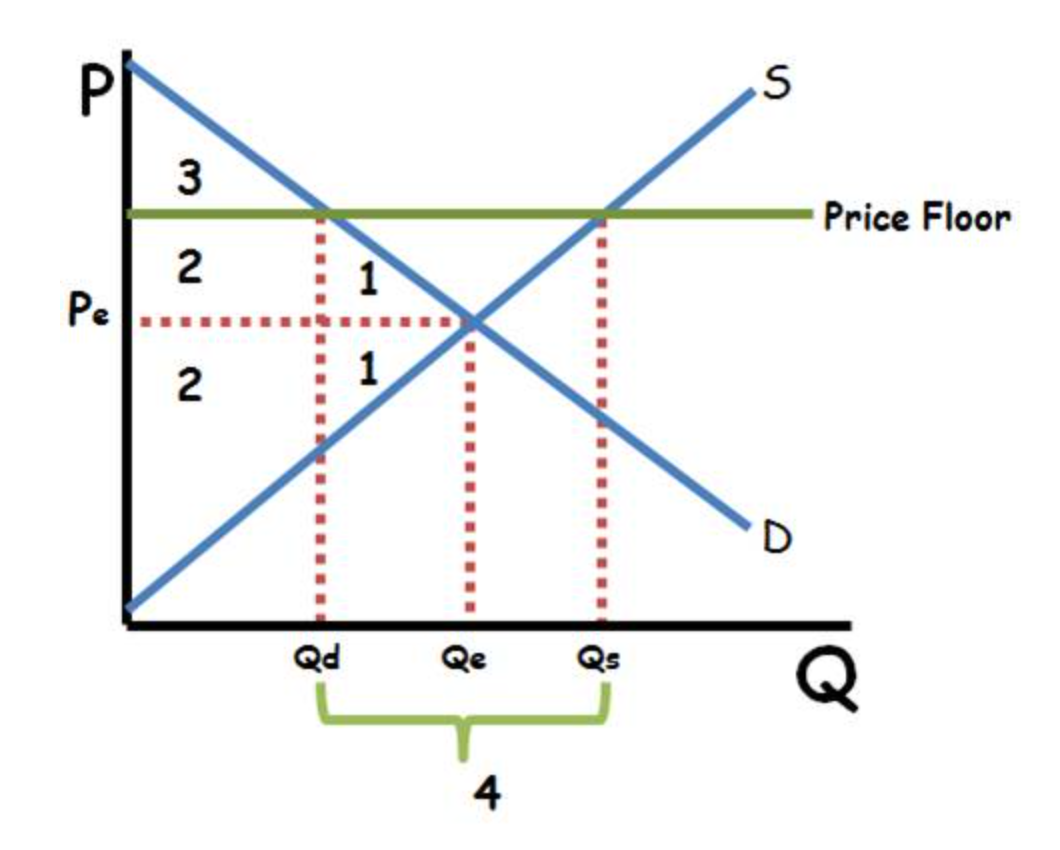

Price Floor

1.Triangle is deadweight loss

2.Producer surplus

3.Consumer Surplus

4.There is a surplus of products in the market (Qs>Qd)

•The quantity that actually exchanges hands is Qd (there can be more sold than consumers are willing to buy at the current price.

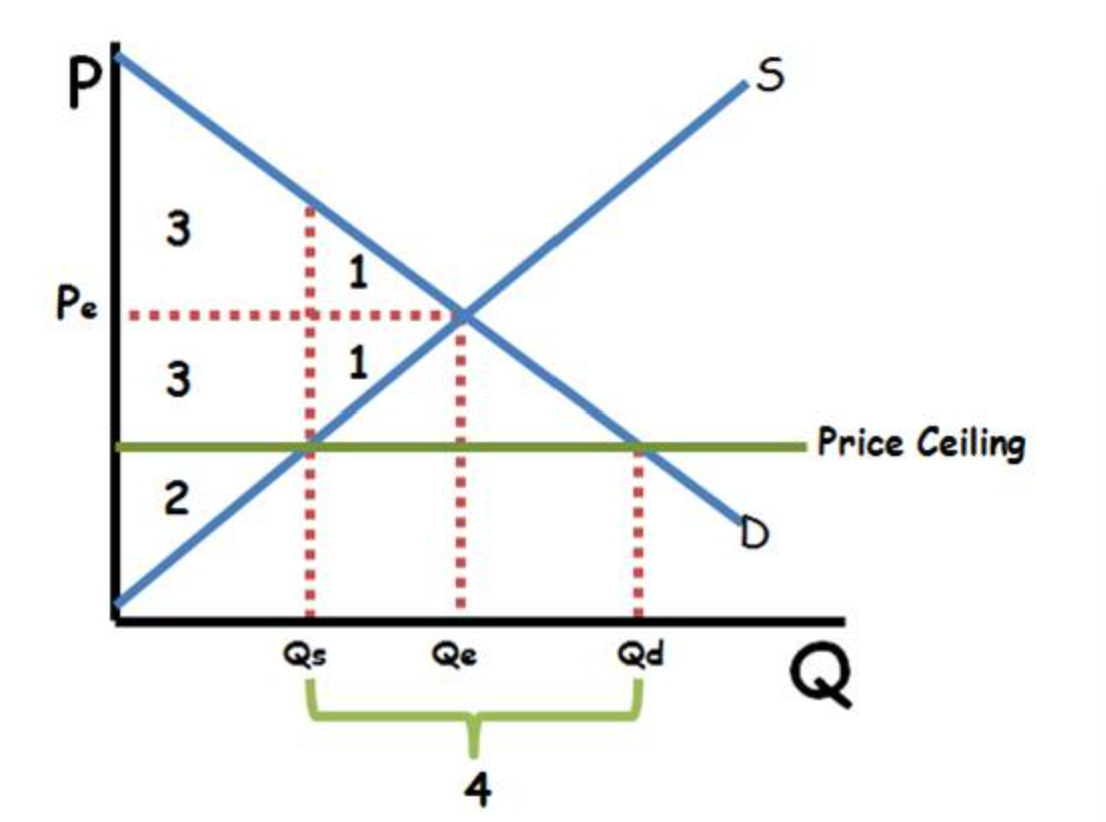

Price Ceiling

1.Triangle 1 is deadweight loss

2.Producer surplus

3.Consumer Surplus

4.There is a Shortage of products in the market (Qs<Qd)

•The quantity that actually exchanges hands is Qs (there can be more sold than producers are willing to sell at the current price.

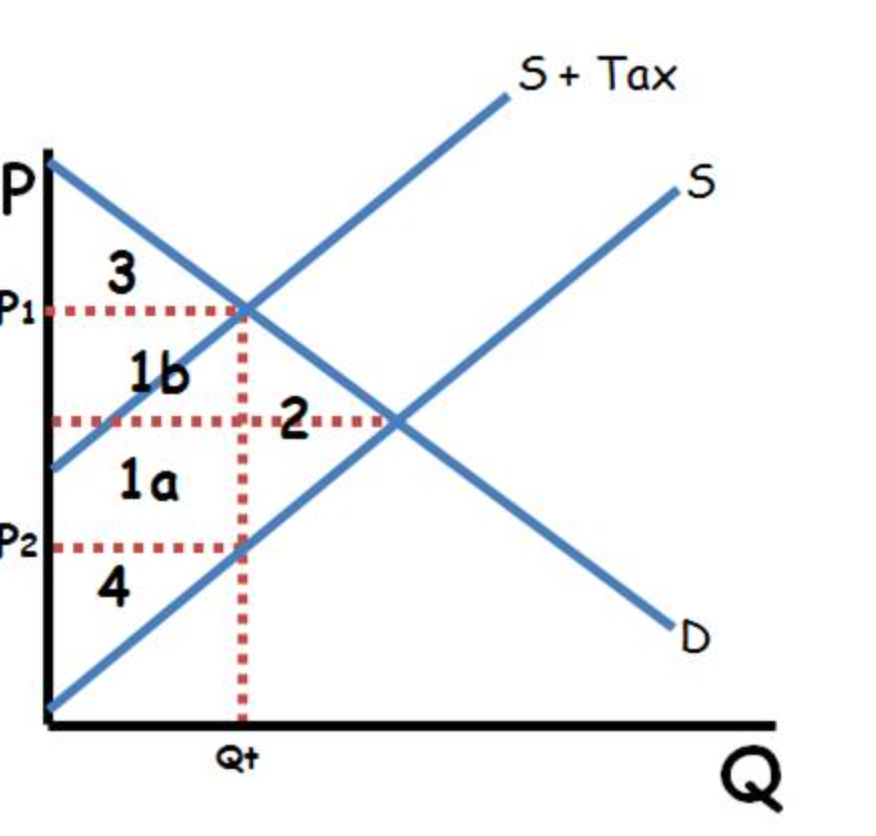

Per Unit Tax with no Externalities

Total Tax Revenue (1a + 1b)

1a Producer tax burden

1b consumer tax burden

2.Deadweight loss

3.Consumer Surplus

4.Producer Surplus

•Qt= Quantity produced and demanded

•Price of tax = P1-P2

•P1=Price consumers pay

•P2=Price producers receive

**This is a per-unit excise tax

**This tax reduces efficiency and creates deadweight loss.

**Tax revenue is part of economic surplus along with consumer and producer surplus.

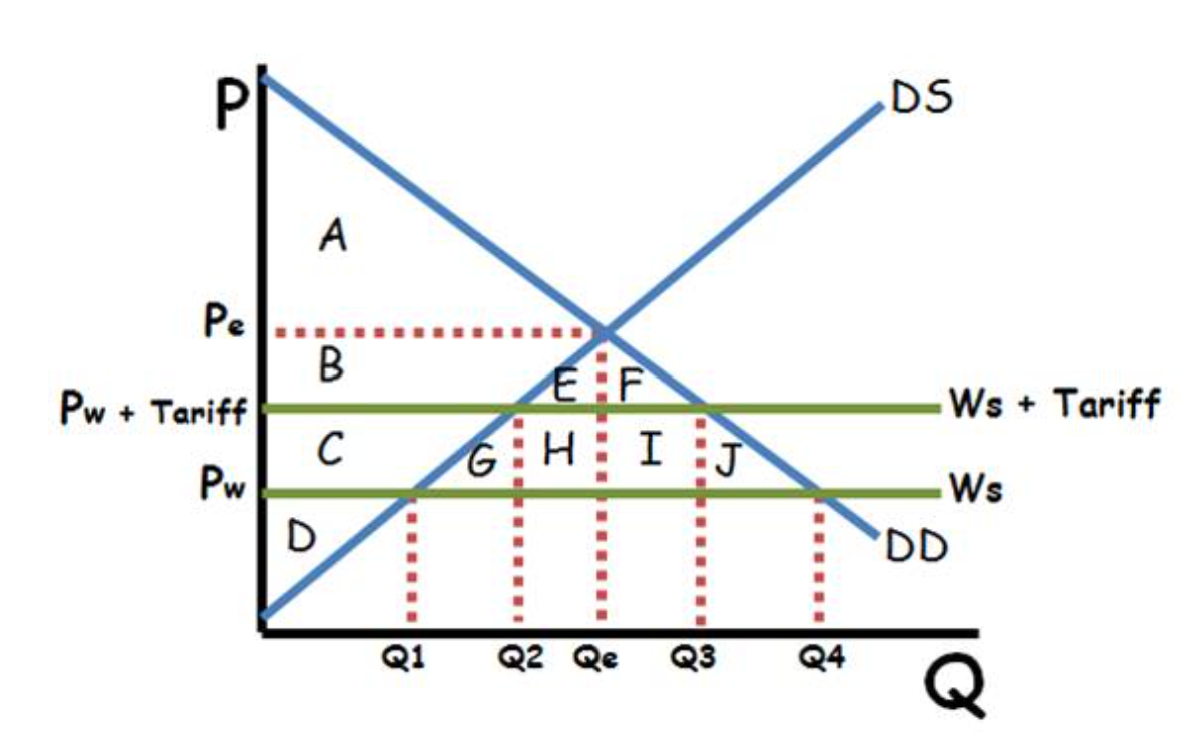

International Trade and Tariff

No trade:

•Pe and Qe equilibrium

•Consumer surplus A

•Producer surplus BCD

No Tariff:

•Pw is the price

•Q1 domestically produced.

•Q4 is consumed

•Q4-Q1 is imported

•Consumer surplus ABCEFGHIJ

•Producer Surplus D

With Tariff:

•Pw+Tariff is the price

•Q2 domestically produced

•Q3 domestically consumed

•Q3-Q2 is imported

•Consumer Surplus ABEF

•Producer Surplus CD

•Tax Revenue HI

•Deadweight loss GJ

A Firm’s Cost Curves

•AFC – Represents all the costs the business must pay to operate even if they produce zero output. Also called sunk costs. i.e. rent, insurance, loan payments, lump sum tax etc. A change in Fixed costs only shifts the AFC and ATC (up or down)

•AVC – Represents the costs associated with producing more or less output. i.e. labor, raw materials, per unit tax, etc. A change in variable costs shifts the AVC, ATC, and MC (up or down)

•ATC = AVC + AFC

•MC = The costs associated with producing one more unit of output (impacted by variable costs)

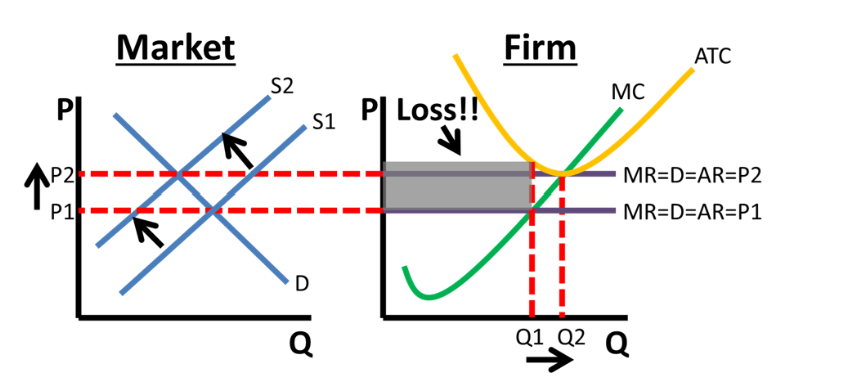

Perfect Competition from short-run loss to long run equilibrium

The economic loss causes firms to exit the industry, shifting the supply curve left, raising the price (MRDARP) until the firm breaks even.

**Allocatively Efficient in the long-run and the short-run (Price=MC)

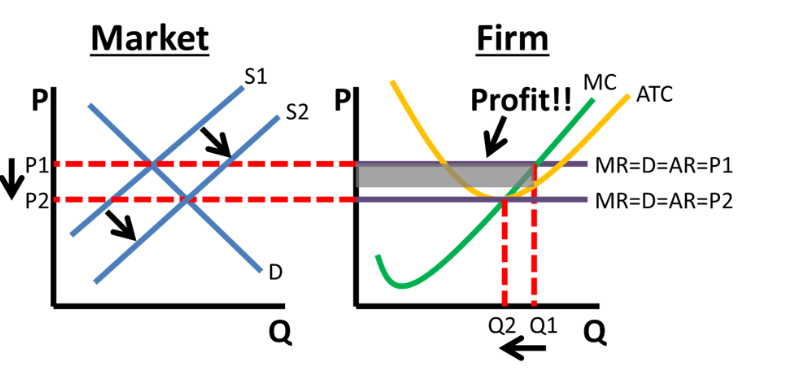

Perfect Competition from short-run profit to long run equilibrium

The economic profit causes firms to enter the industry, shifting the supply curve right, lowering the price until the firm breaks even.

**Productively efficient in the long run (produces at the minimum of the ATC).

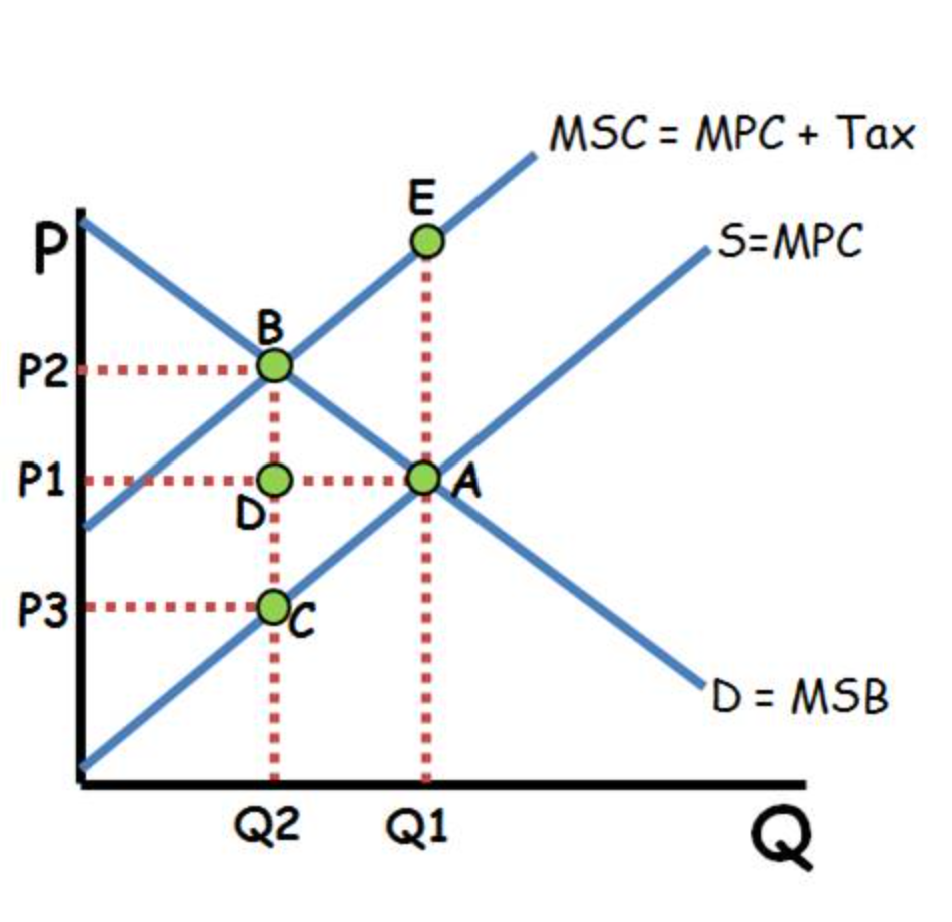

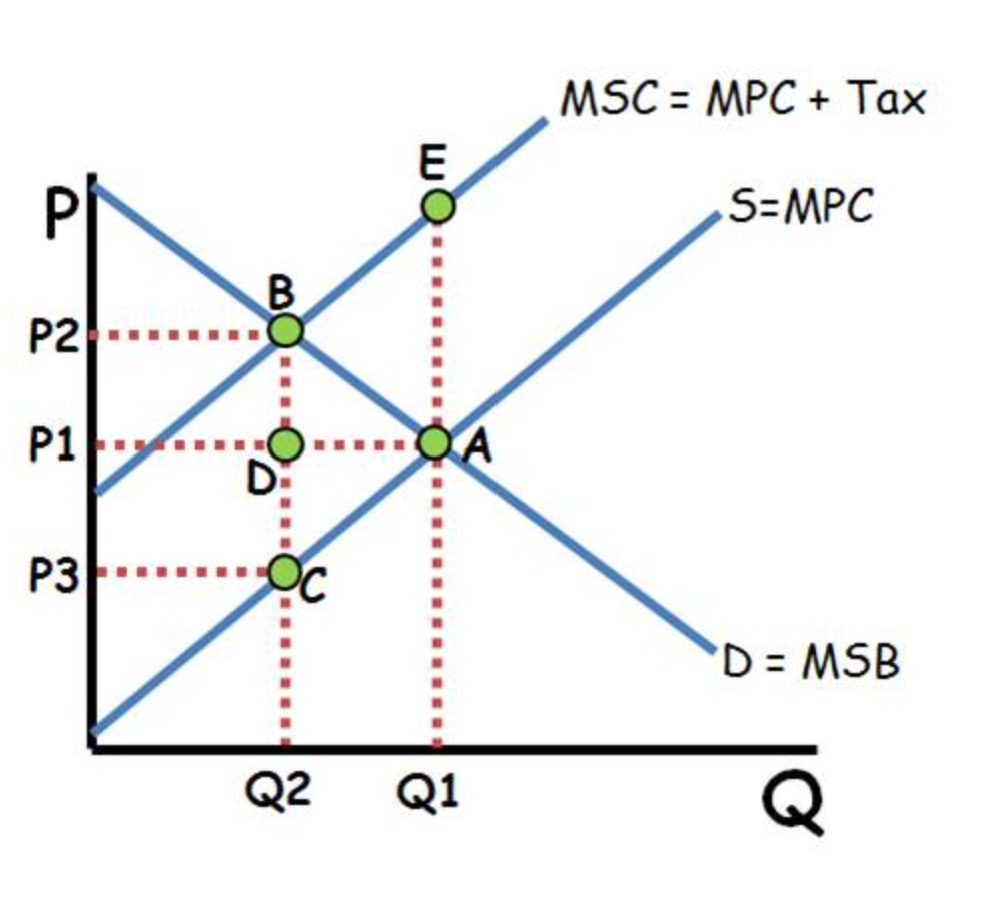

Negative Externalities with Per-Unit Excise Tax Correction

A.The output and price without government intervention. Inefficient because the MSC>MSB due to the externality

ABE = Deadweight loss before the tax (no deadweight loss after the tax) created by over production

B.The output and price after the tax. (The tax shifts the supply curve to the left)

CBP2P3=Total Tax Revenue

P2-P3=The price of the tax

CDP1P3=Tax paid by producer

BDP1P2= Tax paid by consumer

**Here the tax makes the market more efficient and reduces deadweight loss.

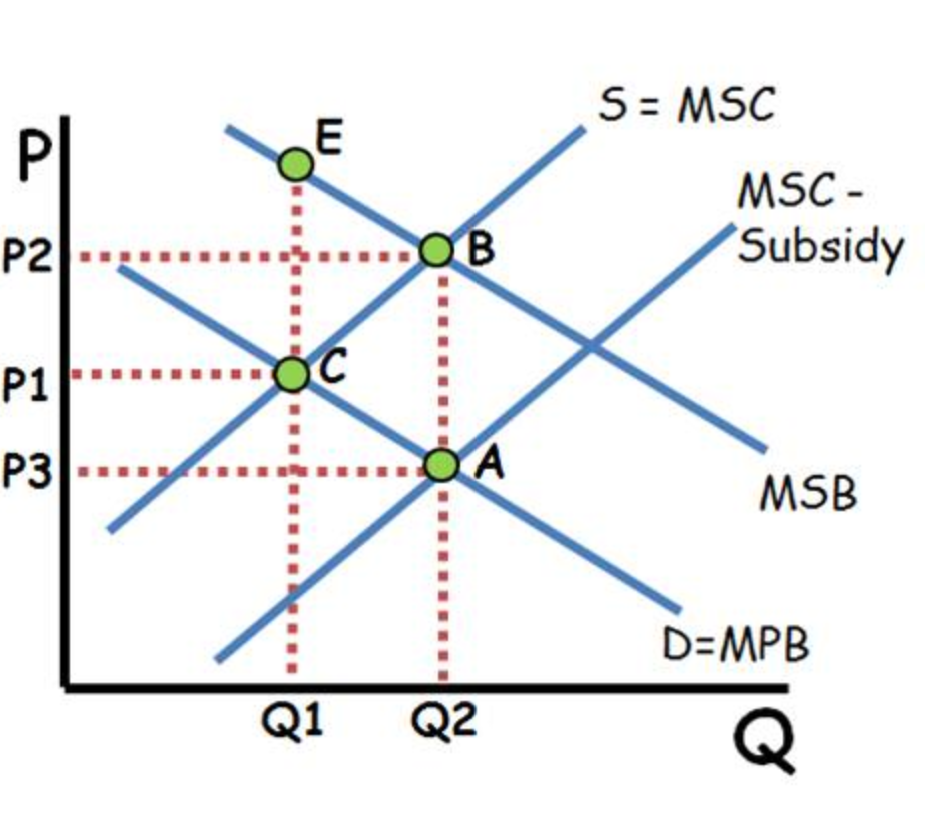

Positive Externalities with Per-Unit Consumer Subsidy Correction

B. The output and price without government intervention (inefficient because MSB>MSC)

C. The efficient output and price where MSC=MSB

ABC=the deadweight loss created by under production prior to the subsidy. There is no deadweight loss after the subsidy corrects this market failure.

P2-P3=The value of the subsidy.

P2P3DC= The total Cost of the Subsidy

**Here a tax would increase deadweight loss.

Positive Externality with Per-Unit Producer Subsidy Correction

C. Output and price without government intervention. Inefficient because MSB>MPC.

BCE=Deadweight loss created by underproduction. There is no deadweight loss after the subsidy

Since the subsidy is given to the producer instead, it shifts the supply curve to the right (MPC-Subsidy)

Q2. The efficient quantity where MSB equals MSC (No external cost so MSC is MPC).

P2 is the price suppliers receive after the subsidy.

P3 is the price consumers pay after the subsidy.

P2-P3=The value of the subsidy

P2P3AB=The Total Cost of the subsidy

**Here a tax would increase deadweight loss.

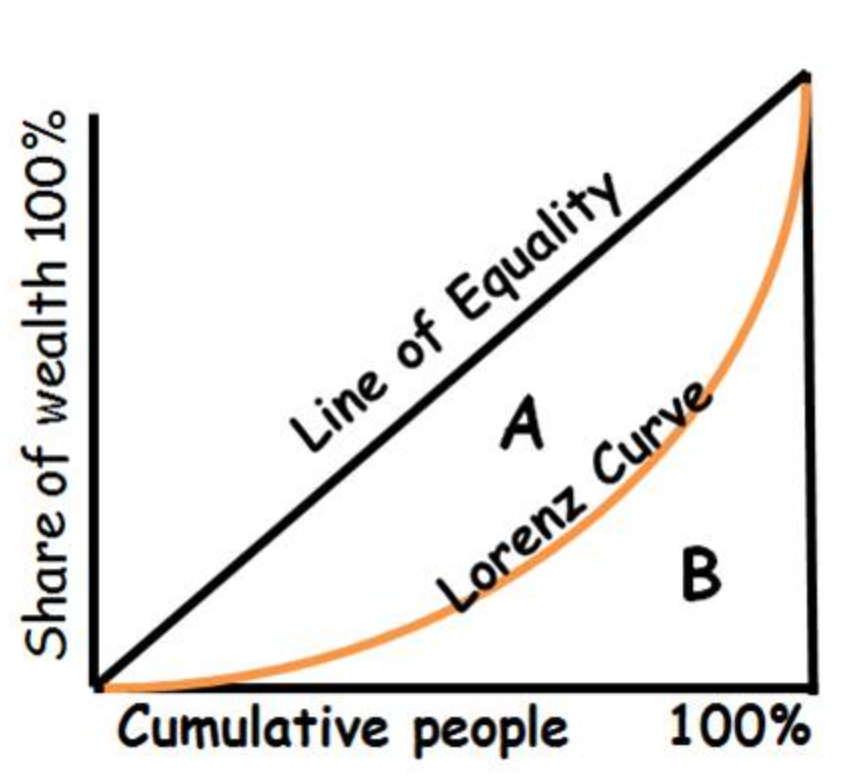

Lorenz Curve

•Lorenz curve – measures the distribution of wealth within a country.

•The closer the curve is to the line of equality, the more equal the distribution is.

•Gini Ratio = A/(A+B)

–Value of zero – Complete equality

–Value of one – Complete inequality